ACYFARP18: Accounting Changes, Correction of Errors, BVPS, EPS, SMEs, Basic Accounting Concepts and Process, Revised Conceptual Framework

1/44

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

45 Terms

Which statement in relation to a change in accounting estimate is true?

a. Change in accounting estimate is accounted for retrospectively

b. Change in accounting estimate results from new information or new development

c. By very nature, the revision of an estimate relates to prior periods and is accounted for as correction of an error

d. All of these statements are true in relation to a change in accounting estimate

B

Under IFRS, a change in accounting estimate is accounted for

a. Retrospectively

b. As a cumulative effect of an accounting change in the income statement

c. Currently in the financial statements

d. Prospectively in the period of change and future periods

D

Changes in accounting policy are reported

a. On a prospective basis

b. On a retrospective basis

c. By restating the financial statements

d. By a cumulative adjustment in the income statement

B

A change in accounting policy requires that the cumulative effect of the change should be shown as an adjustment to

a. Beginning retained earnings for the earliest period presented

b. Net income for the current period

c. Comprehensive income for the earliest period presented

d. Shareholders’ equity for the period in which the change occurred

A

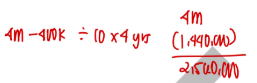

On January 1, 2021, JKL Company purchased equipment for P4,000,000. The equipment had a useful life of 10 years and a residual value of P400,000. On January 1, 2025, the entity determined that the useful life of the equipment was 12 years from the date of acquisition and the residual value was P480,000.

What is the carrying amount of the equipment on January 1, 2025?

a. P2,560,000

b. P2,920,000

c. P2,400,000

d. P2,800,000

A

On January 1, 2021, JKL Company purchased equipment for P4,000,000. The equipment had a useful life of 10 years and a residual value of P400,000. On January 1, 2025, the entity determined that the useful life of the equipment was 12 years from the date of acquisition and the residual value was P480,000.

What is the depreciation of the equipment for 2025?

a. P175,000

b. P260,000

c. P360,000

d. P300,000

B

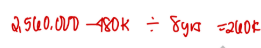

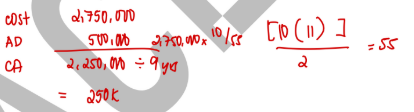

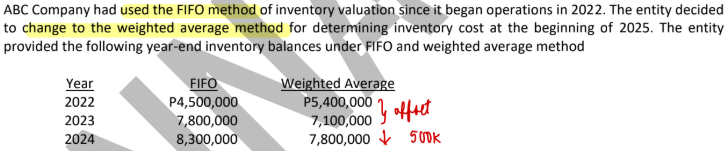

On January 1, 2024, CBA Company purchased a machine for P2,750,000. The machine was depreciated using the sum of years’ digits method based on a useful life of 10 years with no residual value. On January 1, 2025, the entity changed to the straight line method of depreciation.

What is the depreciation for 2025?

a. P180,000

b. P220,000

c. P250,000

d. P275,000

C

What pretax amount should be reported in the 2025 statement of changes inequity as the cumulative effect of the change in accounting policy?

a. P500,000 decrease

b. P300,000 decrease

c. P500,000 increase

d. P300,000 increase

A

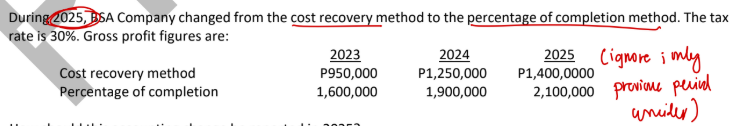

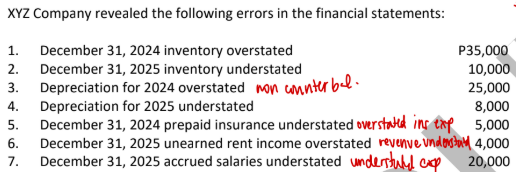

How should this accounting change be reported in 2025?

a. P1,300,000 increase in profit or loss

b. P1,300,000 increase in retained earnings

c. P910,000 increase in profit or loss

d. P910,000 increase in retained earnings

D

In which of the following situations should an entity report a prior period adjustment?

a. A change in the estimated useful life of property, plant and equipment purchased in prior years

b. A switch from the straight line to double declining balance method of depreciation

c. The scrapping of an asset prior to the end of the expected useful life

d. The correction of a mathematical error in the calculation of prior years’ depreciation

D

If at the end of current reporting period, an entity erroneously excluded some goods from ending inventory and also erroneously did not record the purchase of these goods, these errors would cause

a. The ending inventory to be overstated

b. The retained earnings to be understated

c. No effect on net income, working capital and retained earnings

d. Net income to be understated

C

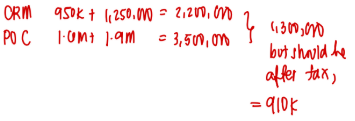

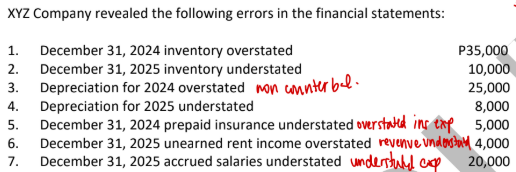

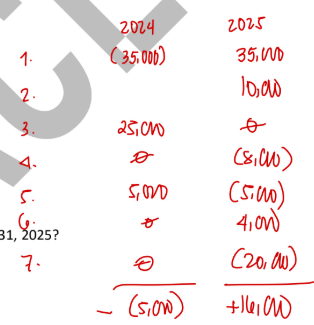

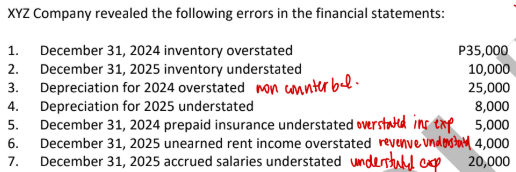

What is the effect of the errors on net income for 2024?

a. P10,000 understated

b. P10,000 overstated

c. P5,000 understated

d. P5,000 overstated

D

What is the effect of the errors on net income for 2025?

a. P16,000 understated

b. P16,000 overstated

c. P12,000 understated

d. P12,000 overstated

A

What is the effect of the errors on retained earnings on December 31, 2025?

a. P11,000 understated

b. P11,000 overstated

c. P16,000 understated

d. P16,000 overstated

A

Total shareholders’ equity divided by the number of shares outstanding represents the

a. Return on equity

b. Par value per share

c. Book value per share

d. Price earnings ratio

C

The cumulative feature of preference shares

a. Limits the amount of cumulative dividends to the par value of the preference shares

b. Requires that dividends not paid in any year must be made up in a later year before dividends are distributed to ordinary shareholders

c. Means that the shareholder can accumulate preference shares equal to the par value of ordinary shares at which time the preference shares can be converted into ordinary shares

d. Enables a preference shareholder to accumulate dividends equal to the par value of the shares

B

In the absence of liquidation value, the preference shareholders shall receive what amount in the event of liquidation?

a. Liquidation value

b. Par value or stated value

c. Book value

d. Fair value

B

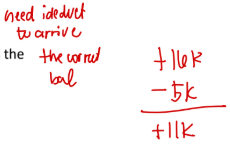

Dividends in arrears on the preference share amount to P250,000. If the entity were to be liquidated, the preference shareholders would receive par value plus a premium of P500,000.

What is the book value per ordinary share?

a. P77.50

b. P75.00

c. P72.50

d. P70.00

D

An entity reported the following outstanding share capital at year-end:

● 30,000 shares of 10% cumulative preference share, par value P100 per share, fully participating as to dividends. No dividends were in arrears in prior years.

● 200,000 ordinary shares with par value of P10.

The entity declared dividends of P1,000,000 at year-end.

What was the amount of dividends payable to ordinary shareholders?

a. P200,000

b. P700,000

c. P400,000

d. P600,000

C

Earnings per share shall be computed on the basis of

a. Ordinary shares outstanding at the end of the year

b. Ordinary shares outstanding at the beginning of the year

c. Ordinary shares outstanding at the middle of the year

d. Average ordinary shares outstanding during the year

D

In computing basic earnings per share, the amount of preference dividends on noncumulative preference shares should be

a. Deducted from net income whether declared or not

b. Deducted from net income only when declared

c. Added to net income only when declared

d. Ignored

B

In the computation of weighted average number of shares outstanding when there is a share split, the additional shares are

a. Weighted by the number of days outstanding

b. Weighted by the number of months outstanding

c. Considered outstanding at the beginning of the year

d. Considered outstanding at the beginning of the earliest years reported

D

The purpose of diluted earnings per share is to

a. Provide a comparison figure for debt holders

b. Indicate earnings shareholders will receive in future periods

c. Distinguish between entities with a complex capital structure and entities with a simple capital structure

d. Show the maximum possible dilution of earnings

D

The “if converted” method of computing diluted earnings per share assumes conversion of convertible bonds payable as of the

a. Beginning of the earliest period reported or at time of issuance, if later

b. Beginning of the earliest period reported regardless of time of issuance

c. Middle of the earliest period reported regardless of the time issuance

d. Ending of the earliest period reported regardless of the time issuance

A

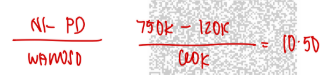

On January 1, 2025, Pinnacle Company had 60,000 ordinary shares issued and outstanding. During 2025, no additional ordinary shares were issued. On January 1, 2025, the entity issued 40,000 nonconvertible preference shares.

During 2025, the entity declared and paid P210,000 cash dividend on the ordinary share and P120,000 on the preference share. The net income for the current year was P750,000.

What amount should be reported as basic earnings per share?

a. P10.50

b. P12.50

c. P7.50

d. P3.50

A

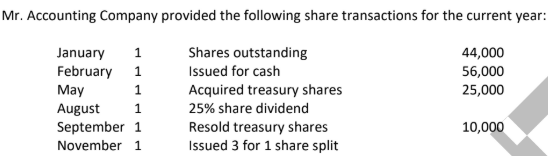

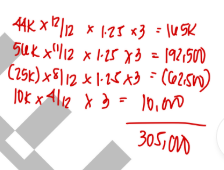

What is the weighted average number of shares outstanding for the year?

a. P305,000

b. P307,000

c. P103,750

d. P311,250

A

On January 1, 2025, ABC Company had 100,000 ordinary shares outstanding. In addition, on January 1, 2025, the entity had issued 10,000 convertible cumulative 5% preference shares with P100 par.

These preference shares were converted on September 1, 2025. Each preference share was converted into six ordinary shares. The entity has no other potentially dilutive securities. The net income for the year was P2,000,000.

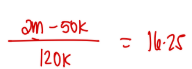

What amount should be reported as basic earnings per share?

a. P20.00

b. P19.50

c. P16.67

d. P16.25

D

On January 1, 2025, ABC Company had 100,000 ordinary shares outstanding. In addition, on January 1, 2025, the entity had issued 10,000 convertible cumulative 5% preference shares with P100 par.

These preference shares were converted on September 1, 2025. Each preference share was converted into six ordinary shares. The entity has no other potentially dilutive securities. The net income for the year was P2,000,000.

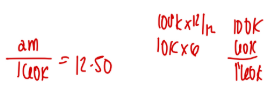

What amount should be reported as diluted earnings per share?

a. P12.50

b. P12.19

c. P16.25

d. P19.50

A

On July 1, 2025, XYZ Company issued P20,000,000 7% convertible bonds at face amount. Each P1,000 bond is convertible into two ordinary share. No bonds were converted during the year.

The entity had 200,000, P100 par value ordinary shares outstanding during the year. The net income for the year was CP6,000,000 and the income tax rate was 30%.

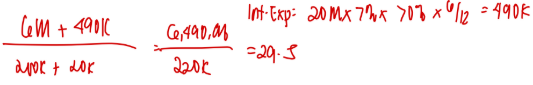

What amount should be reported as diluted earnings per share?

a. P30.90

b. P30.00

c. P29.50

d. P31.73

C

GHI Company had 100,000 ordinary shares outstanding throughout the current year. In addition, at the beginning of current year, the entity had issued share options that allowed employees to purchase 40,000 ordinary shares.

The option exercise price is P10 per share. The average share price for the year was P16. The entity had no other potentially dilutive securities. The net income for the year was P2,000,000.

What amount should be reported as diluted earnings per share?

a. P17.39

b. P20.00

c. P14.29

d. P16.00

A

Which of the following could qualify as an SME?

a. An entity that has total assets between 3 million to 350 million

b. An entity that has total liabilities between 3 million to 250 million

c. An entity that does not have public accountability

d. All of the above could qualify as an SME

D

Which of the following is considered as having public accountability?

a. Companies listed in the stock exchange or in the process of initial public offering (IPO)

b. Public utilities

c. Companies with fiduciary capacity

d. All of the above are considered as having public accountability

D

Which of the following are true for PFRS for SMEs:

a. Investment in equity securities can only be classified as FVPL

b. Investment in debt securities can only be classified as FAAC

c. Investment in associate and joint venture can be accounted for using equity, cost and fair value method

d. All of the above are true

D

Which of the following are true for PFRS for SMEs:

a. Investment properties are measured using the fair value model by default

b. Research and development costs are always expensed outright

c. Goodwill and other intangible assets have finite life and amortized over a maximum useful life of 10 years

d. All of the above are true

D

Which of the following are true for PFRS for SMEs:

a. Borrowing costs are always expensed outright

b. An SME may report actuarial gains and losses in P&L or OCI at its option

c. An SME may prepare a Statement of Income and Retained Earnings (SIRE) in lieu of Statement of Comprehensive Income and Statement of Changes in Equity

d. All of the above are true

D

An independent private sector that develops and approves the IFRS

a. Financial Accounting Standards Board (FASB)

b. International Federation of Accountants (IFAC)

c. International Accounting Standards Board (IASB)

d. Accounting Institute of Certified Public Accountants (AICPA

C

The accounting standard setting body in the Philippines

a. Financial and Sustainability Reporting Standards Council (FSRSC)

b. Accounting Standards Council (ASC)

c. Board of Accountancy

d. Philippine Institute of Certified Public Accountants (PICPA)

A

The following are the steps in the Accounting Cycle:

a. Identifying and journalizing business transactions

b. Journalizing

c. Posting

d. All of the above are steps in the Accounting Cycle

D

The following are the steps in the Accounting Cycle:

a. Preparing the unadjusted trial balance

b. Preparing adjusting entries

c. Preparing the adjusted trial balance

d. All of the above are steps in the Accounting Cycle

D

The following are the steps in the Accounting Cycle:

a. Preparing the financial statements

b. Preparing closing entries

c. Preparing post-closing trial balance

d. All of the above are steps in the Accounting Cycle

D

The following are the purposes of the Revised Conceptual Framework:

a. To assist IASB (FSRSC) in developing new standards

b. To assist IASB (FSRSC) in reviewing existing standards

c. To assist preparers of financial statements in accounting for transactions when no accounting standard applies

d. All of the above are purposes of the Revised Conceptual Framework

D

The following are chapters of the Revised Conceptual Framework:

a. Objectives of financial reporting

b. Qualitative characteristics of useful financial information

c. Financial statements and reporting entity

d. All of the above are chapters of the Revised Conceptual Framework

D

The following are m, chapters of the Revised Conceptual Framework:

a. Elements of financial statements

b. Recognition and derecognition of assets and liabilities

c. Measurement bases and how to use them

d. All of the above are chapters of the Revised Conceptual Framework

D

The following are the fundamental qualitative characteristics of useful financial information:

a. Relevance

b. Faithful representation

c. Both (a) and (b)

d. None of the above

C

The following are the enhancing qualitative characteristics of useful financial information:

a. Comparability, verifiability

b. Timeliness, understandability

c. Both (a) and (b)

d. None of the above

C