IB Business Management OPERATIONS MANAGEMENT 5.5 Production Planning

1/29

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

30 Terms

Stock (inventory)

Materials and goods required to allow for the production of and supply of products to the customer.

Manufacturing businesses will hold stocks in three distinct forms:

1. Raw materials and components. These will have been purchased from outside suppliers. They will be held in stock until they are used in the production process.

2. Work in progress. At any one time the production process will be converting raw materials and components into finished goods and these are 'work in progress'. For some firms, such as construction businesses, this will be the main form of stocks held. Batch production tends to have high work-in-progress levels.

3. Finished goods. Having been through the complete production process goods may then be held in stock until sold and despatched to the customer.

Three costs associated with stock holding:

1. Opportunity cost. Working capital tied up in stocks could be put to another best alternative use. The capital might be used to pay off loans, buy new equipment or pay off suppliers, or could be left in the bank to earn interest.

2. Storage costs. Stocks have to be held in secure warehouses. They often require special conditions, such as refrigeration. Staff will be needed to guard and transport the stocks which should be insured against fire or theft.

3. Risk of wastage and obsolescence. If stocks are not used or sold as rapidly as expected, then there is an increasing danger of goods deteriorating or becoming outdated. This will lower the value of such stocks. Goods often become damaged while held in storage - they can then only be sold for a much lower price.

Costs of not holding enough stocks:

1. Lost sales. If a firm is unable to supply customers 'from stock', then sales could be lost to firms that hold higher stock levels. This might lead to future lost orders too. In purchasing contracts between businesses, it is common for there to be a penalty payment clause requiring the supplier to pay compensation if delivery dates cannot be met on time.

2. Idle production resources. If stocks of raw materials and components run out, then production will have to stop. This will leave expensive equipment idle and labour with nothing to do. The costs of lost output and wasted resources could be considerable.

3. Special orders could be expensive. If an urgent order is given to a supplier to deliver additional stock due to shortages, then extra costs might be incurred in administration of the order and in special delivery charges.

4. Small order quantities. Keeping low stock levels may mean only ordering goods and supplies in small quantities. The larger the size of each delivery, the higher will be the average stock level held. By ordering in small quantities, the firm may lose out on an important economy of scale such as discounts for large orders.

Economic order quantity (EOQ)

The optimum or least-cost quantity of stock to re-order taking into account delivery costs and stock-holding costs

Buffer stocks

The minimum stocks that should be held to ensure that production could still take place should a delay in delivery occur or production rates increase.

Re-order quantity

The number of units ordered each time.

Lead time

The normal time taken between ordering new stocks and their delivery.

Re-order stock level

The level of stocks that will trigger a new order to be sent to the supplier.

Just in case (JIC)

Holding high stock levels 'just in case' there is a production problem or an unexpected upsurge in demand.

Why just in case production methods requires buffer stocks:

1. failure of supplying firm to deliver on time

2. production problems halting output

3. increased consumer demand.

Just in time (JIT)

A stock control method that aims to avoid holding stocks by requiring supplies to arrive just as they are needed in production and completed products are produced to order.

Advantages of Just in Case Stock Management:

1. Stocks of raw materials can be used to allow the firm to meet increases in demand by increasing the rate of production quickly.

2. Raw-material supply hold-ups will not lead to production stopping.

3. Economies of scale from bulk discounts will reduce average costs.

4. Stocks of finished goods can be displayed to customers and increase the chances of sales.

5. Stocks of finished goods used to meet sudden, unpredicted increases in demand - customers can be satisfied without delay.

6. Firms can stockpile completed goods to meet anticipated increases in demand as with seasonal goods or products, such as toys at festival times.

Disadvantages of Just in Case Stock Management:

1. High opportunity costs of working capital tied up in stock.

2. High storage costs.

3. Risk of goods being damaged or becoming outdated.

4. 'Getting it right first time' - a key component of lean production - matters less than with JIT as other supplies are kept in stock to replace defective items.

5. Space used to store stock cannot be used for productive purposes.

Important conditions for JIT to be successful:

1. Relationships with suppliers have to be excellent.

2. Production staff must be multi-skilled and prepared to change jobs at short notice.

3. Equipment and machinery must be flexible.

4. Accurate demand forecasts will make JIT a much more successful policy.

5. The latest IT equipment will allow JIT to be more successful.

6. Excellent employee-employer relationships are essential for JIT to operate smoothly.

7. Quality must be everyone's priority.

Advantages of Just-in-Time (JIT) Stock management systems:

1. Capital invested in inventory is reduced and the opportunity cost of stock holding is reduced.

2. Costs of storage and stock holding are reduced.

3. Space released from holding of stocks can be used for a more productive purpose.

4. Much less chance of stock becoming outdated or obsolescent. Less stock held also reduces the risk of damage or wastage.

5. The greater flexibility that the system demands leads to quicker response times to changes in consumer demand or tastes.

6. The multi-skilled and adaptable staff required for JIT to work may gain from improved motivation.

Disadvantages of Just-in-Time (JIT) Stock management systems:

1. Any failure to receive supplies of materials or components in time caused by, for example, a strike at the supplier's factory, transport problems or IT failure, will lead to expensive production delays.

2. Delivery costs will increase as frequent small deliveries are an essential feature of JIT.

3. Order administration costs may rise because so many small orders need to be processed.

4. There could be a reduction in the bulk discounts offered by suppliers because each order is likely to be very small.

5. The reputation of the business depends significantly on outside factors such as the reliability of supplying firms.

Reasons why JIT may not be suitable for all firms at all times:

1. There may be limits to the application of JIT if the costs resulting from production being halted when supplies do not arrive far exceed the costs of holding buffer stocks of key components.

2. Small firms could argue that the expensive IT systems needed to operate JIT effectively cannot be justified by the potential cost savings.

3. Rising global inflation makes holding stocks of raw materials more beneficial as it may be cheaper to buy a large quantity now than smaller quantities in the future when prices have risen.

4. Higher oil prices will make frequent and small deliveries of materials and components more expensive.

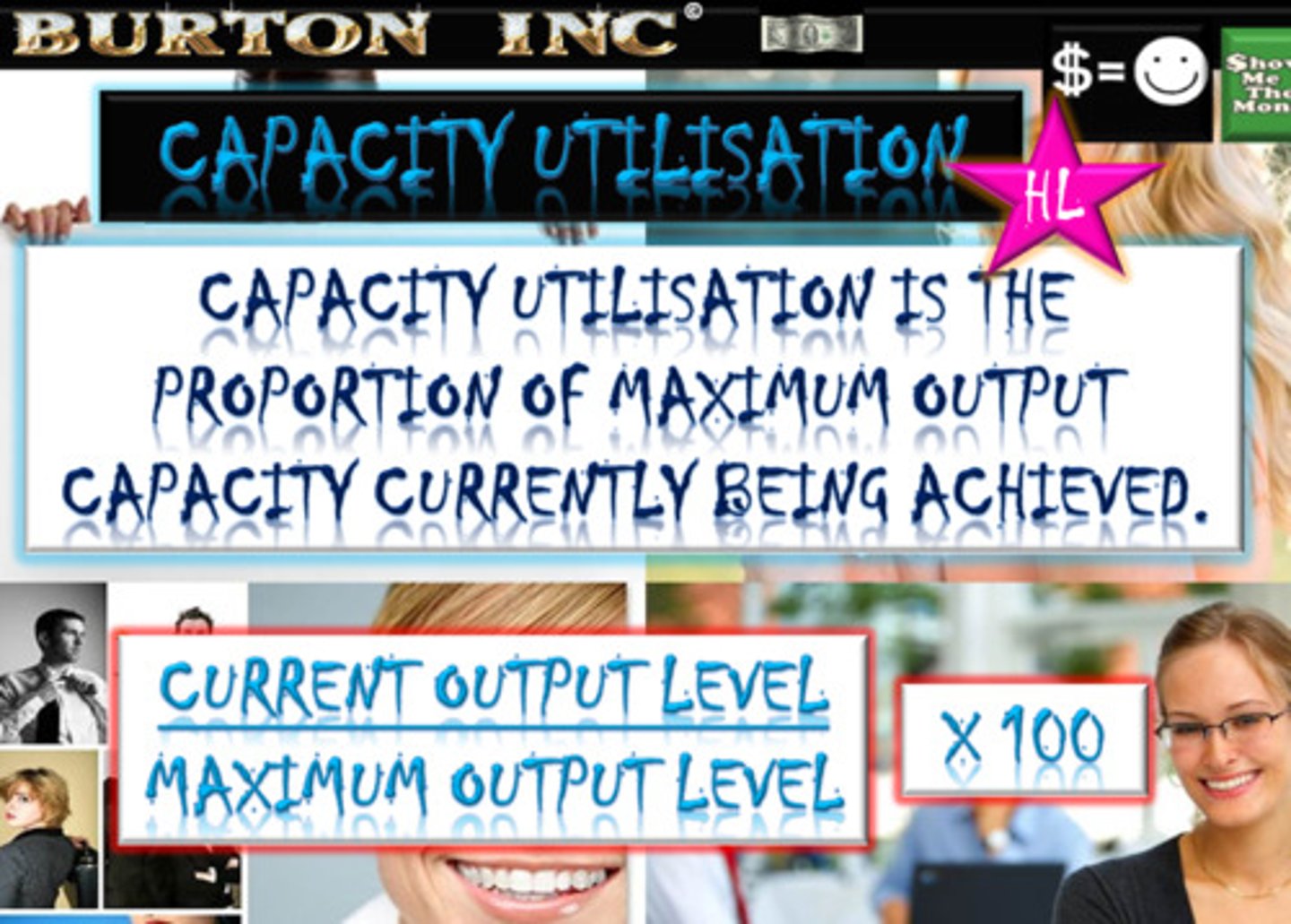

Capacity utilisation

The proportion of maximum output capacity currently being achieved.

Capacity utilisation is calculated by the formula:

Potential drawbacks to operating at full capacity for a long period of time:

1. Staff may feel under pressure due to the workload and this could raise stress levels. Operations managers cannot afford to make any production scheduling mistakes, as there is no slack time to make up for lost output.

2. Regular customers who wish to increase their orders will have to be turned away or kept waiting for long periods. This could encourage them to use other suppliers with the danger that they might be lost as long-term clients.

3. Machinery will be working flat out and there may be insufficient time for maintenance and preventative repairs and this could lead to increased unreliability in the future.

Excess capacity

Exists when the current levels of demand are less than the full capacity output of a business - also known as spare capacity.

Full capacity

When a business produces at maximum output.

Capacity shortage

When the demand for a business's products exceeds production capacity.

Productivity

How well a firm is using its resources in the process of producing its goods or services is measured by its productivity rates.

Productivity Rate

Total output/Total input x 100

Labour productivity

Measuring the output per worker. A good indicator of the current skills and motivation within the workforce.

Cost-to-Buy

Price x Quantity

Cost-to-Make

Fixed costs + (average variable cost x quantity)

Make-or-buy decision

A judgment made by management whether to make a component internally or buy it from the market.