Macroeconomic Fluctuations and Money & Savings: Key Concepts and Models

1/121

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

122 Terms

What is inflation?

Inflation is the increase of average price levels, measured by an index calculated using a specific basket of goods (CPI, PPI, GDP deflator, etc.).

How is inflation different from interest rates?

Inflation is the increase in the price level of a basket of goods, while interest rates are the price of borrowing.

What are the three main measures of U.S. inflation?

CPI, PPI, GDP deflator.

What does the Quantity Theory of Money (QTM) suggest?

The QTM suggests that changes in the money supply can affect price levels but not real output in the long run.

What is meant by 'money is neutral' in the context of QTM?

In the long run, changes in the money supply do not affect output levels, only price levels.

What happens to output when the money supply increases in the short run?

An unexpected increase in the money supply can temporarily boost output, but as expectations adjust, output returns to normal.

What are the costs of unexpected inflation?

Unexpected inflation can lead to confusion in price signals, wealth redistribution, and a breakdown of financial intermediation.

What is 'money illusion'?

Money illusion is when people mistake changes in nominal prices for changes in real prices.

How does inflation act as a tax?

Inflation reduces the value of money held by citizens, effectively taxing their savings.

What is the Fisher effect?

The Fisher effect states that if lenders expect inflation, they will demand a higher nominal interest rate.

What is the Aggregate Demand (AD) curve?

The AD curve is a downward sloping curve that shows the relationship between the overall price level and the quantity of goods demanded.

What causes shifts in the AD curve?

Shifts in the AD curve can be caused by changes in money supply (∆M) and changes in velocity (∆v).

What happens to the AD curve when expenditures increase?

An increase in expenditures shifts the AD curve to the right, indicating an increase in overall demand.

What is the impact of consumer confidence on the AD curve?

Increased consumer confidence can lead to higher consumption, shifting the AD curve to the right.

What is the difference between income and wealth?

Income is the flow of earnings over time, while wealth is the total value of assets owned.

What are the implications of high and volatile inflation?

High and volatile inflation undermines the signaling role of prices, leading to misallocation of resources.

What is the role of velocity in inflation?

Velocity refers to the rate at which money circulates in the economy; changes in velocity can impact inflation rates.

What is the relationship between real interest rates and negative growth?

Negative real interest rates can lead to decreased savings and investment, correlating with negative growth rates.

What is the long-term effect of an increase in money supply on output?

In the long run, an increase in money supply does not affect output; it only affects price levels.

What is the significance of price confusion during inflation?

Price confusion can lead to misinterpretation of market signals, causing producers to misjudge demand.

What is the impact of inflation on wage negotiations?

Inflation can complicate wage negotiations as workers may demand higher wages to keep up with rising prices.

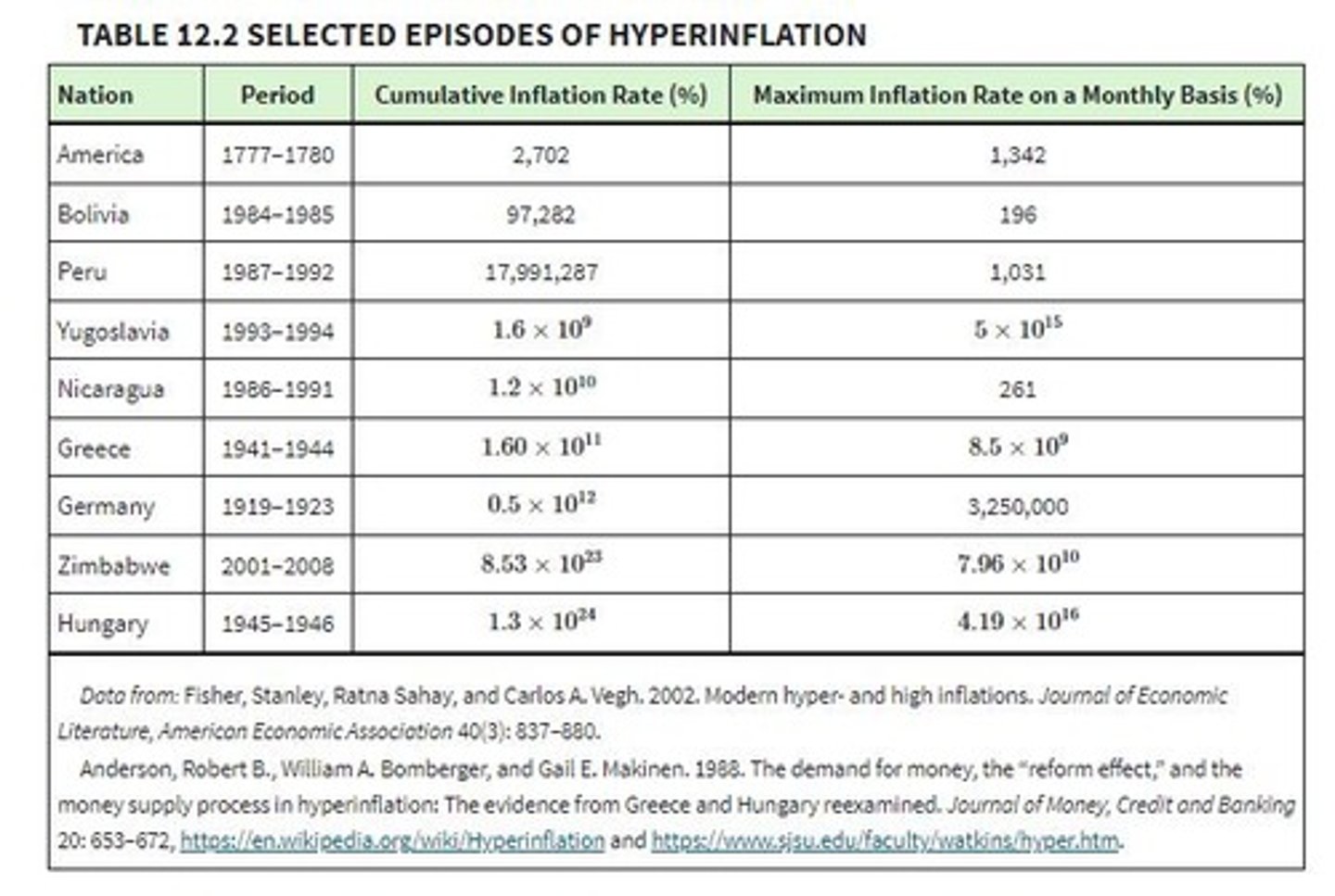

What is a hyperinflation episode?

A hyperinflation episode is characterized by extremely high and typically accelerating inflation rates.

What is the relationship between inflation and government debt?

Governments may resort to inflation to manage debt, effectively taxing citizens through reduced money value.

How does inflation affect financial intermediation?

Inflation can lead to negative real interest rates, causing people to withdraw savings from banks, disrupting lending.

What is the role of expectations in inflation?

Expectations of inflation can become entrenched, making it difficult to change inflation rates without tight monetary policy.

What is the AD curve's slope indicative of?

The downward slope of the AD curve indicates that as price levels decrease, the quantity of goods demanded increases.

Why can't consumers cut back on consumption forever?

Eventually, some consumption goods become essential, and increased savings may lead them to start spending again.

What happens if the government increases its spending year after year?

It could dominate the entire economy, but long-term growth can only match the growth rate of the economy (G=GDP).

What is the Long-Run Aggregate Supply (LRAS) Curve?

The LRAS Curve represents the economy's potential growth rate driven by technology, physical, and human capital.

What does the LRAS curve indicate about money in the long run?

The LRAS curve is vertical, indicating that money is neutral in the long run.

How is the long-run equilibrium inflation rate determined?

It is determined by the long-run growth rate of the money supply, ∆M.

What is a positive shift in the LRAS?

A positive shift, or productivity shock, increases the economy's ability to produce goods and services, leading to lower inflation.

How did weather impact India's economy in the 1970s?

Good and bad weather significantly affected agricultural output and GDP, correlating rainfall with economic performance.

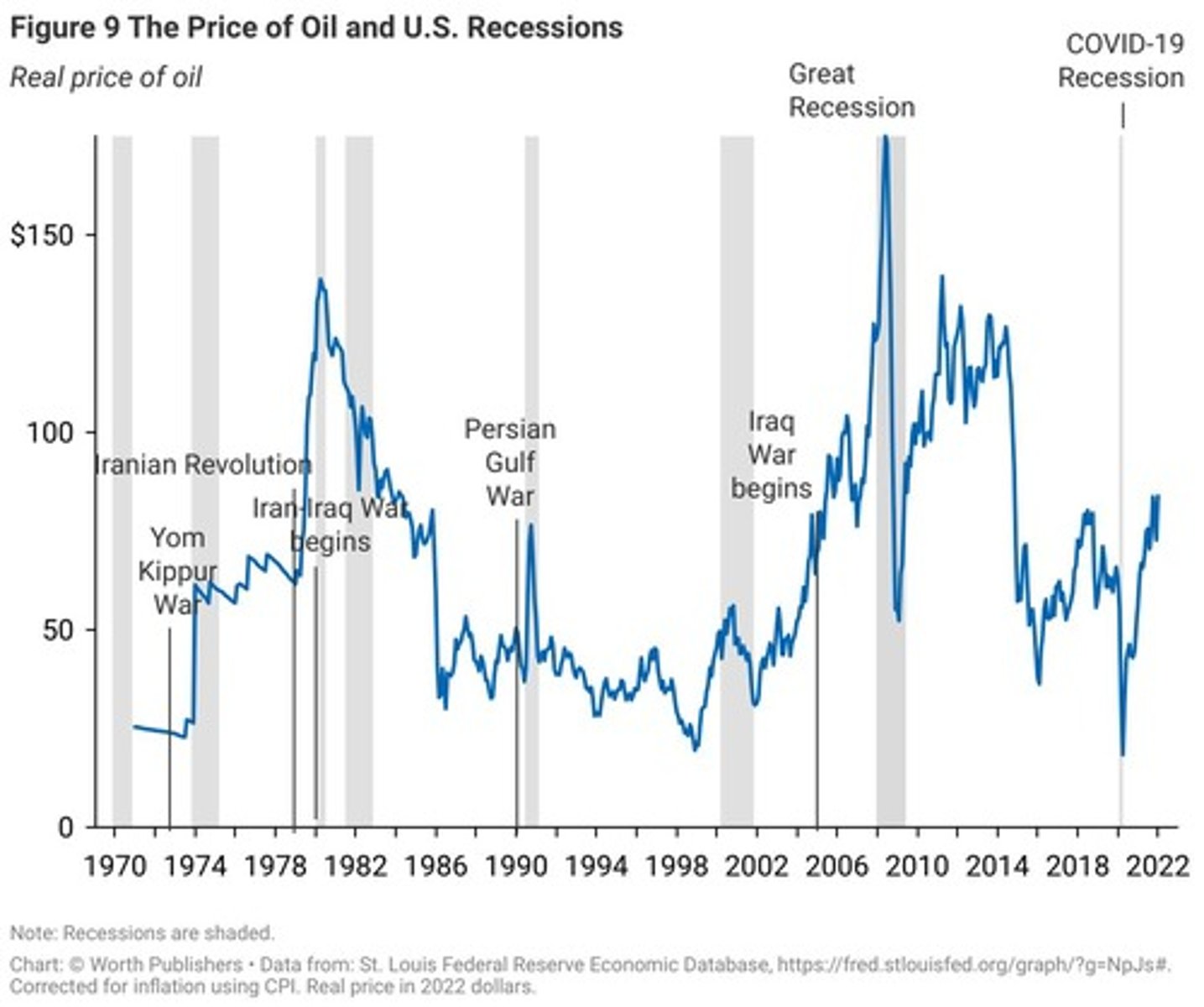

What was the effect of higher oil prices in the 1970s on the U.S. economy?

Higher oil prices led to inflation and brief recessions, impacting productivity and consumer behavior.

What is the Short-Run Aggregate Supply (SRAS) Curve?

The SRAS curve is upward sloping, indicating that increases in aggregate demand can lead to higher output and prices.

Why are prices and wages considered sticky in the short run?

Workers dislike wage reductions, unions set long-term contracts, and menu costs make price adjustments costly.

What happens when the money supply (M) unexpectedly increases?

It creates a temporary economic boom, increasing both inflation and real growth before returning to long-run equilibrium.

What is the relationship between expected inflation and actual inflation in the long run?

In the long run, expected inflation equals actual inflation, leading to adjustments in the SRAS curve.

What does a negative real shock do to inflation?

A negative real shock typically leads to higher inflation due to reduced production capacity.

What is the 'Solow' growth rate?

The Solow growth rate is the potential growth rate of an economy driven by factors like technology and capital.

How do small shocks affect GDP growth?

Economies experience many small shocks, and typically, good shocks outweigh bad ones, leading to overall growth.

What is the impact of a 4 percentage point increase in output growth?

It leads to a 4 percentage point decline in inflation.

What is the significance of the AD curve in relation to output growth?

Changes in consumption (C), government spending (G), investment (I), and net exports (NX) do not affect output growth in the long run.

What role does technology play in economic growth?

Technology is a key factor that drives the potential growth rate of an economy.

What is the effect of increased government spending on velocity (∆v)?

In the short run, increased government spending can temporarily increase velocity, but this effect is not sustainable.

How do price changes affect the SRAS curve?

Increased aggregate demand can lead to higher output and price growth due to price stickiness.

What is the long-run effect of an increase in money supply on inflation?

In the long run, only higher inflation remains after an increase in money supply.

What is the relationship between nominal changes and real changes in the short run?

Nominal changes can be confused with real changes, leading to temporary increases in production.

What happens to the economy after a shock to the LRAS?

The economy's fundamental ability to produce goods and services changes, impacting inflation and output.

What happens to firms' prices when input costs and wages increase?

Firms increase their prices, leading to a rise in the inflation rate.

What is the long-run effect of increases in money supply (∆M)?

Increases in ∆M only create inflation in the long run.

What can a drop in velocity (v) lead to in the economy?

A drop in v can generate a long recession.

What occurs when the economy moves from point a to point b due to a decline in v?

There is a small reduction in the inflation rate and a large drop in real GDP growth.

Why are wages and prices considered sticky downwards?

Workers dislike wage reductions, and wage increases are often contractually binding.

What is the impact of a drop in aggregate demand (AD) on recessions?

It can lead to long recessions because wages take time to adjust.

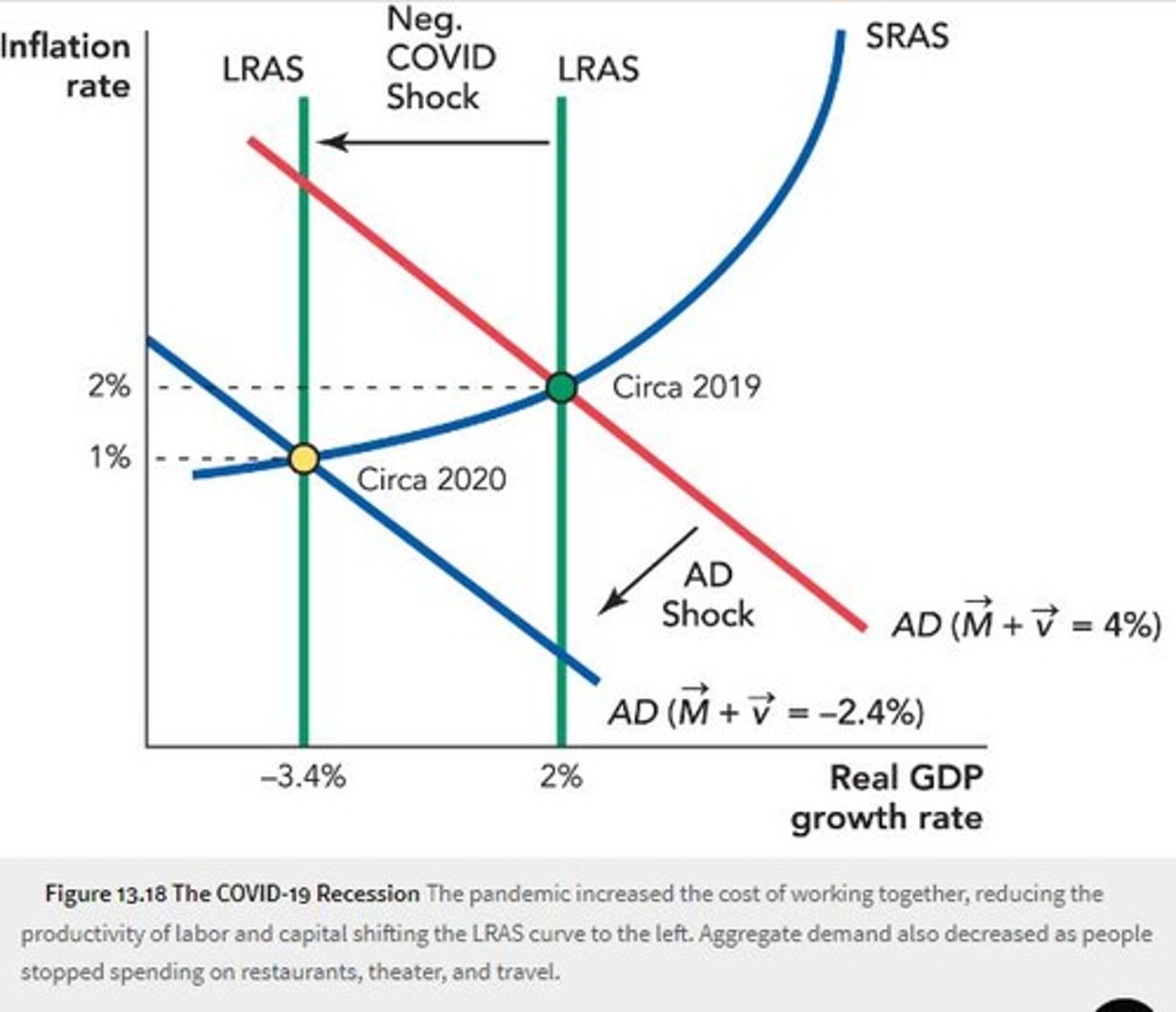

What were the economic conditions before the COVID-19 recession?

Stable growth rate of real GDP (2%), inflation (2%), and unemployment (5%).

What caused the COVID-19 recession?

The spread of COVID-19 led to a negative supply shock and a negative demand shock.

What was the effect of the leftward shift of the LRAS during the COVID-19 recession?

It increased inflation but was offset by the leftward shift in AD, leading to a small drop in inflation rate.

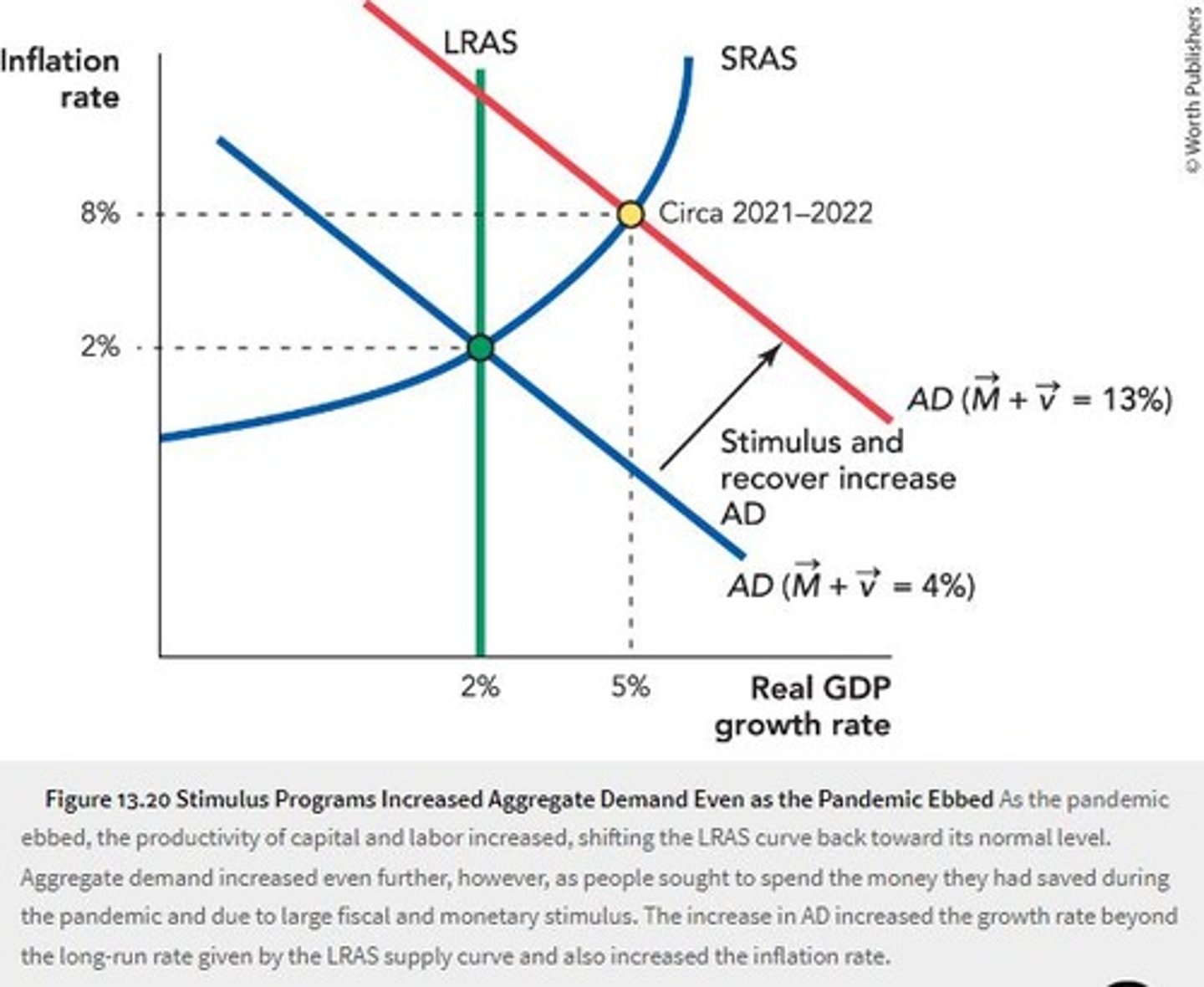

What characterized the recovery phase after the COVID-19 recession?

Most negative labor supply shocks were eliminated, and the LRAS returned to its 2019 level.

What role did fiscal and monetary policy play during the COVID-19 recovery?

They led to a large rightward shift of AD, mitigating the recession's severity.

What are amplification mechanisms in the AS-AD model?

They are economic forces that can amplify shocks and transmit them across sectors.

What is intertemporal substitution?

It refers to the adjustment of work effort based on expected returns over time.

How does uncertainty affect economic shocks?

Uncertainty amplifies and lengthens shocks, especially in the presence of sunk costs.

What are labor adjustment costs?

Costs associated with shifting workers from declining sectors to growing sectors.

How does collateral and net worth affect lending during recessions?

Decreased collateral and net worth reduce banks' willingness to lend, amplifying economic downturns.

What are the two types of shocks that generate business fluctuations?

Real shocks (to the LRAS) and aggregate demand shocks (shifts to the AD).

What factors create upward sloping (convex) SRAS?

Nominal wage and price confusion, sticky wages, sticky prices, menu costs, and uncertainty.

What is the long-run effect of rightward shifts of the AD?

They create short-run booms but are only inflationary in the long run.

What does the AS-AD model help understand?

It helps understand how fiscal and monetary policy can smooth business cycle fluctuations.

What is money?

Money is anything that is used to buy and sell goods and services.

What are the three necessary functions of money?

Medium of Exchange, Unit of Account, Store of Value.

What is commodity money?

Commodity money serves both as money and as a commodity, such as corn, fur pelts, or metals.

What is representative money?

An item like a token or piece of paper that has no intrinsic value but can be exchanged for a commodity with intrinsic value.

What is fiat money?

Paper money that cannot be redeemed for anything but is decreed legal tender by the government.

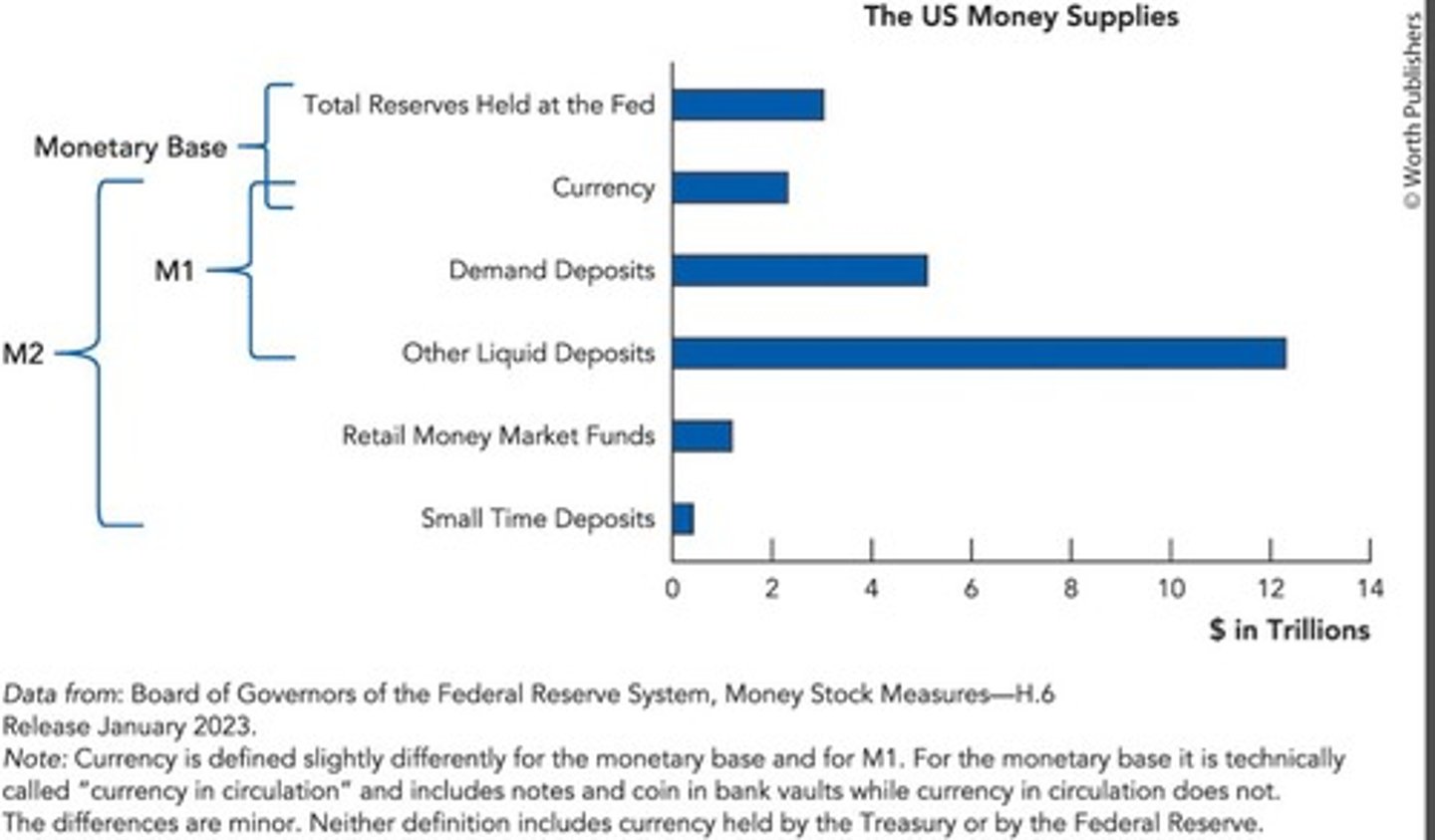

What is the monetary base (MB)?

Currency (bills and coins) and reserves held at the Federal Reserve.

What does M1 include?

Monetary Base plus demand deposits and other liquid deposits.

What does M2 include?

M1 plus small time deposits and retail money market mutual funds.

What is the opportunity cost of holding money?

The potential interest income that could be earned by investing the money instead.

What determines the equilibrium interest rates in the economy?

The supply and demand for real money balances.

What happens when there is excess money in the economy?

Individuals use the excess money to purchase financial assets, which reduces interest rates.

What is the savings market?

The market for borrowing/lending, also known as the market for loanable funds.

What is consumption smoothing?

The practice of saving less than income during working years and spending savings during retirement.

Why does consumption smoothing matter?

It allows individuals to manage income fluctuations and supports economic growth.

What are individual time preferences?

The degree to which individuals prefer to consume now rather than later.

How do marketing and behavioral biases affect savings decisions?

Individuals tend to save more when saving is presented as the default option.

How does the interest rate affect the quantity of savings?

Higher interest rates usually encourage more savings as they increase the return on saved funds.

What are the motives for borrowing?

To smooth consumption, finance large investments, and respond to interest rates.

Why do young people often borrow for education?

To spread out tuition payments over time, making the financial burden less painful.

What is the role of financial intermediaries in the savings market?

They bridge the gap between savers and borrowers, facilitating the flow of funds.

What is the relationship between savings and investment?

Savings provide the funds necessary for investment, which drives economic growth.

What is the impact of increased life expectancy on savings?

It typically leads to higher savings rates as individuals plan for longer retirement periods.

What is the significance of the Solow model in relation to savings?

It states that savings are necessary for capital accumulation, which increases GDP per capita.

What is the definition of borrowing?

Borrowing is an intertemporal substitution: increasing consumption today and paying for it tomorrow.

What is the effect of a shortage of money in the economy?

Individuals sell financial assets to obtain more cash, causing interest rates to rise.

What is the relationship between money demand and interest rates?

As demand for money increases, the demand for bonds decreases, leading to higher interest rates.

What are small time deposits?

Deposits that cannot be withdrawn without a small penalty, included in M2.

What are retail money market mutual funds?

Relatively safe short-term debt and government securities included in M2.

What is the purpose of student borrowing?

To spread out tuition payments over time, making sacrifices less painful.

What does the lifecycle theory of savings explain?

It unifies the demand to borrow and save, showing how income varies over a person's life.

How do people typically finance college and buy their first home?

By borrowing and consuming above their income.