SPTM314 Exam 1

1/59

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

60 Terms

NIKE

What is the largest sport-related company?

Financial Management

Using financial information to make the best decisions for your organization

Revenue

Money coming INTO an organization

Expenses

Costs that are incurred by an organization

Credit

Money owed to the business by others

Debt

Money owed to others by the business

Balance Sheet

The financial position of a business on a specific day

Assets=Liabilities+Owners Equity

Asset

Items of value such as cash, inventory, plant, property, equipment, accounts receivable, etc

Liabilities

Items of value owed to others

-Acc payable

-Notes payable

-Outstanding salaries/contracts

Owner's Equity

the amount remaining after the value of all liabilities is subtracted from the value of all assets

Income Statement

provides a financial summary of the firm's operating results during a specified period

Cash Flow Statement

Explains the inflows/outflows of cash only during a specific period of time

Current Ratio

Current Assets/Current Liabilities

Quick Ratio

(Current Assets - Inventory) / Current Liabilities

Net Working Capital

current assets - current liabilities

Total Asset Turnover Ratio

revenue/Total Assets (avg)

Debt Ratio

total liabilities/total assets

Debt-Equity Ratio

Total Debt/Total Equity

Net Profit Margin

Net Income/Revenue

Gross Profit Margin

EBIT/Revenue

Return on Assets

net income/average total assets

Return on Equity (ROE)

Net Income / Average Stockholders' Equity

Market Value

(Price per share of common stock) X (# of Outstanding shares)

Book Value

Total Assets-Total Liabilities

Earnings Per Share

(Net income)/(avg number of shares outstanding)

Price-Earnings Ratio

price per share/earnings per share

Sole Proprietorship

a business owned and managed by a single individual

-Owner keeps all profits

-unlimited liability

Partnership

a business owned by two or more people

Corporation

A distinct legal entity composed of one or more individuals/entities

-Most complicated to start

-Board of Directors

-Shareholders

-Easy to raise capital

Public Corporation

a corporation whose stock anyone may buy, sell, or trade

Private Corporation

business whose shares are not traded publicly on the stock market

S Corporation

a form of corporation that avoids double taxation by having its income taxed as if it were a partnership

Limited Liability Partnership

a type of partnership in which all partners are limited partners

Forecasting

Predicting future revenues and expenses

Budget

A tool used to predict the income and expenses of an organization on a long-term and short-term basis

Operational Budget

Day to day budget

Lists sales/revenues and expenditure for normal operations (Day-to-Day)

Capital Budget

Long term debt

Focuses on future expenditures such as new buildings, stadiums, and arenas (Long-Term)

Cash Flow Budget

examines the inflows and outflows of cash in a business on a day-to-day basis

Ability to pay bills with incoming cash

Zero Based Budgeting

A budgeting approach in which managers begin with a budget of zero and must justify every dollar put into the budget.

Incremental/Decremental Budgeting

Taking a prior budget and increasing or decreasing all items by some %

VERY EASY

Present Valuation

Measuring the present value of future cash flows

- (Cash Flow)/(1+r)

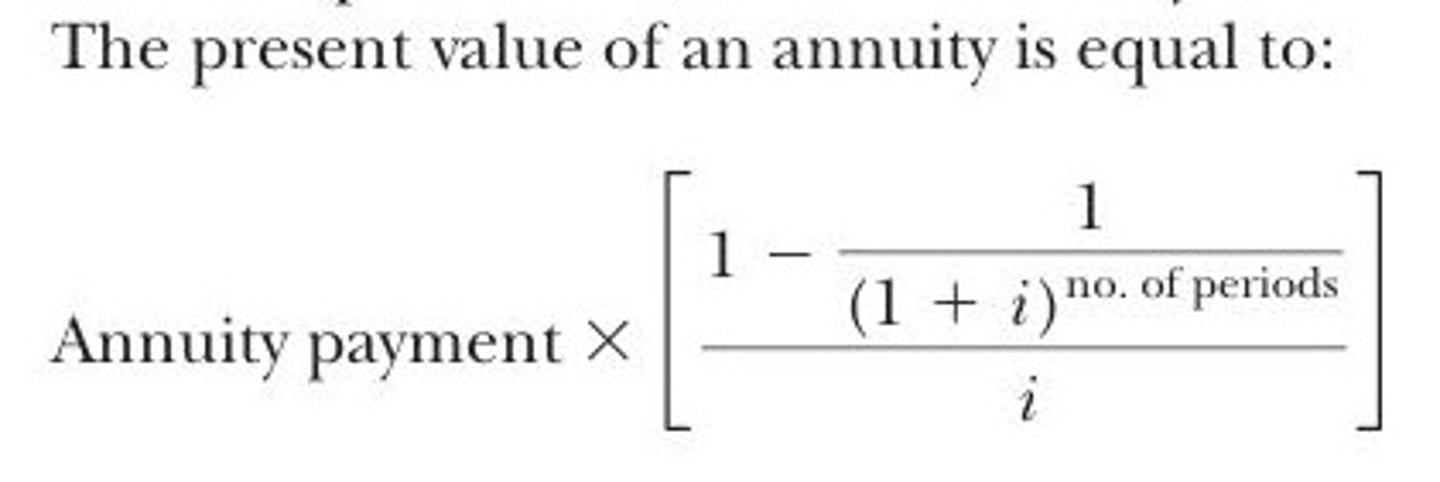

Annuity

A constant stream of payments that is received for a fixed number of periods

Revenue Sharing

Narrow revenue gap between large and small market teams by dividing funds equally amongst all teams

EBITDA

Earnings before interest, taxes, depreciation, and amortization

10-Q report

Quarterly report

10-K report

Required annual report filed with the SEC by publicly held firms

Uses of Ratio Analysis

- Comparing the performance of the business with previous years

- Comparing the performance of the business with its competitors'

- Comparing against other organizations of similar size and scope

Inventory Turnover Ratio

cost of goods sold/average inventory

Book value

Book value = Total assets - total liabilities

Present Value Formula

PV=FV/(1+r)^n

= Cash flow received in 1 year/(1 + the normal rate of return)

Our example:

Lets assume the current interest rate is 4%

PV = 105,000/1.04

PV=100,962

Future Value Formula

FV=PV(1+r)^n

Annuity Formula

MLB National TV deal dates

ended 2021 new ones run 2022-2028

During covid what was MLB player prorated salary?

37%

MLB revenue sharing

-The goal is to narrow the revenue gap between large and small market teams

-Transfer money from the large market to small-market teams

Approximately 34% of net local revenue after ballpark expense. Funds divided equally amongst all teams

mlb revenue sharing supplemental plan

Approximately 14% of net local revenue after ballpark expenses

Funds are redistributed based on "performance factors" which measure financial performances of each team → need to hit certain revenue quotas etc

Top 13 Markets not permitted to receive $ from this plan

Luxury tax violators not permitted to be revenue sharing plan receivers (only pay in)

NEGATIVE of the system → the clubs can use the funds for anything even personal profit

MLB Salary Arbitration

Arbitrator must select either the player's salary proposal (after a couple years in the league) or the teams proposal

(based of performance)

can't split the difference or choose another figure

set up to drive compromise between the parties before trial

MLB Luxury Tax

funds paid to the tax is distributed to clubs, not over the tax

Tax % increased each time you have an additional offense

Put in place to limit large teams from buying everyone

Define finance

involves identifying current and future revenues and expenses and determining future budgets to help an organization succeed.

credit vs debit

Credit - $$ owed to the business by others

Debt - money owed to others by the business