2.1.2 Inflation

1/18

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

19 Terms

Inflation

The sustained increase in the general price level of g+s in an economy over time

Leads to a decrease in the purchasing power of money

Deflation

The sustained decrease in the general price level

Increases purchasing power of money but can discourage spending + investment (if prices keep getting lower, consumers may delay purchases/investments)

Disinflation

When the rate of inflation declines but remains positive

Prices are still rising but at a slower rate than before

Consumer prices index (CPI)

→ Widely used measure of inflation in the UK

→ Tracks changes in the prices of a basket of g+s purchased by an average household

To calculate CPI rate of inflation, gov statisticians select the 700 most popular + representative products in the UK

Calculating CPI inflation

[(Current CPI - Previous CPI) / Previous CPI] × 100.

Limitation 1 of CPI measuring inflation

Substitution bias

CPI assumes constant consumption patterns, whereas consumers often adjust their purchases in response to changing prices

This can lead to an overestimation of inflation

Limitation 2 of CPI measuring inflation

Quality changes

CPI may not adequately account for quality improvements in g+s over time

This can result in an overestimation of price increases

CPI core inflation

Takes out food + fuel prices as these products are very popular + therefore distort the true inflation picture

Retail prices index (RPI)

Alternative measure of inflation in the UK that includes a broader range of expenditures than CPI

Used for various purposes, including index-linked bonds, + some pension calculations

Differences from CPI

RPI tends to produce a higher inflation rate than CPI as it includes housing costs + uses a different formula

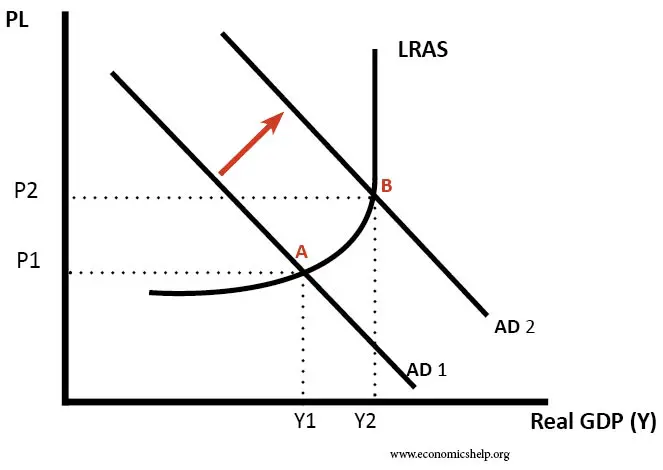

Cause 1 of inflation: Demand-pull inflation

→ Occurs when AD exceeds AS, leading to upwards pressure on prices

→ AD shifts to the right - leads to greater pressure on existing FofP to produce more output

→ More output is being made, but we are getting closer to yfe - existing FofP are getting scarcer

E.g. an economic boom that stimulates consumer spending + business investment may result in demand-pull inflation

Factors that cause shift of AD to right (5)

Decreased interest rates

Decreased income/corporation tax

Increased consumer/business confidence

Increased gov spending

Weak exchange rate

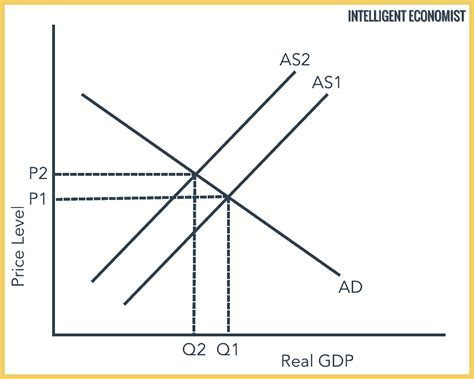

Cause 2 of inflation: Cost-push inflation

→ When production costs increase, causing firms to raise prices to maintain profitability

→ Due to a shift in of SRAS (due to increased costs of production - firms will pass this on to consumers through higher prices)

E.g. a spike in oil prices can trigger cost-push inflation as it raises production costs for many g+s

Factors that cause inward shift of SRAS (4)

Increase in raw material prices

Increase in wages

Increase in business taxes e.g. VAT

Increase in price of imported raw materials due to a weaker exchange rate

Growth of the money supply

If the money supply increases faster than the economy’s ability to produce g+s, demand can outstrip supply

This excess demand pushes prices up, leading to inflation

E.g. central banks printing excessive amounts of money can contribute to inflationary pressures

Effects of inflation of consumers

Inflation erodes purchasing power of money, reducing real value of savings

→ Fixed-income earners may experience reduced real incomes

→ People on fixed pensions may find it more challenging to maintain their standard of living

Effects of inflation on firms

→ Firms may face rising production costs, reducing profit margins (the amount by which revenue from sales exceeds costs in a business)

→ They may adjust prices upwards to maintain profitability

Effects of inflation on gov

→ Higher debt costs: Inflation can raise interest payments on government debt, leaving less money for public services.

→ Bracket creep: If tax brackets aren’t adjusted, people pay more tax as incomes rise with inflation — increasing tax burdens.

Effects of inflation on workers

→ May see nominal wage increases, but real wages may decline

→ Labour unions may negotiate for higher wages to keep pace with rising prices