4.2 trade protection and exchange ratesFree

1/28

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

29 Terms

Free trade

International trade with no government intervention imposing restrictions of any kind of imports or exports

Benefits of trade

Greater choice for consumer

Benefits for producer of economies of scale

Increased competition

Greater efficiency in production

Lower prices for consumers

More efficient allocation of resources

Ability to acquire needed resources

Greater flow of ideas and technology

An “engine for growth”

World Trade Organization (WTO)

An international organization with the key objective to promote free trade among countries around the world

Trade protection

Government intervention in international trade involving the imposition of trade barriers intended to limit the quantity of imports and protect the domestic economy from foreign competition

Tariff

A tax on imported goods (indirect)

Quota

A restriction on the quantity of imports

Subsidy

Payment by the government to firms to lower costs of production and price

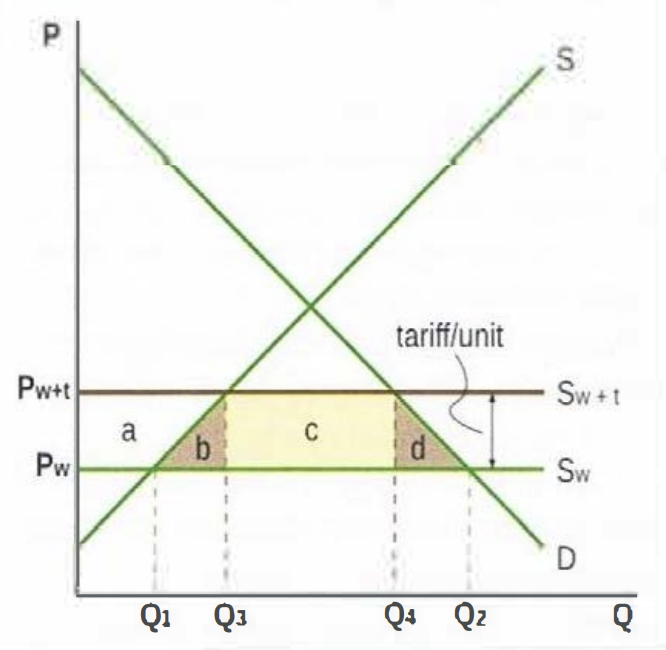

Tariff diagram

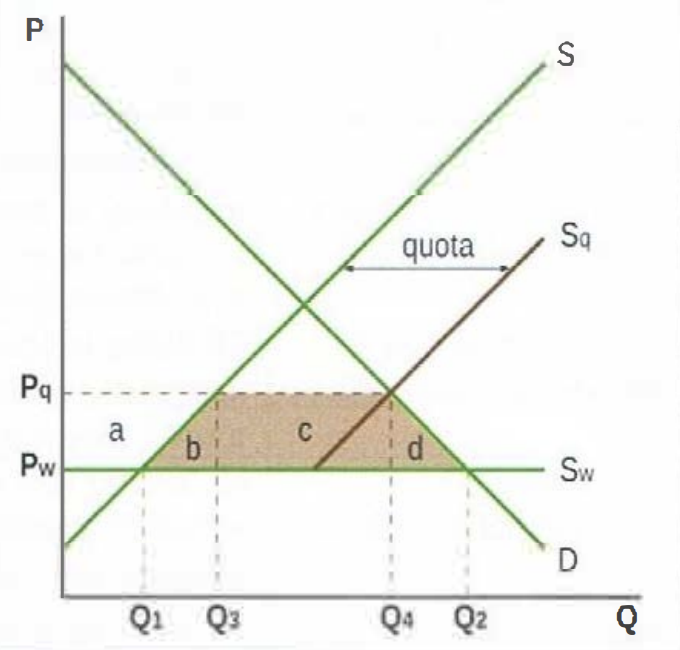

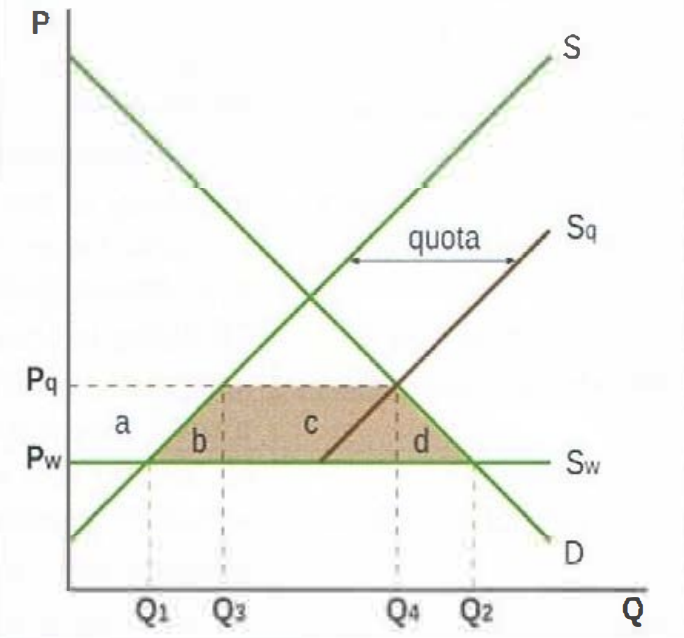

Quota diagram

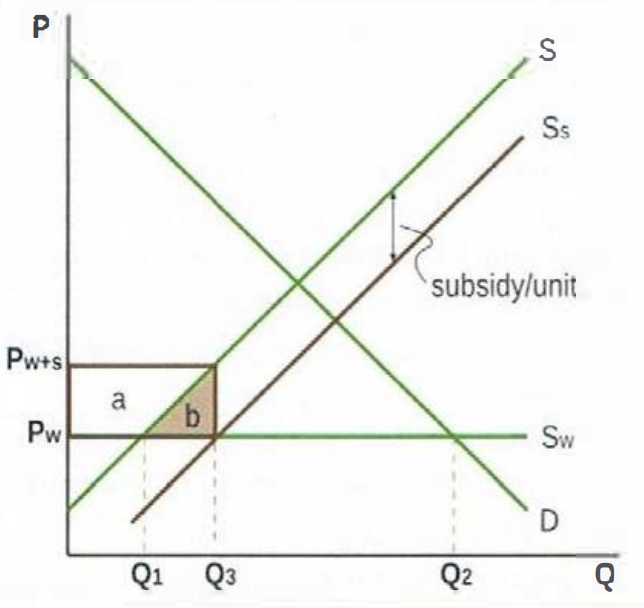

Subsidy diagram

Tariff effect on stakeholders

Domestic producers gain as Q produced goes up from Q1 to Q3, P received goes up from Pw to Pw+t

Workers gain as domestic employment goes up due to increased production

Government gains tariff revenue (yellow area)

Domestic consumers lose, Q bought down from Q2 to Q4 and paid up from Pw to Pw+t

Domestic society lose, there is inefficiency in production since higher cost firms are protected by the higher P

Allocative inefficiency, welfare loss = brown triangles. consumer surplus lost = a + b + c + d, producer surplus gained = a. government revenue gained = c. net loss = b+d

Quota effect on stakeholders

Domestic producers gain as Q produced goes up from Q1 to Q3, P received goes up from Pw to Pq

Workers gain as domestic employment goes up due to increased production

Government unaffected: no revenues or spending

Domestic consumers lose: Q bought down from Q2 to Q1 and paid up from Pw to Pq

Domestic society loses: there is inefficiency in production since higher cost firms are protected by higher P

Allocative inefficiency: shown by welfare loss = brown area (b+c+d) (consumer surplus lost = a+b+c+d; producer surplus gained = a; net loss = b+c+d, since revenues = c, are usually taken by exporting countries

Subsidy effect on stakeholders

Domestic producers gain as Q produced goes up from Q1 to Q3, P received goes up from Pw to Ps

Workers gain as domestic employment goes up due to increased production

Domestic consumer unaffected: same Q and same P before and after

Government loses: must pay subsidy equal to the rectangle outlined in brown

Domestic society loses: inefficiency in production since higher cost firms are protected from higher P

Allocative inefficiency, shown by welfare loss = brown triangle (b) (consumer surplus remains same after the subsidy; producer surplus gained due to subsidy = a; government spending lost = a+b; net loss=b

Exchange rates

The value of one currency expressed in terms of another; can be thought of as the “price” of a currency

Freely floating exchange rate

An exchange rate that is determined entirely by demand and supply of the currency, with no government intervention

Currency appreciation

An increase in the value of a currency in a freely floating exchange rate system; may occur due to an increase in demand or a decrease in the supply of a currency

Currency depreciation

A decrease in the value of a currency in a freely floating exchange rate system; may occur due to a decrease in demand or an increase in the supply of a currency

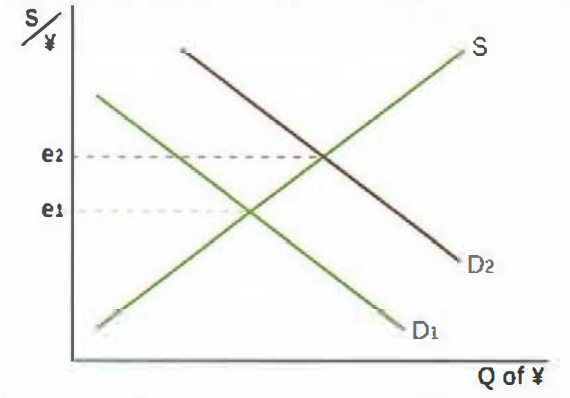

Currency appreciation diagram

Administrative barriers

Application of bureacratic standards and regulations imposed on foreign firms in order to protect domestic firms and consumers

Portfolio investment

The purchase of financial investments abroad, such as the purchase of stocks, shares, and bonds of overseas firms and governments

Remittances

The movement of money when nationals working abroad send money back to their home country

Devaluation

A decrease in the value of a currency in a fixed exchange rate system

Revaluation

An increase in the value of a currency in a fixed exchange rate system

Fixed exchange rate

Exists when the central bank buys and sells foreign currencies to ensure the value of its currency stays at a single, predetermined rate

Foreign currency reserves

Stocks of foreign currencies held by a central bank, usually to influence the value of its currency

Managed exchange rate

A system where the government or the central monetary authority intervenes periodically in the foreign exchange market to influence the exchange rate, when deemed necessary to maintain certainty and confidence in the economy

Overvalued currency

A currency whose value or exchange rate is greater than its equilibrium exchange rate, usually achieved through central bank intervention; may occur in a pegged or managed exchange rate system

Undervalued currency

A currency whose value or exchange rate is less than its equilibrium exchange rate, usually achieved through central bank intervention; may occur in a pegged or managed exchange rate system