3.9 - other policies to reduce income and wealth inequalities and poverty, policies to reduce discrimination

1/10

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

11 Terms

other policies to reduce income and wealth inequalities

investment in human capital

transfer payments

conditional cash transfers

targeted government spending on merit goods

universal basic income

investment in human capital

enhancing the skills, knowledge, and productivity of the workforce

to tackle inequality of opportunity

transfer payments

payments made by government to vulnerable individuals

redistributing income away from those who work and pay taxes towards vulnerable

-burden on the government

-may reduce incentive to work

types of transfer payments

old age pensions

disability pensions

unemployment benefits

war veteran’s benefits

maternity benefits

housing benefits

child allowances

student grants

conditional cash transfers

granted to poor households on conditions that they meet certain requirements

usually children’s education and healthcare

targeted government spending on merit goods

spending aimed at providing and improving access to essential services for those in need

education

health care

clean water

sanitation

sewerage

universal basic income

a government program providing all citizens with a regular, unconditional sum of money to cover basic needs

to reduce poverty and support livelihoods.

advantages of universal basic income

simple to carry out

supports diverse groups

provides better balance between workers and employers

stabilises economy during recession

disadvantages of universal basic income

too expensive as ALL household would get it

can only be financed by serious cuts in other sectors

lost incentive to work

opportunity cost to government

policies to reduce discrimination

legislation that forbid discrimination in the workplace

management training on anti-discrimination practices

communication of anti-discrimination policy to employees

*employers not always comply

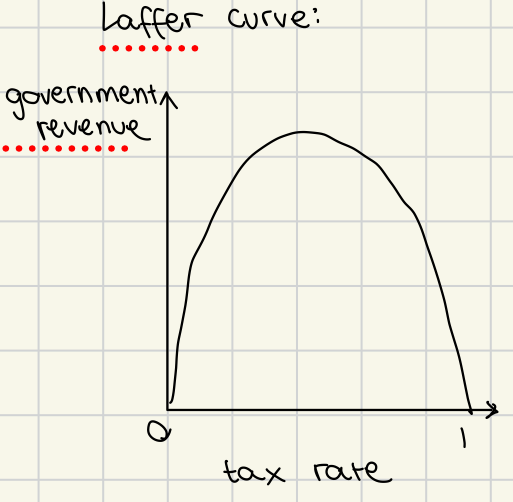

Laffer curve

illustrates the relationship between tax rates and tax revenue

suggests there is an optimal tax rate that maximizes revenue without discouraging productivity.