the global context (macro)

1/84

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

85 Terms

define globalisation

globalisaiton is the increasing integration of the world's economies into a single international market

what are some characteristics of a globalised markets

- free movement of capital and labour

- free trade in goods and services

- availability of technology on an international scale

how does the reduction of trade barriers drive globalisation?

reductions of trade barriers create greater opportunities to trade

how does the growth of trading blocs drive globalisation

facilitates the free movement of labour and capital

how does the fall in the cost of transport drive globalisation?

how can labour be more mobile?

how can that drive globalisation?

fall in the cost of transport and improvement in transport, making it more viable for businesses to source goods globally and for labour to be more mobile

what is FDI

investment undertaken in one country by companies based in other countries

how can countries increase levels of FDI?

reduction in the restrictions of the movement of international finance allowing FDI to move more freely between economies

what is containerisation

A system of standardised transport that uses large standard-size steel containers to transport goods. The containers can be transferred between ships, trains and lorries, enabling cheaper, more efficient transport.

how does containerisation drive globalisation

makes international trade easier and cheaper

What is an MNC (multinational corporation)?

multinational corporation is any business that operates in more than one country

→ have headquarters in one country (usually developed), with operations and other premises, such as offices, factories, and retail stores, in other countries.

how does the growth of MNC's drive globalisation?

creating global supply chains and global brands

what is liberalisation?

A reduction in government control within industry creating opportunity for greater participation from private businesses and TNCs within an industry.

how does increasing liberalisation drive globalisation

reduces tariffs and quotas - trade restrictions.

attracts FDI by relaxing rules

facilitates movement of people

define international competitiveness

The ability of a nation to compete successfully overseas and sustain improvements in real output and living standards.

what is the impact of international competitiveness on firms, consumers

greater competition drives firms to be more statically efficient (both allocative and productive), decreasing unit costs

consumers - decreases the average prices

firms - can make supernormal profits then invest in R&D increasing the quality of products, decreasing costs more

-> cycle of more static efficiency

Define absolute advantage

when a country can produce goods and services at a lower unit cost than other coutries

define comparitive advantage

When a country produces a good or service at a lower opportunity cost relative to another country

how does trade liberalisation drive globalisation

trade liberalisation is the reduction of tariffs and restrictions on international trade, reducing protectionist barriers facilitating the free movement of goods and services

how has improvements in communications across the world driven globalisaiton

improvements in communications makes the communication for international trade easier, cheaper and quicker

what is a fixed exchange rate system

how does a gov devalue and revalue the currency

A fixed exchange rate, sometimes called a pegged exchange rate, is a type of exchange rate regime where a currency's value is fixed against the value of another single currency

- to devalue, gov must sell currency in the foreign exchange market, which increases supply of currency shifting supply right

- to revalue, the must buy its own currency using foreign exchange reserves, shifting supply left

Why would a country with a floating exchange rate system experience depreciation if there is a BoP deficit

country importing more than exporting

to import, consumers and firms must exchange their domestic currency for foreign currency

This increases the supply of domestic currency in the foreign exchange market, shifting supply right = depreciation

What is speculation in foreign exchange markets?

when people buy and sell currency because of changes they expect will happen in the future

how does relative inflation rates cause a change in the exchange rate

A lower relative inflation rate means lower prices, so exports are more competitive, increasing demand for exports, increasing demand for the currency, causing an appreciation

how do changes in relative interest rates cause cause changes in exchange rates

higher interest rates relative to other countries make it more attractive to invest funds into the economy because there is a greater return on investment, increasing demand for the currency and causing an appreciation, known as hot money inflows

opposite = hot money outflows

How does speculation influence exchange rates?

If speculators believe economic prospects are improving, and the value of currency will rise in the future, they will demand more, causing an appreciation

what does a fall in the value of a currency mean for economic growth, employment, inflation

- increased economic growth by an increase in AD

- unemployment can be reduced through job creation as a by-product of economic growth

- inflation could rise if demand for imports are price inelastic

What is the Marshall-Lerner condition?

The Marshall-Lerner condition is that when a currency depreciates, its exports become more competitive and people will import less, which improves the trade balance

ONLY WHEN

When the sum of elasticity of demands for imports and exports are greater than one (elastic), then a depreciation of the currency will improve the current account.

When the sum of elasticity of demands for imports and exports are less than one (inelastic), then a depreciation of the currency will worsen the trade balance

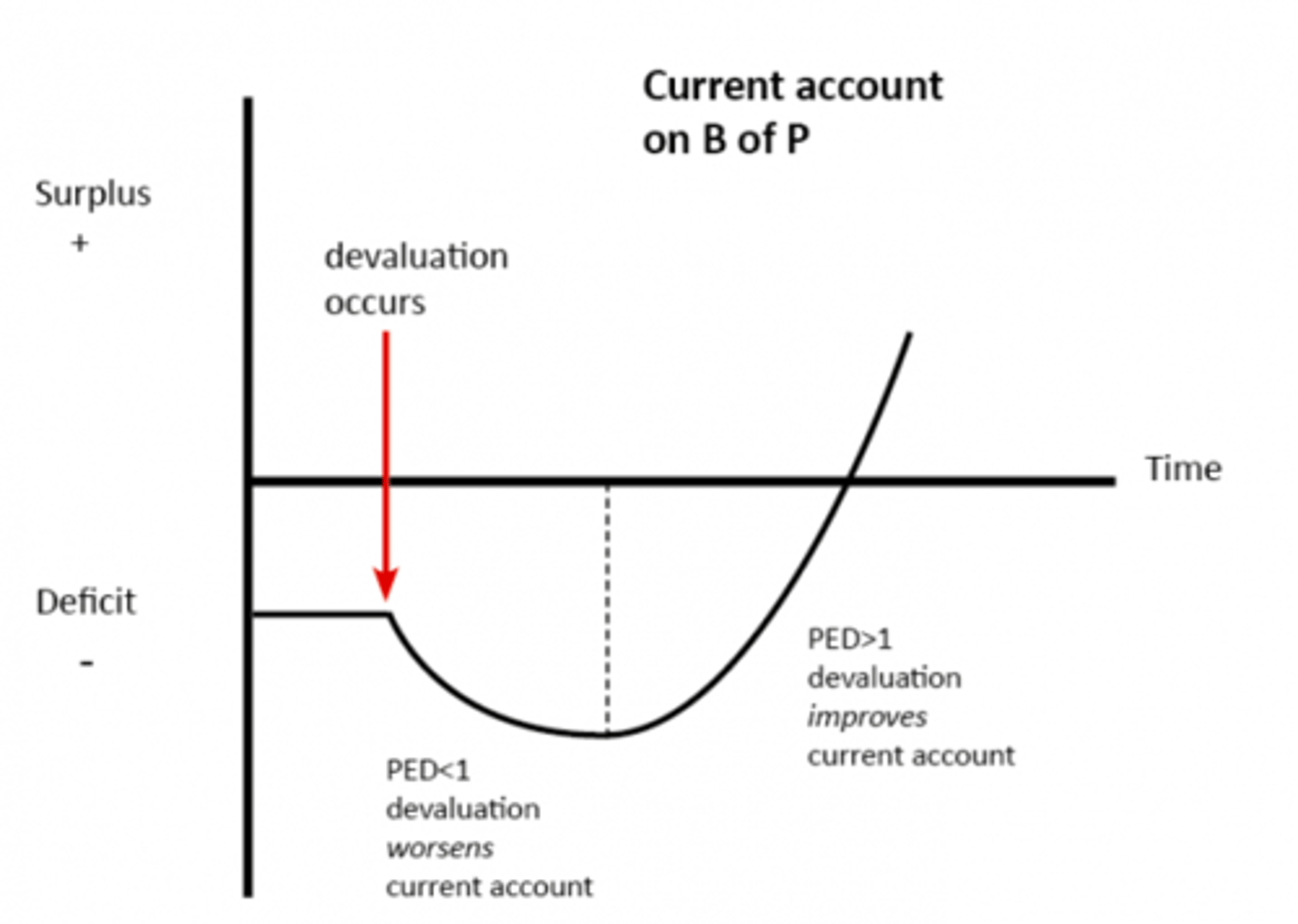

What is the J-curve effect?

in the short run, when a currency depreciates, it is likely that the current account deficit will worsen as demand for imports and exports are inelastic in the short run because it takes time for people to switch goods and services, firms may be in contracts and pre-existing agreements both causing a time-lag

so, in short-run, the price elasticity of demand for imports and exports is inelastic, but in the long run, they are elastic

what price factors can you compare competitiveness of international companies

relative unit labour costs

relative productivity

relative export prices

how can a government help make a country more internationally competitive

evaluate these, why is it not that simple

improve education and training improving labour market flexibility

create incentives for firms to invest in R&D

improve infrastructure like transport links

cut red tape, so removing regulations

It is not that simple, because there will be a massive time lag for some of these, some policies may be controversial, like cutting red tape, and it is also difficult to afford infrastructure investment

how does labour-market flexibility affect the international competitiveness of a country

a flexible labour market is one where the supply of labour is able to adapt quickly to the changing needs of businesses

what are some non-price factors to compare the competitiveness of international companies

how can they be improved

design

quality

Reliability

availability

all can be improved massively by R&D

what is meant by absolute advantage

what is it trying to explain

when a country can produce goods and services at a lower unit cost than other countries

- tries to explain global trade patterns

what is meant by comparative advantage

a country should specialise in producing goods or services where they have a lower opportunity cost in production compared to other countrys

what is the gain of specialising where a country's comparative advantage lies?

- as countries move resources from inefficient production to efficient production, output will be maximised

- countries will be able to consume beyond their PPF's

- lower global prices

- allocative efficiency as resources are allocated to countries that are most efficiently producing using those resources and maximise their output, satisfying consumer demand, achieving allocative efficiency

What is the terms of trade?

The ratio of index export prices to index import prices x 100

if ToT > 100 then that means...

if ToT < 100 then that means...

- export prices have risen relative to import prices

- import prices have risen relative to export prices

what does an improvement in the ToT mean for a country

an improvement in the ToT means that export prices are rising faster than import prices, so the country can buy more imports with the same amount of exports, leading to higher purchasing power, which is generally good for consumers and the standard of living

what does a deteriorating ToT mean for a country

Export prices are falling relative to import prices

The country must export more goods to afford the same amount of imports

This can hurt living standards as imports, especially essentials with an inelastic price elasticity of demand, become more expensive

how do changes in demand/supply for exports/imports + relative inflation rates + changes in exchange rates, change the terms of trade of a country in the short run

- change in demand and supply for exports or imports changes the price of them, leading to an improvement or a deterioration

- relative inflation rates - domestic inflation is higher, so export prices rise faster than imports = improvement, but if foreign inflation is higher, import prices rise faster than exports so deterioration

- changes in exchange rates as if an exchange rate goes up or down, it affects the price of exports and imports

how can changes in incomes, changes in productivity and changes in tech lead to changes in the terms of trade of a country in the long run

- changes in incomes as higher incomes domestically increase the demand for imports of manufactured goods, especially as they are income-elastic (high YED), so as demand increases, prices will rise so ToT deteriorates

if foreign incomes rise, demand for exports increases so export prices rise to ToT improves

- improvement in productivity and tech can lower production costs so export prices will decrease causing a deterioration but an improvement in competitiveness

if other countries' productivity increases, their exports (your imports) become cheaper so ToT improves

what are the benefits of an improvement in the ToT

- If demand is inelastic then foreign buyers will continue purchasing despite higher prices, increasing export earnings, improving balance of payments

- if import prices fall, domestic consumers and firms benefit from lower costs, which can reduce cost-push inflation and increase living standards

- if export prices increase and demand is inelastic, then foreign buyers must buy more of the domestic currency for the exports, which increases demand for the domestic currency, leading to an appreciation which can improve purchasing power and reduce cost of imported raw materials

is an improvement in ToT always beneficial

- if export prices rise too much, foreign buyers may switch to alternatives reducing long-term export demand and leading to trade deficits

what are the negative effects of a ToT deterioration

- more exports are needed otherwise buy the same imports

- higher import costs mean cost-push inflation reducing purchasing power and increasing living costs

- if export prices fall, the currency may depreciate due to less demand for the currency making imports more expensive

is a ToT deterioration always bad?

- lower export prices boost demand for exports as they become more competitive, increasing employment and GDP

- Falling terms of trade can weaken the currency as the country earns less from imports, so foreign buyers need to spend less foreign currency to buy the same amount of exports, so less foreign currency is converted into domestic currency, reducing the demand for the domestic currency → deteriortaiton

what is meant by the theory of comparative advantage

what does it mean for the PPF of a country

theory of comparative advantage by David Ricardo suggests countries should fully specialise in where they have a comparative advantage, which is specialising in the good where they have a lower opportunity cost in production

- by specialising this way countries are able to consume beyond their PPF

how can comparative advantage explain the trade patterns we see today: how did developing countries specialise in secondary sectors and gain their comparative advantage? (FDI explanation)

- developed countries have lost comparative advantage in labour-intensive manufacturing industries as these developed nations are high-wage countries making costs of production higher, as a result, firms move to low-wage countries like developing countries

developing countries now gain a comparative advantage in manufacturing as these firms bring over lots of capital and FDI, allowing them to industrialise and gain a comparative advantage in manufacturing

how can comparative advantage explain the trade patterns we see today: how did developing countries specialise in secondary sectors and gain their comparative advantage? (how did they diversify comparative advantage)

economic development, through trade liberalisation in developing countries, allows them to diversify their comparative advantage

industrialisation allows developing countries to specialise in more advanced industries

what are factor endowments

the amount of land, labor, capital, and entrepreneurship that a country possesses and can exploit for manufacturing.

how can factor endowments explain the trade patterns we see using the theory of comparative advantage

countries specialise in producing goods and services that align with their factor endowments.

what 3 assumptions limiting the theory comparative advantage to explain global trade patterns

- no economies of scale

- complete factor mobility

- free trade

explain how economies of scale not being considered is a limitation of comparative advantage theory

countries with similar factor endowments and opportunity costs still trade heavily, contradicting the law of comparative advantage

- this happens because firms gain economies of scale, suggesting that specialisation is driven by market size and firm efficiency rather than factor endowments

- this can lead to trade patterns where some countries never develop industries even if they have a comparative advantage in producing them

what is factor mobility

refers to the ease with which factors of production can move between different industries or different locations

explain how comparative advantage theory not considering factor mobility is a limitation of its ability to explain trade patterns

comparative advantage assumes complete factor mobility, so if an economy shifts production towards a good with a lower opportunity cost, all factor endowments should easily be able to as well

in reality, factor endowments are relatively immobile meaning they can't easily transition from one sector to another

- so if an economy decides to do this, they may actually cause mass structural unemployment and disrupt the economy massively which the law of comparative advantage does not account for

comparative advantage assumes free trade. how is this a limitation to explaining trade patterns

- comparative advantage assumes free trade

- in reality, there are protectionist measures like tariffs, quotas & and subsidies to protect domestic industries that countries may use, even though they do not have a comparative advantage

- trade agreements and trade blocs explain trade patterns in ways that comparative advantage does not predict as comparative advantage assumes perfect competition

explain how inflation and exchange rates also contradict the theory of comparative advantage

- countries with high inflation can see their comparative advantage erode

- countries with a high exchange rate also see their comparative advantage erode

what are some causes of globalisation

- trade liberalisation and formations of trading blocs

- formation of the WTO

- improvements in communications

- MNCs, expanding overseas to exploit economies of scale, driving FDI

- MNCs increase trade and international investment

what are some benefits of globalisation to an economy, producers, consumers and governments

economy:

- encourages countries to specialise in goods and services which increases output

- Specifically specialising in areas where they have a comparative advantage allows them to improve efficiency and reach the optimum allocation of resources

producers:

- producers benefit from economies of scale and lower costs of raw materials

Consumers:

- lower costs of production passed on as lower prices

- Consumers have a greater choice

- levels of absolute poverty reduce, improve standards of living as employment has increased

governments:

- increased growth and employment achieve macroeconomic objectives

- increased awareness and quicker response to natural disasters that can lead to major supply-side shocks

what are some drawbacks of globalisation to inflation, dependency, and domestic firms

- globalisation can increase the prices of some goods and services as more people gain stable incomes, which can lead to demand-pull inflation

- economic dependency on others can lead to instability as an external shock to one economy can create a chained reaction taking down other economies with it

- specialisation can lead to an overreliance on a few industries which is risky for an economy

- domestic firms may not be able to compete with large MNCs, driving them out of business

what are some benefits of the growth of MNCs

- FDI by new MNCs create new jobs and bring new skills and wealth to an economy

- MNCs benefit from economies of scale leading to lower prices

- MNCs buy local goods & and services leading to them needing to convert their currency to domestic currency increasing demand and appreciating the currency increasing purchasing power

what are some negative effects of growth of MNCs

- some MNCs exploit workers in developing countries by paying them lower wages

- MNCs can drive domestic firms out of business due to their exploitation of economies of scale

- MNCs can relocate and cause mass unemployment

- they can withdraw profits from one country and place them in another with low-tax rates so the former country will be able to gain tax rev

what is the impact of globalisation on developed economies - increasing export revenue

globalisation allows developed economies to trade, leading to more exports in high value goods and services, increasing export revenue, which is a direct injection in the circular flow of income which can lead to a multiplier effect.

Higher trade activity can lead to less unemployment, less poverty and higher standards of living.

cheaper imports and higher consumer choice - globalisation gives access to low-cost manufactured goods, keeping inflation low

- Increasing international competitiveness can allow exports to become more price inelastic, if demand for exports is high, the price of exports can increase which can increase ToT, meaning the economy can buy the same imports with fewer exports

what is the impact of globalisation on developed economies - higher consumption of merit goods

- more trade & and investment allow for higher spending on education and health. imporving education can increase the consumption of merit goods

what is the impact of globalisation on developed economies - MNCs gaining economic benefits

- MNCs can exploit the low costs of production in developing countries, gain more profits which are bought back to developed economies where the MNC is located, boost tax revenues allow more welfare spending, and decrease a budget deficit

low-skilled jobs for MNCs tend to stay in developing countries but high-skilled jobs for MNCs stay in developed economies increasing jobs in high-paid sectors like R&D, analytics and design in the developed economies

MNCs can gain more and more economies of scale

lower costs are usually passed onto consumers as lower prices

What is the impact of globalisation on developed economies - increased labour mobility

- globalisation has led to increasing labour mobility so workers can travel between countries increasing labour supply in different countries that need it

allows developed countries to fill skill shortages in key sections like medicine, engineering and finance

greater mobility raises productivity

what is the impact of globalisation on developed economies - fiscal benefits

- as economies grow through trade & and FDI, gov collect higher income tax & and corporation tax which provides funds for public services 7 helps reduce the national debt

this strengthens economic stability and allows for long-term investments in the economy

what is the impact of globalisation on developed economies - exposure to external shocks

- greater reliance on trade makes developed countries vulnerable to global shocks

if markets that developed economies depend on for goods face external shocks, that will expose the weakness brought by overreliance on trade, as AD will decrease, decreasing GDP. there could be massive amounts of inflation especially if the imported good is price inelastic

what is the impact of globalisation on developed economies - deindustrialisation

manufacturing jobs have moved to low-wage countries. deindustrialisation in developed economies where entire industries in manufacturing shrink causing major structural unemployment

regional inequality increases as industrial areas are impacted most

income inequality can rise between high-skilled workers and low-skilled workers

What is the impact of globalisation on developing economies - MNCs leading to higher growth, MNC's FDI, MNCs FDI savings gap

MNCs create jobs, reduce employment and increase national income, earning higher wages leads to poverty reduction and improved living standards

all resulting in higher economic growth

furthermore, their FDI is an injection into the circular flow of income which, through the multiplier effect, can create secondary, tertiary and so-on benefits(job creation, higher incomes, higher tax revenues)

MNCs enhance capital accumulation, improve human capital and foster industrial development.

furthermore, their FDI helps overcome the savings gap in developing countries, stimulating the economy without the need for the initial savings for investment, and it also creates savings through the multiplier effect, leading to higher long-run domestic savings supporting sustainable development

What is the impact of globalisation on developing economies - specialisation & comparative advantage + trade liberalisation allowing trade for capital goods

developing countries can focus on industries where they have a comparative advantage improving their efficiency as they can rely on international trade for other goods. this allows them to consume beyond their PPC

- furthermore, trade liberalisation allows developing countries to import capital goods like different types of machinery and technology which can boost productive capacity in the long run leading to higher long-run economic growth (shifts LRAS right), helping to overcome the constraint of small domestic capital stock

What is the impact of globalisation on developing economies - greater consumer surplus

- globalisation increases competition, so firms face pressure to reduce costs to lower their prices. this boosts consumer surplus. this is particularly beneficial to low-income households as they gain cheaper access to basic goods like food and clothing

What is the impact of globalisation on developing economies - improves supply-side efficiency

with increased competition, firms must become more internationally competitive. they can improve labour productivity by investing in training schemes, which reduces unit labour costs. firms can invest in new production technologies to increase capital productivity. through R&D they can improve the quality of their products

this factor will shift LRAS right, leading to long-run non-inflationary growth

What is the impact of globalisation on developing economies - domestic industries unable to compete

some domestic industries are unable to compete with in global markets as their AC could be higher than large global corporations that have already exploited economies of scale

What is the impact of globalisation on developing economies - Prebisch-Singer hypothesis

many developing countries tend to specialise in commodities. the prebisch-singer hypothesis suggests that over time, the price of commodities tends to fall relative to the price of manufactured goods, causing a decline in the terms of trade for a developing country. this means that the developing countries have to export more and more over time to import the same amount of goods making development harder as they earn less from exports and pay more for imports. the reason this happens is commodities have a low income-elasticity of demand whereas manufactured goods have a high income-elasticity of demand

What is the impact of globalisation on developing economies - vulnerability to external shocks causing volatility

developing countries tend to export primary commodities which experience volatile export prices due to their vulnerability to external shocks

- some commodities are necessities so when external shocks happen like wars or pandemics, demand for the necessities tends to rise massively, leading to excess demand and a shortage in supply leading to higher prices, although, not every commodity is a necessity. Some commodities like coffee and cocoa are not considered necessities so during external shocks, their demand falls sharply decreasing their prices. due to this volatility, and unpredictability, the economy will be considered unstable by investors which will deter investment into the economy

What is the impact of globalisation on developing economies - MNCs may not always benefit the economy: profit repatriation, relocation causing capital flight

MNCs tend to engage in profit repatriation when they send their profits back to the developed country where their headquarters are situated. This leakage limits capital accumulation and slows domestic growth, furthermore, profit repatriation is an outflow in the primary income section of the current account, worsening a current account deficit. The multiplier effect gets weakened as profits are not reinvested but taken out from the circular flow of income

- another way MNCs can harm developing countries is through relocation. MNCs seek low production costs and may relocate if increasing wages increase their unit labour costs. This can lead to mass unemployment and put the economy at risk of mass structural unemployment which can lead to lower household incomes, a reduction in consumer spending and a fall in GDP. furthermore, the MNCs removing machinery, investment and funds may lead to capital flight which can depreciate the currency causing financial instability

What is the impact of globalisation on developing economies - MNCs increasing inequality

FDI from MNCs often concentrate in urban areas which can widen the income gap between cities and rural areas. the weak infrastructure restricts geographical mobility leading to a rural-urban migration crisis. the growing inequality may give rise to the informal sector

What is the impact of globalisation on developing economies - structure of the economy

developing economies tend to have primary sector dominated economies, so a large share of their GDP is concentrated in agriculture, mining and raw material extraction. primary sector industries are subject to price volatility. furthermore, prebisch signer hypothesis suggests over time, the price of raw materials fall relative to manufactroes goods making these devloping economies worse off in the long run. However, a developing country can divsersify their industries and enter the secondary and tertiary sector as they can benefit more from these sectors due to higher wages and more opportunities

how can a developing economy maximise benefits of globalisation by investing in human capital

- investing in human capital improves labour productivity

- a more skilled workforce increased MRP of labour, making workers more valuable to firms, increasing teir potential wages and employability. as a result, employment increases as firms are more willing to hire higher-MRP workers

- without investing in human capital, benefits of globalisaiton may be concentrated among a few people widining income inequality, increasing the Gini coefficent, and low income householes may expiernce relative poverty

how can a gov in a developing country prevent the risks of globalisation through policies and economic management

- effective gov policies like trade agreements, stable inflation, and legal protections for businesses and workers help attract FDI. more FDI leads to more capital inflows, strengthing the financial account in the balance of payments

- poor governance can lead to profit repatriation, weakening the multiplier effect

- if there is economic instability, there may be large amounts of capital flight leading to a reverse multiplier effect

what is an emerging economy

An economy in the process of rapid growth and industrialisation

explain an advantage of globalisation to an emerging economy - increased market access + MNC helping with the transition from the primary sector + diversification

- as global markets expand, emerging economies gain greater export opportunities allowing them to specialise in industries in which they have a comparative advantage in

- MNC investment helps emerging economies transition from the primary sector to secondary and tertiary sector industries through the provision of knowledge and training and new capital technology

- furthermore, globalisation MNCs and free trade all facilitate an emerging economy to diversify their economy with ease, reducing reliance on primary commodities and shifting towards high-value secondary and tertiary sectors

- this allows higher economic growth as manufactured goods tend to increase in price over time as they have a high income elasticity of demand

how is growth being unsustainable and inflationary pressures a drawback of globalisation for an emerging economy

- rapid economic growth requires parallel growth in supply-side capacity to prevent inflation.

- With AD increasing, and shifting right, there must be a corresponding shift in LRAS increasing productive capacity to prevent demand-pull inflation.

- if this does not happen, purchasing power is reduced, cost of living increases

- this type of growth is unsustainable as it can lead to the economy working beyond its capacity which is not sustainable as machinery and human capital are overworking, causing the economy to overheat which may eventually collapse when demand cannot be met or when inflation gets out of control. the demand-pull inflation can lead to a wage-price spiral.

explain the disadvantages of an MNC in an emerging economy (exploitation of labour, environmental damages, income inequality)

MNCs may exploit cheap labour by paying low wages or imposing poor working conditions.

- this tends to be in economies with weak labour laws meaning workers have little bargaining power

- MNCs may cause environmental degradation as rapid industrialisation may lead to deforestation, air pollution and depletion of natural resources

- these negative externalities of production cause market failure

- MNCs may also increase income inequality due to their FDI mainly being concentrated in urban areas while rural areas remain excluded from the economic gain

- this worsens the Gini coefficient as wealth becomes concentrated among the urban population

- this may lead to a dual economy where a modern =, industrial sector coexists with a low-productivity primary sector showing that globalisation can cause a major divide in a growing economy