CMA Part 1

1/313

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

314 Terms

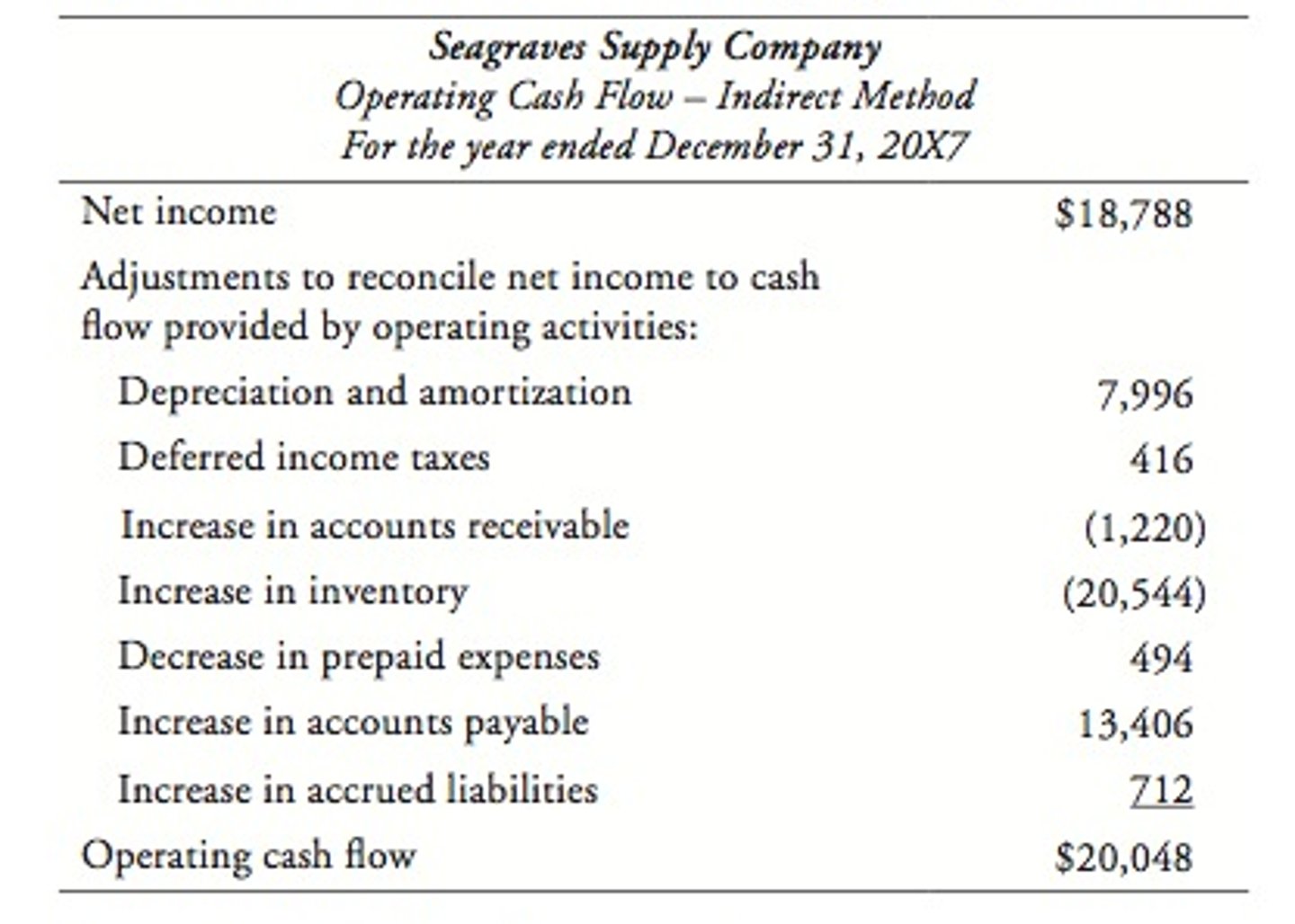

Operating Activity Cash Flow - Indirect

Cash Flows from Operating Activities:

Net Income

+ Non-Cash Expenses:

(Depreciation, Depletion & Amortization Expense)

+ Non-Operating Losses:

(Loss on Sale of Non-Current Assets)

− Non-Operating Gains:

(Gain on Sale of Non-Current Assets)

+ Decrease in Current Assets:

(Accounts Receivable, Prepaid Expenses, Inventory etc.)

− Increase in Current Assets

+ Increase in Current Liabilities:

(Accounts Payable, Accrued Liabilities, Income Tax Payable etc.)

− Decrease in Current Liabilities

= Net Cash Flow from Operating Activities

All of the following are likely to be used as a cost allocation base in activity-based costing EXCEPT the...

cost of materials used to manufacture the product.

Target Pricing

Is a pricing strategy used to create a competitive advantage, because it is a customer-oriented approach that focuses on what products can be sold at what prices. It is also advantageous because it emphasizes control of costs prior to their being locked in during the early links in the value chain. The company sets a target price for a potential product reflecting what it believes consumers will pay and competitors will do. After subtracting the desired profit margin, the long-run target cost is known. If current costs are too high to allow an acceptable profit, cost-cutting measures are implemented or the product is abandoned. The assumption is that the target price is a constraint.

Life-Cycle Costing

Is sometimes used as a basis for cost planning and product pricing. Life-cycle costing estimates a product's revenues and expenses over its expected life cycle. This approach is especially useful when revenues and related costs do not occur in the same periods. It emphasizes the need to price products to cover all costs, not just those for production. Hence, costs are determined for all value-chain categories: upstream (R&D, design), manufacturing, and downstream (marketing, distribution, and customer service). The result is to highlight upstream and downstream costs in the cost planning process that often receive insufficient attention

In Target Costing...

The market price of the product is taken as a given. Target costing begins with a target price, which is the expected market price given the company's knowledge of its customers and competitors. Subtracting the unit target profit margin determines the long-term target cost. If this cost is lower than the full cost, the company may need to adopt comprehensive cost-cutting measures. For example, in the furniture industry, certain price points are popular with buyers: a couch might sell better at $400 than at $200 because consumers question the quality of a $200 couch and thus will not buy the lower-priced item. The result is that furniture manufacturers view $400 as the target price of a couch, and the cost must be lower.

Absorption vs Variable Costing - difference in operating income

When comparing absorption costing with variable costing, the difference in operating income can be explained by the difference between the...ending inventory in unites and the beginning inventory in unites, multiplied by the budgeted fixed manufacturing cost per unit. Absorption and variable costing differ in their treatment of fixed overhead: It is capitalized as inventory under absorption costs and not under variable costing.

Management would like to determine profitability of its Alpha product line. To eliminate the possibility of profit distortion due to changes in production, the managers should primarily review...

Variable (direct) costing income statements. Under variable costing, fixed manufacturing costs are not included in product costs. Rather, they are period costs and expensed in the current period as incurred. Consequently, any variability in profits will not be attributed to changes in production. Instead, profits will vary closely with sales. Thus, managers should primarily review variable costing income statements to eliminate the possibility of profit distortion due to changes in production.

In which one of the following situations will ending inventory on the balance sheet computed under absorption costing be exactly equal to ending inventory computed under variable costing?

When there is no fixed factory overhead cost. Fixed factory overhead cost is treated as a product cost under absorption costing and as a period cost under variable costing. Under variable costing, only variable costs are assigned to units of product and therefore included in the inventory. Under absorption costing, both variable factory overhead costs and fixed factory overhead costs are assigned to units of product and therefore included in the inventory. Thus, ending inventory is the same under both absorption costing and variable costing only when there is no fixed factory overhead cost.

Joint costs are useful for

Joint costs are useful for inventory costing when two or more identifiable products emerge from a common production process. The joint costs of production must be allocated on some basis, such as relative sales value.

In joint-product costing and analysis, which one of the following costs is relevant when deciding the point at which a product should be sold to maximize profits?

Joint products are created from processing a common input. Joint costs are incurred prior to the split-off point and cannot be identified with a particular joint product. As a result, joint costs are irrelevant to the timing of sale. However, separable costs incurred after the split-off point are relevant because, if incremental revenues exceed the separable costs, products should be processed further, not sold at the split-off point.

The principal disadvantage of using the physical quantity method of allocating joint costs is that

Joint costs are most often assigned on the basis of relative sales values or net realizable values. Basing allocations on physical quantities, such as pounds, gallons, etc., is usually not desirable because the costs assigned may have no relationship to value. When large items have low selling prices and small items have high selling prices, the large items might always sell at a loss when physical quantities are used to allocate joint costs.

A company produces three main joint products and one by-product. The by-product's relative sales value is quite low compared with that of the main products. The preferable accounting for the by-product's net realizable value is as

A reduction in the common cost to be allocated to the three main products. Because of the relatively small sales value, a cost-effective allocation method is used for by-products. The net realizable value of by-products is usually deducted from the cost of the main products.

The primary purpose for allocating common costs to joint products is to determine

The inventory cost of joint products for financial reporting. Joint products must be valued for external financial reporting purposes based on the full (absorption) cost of the product. Any common costs attributable to the joint production process must therefore be allocated on a systematic and rational basis.

The distinction between joint products and by-products is largely dependent on

Market value. A by-product is one of relatively small total value. The first question that must be answered in regard to by-products is: Do the benefits of further processing and bringing them to market exceed the costs; that is, is the incremental revenue worth the effort? Market price determines this. The same can essentially be said for the main products of the production process.

In a production process where joint products are produced, the primary factor that will distinguish a joint product from a by-product is the

Relative total sales value of the products. In a production process where joint products are produced, the primary factor that will distinguish a joint product from a by-product is the relative total sales value of the products.

All of the following are methods of allocating joint costs to joint products except...

Separable production cost method. No "separable production cost method" is recognized for allocating joint costs. The nature of the problem is such that all costs are joint and cannot be separated.

A company manufactures several products that originate in a joint process and are separated at a split-off point. Which one of the following methods of joint-cost allocation would allocate the same unit cost to each separable product?

Physical quantity method. The physical quantity (unit) method is the simplest; it allocates joint production costs to each product based on their relative proportions of the measure selected. Using this method results in a an identical unit cost for each separable product.

If all of the joint products are sold at the split-off point and an overall profit is made on all of the products, which one of the following joint costing methods will result in the same gross margin percentage on each joint product?

Sales value at split-off method. The sales value at split-off method is based on the relative sales values of the separate costs at split-off. Gross margin percentage is calculated as the difference between sales price and cost divided by sales price. Since each joint product receives the amount of separate cost proportional to its sales value, the gross margin percentage calculation will be the same. For instance, if there are two products whose sales prices are $40 and $60, respectively, the joint product costs allocated will also be in a 2:3 ratio, e.g., $10 and $15.

The first product will have a gross margin percentage of the following:

($40 - $10) ÷ $40 = 75%

The second product will also have a gross margin percentage of the following:

($60 - $15) ÷ $60 = 75%

Residual Income

Residential income measures performance in dollars rather than a percentage return

net income-(avg total assets *target rate of return)

Residual income is a better measure for performance evaluation of an investment center

manager than return on investment because......

Residual income is the excess of the return on an investment over the

targeted amount (the imputed return on investment). Some enterprises prefer to measure

managerial performance in terms of the amount of residual income rather than a percentage

ROI. The principle is that the enterprise is expected to benefit from expansion as long as

residual income is earned. Using a percentage ROI approach, expansion might be rejected if it

lowered ROI in a highly profitable division even though residual income would increase. For

example, if managers are expected to earn a 15% ROI, a division with a 30% ROI might not

invest in a project offering a 25% rate of return

Life-cycle costing

is sometimes used as a basis for cost planning and product pricing.

After investing in a new project, Lee Company discovered that its residual income remained unchanged. Which one of the following must be true about the new project?

The return on investment of the new project must have been equal to the firm's cost of capital.

Cash Budget

The last schedule to be prepared in the normal budget preparation process is...

Flexible Budget Variance

The difference between the actual amounts and the flexible budget amounts for the actual output achieved.

Process costing

a term used in cost accounting to describe one method for collecting and assigning manufacturing costs to the units produced. Processing cost is used when nearly identical units are mass produced.

Activity-based costing

assigns manufacturing overhead costs to products in a more logical manner than the traditional approach of simply allocating costs on the basis of machine hours. Activity based costing first assigns costs to the activities that are the real cause of the overhead. It then assigns the cost of those activities only to the products that are actually demanding the activities.

business process reengineering

It reinvents, rather than improving or modifying. It disregards existing processes and invents new ways of doing work. It refers to the fundamental rethinking and radical redesign of a business activity to achieve dramatic improvements in performance?

The imputed interest rate used in the residual income approach to performance evaluation can best be described as the

target return on investment set by the company's management.

Three of the basic measurements used by the Theory of Constraints (TOC) are

throughput (or throughput contribution), inventory (or investments), and operational expense. Theory of constraints (TOC) analysis describes three basic measurements:? throughput contribution (sales - direct materials), investments (raw materials; work-in-process; finished goods; R&D costs; and property, plant, and equipment), and operating costs (all costs except direct materials).

Throughput Contribution

Sales - Direct Materials.

Manufacturing Investments

Raw Materials + WIP + Finished Goods + R&D Costs + PPE.

Operating Costs

All costs except direct materials

The variance in an absorption costing system that measures the departure from the denominator level of activity that was used to set the fixed overhead rate is the

production volume variance.

Theoretical (Ideal) Capacity

is the maximum capacity given continuous operations with no holidays, downtime, etc. It assumes perfect efficiency at all times. Consequently, it can never be attained and is not a reasonable estimate of actual volume.

Practical Capacity

is based on realistic, attainable levels of production and input efficiency and is the most appropriate denominator level to use in selecting an overhead application rate.

Generally, individual departmental rates rather than a plantwide rate for applying manufacturing overhead are used if

The manufactured products differ in the resources consumed from the individual departments in the plant.. Overhead is usually assigned to products based on a predetermined rate or rates. The activity base for overhead allocation should have a high degree of correlation with the incurrence of overhead. Given only one cost driver, one overhead application rate is sufficient. If products differ in the resources consumed in individual departments, multiple rates are preferable.

The numerator of the overhead application rate equals

Estimated overhead costs. The overhead application rate is established at the beginning of each year to determine how much overhead to accumulate for each job throughout the period. The estimated annual overhead costs are divided by the annual activity level or capacity in terms of units to arrive at the desired rate.

Direct labor cost.

In labor intensive industries, overhead is usually allocated based on a labor activity base. If more overhead is incurred by the more highly skilled and paid employees, the overhead rate should be based upon direct labor cost rather than direct labor hours.

Annual overhead application rates are used to

Smooth seasonal variability of overhead costs. Annual overhead application rates smooth seasonal variability of overhead costs and activity levels. If overhead were applied to the product as incurred, the overhead rate per unit in most cases would vary considerably from week to week or month to month. The purpose of an annual overhead application rate is to simulate constant overhead throughout the year.

Departmental overhead rates are usually preferred to plant-wide overhead rates when

The activities of each of the various departments in the plant are not homogeneous. The activity base for overhead allocation should have a high correlation with the incurrence of overhead. Thus, the activities of various departments are usually more appropriate as activity bases than plant-wide activities, particularly when products and production activities are not homogeneous.

Normal Costing

Normal costing can provide more timely information about job and product costs, and it can helpfully smooth product costs throughout a period, but it cannot in and of itself improve the accuracy of costing.

The most important criterion in accurate cost allocations is

Using homogeneous cost pools. All the cost objects gathered in a cost pool should be similar enough that a single allocation base can be selected that will accurately allocate the costs in the pool.

A company has budgeted overhead costs at its normal capacity based on machine hours. Variable factory overhead is $180,000, and fixed factory overhead is $560,000. If the firm operates at a slightly lower rate of activity, it will expect total

Fixed factory overhead of $560,000 and the same hourly rate for variable overhead. Since fixed costs are by their nature unchanging within the relevant range, fixed costs will remain constant at $560,000. Additionally, variable overhead costs per hour remain constant in the relevant range.

A manufacturing process normally produces defective units equal to 1% of production. Defective units are subsequently reworked and sold. The cost of reworking these defective units should be charged to

Factory overhead control. Normal rework costs incurred because of factors common to all units produced ordinarily are charged to factory overhead control to spread the costs over all good units.

Actual Costing

AQ*AP = AC Actual Quantity x Actual Price = Actual Cost. Simplest and most accurate, but not timely, as expenses are typically recorded before actual quantity and pricing are known.

Normal Costing

AQ x POR = NC Actual quantity x Predetermined Overhead Rate. Moderately simple and moderately accurate method where direct materials and direct labor are traced to Work in process (WIP) when costs become known. Can be done on a periodic basis; monthly, weekly, or daily. Overhead costs (OH) must be allocated by using a predetermined overhead rate this is estimated at the beginning of the year. Results are then reconciled to actual at the end of the year.

Standard Costing

SQA x SP = SC Standard Quantity Allowed x Standard Price = Standard Costing. Estimated Quantity and Estimated Pricing = Standard Cost. Costing method that uses predetermined, estimated rates and quantities to record both direct costs and overhead.

Product Costs

Net Sales

- Cost of Goods Sold (Product Costs)

= Gross Profit

Period Costs

Gross Profit - Selling & Administrative Expenses (Period Costs) = Net Profit/loss

Manufacturing or Inventoriable Costs

Direct Material + Direct Labor + Factory Overhead

Value Added Costs

Product costs that enhance the value of the product in the eyes of the consumer. Most direct costs are value-added costs.

Non-Value Added costs

Costs that could be eliminated without deterioration of product quality, performance, or perceived value to the consumer. Many non-value-added costs are essential to the production and cannot be completely eliminated. For example, oiling the machine that is used to sew the briefcase together...Most, though not all, overhead costs are non-value-added costs.

Marginal costs or revenue

additional cost or revenue resulting from one more unit of output.

Accounting Cost

explicit costs that are "accounted for", typically as evidenced by an entry in fundamental book or accounting record (e.g., the general ledger).

Average Fixed Cost

Decreases as volume increases (subject to the relevant range).

Average Variable Cost

Increases as volume increases (subject to the relevant range).

Committed Cost

cannot be avoided in the current accounting time period (opposite of discretionary costs).

Discretionary Cost

may or may not be included in the budget and can be considered avoidable as determined by a decision maker with the authority to do so.

Absorption Costing (ABC)

also called full accrual costing - assigns all three factors of production to inventory; Direct Material, Direct Labor, Variable and Fixed Manufacturing overhead.

Costing for income statements

many companies use the contribution format for income statements (Absorption Costing), and use variable costing to calculate income.

Difference between variable and absorption costing

The only difference between the two is the treatment of fixed manufacturing costs. Fixed selling and administrative costs are treated the same with either method. When no ending inventory is present, net income is the same.

Absorption Costing

is required for external reporting purposes

Variable Costing

also known as direct costing, assigns only variable manufacturing costs to inventory, plus direct materials and direct labor. Variable costing is only used for internal decision making.

Fixed manufacturing overhead is...

treated as a period cost when using variable costing.

Exam Hint for the CMA

The CMA will focus on three areas when it comes to absorption and variable costing. 1. inventory valuation, i.e., product costing. 2. Calculation of variable costing and absorption costing income. 3. Reconciliation of variable costing and absorption costing income.

Absorption costing income statement

Sales minus variable manufacturing costs for units sold minus fixed manufacturing costs for units sold equals gross margin. Gross margin minus variable selling and administrative costs minus fixed selling and administrative costs equals operating income.

This means that if we produce more than we sell, or have an ending inventory, a portion of the fixed manufacturing costs are capitalized as inventory. That is, these costs are deferred to the balance sheet as an assets and not expensed until the inventory is sold.

Variable Costing Income Statement

Commonly uses the contribution margin format for the income statement: Sales minus variable manufacturing costs minus direct labor minus direct materials equals manufacturing contribution margin. Manufacturing contribution margin less variable selling and administrative expenses equals regular contribution margin.

Contribution margin minus all fixed costs equals operating income.

Variable Costing income statement CANNOT be used for external reporting.

Absorption and Direct Costs misconceptions

Popular misconceptions: 1. variable selling and administrative expenses are product costs, they are not.

2. It's not true that variable and absorption costing always produce different net incomes. When the number of production units equals the number of units sold, net income is identical.

Variable vs Absorption costing

The difference in income levels can be calculated by finding the change in inventory levels and multiplying that by the fixed manufacturing overhead per unit. Absorption costing will be greater than variable costing.

When: Units sold equals units produced; AC equals VC income

When: Units Sold is less than Units produced; AC income is greater than VC income. Costs are deferred and inventory levels increase.

When: Units sold is greater than units produced; VC income is greater than AC income. Costs are expensed and inventory levels decrease

Finding the difference in income for Absorption vs Variable costing, or reconciling income.

Subtract the beginning inventory from the ending inventory and multiply by the fixed cost per unit. The amount is the difference between the Absorption costing income vs the Variable costing income. Or

Ending inventory units x fixed cost per unit - beginning inventory units x fixed cost per unit.

Selling and Administrative Costs

are treated as period costs regardless of whether the absorption or variable/direct costing method is used.

Variable Costing Contribution Margin

Sales minus variable manufacturing costs and variable selling and administrative costs and direct materials and labor equals contribution margin.

Variable Costing Operating income

Contribution Margin minus fixed manufacturing costs and fixed selling and administrative costs equals operating income.

Variable selling and administrative costs are...

NOT considered to be product costs and are not part of Cost of Goods sold.

Variable Manufacturing costs

are direct material, direct labor and variable manufacturing overhead.

Inventory Valuation

inventory valuation under absorption costing will always be greater than the inventory valuation under direct/variable costing. From and external reporting point of view, direct/variable cost understates assets on the balance sheet.

Joint and By-product

Joint products and by-products are the result of a single manufacturing process that yields multiple products.

Two or more products of significant sales value are said to be joint products when they: 1. Are produced from the same set of raw materials. 2. Are not separately identifiable until a split off point.

Split off

The point at which products manufactured through a common process are differentiated and processed separately.

Joint costs

Cost incurred prior to the split off; must be allocated to the joint products.

Separable costs

Additional processing costs incurred beyond the split off point. Separable costs are attributable to individual products; they are NOT allocated to the joint products.

Cost allocation methods: Relative physical volume

Costs are allocated based on the quantity of products purchased. The total volume of all products is established i.e., pounds, feet, gallons, etc., each products pro rata share is determined, and the joint costs are allocated based on that proportion.

Cost allocation methods: Relative sales value or Sales value at split-off method

Costs are allocated based on the relative sales values of the products either at split off or after additional processing. When significant markets exist for products at the split-off points, the relative sales value of each product is used to allocate costs.

Cost allocation methods: No Market Value at Split off or Net realizable method

When there is no established market at split-off, the ratio of the net realizable value of each product to the total net realizable value is used to allocate costs, i.e., final market value less any additional separable processing costs of each product.

By-Products

1. By-products differ from joint products in that they have relatively insignificant sales value when compared to the main products.

2. Costing - because of their relatively insignificant sales value, by-products are not usually allocated a share of the joint costs of production. However, when by-products are processed beyond the split-off point, the additional cost is are assigned to the by-product and reduces the net proceeds sale of all products from the sale of the by-product and are used to reduce the cost of the main products. No revenue is recognized from the sale of by-products.

By-products can be recognized as miscellaneous income.

Scrap

A remnant of the production process that has some, but very little, recovery value. Scrap is seldom processed beyond the split-off point.

Net proceeds from the sale of scrap are used to reduce overhead costs, i.e., they are credited to factory overhead control.

If scrap is identified with a particular direct materials, it may be offset against that cost.

Conversion Costs

Conversion costs are the combination of direct labor costs plus manufacturing overhead costs. You can think of conversion costs as the manufacturing or production costs necessary to convert raw materials into products.

Cash Sale - Receivables

Cash Sale - Cash Received and record revenue

Cash Debit

Revenue Credit

COGS Debit

Inventory Credit

Company has made 400 gross profit

Credit Sale - Receivables

Receive - AR Debit

Revenue - Credit

COGS Debit

Inventory Credit

Gross Profit - 400

Credit Risk

Risk that a company may not pay for goods and services received.

Allowance

Amount set aside based on credit risk for goods and services provided on credit.

Accounting for Bad Debts

Two methods for bad debt risk

Allowance Method

Direct Write-Off Method

Difference between is the timing bad debt expense is recorded.

Direct Write Off Method

Recorded when we actually write off an account that has gone bad.

Allowance Method

Bad Debt expense is recorded when the sale is recorded.

Allowance Method - Recording

1. Debit Receivables

2. Credit Revenue

3 Credit Allowance Bad Debt (contra-asset account)

Later - if an account goes bad, the entry is as follows

Debit Allowance for bad debt

Credit Receivable

Net Accounts Receivable

Receivables - Allowance for bad debt equals net receivables.

Balance Sheet Approach for estimating the cost of bad debt

0-30 3% 31-50 5% 61-90 10% >90 days 60%

Income Statement Approach for estimating bad debt

Total Revenue by a percentage - for example 100,000 of revenue each month and assumes 1% of all revenues are noncollectable.

Both the Balance Sheet and Income statement for the recording of bad debt expense is:

Debt Bad Debt Expense

Credit Allowance for bad debt

Accounting for Bad Debt - Direct Write Off Method

At time of Sale

Deb Receivables

Cr Revenue

When we determine an account is uncollectible the recording is:

Dr Bad Debt Expense

Cr Receivable

If later an account that was written off the accounting record is:

Dr Receivable

Cr Bad Debt Expense

Dr Cash

Cr Receivable

This is the required method for tax purposes

Factoring Receivables

Company takes receivables and sells them to a factor. The factor then takes over the collection of the receivables.

Advantages:

1. Get money sooner

2. Fees based on customer credit cards are not taken out.

3. It's and alternative to obtaining debt

4. There is no collateral needed.

Disadvantages:

1. Short-Term solution to liquidity issues.

2. May signal to the market the company is in distress.

3. Factoring fees can be very high.

Factoring with Recourse

Factor or purchaser of the receivable can come back to the company to collect on receivables that did not pay.

Company A Sells $100K of AR to Company B with Recourse

Company B assesses a 2% finance charge to cover possible uncollectible amounts.

Company A estimates the recourse obligation to be $3,500