MGT223 NEW

1/123

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

124 Terms

equivalent units

product of number of partially completed units and their percentage of completion with respect to a particular cost.

FIFO method

A method of accounting for cost flows in a process costing system in which equivalent units and unit costs relate only to work done during the current period.

Weighted-Average Method

method of process costing that blends together units and costs from both the current and prior periods.

equivalent units of production (weighted-average method)

the units transferred to the next department (or to finished goods) during the period plus the equivalent units in the department’s ending work in process inventory.

formula for equivalent units (weighted average method)

equivalent units of production units transferred to the next department or to finished goods + equivalent units in ending work in process inventory

activity based costing (ABC)

costing method based on activities designed to provide managers with cost information for strategic and other decisions that potentially affect capacity and therefore fixed costs

overhead cost pools

groups of overhead cost elements.

activity cost pool

bucket in which costs are accumulated that relate to a single activity measure in activity-based costing system.

activity measure

an allocation base in an activity based costing system; ideally, a measure of the amount of activity that drives the costs in activity cost pool; also called a cost driver.

transaction driver

a simple count of the number of times an activity occurs

duration driver

a measure of the amount of time required to perform an activity

unit-level activities

performed every time a unit is produced, proportional to the number of units produced. ex. providing power to run processing equipment, since power tends to be consumed in proportion to the number of units produced.

batch-level activities

performed every time a batch is handled or processed, regardless of how many units are in the batch. for example, the cost of setting up a machine for batch processing.

product-level activities

activities that relate to specific products that must be carried out regardless of how many units are produced and sold or batches run. for example, activities such as designing or advertising a product.

customer-level activities

relate to specific customers and include activites such as sales calls, catalogue mailings and general tech support which are not tied to any specific product.

organization-sustaining activities

activities carried out regardless of which customers are serviced, which products are produced, how many batches are run or how many units are made.

variable cost

Varies, in total, in direct proportion to changes in the level of activity. Is CONSTANT per unit.

fixed cost

Does not vary per unit. (ie the cost of rent is always 2,000 no matter how much is produced)

MOH (manufacturing overhead)

manufacturing costs that cannot be practically traced to a unit of finished goods. consists of indirect materials and indirect labour (ie. supervisors of factory)

sunk cost example

legal costs, paid at the beginning of or during the business

direct material costs (for a company selling computers)

the cost of a hard drive installed in a computer

direct labour costs (for a company selling computers)

the wages of employees who assemple computers from components

manufacturing overhead (for a company selling computers)

depreciation on equipment used to test assembled computers before release to customers, the salary of the assembly shop supervisor

selling and administrative costs

the cost of advertising in the Peel Region Computer User newspaper, sales comissions paid to company's salespeople, salary of company's accountant

is depreciation a fixed cost

yes

examples of opportunity costs

forgone salary at tech company, withdraw of savings

can legal fees paid to incorporate be a differential cost

no, because they have already been incurred and are thus a sunk cost

four functions of managers

planning, directing and motivating, controlling and decision making

planning activities

developing goals and specifying how to achieve them; estimating advertising revenues for a future period, scheduling designated broadcast time slots for games, special programming, news shoes, estimating total expenses for future periods including salaries of news desk anchors

directing and motivating activities

mobilizing people to carry out plans and run routine operations; scheduling news desk anchors for each day’s broadcast news, assigning camera crew employees to cover specific events, reviewing scripts used by news desk anchors, providing performative based incentives based on viewership

controlling

gathering feedback to ensure the plan is being properly executed or modified as necessary; contrasting the actual number of viewers with its projected viewership, comparing actual costs of producing a broadcast with its budget, comparing the advertising revenues earned from broadcasting a sporting event by costs incurred to broadcast at that event

decision making

selecting a course of action from alternatives; determining which news anchor personnel to sign to contracts, identifying and evaluating a new product line to compliment the network’s offering, such as a sport popular in foreign countries, determining which specific games to broadcast in each sport carried by the network.

direct materials

materials that become an integral part of finished product and can conveniently traced to it

indirect materials

small items of material that may become part of an item, but are costly to trace back (ie. glue)

direct labour

factory labour costs that can easily be traced back to individual units of product

indirect labour

factory labour costs of janitors, supervisors, materials handlers and other factory workers that cannot easily be traced to particular products

conversion cost formula

direct labour plus manufacturing overhead (DL + MOH)

prime cost formula

direct material plus direct labour (DM + DL)

what are conversion costs

direct labour costs and overhead costs are incurred to convert materials into finished products

different terms for MOH

indirect manufacturing cost, factory overhead, factory burden

two categories for non-manufacturing costs

marketing or selling costs and administrative costs. note: these are also called period costs

raw (direct) materials inventory

materials used to make a product not yet placed into production

work in process inventory

inventory consisting of units of product only partially complete and will require further work before they are ready for sale to a customer

finished goods inventory

inventory consisting of completed units of product not yet sold to customers

cost of goods sold in a manufacturing company

beginning finished goods inventory + COGM = ending finished goods inventory + cost of goods sold

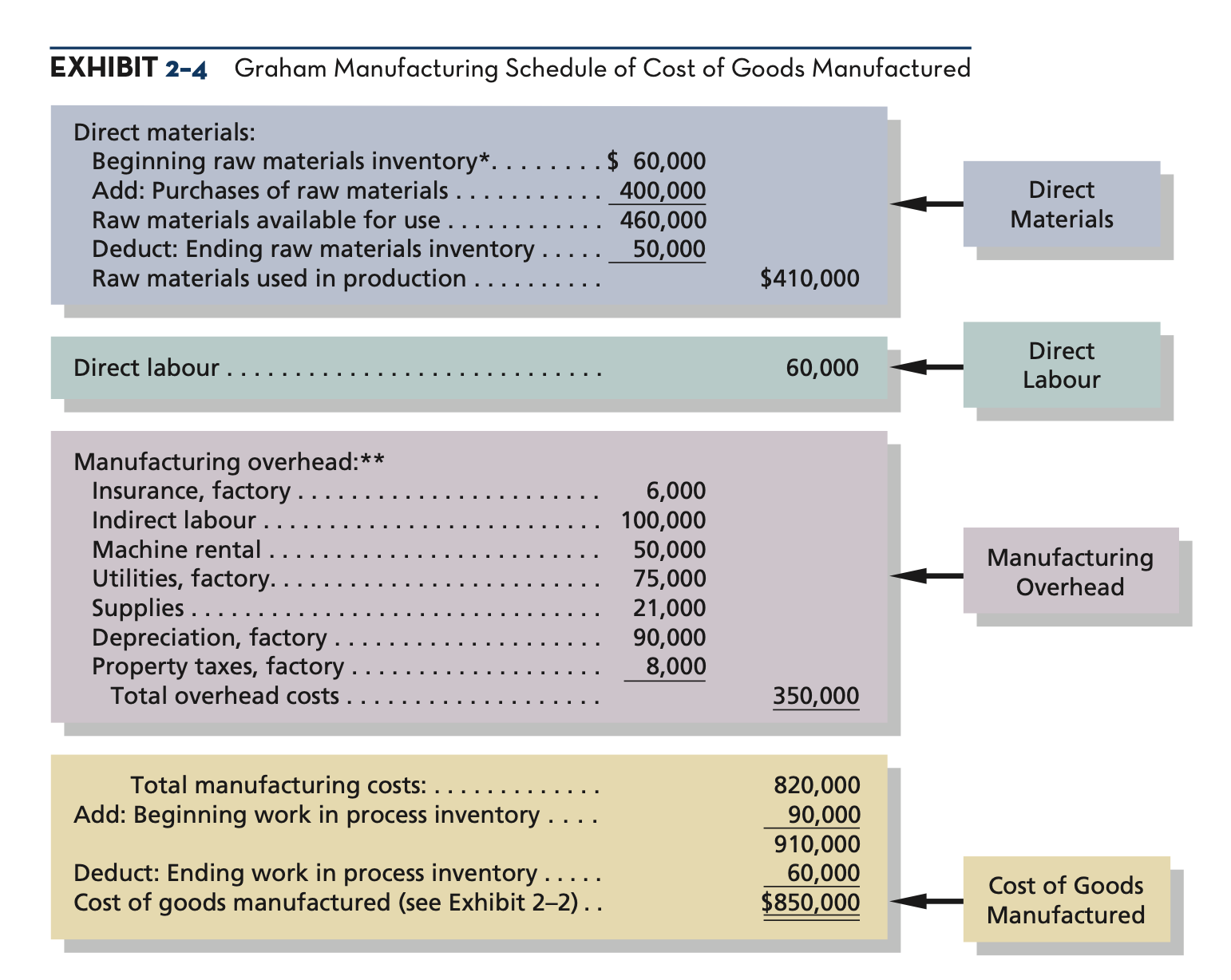

cost of goods manufactured (COGM)

costs that include the direct materials, direct labour and manufacturing overhead used for the products finished during the period.

direct/raw materials formula (for schedule of cost of goods manufactured)

beginning raw material inventory + raw materials purchased (NOT used) = raw materials available for use in production - less ending raw materials inventory = raw materials used in production

manufacturing costs formula (for cost of goods manufactured)

direct materials USED (not purchased) + direct labour + manufacturing overhead

work-in process inventory (for cost of goods manufactured)

beginning work in process inventory + total manufacturing costs = total WIP for the period - ending WIP = cost of goods manufactured

cost of goods sold formula

beginning finished goods inventory + cost of goods manufactured = cost of goods available for sale - ending finished goods inventory

preparing a “schedule of cost of goods manufactured”

direct materials

direct labour

manufacturing overhead

work in progress inventory

mixed cost

cost that has both a variable and fixed cost component

what does the fixed portion of a mixed cost represent

the basic minimum cost of having a resource ready and available for use

what does the variable portion of a mixed cost represent

represents the cost incurred for the actual consumption of the resource

schedule of cost of goods manufactured

schedule showing DM, DL, and MOH incurred for a period and assigned to work in process and completed goods

total manufacturing costs

costs that represent the DM, DL and MOH used to perform the production work for finished or unfinished products for the period

two general classifications for costs

manufacturing and non-manufacturing costs

matching principle

costs are recognized as expenses when related revenue is realized

product costs

recorded in inventory before expensed in the period where revenue is recognized. all manufacturing costs are product costs.

period costs

recorded in the same period they occur. non-manufacturing costs are period costs. includes administrative, marketing or selling costs.

cost object

anything for which costs are desired, including products, customers, job organization sub-units

direct costs

costs that can be directly traced to cost object (DM and DL)

indirect costs

cannot be directly traced to cost object

ending balance of raw materials

beginning balance of raw materials + raw materials purchased - raw materials used

ending balance of work in process

beginning balance of WIP + manufacturing costs in period - cost of goods manufactured

cost driver

activity or factor that causes a specific cost to occur or change, like machine hours, customer orders or production costs

differential cost

differs between alternatives

high-low method

method of separating a mixed cost into fixed and variable elements by analyzing the change in cost between the high and low levels of activity

how to calculate variable cost using high low method

step 1: change in total cost = TC at highest activity level - TC at lowest activity level

step 2: change in activity level = highest activity level - lowest activity level

step 3: (change in total cost / change in activity level) = variable cost per unit

step 4: total cost - variable cost per unit*(Activity level) = total fixed cost

fixed cost element

fixed cost element = total cost - variable cost (* data point)

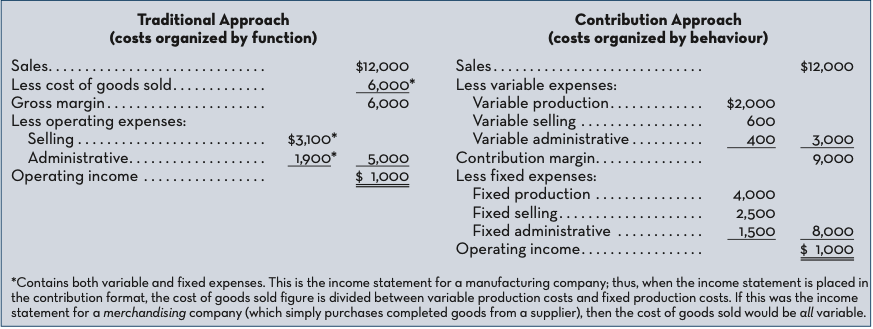

contribution approach

an income statement format where costs are separated into variable and fixed categories

contribution margin

the amount remaining from sales revenues after all variable expenses have been deducted

break-even point

level of sales at which profit is 0. ie. when total sales = total expenses, or total contribution margin = total fixed expenses, or sales - variable expenses - fixed expenses = 0

cost-volume-profit (CVP) graph

the relationships among revenues, costs and level of activity represented in graphic form

equation for profit graph

profit graph = unit CM x Q - fixed expenses, where CM is contribution margin and Q is quantity

contribution margin ratio

the contribution margin as a percentage of total sales.

variable expense ratio

ratio of variable expenses to sales

cm ratio and variable expense ratio relationship

cm ratio = 1 - variable expense ratio

incremental analysis

analytical approach focuses only on items of revenue, cost and volume that will change as the result of a decision

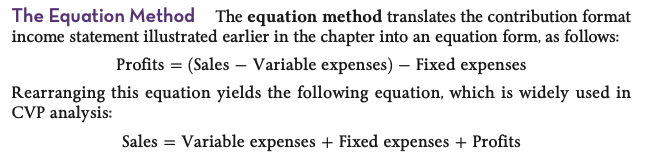

equation method

method of computing break-even sales using contribution format income statement

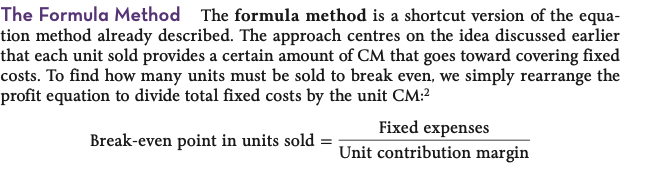

formula method

method of computing the break-even point where fixed expenses are divided by the unit contribution margin

margin of safety

total sales - break even sales

break even point in units

fixed cost / contribution margin per unit

break even point in dollars

fixed cost / contribution margin %

degree of operating leverage

contribution margin / (net) operating income

% change in (net) operating income is determined by

degree of operating leverage x percentage change in sales

net income before taxes

NIBT = NIAT/(1-tax rate)

weight average contribution margin (WACM) per unit

CM per unit of A x % sales of A + CM per unit of B x % sales of B

sales mix

relative proportions in which company’s products are sold. sales mix is computed by expressing the sales of each product as a % of total sales

weighted average contribution margin (%)

total CM/total sales = WACM per unit / WA price per unit

break even sales

fixed cost / weighted average contribution margin (%)

absorption costing

a costing method that includes all manufacturing costs - direct materials, direct labour and both variable and fixed overhead - as part of the cost of a finished unit of producst. also known as full costing