Trusts

1/73

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

74 Terms

Create a Trust - GOATS

Grantor with legal capacity and a present, unequivocal intent to create the trust; Object (trust res), specific, identifiable property that the settlor presently owns or will receive automatically; Ascertainable beneficiaries; Trustee with duties—human, bank, or corporate fiduciary owning enforceable duties to manage the res (no trustee? a court can appoint one, but someone capable most exist); Suitable (lawful) purpose—not against public policy and possible to perform

Trust Creation Rule

To create a valid trust, a settlor must intent to create a trust and manifest that intent (often by written or spoken words), there must be an identified property (res), at least one definite beneficiary (unless it’s a charitable trust), and a trustee to hold legal title. The trust must also have a valid trust purpose (not illegal or against public policy).

Testamentary/Real Property Trust vs Inter Vivos Trust of Personal Property

Testamentary/Real Property Trust: must comply with SoFs (in writing); Inter Vivos Trust of Personal Property: can be created orally (inter vivos = between the living; a trust created during settlor’s lifetime)

Trust Formation MEE Trick #1 (No Asset = No Trust)

A trust will not exist until it is funded with some property; a mere promise or declaration of a future trust is not enforceable unless supported by consideration. A trust res can be any certain and identifiable property interest. Trust does not exist until property is transferred into it. Once funded, the trust can spring into existence without further formalities if the prior intent is re-manifested (for example, by titling asset in the name of the trust)

Trust MEE Example: Property Later Provided

A trust was tested on an MEE where a settlor announced creation of a trust but had no assets in it until later. Initially, the trust was not valid bc it was unfunded. But once the settlor sold stock and deposited $100,000 into a bank account titled as trustee of the trust, the trust became valid at that moment, as the previously-declared intent coupled with funding completed the trust. By retitling an account in settlor’s name as trustee, he remanifested his intention to create the trust and now had property in the trust.

Settlor’s Intent

Courts distinguish an enforceable trust from mere precatory language (a non-binding wish or suggestion). Ex: if a will “requests” or “hopes” that an heir use property for a certain person’s benefit, the heir takes it outright (no trust) absent clear intent to impose fiduciary duties

Settlor’s Intent MEE

Past MEEs have also required spotting when an arrangement is a trust instead of a debt or a gift. For ex: if someone gives property to X “to hold and manage for Y“—signals a trust intent, not an outright gift to X or loan. Likewise, if a person declares themselves trustee over certain funds for another, it creates an immediate trust (assuming other elements met), not just a future promise

Trustee Reqs

A trust will not fail for want of a trustee—if the settlor fails to name one or if the trustee dies/resigns with no successor, a court will appoint a trustee so long as the settlor’s intent to create the trust is clear. If trustee dies or resigns, court will appoint a new one, trust will not just fail.

Beneficiaries Req

A trust can fail for want of definite beneficiaries in a private (non-charitable trust). Beneficiaries must be ascertainable individuals (or a defined class) such that a court can enforce the trust for their benefit—a vague category like “friends” does not suffice

Beneficiaries MEE Ex

A bequest “in trust for my friends” was held invalid for lack of beneficiaries so the property never became a valid trust. “friends” is not an ascertainable group—there’s no objective definition of who qualifies. No beneficiary could enforce the trust and the trustee had no criteria to determine shares, so no trust has created. Likely result in this case is that the $200,000 will fall back into the settlor’s residuary estate or intestacy (a resulting trust for settlor’s heirs)

No Beneficiaries Rationale

Without a definite beneficiary, there is no one with standing to hold the trustee accountable, and the trustee’s duties are essentially unenforceable. A key feature of private trusts is the enforceability by beneficiaries: ea beneficiary (or a group acting together) can sue the trustee for breach of trust or to enforce the trust’s terms. This is why beneficiaries must be ascertainable—so someone has standing to hold the trustee to account

Uniform Trust Code (UTC): Non-Charitable Trusts

The UTC allows non-charitable purpose trusts without definite beneficiaries to exist for a period of up to 21 years (cut off at 21 years or make invalid at the onset), effectively permitting honorary trusts within that time limit (ex: maintaining a private garden or caring for a pet)

Charitable Trust Purposes—RAP Does Not Apply

Relief of property; education; religion; governmental or municipal purposes; and other purposes beneficial to the community. If charitable trust deemed not truly charitable (ex: to “benefit my friends in the community” without a public element), the trust would have failed for no definite beneficiaries unless saved as an honorary private purpose trust for 21 years

Past MEE Charitable Trust Exs

Testator’s will created a trust to plant trees and flowers on city streets to beautify the community. This was ruled a valid charitable trust bc it served a public municipal purpose and benefitted the community at large (aesthetics of the town). Bc it was charitable, it could las perpetually (exempt from RAP)

Cy Pres

If the specific charity named ceases to exist or the precise purpose becomes impossible/impracticable, courts can apply the doctrine of cy pres (“as near as possible”) to modify the trust and carry out the general charitable intent with a similar purpose or beneficiary. State atty general (or relevant official) has no oversight and standing to enforce charitable trusts, since there is no single private beneficiary

Cy Pres MEE Exs

Trust left funds to Business College. Charity dissolved at termination. Instead of sending funds back to estate, court applied cy pres: redirected money to another educational institution bc settlor had broad charitable intent. Rule of Thumb: if charity can’t take gift and general charitable purpose exists, cy pres saves the gift; otherwise it revers to estate (resulting trust)

Trust Mistakes: No Property, No Trust

Equity won’t execute an empty trust

Trust Mistakes: Precatory Language ≠ Trust

“hope” or “wish” does not impose duties

Trust Mistakes: Req’s Ascertainable Beneficiaries

Vague terms like “friends” are invalid

Trust Mistakes: Charitable Purpose

Charitable purpose saves indefinite beneficiary issue

Trust Mistakes: Trustee Vacany

Court appoints trustee successor; trust continues

Trust Mistakes: SoFs

Oral trust of land invalid under SoFs

Charitable-Trust Pitfalls: Recognize Charitable Purpose

If benefiting an indefinite group (like “the public” or education), don’t declare failure for lack of definite beneficiaries

Charitable-Trust Pitfalls: Cy Pres When Made Impossible

If the method becomes impossible, but there’s general charitable intent, modify the gift instead of letting it lapse

Charitable-Trust Pitfalls: No Cy Pres for Private Trusts

For failed private trusts, use a resulting trust back to the settlor’s estate; you cannot redirect the property

Charitable-Trust Pitfalls: Watch RAP for Private

Void gifts to future descendants if no gift within lives in being +21 years. Mention RAP if relevant.

Charitable-Trust Pitfalls: Who can Enforce?

Atty General (or Settlor) can enforce a charitable trust; beneficiaries cannot

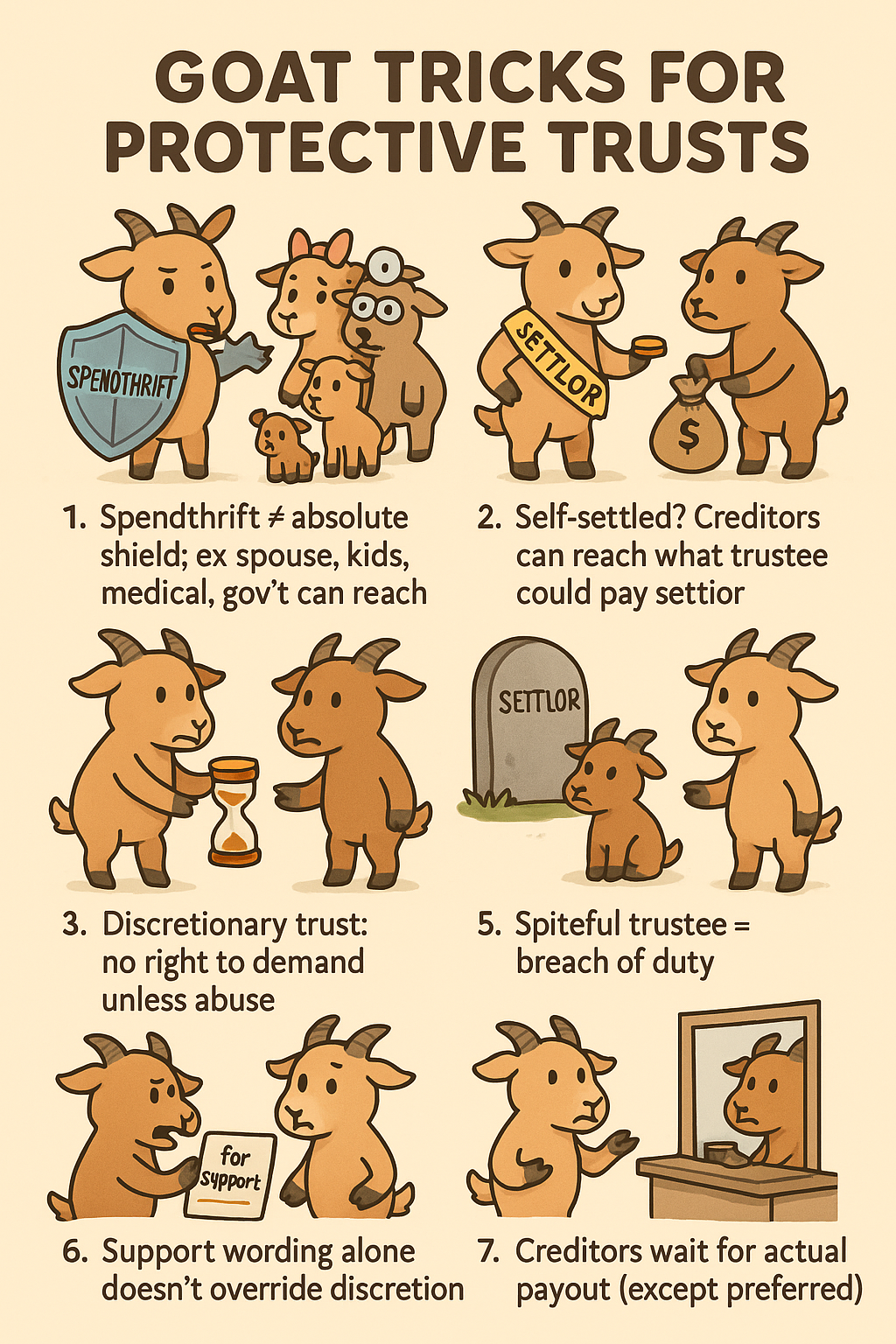

Spendthrift Trust

A spendthrift trust is a type of trust designed to protect the beneficiary’s assets from both their own poor spending habits and from creditors. Trust holds assets on behalf of the beneficiary, but the beneficiary can’t directly access the principal or assign their interest to creditors.

How Spendthrift Trust Works

Trustee has discretion over distributions, so even if the beneficiary owes money or makes poor financial decisions, creditors generally cannot reach the trust assets. The beneficiary receives income or distributions at the trustee’s discretion but can’t pledge future payments. These trusts are popular for wealthy families who want to provide for heirs while protecting against potential creditors, divorce, or the heir’s own financial mismanagement.

Spendthrift Clause

A spendthrift clause is language in the trust that prohibits the beneficiary from transferring their interest and prevents creditors from attaching the beneficiary’s interest before distribution. (Ex: “no beneficiary may assign his interest nor shall such interest be claims of creditors or legal process“)

Spendthrift Protection Ends Upon Distribution

The effect is that creditors cannot intercept payments before the beneficiary actually receives them. Once the trustee distributes income to the beneficiary, however, the money is the beneficiary’s and creditors can go after it (spendthrift protection ends upon distribution).

MEE Exceptions to Spendthrift Protection

Nearly all jurisdictions recognize some exceptions to spendthrift protection, typically for certain “preferred creditors“ or “exception creditors.“ Classic MEE ex: child support and alimony claims are repeatedly highlighted as exceptions: public policy will not allow a trust to shield a beneficiary’s assets from their legal obligation to support a child or former spouse. (Ex: beneficiary’s ex-wife obtained a judgment for unpaid alimony, and q was whether a spendthrift trust could be reached. The analysis stated that most states do not permit a spendthrift clause to block an unpaid alimony or child support claim, bc the interest of enforcing support obligations outweighs the settlor’s intent to protect the trust)

Add’l Spendthrift Exceptions

Similarly, many jdxs allow creditors who supplied necessaries (like medical care) to reach a spendthrift trust interest, again on public policy grounds. Other common exceptions are government claims (e.g., tax liens) and sometimes tort judgment creditors.

Spendthrift MEE Ex:

Typical creditors (credit card companies, banks, or a friend who made an unsecured loan) cannot directly attach a beneficiary’s spendthrift trust interest. One MEE scenario had a $20,000 judgment against a beneficiary bc the trust had a valid spendthrift clause (prohibiting both voluntary and involuntary transfers), the bank—as an ordinary creditor—was out of luck

Ordinary Creditors = Blocked by the Spendthrift

Bank could not compel the trustee to pay it, nor intercept payments to the beneficiary. The trust assets remained safe from that debt. Protected UNTIL distribution.

Settlor = Beneficiary, Spendthrift Protection Fails

If you create a trust for yourself and you’re the beneficiary, it can’t be a spendthrift trust. MEE Ex: guy who got a tort judgement against him created a spendthrift trust with himself as the income beneficiary and tried not to pay the judgment. Court made him pay. If Settlor = Beneficiary then Spendthrift Protection Fails

Final Summary of Spendthrift: Spendthrift Trust on MEE, Outline that:

(1) beneficiaries cannot transfer their interests (cannot sell or borrow against future trust payments); (2) most creditors cannot attach the trust interest or compel the trustee to pay them; (3) however, certain creditors (spouses, children owed support, providers of necessities, and gov in many cases) can pierce the spendthrift shield and get at the trust income (usually by court order directing the trustee to pay them instead of the beneficiary to the extent of the obligation); (4) if the beneficiary is also the settlor, spendthrift protection is ineffective—the trust assets can be reached by the settlor’s creditors to the maximum amount the trustee could pay the settlor; and (5) once funds are distributed to a beneficiary, normal creditor rules apply (no protection)

Support Trusts

Pay for beneficiary’s support & maintenance only; pure support: must pay proven needs; beneficiary can compel; discretionary support: trustee chooses; beneficiary cannot compel unless abuse; standard based on beneficiary’s basic needs/accustomed lifestyle

Support Trust Rule

A support trust is one in which the trustee is directed (either mandatorily or in their discretion) to pay only so much of the income and/or principal as is necessary for the beneficiary’s support, maintenance, health, or education.

Support Trust Language

“Trustee shall pay for Beneficiary’s support and maintenance.“ This creates an obligation (or power) to use the trust for the beneficiary’s basic needs or accustomed standard of living. Often the trustee is given some discretion to determine what amount is needed for support, which leads to the concept of pure vs discretionary support trust.

Pure Support Trust

Beneficiary has rights to payments strictly for their needs (medical, bills, food, shelter). If they have that need, trustee must pay it (assuming the trust has funds) and they CAN go to court to fight for it.

Discretionary Support Trust

A discretionary trust is one where the trustee has full or significant discretion to decide when, to whom (among a class), or how much to distribute to beneficiaries. The beneficiaries have no guaranteed entitlement to any specific payment—they can only receive something if the trustee exercises discretion in their favor.

Pure Trust vs Discretionary Trust

(1) Pure Discretionary Trust: the trustee may pay or withhold income/principal to the beneficiary as the trustee sees fit, for any reason or no reason (except an improper reason). Beneficiary cannot demand a distribution; they only have an expectation or hope. (2) Discretionary Support Trust: blend a support standard with discretion. In both cases, courts are very reluctant to interfere with a trustee’s discretion unless the trustee abuses it or acts in bad faith

MEE Support Trust Ex:

Trust stated the trustee “may pay so much of income and principal as he deems advisable, in his sole discretion for each child’s support.” This language created a discretionary support trust: the trustee is only to pay for support, but he has latitude to withhold payments even if the child has support needs (so long as he is not acting in bad faith or beyond the bounds of reasonable judgment). Trustee had personal animosity and paid nothing to one child despite clear needs, the issue was whether he abused his discretion—ultimately the answer found he did abuse it by acting out of personal bias and failing to satisfy even the beneficiary’s needs. If personal issue against a beneficiary out of a support trust, talk about bad faith

MEE Support Trust Language

A support trust is indicated by words like “for the beneficiary’s support,” “maintenance,” “education,” “comfort,” "etc. If it says the trustee “shall pay all income for B’s support,” that’s a mandatory support trust. If it says “may pay such amounts as necessary for support, in trustee’s discretion,” that’s discretionary language. Always parse the exact language.

Trustee Discretion & Duty MEE

Mom’s trust gave her daughter “absolute and uncontrolled” discretion to divide income between siblings David & Edna. Daughter paid David 100% and Edna 0% purely because she disliked Edna’s politics. Rule: Even “absolute” discretion isn’t a blank check—trustee must act in good faith and for the trust’s purpose. Denying Edna solely out of personal animus was an abuse of discretion; trustee may be liable

Discretionary Trust Note on Creditors

Generally, if a beneficiary themselves cannot demand a distribution (bc at Trustee’s discretion), then their creditors also cannot demand the trustee pay them. Even without a spendthrift clause, most states say a creditor of discretionary trust beneficiary steps into the beneficiary’s shoes. I.E., they cannot force a distribution that the beneficiary couldn’t force

Common MEE Mistakes: Spendthrift Clause

Do not treat a spendthrift clause as an absolute shield without exceptions. Must discuss special creditors who can still reach the trust despite a spendthrift provision. IF a fact pattern includes an ex-spouse, minor child, or unpaid alimony/child support, that’s a clue for an exception. Similarly, if medical or necessary living expenses are involved, note that those are providers who may be able to reach the trust.

Common MEE Mistakes: Self-Settled Trust (Spendthrift Provision)

If the settlor is also a beneficiary (even of just the income), spendthrift protection is void as to the settlor’s creditors. Sometimes bar expects you to say: The spendthrift clause will not protect the settlor-beneficiary’s interest from creditors.

Common MEE Mistakes: Timing of Creditor Claims

Ex: in one essay, tort victim tried to reach trust assets after the settlor-beneficiary died—since the trust then passed to others, that creditor could only have reached what settlor himself could before death (ended up being moot once settlor died)

Common MEE Mistakes: Beneficiary’s Ability to Force Distributions

If it’s a discretionary trust, don’t say “that beneficiary can force the trustee to pay them,” that’s wrong unless there’s an abuse of discretion. If the terms give the trustee sole discretion, always gauge the level of discretion granted before determining whether “because it’s for support, the beneficiary can demand all income.” Depends on discretion.

Common MEE Mistakes: Trustee’s Discretion

If the trustee’s judgment, “shall be conclusive” or “sole discretion,“ then the beneficiary’s rights are limited to cases of abuse. On the flip side, when a trustee clearly is acting out of personal spite or ignoring the settlor’s instructions, many students are hesitant to call it out, but it must be called out. Breach of the trustee’s duty (abuse of discretion) bc the trustee acted with an improper motive or failed to act impartially

Common MEE Mistakes: Creditor of Beneficiary

A creditor of a beneficiary cannot compel a distribution that the beneficiary themselves could not demand. If a trust is discretionary and the beneficiary has no right to payment this year, the creditor can’t get a court to force the trustee to pay the creditor either (except those narrow exceptions). Creditor does not step into the beneficiary’s shoes and can demand distribution if the beneficiary couldn’t demand it themselves. Creditor of spendthrift or discretionary trust must largely wait until the beneficiary actually receives something. Always mention that distinction

MEE Tricks for Protective Trusts Summary

Pour-over Will

A pour-over will is a back-up clause in your will that sends (“pours”) any probate assets you still own at death into your revocable living trust. That way, even forgotten or newly acquired property ends up under the trust’s private, changeable terms instead of the public will.

Pour-Over Clause is valid if:

the will clearly identifies the trust (name, date, or similar), and the trust’s terms are in written instrument executed before the testator dies (the UPC lets amendments up to the date of death)

Pour Over Clause Notes

Trust can be changed or even remain unfunded during life; it still receives the assets at death. The will itself can stay short bc the detailed dispositive terms live in the trust document, keeping them private and flexible

Will vs Trust

A will becomes public once probated; the trust does not. With a pour-over, the will just says “everything to my living trust,“ while the detailed who gets what stays in the private trust document. You can change beneficiaries or distribution terms by amending the trust (no new will signing ceremony). The pour-over will still funnels everything into the current version of that trust. They are useful.

Pour Over if Trust Revoked

If the trust is revoked or terminated before the testator dies, then typically the pour-over gift lapses (bc there is no longer a “trust” to receive it).

Pour Over Clause Language

Spot the pour-over: will sends assets “to trustee of ABC Trust.”

Resulting Trusts: Lack of a Beneficiary or Purpose is Illegal

It does not go to the void beneficiaries, and the trustee can’t keep it, instead, it returns to the settlor’s estate by way of a resulting trust. The MEE answer for the invalid class (“friends”) implied this outcome by stating the trust was “invalid,” so those funds would be distributed as part of the settlor’s estate (effectively a resulting trust bc the trustee held the money with no valid instructions)

Resulting Trusts: Trust Purpose Fulfilled or Trust Corpus Partially Undisposed

If a trust is fully performed and assets remain (e.g., income accumulated that wasn’t needed), or if the trust document doesn’t dispose of all trust property (no residuary clause in the trust), a resulting trust in favor of the settlor or the settlor’s heirs is the fallback

Resulting Trust Summaries

Money left over after trust purpose fulfilled = resulting trust; charitable trust fails = resulting trust; no beneficiary = trust is void = resulting trust; just write the words “resulting trust” if a trust fails and move on.

MEE Answers Key: Trust Fails or Found Void

Whenever a trust fails or is found void, say what happens to the property. Typical answer: “a resulting trust in favor of the settlor or settlor’s successors, meaning the trustee or hold of legal title must return it to the estate.“

Totten Trust

A Totten trust is a bank account where the depositor retains full control during their lifetime but designates a beneficiary to automatically receive the funds upon the depositor’s death without going through probate.

Revocation of Trusts: Common Law vs UTC

Common Law: trust IRREVOCABLE unless settlor expressly reserves right to revoke; UTC: trust revocable unless settlor declares irrevocable (settlor may amend/revoke any time by signed writing delivered to trustee while settlor alive); if trust says “irrevocable“ or settlor has died: settlor alone cannot revoke

MEE Revocation

Revocation is typically settlor-driven. Most essay issues were about termination by beneficiaries. Could mention: if the settlor is alive and wants to revoke, under modern law in a majority of states, the settlor can if the trust is revocable (presumed revocable in UTC states), or cannot if irrevocable unless beneficiaries consent or a court allows (but usually irrevocable means settlor’s done)

Claflin Rule

Beneficiaries, even if all are in agreement and of age and competent, cannot terminate or modify a trust prematurely if doing so would be contrary to a material purpose of the settlor. Exs of material purposes: settlor wanted to provide income to someone for life (a life trust indicates a purpose of support for that period), or spendthrift protection (indicating the settlor’s purpose to protect against the beneficiary’s creditors or improvidence), or to postpone enjoyment until a certain age (a purpose to encourage savings until then), or to provide for successive generations.

If such a purpose is not yet fulfilled, the trust can’t be terminated just bc beneficiaries want the money now. Trust will not be given over until the trust purpose is over.

Claflin Rule MEE Ex

Trust setup: income to Adam 10 yrs→ charity 5 years → principal to Beth. All beneficiaries petitioned early termination. Spendthrift clause signals material purpose: protect Adam’s income & principal from creditors. Material purpose unfulfilled→court denies termination. It is all about finding out if the material purpose is over yet.

Spendthrift a Material Purpose

Historically, any spendthrift clause automatically indicated a material purpose of the trust (to protect beneficiary from creditors and self).

Remarriage Clause a Material Purpose

Another ex: trust said Husband’s right to receive the trust income shall cease automatically if he remarries. Wife didn’t want new woman to benefit from her money. End the trust? All beneficiaries consent. Court asks: is remarriage clause a material purpose? All the kids agreed and the husband. Answer had good arguments both ways on whether the remarriage clause was material or not and whether or not the court would allow termination. argue BOTH sides if not a clear material purpose

Unborn Beneficiaries

Historically, needed everyone for termination; unborn or unascertainable beneficiaries could block (since they can’t consent). Modern statutes under UTC allow courts to approve termination even if not all beneficiaries consent, as long as the trust could have been terminated if everyone had consented and the interests of any non-consenting beneficiaries are adequately protected. This allows a court to terminate a trust even if a minor beneficiary can’t consent, by ensuring that minor’s interest is secured (maybe via conservatorship or bond)

Ending Trust

So settlors can sometimes revoke; beneficiaries can agree if no material purpose exists; trustees cannot unilaterally terminate the trust; courts may modify trusts sometimes but only to fulfill the intent of the settlor

Equitable Deviation Doctrine

Courts may modify trust terms when unforeseen circumstances threaten the settlor’s purpose; Goal: carry out settlor’s intent, not rewrite trust; historically limited to administrative provisions (e.g., investment instructions); modern statutes permit changes to dispositive terms as well if necessary to fulfill core intent (ex: trust limited to railroad bonds; railroads are obsolete → court allows diversified investments)