The Market System - IGCSE Economics

1/192

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

193 Terms

What is the basic economic problem?

the allocation of a nations scarce resources between competing uses that represent infinite wants

Define free good

A good for which the choice of one use does not require that another be given up.

Define economic good

Things people want that are scarce - there is an opportunity cost involved.

State the three economic questions

What to produce?

How to produce?

For whom to produce?

Microeconomics is...

the study of how households and firms make decisions and how they interact in markets

Define "Needs"

things that are required in order to live

Define "Wants"

Desires that can be satisfied by consuming a good or service

Define "distribution"

act of sharing things among a large group of people in a planned way

What is "opportunity cost"?

cost of the next best alternative given up when making a choice

Describe the effects of opportunity costs on consumers

they have many different goods or services to choose from in a limited budget

Elaborate on "What to produce"

It is determined by what the consumer prefers. They tell producers what they want by demand and using their spending power.

Elaborate on "How to produce"

Producers seek to maximise profit and minimise production costs. This can be done by organising the four factors of production in different production methods.

Elaborate on "For whom to produce"

Whoever has the greatest purchasing power in the economy buys it (in a market system). In a planned economy, the government decides how to distribute it.

Describe the effects of opportunity costs for producers

Producers have to decide what to make and what the resources could earn in their next best alternative. They take the route that gives them the most profit and takes into account the demand for different products and their production costs.

What is the effects of opportunity costs for governments?

They have to decide how to spend its expenditure of tax revenue on different things.

E.g

more spending on healthcare = less for education.

Rising tax revenue = people have opportunity costs for buying goods or saving

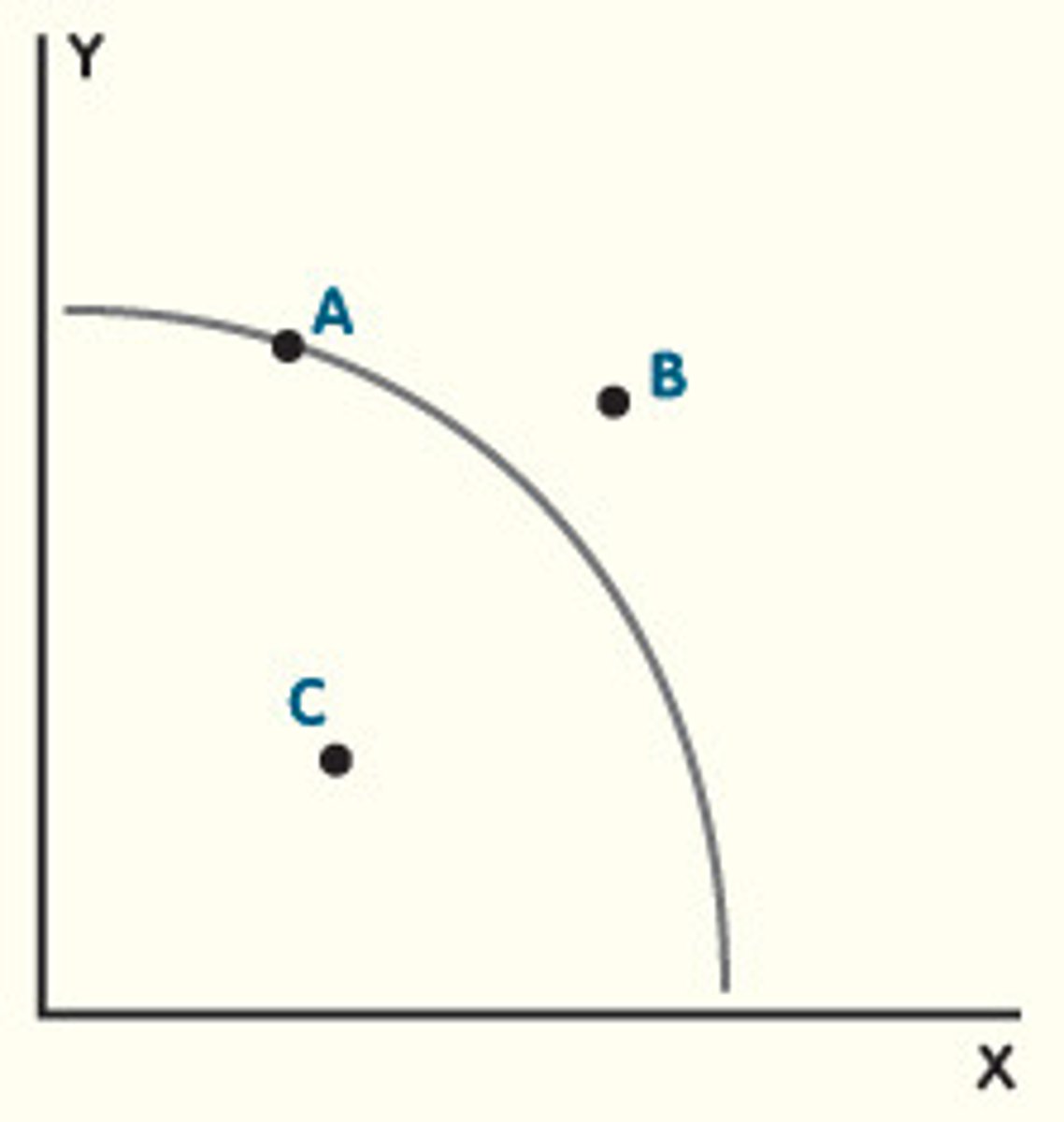

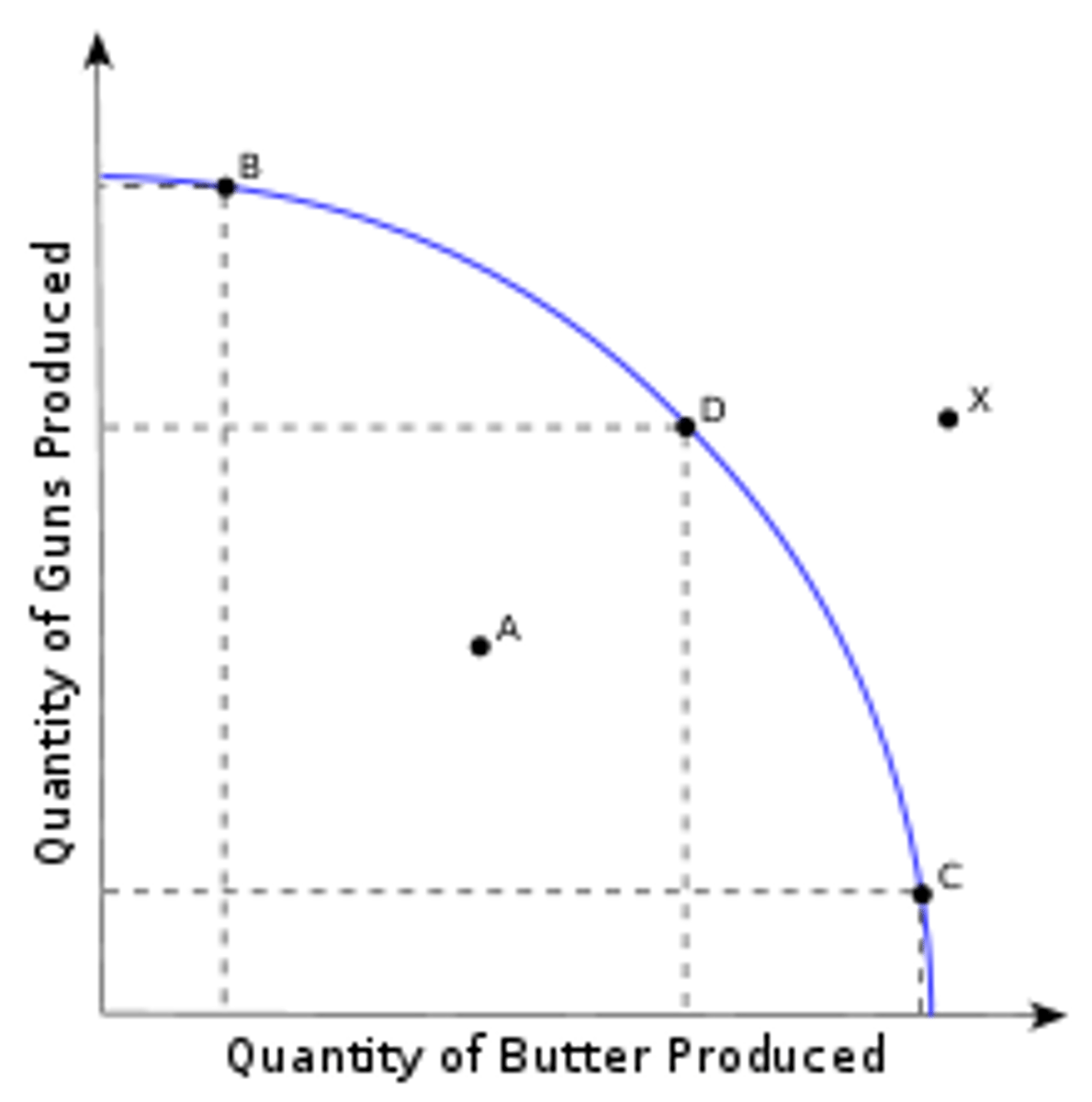

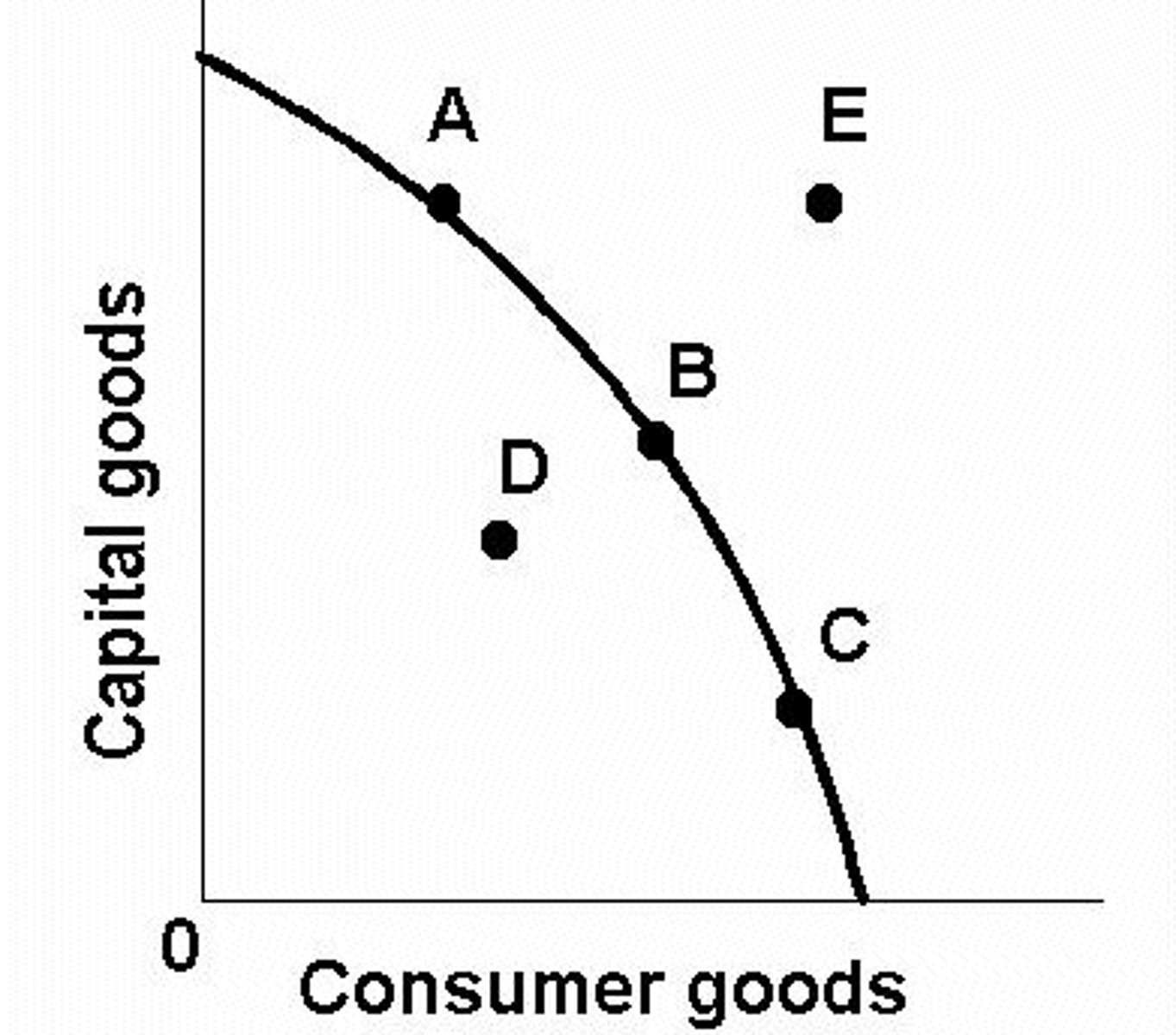

Define the production possibilities curve

a line that shows the different combinations of two goods an economy can produce if all resources are used up

What are capital goods?

those purchased by the firm and used to produce other goods such as factories machinery, tools and equipment

Why might A shift to B? (positive economical growth)

New tech

Improved efficiency/new production methods

Education and training

Division of labour

New resources

Increased labour force

What does a PPC graph show?

- max productive potential of a country

- full employed or unemployed resources

- oppurtunity cost

- possible and unobtainable production

- positive pr negative economical growth that shifts the PPF out or in

Why might the PPC shift inward? (negative economic growth)

- natural disasters (destroy built-up capital and potentially causes significant loss of life.)

- resource depletion

- recession (high unemployment and limited money supply), which causes capital investment to fall

- mass migration of skilled workers (brain drain causes the skilled people to immigrate to other countries which reduces production potential.)

- war/conflict

- failure to invest

Real capital, such as machinery and equipment, wears out with use and its productivity falls over time. As the output from real capital falls, the productivity of labour will also fall.

The quality and productivity of labour also depend on the acquisition of new skills.

Explain why improved tech shifts PPC outwards

- more reliable and more efficient

- greater quantities can be produced with the same amount of resources

- lower costs of production

Explain why improved effeciency shifts PPC outwards

more output produced with fewer resources due to efficent methods

reduce waste

E.g

kaizen - continuous improvement

lean production - using fewer resources in production

Explain why education and training/division of labour shifts PPC outwards

more educated workers can carry out tasks on both sides of the axis

enables an economy to increase its potential output due to an increase in the human capital of a society.

Explain why new resources shifts PPC outwards

enables them to produce more

why might it be at A?

- the underemployment of any of the four economic resources

- its resources are not being used efficiently.

What happens when the curve moves from one point to another (like A to C) ?

OPPORTUNITY COST between different combinations of capital and consumer goods

e.g

more capital goods now = more consumer goods later

more capital goods now = less consumer goods in the short term

explain how consumers aim to maximise their benefit

- they choose the course of action that gives them the greatest satisfaction

- they always buy from the cheapest supplier

- they always buy the best quality product

explain 5 ways why consumers may not maximise their benefit

advertisements -

puts pressure on consumers to purchase certain items

buying habits/brand loyalty/familiarity with the product -

they might continue to purchase it regularly even if there are better alternatives on the market with better value or are healthier

difficulty calculating benefits

what gives them the most enjoyment

what is good/not good for them

peer pressure -

they wish to fit in with the popular culture and the group, creating buying habits based on others, rather than personal pleasure

lack of information - cannot compare prices/quality

explain how producers aim to maximise profit

choose a course that has the best financial results and maximise revenue and profit

always chooses the cheapest resources as long as the quantity is the same

always chooses the highest market price possible

define revenue

money that a business recieves over a period of time

define profit

a financial gain, especially the difference between the amount earned and the amount spent in buying, operating, or producing something.

explain five reasons why producers do not maximise their profit

the behavior of others in the organisation/profit satisficing -

seperation between ownership and control

owners may wish to max profit but managers do not due to less incentive to

OR managers aim to max profit due to salary levels being linked to sales levels and sell larger quantities which cause prices to be lowered due to surplus. profit made from each unit will then fall

alternative business objectives -

aim to maximise the well-being of all stakeholders

e.g focus on customer care -> extra costs in training -> less profit

Charities -

raise awareness and money for a cause, not for profit

social enterprises -

operate commercially but aim to max improvements in human or environmental wellbeing

lack of info

Factors of production are...

land, labor, capital, entrepreneurship

Define land with examples

all natural resources used to produce goods and services

timber from trees

wool from sheep

water from streams

Define labour

Human effort used in production which also includes technical and marketing expertise.

Define capital with examples

Human-made goods (or means of production) which are used in the production of other goods.

These include machinery, tools and buildings.

Define enterprise

The skill and risk taking ability of the person who brings together all the other factors of production together to produce goods and services.

how government policies deal with externalities = five

1. Taxation

2.subsidies

3.fines

4. government regulations

5. pollution permits

explain how taxation reduces externalities

This taxation increases the cost of producing or consuming goods. Such taxation attempts to make the producer/consumer pay for the full cost of production. As a result of the higher cost of production, the firm will reduce its production. This reduces supply which raises the price, causing demand to fall and fewer third parties suffering.

increases revenue for the government

explain how subsidies increase positive externalities

A government subsidy is a payment that lowers the cost of producing a given good or service. Such subsidies provide an incentive for firms to increase the production of goods that provide positive externalities.

explain how fines decrease externalities

prevents people from committing the crime again

explain how regulation decrease externalities

they aim to reduce external costs of production

they make such activities illegal and thus dissuades firms from doing it in fear of hurting their reputation and decreased revenue from fines

define and explain how pollution permits decrease externalities

a government issues document that gives a business the right to discharge a certain quantity of polluting material into the environment

they are tradeable, which creates incentive in the market for companies to invent new tech that reduces pollution so they can sell the permits for-profit

define external costs

A spillover cost associated with production or consumption which is borne by a third party

define external benefits

Producing or consuming a good that causes a positive spillover benefit to a third party

Explain a problem associated with subsidies/advertisements in reducing negative externalities

OPPORTUNITY COST

money spent by government on subsidies to raise external benefits or lower external costs might be spent more effectively on other government projects

explain problems with pollution permits in reducing externalities

governments may overissue or under issue permits

opportunity cost in permit administration

producers may shift to countries with lower taxes or hide their levels of pollution

explain how advertisements reduce externalities

used by the government in order to try to discourage consumption of a good

explain problems on how taxation reduces externalities

- hard to measure the costs of the harm done and setting the tax at the right level.

- Income inequality may worsen, as items become more expensive for lower-classes leading to widening of inequalities in the distribution of income

- Producers may pass on the tax to the consumers if the demand for the good is inelastic

explain problems with government regulation in reducing externalities

- government lack resources (labour and administrative) or commitment to enforcing laws

- companies are powerful and able to stand against the government through legal disagreements

- people may try to evade the law

- cost of meeting regulations may dissuade smaller businesses and lower competition

social benefit formula

private benefits + external benefits

define social benefits

The total economic benefit to society of an economic activity.

define private benefits

The benefit derived by an individual or firm from an economical activity, such as consumption or production

define private costs

costs of an economic activity to individuals or firms

define social costs

costs of an economical activity to society as well as individuals or firms

social cost formula

Private Cost +External Cost

external benefits include...

1. education

2. healthcare

3. vaccinations

effects of external benefits

-better quality of life, better job, higher wages

- higher productivity

- lower unemployment, household mobility and political participation

- longer lifespan

- decreased likelihood of disease and epidemics

define third parties

someone who is not one of the two main people or organisations involved in an agreement or legal case

examples of external costs

- Human health problems

- Environmental damage

- Property damage or decline in value

- resource depletion

- traffic congestion

- overcrowding

- air, water, noise pollution

explain some private benefits

better transport - shorten the travelling time, increased convenience

Effects of privatisation on the government - good

Short term: revenue generated from sale taxes increases the wealthiness of the government

Long term:

- raise tax revenue should the business make a profit

- saves money overall from not having to pay for business costs

Effects of privatisation on the government - bad

renationalising companies would be very difficult.

opportunity cost with advertising for privatisation

assets sold off too cheaply and failed to maximise revenue

lose out on future divends

Privatisation creates private monopolies, such as water companies and rail companies. These need regulating to prevent abuse of monopoly power

Effects of privatisation on the producer - good

profit-making - new objective

more investment - more funding for new products

mergers

diversification - able to take advantage of risk-taking economies of scale

without government interference/increased efficiency - allows it to revamp its management structure

Effects of privatisation on the producer - bad

- firing a lot of experienced workers weaken companies

and makes it more difficult and expensive to scale up in the future.

This is because they will need to use resources to find new employees.

- it may decrease staff morale

- as workers are pressed to improve efficiency

- as mass redundancies lead to a higher workload for the remaining employees, causing burnout

Effects of privatisation on the consumer - good

better quality - companies are held accountable to meet customer needs and return profits to stakeholders, otherwise, they will lose customers and revenue and not earn enough to survive

reasonable price

efficiency

Effects of privatisation on the consumer - bad

in public services, privatization may lead to the priority of profit over customer care

monopolies might be created, leading to the customer being exploited and all disadvantages associated with monopolies like higher prices, lack of choice and poor customer service

Effects of privatisation on the workers- bad

many people made unemployed in order to cut costs

restructuring and change in motives (profit-orientated) could negatively influence workers, leading to unfavourable working conditions/wages

if a company is made private, it can sell shares. but workers may not be able to purchase shares

Define privatization

the transfer of a business, industry, or service from public to private ownership and control.

State the Benefits of privitisation

1. improved economic efficiency

2. lack of political interference

3. short term vs long term view

4. accountability to shareholders

5. increased competition

6. government raises revenue

7. raise living standards

define takeover

act of gaining control of a company by buying over 50% of its share

why does privatisation happen

1) income generation

However, this is a one-off benefit. It also means the government lose out on future dividends

2) fail of public sector

they lack the incentive to make a profit and make losses.

3)reduction of political interference -

Deregulation opens up markets and encouraging the entry of new suppliers. this increase in competition that can be the greatest spur to improvements inefficiency.

effects of privatisation on the economy

good -

increased expenditure for the government to spend on other sectors

increased productivity may lead to higher output and more exports

consumers may then have more choice

bad -

mass redundancies increase unemployment

governments may then need to use the expenditure to retrain workers and support them while placing them in other areas of work

define hostile takeover

takeover that a company does not want to or agree to

State and describe 3 types of privatisation

1) sale of national industries - they were sold off, many after years of being under state ownership

2) contracting out - contractors are given a chance to bid for services normally supplied by the public sector

3) the sale of land - e.g sale of land with discounts to encourage people to buy homes

Define free rider problem.

When individuals reap the benefits of a good without paying for it

Public good characteristics

non-rivalry

when a good is consumed, it doesn't reduce the amount available for others.

non-excludability

when it is not possible to provide a good without it being possible for others to enjoy

why might a public good be unprovided ?

- impossible for private firms to charge consumers,

it would not be provided by firms at all due to an incentive not to pay by users which creates a lack of profit incentive. this will cause social inefficiency.

so there will be a need for the govt to provide it directly out of general taxation.

define market failure

a situation in which a market left on its own fails to allocate resources efficiently

Reasons for Market Failure or government intervention

1) Externalities

2) Lack of competition

3)Missing markets

4) Lack of information

5) Factor immobility

why do externalities lead to market failure?

firms do not take in the costs of production and causes negative externalities that impose a cost on society

why do lack of competition lead to market failure?

it becomes dominated by one firm and causes all problems associated with monopolies

consumers are exploited, prices are charged too high and choice is limited

why do lack of info lead to market failure?

consumers need to know price and quality

business need to know resource and production info

a lack of this will lead to wrong things/prices being produced or paid for

why do missing markets lead to market failure?

not provided by private sector, thus it is underprovided

why do factor immoblity kead to market failure?

if they are immobile, resources will be wasted should they be made redundant

Define mixed economy

an economy where goods and services are provided by both the private and public sectors

state and describe three types of economies

- free enterprise economy

-goods and services vastly provided by private businesses

-market forces determine the allocation of resources

-government is limited to provided a monetary system, key state services and a legal system

- mixed economy

you know already

- command economy

- relies entirely on the public sector to choose, distribute and produce goods

- all assets belong to the government

- government organises, coordinates and plans

- prices are set by the state. items sold by the state

describe how the three economical questions are solved with the mixed economy

What?

consumers goods are left to the private sector as

the market system ensures businesses produce what consumers want

merit goods are best provided by the state, as the private sector will not produce a sufficient amount - if they are, they would be so expensive many people would not be able to afford it

How?

Competition exists to provide choice and variety and spur firms to form production methods that help maximise quality/profit and minimise costs

Whom?

Private sector - anyone who can afford them

Public sector - free to anyone and paid by taxes

+ Financial benefits exist to help struggling people survive

define merit goods

Merit goods are goods whose consumption creates external benefits.

how to overcome market failure?

- fine/regulate/ban externalities

- legalisation to prevent companies from dominating

- state money to provide merit and public goods

- pass legislation to force firms to provide information and pay taxes

- nationalise firms with high externalities

- make resources more mobile by retraining and reducing waste

- education/advertisement

define assets

resources owned by a business that has value or the power to own money

Define liabilities

amounts of debt you owe

state and descrbe: what are the Aims of the public sector?

1) improving service quality

focus on reliability, professionalism, levels of customer service and speed of service

2) minimising costs

resources are scarce. governments regularly look for a way to cut costs while being efficient and minimising waste

3) take into account social costs and benefits

they do not need to make a profit, thus they can take into account the needs of a wider range of stakeholders

4) Making a profit

state and descrbe: what are the Aims of the private sector?

Survival - establish a business and overcome difficulties

- important when trading conditions are difficult (like recessions)

Growth

- bigger businesses enjoy exploiting economies of scale

- makes jobs more secure

however profits may be shared out between more stakeholders, so overall dividend for everyone are lower

Social Responsibility

- to be good corporate citizens and please a wide range of stakeholders due to pressure from stakeholders

Profit

- Private businessmen don't have to worry about political popularity and so are more willing to make people redundant if it helps efficiency.

- stakeholders want dividends to be as high as possible

- Private firms have a profit incentive to cut costs and develop products demanded by consumers.

define dividend

a distribution from the net profits of a company to its shareholders

What are local authority services?

services that are delivered by local councils

What are public corporations?

enterprises owned by government

- government selects people to run the organisation

- Government is responsible for policies, assets, liabilities

- state-funded by taxes

they can be sued and enter contracts under its own name

what are central government departments?

departments which are controlled by teams lead by a government minister

state 4 Types of public sector organisations

1) central government departments

2)public corporations

3)local authority services

4) other public sector organisations

Define sole trader

business owned and operated by one person