Monetary Policy (4.4)

1/21

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

22 Terms

Inflation

A sustained increase in the general price level of goods and services in an economy over a period of time. (Lowers purchasing power)

Disinflation

A reduction in the rate of inflation (prices still increasing but at a slower rate)

Deflation

A decrease in the general price level of goods and services (raises purchasing power)

CPI

Measures the overall change in the average level of prices of goods and services that people typically buy over time.

How to measure CPI

Choose a base year

Decide what goods will be put in the CPI - based on the ‘National Average Family Shopping Basket

Gather the data: obtain prices of goods for each time period being observed.

Find how much a typical consumer spends on the category of good as a proportion of total income (weight of each good)

Multiply the price change index for each good by its weight.

Add up all the price changes to get the overall change in prices.

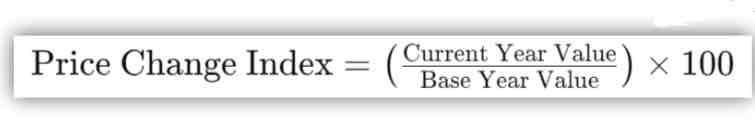

Price Change Index formula.

Uses of the CPI

Measures the rate of Inflation: Monthly changes in the CPI give the change in the average level of prices.

Measure of government performance: It gives an indication of how well the economy is performing compared to its target of inflation to be below 2%.

Used in wage negotiations: Used by trade unions as a basis for wage increase claims.

Make comparisons: It allows us to measure inflation rates across the EU and understand how this may affect the competitiveness of various countries.

Limitations of the CPI

Regional disparities: Both urban and rural households are represented by the present set of weights, but this may not reflect accurate changes in respective costs of living.

Introduction of new products: New products are not included in the calculation of the CPI. This can result in inaccuracies when consumers significantly alter purchasing patterns.

Quality changes: The CPI does not take account of changes in the quality of products. Higher prices may reflect an improvement in the quality of the product.

Limitations of an average: As the CPI is taken from average expenditure, it cannot be applied to particular groups. Therefore the price increases shown may not apply to certain individuals. For example the rise in the price of cigarettes may rise a large amount and be a big portion of expenditure which may give the illusion of higher inflation for a whole population.

Causes of Inflation

Demand-Pull Inflation

Cost-Push Inflation

Increased lending by banks: Accessibility of credit → increase in borrowing → increase in expenditure → increase in inflation

Imported Inflation / Cost Inflation

Government induced inflation: Increasing direct tax like income tax or increasing indirect tax like VAT.

The European Central Bank

Problems caused by Rising Inflation

Standard of living falls: As it requires more money to purchase the same amount of goods or services it means that purchasing power of the consumer has fallen.

Saving is discouraged: If rate of inflation > rate of interest on savings consumers will be less inclined to save as their savings are losing value.

Wage demands increase: Employers may be faced with industrial disputes as workers seek compensation for their reduced standard of living

International competitiveness declines: If a country is experiencing higher inflation than its trading partners, it will mean that it is losing international competitiveness. This will mean it is more difficult to sell exports.

Hyperinflation

Occurs when inflation is very high, sometimes defined as being above 50% per month.

Government role in reducing inflation

Increase direct taxation: The government increasing the rates of PAYE means consumers have less disposable income so aggregate demand falls, leading to inflation.

Reduce government expenditure: A drop in government expenditure means a drop in aggregate demand, which is a reduction in an injection into the circular flow of income and lessens the spending power available to firms and households.

Reduce the rate of V.A.T: A reduction in indirect tax by the government would reduce rate of increase in business costs and would therefore counteract cost-push inflation.

Problems caused by low inflation

Consumers may postpone spending: during period of low inflation consumers may be less willing to spend their disposable income on goods and services as they believe prices will continue to fall.

Low wage increases: Employees are less likely to be granted pay increases. This is because in many wage agreements, natural pay rises are tied to the inflation rate and with low inflation, many workers will experience no wage growth.

No debt burden effects: During periods of inflation, the real cost of repaying loans decreases. Therefore when inflation is low the cost of repaying loans remains the same.

Problems caused by Deflation

Reduced consumer spending: Consumers see prices falling and expect them to continue to fall leading to them postponing spending and leads to an overall fall in spending.

Decreased Investment: Firms are uncertain about the future and are worried that their total revenue will fall if a recession begins. Thus, they stop investing in machinery and expansion.

Unemployment rises: Due to reduced consumer spending and decreased firm investment, workers begin to be laid off, increasing unemployment and putting a larger burden on social welfare payments.

Government Budget difficulties: Due to a fall in spending, investment and employment, the government’s current revenue begins to fall. This may lead the government to run a current budget deficit

The European Central Bank (ECB)

The ECB is the central bank of the 19 eurozone countries. It’s main task is to maintain price stability in the euro area using monetary policy.

Monetary Union Index of Consumer Prices.

This is the standardised method of measuring inflation across the 19 eurozone countries. It allows the ECB to measure if it is reaching it’s primary goal of price stability.

Central banks

The objective and role of a central bank is to maintain price stability

Price Stability

When there is little to no change in the economy over a period of time. This means there is a lack of inflation or deflation occurring with prices (roughly over 2% in the medium term).

Monetary Policy

Any actions by the ECB to influence the money supply, interest rates or the availability of credit.

Main Responsibilities of the ECB:

Maintain Price Stability: The key aims of the ECB is to maintain price stability in the eurozone of 2% over the medium term in order to maintain the purchasing power of citizens.

Sets Interest Rates: The ECB sets its key interest rate at which it lends to commercial banks in the eurozone, thus influencing inflation and money supply.

Authorise bank notes: Has the exclusive right to authorize the issuance of banknotes within the Euro area.

Financial Stability and Supervision: The ECB ensures national authorities supervise credit institutions and financial markets by regulating commercial banks. They also ensure the payment system works effectively.

Quantitative easing.

Occurs when a central bank buys financial assets from commercial banks with new money that the central bank has created. (Essentially its when a central bank prints money and then buys bonds from commercial banks)

ECB’s impact on Ireland

ECB controls monetary policy: Ireland’s membership of the Eurozone means that Ireland does not operate its own monetary policy. It is under the ECB.

Decisions by the ECB may not suit Ireland: As Ireland’s economy represents only 2% of the eurozone area, decisions by the ECB regarding interest rate changes may not always suit the Irish economy.

Emergency liquidity Assistance: If there is a systemic crisis or banking crisis the ECB can provide ELA which is cheap emergency loans to banks running out of funds.