Business economies of scale

1/83

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

84 Terms

Stakeholders

Vested interest in the business as its actions will directly effect them

Internal stakeholders

Individuals or groups that are inside the business

Multiple stakeholder interests

Employees who own shares, employees who are still citizens and therefore can vote too

The interests of internal stakeholders

Shareholders- return on their investments

CEO- coordinating business strategy; profits

employees and unions- protecting their rights and working conditions

middle managers- tactical objectives of their functional area

Interests of external stakeholders

government- how business operates in the business environment

suppliers- maintaining a stable relationship

consumers- best product that meets their needs

media- impact of business in news stories

local community- impact of business on local area

competitors- effect their business operations

conflict between stakeholders interest

although all stakeholders have a stake in the business, their focuses are different

any decision of importance such as general pay rise at the business will cause different reactions from different stakeholders

friction may result and alliances may form

Succesful businesses

satisfy the stakeholders interests as suffiencietly as possible

this is not so complicated for sole traders but for large businesses it is

Stakeholder analysis

Large businesses that have complicated stakeholder interests prioritise or rank the interests of various stakeholders

do it in two ways

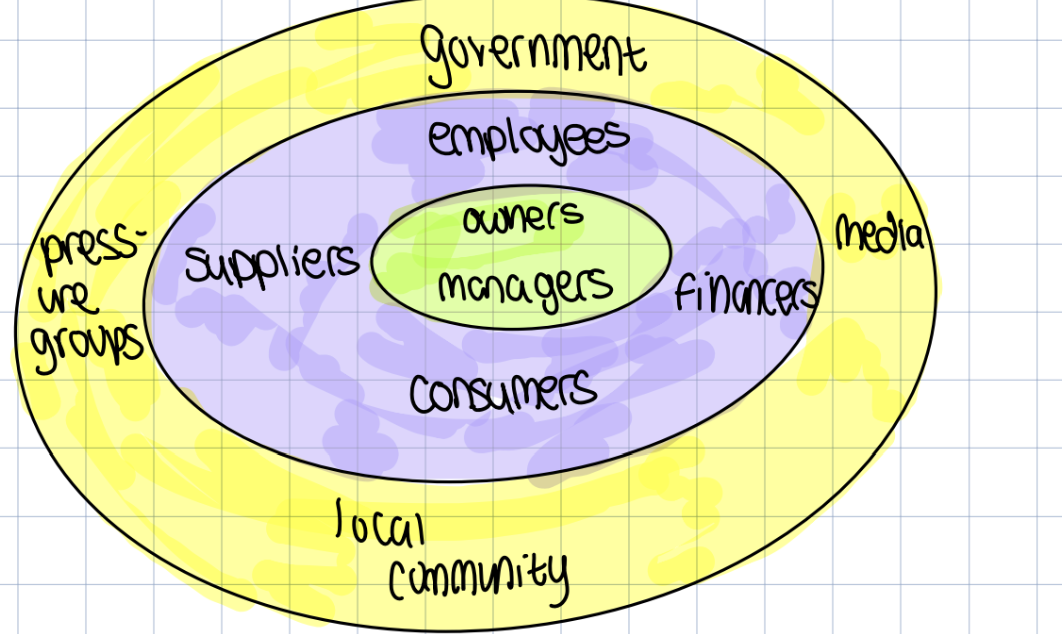

Circle method stakeholder analysis

How close the stakeholder is to decision making in the business

try to satisfy the stakeholders closest to the center (decision makers)

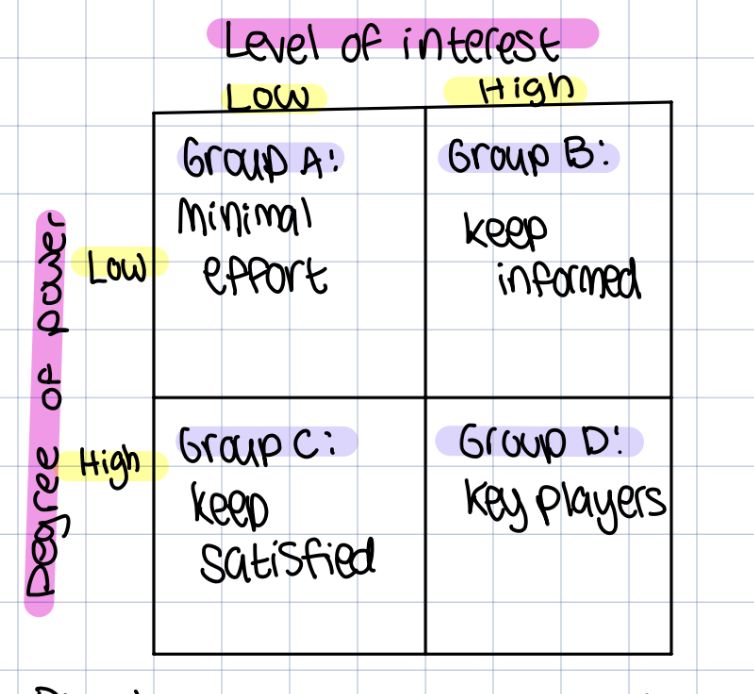

Power interest model

By placing each stakeholder in the matrix, business can decide on strategy

A- rarely a problem, safely be ignored, limited attention to their interest (media)

B- make this group feel included, newsletters, events etc (consumers)

C- power to influence over others, flatter self esteem of those in this group, make them feel important (employees)

D- important, consult with them before decision making, focus on their needs (owners)

Scale of operations

Size or volume of output, increased scale of operations means producing more in greater volume

Economies of scale

Reduction in average unit cost as business increases in size

if a business increases scale of operations and becomes more efficient in doing so

Diseconomies of scale

increase in average costs as business increases in size

if a business experiences inefficiencies when it grows, it has achieved diseconomies of scale

fixed vs variable costs

fixed costs are costs that do not change as production changes (rent)

variable costs are costs that vary as production changes (raw materials)

total costs

variable costs plus fixed costs

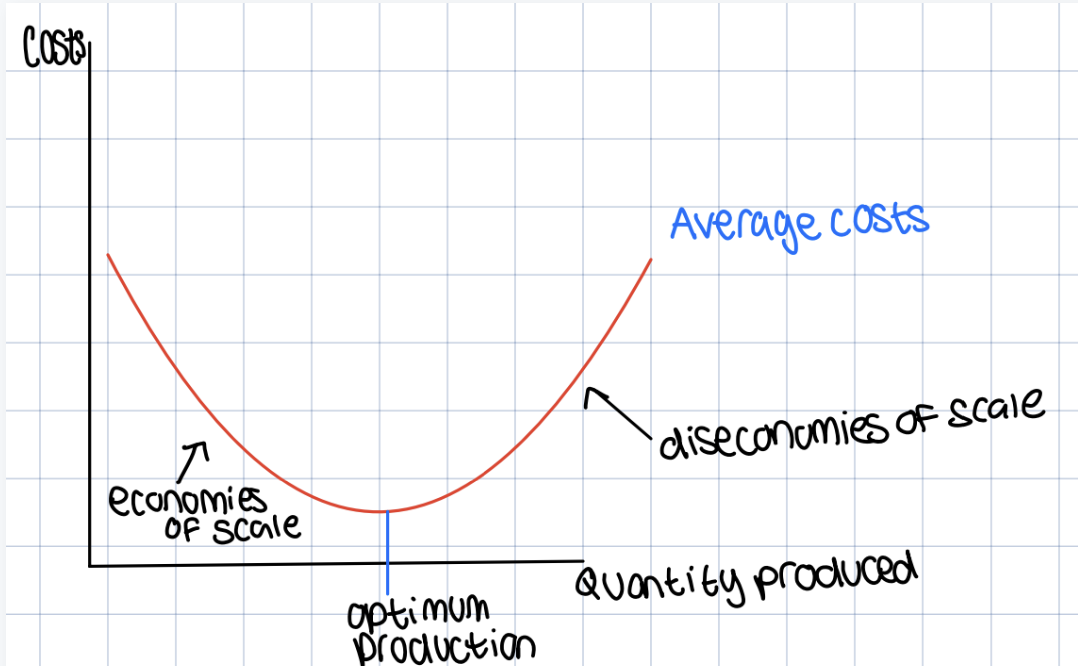

Average costs

total costs/ quantity produced

Optimum production graph

Increasing quantity produced in beginning, and costs decrease, after a certain Time of increasing quantity produced you get optimum production when average costs are at the lowest so profit is at its maximum, after this you continue increasing the quantity produced and start to experience inefficiencies causing average costs to increase like if you hire too many people in the kitchen and even with the extra costs of paying them to make more pizzas, they are just getting in the way of each other and end up making less pizzas for more costs of paying more people

Internal economies of scale

efficiencies a business itself can make

Technical economies of scale internal

bigger units of production lowers costs as the increase in variable costs is spread against a spread of fixed costs ex. a container ship with one crew, one fuel bill, one big fee cheaper than 2 small ones

managerial internal economies of scale

bigger businesses can afford to have mangers specialising in one job as opposed to one manager doing everything, more efficient

financial internal economies of scale

bigger businesses are less risky than smaller ones

marketing internal economies of scale

bigger businesses can run more effective marketing campaigns

purchasing internal economies of scale

big businesses can get discounts by bulk buying

risk bearing internal economies of scale

big businesses can afford to produce a big range of products, spread the risk of one product family

external economies of scale

efficiencies the business achieves because someone else has expanded

consumers external economies of scale

shopping mall increases number of potential customers, more people go to a mall than independent shop, Whole range of businesses benefit from infrastructure

employees external economies of scale

some geographic areas focus on one industry, operating in these areas allows for a business to benefit from lower recruiting and training costs like Hollywood with many actors

Internal diseconomies of scale technical

airports too big to land at smaller airports

internal diseconomies of scale

inefficiencies that the business itself makes

managerial internal diseconomies of scale

over specialised managers who cannot or will not work outside of their area of expertise for anyones benefit

financial internal diseconomies of scale

big businesses with a lot of surplus cash make poor investments

marketing internal diseconomies of scale

big businesses can make big marketing mistakes

purchasing internal diseconomies of scale

large businesses often buy too much stock so can end up being costly if capital expenses is greater than cost savings from buying in bulk

risk bearing internal diseconomies of scale

sharing of responsibility if something goes wrong; some risk exists in all economic activity

external diseconomies of scale

inefficiencies that an external source makes for a business

external diseconomies of scale employees

if one geographical area becomes too concentrated on one economic activity, shortage of skilled workers in the industry will occur, businesses will have to pay high wages to attract these workers

reasons for a business to grow

survival, economies of scale, higher status, market leader status, increased market share

survival reason for business to grow

large firms have a greater chance of surviving, less likely to fail or be taken over

economies of scale reason for business to grow

large firms enjoy economies of scale, greater profits, higher returns

higher status

large firms have more status and more motivation for employees

market leader status

if your the market leader, you can shape market habits and give yourself a competitive advantage

increased market share

large companies with large market share can control the market by determining prices and decide which services will be the industry standard

reasons for a business to stay small

greater focus, greater prestige, greater motivation, competitive edge, less competition

greater focus

small businesses can focus investments where they want and where they can earn profit, often having greater return

greater prestige

more exclusiveness, can charge more for goods and services, more profit

greater motivation

more prestige, motivate employees, employees feel like they matter to the business

competitive edge

being small, more personalised service, more flexible

less competition

such a small and niche market, sometimes big businesses do not want to even get involved

internal growth

organic, happens slowly and steadily, grows from existing operations of the business, long time, no risk

selling more products or developing a bigger range

external growth

quicker, riskier method of growth, expands by entering arrangement to work with another business, high risk high reward

external growth methods

merger- two businesses join together

acquisition- one business taking over the other

takeover- acquisition is unwanted by the company being acquired, only cubically held companies can be taken over

all result in one bigger business

horizontal integration

2 businesses same line of business, same chain of production, results in increased market share and power

vertical integration

one business integrated with another at different stages in production chain, can be to ensure supply, avoid taxing and price controls

backwards vertical integration

business involved in earlier stage of chain of production, business wants to protect its supply chain

forwards vertical integration

business involved in further forward in chain of production, secure an outlet for its products

conglomeration

two businesses in unrelated lines of business integrate, known as diversification, to decrease corporate risk

Mergers and acquisition disadvantages

can be costly, high legal and consulting fees

culture clash with employees from companies

joint ventures

2 businesses agree to combine resources for a specific goal over a period of time, separate business created with funding by 2 parent businesses, after time period is over new business is dissolved or incorporated into one of the parent business

advantages and disadvantages joint ventures

advantages- transfer of skill, knowledge, experience, greater sales without losing legal identity as a company

disadvantages- possible disagreements between partners

strategic alliances

more than 2 businesses can be apart of an alliance, no new business is created simply agreement to work together for mutual benefit, still remain independent businesses, member ship is fluid

advantages and disadvantages to strategic alliances

advantages- more members

disadvantages- more challenging to coordinate on a agreement, no legal entity, alliance will have less force, fluidity of members, alliance lack stability

franchises

original business- franchisor- developed the business concept and product/service sells the right to offer the concept

business- franchisee- buys the right to offer the concept and sell the product/service, must be consistent with the original business concept developed by the franchisor

rapid form of growth- franchisees know local conditions and market and language to grow

costs- franchisee must pay for franchise itself, must pay royalties (percentage of sales to franchisor)

franchisor provides

stock

uniform

training

legal and financial help

global advertising

global promotion

franchisee provides

employ staff

set prices and wages

pay royalty

local promotions

only sell franchisor products

advertise locally

advantages and disadvantages to the franchisee

advantages-

product exists and is well known

selling product format is established

set up costs are reduced

secure stock supply

franchisor helps with legalities, managers, finances, technicals

disadvantages-

unlimited liability for franchise

pay royalties

no control over what to sell

advantages and disadvantages franchisor

advantages-

quick access to wider markets

use of local knowledge and expertise

no risks or liability for franchise

more profits

makes all global decisions

disadvantages-

loses control in day to day business running

image can suffer if it fails

the impact of multinational companies on host countries advantages

economic growth- provides employment develop local suppliers, paying taxes

new ideas- introduce new ways of doing business and interacting socially

skills transfer- develop skills of local employees, can set up their own business with what they learn

greater choose- domestic market will benefit with more variety in products

disadvantages of multinational companies on host country

profits being repatriated- bulk of MNCs profits are rerouted away from host country

loss of cultural identity- appeal of domestic products, ways of doing business, cultural norms may all suffer

brain drain- many high skilled employees may look to work for the MNC in another country

loss of market share- as MNCs take over domestic market, domestic producers may suffer

depreciation

decrease in value of a non current asset over time due to wear and tear or becoming obsolete

2 methods of calculating this,

straight line method

Annual depriciation= original cost- residual value/ expected useful life of the asset

residual value- estimation of its worth or value over its useful life

remember this only gives you annual, remember to multiply it for more years if needed

advantages-

simple to calculate, predictable expense spread over a number of years

suitable for less expensive items, can be written off within the assets useful life

disadvantage-

note useful for plant machinery and more expensive assets as it does not cater for efficient loss or increase in repair prices

can inflate the value of assets which may lose greatest amount of value in first or second usage

units os production method

depreciation of asset based on usage

depreciation expense= (cost basis of asset- salvage value) / estimated total units to be produced over useful life x actual units produced

cost basis= original value of asset

salvage value= value of asset if it were to be sold at the end of its useful life

advantages-

asset based on usage not only time, declining physical value of asset taken into account

disadvantage-

only useful to manufacturers and producers

can be complicated to calculate

ratio analysis

financial analysis tool used in interpretation and assessment of a firm’s financial statements

gross profit margin gross profit/sales revenue x 100

how much profit they retain from what they sell in percentage

strategies to improve-

increase price for products in markets where there is less competition or consumers less sensitive to price change

source cheaper suppliers of materials

promotional strategies

profit margin profit before interest and tax/sales revenue x 100

profit that remains as a percentage after deducting all costs from revenue

strategies to improve

check indirect costs to see where unnecessary expenses can be avoided

negotiate with key stakeholders to cut costs

return on capital employed = profit before interest and tax/ capital employed x 100

capital employed= non current liabilities + equity (total assets minus total liabilities) ( equity is also share capital plus retained earnings)

asseses the returns a firm is making from its capital employed

how to improve-

reduce the number of long term loans while insuring that profit before interest and taxes stays the same

pay additional dividends to shareholders

reduce retained profits and reduce capital employed

any values given that are not long term loans or profit before interest and tax are meant to be apart of equity

current ratio = current assets/ current liabilities

ratio expressed as 500,000/250,000= 2 to 1

current assets should be higher than current liabilities, then you have enough to pay off short term debt

current assets is lower than current liabilities you have financial difficulties to pay back short term debt

a high current ratio should also be avoided as that can mean too much cash being held and not invested, many debtors meaning there may be bad debts, too much stock held

how to improve

reduce bank overdrafts and choose more long term loans

sell existing non current assets for cash

acid test ratio- current assets-stock/ current liabilities

better indicator of how well a firm is able to meet short term debt as it removes stock from current assets because there is not guarantee stock can be sold and it can become obsolete

too high of an acid ratio has some implications like having too many debtors and too much cash being held

less than 1 to 1 is bad as it means a firm is in bad financial health and financial institutions should proceed with caution

strategies to improve

sell stock at a discount for cash

get more cash and debtors and less stock

less short term loans and more long term loans

stock turnover ratio= cost of sales/average stock (number of times)

average stock- opening stock + closing stock/ 2

measures how many times over a given period is the stock sold and replenished

if it is higher than means firm sells stock quickly and earns more profits from its sales, goods do not become obsolete quickly and business has good control over its purchasing decisions

strategies to improve

obsolete products must be exposed of to lower stock

narrower and better selling range of products

stock turnover ratio= average stock/ cost of goods sold x 365 (number of days)

how many days it takes to sell given stock

if it is higher than means firm sells stock quickly and earns more profits from its sales, goods do not become obsolete quickly and business has good control over its purchasing decisions

strategies to improve

try to find cheaper alternatives to lower the cost of your goods/ buy in bulk if possible

narrower and better selling range of products

debtor days = debtors/total sales revenue x 365

lower number of days is better as it provides the firm with working capital

too long of credit period could provide cash flow problems

strategies to improve

provide discounts or incentives to get them to pay back their debts earlier

firm could impose stiff penalties such as fines for late payers or forbidding them from buying again

creditor days= creditors/cost of sales

asseses how quickly a firm is able to pay its suppliers

higher ratio enables the firm to use available cash to fufill short term obligations, and not have to spend It all immediately on suppliers, but extending period too long may ruin relationship with suppliers

investors may see this ratio as a business being in financial trouble and will not want to invest

strategies to improve

having a good relationship with creditors such as suppliers gives you extended credit period

effective credit control, managers asses the risks of paying creditors too early vs how long they can delay making their payments

gearing ratio = loan capital/capital employed x 100

measures the extent to capital employed by a firm being financed by loan capital

capital employed includes loan capital, shares capital, and retained profits

measured as a percentage, high geared is above 50 percent and low geared is below 50 percent

high geared viewed as risky by finances, a lot of loan capital

low geared viewed as safe, not a lot of loan capital, but may not be borrowing enough to boost future growth, not risk taking, shareholders may see them as not offering good returns

strategies to improve

business finds other sources of funding that are not loan related

decide not to issue dividends to share holders to increase retained profits

debt factoring

when you know you are not going to get your debt back so someone buys your debt off of you for part of the debt you were supposed to get from the debtors and they chase down the debtor to get the debt and they will get profit from It

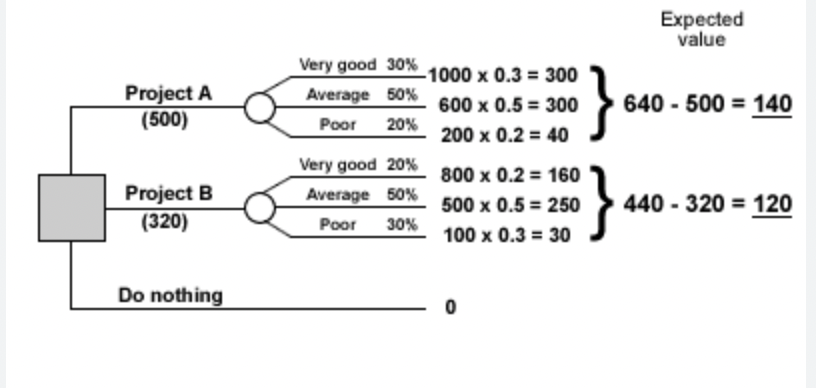

decision trees

helps managers analyse the probability of success of different strategies or options

circle for chance node

square for choice or decision

multiply the probability by expected outcome and add them all together and minus it from the cost it would cost to decide the best choice (branch) which has the highest expected value