Business: Finance

1/32

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

33 Terms

What is the role of finance function?

Calculate profit & loss using SR & PC

Forecast cashflow + decide if finance is needed

Manage payments

Arrange finance (loans etc)

Calculate break even output needed

Calculate ARR

What is the definition of finance?

The money raised and used by a business

WHat is the definition of the finance function?

The financial department, usually only found in larger businesses as small businesses usually employ a firm of accountants to help with their finance function.

What is the definition of financial information?

Includes details of profits, loss, cashflow, break-even, profit margin and average rate of return. This info is used in business decision making.

Why do businesses need to raise finance?

Establishing a business - Pay for upfront costs e.g. rent, furniture & machinery

Funding expansion - Pay for a larger factory, machinery, more stock or materials to support an increase in scale

Recruitment - Recruitment is always needed & wages / salaries need to be paid (start up, expansion, staff leaving)

Marketing - Campaigns, ads & public reations (maintaining a good image)must be funded

Running the business - Buying materials, paying for utilities, paying wages

What are all the sources of finance (9)

Owners capital

Retained profit

Sale of assets

Overdraft

Trade credit

New partner

Loan

Shar issue

Crowdfunding - money donated by investors / customers

What are the Advantages and Disadvantages of Owners Capital?

Adv | DisAdv |

No need to repay | Owner risks savings |

No interest | May not have enough |

Doesn’t affect ownership or control |

What are the Advantages and Disadvantages of retained profit?

Adv | DisAdv |

No need to repay | May not have made profit yet |

No interest | Owner won’t keep profit as income |

What are the Advantages and Disadvantages of Sale of assets?

Adv | DisAdv |

No need to repay | May be difficult to sell |

No interest | No longer have the benefit of the asset |

Good if selling old machinery or stock | May take time to sell |

What are the Advantages and Disadvantages of Overdraft?

Adv | DisAdv |

Meets short-term cashflow problem | Interest charged daily |

Interest paid only on what is owed | |

Only repaid when not needed / business closes |

What are the Advantages and Disadvantages of Trade Credit?

Adv | DisAdv |

Have goods to sell before paying for them via credit period (30/60/90 days) | Goods must be paid for even if they don’t sell |

No interest if paid back on time | Interest charged on late payment |

Can help with cashflow problems |

What are the Advantages and Disadvantages of Taking on a New partner?

Adv | DisAdv |

May bring new skills | Share ownership, control & profits |

Don’t need to repay | Sole traders become partnerships |

No interest |

What are the Advantages and Disadvantages of a loan?

Adv | DisAdv |

Paid in fixed sums monthly over period of time | Interest |

Money is available immediately | May need to give the lender security |

What are the Advantages and Disadvantages of a Share issue?

Adv | DisAdv |

New investors can contribute lots of money | Share control, ownership & decisions |

Don’t have to repay | Pay dividends |

No interest | Shares only sold by PLC or LTD |

What are the Advantages and Disadvantages of Crowdfunding?

Adv | DisAdv |

Can contribute lots of money via loans, donations or investing | Interest if money raised through a loan |

Don’t need to repay | Shared ownership if money is from investors |

No interest |

What types of finance are short term?

Owners capital

Trade credit

Sale of assets

What types of finance are mid term?

Owners Capital

Sale of assets

Bank loan

Crowdfunding

What types of finance are long term?

Owners capital

Sale of assets

Retained profit

Bank loan

Crowdfunding

New Partner

Share issue

What is revenue and the formula?

The money coming into the business through sales

Quantity sold x Selling price = Total Revenue

What are the different types of costs?

Variable costs - Change depending on output of business e.g. materials, tax, wages

Fixed Costs - Don’t change even if output changes and usually paid monthly e.g. rent, salaries

Total Costs - FC + TVC

What are the types of profit and the formula?

The total amount of money made left from sales after deducting costs

Profit is only made if there is more revenue than costs.

If there is less revenue than costs, you have made a loss.

Gross Profit = Sales (TR) - Cost of sales (TVC)

Net Profit = Gross profit - Operating costs (FC)

Total Revenue - FC - TVC = Profit

What are the benefits of keeping costs low?

Better profit margin

Reduce sales price → more sales

Lowers the breakeven → make profit quicker

Profit Margins

Gross profit margin = Gross profit / Total Revenue x100

Net Profit margin = Net profit / Total Revenue

What is ARR and the formula?

Average Rate of Return is used for decision making as it determines the profitability of an investment

ARR= Avr annual profit / initial capital outlay x100

Advantages and Disadvantages of ARR

Adv | DisAdv |

Easily understood | Ignored time-value of money (Inflation) |

Easy to calculate | Limited to one metric |

Quick comparison of investments | Reliance on estimates |

Useful in decision making | |

Long-term performance evaluation |

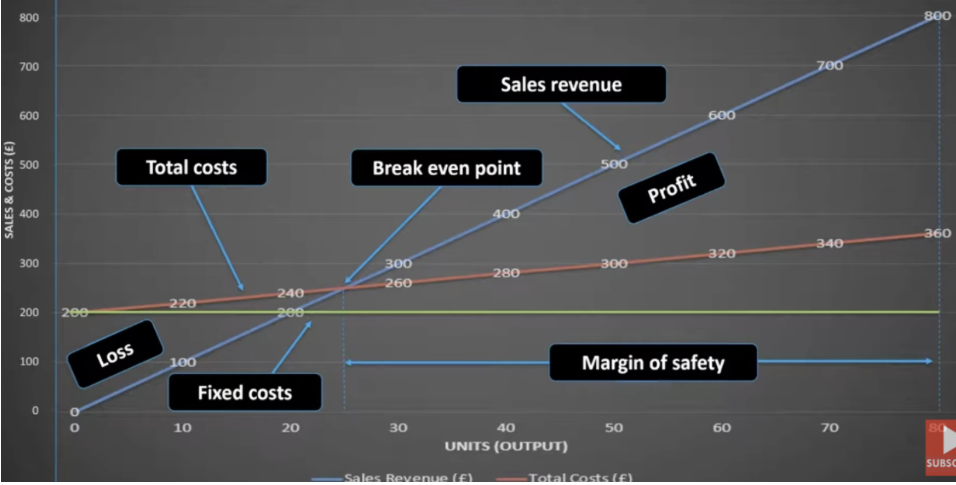

What is Break-Even and what is the formula?

The point when the total revenue equals the total costs. You are not making a profit or a loss. Calculates how much each unit contributes to initial costs and long-term profits.

Fixed Costs / Selling price - VC = contribution

(Per unit)

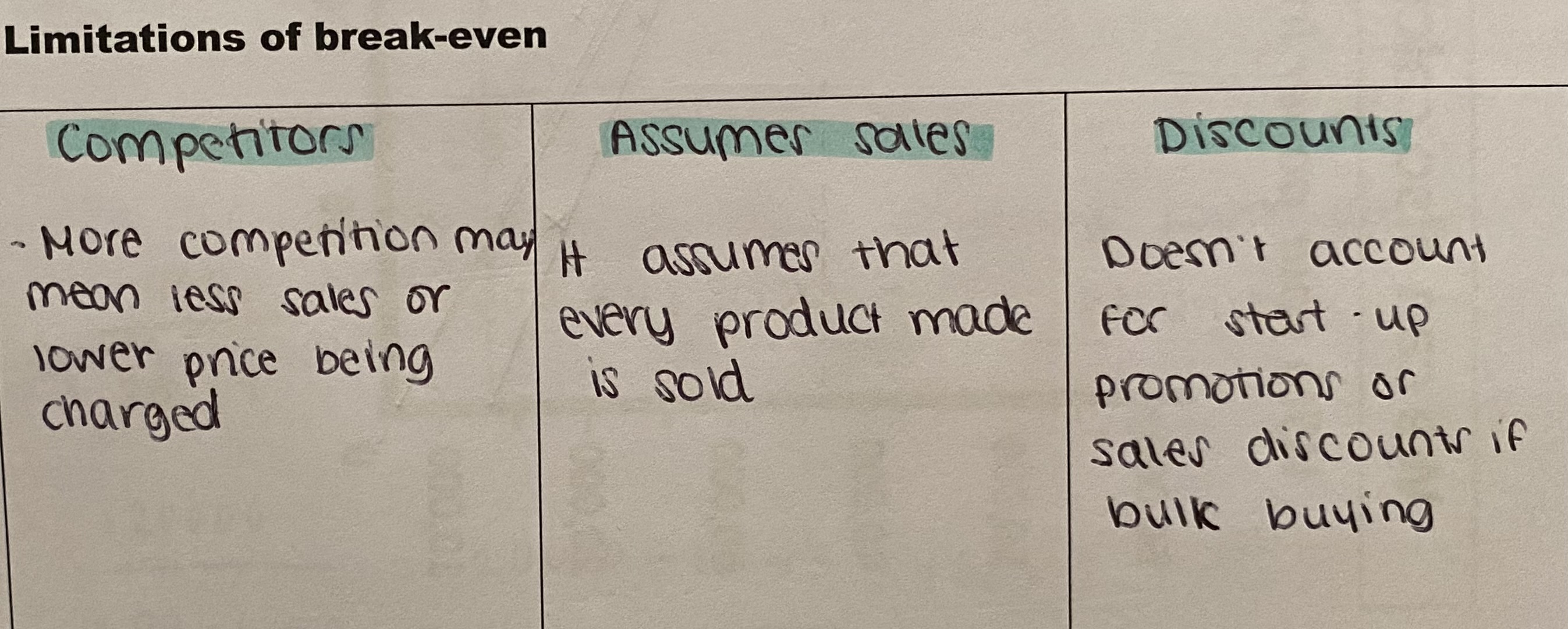

Advantages and Disadvantages of Break-even

Adv | DisAdv |

Quick, simple & helps decision making | Only a forecast |

Predicts level of risk | Not good for services as prices vary |

Shows potential profitability | Assumes all products made are sold |

Shows no. of units to sell before making a profit | Costs can change |

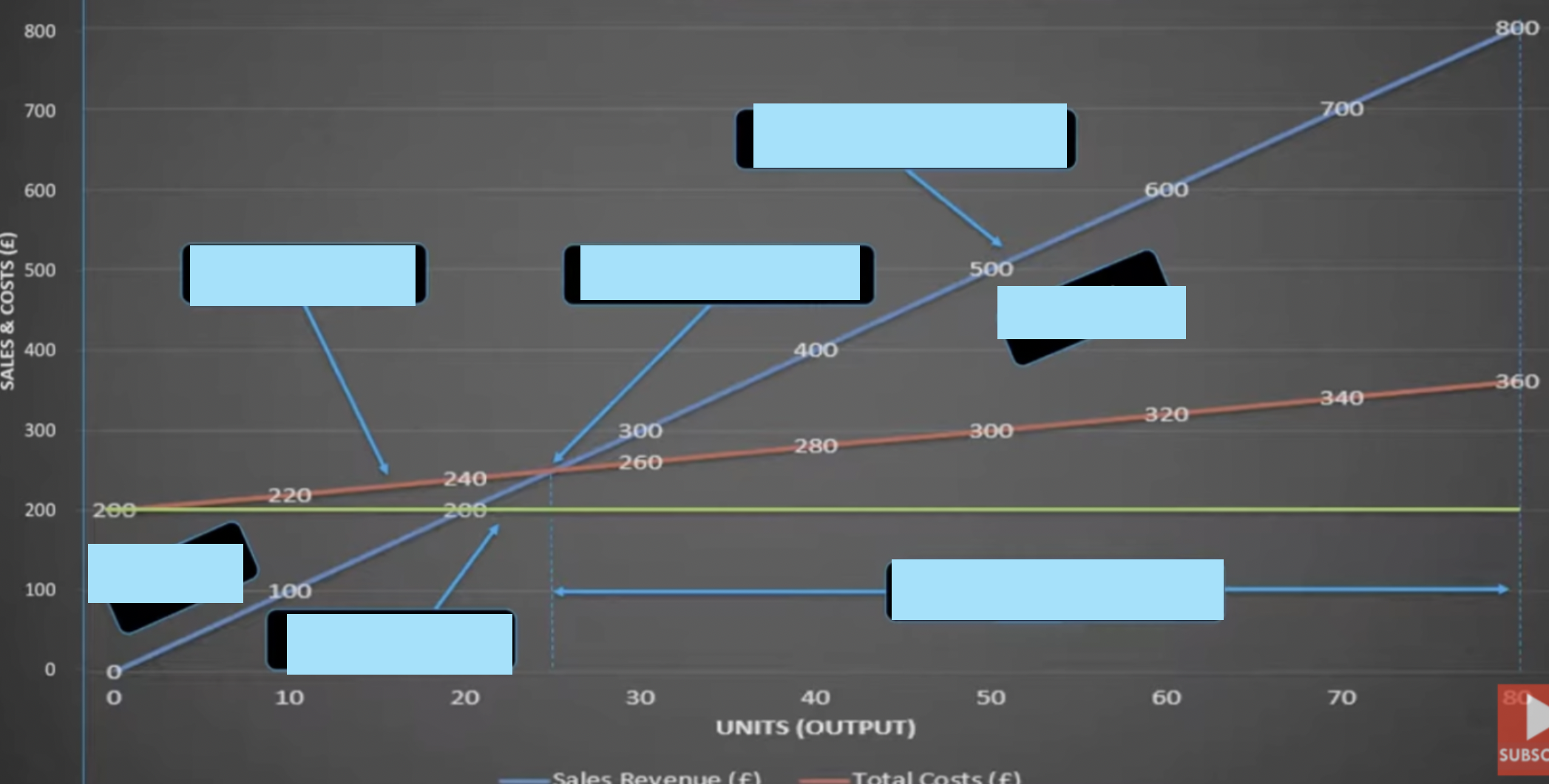

Label this break even graph

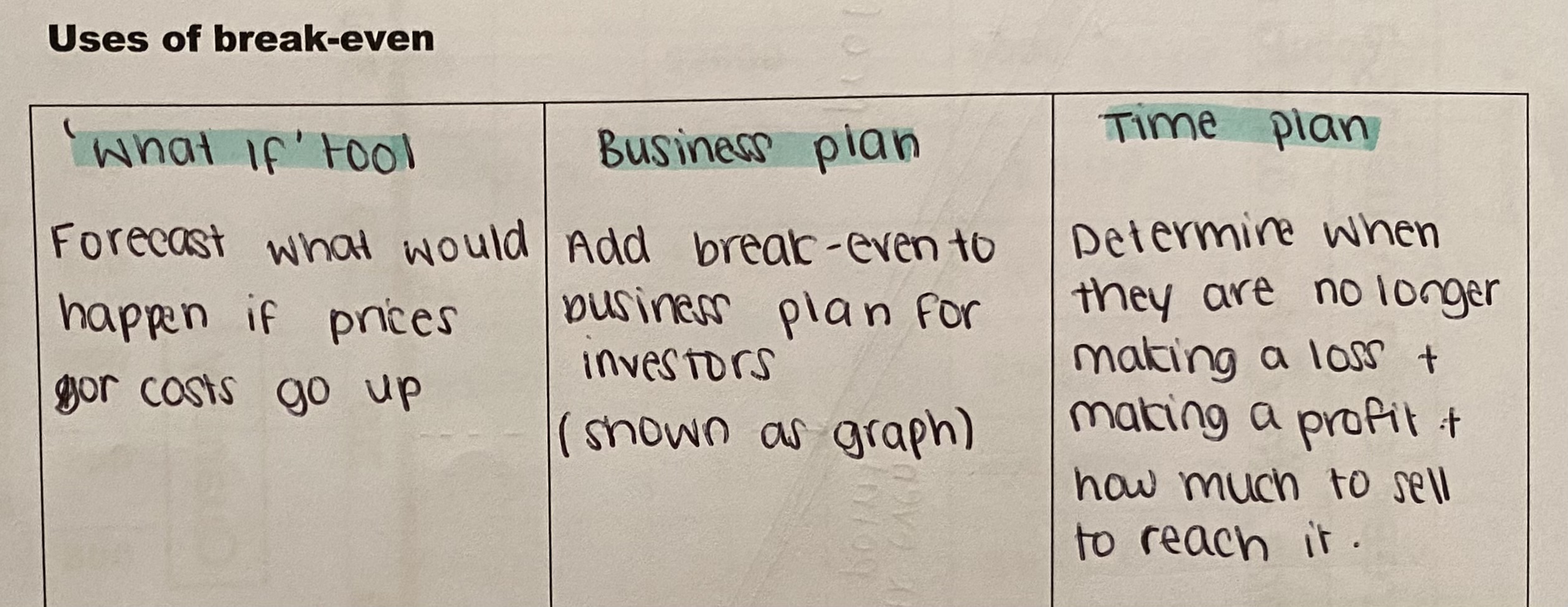

Uses of Break Even

Limitations of Break Even

What is cashflow forecast?

A Statement showing the expected flow of money into and out of a business over a period of time

What are the uses of a cashflow forecast?

Planning tool, get a loan

Anticipate shortfall of cash & arrange finance

Provides targets (enough cash to pay bills in a shortfall)

May not always be accurate:

Sales may not be as high as expected, higher costs or lower prices

What is liquidity?

The business is able to pay its bills