PINNACLE - BusCom, GAM, NPO, Forex and Derivatives

1/150

Earn XP

Description and Tags

Combined set

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

151 Terms

Derivative

A financial instrument that derives its value from the movement in commodity prices, foreign exchange rate, and interest rate of an underlying asset or financial instrument.

It is an executory contract, not a transaction, because it is an exchange of promises about future action.

They are used for hedging. They are also called hedging instruments.

It created rights and obligations that have the effect of transferring between the parties to the instrument the financial risks inherent in an underlying primary financial instrument.

Price risk

Uncertainty in the future price of an asset.

Credit risk

Uncertainty over whether a counterparty or the party on the other side of the contract will honor the terms of the contract.

Interest rate risk

Uncertainty about future interest rates and their impact on cash flows and the fair value of financial instruments.

Foreign exchange risk

Uncertainty about future Philippine peso cash flows stemming from assets and liabilities denominated in foreign currency.

Underlying variable

A specified interest rate, commodity price, foreign exchange rate, index of prices or rates, and other variables that influence the value of a derivative. It may be a price or rate of an asset or a liability but not the assets or liability itself.

Forward contract

A contract to purchase or sell a commodity at a designated future date at a predetermined price; a private or over-the-counter contract between two parties. Banks are the typical counterparties.

Futures contract

A contract to purchase or sell a commodity at a designated future date at a predetermined price; a standardized contract traded on an exchange market and one party will never know who is on the other side of the contract. All cash settlements are made through the exchange market.

Option

A contract that gives the holder the right (not an obligation) to purchase or sell an asset at a specified price within a given future time period. A derivative that requires initial small payment for the protection against unfavorable movement in price. Thus, it must be paid for unlike an interest rate swap, forward contract and future contract.

Call option

Gives the holder the right to purchase an asset.

Put option

Gives the holder the right to sell an asset.

Interest rate swap (IRS)

A contract whereby two parties agree to exchange cash flows for future interest payments based on a contract of loan.

Hedging

Designating one or more hedging instruments so that their change in fair value is an offset, in whole or in part, to the change in fair value or cash flows of a hedged item. A means of protecting a financing loss or the structuring of transactions to reduce risk.

Fair value hedge

Protection against the risk from changes in fair value caused by fixed terms, rates, or prices.

Cash flow hedge

Protection against the risk from changes in cash flows caused by variable terms, rates, or prices.

Hedge of a net investment in a foreign operation

Involves an underlying variable which is the foreign currency.

Four types of Financial risks

Price risk

Credit risk

Interest rate risk

Foreign exchange risk

Basic types of derivatives

Forward contract

Future contract

Option

Interest rate swap

Hedged items can be

A single asset or liability

Firm commitment

Highlt probable forecast transaction

Net investment in a foreign operation

Three types of relationship in hedging

Fair value hedge

Cash flow hedge

Hedge of a net investment in a foreign operation

Hedge Accounting

All derivatives are recognized as either “investment” assets or liabilities being recognized by either party, as market conditions change.

They are measured at fair values. A change in fair values requires the recognition of a gain or loss. A gain or loss on derivative financial instruments is accounted for depending on how the derivative is used.

Accounting in a gain or loss on derivative financial instruments when the derivative is used without hedging designation

Changes in fair value are recognized in earnings immediately.

Accounting in a gain or loss on derivative financial instruments when the derivative is used in Fair value hedge

Changes in fair value are recognized in earnings immediately. Gain or loss on the hedged risk should adjust the carrying amount of the hedged items and be recognized in earnings immediately.

Accounting in a gain or loss on derivative financial instruments when the derivative is used in Cash flow hedge

The effective portion of the gain or loss on the hedging instrument is reported in equity. The ineffective portion of the gain or loss on the hedging instrument is reported immediately in earnings.

Accounting in a gain or loss on derivative financial instruments when the derivative is used in Hedge of a net investment in foreign operation

The effective portion of the gain or loss on the hedging instrument is reported in equity. The ineffective portion of the gain or loss on the hedging instrument is reported immediately in earnings.

Types of Option

Call option and Put option

Objective of PAS 21 (The Effects of Changes in Foreign Exchange Rates)

To prescribe how to include foreign currency transactions and foreign operations in the financial statements of an entity and how to translate financial statements into a presentation currency.

Functional Currency

The currency of the primary economic environment in which the entity operates; the entity’s own currency.

Presentation Currency

The currency in which the financial statements are presented.

Number of functional currencies an entity can have

Only one, but it can have one or more presentation currencies, if an entity decides to present its financial statements in more currencies.

Initial recognition of functional currency transactions

Shall be translated to functional currency by applying the spot exchange rate between the functional currency and the foreign currency at the date of the transaction.

Subsequent reporting of functional currency transactions

You should translate all monetary items in foreign currency using the closing rate, all non-monetary items at historical cost using the exchange rate at the date of the transaction (historical rate), and all non-monetary items at fair value using the exchange rate when fair value was measured.

How all exchange rate differences are reported in foreign exchange

Shall be recognized in profit or loss, with the following exceptions:

Exchange rate gains or losses on non-monetary items are recognized consistently with the recognition of gains or losses on an item itself.

Exchange rate gain or loss on a monetary item that forms a part of a reporting entity’s net investment in a foreign operation shall be recognized:

In the separate entity’s or foreign operation’s financial statements: in profit or loss

In the consolidated financial statements: initially in other comprehensive income and subsequently, on disposal of net investment in the foreign operation, they shall be reclassified to profit or loss.

Procedure when there is a change in functional currency

The entity applies the translation procedures related to the new functional currency prospectively from the date of the change.

Translation rules for entities in non-hyperinflationary economies

An entity should translate:

All assets and liabilities for each statement of financial position presented using the closing rate of that statement of financial position. This rule applies for goodwill and fair value adjustments.

All income and expenses and other comprehensive income items using the exchange rates at the date of transaction. PAS 21 permits using some period average rates for the practical reasons, but if the exchange rates fluctuate a lot during the reporting period, then the use of averages is not appropriate.

All resulting exchange differences shall be recognized in other comprehensive income as a separate component of equity.

However, when an entity disposes the foreign operation, then the cumulative amount of exchange differences relating to that foreign operation shall be reclassified from equity to profit or loss when the gain or loss on disposal is recognized.

Primary economic environment

Is normally the one in which the entity primarily generates and expends the cash.

Date of transaction

The date when the conditions for the initial recognition of an asset or liability are met in line with PFRS.

Non-Profit Organizations (NPOs)

Civic organizations, colleges and universities, cultural institutions, hospitals, labor unions, private foundations, professional organizations, religious organizations, cooperatives and social and country clubs. They do not include governmental units.

Accounting Standards for NPOs

Adopted from the guidelines issued by the American Institute of Certified Public Accountants (AICPA) applicable to all NPOs.

Financial Statements of NPOs (FASB Statement No. 117)

Statement of Financial Position

Statement of Activities

Statement of Cash Flows

Notes to the financial statements.

Statement of Financial Position (NPOs)

Shall report the following:

Amounts of the organization’s total assets, total liabilities, and total net assets.

Amounts for each of the three classes of the organization’s net assets:

Permanently restricted net assets

Temporarily restricted net assets

Unrestricted net assets.

Statement of Activities (NPOs)

Shall report the following:

Gross amounts of revenues and expenses of the organization. Expenses by functional classifications such as program services and supporting services.

Amount of the change in the organization’s net assets for the period.

Amount of the changes in each of the three classes of the organization’s net assets: permanently restricted, temporarily restricted, and unrestricted.

Unrestricted Net Assets

Usually are those in the unrestricted (or general) fund.

Temporarily Restricted Net Assets

Generally are those in restricted funds, loan funds, and plant funds. These are expected to be released from restriction due to passage of time or the performance of some act by the NPO.

Permanently Restricted Net Assets

Ordinarily arise from permanent endowments funds.

Donor-imposed restrictions

Restrictions placed on the use of assets, liabilities, revenues, or expenses. The restrictions can be temporary or permanent.

Expenses

Reported by their functional classification such as major classes of program activities and supporting activities.

Program Activities

Goods and services provided to beneficiaries or customers that fulfill the purpose of the organization.

Supporting Services

All activities of the organization other than the program services, such as general and administrative expenses, and fund-raising costs.

Unrestricted Fund

This fund includes all the assets of a NPO that are available for use as authorized by the board of directors and not restricted for specific purposes.

Hospital's Sources of Unrestricted Fund Revenues

Patient services, unrestricted donations, and unrestricted income from endowment funds.

College and University's Sources of Unrestricted Fund Revenue

Student tuition fees, government grants, donations and private grants, and unrestricted income from endowment fund.

Nonprofit Organization's Total Revenues

Reported in the period in which services are rendered, even though part or all of the revenues is to be waived or reduced.

Contractual Adjustments

Show the unique feature of nonprofit hospitals. Accounts receivables are collectible from a third-party payor, rather than from the patient. Among the third-party payors are the Philippine Health, Medicare, and private medical insurance companies. For colleges and universities, the comparable tuition adjustment is debited to Expenditures - Student Aid account.

In the Statement of Activities, these accounts are to be deducted from the total service revenue for the month.

Allowance for Doubtful Accounts

A deduction from the Accounts Receivable in the balance sheet.

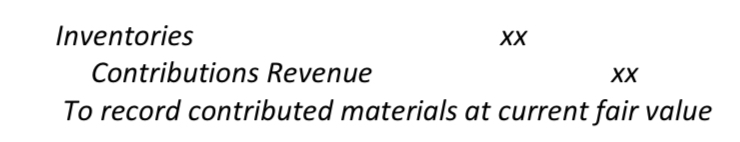

Contributed Material

Recorded in the Inventories account at its current fair value, with a corresponding credit to a revenue account in an unrestricted fund.

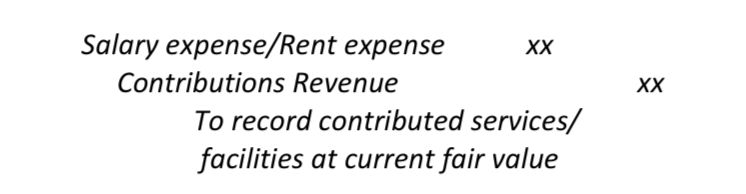

Contributed Services and Facilities

Debited to an unrestricted fund as Salary Expense for contributed services and Rent Expense for contributed facilities, with a corresponding credit to Contributions Revenue account.

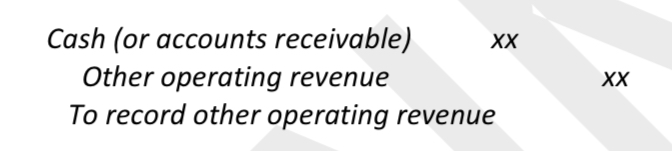

Other Operating Revenues

These represent income derived from other related activities, other than service revenues of nonprofit organizations.

Examples are proceeds from gift shops, cafeterias, snack bars, newsstands and parking lots, are all recorded as other operating revenues.

Pledges (promise to give)

A commitment by a prospective donor to contribute a specific amount of cash or property to an NPO on a future date or in installments. Those due in the future accounting periods or having restrictions as to their use are accounted for in a restricted fund.

Depreciation

Required on all the property and equipment of nonprofit organizations, except for individual works of art or historical treasures having extraordinary long economic lives.

Typical Assets of an Unrestricted Fund

Cash, investments, accounts receivable, inventories, and prepaid expense.

Liabilities of an Unrestricted Fund

Payables, accrued expenses, and deferred revenues.

Restricted Fund

NPOs establish this fund to account for assets received from donors. These assets are available for current use but expendable only as authorized by the donor of the assets.

Temporarily Restricted Funds

(1) specific- purpose funds, (2) time-restricted funds, and (3) plant replacement and expansion funds.

Permanently Restricted Funds

Assets that are to be held for an indefinite period of time and generally are included in an endowment fund.

Permanent Endowment Fund

One in which the principal must be maintained indefinitely in revenue-producing investments.

Statement of Cash Flows (NPOs)

Similar to that of a for-profit business in format (direct method or indirect method). It reports the organization's change in its cash and cash equivalents during the accounting period.

Net Cash from Operating Activities (NPOs)

All unrestricted donations are presented under operating activities. Program and support expenses are reported under operating activities.

Net Cash from Investing Activities (NPOs)

Reports the amounts spent to purchase long-term assets such as equipment, vehicles, and long-term investments. Reports the amount received from the sale of long- term assets.

Net Cash from Financing Activities (NPOs)

All temporarily or permanently restricted donations are presented under financing activities. Reports the amounts received from borrowings and any repayments.

Revenues and gains of unrestricted fund

Derived from a number of sources including membership dues, dividends and gains from investments in debt and equity securities.

Revenues derived from the endowment funds

Are accounted in accordance with the instruction of the donor to the board of directors. If there are no restrictions in its use, it is transferred to the unrestricted fund. Otherwise, these are transferred to an appropriate restrictedn fund.

Government Accounting

Encompasses the processes of analyzing, recording, classifying, summarizing, and communicating all transactions involving the receipt and disposition of government funds and property, and interpreting the results thereof.

Charged with government accounting Responsibility

Commission on Audit (COA)

Department of Budget and Management (DBM)

Bureau of Treasury (BTr)

Other government agencies.

Commission on Audit (COA)

Has the exclusive authority to promulgate accounting and auditing rules and regulations.

Keeps the general accounts of the government, supporting vouchers, and other documents.

Submits financial reports to the president and congress.

Department of Budget and Management (DBM)

Responsible for the formulation and implementation of the national budget with the goal of attaining the nation’s socio-economic objectives.

Bureau of Treasury (BTr)

Acts as cash custodian of the government.

Authorized to receive and keep national funds and manage and control the disbursements thereof

Maintains accounts of financial transactions of all national government offices, agencies and instrumentalities.

Government Agencies

Refers to any department, bureau or office of the national government, or any of its branches and instrumentalities, or any political subdivision, as well as any government owned or controlled corporation (GOCC), including its subsidiaries, or other self-government board or commission of the government.

National Budget

The government’s estimate of the sources and uses of government funds within a fiscal year.

The Budget Cycle

Budget Preparation

Budget Legislation

Budget Execution

Budget Accountability.

Budget call

The budget preparation starts when the Department of Budget and Management (DBM) issues this to all government agencies.

It contains, among other things, the next fiscal year’s targets, the agency’s budget ceiling and other guidelines in the completion and submission of agency budget proposals.

Budget hearing

The DBM deliberates on the budget proposals, makes recommendations, and consolidates the deliberated proposals into the National Expenditure Program (NEP) and Budget of Expenditures and Sources of Financing (BESF). The DBM then submits the proposed budget to the President

Preparation to the Office of the President

After the President approves the proposed budget, the DBM finalizes the budget documents to be submitted to the Congress. At this point, the proposed budget is referred to as the President’s Budget.

House Deliberations

The house of representatives conducts hearings to scrutinize the various agencies’ respective proposed programs and expenditures. Thereafter, the HOR will prepare General Appropriation Bill (GAB).

Senate Deliberation

The senate conducts its own deliberations on the GAB

Bicameral deliberations

This is formed to harmonize any conflicts between the representatives and senate versions of GAB. Thereafter, final GAB is submitted to the President for enactment.

President’s enactment

The president enacts the GAB and will now known as General Appropriations Act (GAA). The president, however, may exercise his veto power before his enactment of the bill.

Release guidelines and BEDs

The DBM issues guidelines on the release and utilization of funds while the various agencies submit their Budget Execution Documents (BEDs).

Allotment

Authorization issued by the DBM to government agencies to incur obligations for specified amounts contained in a legislative appropriation in the form of budget release documents.

Posted in the Registry of Appropriations and Allotments (RAPAL) and Registries of Allotments, Obligations, and Disbursements (RAOD).

Incurrence of obligations

Government agencies incur obligations which will be paid by the government.

Recorded in the Obligation Request and Status (ORS) documents and Registries of Allotments, Obligations, and Disbursements (RAOD)

Appropriation

Authorization by a legislative body to allocate funds for specified purposes.

Posted in the Registry of Appropriations and Allotments (RAPAL).

Obligation

Amount contracted by an authorized officer for which the government is held liable.

Disbursement

Actual amount paid out of the budgeted amount.

Budget accountability reports

It is required by the government agencies to submit.

Performance reviews

The DBM and COA perform periodic reviews of the agencies’ performance and budget accountability and report to the president.

Audit

The COA audits the agencies

Budget Registries

Registries of revenue and other receipts (RROR)

Registries of appropriations and allotment (RAPAL)

Registries of allotments, obligations and disbursements (RAOD)

Registries of budget, utilization, and disbursements (RBUD)

Registries of revenue and other receipts (RROR)

Used to monitor the budgeted amounts, actual collections and remittances of revenue and other receipts.

Registries of appropriations and allotments (RAPAL)

Used to monitor appropriations and allotments. This is to ensure that allotments will not exceed appropriations.

Registries of allotments, obligations and disbursements (RAOD)

Used to monitor the allotments received, obligations incurred against the corresponding allotment, and the actual disbursements made.