macroeconomics

1/109

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

110 Terms

participation rate

percentage of the working-age population that is either employed or actively seeking work (labour force)

formula for the participation rate

labour force/working-age population * 100

circular flow model

illustrates how money moves through the economy, showing the interactions between different sectors like households, businesses, the government, and foreign markets. In the model:

Households provide labor to firms in exchange for income.

Firms produce goods and services, which they sell to households and other firms.

Government and foreign sector also interact with these flows by collecting taxes and providing goods and services or importing/exporting goods.

key insights from the circular flow model

-aggregate spending (total spending in the economy, including consumption, investment, government spending, and net exports) drives aggregate output (the total value of goods and services produced)

-if the total spending declines, firms will experience lower demand which leads to lower production

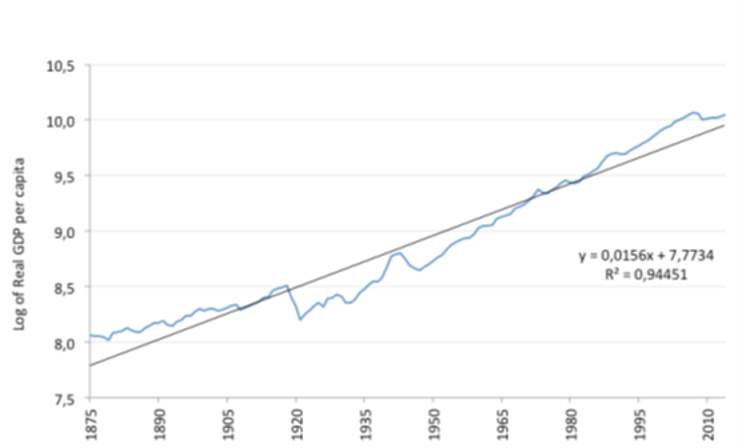

The figure above (If the image is not displayed, use this link Download link) shows the evolution of the log of UK real GDP per capita over time. Consider the statement "The growth rate of GDP per capita in the 1950s was above the long-run average since 1875."

-statement is correct, because in the 1950s the slope of the blue line is steeper than that of the black line and so growth is more rapid

-the fact that the blue line lies below the black line during this decade is irrelevant

primary reason that measuring GDP using the income approach and the spending approach yield the same value in theory?

any spending that occurs in the economy generates an equal amount of income which goes to firms, households, and the government

What happens to GDP if both domestic consumption and imports decrease by the same amount?

GDP remains unchanged.

Domestic consumption decreases, and imports decrease by the same amount.

No change in domestic production, so GDP is unaffected.

GDP deflator formula

nominal GDP/real GDP

The contribution of the growth of investment to the percentage change in GDP is given by

The percentage change in investment multiplied by the share of investment in GDP.

Dutch CPI

-CPI includes imports, they are part of the basket of products and services that households consume

-if imports become more expensive, this raises the CPI

GDP deflator

only considers goods and services that are domestically produced, so it is not affected by the prices of imported goods and services

multiplier is larger than one if and only if

the indirect effect is positive

essential feature of a goods market equilibrium in the multiplier model

Output is equal to aggregate demand

stock

measured at a point in time (flow is measured per unit of time, depreciation is the decline in the value of wealth due to use or the passage of time)

a household that buys and consumes a bar of chocolate, paying with its bank deposits. How does this affect the household's balance shee

Both assets and net worth decline.

financial accelerator

mechanism where adverse economic conditions, such as a recession, worsen financial constraints for borrowers, leading to a further decline in economic activity

Base money is equal to

cash plus reserves

which of the following best describes the role of commercial banks in the money market

They borrow base money from each other and potentially from other participants in the money market such as the central bank.

multiplier of investment spending is equal to one if and only if an increase in investment spending

increases GDP exactly by the initial increase in investment spending

In the multiplier model, an initial increase in investment induces a larger increase in output because

it increases the income of households, increasing their consumption spending (multiplier mechanism works through the consumption of households. This is why the size of the multiplier depends on the marginal propensity to consume)

leakage from the circular flow of income in the multiplier model

any portion of income that is not spent on domestic goods and services, thereby reducing the potential multiplier effect on national income

strengthening automatic stabilizers

weakens the multiplier effect, making the economy more stable

crowding out

the increase in government spending reduces private spending

process for setting the nominal wage and the nominal price at a given firm in the labour market model

the HR department does not need to know the price set by the marketing department to set the wage, but the marketing department needs to know the wage set by the HR department to set the price

Suppose that the social norms of the country change in a way that reduces the stigma of being unemployed, making it less painful for workers to become unemployed. How does this affect the wage-setting curve?

it shifts up, because there is less of an incentive to be employed

When the competition that firms face for their product decreases,

the price-setting curve shifts down

(Less competition → Higher markups (firms charge higher prices relative to costs).

Firms keep a larger share of revenue as profits, leaving less for wages.

Real wages fall because prices rise faster than wages.

The price-setting curve represents real wages, so it shifts downward)

paradox of thrift

an increase in saving by individual households (part of the economy) does not necessarily increase saving of the economy as a whole (this is because the spending of individual households is the income of other households, if the parts of the economy try to save more, total spending decreases, undermining the ability of individual households to sustain higher saving)

empirical finding of Auerbach and Gorodnichenko (2012) about the size of the multiplier?

The multiplier in expansions is smaller than one

reason why the wage setting curve is increasing in the model of the labor market

Lower unemployment makes it less costly for workers to lose their jobs, so they require a higher wage to provide effort

in the diagram of the labour market model in The Economy profits per worker are given by

the distance between the average product of labour curve and the price-setting curve

definition of automatic stabilizers in The Economy

features of the tax and transfer systems that temper the economy when it overheats and stimulate the economy when it slumps, without direct intervention by policymakers (example: proportional tax system)

What best describes what the level of the price-setting curve captures in the labor market model in The Economy?

The level of the real wage when all firms choose a profit-maximizing markup

Austerity

raising taxes or cutting government spending, which destabilizes rather than stabilizes the economy

how does reduced immigration affect the wage-

setting curve?

it shifts up, because that mens that there is less unemployment because the labour force is just smaller overall, so firms need to pay a higher real wage to induce effort

How does reduced immigration shifts the price-setting curve?

it shifts down, because a reduction in labour productivity reduces the pie, that is divided between firm owners and workers, but workers still get the same share determined by the markup, so the price-setting curve shifts down

overall explanation on how reducing immigration would affect the wage-and the price setting curves

-Reduced immigration → Fewer workers → Lower unemployment rate at each employment level → Higher wages required to induce effort → Wage-setting curve shifts up

-But lower labor productivity means firms can afford lower wages → Price-setting curve shifts down

price setting curve

-determines the real wage that firms can afford to pay workers while maintaining a given markup (profit margin) over costs

-downward shift in the price-setting curve means that firms can now afford to pay lower real wages at every level of employment, can lead to higher unemployment

-upward shift means higher real wages

wage setting curve

determines the real wage necessary to motivate workers to provide effort at each level of employment

Higher unemployment → Lower wages needed to induce effort (curve lower)

Lower unemployment → Higher wages needed to induce effort (curve higher)

interactions between the price-and the wage-setting curves

If the wage-setting curve remains unchanged, but the price-setting curve shifts down, real wages will be too low to maintain worker effort.

This can lead to higher unemployment in the long run, as firms cannot sustain high wages.

In extreme cases, stagflation (high unemployment + high inflation) can occur if wages stagnate while prices continue rising.

lower interest rates

increase autonomous consumption c0(rB)

if the output level is restored

disposable income-dependant consumption remains unchanged

Nominal interest rate

interest rate set by the central bank, and it cannot go below a certain level

Real interest rate

nominal interest rate minus the inflation rate

aggregate demand

total quantity of goods and services demanded in an economy at a given overall price level and in a given period

multiplier model

A short-run model that explains how changes in spending (e.g., government spending, tax cuts) affect aggregate demand and output.

A tax cut increases disposable income → higher consumption → shifts aggregate demand up → increases output and income.

Higher output leads to lower unemployment in the short run

Medium-Run Model

A model that accounts for how output, wages, and prices adjust over time after a demand shock.

Key Mechanism:

Higher aggregate demand lowers unemployment.

Workers demand higher wages to compensate for effort.

Firms raise prices to maintain markups, leading to higher inflation.

Over time, the economy adjusts to a new equilibrium with potential inflationary effects

Long-Run Model

Definition: Focuses on economic growth and productivity rather than demand fluctuations.

Key Mechanism:

Labour productivity growth is crucial for long-term supply-side expansion.

If tax cuts increase productivity growth, they could lower unit costs for firms.

This could reduce inflation by allowing firms to set lower prices while maintaining markups

how do we determine monthly inflation

month-to-month percentage change in the consumer price index for a given

month (e.g. November) and averaged it across all available years before 2022, and compared

this average to the value for this month in 2023

According to the mechanisms of precautionary saving and the financial accelerator, a decline in house prices will

reduce consumption for both credit-constrained households as well as households that are not credit constrained

Precautionary Saving

Saving money for unexpected events or emergencies, such as medical expenses, job loss, or natural disasters

financial accelerator,

A mechanism in the economy where small changes in economic conditions, such as income or asset prices, can be amplified and magnified by financial markets, leading to larger changes in economic activity

model of the investment decision in The Economy

-for projects to go ahead, the profit rate must exceed both the interest rate and the discount rate

-if the discount rate is higher than the interest rate, it is the discount rate which determines which projects can go ahead

endowment point

represents the initial amount of consumption available without any borrowing or lending

It is where a consumer’s income or wealth intersects with their initial consumption

the slope of the budget line (which shows trade-offs between consumption now vs. later) changes depending on whether the individual is borrowing or lending, and this switch happens at the endowment point

slope of the budget line change when moving to the right of the endowment point

becomes steeper if it reflects a higher interest rate when borrowing

if an individual borrows more (increasing current consumption), they sacrifice future consumption too pay back the debt

medium run model diagram analysis

inflation is equal to expected inflation pus the bargaining gap

bargaining gap

difference between the real wage that firms are willing to pay to keep workers motivated and the real wage they need to pay them to maximize profits

CPI

measures inflation, includes imports, if they become more expensive the CPI rises

a bigger participation rate

means a bigger labour force so probably more unemployment overall

labour force

employed + the unemployed

participation rate

percentage of people (both employed and unemployed) of a working age and condition

no effect on the multiplier

change in autonomous spending

the price level (in the short-run)

autonomous spending

spending that is not affected by changes in income or the GDP (so necessary spending/spending that occurs even if there’s no income)

effects on the multiplier

a higher MPC (marginal propensity to consume) leads to a higher multiplier

a higher MPS (marginal propensity to save) leads to a lower multiplier

taxes (higher taxes reduce disposable income and therefore spending, which lowers the multiplier)

imports, more money leaving the country reduces the multiplier

interest rates, higher ones reduce spending, and therefore the multiplier

indirect effects of government spending (initial spending increases economic activity and therefore the multiplier)

increased consumption (people who receive government contracts or wages spend their “new” income on goods and services boosting the economy

potential business investments, so if the money is pumped into certain sectors that may increase output

increased tax revenues (as businesses grow more they may have o pay bigger taxes)

an increase in government spending

has a direct impact on aggregate demand and output raising them one for one

size of the multiplier than depends on the strength of the additional indirect effects such as the consumption of households

key to the size of the multiplier

how sensitive consumption is to changes in output

BVAR (Bayesian Vector Autoregression)

statistical model to analyse the relationships between multiple economic time series

improves estimates, especially with small data samples & limited information

helps quantify the effects of monetary policy like interest rate changes on inflation output etc.

particularly useful for studying monetary policy shocks and understanding how central bank actions influence economic variables (inflation output etc.) especially in the context of high inflation

incorporating Bayesian priors (using prior knowledge) reduces overfitting by ensuring that the model doesn't just memorize the data but rather incorporates prior beliefs about how the world works, leading to more robust and reliable predictions

the priors help reduce overfitting (focusing too closely on a specific data sample)

Incidental (also referred to as one-off) contributions to inflation

-one time shocks that are non-reoccurring but contribute to inflation nonetheless

-such as supply chain disruptions (natural disasters, pandemics, geopolitical tensions)

-tax increases (tho once they are absorbed inflation stabilises)

-commodity price shocks

-currency depreciation

DNB NJR Scenario

describes main effects of international protectionism on world trade and on Dutch economy under increasing uncertainty

assumptions: US implements 60% import tariffs on goods from China and 10% from Europe

they retaliate with tariffs for the US

uncertainty increases world-wide

central banks react by setting policy rates (interest rates) according to inflation

imports would get more expensive worldwide

world trade is dampened

dollar appreciates, which would be bad for the US foreign competitiveness

US would take a big hit, the GDP would drop, pulling down world trade even further

direct effects seem limited but indirect effects would mount for the Netherlands > trade war

US would be worst off, protectionism would backfire cuz they would barely have trade partners while Europe would still have each other

Netherlands for example super dependent on trade, so better of than the US but worse than the rest of Europe

so the negative effects for the Netherlands would be lower exports, lower investments, higher unemployment

economic growth would be reduced, inflation would rise

financial accelerator vs multiplier

financial accelerator focuses on changes in financial condition

multiplier on spending

the multiplier is larger than one only if

the indirect effect is positive

when the primary deficit is zero

debt grows at the rate of interest while the GDP is growing with its growth rate

if the ratio is shrinking the GDP is growing faster than the debt, so the interest rate must be lower

why does crowding out happen

an increase in government spending can also increase interest rates

taylorism

method of industrial management designed to increase efficiency and productivity

bargaining effect increases unemployment because

unions/workers can bargain for higher wages & better conditions

if wages rise above the market-clearing level employers higher fewer workers/replace them with automation

voice effect (being able to voice dissatisfaction etc. in the workplace) decreases unemployment, because

allows for workers to express their discontentment without quitting

can lead to workplace improvements making jobs more attractive ad stable

diffusion gap when introducing new technology

large differences in productivity between most & least productive firms when many firms are slow to adapt new technologies

PAYG (pay as you go) pension vs funded pension

PAYG depend on current contributions for retirees' benefits

funded pensions is when investments & their returns provide for future pensions

calculating the innovation rate

difference between (for example) how much it costs to employ a worker vs technology BEFORE - AFTER (so like how much it changed)

if real wages increase & the average product of labour goes up

unemployment (usually) decreases

steady state

key economic variables—such as capital stock, output, consumption, and population—grow at constant rates, and the economy is in long-term equilibrium

in this state, the economy maintains a balanced growth path where net investment (new capital formation minus depreciation) is zero, meaning that capital per worker remains unchanged over time

net employment growth

subtracting total job destruction from total job creation

when calculating by how much steeper a graph is

look at the exponent so its not like 4 increase to 16 is an increase times 4 its like 2² to 2^4 is an increase in 2 > 2 times steeper

to determine the comparative advantage

look at how much it “costs” them to produce one product vs another, so if it costs less for one they have the comparative advantage

steady-state population size

number of births=number of deaths over time, population is steady

key features of Robert Allen's model of the industrial revolution

Britain’s high wages and cheap energy (coal) made it profitable to invest in labour saving technologies

innovation rent

reward the company receives in form of additional profits from innovations

insocost curve

when the whole budget is spent on either one

gini coefficient

more bowed Lorentz curve means higher inequality & a higher mini coefficient

if its closer to the equality 45 degree line its smaller &there is less inequality

secular stagnation

prolonged period of no economic growth

total factor productivity

portion of output growth that cannot be explained by labour or capital alone

misallocation of research&development resources

when the research funds fail to reach the most promising & productive firms and sectors

labour hoarding

retaining more workers than needed to avoid rehiring challenges later

what makes capitalism less dynamic according to the economy

organised crime forcing small businesses to hand over their private property

capital intensity

physical assets (machinery, resources) needed to produce good & services relative to labour

as capital intensity increases

capital productivity (the average product of capital) decreases

figures showing adjustment paths

always have the wage/employment gaps regarding the new equilibrium not the old one

tfp

=total factor productivity, so how efficiently an economy/business uses its inputs

capital per worker

machinery etc available to each worker aka physical capital

increase in capital per worker

happens when investment exceeds depreciation

triggers further increases in capital per worker because output is increased, so there’s more capital for investment left

as depreciation exceeds investment with time the marginal product of capital diminishes

the improvements in tech stay tho so the output reaches & stays at a new steady-state