Understanding Bond Prices and Yields IM exam 2

1/110

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

111 Terms

Bond

A security that obligates the issuer to make specified payments to the holder over a period of time

Bond indenture

The contract between an issuer and the bond holder

Par value (face value)

The payment to the bondholder at the maturity of the bond

Coupon payments

Per period payments of interest for the life of the bond

Coupon rate

A bond's annual interest payment per dollar of par value

Zero-coupon bonds

A bond paying no coupons that sells at a discount and provides only a payment of par value at maturity

Accrued interest

Annual coupon payment divided by Days separating coupon payments multiplied by Days since last coupon payment

Flat price

Net of accrued interest

Invoice price

Includes the accrued interest

Corporate Bonds

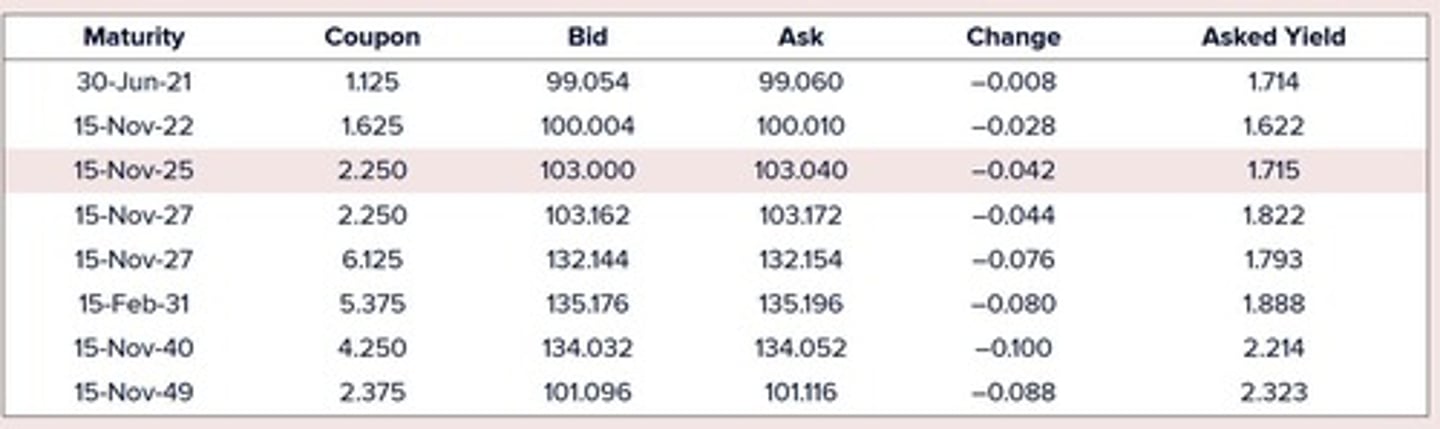

Thin market due to variety of issues along maturity, coupon rate, seniority, etc.

Straight bonds

Bond that pays a fixed coupon every period and repays its full face value at maturity

Callable bonds

Bond that may be repurchased by the issuer at a specified call price during the call period

Refunding

New bond issue pays for repurchase of higher-coupon callable bonds

Deferred callable bonds

Callable bonds with a period of call protection

Convertible bonds

Bond where the bondholder can exchange the bond for a specified number of stock

Market conversion value

The current value of the shares for which the bonds may be exchanged

Conversion premium

Excess of the bond price over its conversion value

Puttable bonds

Bond where investor can exchange for par value at some date or extend for a given period

Floating-rate bonds

Bond with coupon rates periodically reset according to a specified market rate

Preferred stock

Considered equity but functions like fixed-income

Floating-rate preferred stock

Pays dividend rate linked to a measure of current market interest rates

Maturity

Some firms issue 50 to 100 year bonds, whereas convention is 30

Inverse floater

Interest rate falls when general level of interest rate rises

Asset-backed bonds

Income from a specified group of assets servicing debt

Pay-in-kind bonds

Issuer may pay interest in either cash or additional bonds

Catastrophe bonds

Payments halted conditional on a catastrophe

Indexed bonds

Payments tied to a general price index or the price of a commodity

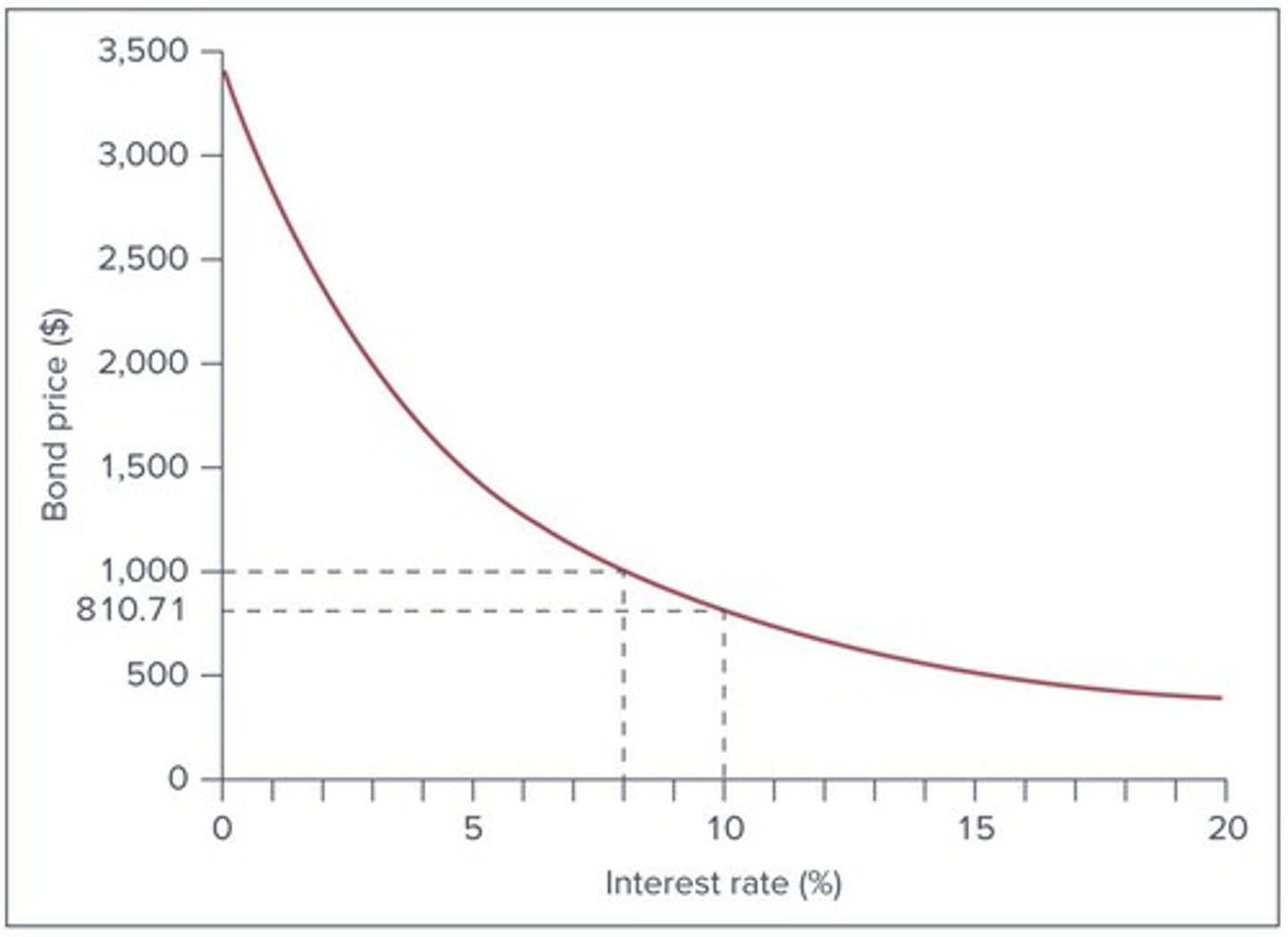

Bond value

Present value of coupons + Present value of par value

Annuity Factor

1/r * (1 - (1/(1 + r)^T))

Present Value Factor

1/(1 + r)^T

Example of Bond Pricing

Consider 30-yr bond with a 8% semi-annual coupon and par value of $1000

Yield to Maturity

Annualized discount rate (i.e. r × N) that makes the PV of payments equal the price for a bond paying N times a year.

Average rate of return

Average rate of return earned by an investor purchasing a bond at a given price

Bond price formula

Bond price = Coupon × Annuity factor(r, T) + Par value × PV factor(r, T)

Current yield

Current yield = Annual Coupon, differs from the coupon rate because it uses bond price instead of par value and differs from the yield to maturity because it doesn't account for changes in bond prices.

Premium bonds

Bonds that sell above par value.

Discount bonds

Bonds that sell below par value.

Yield to Maturity (YTM)

The total return anticipated on a bond if the bond is held until it matures.

Example of Yield to Maturity

Suppose you have a 8% semi-annual coupon on a 30-yr bond with a face value of $1000 and bond price of $1276.76.

Bond equivalent yield

Bond equivalent yield is calculated as r × n, where n is the number of periods within a year.

Effective annual yield

Effective annual yield is the return after accounting for compound interest, calculated as (1 + r)n.

Yield to Call

Yield to call is how much investors should demand if the firm calls its bond after call protection is over.

Callable bond

A bond that can be redeemed by the issuer prior to its maturity.

Reinvestment rate (RR)

Rate at which a coupon payment can be reinvested.

Realized compound return (RCR)

Compound rate of return on a bond with all coupons reinvested until maturity.

Total Value calculation

Total Value = Coupon1(1 + RR1) + Coupon2 + Par Value.

Realized Compound Return formula

V0(1 + r)T = VT.

Horizon analysis

Analysis of bond returns over a multiyear horizon using forecasts of YTM and RR.

Properties of YTM, RR, & RCR

When RR equals the YTM, then the RCR equals the YTM; when RR is higher than the YTM, then the RCR is higher than the YTM; when RR is lower than the YTM, then the RCR is lower than the YTM.

Interest rates effect on callable bonds

Interest rates fall → Future payments expensive; Interest rates rise → Future payments cheaper.

RCR with RR equal to YTM

If RR equals YTM, then RCR equals YTM.

RCR with RR less than YTM

When RR is lower than the YTM, then the RCR is lower than the YTM.

RCR with RR greater than YTM

When RR is higher than the YTM, then the RCR is higher than the YTM.

Reinvestment rate risk

Uncertainty surrounding the cumulative future value of reinvested bond coupon payments.

Bond prices

Must adjust to compensate or cost investors.

Coupon rate

Determines whether a bond sells above or below par based on its comparison to the market rate.

Selling above par

Occurs when the coupon offers more than the market rate.

Selling below par

Occurs when the coupon offers less than the market rate.

Price at maturity

Must equal par value.

After-tax risk-adjusted basis

Rates must be comparable on this basis.

Holding-period return (HPR)

Calculated as Total Annual Coupons + Final Bond Price - Initial Bond Price.

Yield to Maturity (YTM)

Based on bond's coupon, current price, and par value at maturity.

Difference between YTM and HPR

YTM is based on bond's coupon, current price, and par value at maturity; HPR is based on bond's coupon, current price, and price at the end of a holding period.

Market rates fall

Holding-period return will reflect a rise in price.

Market rates rise

Holding-period return will reflect a fall in price.

Longer horizons

At longer horizons, the YTM will reflect reinvestment of coupons.

Example of HPR

Consider a 3-yr bond with a 7% annual coupon and face value $1000.

Capital Gains

The increase in the bond's price over time.

Bond Characteristics

Attributes that define a bond's behavior and pricing.

Bond Pricing

The process of determining the fair value of a bond.

Price

Price = 70 × Annuity Factor(8%, 3) + 1000 × PV Factor(8%, 3)

Holding Period Return (HPR)

HPR = (982.17 − 974.23 + 70) / 974.23 = 8%

Original Issue Discount Bonds

Bonds issued with low coupon rates, sell below par value

Zero-Coupon Bonds

Bonds that carry no coupons, such as T-bills

Treasury STRIPS

Each semiannual coupon is treated as a zero-coupon bond

Price of 30-year zero-coupon bond

Price = 1000 / (1+r)^T

Taxable Interest Income

IRS calculates taxable interest income from the price appreciation even if original-issue discount bond does not sell

Imputed Interest Income

IRS will impute interest income as 63.04 - 57.31 = 5.73

Capital Gains

Calculated as 64.72 - 63.04 = 1.68

Bond Ratings

Rating agencies assess credit risk of firms; bonds rated BBB or Baa and above are considered investment grade

Coverage Ratios

Ratio of company earnings to fixed costs (e.g. times-interest-earned ratio, fixed-charge coverage ratio)

Leverage Ratios

Measures how debt laden a firm is (e.g. debt-to-equity)

Liquidity Ratios

Measures the firm's ability to raise cash (e.g. current ratio, quick ratio)

Profitability Ratios

Measures overall performance (e.g. return on assets, return on equity)

Bond Indenture

Contract between the issuer and bondholder specifying restrictions protecting the bondholder

Sinking Fund

Issuer must periodically repurchase some bonds prior to maturity

Subordination Clause

Restricts additional borrowing, may allow subordinated/junior debt

Yield-to-Maturity

Represents maximum possible yield; expected yield to maturity must take into account default

Default Premium

Premium to compensate for default risk; difference between promised yield and riskless government bond

Credit Default Swaps

Insures against the default risk of a bond

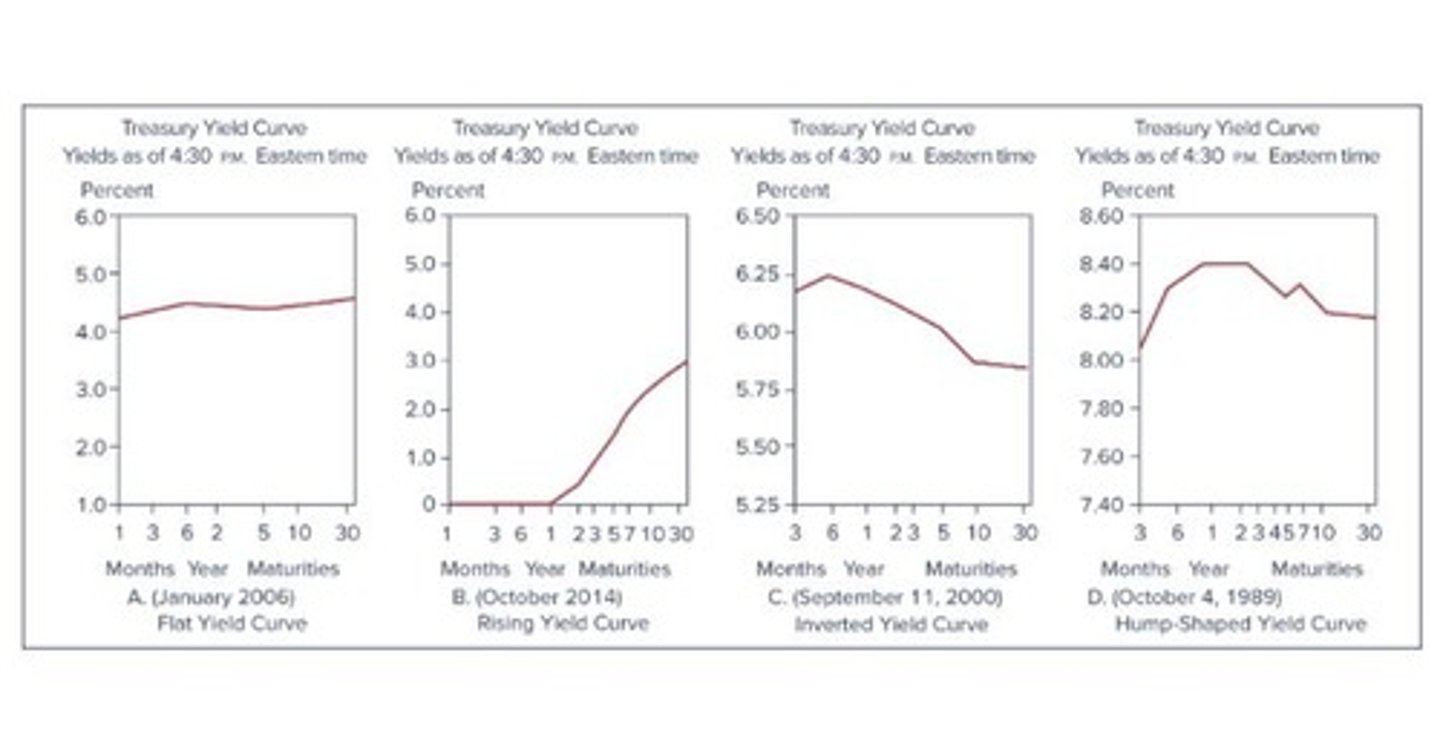

Term Structure of Interest Rates

The relationship between yields to maturity and terms to maturity across bonds

Expectations Theory

Slope of the yield curve is due to expectations of changes in short-term rates

Forward Rate

Inferred future interest rate based on current yield curve

Example of Forward Rates

Using YTM values to calculate implied forward rates for future periods

ynew1

0

ynew2

0

Price of a two-year zero-coupon bond

811.62 when YTM is 11%

Price with ynew1

892.78 when discounted by (1 + 0.1201)

HPR

0.10 calculated as (892.78 - 811.62) / 811.62

Liquidity Preference Theory

Investors demand a risk premium on long-term bonds.