micro ch 4 elasticity

1/67

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

68 Terms

elasticity

measures responsiveness of one variable to changes in another variable

price elasticity

the ratio btw the percentage change in the qty demanded Qd or supplied Qs and the corresponding percent change in price

price elasticity of demand

the percentage change in the qty demanded of a good or service divided by the percentage change in the price

ex., price goes up or down by 2% how much will the qty demanded change?

price elasticity of supply

the percentage change in qty supplied divided by the percentage change in price

ex., if price goes up or down by 6%, how much will the qty supplied change?

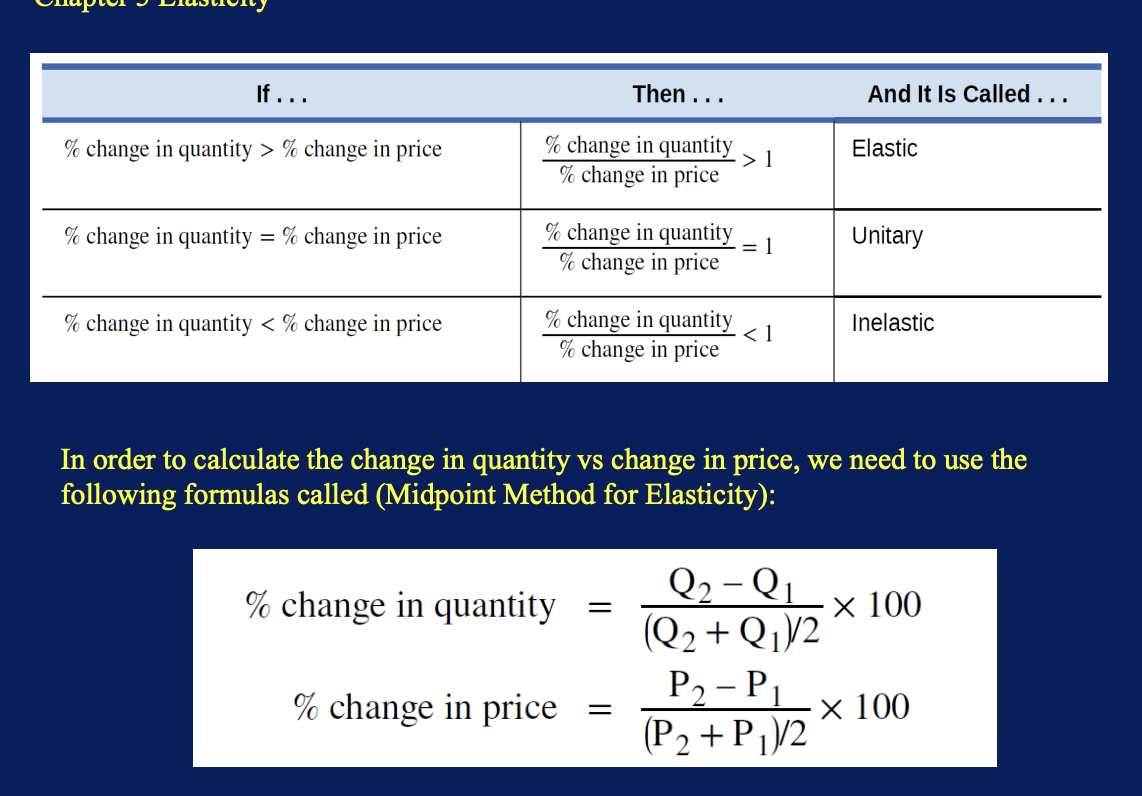

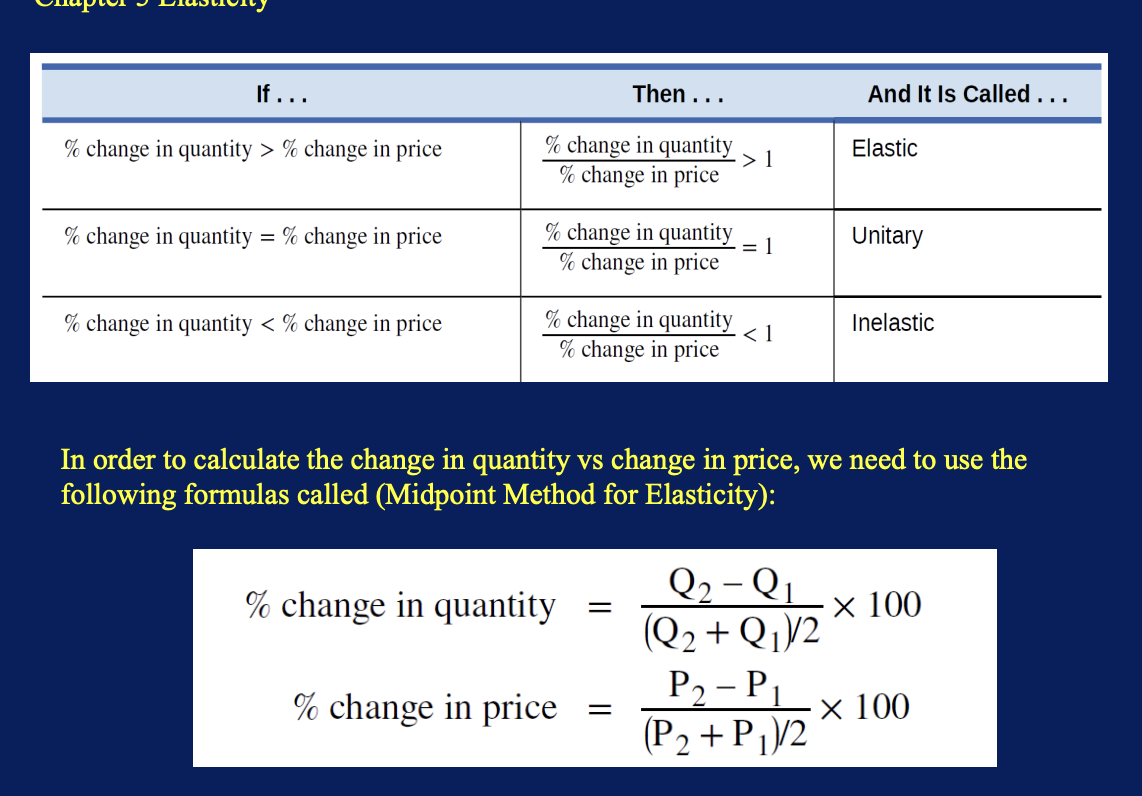

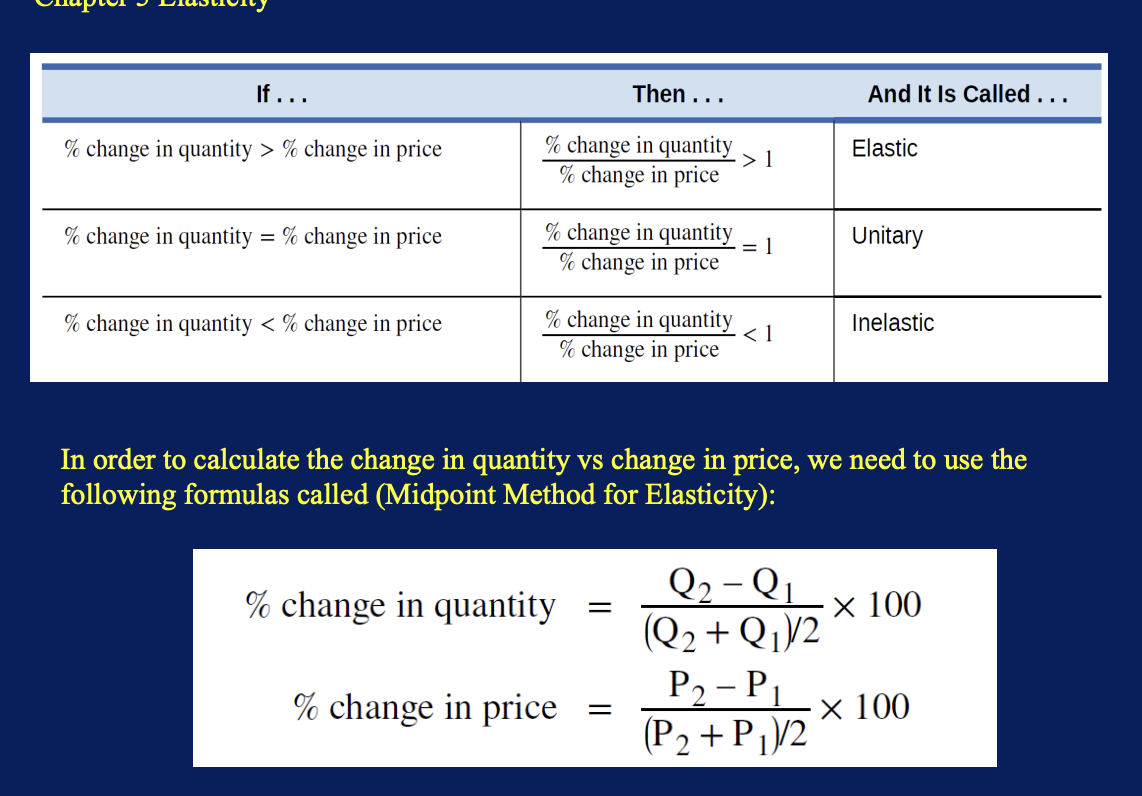

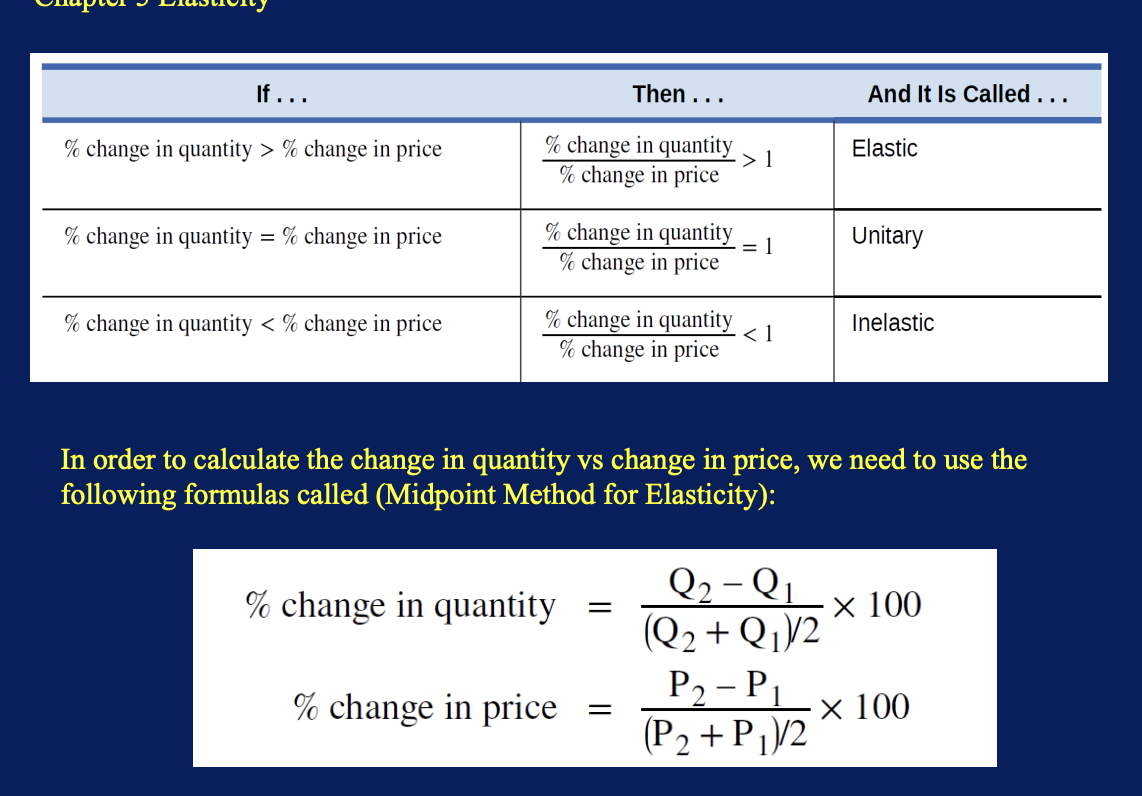

3 categories of elasticities

elasticity

unitary

inelasticity

elastic demand (luxuries) or elastic supply

which the elasticity is greater than one

indicates a high responsiveness to changes in price

price goes up by less percentage than change of qty demanded

ex., P up by 4%

Q down by 8%

ex., when there are acceptable substitutes for the product, e.g., cookies, luxury automobiles, and coffee

these goods are considered non-essential since they are elastic to any price change

unitary elasticities

indicate proportional responsiveness of either demand or supply

if prices changed (rise or fall) by 1%, qty will change by the same percentage (1%)

elasticity = 1

inelastic demand (necessities) or inelastic supply

less than 1

indicate low responsiveness to price changes

a given % rise in price will cause a smaller % fall in qty demanded so that total revenue (Price x Qty) rises. typically less than 1%.

in short run, supply and demand often inelastic, so that shifts in either demand or supply can cause a relatively greater change in prices

also when cost of production fall for inelastic products, customers will notice price decrease

ex., gasoline and water

midpoint method for elasticity

absolute values

price elasticities of demand are negative numbers indicating that the demand curve is downward sloping, but we read them as ?

negative since price and qty demanded always move in opposite directions (on the demand curve)

by convention, we always talk about elasticities as positive numbers

mathematically, we take the ? of the result

common mistake

common mistake to confuse the slope of either the supply or demand curve with its elasticity

slope is rate of change in units along the curve, or the rise/run

price elasticity is the ratio btw the % change in the Qd or Qs and the corresponding % change in price

2 extreme cases of elasticity

when it is infinite

when elasticity equals zero

AND when constant unitary elasticity occurs

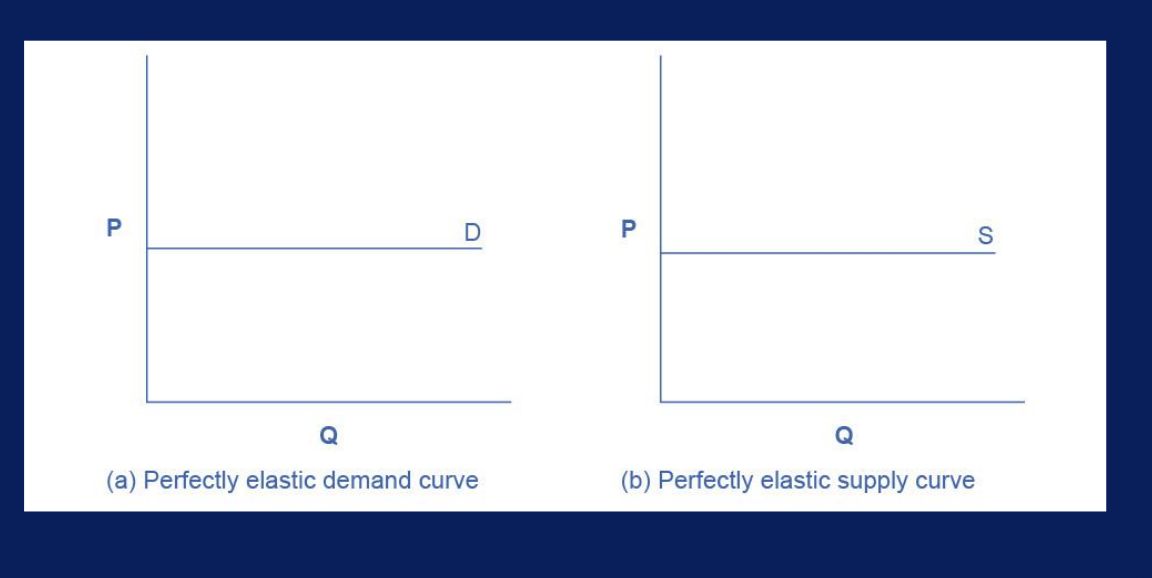

infinite elasticity or perfect elasticity

refers to the extreme case where either the quantity demanded Qd or supplied Qs changes by an infinite amount in response to any change in price at all

while perfectly elastic supply curves are mostly unrealistic, goods with readily available inputs and whose production can easily expand will feature highly elastic supply curves (a horizontal demand or supply curve)

high elastic demand curves

such as goods are Caribbean cruises and sports, vehicles, and vegetable sellers in farmers markets

highly elastic supply curves

such as books and bread (unrealistic bc government (consumer protection) policies).

perfectly elastic

the qty supplied or demanded is extreme responsive to price changes, moving from 0 for prices close to P to infinite when prices reach P

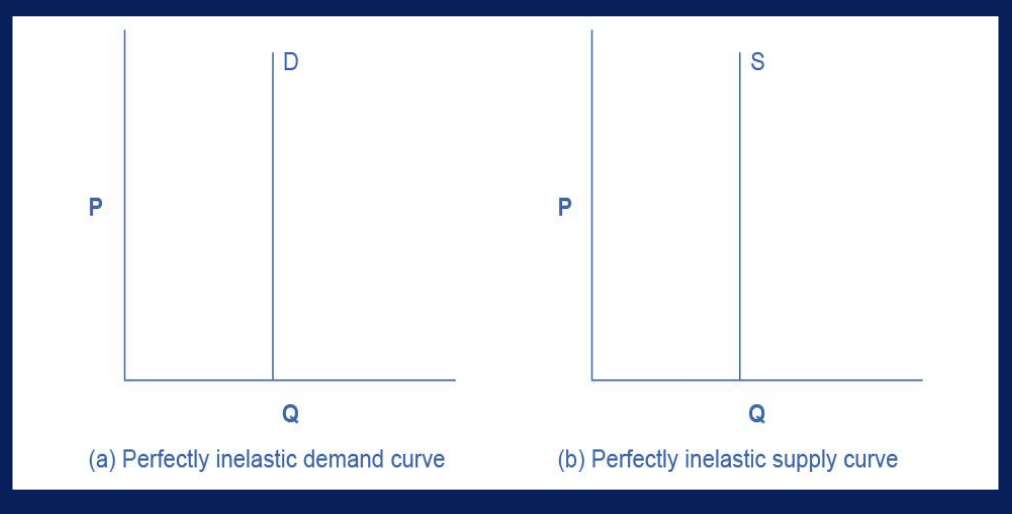

zero elasticity or perfect inelasticity

refers to the extreme case in which a % change in price, no matter how large, results in zero change in qty

ex., medicine and water

while a perfectly inelastic supply is an extreme example, goods with limited supply of inputs are likely to feature highly inelastic supply curves

exs., diamond rings or housing in prime locations such as apartments facing Central Park in NYC

perfectly inelastic

extreme case

alternatively, necessities with no close substitutes are are likely to have highly inelastic demand curves (e.g., life-saving drugs and gasoline)

% change of gasoline price affects courier service

ex., if demand curve for a life-saving medicine or gasoline are perfectly inelastic, then a reduction in supply will cause the equilibrium price to rise and the equilibrium qty (qty demanded) to stay the same

zero elasticity is the vertical supply curve and vertical demand curve show that there will be zero percentage change in qty demanded or supplied, regardless of the price

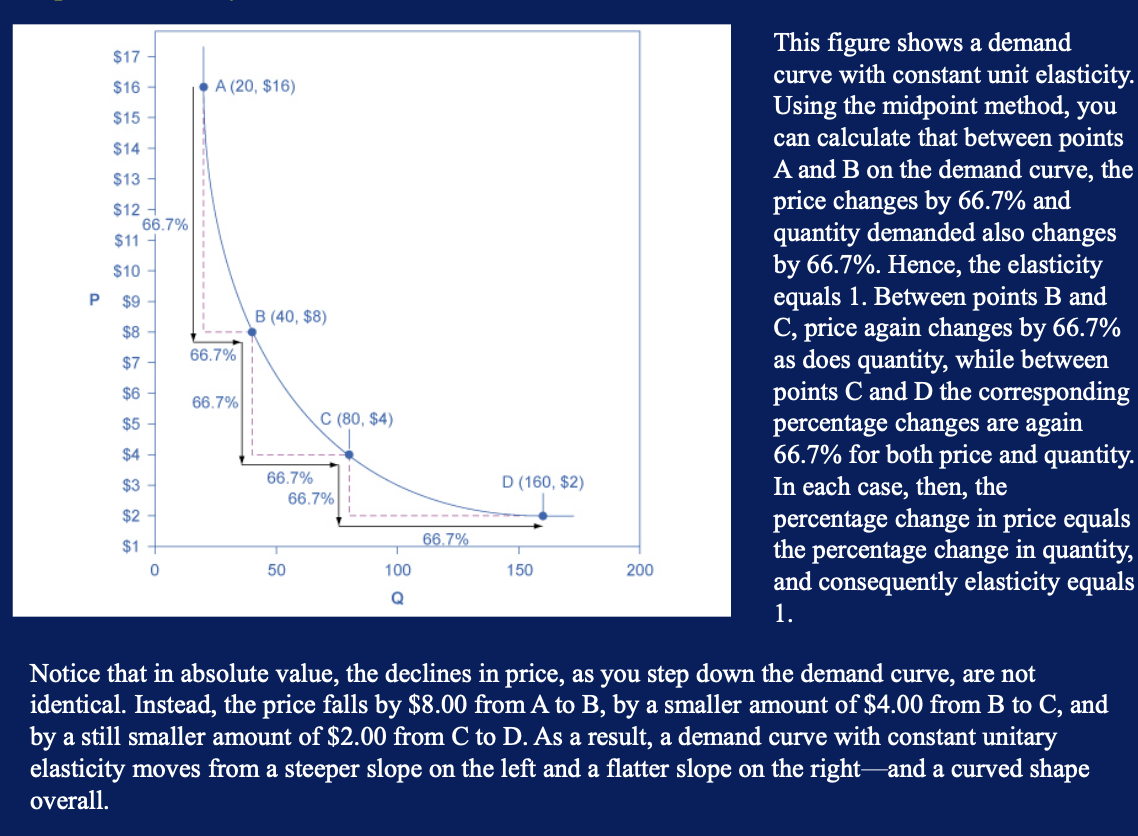

constant unitary elasticity

in either a supply or demand curve, occurs when a price change of 1% results in qty change of 1%

a demand curve with ? be a curved line

price and qty demanded change by an identically %age amt btw each pair of points on the demand curve

constant unitary elasticity demand curve

move from steeper slope on the L and flatter slope on the R, curved shape overall

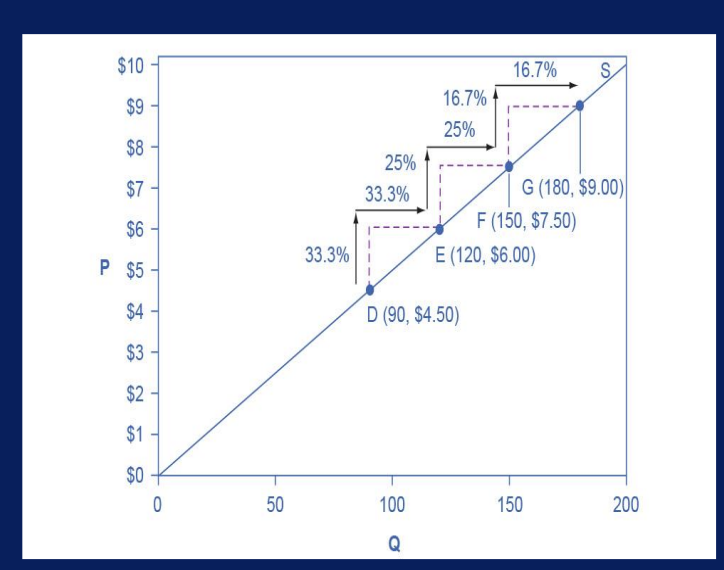

constant unitary elasticity supply curve

straight line reaching up from the origin

btw each pair of points the %age increase in qty supplied is the same as the %age increase in price

along the curve, the %age qty increases on the horizontal axis exactly match the percentage price increases on the vertical axis so this supply curve has a constant unitary elasticity at all points

leonardo da vinci

supply of paintings is highly inelastic

supply of paintings represented by a vertical line, since no amount of price fluctuation can change them

price is therefore wholly determined by the position of the demand curve

inelastic

note that demand for necessities like housing and electricity is ?

a 10% increase in the price of housing will cause only a slight decrease of 1.2% in the qty of housing demanded

items that are not necessities (e.g., restaurant meals) are more price sensitive

if price of restaurant meal increases by 10% the qty demanded will decrease by 22.7%

pricing and revenue

key concept in collecting max revenue is the price elasticity of demand

total revenue is price times quantity (P*Q)

suppose

maximizing tix revenue

if demand is elastic, band should cut the prices bc the % drop in price will cause even larger % increase in qty sold- thus raising total revenue

if demand is inelastic at og qty level, the the band should raise the ticket price bc a certain % increase in price will result in a smaller %age decrease in the qty sold and total revenue will rise

demand is elastic

? at that price level, band should cut the price bc the percentage drop in price will result in an even larger percentage increase in the qty sold- thus raising total revenue

demand has unitary elasticity

? at that qty, then an equal percentage change in qty will offset moderate percentage change in the price- so the band will earn the same revenue whether it (moderately) increases or decreases the ticket price

demand is inelastic

at that og qty level, then the band should raise the ticket price bc a certain percentage increase in price will result in a smaller percentage decrease in the qty sold and total revenue will rise

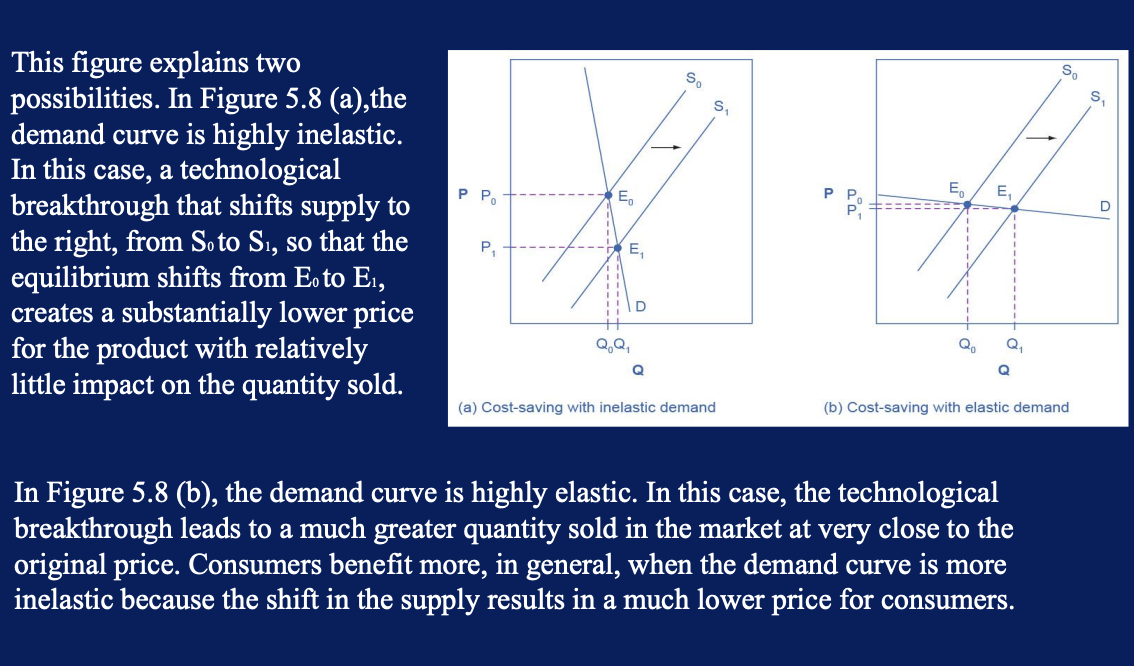

demand curve is inelasic

consumers generally benefit more when ? bc the shift in the supply results in a much lower price for consumers

elasticity reveals if firms can pass on higher costs they incur on to consumers

governments mainly pass along these taxes to consumers in the form of higher prices

these higher taxes on cigarettes will raise tax revenue for the govt but they will not much affect the quality of smoking

youth smoking is more elastic than adult smoking (qty of youth smoking will fall by a greater percentage than the qty of adult smoking in response to a given percentage increase in price)

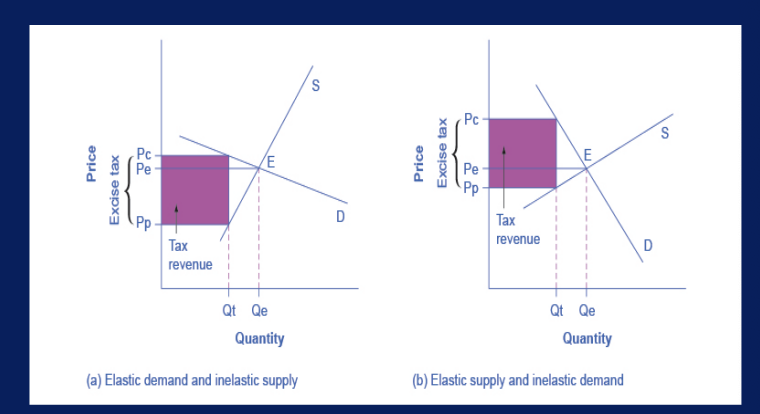

tax incidence

the analysis, or manner, of how a tax burden is divided btw consumers and producers

typically the tax incidence or burden falls both on the consumers and producers of the taxed good

BUT

if demand is more inelastic than supply, consumers bear most of the tax burden and the qty bought and sold stay unaffected with the tax

if supply is more inelastic than demand, sellers bear most of the tax burden

consumers bear most of the tax burden when supply is more elastic than demand

the govt can then pass the tax burden along to consumers as higher prices, wo much of a decline in the equilibrium qty

excise tax

introduces a wedge btw the price paid by consumers Pc and the price received by producers Pp

the vertical distance btw Pc and Pp is the amount of the tax per unit

Pe is the equilibrium price prior to introduction of the tax

when the demand is more elastic than supply, the tax incidence on consumers Pc-Pe is lower than the tax incidence on producers Pe-Pp

when the supply is more elastic than demand, the tax incidence on consumers Pc-Pe is larger than the tax incidence on producers Pe-Pp. the more elastic the demand and supply curves, the lower the tax revenue.

long run vs short run

long run

elasticities are often higher

on demand side, it can sometimes be easier to change the Qd

elasticity of demand for energy more elastic

short run

elasticities often lower

on demand side, sometimes difficult to change Qd in short run

elasticity of demand for energy is somewhat inelastic in the short run

ex., energy

long run

you can buy car that get more mpg, choose job that is closer to house, buy more energy efficient home appliances, install more insulation, change energy service company

short run

not easy for person to make substantial changes in energy consumption

maybe u can carpool to work sometimes or adjust your home thermostat by a few degrees if the cost of energy rises

in most markets, prices bounce up and down more than quantities in the short run, but quantities often move more than prices in the long run

underlying reason is that supply and demand are often inelastic in the short run, so that shifts in either demand or supply can cause a relatively greater change in prices

however, since supply and demand are more elastic in the long run, the long-run movements in prices are more muted, while quantity adjusts more easily in the long run

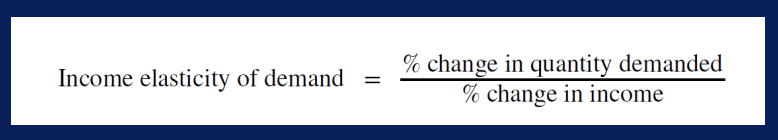

income elasticity of demand

%age change in qty demanded/%age change in income

normal goods

a higher level of income causes a demand curve to shift to the R

means that the income elasticity of demand is positive

inferior goods

when the income elasticity of demand is negative, a higher level of income would cause the demand curve for that good to shift to the left

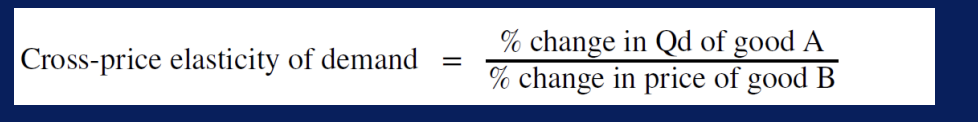

cross-price elasticity of demand

price of one good is affecting the qty demanded of a diff good

specifically, it is the percentage change in the qty of good A that is demanded as a result of a percentage change in the price of good B

negative number

goods are complimentary

ex., bread and peanut butter

drop in price of one good will lead to an increase in the qty demanded of the other good

positive number

goods are substitute

ex., plane tickets and train tickets

drop in price of one good will cause ppl to substitute toward that good, and to reduce consumption of the other good

cheaper plane tickets lead to fewer train tickets, and vice versa.

a change in the price of one good can shift the qty demanded for another good

good A is complement for good B

higher price for good B will mean a lower qty consumed of good A

good A is substitute for good B

higher price for good B means a greater qty consumed of good A

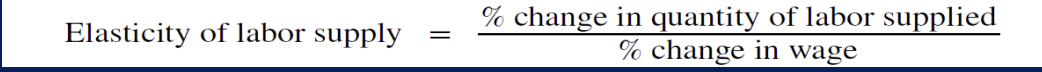

elasticity of labor supply

percentage change in hours worked divided by the percentage change in wages- will reflect the shape of the labor supply curve

wage elasticity of labor supply for teens is generally fairly elastic (a certain percentage change in wages will lead to a larger percentage change in the qty of hours worked)

conversely, wage elasticity of labor supply for adult workers in their 30s and 40s is fairly inelastic

elasticity of savings

percentage change in qty of savings divided by the percentage change in interest rates will describe the shape of the supply curve for financial capital

sometimes laws proposed to increase qty of savings by offering tax breaks so return on savings is higher

comparatively large impact on increasing the qty saved if the supply curve for financial capital is elastic, bc then a given percentage increase in the return to savings will cause a higher percentage increase in the qty of savings.

if the supply curve for financial capital is highly inelastic, then a percentage increase in the return to savings will cause only a small increase in the qty of savings.

the evidence on the supply curve of financial capital is controversial but, at least in short run, elasticity of savings with respect to interest rate appears fairly inelastic.

their cross price elasticities are greater than zero

If cola and iced tea are good substitutes for consumers, then it is likely that:

Option A

their cross price elasticities are greater than zero.

Option B

their price elasticities of supply are less than one .

Option C

their income elasticities are less than zero.

Option D

their price elasticities of demand are less than one.

Perfectly elastic

A horizontal demand curve or supply curve would be called:

Option A

Cross elastic

Option B

Unit elastic

Option C

Perfectly inelastic

Option D

Perfectly elastic

There is no change in quantity demanded or supplied in response when a change in price

A perfectly inelastic demand curve or supply curve means...

Option A

There is an infinite change in quantity demanded or supplied in response to a change in price.

Option B

There is a 1% change in quantity demanded in response to a 1% change in price.

Option C

There is no change in quantity demanded or supplied in response when a change in price

Option D

If the price of one good changes by 1% the % change in quantity demanded will be greater than 1%.

rise and the equilibrium quantity to stay the same.

If the demand curve for a life-saving medicine is perfectly inelastic, then a reduction in supply will cause the equilibrium price to:

Option A

rise and the equilibrium quantity to stay the same.

Option B

stay the same and the equilibrium quantity to fall.

Option C

rise and the equilibrium quantity to fall.

Option D

rise and the equilibrium quantity to rise.

% change in quantity demanded / % change in income

If income elasticity of demand for a good is positive, we say that good is a normal good. You can use the following approach to calculate the income elasticity of demand for a good:

Option A

% change in quantity supplied / % change in income

Option B

% change in quantity demanded / % change in income tax rates

Option C

% change in income / % change in quantity demanded

Option D

% change in quantity demanded / % change in income

3.0

Billy Bob's Barber Shop knows that a 5 percent increase in the price of their haircuts results in a 15 percent decrease in the number of haircuts purchased. What is the elasticity of demand facing Billy Bob's Barber Shop?

Option A

0.10

Option B

0.05

Option C

0.15

Option D

3.0

% change in quantity supplied / % change in price

To calculate the price elasticity of supply using the midpoint method, you would use the following approach:

Option A

Price times quantity

Option B

% change in quantity supplied / % change in price

Option C

% change in quantity minus the % change in price

Option D

% change in price / % change in quantity

elastic

Demand is said to be ___________ when the quantity demanded is very responsive to changes in price.

Option A

inelastic

Option B

independent

Option C

unit elastic

Option D

elastic

inelastic; elastic

taxes on goods with __________ demand curves will tend to raise more tax revenue for the government than taxes on goods with __________ demand curves.

Option A

elastic; inelastic

Option B

unit elastic; inelastic

Option C

elastic; unit elastic

Option D

inelastic; elastic

1.0

Suppose that Mimi plays golf 5 times per month when the price is $40 and 4 times per month when the price is $50. What is the price elasticity of Mimi’s demand curve?

Option A

10.0

Option B

0.1

Option C

1.0

Option D

0.8

% change in quantity demanded / % change in price

To calculate the price elasticity of demand using the midpoint method, you would use the following approach:

Option A

Price times quantity

Option B

% change in price / % change in quantity

Option C

% change in quantity demanded / % change in price

Option D

% change in quantity minus the % change in price

5 units

The demand for a product is unit elastic. At a price of $20, 10 units of a product are sold. If the price is increased to $40, then one would expect sales to equal:

Option A

5 units.

Option B

0 units.

Option C

10 units.

Option D

15 units.

The elasticity of supply is defined as the ________ change in quantity supplied divided by the _______ change in price.

Option A

marginal; percentage

Option B

total; percentage

Option C

percentage; marginal

Option D

percentage; percentage

cross-price elasticity of demand for soda is -3

A 10 percent decrease in the price of potato chips leads to a 30 percent increase in the quantity of soda demanded. It appears that:

Option A

elasticity of demand for soda 3.

Option B

elasticity of demand for potato chips is 3.

Option C

cross-price elasticity of demand for soda is -3

Option D

elasticity of demand for potato chips is 13.

Supply is more elastic than demand.

How a tax burden is divided between consumers and producers is called tax incidence. Consumers bear most of the tax burden when:

Option A

Supply is more elastic than demand.

Option B

Demand is more elastic than supply

Option C

The firm decides to pass none of the tax on to the consumer via a higher price.

Option D

Cross elasticity of demand is .35

a relatively greater change in prices

In general, supply and demand are often inelastic in the short run, so that shifts in either demand or supply can cause:

Option A

A monopoly situation in all cases

Option B

A relatively smaller change in prices

Option C

No change in prices

Option D

A relatively greater change in prices

unit elastic

Demand is said to be __________ when the quantity demanded changes at the same proportion as the price.

Option A

elastic

Option B

unit elastic

Option C

independent

Option D

inelastic

% change in quantity of labor supplied / % change in wage

The wage elasticity of labor supply can be calculated using the following approach:

Option A

% change in quantity of labor supplied / % change in wage

Option B

The labor force participation rate / the inflation rate

Option C

% change in quantity of labor supplied / the savings rate

Option D

% change in wage / % change in quantity of labor supplied

inelastic

If demand is ___, then a given % rise in price will cause a smaller % fall in quantity demanded so that total revenue (Price × Quantity) rises.

Option A

Elastic

Option B

Perfectly Inelastic

Option C

Unit Elastic

Option D

Inelastic

consumers are not very responsive to changes in price

When demand is inelastic:

Option A

consumers are not very responsive to changes in price.

Option B

demand curves appear to be fairly flat.

Option C

the percentage change in quantity demanded resulting from a price change is greater than the percentage change in price

Option D

price elasticity of demand is greater than 1.

–30.77 divided by 31.5, inferior good

The average annual income rises from $25,000 to $38,000, and the quantity of bread consumed in a year by the average person falls from 30 loaves to 22 loaves. What is the income elasticity of bread consumption? Is bread a normal or an inferior good?

Option A

–30.77 divided by 31.5, inferior good

Option B

30.77 divided by 31.5, inferior good

Option C

–30.77 divided by 31.5, normal good

Option D

–30.77 divided by -31.5, normal good

elastic

Youth smoking seems to be more __________ than adult smoking—that is, the quantity of youth smoking will fall by a greater percentage than the quantity of adult smoking in response to a given percentage increase in price.

Option A

elastic

Option B

unitary elastic

Option C

inelastic

Option D

cross-price elastic

4.25

Suppose that Bobo purchases 1 pizza per month when the price is $19 and 3 pizzas per month when the price is $15. What is the price elasticity of Bobo’s demand curve?

Option A

0.235

Option B

6.33

Option C

2.00

Option D

4.25

price decrease

A company discovers a new technology that allows it to substantially reduce its cost of production. The demand for the product is inelastic. Consumers will in general experience:

Option A

No change in the price of the product

Option B

A monopoly in the long run or a lower demand

Option C

A price decrease

Option D

A price increase