Homework 3 International Trade

1/49

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

50 Terms

Chapter 9: When an import quota is used to protect a home monopolist from international competition, quota rents will ________, and the domestic price will ______.

rise, rise

Chapter 9: A home monopolist faces a demand curve given by P = 20 - Q and has total costs provided by TC = Q². By using a bit of calculus, you should be able to determine that the firm's marginal revenue is MR = 20 - 2Q, and its marginal cost is MC = 2Q. What is the no-trade profit-maximizing price?

15

Chapter 9: A home monopolist faces a demand curve given by P = 20 - Q and has total costs TC = Q². By using a bit of calculus, you should be able to determine that the firm's marginal revenue is MR = 20 - 2Q, and its marginal cost is MC = 2Q. Suppose that the country where this domestic monopolist is located decides to engage in international trade. The world price of the product produced by the monopolist is $12. What is the home monopolist's profit-maximizing output level?

6

Chapter 9: A home monopolist faces a demand curve given by P = 20 - Q and has total costs TC = Q². By using a bit of calculus, you should be able to determine that the firm's marginal revenue is MR = 20 - 2Q, and its marginal cost is MC = 2Q. Suppose that the country where this domestic monopolist is located decides to engage in international trade. The world price of the product produced by the monopolist is $12. What is the profit-maximizing price that the domestic monopoly charges?

12

Chapter 9: A home monopolist faces a demand curve given by P = 20 - Q and has total costs TC = Q². By using a bit of calculus, you should be able to determine that the firm's marginal revenue is MR = 20 - 2Q, and its marginal cost is MC = 2Q. Suppose that the country where this domestic monopolist is located decides to engage in international trade. The world price of the product produced by the monopolist is $12. What is the quantity of imports under free trade?

2

Chapter 9: When a tariff is applied to a good exported by a foreign monopoly (with no home producer and linear demand curve), the increase in the equilibrium price is _______ the tariff applied.

less than

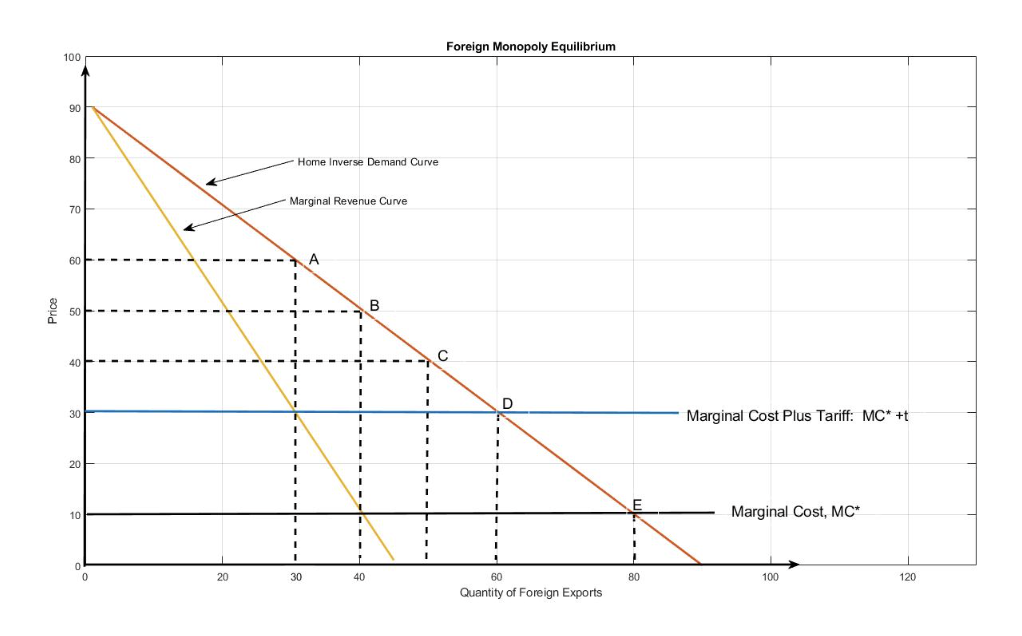

Chapter 9: The above figure shows the equilibrium of a Foreign Monopoly selling natural gas to the Home country under free trade and a specific tariff t=$20 imposed by the Home's government. Point _____determines the free-trade equilibrium price and quantity.

B

Chapter 9: The above figure shows the equilibrium of a Foreign Monopoly selling natural gas to the Home country under free trade and a specific tariff t=$20 imposed by the Home's government. Faced with a tariff of t = $20, the Foreign monopoly charges a price of ____to Home consumers.

60

Chapter 9: The above figure shows the equilibrium of a Foreign Monopoly selling natural gas to the Home country under free trade and a specific tariff t=$20 imposed by the Home's government. The Home's government collects a tariff revenue equal to ________.

600

Chapter 9: The above figure shows the equilibrium of a Foreign Monopoly selling natural gas to the Home country under free trade and a specific tariff t=$20 imposed by the Home's government. The net-of-tariff price that the Foreign monopoly receives is

40

Chapter 9: The above figure shows the equilibrium of a Foreign Monopoly selling natural gas to the Home country under free trade and a specific tariff t=$20 imposed by the Home's government. By imposing a tariff t = $20, the Home government experiences a net welfare change equal to

250

Chapter 9: A Foreign monopolist sells natural gas to the Home market, where the domestic demand for natural gas is given by equation P = 150 - Q. The Foreign monopolist has constant marginal costs equal to MC*=20. Suppose that the Home government imposes a specific tariff t = 30 . Under the tariff, the profit-maximizing price that the Foreign monopoly charges Home consumers equals

100

Chapter 9: A Foreign monopolist sells natural gas to the Home market, where the domestic demand for natural gas is given by equation P = 150 - Q. The Foreign monopolist has constant marginal costs equal to MC*=20. Suppose that the Home government imposes a specific tariff t = 30 . The home government collects tariff revenue equal to

1500

Chapter 9: Consider a discriminating monopolist facing the following market conditions: The demand curve in its home market is P = 200 - Q yielding a marginal revenue curve MR = 200 - 2Q; the demand curve in its foreign market is P = 160 - Q yielding a marginal revenue curve MR = 160 - 2Q; and its marginal cost is constant and equal to $20 per unit produced. The monopolist's profit-maximizing output in the domestic market is

90

Chapter 9: Consider a discriminating monopolist facing the following market conditions: The demand curve in its home market is P = 200 - Q yielding a marginal revenue curve MR = 200 - 2Q; the demand curve in its foreign market is P = 160 - Q yielding a marginal revenue curve MR = 160 - 2Q; and its marginal cost is constant and equal to $20 per unit produced. The discriminating monopolist's profit-maximizing output in the foreign market is

70

Chapter 9: Consider a discriminating monopolist facing the following market conditions: The demand curve in its home market is P = 200 - Q yielding a marginal revenue curve MR = 200 - 2Q; the demand curve in its foreign market is P = 160 - Q yielding a marginal revenue curve MR = 160 - 2Q; and its marginal cost is constant and equal to $20 per unit produced. The monopolist's profit-maximizing price in the domestic market is

$110

Chapter 9: Consider a discriminating monopolist facing the following market conditions: The demand curve in its home market is P = 200 - Q yielding a marginal revenue curve MR = 200 - 2Q; the demand curve in its foreign market is P = 160 - Q yielding a marginal revenue curve MR = 160 - 2Q; and its marginal cost is constant and equal to $20 per unit produced. The monopolist's profit-maximizing price in the foreign market is

90

Chapter 9: International dumping occurs when:

Monopolistic firms charge a higher price in their domestic market and a lower price in their foreign (export) market.

Chapter 9: A foreign discriminating monopolist may engage in

Dumping its product

Chapter 9: A foreign firm that is selling below cost and is accused of dumping often

raises its export prices to reap the rents and avoid the antidumping tariff completely.

Chapter 9: A knowledge spillover occurs when firms

imitate the successful innovations of other firms.

Chapter 9: An example of infant industry protection is the computer industry in Brazil from 1977 to 1988. It is widely concluded that the effort was

a failure

Chapter 9: As China's auto production capability has evolved, it is unclear whether protection was beneficial or harmful. Why?

Even greater progress in moving toward exports was made by firms that did not gain from tariffs or technology transfer.

Chapter 9: An analysis of the case of Harley-Davidson reveals that the deadweight loss of import protection______ the gain in future producer surplus

was slightly less than

Chapter 9: Which example cited in the textbook was the most successful case of infant industry protection?

Harley-Davidson

Chapter 10: A major reason why the Doha Round was not successful was disagreements over:

Export subsidies to agriculture in land-rich developed countries.

Chapter 10: In the small open economy of Gatorland, the domestic demand for widgets is given by P=100-3Q; the home supply of widgets is provided by P = Q. If the world price is $40, how many widgets will be consumed domestically and how many will be exported?

It will consume 20 units and export 20 units.

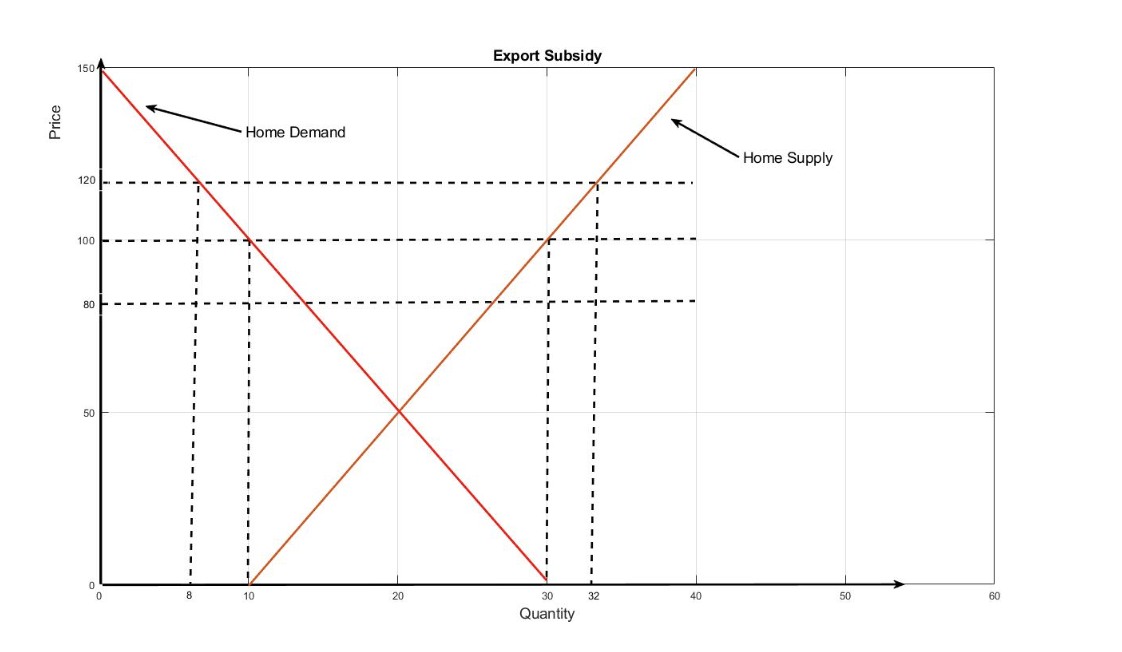

Chapter 10: In the small open economy of Gatorland, the domestic demand for widgets is given by P=100-3Q; the domestic supply of widgets is provided by P = Q. The world price is $40. Now let the government of Gatorland provide a $15 per unit subsidy on each widget exported. What will be the new price and quantity consumed in the domestic market?

$55 and 15 units

Chapter 10: In the small open economy of Gatorland, the domestic demand for widgets is given by P=100-3Q; the home supply of widget is given by P = Q. The world price is $40. Now let the government of Gatorland provide a $15 per unit subsidy on each widget exported. What is the value of total subsidy payments to Gatorland's widget exporters?

600

Chapter 10: Why is food aid to poor countries considered an "indirect subsidy" by the WTO?

It enables firms to increase exports, partially paid for by the government of the exporting country.

Chapter 10: Under the WTO, which trade remedy can importing countries use to offset export subsidies?

countervailing duties.

Chapter 10: Suppose the world price of sugar is $100 per ton. If Cuba, which is considered to be a large country in the global sugar market, gives its sugar exporters a subsidy of $50 per ton, then the world price of sugar will:

Fall by less than $50 per ton.

Chapter 10: Suppose the world price of sugar is $100 per ton. If a small country gives its sugar exporters a subsidy of $50 per ton, then the world price of sugar will

remain at $100 per ton.

Chapter 10: If a large country such as Ukraine subsidizes its wheat exports, it will increase the world supply of wheat and

the world price of wheat will fall.

Chapter 10: Russia is a large exporting country facing a free-trade world wheat price of $100 per ton. Russia provides a $40 per ton export subsidy to its domestic producers. As a result, the local price of wheat increases to $120, while the foreign market price declines to $80 per ton. The effect of the export subsidy on government revenue is minus

960

Chapter 10: Russia is a large exporting country facing a free-trade world wheat price of $100 per ton. Russia provides a $40 per ton export subsidy to its domestic producers. As a result, the local price of wheat increases to $120, while the foreign market price declines to $80 per ton. The net welfare effect of the export subsidy on Russia's welfare is____________and equal to ___________.

negative; $520

Chapter 10: In the case of a large country, export subsidies result in

a deadweight welfare loss.

Chapter 10: In the case of a small open economy, the deadweight welfare loss caused by a production subsidy is ____________than the deadweight welfare loss caused by an equivalent export subsidy.

smaller

Chapter 10: Consider Slovenia, which is a small open economy exporting wheat to the global market. Perfect competition prevails in the wheat market, and the world price is P^W = 510 . Slovenia's domestic demand for wheat is given by P = 610 - Q , and its domestic supply of wheat is provided by P = 10 + 2Q , where P is the price of wheat and Q is its quantity produced and consumed. Under free trade, what is the amount of wheat exported?

150

Chapter 10: Consider Slovenia, which is a small open economy exporting wheat to the global market. Perfect competition prevails in the wheat market, and the world price is P^W = 510 . Slovenia's domestic demand for wheat is given by P = 610 - Q , and its domestic supply of wheat is provided by P = 10 + 2Q , where P is the price of wheat and Q is its quantity produced and consumed. Suppose that the government of Slovenia applies a specific export tariff t = 60 per unit of wheat. What will be the domestic price that producers and consumers of wheat in Slovenia face after the imposition of the tariff?

450

Chapter 10: Consider Slovenia, which is a small open economy exporting wheat to the global market. Perfect competition prevails in the wheat market, and the world price is P^W = 510 . Slovenia's domestic demand for wheat is given by P = 610 - Q , and its domestic supply of wheat is provided by P = 10 + 2Q , where P is the price of wheat and Q is its quantity produced and consumed. Suppose that the government of Slovenia applies a specific export tariff t = 60 per unit of wheat. What will be the quantity of wheat exported after the imposition of the tariff?

60

Chapter 10: Consider Slovenia, which is a small open economy exporting wheat to the global market. Perfect competition prevails in the wheat market, and the world price is P^W = 510 . Slovenia's domestic demand for wheat is given by P = 610 - Q , and its domestic supply of wheat is provided by P = 10 + 2Q , where P is the price of wheat and Q is its quantity produced and consumed. Suppose that the government of Slovenia applies a specific export tariff t = 60 per unit of wheat. What will be the value of the export tariff revenue collected by Slovenia’s government?

3600

Chapter 10: Consider Slovenia, which is a small open economy exporting wheat to the global market. Perfect competition prevails in the wheat market, and the world price is P^W = 510 . Slovenia's domestic demand for wheat is given by P = 610 - Q , and its domestic supply of wheat is provided by P = 10 + 2Q , where P is the price of wheat and Q is its quantity produced and consumed. Suppose that the government of Slovenia applies a specific export tariff t = 60 per unit of wheat. What is the value of the deadweight welfare loss generated by the export tariff?

2700

Chapter 10: In the case of a small country, export tariffs generate

A deadweight welfare loss

Chapter 10: In the case of a large country export tariffs result in

a terms-of-trade gain.

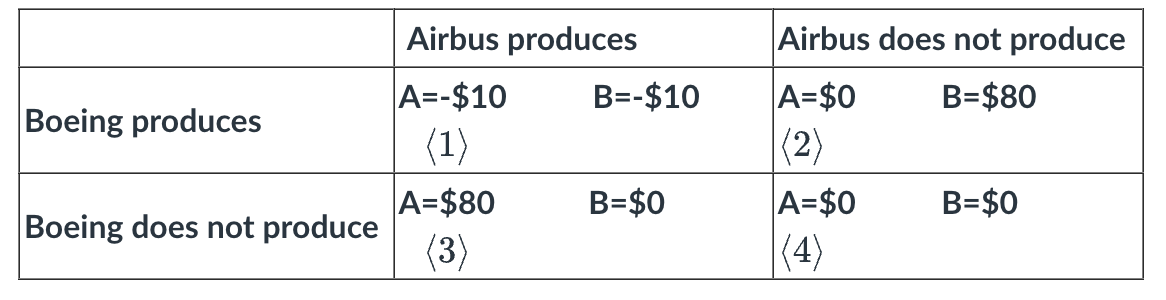

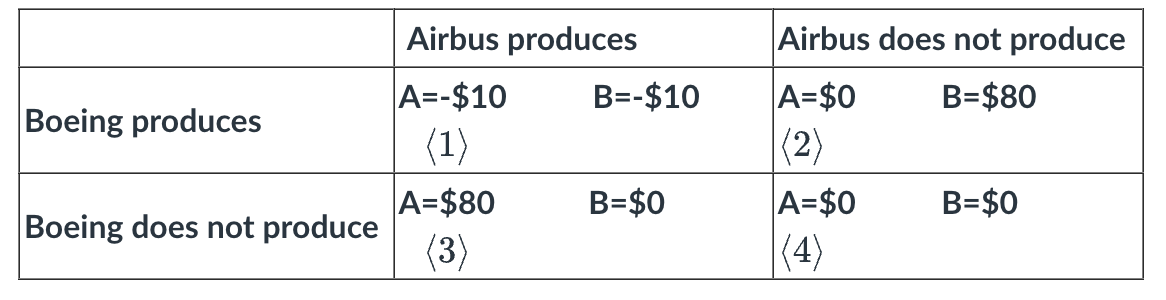

Chapter 10: Consider the following payoff matrix (with profits expressed in millions) for Airbus and Boeing. Each company must decide whether or not to produce a new airplane.

Which elements (quadrants) are nash equilibria?

Quadrant 2 and quadrant 3

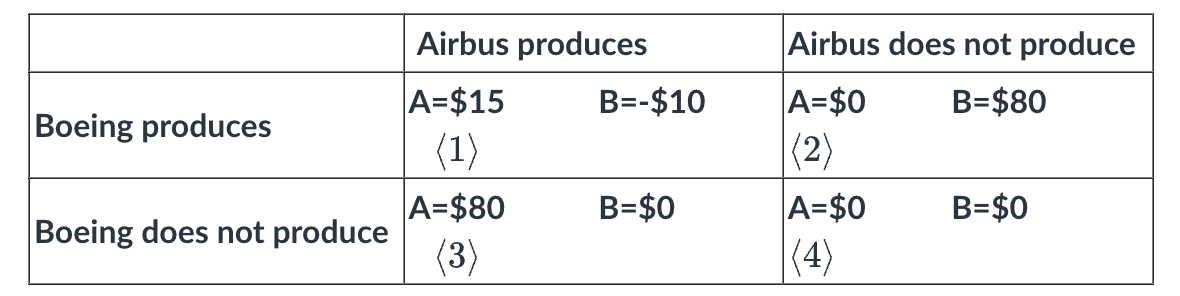

Chapter 10: Consider the following payoff matrix (with profits expressed in millions) for Airbus and Boeing. Each company must decide whether or not to produce a new airplane.

Suppose now that the US government provides a subsidy of $15 million to Boeing. What is the Nash equilibrium

Only Boeing produces the new plane.

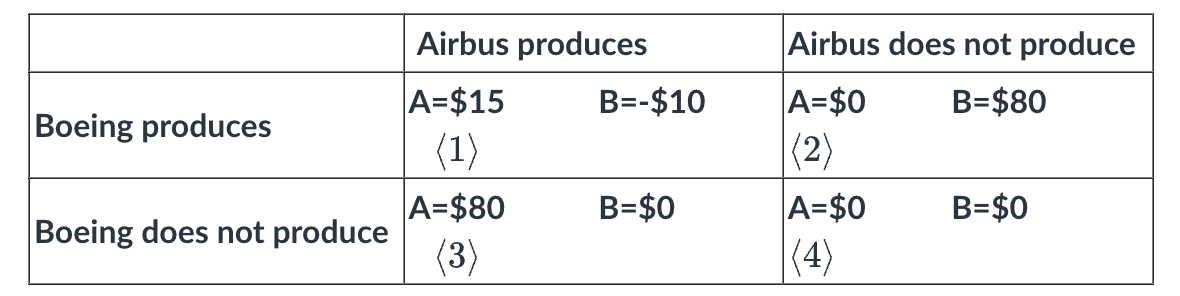

Chapter 10: Consider the following payoff matrix (with profits expressed in millions) for Airbus and Boeing. Each company must decide whether or not to produce a new airplane.

Which quadrant is the Nash equilibrium?

Quadrant 3

Chapter 10: Consider the following payoff matrix (with profits expressed in millions) for Airbus and Boeing under no government intervention. Each company must decide whether or not to produce a new airplane. The payoff matrix indicates that Airbus is more efficient than Boeing in building the new plane.

Suppose the US government offers a subsidy of $20 million to Boeing. What is the subsidy-ridden Nash equilibrium?

Both companies produce the new airplane.

Chapter 10: The 1992 agreement between the United States and Europe

limited the subsidies provided to the production and development of civilian aircraft.