managerial accounting exam 3

1/86

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

87 Terms

Here are 3 statements. Which; if any; are true?

1. The Balanced Scorecard includes a Learning and Growth perspective.

2. The Customer Perspective focuses solely on financial metrics.

3. Operational Excellence aims to deliver products faster and cheaper.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Statements 1 and 3

E. None of the above

D

Here are 3 statements. Which; if any; are true?

1. Prevention costs are incurred to identify defective products.

2. External failure costs are incurred due to defects found after delivery.

3. Appraisal costs include training activities to reduce defects.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Statements 1 and 2

E. None of the above

B

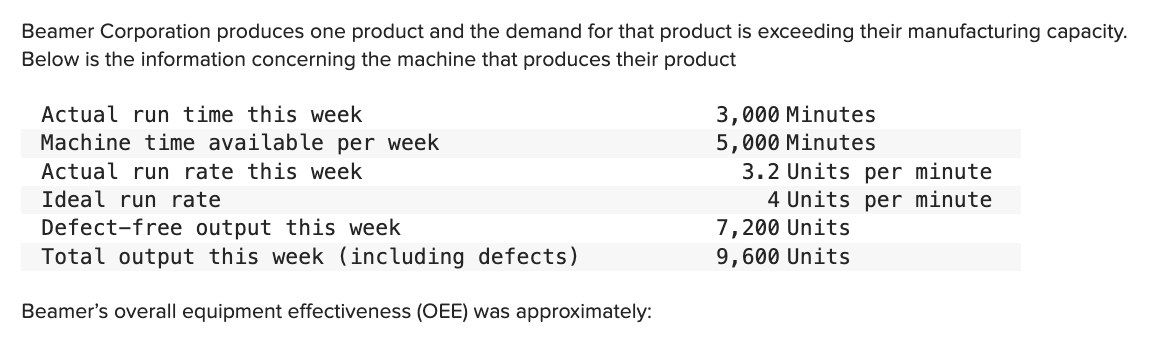

Here are 3 statements. Which; if any; are true?

1. Manufacturing Cycle Efficiency (MCE) is calculated as Process Time divided by Throughput Time.

2. Overall Equipment Effectiveness (OEE) measures the productivity of a piece of equipment.

3. Delivery Cycle Time includes only the time from order receipt to production start.;

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Statements 1 and 2

E. Statements 1, 2, and 3

D

Here are 3 statements. Which; if any; are true?

1. The Balanced Scorecard includes only non-financial measures.

2. Financial measures are not important in the Balanced Scorecard framework.

3. The Balanced Scorecard is used to align business activities with the vision and strategy of the organization.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Statements 2 and 3

E. None of the above

C

Here are 3 statements. Which; if any; are true?

1. Customer Intimacy involves customizing products to meet specific customer needs.

2. Product Leadership focuses on delivering products faster and cheaper.

3. Operational Excellence aims to create innovative and high-quality products.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Statements 1 and 3

E. Statements 1, 2, and 3

A

Here are 3 statements. Which; if any; are true?

1. Throughput time is not relevant to MCE.

2. Quality costs can include both prevention and appraisal activities.

3. External failure costs include the cost of field servicing and handling complaints.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Statements 2 and 3

E. Statements 1, 2, and 3

D

Here are 3 statements. Which; if any; are true?

1. Move Time is the total time from start to finish of a process.

2. Delivery Time is the time to move products between workstations.

3. Wait Time is the time from when an order is received to when it is packed.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Statements 1 and 2

E. None of the above

E

Here are 3 statements. Which; if any; are true?

1. The Balanced Scorecard includes measures for Environmental; Social; and Governance (ESG) performance.

2. ESG measures are not relevant to the Learning and Growth perspective.

3. ESG performance reports are shared only with internal stakeholders.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Statements 1 and 2

E. None of the above

A

Here are 3 statements. Which; if any; are true?

1. The Utilization Rate in OEE is calculated as Actual Run Time divided by Machine Time Available.

2. The Efficiency Rate in OEE is calculated as Actual Run Rate divided by Ideal Run Rate.

3. The Quality Rate in OEE is calculated as Defect-Free Output divided by Total Output.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Statements 1, 2, and 3

E. Statements 1 and 2

D

Which of the following is not typically a performance measure category on a balanced scorecard?

A. financial.

B. customer.

C. innovation.

D. learning and growth.

C

The cost of quality training would be classified as a(n):

A. prevention cost.

B. appraisal cost.

C. internal failure cost.

D. external failure cost.

A

The four categories of quality costs in a quality cost report are:

A. external failure, product liability, prevention, and carrying.

B. external failure, internal failure, prevention, and appraisal.

C. warranty, product liability, prevention, and appraisal.

D. warranty, product liability, training, and appraisal.

B

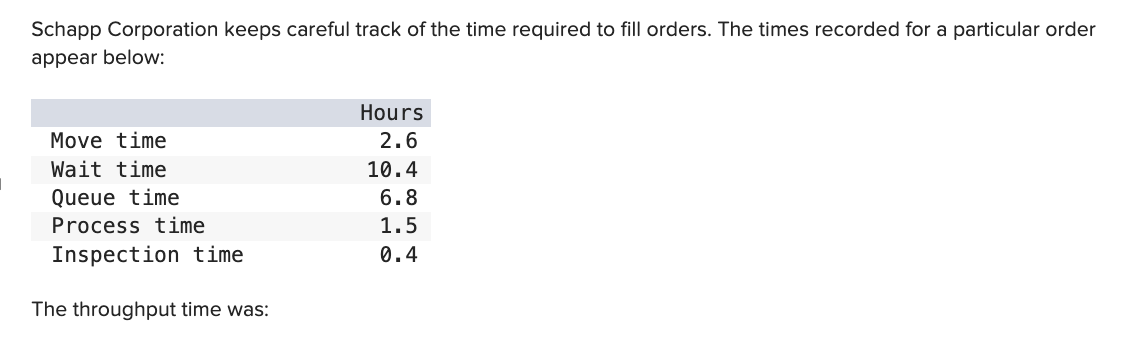

A. 11.3 hours

B. 21.7 hours

C. 17.2 hours

D. 4.5 hours

A

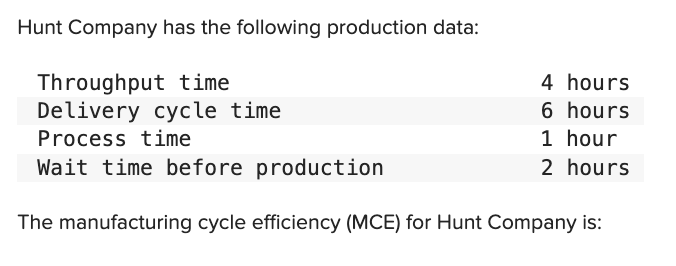

A. 50%

B. 25%

C. 20%

D. 75%

B

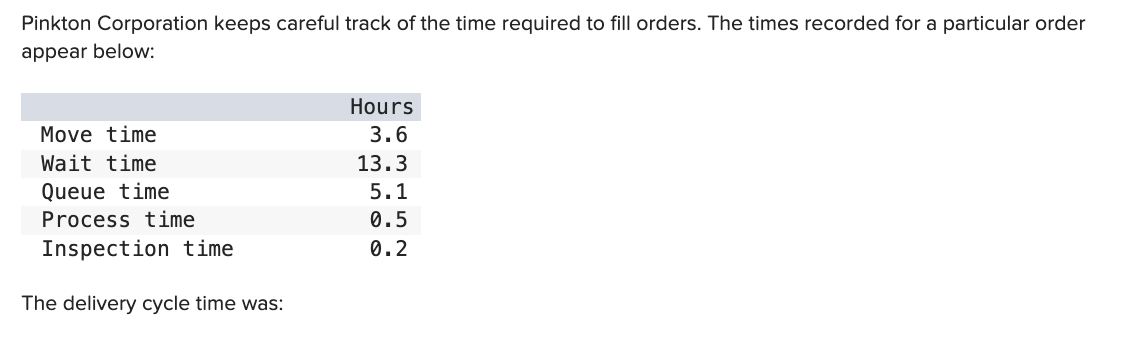

A. 8.7 hours

B. 3.6 hours

C. 22.0 hours

D. 22.7 hours

D

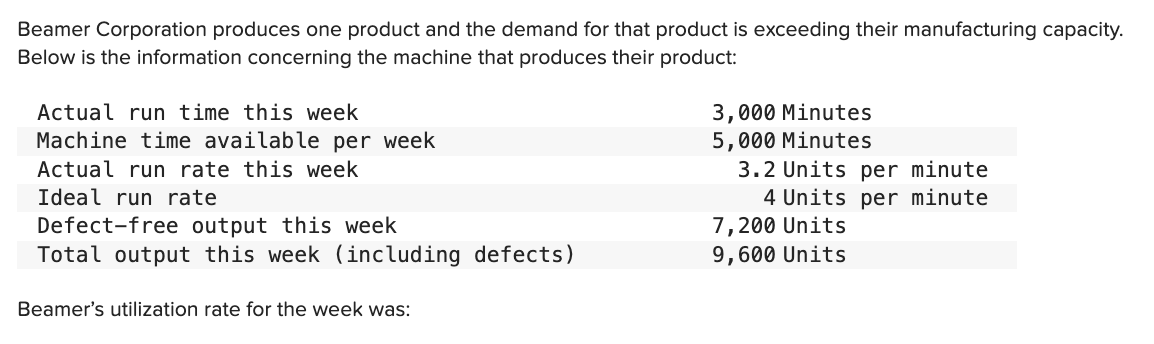

A. 0.31

B. 0.42

C. 0.60

D. 0.80

C

A. 0.10

B. 0.20

C. 0.25

D. 0.36

D

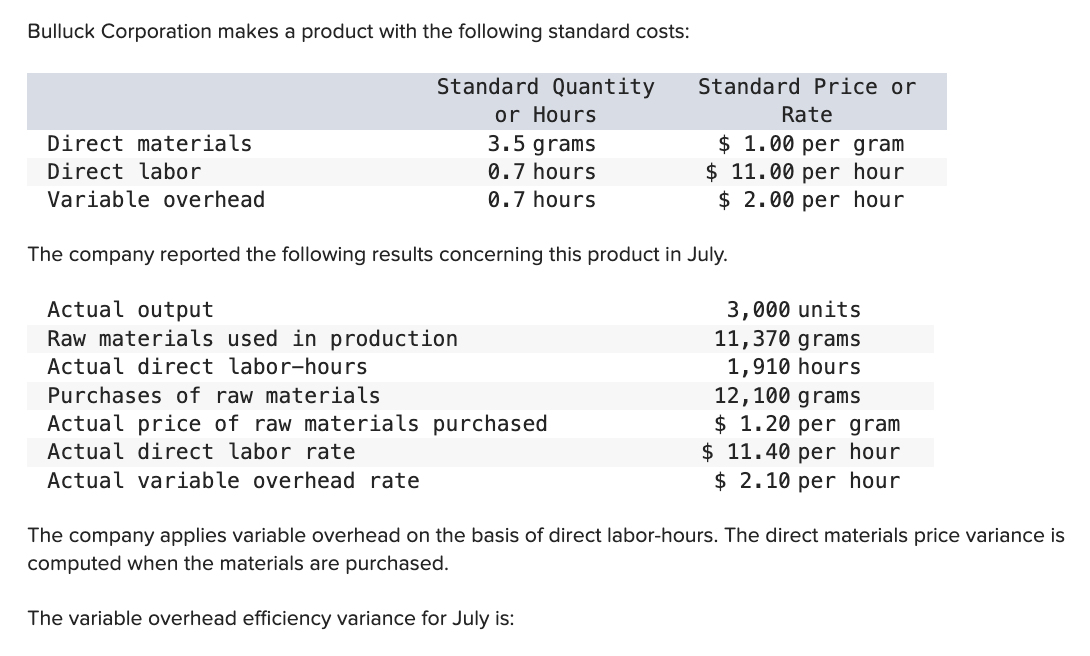

The general model for calculating a quantity variance is:

A. Actual quantity of inputs used × (Actual price − Standard price).

B. Standard price × (Actual quantity of inputs used − Standard quantity allowed for output).

C. (Actual quantity of inputs used × Actual price) − (Standard quantity allowed for output × Standard price).

D. Actual price × (Actual quantity of inputs used − Standard quantity allowed for output).

B

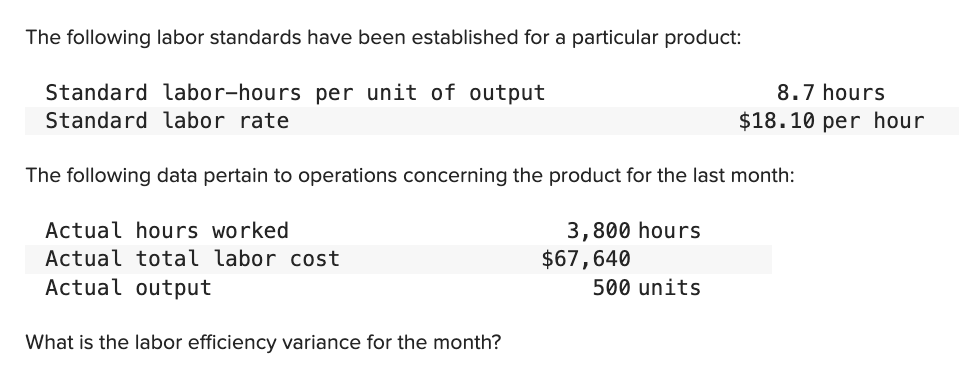

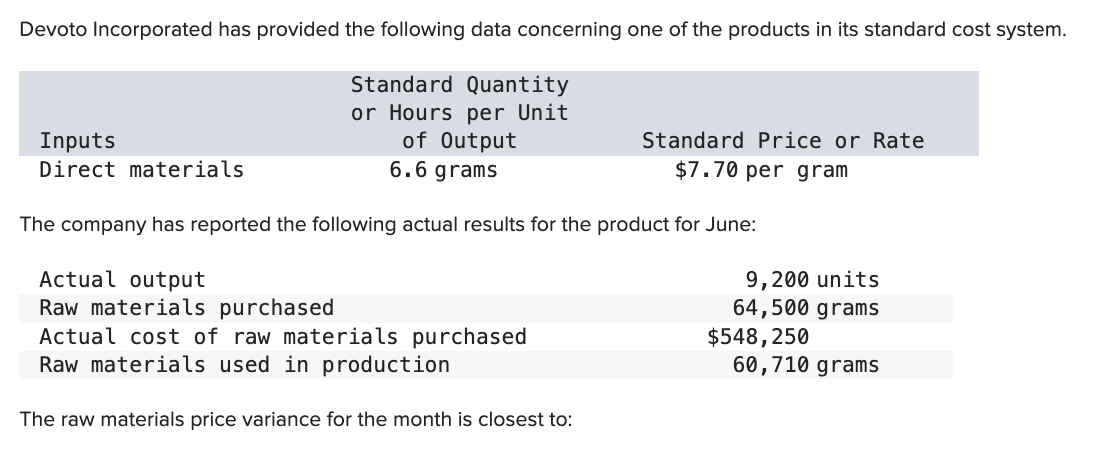

A. $9,790 F

B. $11,095 U

C. $9,955 F

D. $11,095 F

C

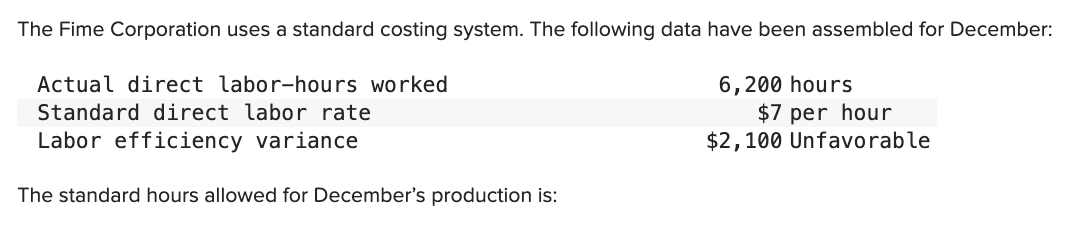

A. 5,900 hours

B. 6,500 hours

C. 6,200 hours

D. 6,000 hours

A

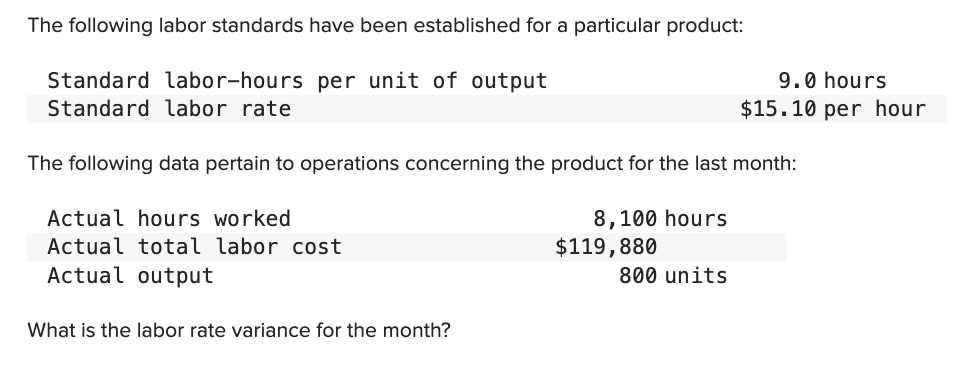

A. $11,160 F

B. $13,320 U

C. $11,160 U

D. $2,430 F

D

A. $51,600 U

B. $48,568 F

C. $51,600 F

D. $48,568 U

A

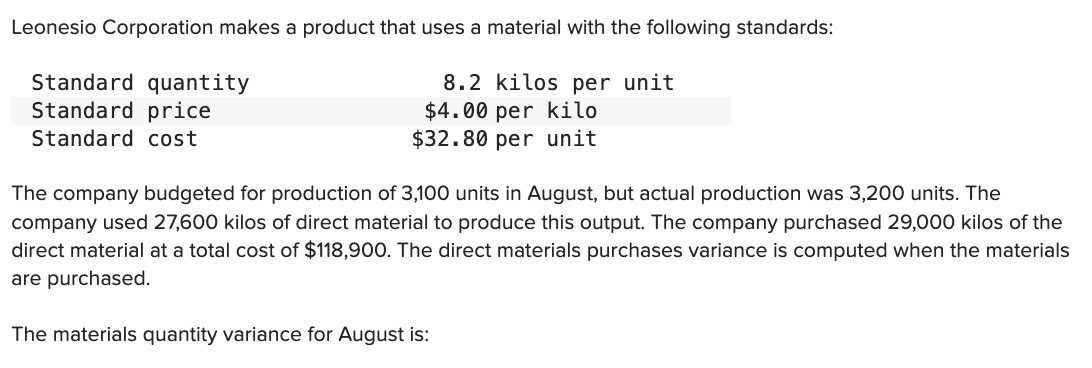

A. $5,576 F

B. $5,576 U

C. $5,440 F

D. $5,440 U

D

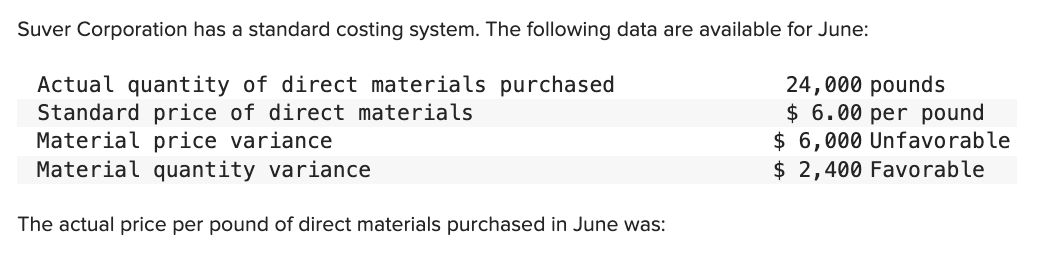

A. $6.10 per pound

B. $5.90 per pound

C. $6.25 per pound

D. $6.30 per pound

C

A. $2,000 Favorable

B. $720 Favorable

C. $1,260 Unfavorable

D. $1,980 Favorable

D

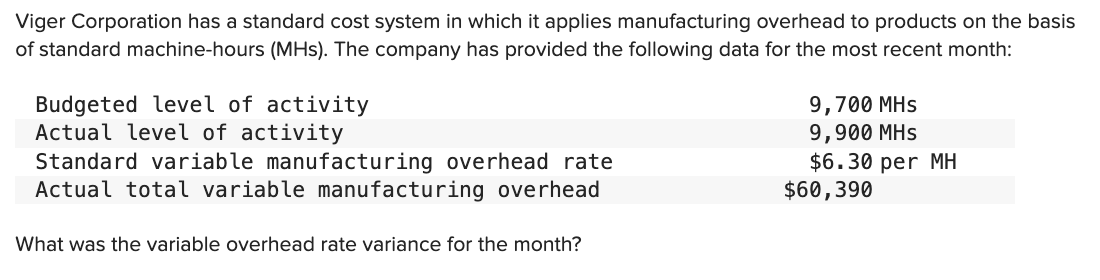

A. $380 F

B. $399 U

C. $380 U

D. $399 F

A

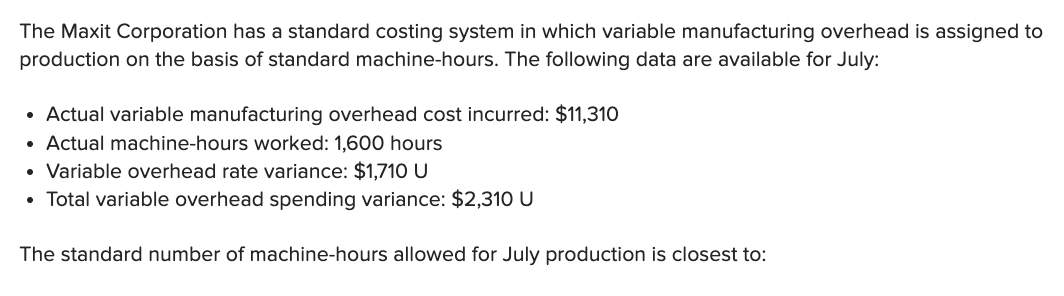

A. 1,600 hours

B. 1,700 hours

C. 1,300 hours

D. 1,500 hours

D

The following data has been provided for a company’s most recent year of operations:

Return on investment | 20% |

|---|---|

Average operating assets | $ 100,000 |

Minimum required rate of return | 15% |

The residual income for the year was closest to:

A. $20,000

B. $3,000

C. $5,000

D. $15,000

C

Bungert Incorporated reported the following results from last year’s operations:

Sales | $ 15,200,000 |

|---|---|

Variable expenses | 9,470,000 |

Contribution margin | 5,730,000 |

Fixed expenses | 4,818,000 |

Net operating income | $ 912,000 |

The company’s minimum required rate of return is 12% and its average operating assets were $8,000,000. Last year's residual income was closest to:

A. $912,000

B. ($48,000)

C. $992,000

D. ($972,800)

B

Runyon Incorporated reported the following results from last year’s operations:

Sales | $ 16,800,000 |

|---|---|

Variable expenses | 12,230,000 |

Contribution margin | 4,570,000 |

Fixed expenses | 3,394,000 |

Net operating income | $ 1,176,000 |

The company’s average operating assets were $7,000,000.

Last year's turnover was closest to:

A. 0.42

B. 14.29

C. 0.07

D. 2.40

D

BR Company has a contribution margin of 40%. Sales are $312,500, net operating income is $25,000, and average operating assets are $200,000. What is the company's return on investment (ROI)?

A. 12.5%

B. 62.5%

C. 8.0%

D. 64.0%

A

Minar Incorporated reported the following results from last year’s operations:

Sales | $ 5,700,000 |

|---|---|

Variable expenses | 3,510,000 |

Contribution margin | 2,190,000 |

Fixed expenses | 1,734,000 |

Net operating income | $ 456,000 |

Average operating assets | $ 3,000,000 |

At the beginning of this year, the company has a $900,000 investment opportunity with the following characteristics:

Sales | $ 1,530,000 |

|---|---|

Contribution margin ratio | 60% of sales |

Fixed expenses | $ 810,900 |

If the company pursues the investment opportunity and otherwise performs the same as last year, the combined ROI for the entire company will be closest to:

A. 14.4%

B. 2.7%

C. 11.7%

D. 18.8%

A

Levar Corporation has two operating divisions—a Consumer Division and a Commercial Division. The company's Order Fulfillment Department provides services to both divisions. The variable costs of the Order Fulfillment Department are budgeted at $73 per order. The Order Fulfillment Department's fixed costs are budgeted at $470,400 for the year. The fixed costs of the Order Fulfillment Department are determined based on the peak period orders.

| Percentage of Peak Period Capacity Required | Budgeted Orders |

|---|---|---|

Consumer Division | 25% | 1,800 |

Commercial Division | 75% | 6,600 |

At the end of the year, actual Order Fulfillment Department variable costs totaled $621,600 and fixed costs totaled $473,970. The Consumer Division had a total of 1,840 orders and the Commercial Division had a total of 6,560 orders for the year. For purposes of evaluation performance, how much Order Fulfillment Department cost should be charged to the Commercial Division at the end of the year?

A. $831,680

B. $855,588

C. $840,918

D. $846,240

A

Lakeside Nursing Home has two operating departments, Custodial Care and Rehabilitation. It also has a Housekeeping Department that serves the two operating departments. The costs of the Housekeeping Department are all variable and are charged to the operating departments on the basis of labor-hours. Data for September follow:

| Custodial Care | Rehabilitation |

|---|---|---|

Budgeted labor-hours | 3,000 | 1,000 |

Actual labor-hours | 3,200 | 1,600 |

The budgeted costs of the Housekeeping Department for September were $24,000 and the actual costs were $29,760.

How much Housekeeping Department cost should be charged to Rehabilitation at the end of September?

A. $19,840

B. $9,920

C. $9,600

D. $7,440

C

Mangiamele Corporation's Maintenance Department provides services to the company's two operating divisions—the Paints Division and the Stains Division. The variable costs of the Maintenance Department are budgeted based on the number of cases produced by the operating departments. The fixed costs of the Maintenance Department are budgeted based on the number of cases produced by the operating departments during the peak period. Data appear below:

Maintenance Department: |

|

Budgeted variable cost | $ 4 per case |

|---|---|

Budgeted total fixed cost | $ 693,000 |

Paints Division: |

|

Percentage of peak period capacity required | 30% |

Actual cases | 18,000 |

Stains Division: |

|

Percentage of peak period capacity required | 70% |

Actual cases | 59,000 |

For performance evaluation purposes, how much Maintenance Department cost should be charged to the Paints Division at the end of the year?

A. $234,000

B. 500,500

C. $279,900

D. $300,300

C

Toldness Products, Incorporated, has a Connector Division that manufactures and sells a number of products, including a standard connector that could be used by another division in the company, the Transmission Division, in one of its products. Data concerning that connector appear below:

Capacity in units | 57,000 |

|---|---|

Selling price to outside customers | $ 67 |

Variable cost per unit | $ 22 |

Fixed cost per unit (based on capacity) | $ 29 |

The Transmission Division is currently purchasing 11,000 of these connectors per year from an overseas supplier at a cost of $58 per connector.

What is the maximum price that the Transmission Division should be willing to pay for connectors transferred from the Connector Division?

A. $51 per unit

B. $58 per unit

C. $22 per unit

D. $29 per unit

B

Lumpkins Products, Incorporated, has a Valve Division that manufactures and sells a number of products, including a standard valve that could be used by another division in the company, the Pump Division, in one of its products. Data concerning that valve appear below:

Capacity in units | 46,000 |

|---|---|

Selling price to outside customers | $ 62 |

Variable cost per unit | $ 38 |

Fixed cost per unit (based on capacity) | $ 12 |

The Pump Division is currently purchasing 9,000 of these valves per year from an overseas supplier at a cost of $59 per valve.

Assume that the Valve Division is selling all of the valves it can produce to outside customers. Also assume that none of the variable expenses can be avoided on transfers within the company. What should be the minimum acceptable transfer price for the valves from the standpoint of the Valve Division?

A. $50 per unit

B. $38 per unit

C. $62 per unit

D. $59 per unit

C

The Tolar Corporation has 400 obsolete desk calculators that are carried in inventory at a total cost of $26,800. If these calculators are upgraded at a total cost of $10,000, they can be sold for a total of $30,000. As an alternative, the calculators can be sold in their present condition for $11,200.

What is the financial advantage (disadvantage) to the company from upgrading the calculators?

Multiple Choice

A. $8,800

B. ($18,000)

C. $20,000

D. ($8,000)

A

Product U23N has been considered a drag on profits at Jinkerson Corporation for some time and management is considering discontinuing the product altogether. Data from the company’s budget for the upcoming year appear below:

Sales | $ 730,000 |

|---|---|

Variable expenses | $ 350,000 |

Fixed manufacturing expenses | $ 234,000 |

Fixed selling and administrative expenses | $ 161,000 |

In the company's accounting system all fixed expenses of the company are fully allocated to products. Further investigation has revealed that $144,000 of the fixed manufacturing expenses and $93,000 of the fixed selling and administrative expenses are avoidable if product U23N is discontinued. The financial advantage (disadvantage) for the company of eliminating this product for the upcoming year would be:

A. $15,000

B. $143,000

C. ($143,000)

D. ($15,000)

C

The Draper Corporation is considering dropping its Doombug toy due to continuing losses. Data on the toy for the past year follow:

Sales of 15,000 units | $ 150,000 |

|---|---|

Variable expenses | 120,000 |

Contribution margin | 30,000 |

Fixed expenses | 40,000 |

Net operating loss | $ (10,000) |

If the toy were discontinued, Draper could avoid $8,000 per year in fixed costs. The remainder of the fixed costs are not avoidable.

Suppose that if the Doombug toy is dropped, the production and sale of other Draper toys would increase so as to generate a $16,000 increase in the contribution margin received from these other toys. If all other conditions are the same, the financial advantage (disadvantage) from discontinuing the production and sale of Doombugs would be:

A. ($6,000)

B. $14,000

C. ($2,000)

D. $28,000

A

Sharp Corporation produces 8,000 parts each year, which are used in the production of one of its products. The unit product cost of a part is $36, computed as follows:

Variable production cost | $ 16 |

|---|---|

Fixed production cost | 20 |

Unit product cost | $ 36 |

The parts can be purchased from an outside supplier for only $28 each. The space in which the parts are now produced would be idle and fixed production costs would be reduced by one-fourth. Based on these data, the financial advantage (disadvantage) of purchasing the parts from the outside supplier would be:

A. $24,000

B. ($24,000)

C. $56,000

D. ($56,000)

D

Mcfarlain Corporation is presently making part U98 that is used in one of its products. A total of 7,000 units of this part are produced and used every year. The company's Accounting Department reports the following costs of producing the part at this level of activity:

| Per Unit |

|---|---|

Direct materials | $ 3.70 |

Direct labor | $ 3.60 |

Variable overhead | $ 1.40 |

Supervisor's salary | $ 4.00 |

Depreciation of special equipment | $ 3.90 |

Allocated general overhead | $ 4.10 |

An outside supplier has offered to produce and sell the part to the company for $17.10 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally.

In addition to the facts given above, assume that the space used to produce part U98 could be used to make more of one of the company's other products, generating an additional segment margin of $24,000 per year for that product. What would be the financial advantage (disadvantage) of buying part U98 from the outside supplier and using the freed space to make more of the other product?

A. ($6,800)

B. ($1,200)

C. $24,000

D. ($49,200)

A

The constraint at Pickrel Corporation is time on a particular machine. The company makes three products that use this machine. Data concerning those products appear below:

| VD | JT | SM |

|---|---|---|---|

Selling price per unit | $ 344.85 | $ 415.40 | $ 119.32 |

Variable cost per unit | $ 270.18 | $ 310.88 | $ 91.96 |

Minutes on the constraint | 5.70 | 6.70 | 1.90 |

Rank the products in order of their current profitability from most profitable to least profitable. In other words, rank the products in the order in which they should be emphasized.

A. JT, VD, SM

B. JT, SM, VD

C. VD, SM, JT

D. SM, VD, JT

B

Bertucci Corporation makes three products that use the current constraint which is a particular type of machine. Data concerning those products appear below:

| TC | GL | NG |

|---|---|---|---|

Selling price per unit | $ 494.40 | $ 449.43 | $ 469.68 |

Variable cost per unit | $ 395.20 | $ 320.21 | $ 373.92 |

Minutes on the constraint | 8.00 | 7.10 | 7.60 |

Assume that sufficient constraint time is available to satisfy demand for all but the least profitable product. Up to how much should the company be willing to pay to acquire more of the constrained resource?

A. $12.40 per minute

B. $18.20 per minute

C. $129.22 per unit

D. $95.76 per unit

A

Younes Incorporated manufactures industrial components. One of its products, which is used in the construction of industrial air conditioners, is known as P06. Data concerning this product are given below:

| Per Unit |

|---|---|

Selling price | $ 220 |

Direct materials | $ 38 |

Direct labor | $ 1 |

Variable manufacturing overhead | $ 8 |

Fixed manufacturing overhead | $ 16 |

Variable selling expense | $ 4 |

Fixed selling and administrative expense | $ 16 |

The above per unit data are based on annual production of 4,000 units of the component. Assume that direct labor is a variable cost.

The company has received a special, one-time-only order for 400 units of component P06. There would be no variable selling expense on this special order and the total fixed manufacturing overhead and fixed selling and administrative expenses of the company would not be affected by the order. Assuming that Younes has excess capacity and can fill the order without cutting back on the production of any product, what is the minimum price per unit below which the company should not accept the special order?

A. $83 per unit

B. $63 per unit

C. $47 per unit

D. $220 per unit

C

A customer has requested that Lewelling Corporation fill a special order for 9,000 units of product S47 for $20.50 a unit. While the product would be modified slightly for the special order, product S47's normal unit product cost is $14.40:

Direct materials | $ 3.10 |

|---|---|

Direct labor | 1.50 |

Variable manufacturing overhead | 6.40 |

Fixed manufacturing overhead | 3.40 |

Unit product cost | $ 14.40 |

Assume that direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like modifications made to product S47 that would increase the variable costs by $5.00 per unit and that would require an investment of $36,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order. The annual financial advantage (disadvantage) for the company as a result of accepting this special order should be:

A. $(9,900)

B. $4,500

C. $54,900

D. $(26,100)

B

Faustina Chemical Corporation manufactures three chemicals (TX14, NJ35, and KS63) from a joint process. The three chemicals are in industrial grade form at the split-off point. They can either be sold at that point or processed further into premium grade. Costs related to each batch of this chemical process is as follows:

| TX14 | NJ35 | KS63 |

|---|---|---|---|

Sales value at split-off point | $ 16,000 | $ 12,000 | $ 5,000 |

Allocated joint costs | $ 6,000 | $ 6,000 | $ 6,000 |

Sales value after further processing | $ 20,000 | $ 18,000 | $ 9,000 |

Cost of further processing | $ 5,000 | $ 3,000 | $ 2,000 |

For which product(s) above would it be more profitable for Faustina to sell at the split-off point rather than process further?

A. KS63 only

B. TX14 and KS63 only

C. NJ35 and KS63 only

D. TX14 only

D

Here are 3 statements. Which; if any; are true?

The Balanced Scorecard includes four perspectives: Financial, Customer, Internal Business Processes, and Learning & Growth.

Customer Value Propositions include Operational Excellence, Product Leadership, and Customer Intimacy.

The Balanced Scorecard only focuses on financial measures.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Two of the above

E. None of the above

D

Here are 3 statements. Which; if any; are true?

Prevention costs are incurred to identify defective products before they are shipped to customers.

External failure costs include warranty repairs and lost sales due to defective products.

Appraisal costs are part of the costs of quality and include testing and inspecting incoming materials.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Two of the above

E. None of the above

D

Here are 3 statements. Which; if any; are true?

Throughput time is the sum of process time, inspection time, and queue time.

Manufacturing Cycle Efficiency (MCE) is calculated as Process Time divided by Throughput Time.

Delivery cycle time is the sum of wait time and throughput time.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Two of the above

E. None of the above

D

Here are 3 statements. Which; if any; are true?

Overall Equipment Effectiveness (OEE) is calculated as Utilization Rate multiplied by Efficiency Rate and divided by Quality Rate.

OEE focuses solely on the efficiency of equipment without considering quality.

Utilization Rate is calculated as Actual Run Time divided by Machine Time Available.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Two of the above

E. None of the above

C

Here are 3 statements. Which; if any; are true?

Environmental, Social, and Governance (ESG) measures are used to gauge the sustainability and ethical impacts of a company.

ESG measures are not relevant to the Balanced Scorecard.

ESG measures do not include the number of LEED-certified facilities and average carbon emissions per unit produced.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Two of the above

E. None of the above

A

Here are 3 statements. Which; if any; are true?

The Customer Perspective in the Balanced Scorecard includes measures like price, quality, and availability.

The Internal Perspective includes measures like operations management processes and innovative processes.

The Learning & Growth Perspective includes measures like human capital and organizational capital.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Two of the above

E. None of the above

D

Here are 3 statements. Which; if any; are true?

The Financial Perspective in the Balanced Scorecard focuses on improving cost structure and increasing asset utilization.

The Revenue Growth Strategy aims to enhance customer value and expand revenue opportunities.

The Financial Perspective is unrelated to Sustained Shareholder Value.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Two of the above

E. None of the above

B

Here are 3 statements. Which; if any; are true?

Customer satisfaction measures include the percentage of customers who would recommend the company.

Customer acquisition/retention measures include market share percentage and customer defection rate.

Customer lifetime value measures include average revenue per order and average time between purchases.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Two of the above

E. None of the above

D

Here are 3 statements. Which; if any; are true?

Financial measures include sales from new customers and sales from products less than three years old.

Profitability ratios include gross margin percentage and return on equity (ROE).

Cash flow measures include net cash flow from operating activities and net cash flow from operating activities plus sales.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Two of the above

E. None of the above

D

Here are 3 statements. Which; if any; are true?

The Balanced Scorecard helps organizations test the theories underlying management's strategy.

Incentive compensation should not be linked to Balanced Scorecard performance measures.

Managers must be confident that performance measures are reliable and not easily manipulated.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Two of the above

E. None of the above

A

Here are 3 statements. Which; if any; are true?

Standards are benchmarks or "norms" for measuring performance in managerial accounting.

Price standards refer to how much should be paid for each unit of input, while quantity standards refer to how much of an input should be used.

Standards are only used for direct materials and not for direct labor or variable manufacturing overhead.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Two of the above

E. None of the above

A

Here are 3 statements. Which; if any; are true?

The standard price per unit for direct materials is the final, delivered cost of materials, net of discounts.

The standard quantity per unit for direct materials is summarized in the Bill of Materials.

Direct materials standards are not relevant for variance analysis.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Two of the above

E. None of the above

B

Here are 3 statements. Which; if any; are true?

Standard hours per unit for direct labor are determined using time and motion studies for each labor operation.

Direct labor standards are irrelevant for cost control.

The standard rate per hour for direct labor is often a single rate that reflects the mix of wages earned.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Two of the above

E. None of the above

C

Here are 3 statements. Which; if any; are true?

Variable manufacturing overhead (MOH) standards include a price standard, which is the variable portion of the predetermined overhead rate.

The quantity standard for variable MOH is the activity in the allocation base for predetermined overhead.

Variable MOH standards are not used in variance analysis.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Two of the above

E. None of the above

D

Here are 3 statements. Which; if any; are true?

The spending/revenue variance analysis model includes price variance and quantity variance.

Price variance is the difference between actual price and standard price.

Quantity variance is the difference between actual quantity and standard quantity.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Two of the above

E. None of the above

D

Here are 3 statements. Which; if any; are true?

Labor rate variance is the same as the price variance for direct labor.

Labor efficiency variance is the same as the quantity variance for direct labor.

Labor variances are not relevant for cost control.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Two of the above

E. None of the above

B

Here are 3 statements. Which; if any; are true?

The labor efficiency variance is calculated as (Actual Hours × Standard Rate) - (Standard Hours × Standard Rate).

Labor variances are always unfavorable.

The labor rate variance is calculated as (Actual Hours × Actual Rate) - (Actual Hours × Standard Rate).

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Two of the above

E. None of the above

C

Here are 3 statements. Which; if any; are true?

Variable manufacturing overhead rate variance is calculated as (Actual Hours × Actual Rate) - (Actual Hours × Standard Rate).

Variable manufacturing overhead efficiency variance is calculated as (Actual Hours × Standard Rate) - (Standard Hours × Standard Rate).

Variable MOH variances are not relevant for cost control.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Two of the above

E. None of the above

D

Here are 3 statements. Which; if any; are true?

The materials quantity variance is computed only on the quantity budgeted for.

The materials price variance is computed on the entire quantity purchased.

Materials variances are always favorable.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Two of the above

E. None of the above

E

Here are 3 statements. Which; if any; are true?

Standard costs are a key element of the management by exception approach.

Standards can provide benchmarks that promote economy and efficiency.

Standard cost variance reports may contain outdated information.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Two of the above

E. None of the above

D

Here are 3 statements. Which; if any; are true?

A responsibility center is used for any part of an organization whose manager has control over and is accountable for cost, profit, or investments.

Cost centers are responsible for costs but not revenues or investments.

Investment centers are responsible for costs, revenues, and investments in operating assets.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Two of the above

E. None of the above

D

Here are 3 statements. Which; if any; are true?

Return on Investment (ROI) is calculated as Net Operating Income divided by Average Operating Assets.

Profit Margin is calculated as Net Operating Income divided by Sales.

Asset Turnover is calculated as Sales divided by Average Operating Assets.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Two of the above

E. None of the above

D

Here are 3 statements. Which; if any; are true?

Residual Income is Net Operating Income above a minimum return on operating assets.

Residual Income measures NOI relative to the investment in operating assets.

Residual Income is always unfavorable.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Two of the above

E. None of the above

A

Here are 3 statements. Which; if any; are true?

Transfer pricing is the price charged for the internal sale of products between two different divisions of the same company.

Transfer pricing affects operating income, ROI, sales margin, and residual income.

Transfer pricing is irrelevant for cost control.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Two of the above

E. None of the above

B

Here are 3 statements. Which; if any; are true?

Negotiated transfer prices result from discussions between the selling and buying division.

Transfer prices at cost incurred are always favorable.

Market prices are often regarded as the best approach to the transfer pricing problem.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Two of the above

E. None of the above

C

Here are 3 statements. Which; if any; are true?

Service department costs are charged to operating departments to encourage wise use of service department resources.

Budgeted variable service department costs should be charged to consuming departments according to whatever actual activity causes the incurrence of the cost.

Budgeted fixed service department costs should be charged in predetermined lump-sum amounts based on consuming department's peak-period or long-run average service needs.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Two of the above

E. None of the above

D

Here are 3 statements. Which; if any; are true?

Budgeted variable and fixed service department costs should be charged to operating departments.

The operating division should be held responsible for service department cost overruns.

Variable service department costs should be charged as Budgeted Variable Rate per Activity multiplied by Actual Activity.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Two of the above

E. None of the above

A

Here are 3 statements. Which; if any; are true?

If fixed costs are allocated using a variable allocation base that fluctuates over time, fixed costs allocated to one department are heavily influenced by what happens in other departments.

Using sales dollars as an allocation base for fixed costs is always optimal.

Allocating fixed costs using a variable allocation base can lead to suboptimization.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Two of the above

E. None of the above

C

Here are 3 statements. Which; if any; are true?

The principal-agent dilemma occurs when the principal wants the manager (agent) to act in their best interests.

The agent wants to make as much money as possible and doesn't care about the owner's (principal's) interests.

Responsibility accounting addresses the principal-agent dilemma.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Two of the above

E. None of the above

D

Here are 3 statements. Which; if any; are true?

Cost centers are evaluated using spending and quantity variances.

Profit centers are evaluated with actual vs. budgeted NOI.

Investment centers are evaluated based on ROI and RI.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Two of the above

E. None of the above

D

Here are 3 statements. Which; if any; are true?

Incremental costs are additional costs in one alternative.

Relevant costs are future costs that differ between decision alternatives.

Opportunity costs are not relevant for decision-making.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Two of the above

E. None of the above

E

Here are 3 statements. Which; if any; are true?

Incremental costs are additional costs in one alternative.

Avoidable costs can be eliminated in one alternative.

Sunk costs should be considered in decision-making.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Two of the above

E. None of the above

B

Here are 3 statements. Which; if any; are true?

An opportunity cost is the benefit that is foregone as a result of pursuing some course of action.

Opportunity costs are recorded in formal accounting systems.

Opportunity costs are relevant for decision-making.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Two of the above

E. None of the above

C

Here are 3 statements. Which; if any; are true?

The total cost/benefit approach includes all costs and benefits in the analysis.

The differential cost/benefit approach includes only relevant costs and benefits in the analysis.

The differential approach is always preferable to the total cost/benefit approach.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Two of the above

E. None of the above

B

Here are 3 statements. Which; if any; are true?

When making relevant decisions, a general approach is to compare the profitability (cost) from all alternatives.

Start by calculating the total profit (cost) of one decision.

Compare the two profits (costs) to see which will be better for the company.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Two of the above

E. None of the above

D

Here are 3 statements. Which; if any; are true?

When dropping a segment, out of all fixed costs, only avoidable fixed costs should be considered.

The contribution margin lost if a segment is eliminated should be included in the analysis.

All fixed costs are relevant for decision-making.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Two of the above

E. None of the above

A

Here are 3 statements. Which; if any; are true?

In a make or buy decision, only the incremental costs and benefits are relevant.

Existing fixed manufacturing overhead costs are always relevant in a make or buy decision.

Opportunity costs should be considered in a make or buy decision.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Two of the above

E. None of the above

C

Here are 3 statements. Which; if any; are true?

When a limited resource restricts the company's ability to satisfy demand, the company is said to have a constraint.

The machine, input, or process that is limiting overall output is called the constraint.

The product mix that maximizes the total contribution margin should always be selected.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Two of the above

E. None of the above

E

Here are 3 statements. Which; if any; are true?

A special order is a one-time order that is not considered part of the company's normal ongoing business.

When analyzing a special order, only the incremental costs and benefits are relevant.

Existing fixed manufacturing overhead costs are always relevant in a special order analysis.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Two of the above

E. None of the above

B

Here are 3 statements. Which; if any; are true?

Joint costs are irrelevant in decisions regarding what to do with a product from the split-off point forward.

It is profitable to continue processing a joint product after the split-off point so long as the incremental revenue from such processing exceeds the incremental processing costs incurred after the split-off point.

Joint costs should be allocated to end products for decision-making purposes.

A. Only statement 1

B. Only statement 2

C. Only statement 3

D. Two of the above

E. None of the above

A