2.6.4 Conflicts & trade-offs between objectives and policies

1/6

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

7 Terms

Potential conflicts & trade-offs between the macroeconomic objectives

(trade-offs = when an objective is achieved only at the expense of some other objective)

The main idea is that by improving 1 macroeconomic objective, may worsen another

Conflict: improving economic growth may affect other objectives

1) affect environment

GDP increases → income increases → demand for production increases → more resource exploitation + pollution

2) affect balancing the current account

GDP increases → income increases → increase in import → decreasing current account balance → may lead to current account deficit

3) affect inequality

GDP increases → more profits for business returning to the owner of factors of production due to higher production and sales & workers wages rise

workers wages rise due to increase in production that causes demand for labour to increase - if many firms want workers at the same time, competition increases pushing up worker wages to attract them

But worker’s wages rise not as fast as profits → inequality

Conflict: reducing government borrowing → lower economic growth

In order to still ‘survive’ although borrow less is by doing these 2 ways:

1) Cut government spending → AD decreases → GDP decreases

2) Increase tax so more tax revenue

However

Increase direct tax → tax on income increases → less disposable income → less spending on g/s → less consumption → AD decreases → GDP growth decreases

Increase indirect tax (ie VAT) → firms have less profit → less incentivised to invest → investment decreases → AD decreases → GDP growth decreases

EVAL: why this conflict might not happen

If the reduction in government borrowing shows reliability, credibility, responsibility → firms have more trust that future taxes won’t rise as it seems like the government will be able to manage its finances responsibly → increases business confidence to still invest / consumer confidence to spend as their income will not be affected by tax → GDP may not decrease

Conflict: Improving environment → lower economic growth

1) Firms are forced to meet CO2 restrictions by decreasing production (ie. fines / carbon tax) → cost of production increases → SRAS decreases → GDP decreases

2) Government need to invest money into regulating CO2 emissions → taxation increases → consumption/investment decreases → AD decreases → GDP decreases

EVAL:

1) Firms not having to decrease production due to green industries having an incentive to produce green energy (ie. wind energy, light energy) → level of production can still be maintained

2) Government investment increases → investment in better quality infrastructure → firms can transport more raw materials efficiently & cheaply → decrease cost of production → SRAS increases → GDP increases

Conflict: reduce government borrowing → increase inequality

Cut spending → less government spending on benefits → poor people gets less benefits (ie. unemployment benefit, disability benefit, universal credit = support ppl with low wages)

defence spending is often protected from being cut → other areas of spending are cut instead (ie. welfare benefits, education) → affect low-income

EVAL:

Taxation increases → richer ppl pay more tax → less inequality

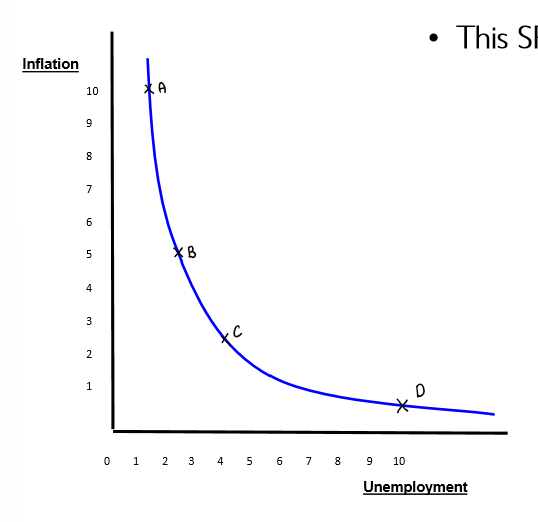

Conflict: low unemployment → high inflation (or vice versa) - can be explained by the Short Run Philips Curve

low unemployment → high inflation

1) Low unemployment often occurs in a boom

2) More income → more disposable income → consumption increases → AD increases → demand pull inflation

3) Also, there is an increase in demand for production during this period → firms need new workers → need to pay high wages to attract them → cost of production increases → cost-push inflation

4) Due to demand pull inflation + cost-push inflation → low rates of unemployment may cause high inflation

High unemployment → low inflation

1) high unemployment often occurs in a recession

2) lower income → less disposable income → consumption decreases → AD decreases → demand pull inflation decreases

3) Also, due to high unemployment, workers can pay low wages to get them due to surplus of labour → cost of production decreases → cost-push inflation decreases

4) Due to lower demand pull inflation + lower cost-push inflation → high rate of unemployment may cause low inflation

Government tries to be at point C: inflation rate at around 3%, unemployment rate around 4% - ie.

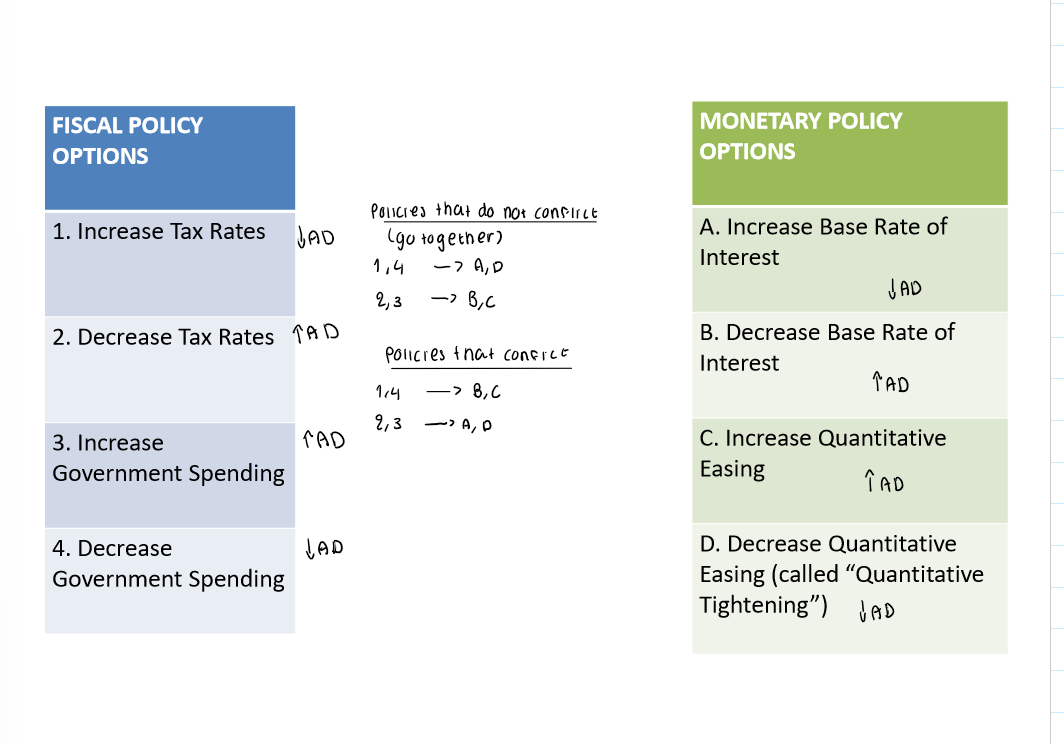

Policy conflicts & trade offs: How to make sure one macroeconomic policy doesn’t cancel out another (doesn’t conflict each other)

Demand-side policies can either be expansionary (AD increases) / contractionary (AD decreases)

If Government fiscal policy is expansionary, Central Bank monetary policy should too to prevent the effects from cancelling each other out (same for contractionary)