Exam on Wednesday Federal Budget

1/30

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

31 Terms

ANTIDEFICIENCY ACT

Prohibits federal agencies from obligating or expending federal funds in advance or in excess of an appropriation, and from accepting voluntary services.

Why was Medicare created? What was the political context surrounding its creation?

Income was declining for elderly and healthcare was becoming more expensive. Could not afford plans or insurance to keep up with prices of new medical tech. Basically, there was a major gap in the social insurance system in 1963.

Who does Medicare serve? 16% of budget

Most American 65 & older, Those eligible for SSDI - Social Security Disability Insurance (after 2-year wait), Those with certain illnesses (immediately)

How is Medicare funded?

Medicare is funded by a combination of payroll taxes, general federal revenues, and premiums paid by beneficiaries. Two trust funds—the Hospital Insurance (HI) Trust Fund and the Supplementary Medical Insurance (SMI) Trust Fund—hold the money and finance different parts of the program.

What are the various ways that patients have payment responsibilities when it comes to Medicare and other healthcare systems (i.e. copays, premiums, deductibles)?

A copay is a small, fixed amount outlined in the policy that you pay each time a covered service is provided. A deductible is the amount you must pay out of pocket for covered expenses before the insurance company will pay the remaining costs. A premium is the amount you must pay for your insurance plan.

How do Medicare Part A, B, & D provide services and collect fees? In the case of Part D, when and how was it created?

Part A covers hospital stays and inpatient care. Part B helps pay for doctor visits and outpatient care. Part C is the Medicare advantage plan, including parts A and B. Part D covers drugs. Part D was created by the MMA in 2003. (Not in effect till 2006) Basically, Medicare pays subsidies to these private plans and then they provide the drugs to enrollees.

MMA

The Medicare Prescription Drug, Improvement, and Modernization Act of 2003 (MMA)

How are Medicare services sometimes supplemented?

Medicaid, state support, medigap plans.

What successes and challenges define the Medicare program?

Coverage is nearly universal for seniors, very popular. Challenges are costs, gaps, and baby boomers.

Why is healthcare so expensive in the U.S. (relative to other countries)? In what ways does the government seek to limit the growth of Medicare costs? What more could it do?

Same drugs, higher prices. Consensus is healthcare is a luxury. Patent protection, few price controls, providers make a lot more. Lobbying!, Medicare does a good job controlling costs because they can bargain prices of services, It could also implement price negotiation for drugs, providers can prioritize outcomes rather than volume of services. The Inflation Reduction Act of 2022.

The Inflation Reduction Act of 2022

The Inflation Reduction Act of 2022 is U.S. legislation that addresses climate change, healthcare costs, and taxes.

Who signed Medicaid into law (and Medicare)?

Lyndon B. Johnson - 1965

What groups of low-income persons does the Medicaid program specifically serve? (since 1965)

Parents, children, pregnant people, seniors, and those with disabilities

How are the costs of Medicaid shared between the federal and state governments?

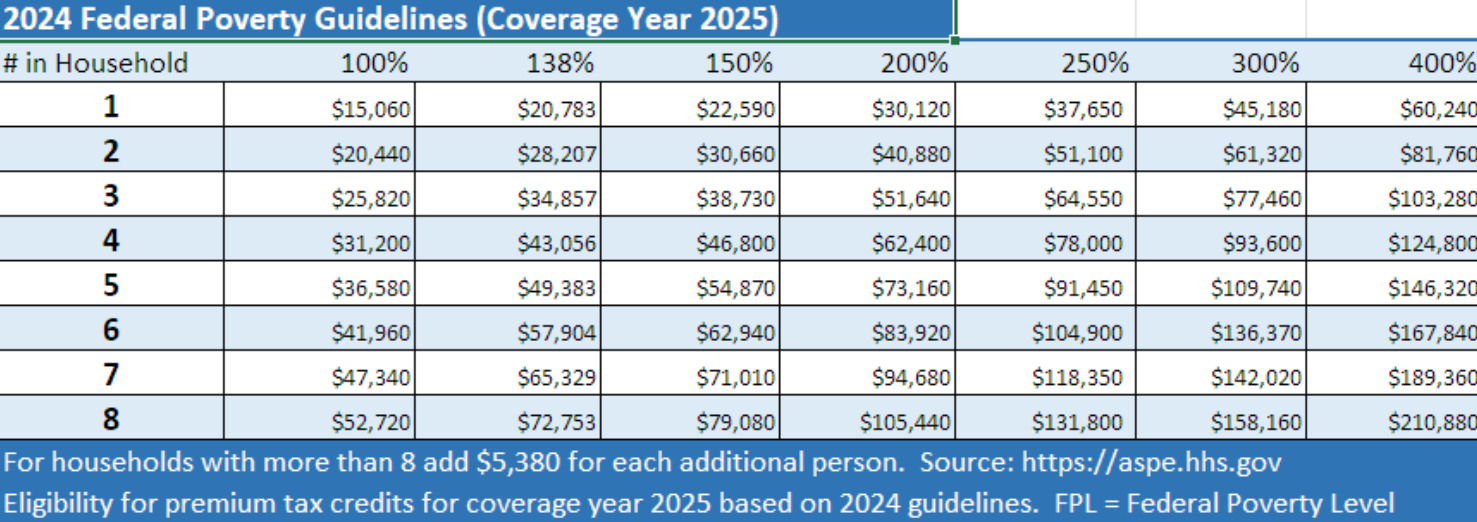

Jointly funded by governments. Always been optional for states. States decide this coverage based on eligible groups. (FPL then Federal Medical Assistance Percentage {FMAP} is applied.

How does the Veterans Health Administration (VHA) categorize veterans for the purposes of providing and charging them for services?

Highest priority are those with a service connected disability. POWs, Medal of Honor winners as well. Also low income veterans. Higher priority pay little copay or deductible + premium., The lower priority are those without a service connected disability, who do usually pay a copay!

Compared to other nations, what remained distinct about the U.S. healthcare system in early 2010?

The U.S. lacked universal, government-guaranteed coverage

Private, employer-based insurance and fragmented public programs (Medicare, Medicaid, VA, etc.) dominated.

Produced higher per-capita spending, more uninsured people, weaker primary-care continuity, and worse population-level access/health outcomes compared with other high-income countries.

What was the political context that led to the passage of the Affordable Care Act? What factors helped shape the final version of the bill?

Political context: Big Democratic majorities in Congress after the 2008 election + President Obama’s 2009–10 push for health reform created a window to move ambitious reform.

Fierce partisan polarization, strong opposition from Republicans and some interest groups, and high stakes for senators in vulnerable seats shaped strategy.

Key events: House and Senate negotiation in 2009–2010, cloture and votes in late 2009, Scott Brown’s Jan 19, 2010 MA special-election win (which cost Democrats their 60-vote filibuster cushion), and follow-on reconciliation steps culminating in enactment on March 23, 2010. Stakeholder pressure (insurers, hospitals, physician groups, patient advocates, unions) and Senate rules (needing 60 votes and later using budget reconciliation) heavily influenced tradeoffs.

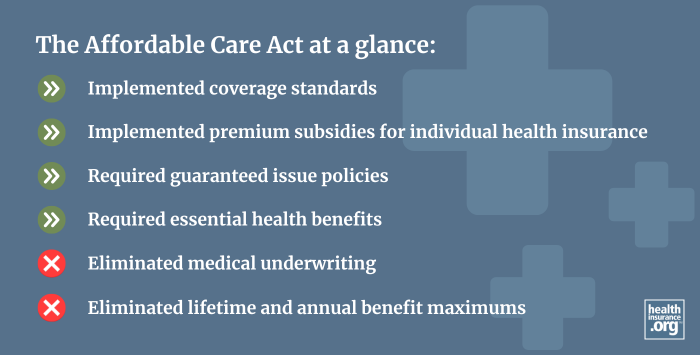

How did the Affordable Care Act seek to achieve certain goals through various changes in healthcare policy? In other words, what does the law do? OBAMACARE

Expanding Medicaid eligibility

Creating health insurance marketplaces with subsidies

Prohibiting insurers from denying coverage for pre-existing conditions

Also requires insurers to spend a minimum percentage of premium dollars on medical care, mandates coverage for essential health benefits like preventive care, and provides tax credits to small businesses that offer health insurance to employees.

Why was the public option left out of the final bill?

Political compromise and coalition management: a government-run public plan was seen as politically infeasible because it would have lost key swing votes and provoked stronger opposition from hospitals, insurers, and some moderate Democrats. White House and congressional Democrats concluded they could not pass reform with a public option without jeopardizing the whole package; instead they prioritized measures likely to get 60 Senate votes (and later reconciliation fixes). Internal strategy and concessions to industry interests helped push the public option off the table.

How were the new services included in the Affordable Care Act funded? How did/does the bill affect the federal budget?

Funding mix: reductions in projected Medicare payment growth (provider payment changes)

New taxes/fees (taxes on high-end employer plans originally, fees on insurers/pharmaceuticals, etc.)

Enhanced federal shares for Medicaid expansion (initially very generous to states)

Revenue offsets (e.g., Medicare cuts, new revenue)., Budget impact: the CBO and subsequent CBO analyses projected that the ACA would reduce federal deficits over the 2012–2021 window (CBO’s comprehensive 2011/2014 style estimates showed net deficit reduction in the 2010s), largely because projected Medicare payment restraints and revenue provisions outweighed new spending in those estimates — though distributional and longer-run fiscal impacts depend on growth, repeal efforts, and later policy changes. (CBO and Treasury analyses are the authoritative budget evidence.)

How has the Affordable Care Act changed since its passage?

Major legal/political changes: the Supreme Court in NFIB v. Sebelius (decided June 28, 2012) upheld most of the law but made Medicaid expansion effectively optional for states (struck down coercive conditionality).

Other changes: Congress set the individual mandate penalty to $0 in 2017 (Tax Cuts and Jobs Act), and subsequent legislation and administrative action (e.g., American Rescue Plan Act of 2021; Inflation Reduction Act 2022) modified subsidies and other provisions. States’ choices about Medicaid expansion created persistent coverage variation. Ongoing rulemaking, lawsuits, and periodic legislative tweaks have continued to modify implementation.

What effects has the Affordable Care Act had?

Coverage: large reductions in the uninsured rate (Medicaid expansion + marketplace subsidies drove most gains; dependent coverage provision also helped young adults)., Access & health outcomes: evidence of improved access, preventive care use, improved financial protection, and research linking Medicaid expansion to improved health outcomes and reductions in mortality in expansion states., Budget/market effects: mixed effects on premiums in some segments, slower Medicare per-beneficiary payment growth in early years, and CBO estimates that the law reduced deficits in the 2010s; redistributional effects and state fiscal impacts vary. Implementation differences across states (especially Medicaid expansion refusal by some) limited national gains in certain populations.

Who (specifically) is served by the SNAP, WIC, and School Lunch programs?

SNAP (Supplemental Nutrition Assistance Program): low-income households across demographics (families with children, elderly, disabled, working poor). SNAP is the broadest, not targeted to a specific age group; many SNAP households include workers.

WIC (Women, Infants, and Children): specifically pregnant, postpartum, and breastfeeding women, infants, and children under age 5 who meet income and nutritional-risk criteria.

National School Lunch Program (NSLP): low-income K–12 students—free meals for families ≤130% of poverty, reduced-price for 130–185% of poverty; many schools use area-eligibility options to expand access.

In the case of SNAP, who are the biggest advocates for the program (in terms of industries)?

Key industry advocates: large food retailers and grocery chains, supermarket associations, and manufacturers of packaged foods — because SNAP benefits are spent at retailers and represent significant retail revenue. Anti-hunger and child-nutrition advocacy groups are also major policy advocates for program preservation and expansion. (Advocacy reflects both public-interest NGOs and private retail interests.)

What factors affect the types of food covered by some of the above programs? What laws have sought to regulate this?

Factors: statutory program rules (Congressional authorization and appropriations), USDA regulatory guidance, nutrition science and program goals (child nutrition standards, WIC food packages), procurement rules, and industry lobbying.

Major laws/regulations include the Child Nutrition Act (governs school meal standards) and periodic Farm Bill provisions that influence SNAP authorization and funding. Administrative rulemaking (e.g., Healthy, Hunger-Free Kids Act of 2010 updated school meal nutrition standards; USDA rule changes update WIC packages) also shapes allowed items.

What benefits are available to the unemployed in the U.S.? How are these benefits funded?

Unemployment Insurance (UI): weekly cash benefits (amount and duration set by states within federal guidelines); state UI programs pay regular benefits, and the program is financed by state payroll taxes on employers and a federal unemployment tax (FUTA) that funds federal administration and loans to states. In downturns, the federal government sometimes funds extended benefits or emergency programs (e.g., during COVID) through supplemental federal legislation.

How have cash assistance (i.e. “welfare”) services evolved in the U.S. since the 1930s?

Evolution: initial New Deal relief and categorical programs expanded over mid-20th century (e.g., Aid to Dependent Children/AFDC).

By the 1980s–1990s criticisms of dependency led to welfare reform. The 1996 Personal Responsibility and Work Opportunity Reconciliation Act (PRWORA) replaced AFDC with TANF, shifted cash assistance from an entitlement to a block-grant system with time limits, work requirements, and state flexibility.

That transformation decentralized policy and reduced caseloads dramatically, but did not eliminate poverty and increased state-by-state variation in assistance.

How is the TANF (Temporary Assistance for Needy Families) program currently structured?

TANF is a federal block grant to states (set annual grant amount)

States required to spend some maintenance-of-effort (MOE) state funds and allowed broad flexibility in program design.

Federal rules include time limits (states commonly enforce a 60-month lifetime limit on federal MOE funds, though state limits vary), work requirements, and performance reporting.

Because TANF is not an entitlement, funding does not automatically expand in recessions, and unspent state TANF balances can accumulate.

What effects has TANF had on providing assistance to the poor?

Effects: TANF drastically reduced cash welfare caseloads (≈60% decline from mid-1990s to 2000s), and increased emphasis on work. But poverty reductions were smaller than caseload declines; TANF’s block-grant design reduced automatic countercyclical support, produced large interstate variation, and critics argue it left many poor families with inadequate cash assistance. Research shows mixed outcomes: higher employment among some former recipients but persistent deep poverty for others.

What group(s) are most served by mandatory programs?

Mandatory programs in the U.S. most serve senior citizens, people with disabilities, and low-income individuals and families.

How does U.S. law serve (or not serve) those who need leave from work for a new child or medical emergency?

FMLA (Family and Medical Leave Act, 1993) guarantees up to 12 weeks of unpaid, job-protected leave for eligible employees at covered employers (private employers with 50+ employees within 75 miles, state/local/federal employees subject to slightly different rules). Eligibility requires 12 months’ employment and at least 1,250 hours in the prior 12 months. The FMLA provides job protection and continuation of group health insurance but does not guarantee paid leave (paid leave depends on employer policy or state laws). Many states and some localities have enacted paid-leave programs (often broader than federal FMLA), but nationally coverage gaps remain (part-time workers, employees at small firms, and short-tenure employees are often excluded).