Accounting Outcome 1

5.0(1)

Card Sorting

1/78

Earn XP

Description and Tags

Study Analytics

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

79 Terms

1

New cards

what are the 5 accounting elements

Assets (current, non-current), Liabilities(current, non-current), Owners Equity, Revenue, Expenses

2

New cards

Asset

A present economic resource controlled by the entity as a result of past events that has the potential to produce future economic benefits

3

New cards

Current asset

Cash and other assets that are expected to be converted to cash within a year

4

New cards

Non-current asset

A company's longterm investments where the full value will not be realised within the accounting year

5

New cards

Liabilities

A present obligation of the entity to transfer an economic resource as a result of past events.

6

New cards

Current liabilities

A company's debts or obligations that are due within one year or within a normal operating cycle.

7

New cards

Non-current liabilities

Long-term liabilities, which are financial obligations of a company that will come due in a year or longer.

8

New cards

Owner’s equity

The residual interest in the assets of an entity after deducting all its liabilities

9

New cards

The accounting equation

The formula that represents the format of the balance sheet. (Assets = Liabilities + Owner’s equity)

10

New cards

Balance Sheet

A financial report that details a business’s financial position by reporting its assets, liabilities and owner’s equity at a particular point of time.

11

New cards

Example of Assets

Cash at bank • Inventory • Accounts receivable • Vehicles • Equipment • Furniture • Fixtures and fittings • Machinery • Building

12

New cards

Revenue

Revenues are increases in assets or decreases in liabilities that result in increases of owner’s equity, other than those relating to contributions of the owner.

13

New cards

Expenses

Decreases in assets or increases in liabilities that result in a decrease of owner’s equity, other than those relating to distributions to the owner.

14

New cards

Net Profit

The total amount remaining after you subtract total expenses from total revenue

15

New cards

How do you calculate Net Profit

Revenue - Expenses = Net Profit

16

New cards

Example of Revenue

Fees – Service business • Sales – Trading business (Cash and credit sales) •

17

New cards

Example of Expenses

Advertising • Electricity • Insurance • Interest • Office Expenses • Rent • Telephone • Wages

18

New cards

When discussing an ethical decision what are the factors we need to consider

Financial (Pros and Cons) then either Social or Environment (Pros and Cons)

19

New cards

The accounting process

Business Documents → Data Input →Business Reports →Business Decision Making

20

New cards

Financial Data

a raw collection of facts

21

New cards

Financial Information

data put into a meaningful form for a particular use

22

New cards

Data is often recorded on…..

Business documents

23

New cards

Business documents

Source of raw financial data - receipts, invoices, EFT documents etc

24

New cards

Data input

Data is sorted into groups and then noted in financial records

25

New cards

Business reports

Financial reports providing useful information in summarised form

26

New cards

Accounting assumptions

Generally accepted rules of how a business should record their accounting information

27

New cards

Accounting Entity Assumption

The requirement that a business must keep the set of financial records seperate to the owners or other business’

28

New cards

Going Concern Assumption

The belief that a business is expected to operate into the future and will continue forever

29

New cards

Accural Basis Assumption

Revenues are reported in the period they are earned and expenses in the period they are incurred in order to determine profit (accounts payable/recievable)

30

New cards

The Period Assumption

Accounting take place over specific periods and that these set segments of time have an equal duration so that meaningful comparisons of progress can be made across the different periods.

31

New cards

What does the entity assumption mean for the business

This assumption enables users of accounting reports to make decisions based soley of the performance of the business

32

New cards

What does the going concern assumption mean for the business

Allows business to recognise transaction that span over the course of one accounting period (like credit transactions) and enables businesses to distinguish between an asset and expense (expense is consumed within a reporting period whereas an asset has the ability to provide future economic benefit)

33

New cards

What does the accural basis assumption mean for the business

Allows for profit to be calculated based on the revenue earned and expenses incurred for a particular reporting period

34

New cards

What does the period assumption mean for the business

Reporting periods should be consistent over the life of a business so comparisons can be made between reports

35

New cards

Qualitative characteristics definition

Standards that must be met when preparing financial reports so the information they contain is useful for decision making

36

New cards

What are the qualitative characteristics

timeliness, understandability, faithful representation, verifiability, comparability, relevance

37

New cards

Timeliness

A qualitative characteristic that requires financial information to be available for decision makers in time to be capable of influencing their decisions. The older the information, the less useful

38

New cards

Understandability

A qualitative characteristic that requires financial information to be presented without any missing information, no misleading information. The report must be concise, clear in presentation with headings and subheadings. Making the report easy to navigate and cross reference. The report must be able to be understood with those who have a basic knowledge of finance

39

New cards

Faithful Representation

A qualitative characteristic that requires financial information contained in the reports to be complete, free from bias and without error

40

New cards

Verifiability

A qualitative characteristic that requires two or more independent observers to reach the same conclusion of the accounting report, that they are faithfully represented and the actual events of the business

41

New cards

Verifiability (details)

Upheld through referencing and maintaining source documents as evidence for transactions (checked through auditing) If the reports are not verifiable then the information has not been faithfully represented

42

New cards

Comparability

Information in the accounting reports can be useful when it is compared to previous reports and with similar information from other entity’s reports

43

New cards

What does comparability allow for

Identify and understand similarities and differences among reports. Display changes in accounting procedures over time

44

New cards

Auditing

an official financial inspection of a company and its accounts

45

New cards

Relevance

Information available is capable of influencing decisions, helps confirm information and form predictions for future outcomes

46

New cards

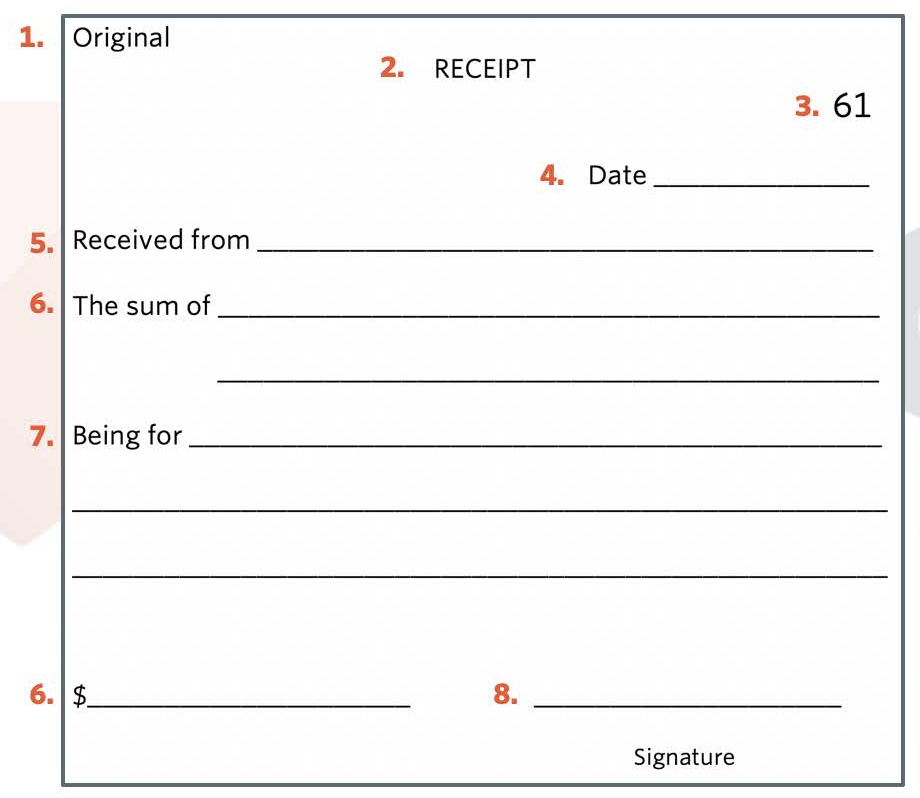

Cash receipt

A document containing financial information, that provides evidence that a financial transaction has occurred (a receipt verifies a business has received cash)

47

New cards

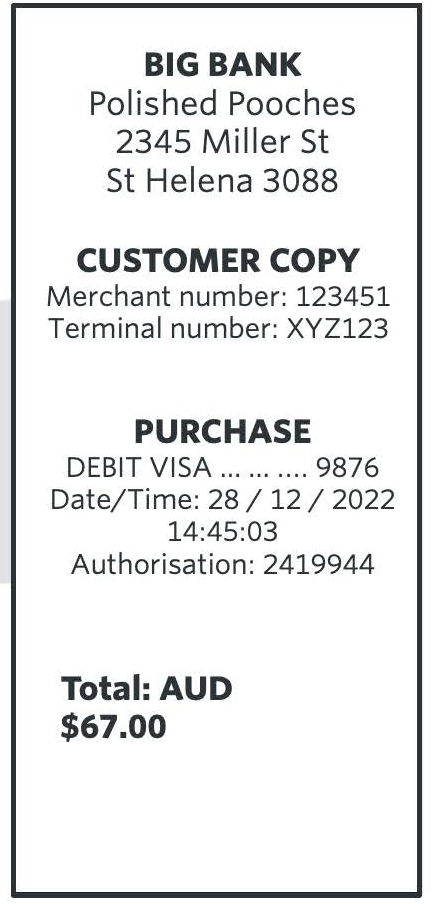

Electronic funds transfer (ETF)

A document containing financial information, that has been issued when an EFTPOS sale. This confirms that funds will be taken from the account and deposited into the business account on behalf of the customer (quicker and can be processed online at any time)

48

New cards

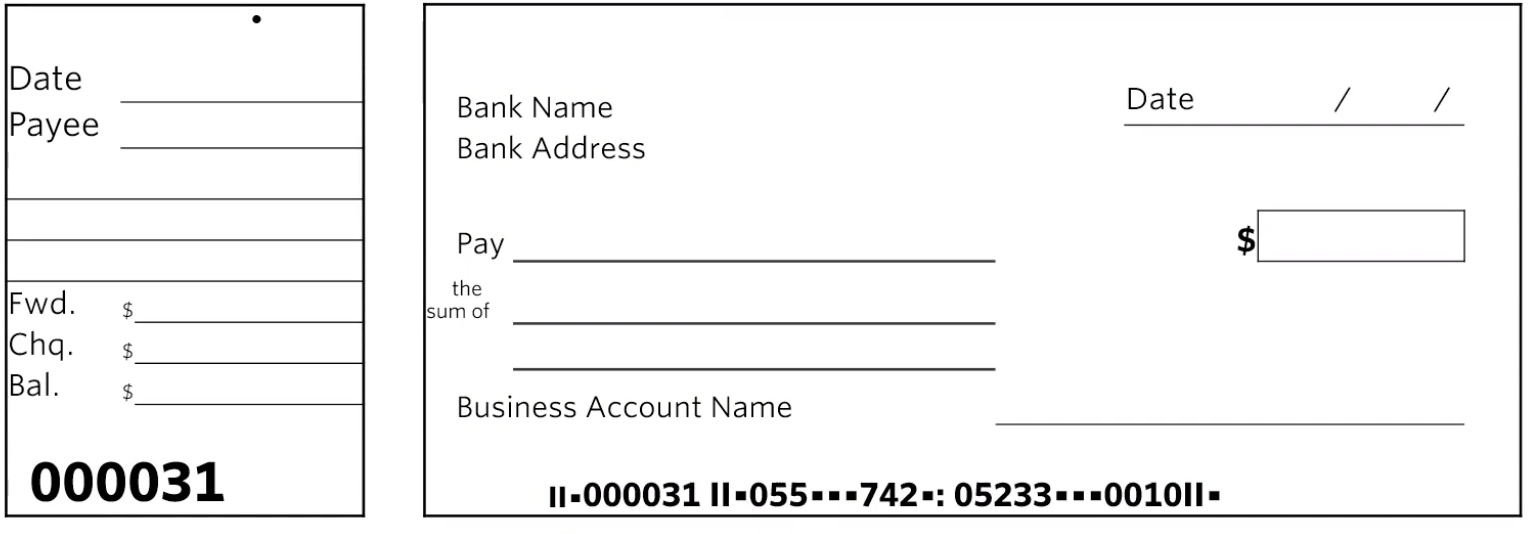

Cheque butt

A source document used to verify the details of a cash payment made by cheque

49

New cards

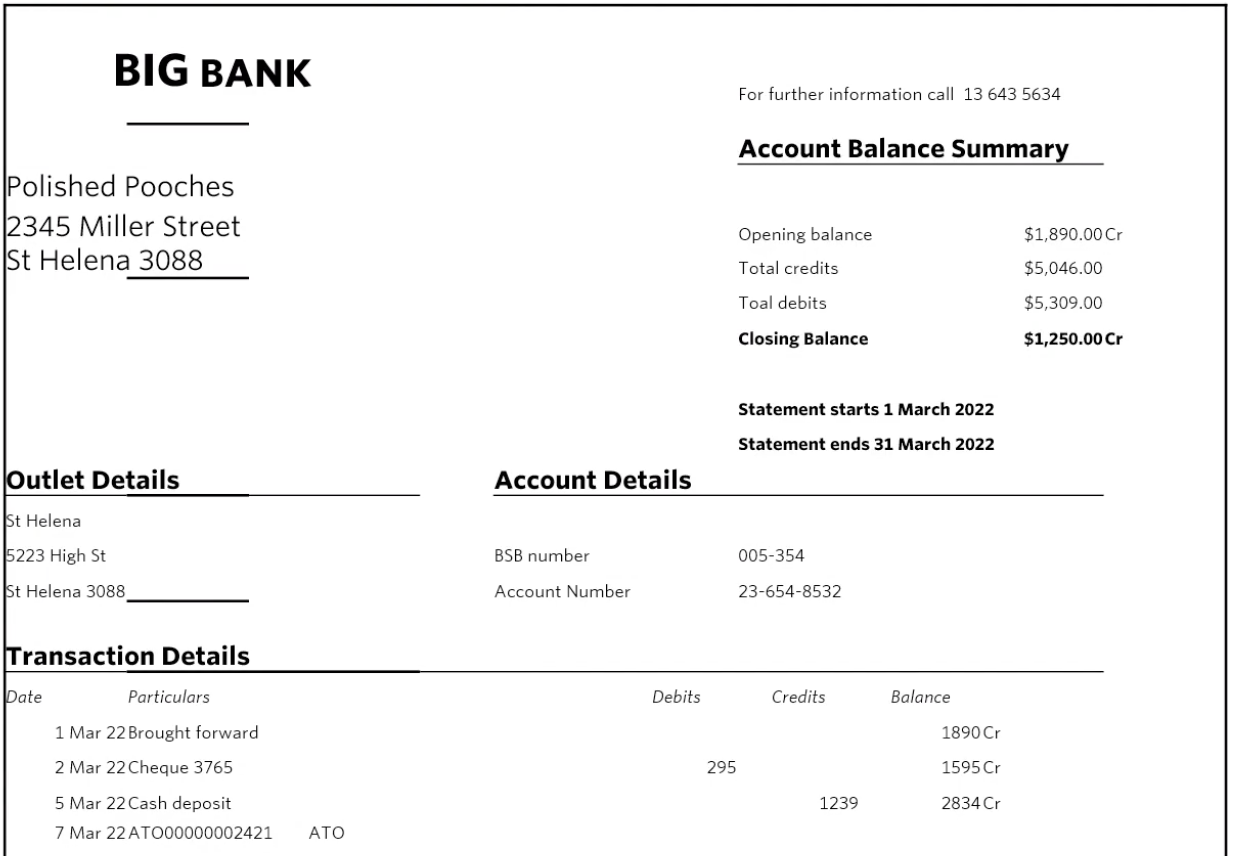

Bank statement

A source document issued by the bank as a record of all transactions affecting the bank account over a period of time

50

New cards

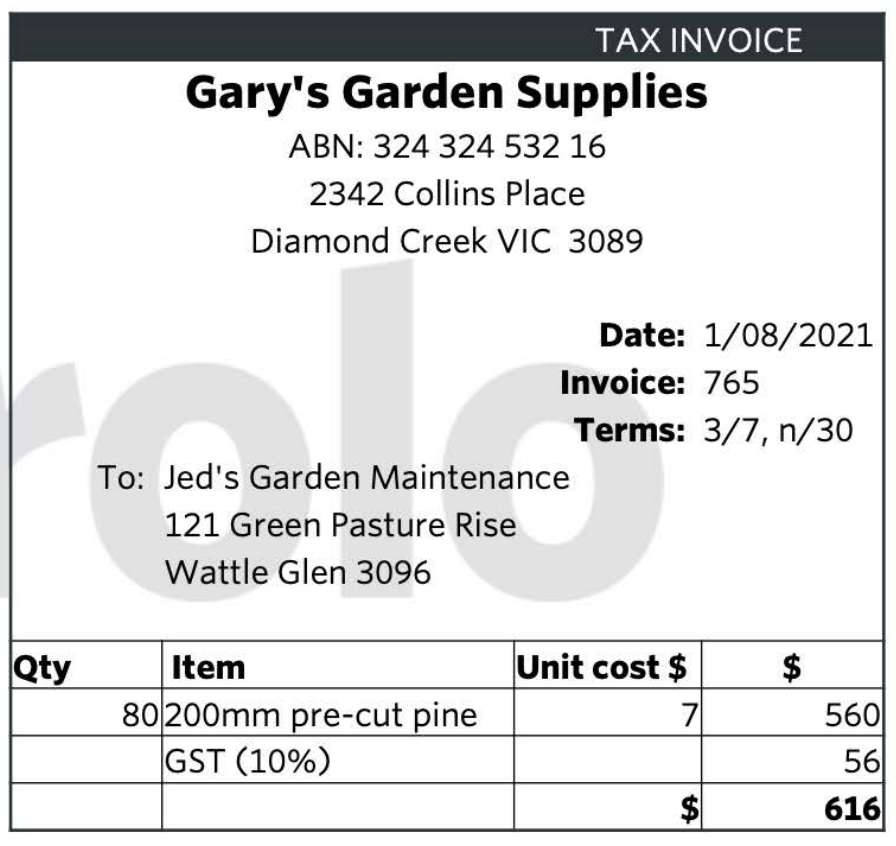

Sales invoice

A source document containing financial information of goods and services sales on credit. This means the business has provided a good or service but is awaiting payment. An accounts receivable is created

51

New cards

Tax invoice

Verifies the details of a credit transaction

52

New cards

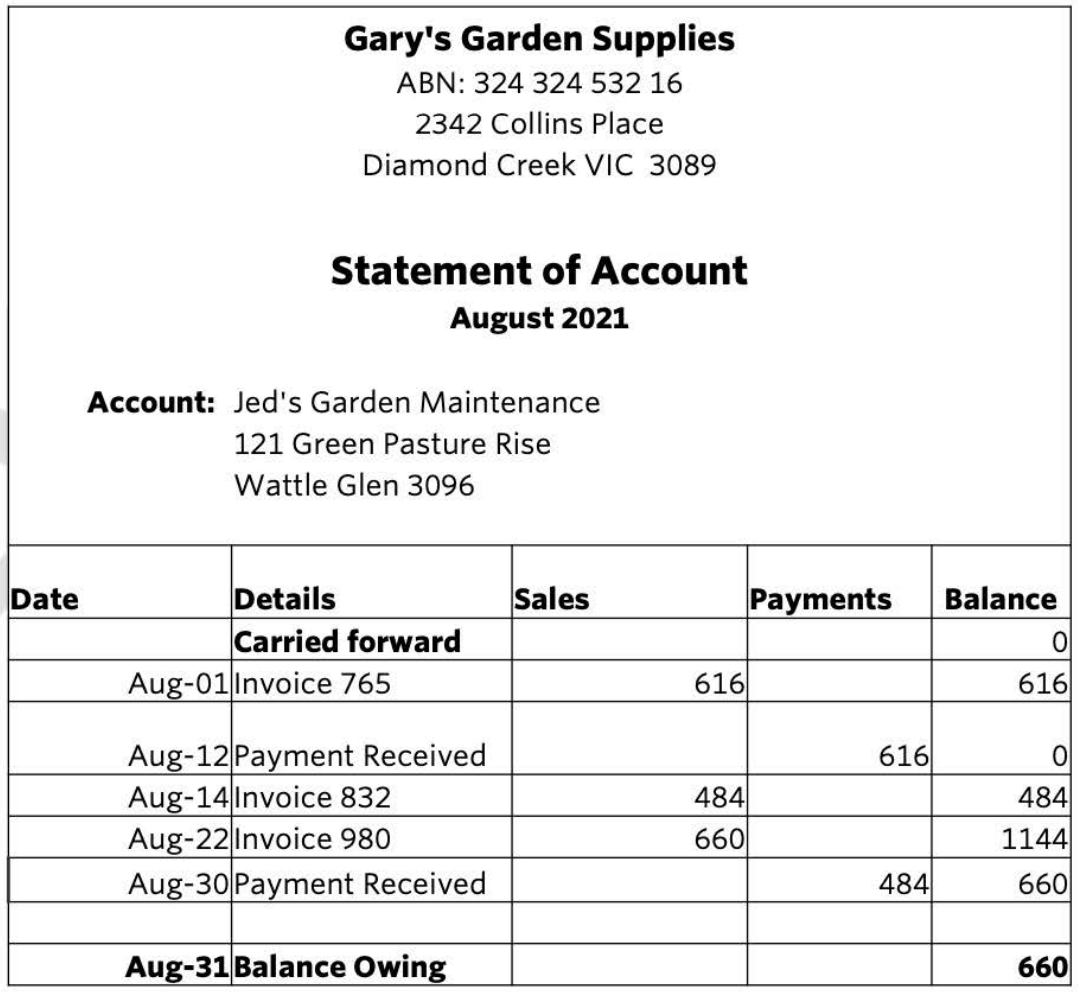

Statement of account

A source document issued by a business to its credit customers summarising the purchases and payments between the customer and the business over a period of time

53

New cards

What source document is this

Cash Receipt

54

New cards

What source document is this

EFT receipt

55

New cards

What source document is this

Sales invoice

56

New cards

What source document is this

Statement of account

57

New cards

What source document is this

Cheque/Cheque butt

58

New cards

What source document is this

Bank statement

59

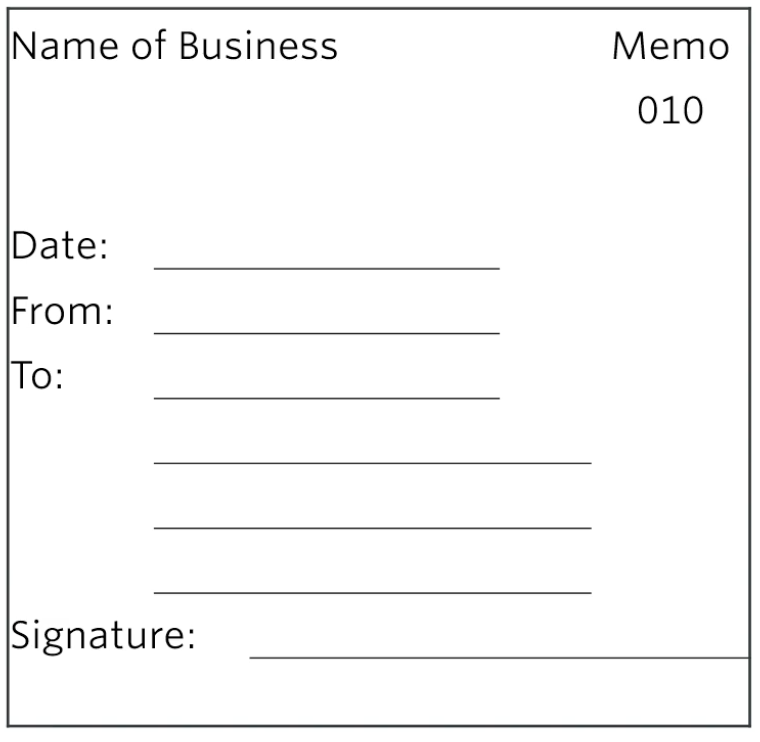

New cards

What source document is this

Memo

60

New cards

Source document

Evidence a financial transaction has occurred,

61

New cards

To calculate capital

capital = assets - liabilities

62

New cards

T-form balance sheet

an accounting report showing assets on one side and liabilities and owners equity on the other

63

New cards

Narrative form balance sheet

an accounting report prepared in a vertical fashion down the page, highlighting the owners equity in the business

64

New cards

Layout of narrative form

Owners equity (capital) → is represented by: → Assets (current/non-current) → Less: Liabilities (current/non-current) → Net assets

65

New cards

A classified balance sheet allows for what qualitative characteristic

Understandability

66

New cards

How to calculate Owners Equity

OE = A - L

67

New cards

How to calculate Working Capital

Working Capital = Current Assets - Current Liabilities

68

New cards

How to calculate Working Capital Ratio

Working Capital ratio = Current assets/Current liabilities

69

New cards

Liquidity

the ability of a business to meet its short-term obligations as they fall due

70

New cards

Single entry accounting

a simple accounting system in which one entry is made for each transaction

71

New cards

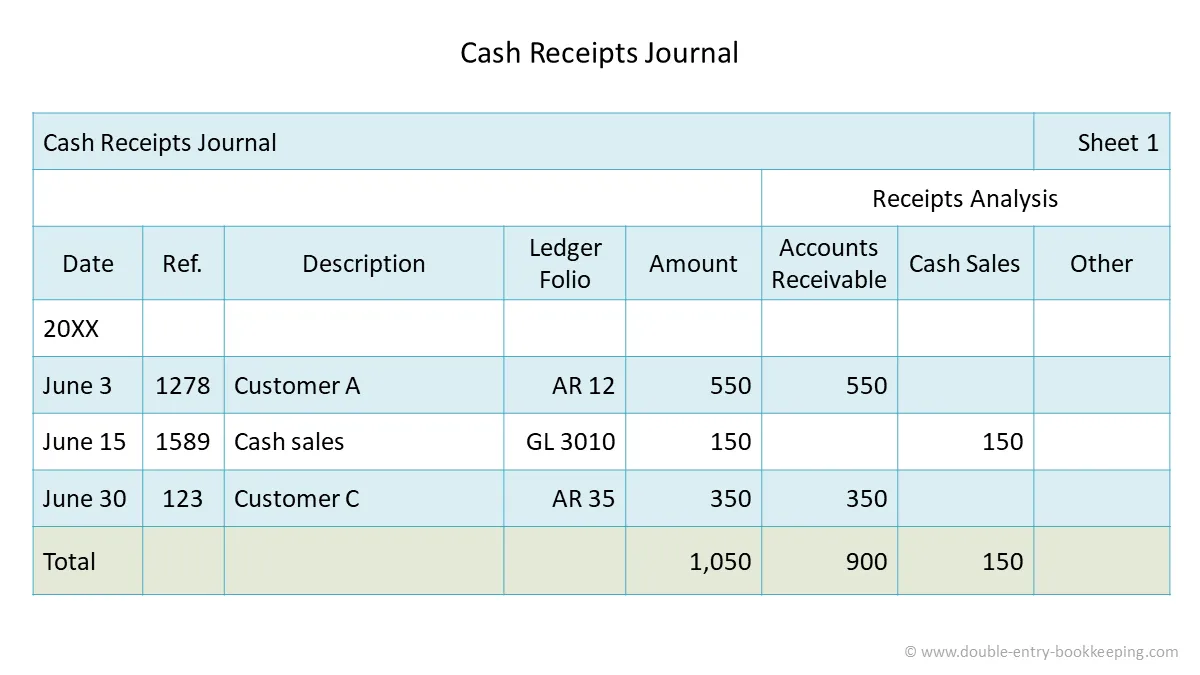

Cash journal

a multi-column record used to record the daily receipts or payments of cash over a period

72

New cards

What is this

Cash Journal

73

New cards

EFTPOS terminal

a machine rented by a business owner from a bank to make EFTPOS transactions

74

New cards

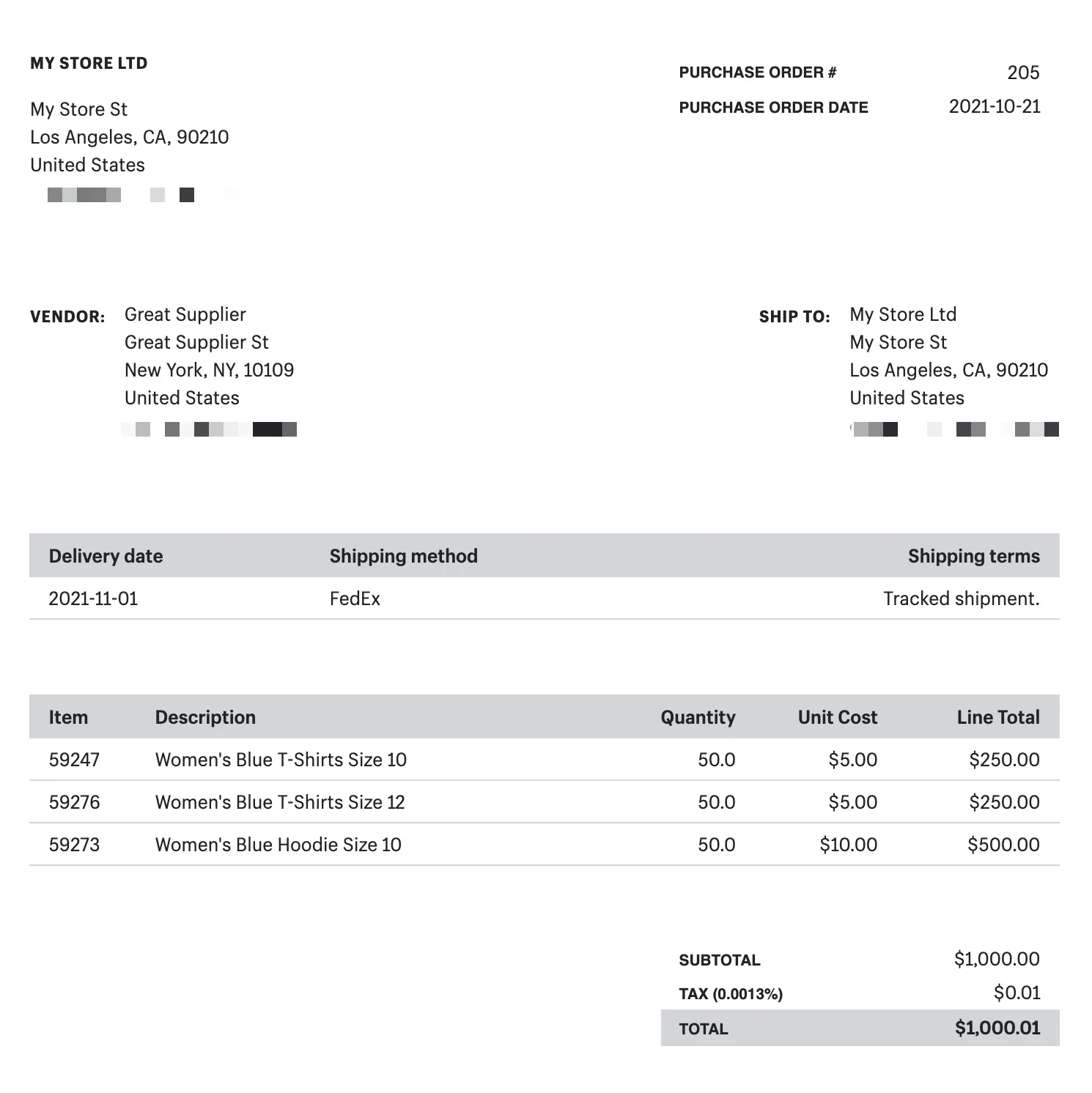

Purchase Order

a document used to confirm a request to a supplier to provide goods or services. (pro: firm has a record of goods ordered, which can be cross-checked with goods delivered). Includes description of goods, quantity, size, colour, range etc plus desired delivery date

75

New cards

Delivery Dockets

a document that may come with goods when they are delivered, that the purchaser is required to sign to acknowledge delivery has occurred. Includes, a description of goods and quantity supplied. Not recorded in the accounting system

76

New cards

Statement of Accounts

a document that informs a business’s customers of all transactions over the previous month.

77

New cards

What is this business document

Delivery Docket

78

New cards

What is the document flow diagram

Order form ( from business to supplier) → Delivery Docket (to business) → Invoice (to business) → Cheque/EFT payment (to supplier) → Statement of account (to business)

79

New cards

What factors do you consider in terms of making ethical decisions to a business

Cost of a decision to a business, Potential benefits to the business, effect on the reputation of the business, potential environmental damage of business decisions, Financial and emotional effect on individuals (including owners, managers and consumers)