econ test 3

1/107

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

108 Terms

true or false: if the government increases the minimum wage, it is likely to increase structural unemployment

true

true or false: frictional unemployment is usually long term and structural unemplo is usually short term

false

true or false: under fractional reserve banking, the banking system creates money

true

the aggregate demand curve is downward sloping, and the long run aggregate supply curve is upward sloping

false

true or false: in the model of aggregate demand and aggregate supply, other things remain the same, an increase in consumption raises the price level

true

suppose all of the adult population, 33 million were employed, 3 million were unemployed, and 24 million were not in the labor force. the labor force participation is

(36/60) x 100 = 60%

suppose all of the adult population, 33 million were employed, 3 million were unemployed, and 24 million were not in the labor force. the unemployment rate is

(3/36) x 100 = 8.3%

an increase in the minimum wage above the equilibrium wage

increases structural unemployment

a decrease in the discount rate and a decrease in the interest rate on reserves

increases the money supply

using the liquidity preference model, when the federal reserve decreases the money supply

the equilibrium interest rate increases

a decreases in the price level

causes movement along AD, not a shift

if the entire company has $50 currency, $150 in checking accounts, $50 in small time deposits, and $100 in credit card limits, the money stock M1 is

M1 = currency + checking deposits

= 50 + 150

= 200

if there is multiplier effect only, an increase in government expenditures would

shift aggregate demand right by a larger amount than the increase in government expenditures

suppose there was a large increase in net exports. if the fed wanted to stabilize output, it could

decrease the money supply, which will increase interest rates

unemployed

people not working

are available for work

have looked for work during previous 4 weeks

those waiting to be recalled after temporary layoff

not in the labor force

those not employed and not unemployed

full time students

homemakers

retirees

natural rate of unemployment

normal rate of unemployment around which the unemployment rate fluctuates

cyclical unemployment

deviation of unemployment from its natural rate

discouraged workers

individuals who would like to work but have given up looking for a job

what happens to the unemployment rate?

hailey lost her job and begins looking for a new one

unemployment rate rises

what happens to the unemployment rate?

joseph, a steelworker who has been out of work since his mill closed last year, becomes discouraged and gives up looking for work

unemployed rate falls because joseph is no longer counted as unemployed

frictional unemployment

results because it takes time for workers to search for the jobs that best suit their tastes and skills ( short term for most workers )

structural unemployment

results because the number of jobs available in some labor markers is insufficient to provide a job for everyone who wants one ( usually long term )

government run employment agencies

provide information about job vacancies

public training programs

aim to ease workers’ transitions from declining to growing industries

advocates

keeps the labor force more fully employed

unemployment insurance

a government program that partially protects the incomes of workers who become unemployed

increases frictional unemployment

who qualifies for unemployment insurance

only the unemployed who were laid off because their previous employers no longer needed their skills

minimum wage

causes structural unemployment

union

a worker association that bargains with employers over wages, benefits, and working conditions

collective bargaining

the process by which unions and firms agree on the terms of employment

strike

the organized withdrawal of labor from a firm by a union

what happens when union raises the age above the equilibrium level?

higher quantity of labor supplied

smaller quantity of labor demanded

unemployment

efficiency wages

above equilibrium wages paid by firms to increase worker productivity

in a competitive labor market, an increase in the minimum wages results in a ______ in the quantity of labor supplied and a _______ in the quantity of labor demanded

increase; decrease

when a firm pays an efficiency wages, it may

find that its workers quit less frequently

medium of exchange

item that buyers give to sellers when they want to purchase goods and services

unit of account

yardstick people use to post prices and record debts

store of value

item that people can use to transfer purchasing power from the present to the future

currency

paper bils and coins in the hands of the public

demand deposits

balances in bank accounts; depositors can access on demand by writing a check

M1 includes

currency, demand deposits at banks, some other liquid deposits (balances in savings accounts)

M2 includes

everything in M1 plus small time deposits and money market funds (except those held in restricted retirement accounts)

M1 =

currency + demand deposits + other liquid deposits

M2 =

M1 + small time deposits + money market funds

central bank

an institution designed to oversee the banking system and regulate the quantity of money in the economy

federal reserve

the central bank of the united states

money supply

the quantity of money available in the economy

monetary policy

the setting of the money supply by policymakers in the central bank

reserves

deposits that banks have received but have not loaned out

frictional-reserve banking

banking system in which banks hold only a fraction of deposits as reserves

reserve ratio

fraction of deposits that banks hold as reserves

money multiplier

the amount of money that results from each dollar of reserves

leverage

use of borrowed money to supplement existing funds for purposes of investment

open market operations

purchase and sale of u.s. government bonds by the fed

an increase in the interest rate on reserves

increases the reserve ratio

lowers the money multiplier

lowers the money supply

federal funds rate

interest rate at which banks make overnight loans to one another

the money stock includes all of the following except

a. metal coins

b. paper currency

c. lines of credit accessible with credit cards

d. bank balances accessible with debit cards

lines of credit accessible with credit cards

if the fed wants to increase the money supply, it can

a. raise income tax rates

by reduce income tax rates

c. buy bonds in open market operations

d. sell bonds in open market operations

buy bonds in open market operations

which of the following actions by the fed would tend to increase the money supply?

a. an open market sale of gov bonds

b. a decrease in reserve requirements

c. an increase in the interest rate paid on reserves

d. an increase in the discount rate on fed landing

a decrease in reserve requirements

if the fed raises the interest rate it pays on reserves, it will ______ the money supply by increasing ______

decrease; excess reserves

in a system of fractional reserve banking, even without any action by the central bank, the money supply declines if household choose to hold _____ currency or if the bank choose to hold ______ reserves

more; more

model of aggregate demand (AD) and aggregate supply (AS)

model that most economists use to explain short run fluctuations in economic activity around its long run trend

aggregate demand curve

curve that shows the quantity of goods and services that households, firms, the government, and customers abroad went to buy at each price level

aggregate supply curve

curve that shows the quantity of goods and services that firms choose to produce and sell at each price level

natural level of output

production of goods and services that an economy achieves in the long run when unemployment is at its normal rate

C stands for

changes in consumption

I stands for

changes in investment

G stands for

changes in government purchases

NX stands for

changes in net exports

what happens to the ad curve?

a ten year old investment tax credit expires

I falls, AD curve shifts left

what happens to the ad curve?

the u.s. exchange rate falls

NX rises, Aad curve shifts right

what happens to the ad curve?

a fall in prices increases the real value of consumers’ wealth

move down along AD curve (wealth-effect)

what happens to the ad curve?

state govt replace their sales taxes with new taxes on interest, dividends, and capital gains

C rises, AD shifts right

when the economy goes into a recession, real GDP ____ and unemployment _____

falls; rises

according to classical macroeconomics theory and monetary neutrality, changes in the money supply affect

the GDP deflator

the aggregate demand curve slopes downward because a fall in the price level causes

the interest rate to decline

which of the following would shift the AD curve to the left?

a. a decline in the stock market

b. an increase in taxes

c. a decrease in governments spending

d. all of the above

all of the above

an increase in AD for goods and services has a larger impact on output ____ and a larger impact on the price level _____

in the short run; in the long run

theory of liquidity preference

keynes’s theory that the interest rate adjusts to bring money supply and money demand into balance

equilibrium interest rate

quantity of money demanded exactly balances the quality of money supplied

if interest > equilibrium

quantity of money people want to hold less than quantity supplied

interest rate falls

if interest rate < equilibrium

quantity of money people want to hold more than quantity supplied

interest rates rises

fiscal policy

the setting of the levels of governments spending and taxation by government policymakers

multiplier effect

additional shifts in AD that result when expansionary fiscal policy increases income and thereby increases consumer spending

crowding out effect

the offset in AD that results when expansionary fiscal policy raises the interest rate and thereby reduces investment spending

some frictional unemployment is inevitable because

the economy is always changing

sectoral shifts: changes in the composition of demand among industries or regions

changing patterns of international trade

minimum wages causes

structural unemployment

examples of commodity money

gold coins, cigarrets in POW camps

the higher the reserve ratio

the less of each deposit banks loan out, the smaller the money multiplier

100-percent-reserve banking

banks hold all deposits in reserve, and do not influence the supply of money

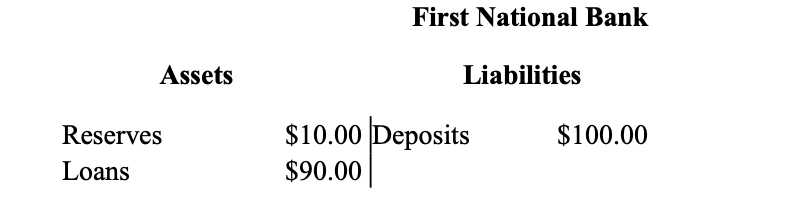

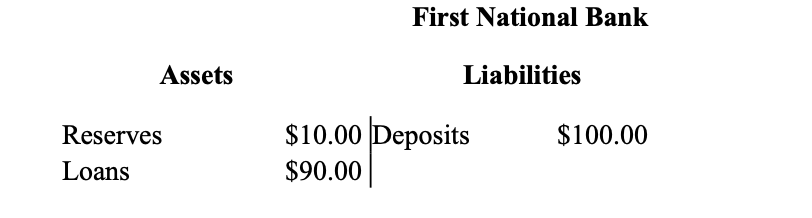

what is the reserve ratio of the table?

10/100 or 10%

what is the money multiplier?

1/0.1 or 10

what tools do the fed have to influence money supply?

open market operations

change reserve requirements

change the discount rate

to expand the money supply

the Fed buys u.s. government bonds

to reduce the money supply

the Fed sells u.s. government bonds

what happens when there’s an increase in the interest rate on reserves?

increases the reserve ratio

lowers the money multiplier

lowers the money supply

why is the long-run aggregate-supply (LRAS) curve vertical?

because the price level doesn’t affect the long run determinants of real GDP

what does real GDP depend on in the long run?

real GDP depends on the supplies of labor, capital, natural resources, and available technology