SIE Exam

1/366

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

367 Terms

types of issuers

corporations

us treasury and government agencies

state and local government

banks (dual purpose; raise money and help others buy and sell securities)

foreign government

types of securities that may be issued

equity

used by corporations and banks (represents ownership)

stocks

Debt

notes and bonds (represents an issuer’s promise to pay)

all issuers can do debt

** when companies borrow money they can do it publicly or privately (large or small)

equity

the stock holders are owners of the business

they may receive dividends

no obligation to pay dividends

debt issuers

bonds

creditors

they receive interest

no ownership

equity disadvantage

you sold a piece of business

equity advantage

never have to pay an equity holder back

bonds advantage

didn’t dilute ownership but you have to pay them back (pay interest, repaying the principal aka par value)

brokers

firm acts as a conduit or agent

finds another party willing to take the other side of the trade (someone willing to find buyer and seller)

collects commission for the service

no risk to the firm (not using own capital)

ABC (agency, broker, commission)

dealer

firm acts as a principal

firm takes the other side of the trade

entitled to markup/markdown

depending on if acting as broker or dealer

inventory/risk (using their own money to buy and if they can not resell them they will loose money)

PDM (principal, dealer, markup/markdown)

front office

deals with clients

back office

deals with operations

investment banking

issuance (underwriters)

M & A (mergers and acquisition)

private equity (using money to make investments)

debt and equity capital markets

research

provides research reports to recommend when companies should be bought or sold

private client

retail brokerage; dealing with investors

sales and trading

secondary market

fixed income (bonds and debt)

equity

information barriers

certain info should not be discussed in different areas of the firm

if a M & A was going to happen

research shouldn’t disclose buyer recommendation to buy ahead

good defense

market maker

a broker-dealer that chooses to display quotes to buy or sell a specific amount of securities at specific prices

quotes are firm for at least 100 shares (obligated to buy and sell)

round lot = 100 shares

generally applies to equity securities not debt securities

bid

represents a client’s selling (liquidation) price

price at which the market maker will buy

ask or offer

represents a clients purchase price

price at which the market maker will sell

Spread = difference between the bid and ask price

the wider the spread the more the market maker will profit

the narrower the spread the less they will make

security that is actively traded usually has a narrower spread (Apple)

who makes spread and who makes commission?

market makers make spread and agents, dealers make commission

investment advisor

an IA is a firm that charges customers a fee for managing their securities portfolios

the fee is based on the assets under management (AUM)

an IA is considered a large institutional customer of a broker-dealer

** advisor earn fees, broker-dealers make commission and markups

municipal advisors (MA)

an MA is a person or firm who advises municipalities on bond offerings and must be registered with the SEC

typically advise issuers (state, county, or city) regarding structure and timing of a new offering

government

advisor for mayors

institutional l investors

defined based on the amount of assets they have invested

customers with a large amount of assets are referred to as “institutional investors” such as

banks

insurance companies

investment companies

corporations, partnerships, individual investors with a certain amt of money invested

registered investment advisers

public and private pension plans

hedge funds (buy and sell on a regular basis which generate comissions)

$50 million or more

retail investors

individual investors who are not defined as institutional investors are considered retail investors

accredited investors

there are other terms used for certain investors, but they are based on regulatory definitions

institutional investors as well as individuals who have met a financial test

net worth of 1 million excluding their primary residence OR

Annual income of 200,000 in each of the last 2 years (300,000 for married couples)

series 7, 65, or 82 registration

qualified institutional buyers (QIB)

buyer must own and invest a minimum of 100 million of securities

cannot be a natural person (insurance company)

primary market

new issue market

regulated by the 1933 securities act

investment bankers will help the corporation issue securities to raise money

secondary market

traded from one investor to another

regulated by the 1934 securities exchange act

might trade in NYSE, Nasdaq, or over the counter

exchanges: listing requirements to be listed on the exchange

OTCBB: over the counter bulletin board

Pink market: stocks that are unlisted

underwriter

facilitates distribution

assumes liability that varies with offering type

signs underwriting agreement with issuer

buying security from issuer and selling to investor

IPO versus follow-on (Initial public offering)

equity securities only

a company going public

don’t sell 100% of the company bc they want to sell securities later on

called a follow on: selling part of company later on

secondary market

where the trading of existing securities between investors occur

NYSE and other traditional centralized exchanges

provide a specific location for trade execution

trading is normally monitored by a specialist or designated market maker (DMM)

NASDAQ

dealer to dealer market

non-physical: phone and computer market

negotiated market

unlimited number of registered “market makers”

company must have at least 3 market makers

classified as a securities exchange

Non-Exchange Issues (OTC)

dealer to dealer

often low prices and thinly traded

a system that offers real-time quotations

OTC pink market

may be reporting or non-reporting companies

Nintendo: quoted in pink market (pink sheets how it got its name)

traders

dealer to dealer

execute trades for their firm or their firm’s clients

do not maintain an inventory

third market

listed securities traded over the counter, trades included in NYSE volume totalsfou

fourth market

transactions between institutions, most true fourth market trades are internal crosses set up by money managers

dark pools

provides liquidity for large institutional investors and high-frequency traders

quotes are ANONYMOUS

limits impacts on the market

DTCC

depository trust clearing corporation

main subsidiaries is called DTC

don’t hold any securities

book entry system

selling street name (firm) don’t have names of actual customers just firms

provides clearing, settlement, and information services for its members

parent of the NSCC

guarantees settlement

removes counterparty risk (act as a buyer for every seller and seller for every buyer (Brighthouse! Doesn’t interact with client directly)

transactions among its members are completed through computerized bookkeeping entries

EQUITY

NSCC

National Securities Clearing Corporation (equity)

FICC

fixed income clearing corporation (debt)

clearing firms

names of firms that do back office

clear trades on omnibus or fully disclosed basis

can clear their own stocks

introducing (correspondent) firms

lots of smaller firms, doesn’t pay for them to have their own back office

they use services of big brokerage firms who not only clear their own trades but are the back office for the introducing firms/smaller firms

fully disclosed accounts

specific information about each individual client is given to the clearing firm

clearing firm is responsible for:

maintaining client assets

establishing a separate account for each client

sending confirmations, statements, and checks

contact information for introducing firm is included

way less paperwork but more costly

must maintain all client info for fully disclosed

omnibus accounts

a single account is set up at the clearing firm

specific client information is maintained by the introducing firm

recordkeeping responsibilities rest with the introducing firm

Options Clearing Corp (OCC)

issues and guarantees option contracts

regulates exchange-traded options (listed options)

act as the 3rd party in all option transactions (the buyer for all sellers and the seller for all buyers)

deals directly with broker-dealers, not customers

trade settlement between broker-dealers and the OCC is next business day

BONDS

Prime Brokerage Accounts

when a primary B/D provides a large client (hedge fund) with the ability to clear all trades through a centralized firm with executions occurring with multiple D/Bs

prevents a single firm from determining the client’s strategy

the prime broker offers specialized services such as custody, securities lending, margin financing, clearing, processing, operational support, research, and customized reporting

don’t want to deal with 10 firms just one

hedge fund community

consolidates all trades

transfer agent

responsible for maintaining a list of the company’s current shareholders and their contract information, and also assists in the transfer of shares

registrar

responsible for ensuring that a corporation doesn’t issue more shares than it’s authorized to issue

arbitrage

buying a stock in one exchange and simultaneously selling it on another exchange

SEC

securities exchange commission

government agency

limited in budget

how oversee securities? SRO (self regulatory) not the SEC

federal reserve board (FRB)

the “fed” is an independent agency of the US government that functions as the US central bank

responsible for controlling monetary policy

money supply interest rates

goal is to create maximum employment and stable prices

tools include

open market operations

discount rate (the only one they set)

reserve requirements

regulation T

FDIC (federal deposit insurance corporation)

acts as a banking regulator

insures baking depositors for up $250,000

buying securities from bank, separate banking products from securities

State Blue Sky Regulators and North American Securities Administrators Association (NASAA)

state administrator (sometimes called commissioner)

enforces the uniform securities act (USA)

the USA is a model law, not the actual law of the state

NASAA responsible for creating the provisions and updating the USA

focuses on protecting investors from fraud

create the examination requirements for selling securities

pr

principal

responsible for supervising registered representatives

The securities Act of 1933

scope of the law

to provide for “full and fair disclosure”

prospectus must precede or accompany any solicitation of a new issue (no marking or highlighting)

SECC “no approval clause”

Requires SEC registration of new issues

registration exemptions are provided to issuers of certain securities and specific types of transactions

Liability

unconditional for issuers regarding information to investors

conditional for the underwriters that are required to perform:

reasonable investigation

“due diligence”

Securities Exchange Act of 1934

scope of the law

regulate the secondary market

created the SEC to enforce federal securities law

SEC utilizes self-regulatory organizations (SROs)

Provisions

margin requirements (Regulation T)

registration requirements for B/Ds and RRs

trading regulations

insider regulations

Investment Advisors Act of 1940s

An IA is defined as any person (firm) that meets the ABC test

A: advice: provides advice about securities, including asset allocation

B: Business: as a regular business

C: compensation: receives compensation for the advice

includes firms that manage wrap accounts (they collect a single fee for providing advice and executing transactions)

Exclusions

broker dealers that receive only commissions

banks, saving institutions, and trust companies

specific professionals who give incidental advice (lawyers, accountants, teachers, engineers LATE)

publishers of newspapers and periodicals (no timed tailored advice is provided to individuals)

not regulated by the SEC

** the SEC has power to regulate the industry and take action over civil penalties (fine) but they cannot imprison you. DOJ can go to criminal court not SEC

Securities Investors Protection Act (SIPA)

Created the Securities Investors Protection Corporation(SIPC)

not a government agency but a non-profit membership corporation, funded through assessments of broker-dealers

protects separate customers (not accounts) if bankruptcy occurs

separate customers include IRAs, as well as joint and custodial accounts (one joint, my own, spouse own = 3 different customers)

separate coverage provided for accounts that are held at different firms

coverage

cash and street name securities (name held as broker dealer) $500,00 will only cover cash up to $250,000

if limits are exceeded, customer becomes a; general creditor

not covered

fraud (covered by fidelity bond), futures contracts, commodities, and fixed annuities

** securities specifically identifiable to a customer are distributed back to customer without limit

investment company act of 1940

identifies three types of investment companies

management companies

unit investment trust

face amount certificate companies

insider trading and securities fraud enforcement act 1988

insiders include corporate officers and directors; owners of more than 10% of a company’s common equity

the use of material, non-public information is prohibited

both tippers and tippees may be in violation

penny stock reform act of 1990

regulates solicited sales of penny stocks (unlisted equities prices below $5.00 per share)

firms must establish suitability, approval, and disclosure procedures

telephone consumer protection act of 1991

call time frame: 8 am to 9pm local time

firms maintain a “do not call” list

USA Patriot Act of 2001

establishes the basis for a firm’s anti-money laundering regulations

requires the filing of reports based on financial transactions

FINRA ( Financial Industry Regulatory Authority)

main SROs

Conduct rules

governs the interaction between customers and firms

Uniform Practice code

standardizes the procedures for doing business in financial markets

Code of Procedure

establishes the process used to discipline any person who violates FINRA rules (cannot imprison you, only DOJ)

Code of Arbitration

provides the method for resolving disputes (typically monetary) between members, including those that involve public customers

cheaper than litigation

doesn’t have to be breaking the law, could be as simple as you thought your advisor didn’t give you the right advice and you lost money

municipal securities rulemaking board

formulates and interprets the rules that apply to

broker dealers and salesperson engaged in municipal business and

municipal advertising

reactive not proactive

MSRB rules do not apply to municipal issuers (government, towns, mayors)

since the MSRB has no enforcement power, its rules are enforces by a separate regulatory agency

for broker dealers: FINRA or SEC

for bank dealer: comptroller of the currency, FRB, or FDIC

Chicago board options exchange (cboe)

self-regulatory organization mainly for the options market

a trading venue for

equity options

index options

yield-based options

ETFs

regulated by the SEC

designated market maker

if an exchange has one entity that controls the trading in a specific stock it is called this

short sellers will profit if the stock price…

decreases

short selling is a trading strategy which an investor sells stock that she doesn’t own

shares are actually borrowed from a broker dealer

belief is that the stock will decline in value (bearish) which will allow her to purchase the borrowed stock at a lower price and deliver it back to the broker dealer

WSP manual

written supervisory procedures

compliance professionals are responsible for creating their firms house rules that form the basis of the WSP

essentially a manual which details the rules and identifies the persons responsible for enforcing these rules

at the civil level, the SEC can sue up to

three times the profit made or loss avoided (referred to as treble damages)

corporations

file articles of incorporation

also referred to as a certificate of incorporation or corporate charter

solicit individuals to serve as members of the Board of Directors

board member responsibilities include:

overseeing the management team

corporate governance

declaring dividends

Proxy: allowing someone to attend to vote on your behalf

how corporations raise money

debt financing: bondholders, senior to equities

equity: stockholders, preferred (senior) common (junior)

issuing stock

the corporate charter determines the number of shares that are authorized and can be issued

authorized: 1,000,000,000 (how many they can sell)

issued: 10,000,000 (how many are out there)

outstanding: same as issued

shares repurchased by corporation

if a corporation chooses to repurchase some of its outstanding shares, they become treasury stock (offer shares to employees)

issued - treasury = outstanding

** treasury stock does not receive dividends and has no voting rights

common stock ownership rights

inspection of book

evidence of ownership

transfer of ownership

participation in corporate earnings (entitled to dividends if declared (not guaranteed))

voting power

election of board members

authorization of additional authorized shares and stock splits (NOT vote for dividends)

two voting methods

statutory

beneficial for large shareholders

one vote her share per issue

cumulative

beneficial for small shareholders

allows shareholders to multiply the number of shares owned by the number of voting issues

restricted stock

when securities are purchased through a private placement, they are referred to as restricted securities or as compensation for senior executives of an issuer

stop-transfer instructions are issued and a legend on the certificates indicates that the securities are unregistered

mandatory 6 month holding period

investment letter or lock-up agreement

purchasers must sign the letter to acknowledge that the shares cannot be resold within a defined period

rule 144

permits the sale of restricted and control stock

shares cannot be sold unless registered with SEC

exemption

When intending to sell, the SEC must be notified

form 144 field at the time the sell order is placed

securities may be sold over 90 days through unsolicited broker’s trades or to a dealer that is acting as principal

if any shares from this filing remain unsold and the investor wants to sell them, an updated form 144 must be filed

maximum sale allowed is the greater of:

1% of the outstanding shares or the average weekly trading volume over the last 4 week

FILINF FORM 144 IS NOT REQUIRED IF SELLING NO MORE THAN 5,000 SHARES AND $50,000 OF SECURITIES

control (affiliated) stock

registered stock that is part of an issuer’s public float and purchased in the open market by officers, directors, or greater than 10% shareholders of the issuer

no minimum required holding period

American Depositary Receipts (ADRs)

priced as US dollars

pay dividends in US dollars

sponsored or unsponsored

sponsored: issued in cooperation with the foreign company, may trade on US exchanges

Unsponsored: issued without involvement of the foreign company, generally traded in OTC market

blue chip stock companies

stock of strong, well-established, dividend paying companies (blue chip is the most expensive in poker)

growth stock companies

stock of companies with sales and earnings that are expanding faster than the economy; pay little if any dividends

income stock

stock of companies that pay higher than average dividends in relation to market price

defensive stock

stock of companies that are resistant to recession (e.g. utilities, tobacco)

cyclical stocks

stock of companies whose value fluctuates with the business cycle (household appliances, automobile)

American Depositary Reciept Stocks

facilitates the trading of foreign stock in US markets

preferred stock

*no voting rights

designed to provide returns that are comparable to bonds

pays a stated dividend (no guaranteed)

states as a % of par

par value is typically $100

dividends are paid to preferred shareholders before common shareholders

there are multiple types of preferred stock

non-cumulative preferred stock

investor is only entitled to the current dividend; the investor is NOT entitled to unpaid dividend (dividend in arrears)

cumulative preferred stock

investor is entitled to unpaid dividends before common stock dividends may be paid

callable preferred stock

issuer has the ability to repurchase the stock

typically repurchased at a premium over par value

allows issuer to remove stock from the market

participating preferred stock

investor may recieve additional dividends based on the company’s profit

convertible preferred stock

investor may convert into a predetermined number of common shares

not as risky as common stock because you have some type of dividend paid out , hybrid

conversion ratio = par value/conversion price

price of convertible preferred = market value of common x conversion ratio

preemptive rights are

a shareholder’s right to maintain percentage ownership; no dilution

** only if you own shares of common stock will you receive any rights

distributed through a rights offering

one right for each share owned

Discounted

shareholders exercise rights at a price that’s below the current market value prior to a public offering

immediate intrinsic value (buy more at discounted price!) the lower the price the more value, the lower the price the less company can make

Short term

typically must be exercised within 4-6 weeks

Tradable

*value of right determined by price

warrants

attached to bonds or stocks, acts as “sweeteners”

allows holders to purchase a specific number of the company’s common shares

exercise price is above the current market value (premium)

long-term

may be exercised years after the original issuance

attached to a new issue

may be “detached” and traded separately

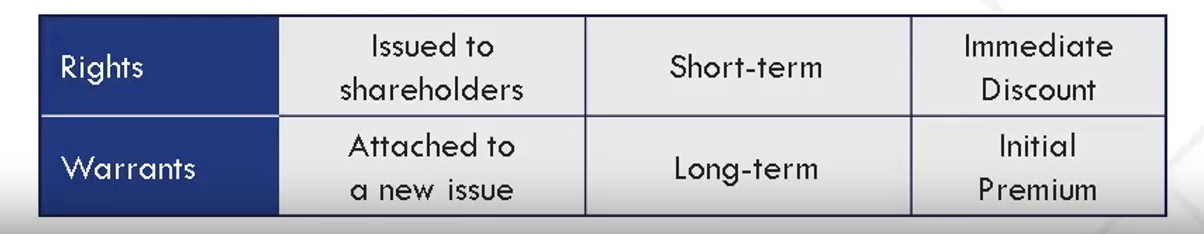

rights vs warrants

FINRA Rule 2261 - Disclosure of Financial Condition

upon request, a member firm must make its balance sheet available to customers in either physical or electronic form

FINRA Rule 2262 - Disclosure of Control Relationship with Issuer

before executing a trade in the issuer’s securities, a broker-dealer must disclose to its customers if it has a control relationship with the issuer

SEC Rule 10b-18 Issuer Purchasing its Own Stock

for the issuer’s purchases to not be considered manipulative, the following conditions must be met

only one broker-dealer used

purchases made late in the day are prohibited

purchase price is restricted

single-day purchase amount is limited

“Safe harbor” you are safe if you follow the guidelines

how to calculate intrinsic value

price of common stock - warrant subscription price

how to calculate market capitalization

issued stock-treasury stock=outstanding stock

outstanding stock x stock price = market capitalization