GDP

1/19

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

20 Terms

What is GDP

Gross Domestic Product, is the total monetary value of all finished goods and services produced within a country’s borders over a specific period of time—usually a quarter or a year. Most common used indicator to measure economic performance of a country.

What is a Security?

A financial instrument that holds monetary value and can be traded. It represents an ownership position, a creditor relationship, or rights to ownership.

Major Economic Indicators

Economic Growth

Inflation

Unemployment

Business Confidence

Housing

Inflation

Inflation is the rate at which the general level of prices for goods and services rises over time, causing the purchasing power of money to decrease.

Business Confidence

Business confidence refers to how optimistic or pessimistic businesses feel about the future of the economy, their industry, and their own performance.

It is an important leading economic indicator because it gives insight into how businesses are likely to act in the near future—especially regarding investment, hiring, and expansion.

Formula for GDP

GDP = C + I + G + (X - M)

C: Personal Consumption

I: Private Investment

G: Government Consumption

X: Exports

M: Imports

X-M: Net Exports

Growth rate

The GDP growth rate is the percentage change in a country's Gross Domestic Product over a specific period, typically quarterly or annually. It reflects how fast an economy is expanding or contracting. There are two main types of GDP growth: nominal and real. Nominal GDP growth measures the increase in economic output using current prices and includes the effects of inflation. In contrast, real GDP growth adjusts for inflation and reflects the actual increase in the volume of goods and services produced. This makes real GDP a more accurate indicator of true economic growth over time. While nominal GDP may rise due to higher prices rather than more production, real GDP isolates economic performance by removing the impact of price changes. As a result, investors and economists primarily focus on real GDP growth because it provides a clearer picture of the economy’s underlying health and productivity.

Example of growth rate

For example, suppose a country’s GDP increased from $2 trillion to $2.2 trillion over one year. This reflects a nominal GDP growth rate of 10%. However, if inflation during that same period was 6%, the real GDP growth rate—which adjusts for inflation—would be only 4%. This means that while the economy appears to have grown by 10% on paper, only 4% of that growth reflects an actual increase in the production of goods and services; the remaining 6% is simply due to higher prices. This distinction is important because investors, policymakers, and economists are more concerned with real growth, as it better reflects improvements in economic productivity and standard of living, rather than price level changes.

Nominal GDP Growth Rate

Nominal GDP Growth Rate refers to the percentage increase in a country’s Gross Domestic Product using current market prices, without adjusting for inflation. It measures the change in the total value of goods and services produced in the economy over a specific period. Because it includes changes in price levels, nominal GDP can rise simply due to inflation, even if the actual quantity of goods and services remains the same.

Nominal GDP Growth = Real GDP Growth + Inflation

Real GDP Growth Rate

Real GDP Growth Rate, on the other hand, measures the percentage increase in economic output after removing the effects of inflation. It reflects the actual growth in the volume of goods and services produced, giving a more accurate picture of an economy’s performance over time

Real GDP Growth Rate = Nominal GDP Growth - Inflation

Recession

Two consecutive quarters of negative real GDP growth

Personal Consumption Expenditures (PCE)

The Personal Consumption Expenditures (PCE) Price Index is another important measure of inflation, similar to the Consumer Price Index (CPI), but with some key differences. It tracks the average change in prices paid by consumers for goods and services over time, and it is the Federal Reserve’s preferred measure for gauging inflation in the U.S.

Consumer Price Index

The Consumer Price Index (CPI) is a measure that tracks the average change in prices over time that consumers pay for a fixed basket of goods and services. It reflects the cost of living and is one of the most widely used indicators of inflation.

Difference between CPI and PCE?

PCE reflects a broader, more flexible measure of inflation accounting for changing consumer habits.

CPI focuses on the prices consumers pay directly and uses a fixed basket of goods.

How fixed basket changes and can affect inflation reports

What people may have been buying continuously a decade ago is subject to change over time as technology evolves and spending habits changes, meaning to capture inflation, the fixed basket we analyze matters and the changes need to be reflected.

How does unemployment affect economic growth

For the US GDP, personal consumption makes majority of the US GDP, which is directly correlated with peoples salary and their jobs. If more people are unemployed, this affects economic growth as personal consumption will decrease and people will need to budget more. The citizens are also more likely to turn on their government if unemployment gets too high, effecting economic growth and stability of the country's.

Recession and Unemployment

Whenever the economy shrinks, this leads to more unemployment

Purchasing Manager Index (PMI)

The Purchasing Managers’ Index (PMI) is an economic indicator that measures the health of the manufacturing and service sectors based on surveys of purchasing managers. These managers report on factors like new orders, production levels, supplier deliveries, and employment. A PMI above 50 indicates that the sector is expanding, while a number below 50 suggests contraction. Because manufacturing and services are major parts of the economy, the PMI gives an early signal of economic growth or slowdown.

Monitoring GDP

To most investors, GDP is a useless metric as it comes out at the end of every quarter, making it less efficient. In comparison, their are other economic indicators, such as ISM Manufacturing PMI, Change in Nonfarm Payrolls, Housing and other indicators which can help predict what the economic performance will be.

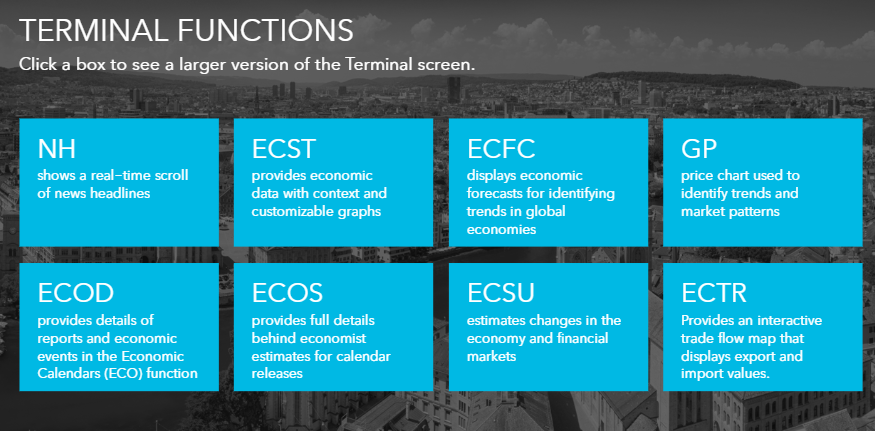

Terminal Functions