FI: Private Debt Fund Returns, Persistence, and Market Conditions

1/9

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

10 Terms

Examples of PD investment strategies

Direct lending

Distressed lending

Mezzanine lending

Special situation lending

Venture debt lending

Contrast to traditional banking or public markets lending

Private debts are organized as partnerships, in which the investor becomes LP and the asset manager is the GP

Such funds imply that the investor cannot withdraw funds until the fund is liquidated, typically eight to ten years after inception.

The LP is a passive investor, doesn’t obtain any decision control over investments and therefore has no influence on the selection and implementation of investment strategy

GP typically receives a management fee of 1.5% - 2% plus 15%-20% of success fee at the end of the lifetime of a fund

How does PD fund generate returns from various sources

Regular Cash Coupons: The fund earns regular interest payments from the loans.

Payment in Kind (PIK): General Partners (GPs) might structure interest to be paid at maturity instead of regularly.

Early Repayment Penalties: They can collect penalties if loans are paid off early.

Portfolio Company Fees: These can include various fees like advisory, transaction, directors', monitoring, capital market, organization cost compensations, placement fees, and more.

Key performance summary of private debt

PD funds generally outperform bond and equity market benchmarks.

Average net-of-fees Internal Rate of Return (IRR) is 9.19%.

High dispersion in performance: Top quartile funds have an IRR of 23.3%, while bottom quartile funds have an IRR of 3.6%.

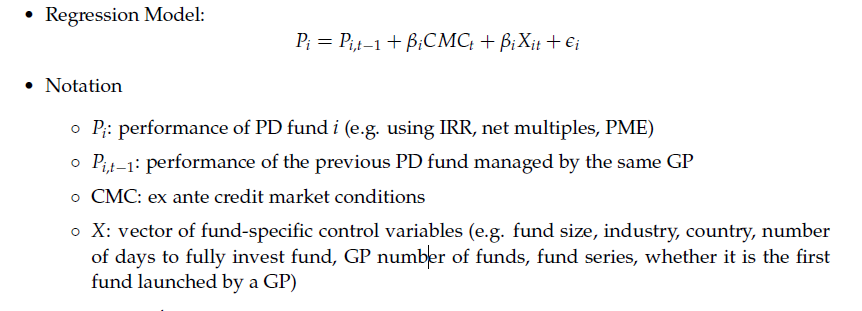

Describe Performance Persistence of private debt

Consistent Performance: Funds managed by the same General Partner (GP) tend to perform similarly over time.

Past Performance Predicts Future: How well a fund did in the past is a good indicator of how it will do now.

Stronger Consistency in Mature Funds: This consistency is even stronger in older funds where at least 75% of the capital has been used.

Market conditions that related to private debt

Credit Market Conditions: Both before (ex ante) and after (ex post) credit market conditions have a big impact on fund performance.

Funding Illiquidity: When funding is hard to get before the event, it hurts performance. But if it gets easier to get funding after the event, performance improves.

Credit Spreads and Volatility: Higher credit spreads and more volatility in the equity market before the event are linked to better performance and higher fund multiples.

GP role in the PD transactions

Selection of attractive credit opportunities

Negotiation and execution of lending contracts

Actively monitoring of investment

Advisory roles

Public market equivalent (PME)

PV distributions / PV contributions

Fund w PME > 1: outperformed the benchmark index over its lifetime

Fund w PME <1: underperformed the benchmark index over its lifetime

Performance Persistence in the PD industry

PE vs. PD funds

PE funds exhibit a J-curve pattern with largely negative cash flows in the early investment phase, and positive cash flows later during the harvesting period

PD contracts are typically quite different; PD funds deliver cash flows earlier