Labor Law Midterms

1/44

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

45 Terms

Sources of Labor Law

1987 Constitution

Article XIII Section 3

Presidential Decree No. 442

Labor Code

Rights of Workers under Constitution

Self-organization

Collective bargaining and negotiations

Peaceful concerted activities

Including right to strike in accordance with law

Security of tenure

Humane conditions of work

Living wage

Participation in policy and decision making processes affecting their rights and benefits

Principle of shared responsibility between workers and employers

Right of labor to its just share in fruits of production

Right of enterprises to reasonable returns to investments

Factors Determining Employer-Employee Relationship

Four-Fold Test

Selection and engagement of worker

Payment of wages or salaries

Power of dismissal

Power of control not just end result but manner and means utilized

Economic Reality test

Based on totality of circumstances → if economic dependency

Kinds of Employees

Found in labor code

Regular → employee engaging in desirable activities

Casual → employment not covered in 1st paragraph of article 295

Project → employment fixed for a specific project

Seasonal → work performed is seasonal in nature and employed for duration of the season

Other kinds

Probationary

Fixed Term Employment

Learners and Apprentices

Women Workers

Minor Employment

Kasambahay

Persons with Disability

Employees Becoming Regular Employees

Casual:

Rendered at least 1 year of service, continuous or broken

Probationary employees

Working after the probationary period ended

Project Employee

Continuous rehiring of project employees even after the end of the project

Tasks performed by employee are vital, necessary and indispensable to business or trade of the employer

Seasonal

Hired repeatedly for the same task or work

Learners:

Employer obliged to hire learner after lapse of learnership period

Probationary Employment

Period to determine whether employee meets standards to become a regular employee

Period shall not exceed 6 months

If past 6: becomes regular employee

Employer makes known to employee the standards being considered

Employment of probationary employee may be terminated only for a just cause, or if they fail to qualify as a regular employee based on the standards

IF NO STANDARDS MADE KNOWN: employee deemed regular

Fixed Term Employment

Contract of employment with fixed term should comply w/:

Fixed period known and agreed upon by parties

Appears that employer and employee dealt with each other on more o r less equal terms with no moral dominance

Learners and Apprentices

Learners employed when:

No experienced workers available

Employment of learners necessary to prevent curtailment of employment opportunities

Employment doesn’t create unfair competition (labor costs or lower working standards)

Apprentices

Employer has to be in highly technical industry

Apprenticeship is in an apprenticable occupation

Approved by Secretary of Labor and employment

Must be signed

WAGES: 75% of legal wage

Duration of apprenticeship: Not exceed 6 months, but not less than 3 months

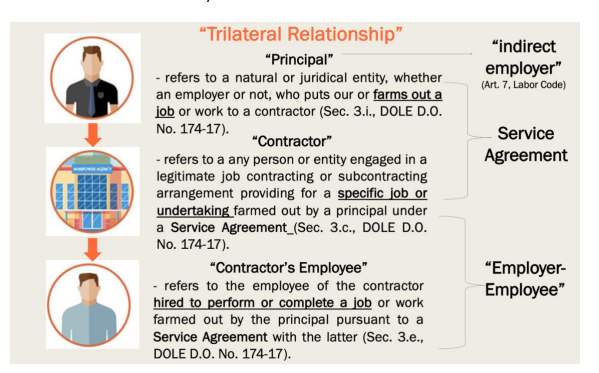

Subcontracting

Trilateral Relationship

Principal

Subcontractor

Subcontracted

Kinds of Subcontracting

Labor only contracting

Person supplying workers to an employer doesn’t have substantial capital or investments in tools, equipment, etc. Basically they are just agents.

Job Contracting

Distinct Business

Substantial Capital

Free from principal’s control

Workers’ rights are ensured

Facilities for Women (Article 130 of labor code)

Proper seats for women to use when free from work or during work hours

Separate toilet rooms

Dressing room

Nursery in the workplace

Appropriate minimum age and other standards for retirement or termination

But not required ^^

Leaves for Women

Maternity Leave (R.A. 11210)

105 days

If solo parent: + 15 days

Leave under R.A. 9262

10 days

Leave due to Gynecological Surgery (R.A. 9710)

2 months

Solo Parent’s Leave (R.A. 8972)

7 working days per year

Prohibitions against Discrimination of Women (Article 133 of labor code)

Payment of lesser compensation to a female employee as against a male employee for work of equal value

Favoring a male employee over a female employee with respect to promotion, training opportunities, etc. solely on account of their sexes

Favoring a male employee over a female employee with respect to dismissal of personnel

Stipulations against Marriage (Article 134)

Unlawful for employer to:

Make a condition of employment be that woman employee shall not get married

That woman employee shall be deemed resigned upon marriage

Dismiss, discharge, discriminate or otherwise prejudice a woman employee by reason of her marriage

Prohibited acts against Women (Article 135)

Deny any women employee the benefits provided for in the labor code or to discharge woman employee to prevent her from enjoying any of the benefits

Discharge a woman on account of her pregnancy, or while on leave or confinement due to pregnancy

Discharge or refuse admission of such woman upon returning to her work for fear that she may again be pregnant

Disabled persons / Handicapped

Those suffering from restriction of different abilities, mental physical or sensory

Equal Opportunity R.A. 7277

Qualified disabled employee shall be subject to same terms and conditions of employment and same compensation, benefits, etc. as a qualified able-bodied person

Sheltered Employment

Provision of productive work for disabled persons through workshop providing special facilities, income producing projects or homework schemes enabling them to acquire a working capacity required in open industry

Incentive for Employers in hiring Disabled Persons

25% deduction from gross income of employed disabled persons

Private entities that modify or improve physical facilities for accommodation are entitled to deduction from net taxable income equivalent to 50% of direct costs of improvements or modifications

Child and Working Child

Child: Anyone below 18 years old

Working child: Any child engaged in work or economic activity

Working Child below 15 Years Old

Child works directly under sole responsibility of his parent/guardian and doesn’t interfere with schooling

Child’s employment in public entertainment or information through cinema, etc. is essential

Working Hours of a Child

Below 15

Max 4 hours a day

20 hours a week

Curfew: 8PM to 6AM

15-17

Max 8 hours a day

40 hours a week

Worst Forms of Child Labor

All forms of slavery

Use, procuring, offering or exposing of a child for prostitution

Use, procuring or offering of a child for illegal or illicit activities (production and trafficking of dangerous drugs)

Work which is hazardous or likely to be harmful to the health, safety or morals of children

Employment of children in certain advertisements

Children can’t be models in advertisements promoting alcoholic beverages, intoxicating drinks, tobacco, gambling, violence or pornography

Coverage of Kasambahay Law

General househelp

Nursemaid / yaya

Cook

gardener or laundry person

Any person who regularly performs domestic work in one household on an occupational basis

DOESNT INCLUDE: children under foster family arrangement

Rights of Kasambahay

Just and human treatment

Lodging, food, medical attendance

Privacy

Access to outside communication

Education and Training

Terms and Conditions of Employment of Kasambahay

Minimum age of 15

8 hours a day

1 rest day a week

Can’t be assigned to work in commercial, industrial or agricultural enterprise at wage lower than what would be provided for those workers

NCR 5,000 minimum wage

Pay wage at least once a month in cash

Entitled to 13th month pay

Worker who rendered at least 1 year of service = gets annual leave of 5 days with pay

Worker who rendered at least 1 month of service = covered by SSS, PhilHealth, Pag-IBIG

Premium payments or contributions shouldered by employee

Unless domestic worker receiving wage of PHP 5000 and above = pay proportionate share

Wages definition (Article 97 f of Labor Code)

Remuneration or earnings expressed in terms of money

Payable by an employer to an employee under a written or unwritten contract of employment for work done or to be done

Generally, employer and employee agree on amount of wage an dhow it is determined

Fixed for a period or by task or result

Minimum Wage

Minimum amount employer is required to pay wage earners, that cannot be reduced.

2 bodies that determine minimum wage for regions: National wages and productivity Commission (policy making body),

Regional Tripartite Wages and Productivity Boards (minimum wages in specific regions)

What should Wages be paid in

Legal Tender

Payment by check, postal money order or ATM is allowed if

Bank or other facility for encashment within a radius of 1 km from workplace

Employer doesn’t receive any benefits from the arrangement

Employees given reasonable time during banking hours to withdraw wages from bank (time considered compensable hours worked if done during working hours)

Check payment with written consent of employees

When should wages be paid

Paid at least once every 2 weeks, or not more than 16 day interval

Where should wages be paid

Made at or near the place of undertaking

To Whom should wages be paid

Paid directly to workers to whom they are due except:

Where fore majeure prevents payments → workers paid through another person

If worker is dead = employer may pay to the heirs

Rules on Wages

No Interference → employer can’t interfere with freedom of employee to dispose of their wages

No deductions except

Reimbursment of insurance paid by employer

Union dues where right to check off has been recognized by employer

When employer is authorized by law such as for taxes and payment of SSS, PhilHealth, PAG-Ibig

No deposits for tools

Forcing, intimidating or otherwise causing worker to give up part of their wage without consent

Coverage of Wage Related Benefits

All except:

Government employees

Managerial employees

Feild personnel

Members of family of employer

Domestic Helpers

Persons in the personal service of another

Workers who are paid by results as determined by Secretary of Labor

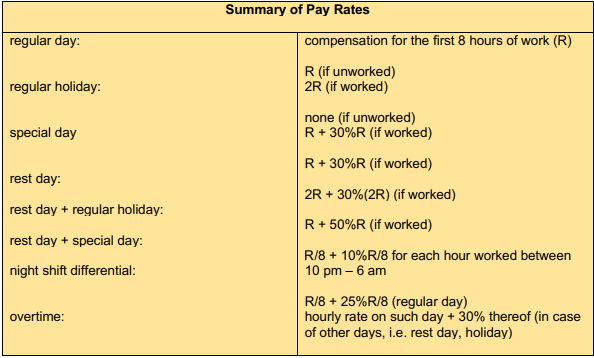

Hours of work and Overtime pay

Normal hours: 8

Meal periods of 1 hour or less: not counted in hours worked

Rest periods and coffee breaks of 5-20 minutes: considered hours worked

Overtime pay: Regular wage + 25%

Overtime on holiday or rest day: Additional compensation equivalent to rate of first 8 hours on a holiday or rest day plus 30%

Night Shift Differential in Wages

Minimum additional of 10% of regular wage for each hour of work during 10PM to 6AM

Weekly Rest Periods

Employees entitled to a rest period of minimum 24 hours after every 6 normal work days

-If worked on rest day: additional compensation of 30% of regular wage

-If worked on rest day that is also holiday: premium is 50% of regular wage

Holidays

2 kinds:

-Regular: 200% of wage if worked, 100% if not

-Special: 130% of wage if worked, 0% if not

Regular Holidays

New Year’s Day- Jan 1

Maundy Thursday, Good Friday, Edul Fitr, Eidul Adha - all movable dates

Araw ng Kagtingan - Monday nearest April 9

Labor Day- Monday nearest May 1

Independence Day- Monday nearest June 12

National heroes Day- Last Monday of August

Bonifacio Day - Monday nearest November 30

Christmas - December 25

Rizal Day - Monday nearest December 30

Special Days/ Special Holidays

Ninoy Aquino Day- Monday nearest August 21

All Saints Day- November 1

Feast of the Immaculate Conception - December 8

Last Day of the Year- December 31

Service Incentive Leave

Every employee who rendered at least 1 year of service: yearly service incentive leave of 5 days with pay

NOT AVAILBLE TO ESTABLISHMENT SWITH LESS THAN 10 EMPLOYEES

Leave days unused by end of year : converted to cash, can’t be added to next year

Service Charges

Service charges collected by hotels, restaurants, etc. will be distributed equally among workers

13th Month Pay

All rank and file employees who worked at least one month during calendar year: Entitled to not less than 1/12 of total basic salary earned within a calendar year

SHOULDN’T BE PAID LATER THAN DEC 24

Summary of Pay Rates