Managerial Accounting Study Guide

1/73

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

74 Terms

The cost of creating the inventory the company sells, and an asset that is expensed off when products are sold. Also known as “inventoriable” costs.

Product Costs

3 examples of Product Costs:

Direct/indirect Materials, direct/indirect labor, factory facilities

What are the 2 period costs?

Selling expenses (advertising, freight-out, sales salaries, and commissions) and Administrative expenses (office salaries, office facilities, etc)

A type of product costing method where the company maintains a separate work-in-progress account for each job.

Job-order costing

A type of product costing method where the company maintains a separate work-in-process account for each department, or process, that the product flows through

Process costing

Which product costs are included in overhead? (3)

Indirect materials

Indirect labor

Cost of factory + facilties

Sort the following into their appropriate groups:

Direct Labor

Indirect Materials

Indirect labor

Factory Facilities

Direct Materials

Group 1: Costs that are charged (debited) directly to the WIP account

Group 2: Costs that are charged (debited) to the overhead account

Group 1

Direct Labor

Direct Materials

Group 2

Indirect materials

Indirect labor

Factory Facilities

A credit balance in the Overhead Account prior to closing it indicates that overhead has been ___-applied ( over / under ).

A debit balance in the Overhead Account prior to closing it indicates that overhead has been ___-applied ( over / under )

Over; (i.e. more overhead cost has been applied to WIP than has been incurred)

Under; (i.e.more overhead cost has been incurred than has been applied to WIP)

How is the overhead rate calculated?

From past experience

What is the easiest (and the current) way to close overhead?

Dump it into COGS

Fill in the blanks as either needing a credit or a debit entry.

When dumping overhead into COGS, if the overhead account has a credit balance, then COGS will be _____.

When dumping overhead into COGS, if the overhead account has a debit balance, then COGS will be _____.

Credited

Debited

Which type of companies use job-order costing, and which use process costing?

Job-order costing is used by companies that produce custom orders, Process costing is used by companies that produce identical units.

Applying overhead to jobs.

Sample problem:

$10 per hour

5,000 hours of labor

Prepare the journal entry to apply overhead to jobs.

Solution:

Overhead is applied to jobs on an hourly basis; $10 × 5,000 = $50,000 of overhead to be applied

Journal entry: Debit Work In Process $50,000 / Credit Overhead $50,000

Calculating Equivalent Units Formulas:

Weighted Average = _____ + (_______ x % of _______)

FIFO equivalent units = _____ + (______ x % of _______) + (________ x % of _______)

Why is FIFO preferred?

Units Completed + (Units in Ending WIP x % of completion)

Units Completed + (Units in Ending WIP x % of completion) + (Units in Beginning WIP x % of completion)

It yields a higher cost per unit.

How do variable costs and fixed costs behave in response to increases in production volume?

When production volume increases, Variable Costs increase in total & Fixed Costs are constant.

Cost-volume graph:

The vertical axis represents ____, and the horizontal axis represents ____.

Cost; Volume

What is the Relevant Range Assumption?

Holds that total variable costs and total fixed costs are assumed to be linear within the relevant range.

Label the parts of the Mixed Cost Formula.

Y = mX + B

Sample problem:

Given that the mixed cost formula is Y = $2.00X + $24,000, what would be the total of the mixed cost for a volume of 100,000 units?

Y= Total of mixed cost

m = Variable cost per unit of volume

X = Volume

B = Fixed portion of the mixed cost

Sample Problem Solution: $2(100,000) + $24,000 = $224,000

Cost-Volume-Profit Analysis

Sample Problem:

Jones sells a product for $125 per unit. If variable costs per unit are 75% of the selling price and fixed costs total $262,500, what is the break-even point in units?

Applicable formulas: Break-even in units = Fixed Costs / CM per unit

CM per unit = Selling price - VC per unit

Solution:

Variable cost per unit = $125 × 75% = $31.25

Breakeven = $262,500 / $31.25 = 8,400

In order for a company to break even, ____ and _____ must be equal.

Contribution Margin (CM); Fixed Cost

Cost Volume Profit Analysis T/F Questions

If Sales changes, VC & CM will change proportionally

If CM changes by 1, NI will decrease by 1

% Change in NI = % change in ____ x ____

Sales

- Variable Cost

Contribution Margin

- Fixed Cost

Net Income

True

False; NI will increase proportionally

% Change in Sales x DOL

Analysis of Cost behavior questions

Which graph is more accurate? Scattergraph or High-Low

T/F, Fixed costs are only fixed in the long run.

What will happen to the fixed cost if you spread it out over more units?

Scattergraph

False; they are fixed in the short run.

Fixed Cost will decrease

Classifying Manufacturing Firm Costs

Sample Problem:

Product Costs: DM, DL, IM, IL, FF

Period Costs: Selling, Admin

Factory Property Taxes

Cardboard boxes for detergent

Salesperson commission

Supervisor salary, factory

Depreciation on executive autos

Wages of workers on an assembly line

Insurance on finished goods warehouses

Lubricants for production equipment

Advertising

Microchips on calculators

The workers who set up the machines for production

FF

DM

Selling

IL

Admin

DL

Selling

FF (isn’t part of the product, so it’s not IM)

Selling

DM

DL

Classifying Manufacturing Firm Costs

Sample Problem:

Product Costs: DM, DL, IM, IL, FF

Period Costs: Selling, Admin

Costs of shipping merchandise sold

Magazines for factory lunchroom

Thread in garments

Premiums on Executive Life Insurance policy

Ink for textbooks

Fringe benefits for assembly line workers

Yarn used to make sweaters

Wages of executive receptionist

Property taxes on finished goods warehouses

Factory equipment maintenance personnel

Selling

FF

IM

Admin

IM

DL

DM

Admin

Selling (already made and not in factory)

IL

The overhead rate is budgeted ___ ___ divided by budgeted ____.

overhead costs; hours

Classifying Manufacturing Firm Costs Question:

How do you determine whether something is considered a material in manufacturing, and how do you tell if it's direct or indirect?

What would a material ordered specifically for a product be? (Indirect or direct)

It must be part of the product to be a material. Indirect or direct is determined by the cost.

Direct

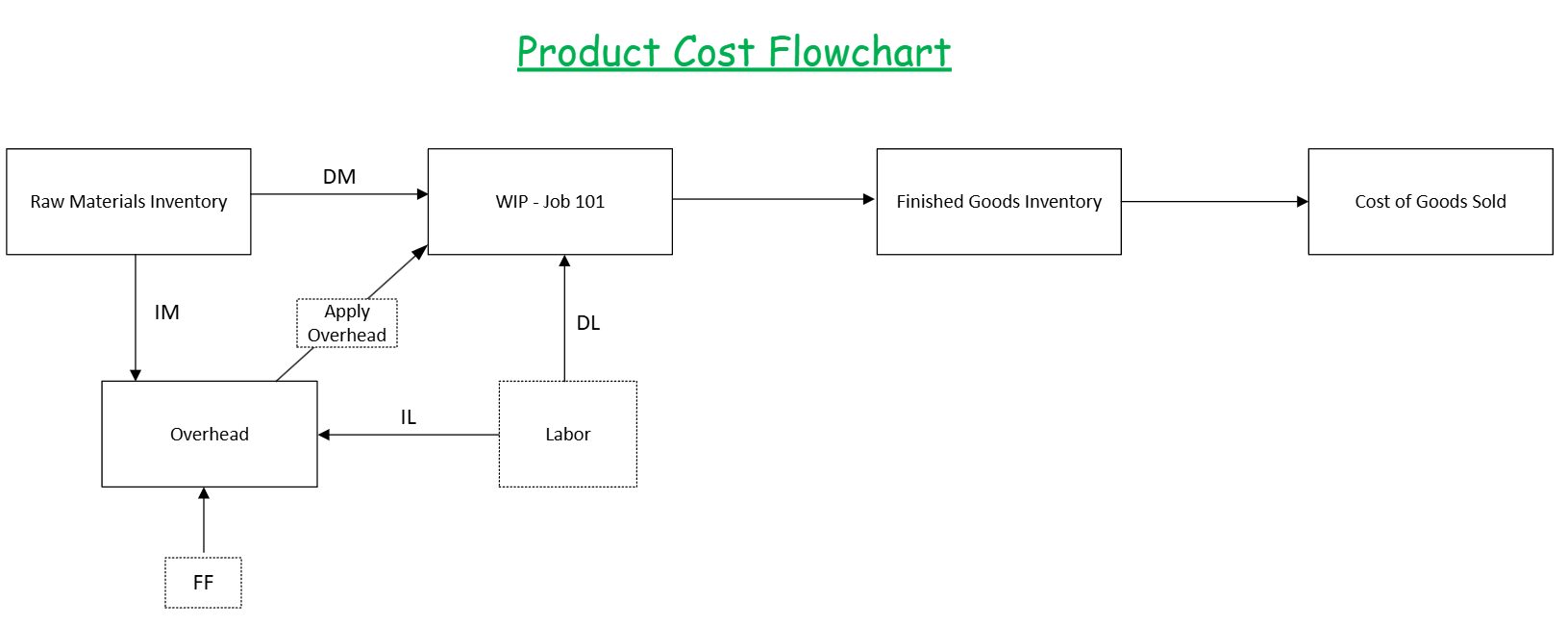

Fill in the blanks for the Product Cost Flowchart using the following terms:

Keep in mind this is to help you with journal entries.

Raw Materials Inventory

Overhead

WIP - Job 101

Labor

Finished Goods Inventory

Cost of Goods Sold

DM

IM

DL

IL

FF

Apply Overhead

Question 1: Which direction is a debit and credit?

Question 2: What would be the credit for FF

Question 3: What would be the credit for Labor?

Question 4: What would be the credit for Raw Materials Inventory?

Debit the account the arrow is pointing towards and credit the account the arrow is pointing away from

Cash or accounts payable, or accumulated depreciation for factory-related depreciation.

Cash or wages payable.

Cash or accounts payable

Job Order Costing Journal Entries Worksheet

Sample Problem:

Jackson Co. had only one job to work this month; Job 7. This job has not yet been started when the month began. The following transactions relate to this month’s production. Prepare the journal entries for each.

$80,000 of materials were purchased on account

$76,000 of the materials were issued for use in production on Job 7. $64,000 of these were direct materials, the rest Overhead.

Total factory payroll for this month was $84,000. 80% of this amount was for direct labor used on Job 7.

Depreciation of $15,000 was incurred on factory assets; and $9,000 of other costs related to factory facilities were incurred on account.

Factory overhead for the year was budgeted at $600,000 and direct labor hours for the year were budgeted at 150,000. The number of direct labor hours worked this month on Job 7 was 12,800.

Job 7 was completed and transferred to the finished goods warehouse.

Job 7 was sold on account for 35% above cost and shipped to the customer (2 entries needed)

Prepare the Journal entry to close the overhead account (to cost of goods sold). Was it over-applied or under-applied? (use a T-account)

What is the Cost of Goods Manufactured?

Debit Raw materials inventory $80,000 / Credit Accounts Pay $80,000

Debit WIP Job 7 $64,000 and Overhead $12,000 / Credit Raw Materials Inventory $76,000

Debit WIP Job 7 $67,200 (84,000 × 0.8) and Overhead $16,800 / Credit Cash $84,000

Debit Overhead $24,000 (15 + 9) / Credit Accum Dep. $15,000 and Accounts Pay $9,000

Labor rate = $600,000 / 150,000 = $4/hour

$4 × 12,800 = $51,200 direct labor

Debit WIP Job 7 $51,200 / Credit Overhead $51,200(add all the Wips)

Debit Finished Goods Inventory $182,400 / Credit WIP Job 7 $182,400$182,400 × 1.35 = $246,240

Debit COGS $246,240 / Credit Finished Goods Inventory $246,240

Debit Accounts Receivable $246,240 / Credit Sales $246,240(add all the overheads in the T-Account)

Manufacturing Overhead Account

1. 12,000 |

2. 16,800 |

3. 24,000|

+ ______| 4. 51,200 -

52800 51200

1600 debit balance

(underapplied)

Debit COGS 1,600 / Credit Overhead $1,600

If it’s overapplied, Credit Overhead and Debit COGS$182,400

Do the Process Costing Practice Problem Weighted Average in your Microsoft 365 account, personal email.

Do the Process Costing Practice Problem FIFO in your Microsoft 365 account, personal email.

Cost-Volume-Profit Analysis Practice

Pool Company’s variable costs are 45% of sales. Pool is contemplating an advertising campaign that will cost $36,000. If sales are expected to increase $120,000, the company’s net income will increase by:

a. $28,800

b. $18,000

c. $84,000

d. $30,000

Sales

- VC

CM

-FC

NI

Sales

- VC 45%

CM 55%, Since CM = NI, that means…

120,000 × 55% = 66,000 income increase

66,000 income - 36,000 cost = $30,000 increase; D

Cost-Volume-Profit Analysis Practice

The following info pertains to Sisk Co:

Sales (50,000 Units)………………………………$1,000,000

Direct materials & Direct labor (both are variable) $475,000

Other Variable costs………………………………….$75,000

Fixed Costs…………………………………………..$121,500

What is the breakeven point in units?

a. 11,571

b. 13,500

c. 12,250

d. 18,493

First, calculate CM, which is Sales - VC

1 million - 475k - 75k = $450,000

Then, divide CM by the amount of units to get CM per unit!

$450,000 / 50,000 = $9 per unit

lastly, divide the fixed costs by the CM per unit

121,500 / $9 = 13,500 units; B

Cost-Volume-Profit Analysis Practice

Jack Co. can increase sales by 43% by spending $37,000 on advertising. If the CM for Jack Co. is currently $120,000, the impact of this decision on net income will be:

a. $14,600

b. $83,000

c. $35,690

d. $18,493

( $120,000 × 1.43 ) - $37,500 = 14,600; A

If sales goes up, so will CM and Net Income proportionately.

Cost-Volume-Profit Analysis Practice

Sales………………6,000 units

Sales price………..$135 per unit

Variable costs…….$85 per unit

Fixed costs……….$30,000

How many units will the company need to sell to reach a target net income of $120,000?

a. 2.400

b. 1,800

c. 3,000

d. 7,800

Relevant equation:

FC + NI /

CM/unit

First we find CM per unit by subtracting sales price from VC.

135 - 85 = $50 CM per unit

Then we plug it into the equation with the rest!

30,000 + 120,000 / 50 = 3,000; C

Cost-Volume-Profit Analysis Practice

Sales…………………….$620,000

-Variable Costs…………$434,000

Contribution Margin……$186,000

-Fixed Costs…………….$120,000

Net Income……………..$66,000

The president believes that a 10% reduction in the selling price would increase sales volume by 50%. If both of these changes occur, what would be the effect on net income?

a. No change

b. $217,000 increase

c. $74,400 increase

d. $70,000 increase

First, we apply the 10% reduction to sales and 1.5x sales volume

( 620,000 × 90% ) x 1.5 = $837,000 Sales

Them apply the 1.5x sales volume to VC too, cuz more production

434,000 × 1.5 = $651,000 VC

Now we complete the Income statement and compare!

837,000

-$651,000

186,000

-$120,000

$66,000; No change!

Cost-Volume-Profit Analysis Practice

Sales…………………….$620,000

-Variable Costs…………$434,000

Contribution Margin……$186,000

-Fixed Costs…………….$120,000

Net Income……………..$66,000

What must Jones sales be to break even (in dollars?)

a. $554,000

b. $486,000

c. $578,000

d. $400,000

Relevant equations:

Breakeven (dollars) = FC / CMR

CMR = CM / Sales

First we find CMR

$186,000 / $620,000 = 0.3

Then we find Breakeven in dollars.

120,000 / 0.3 = $400,000; D

Cost-Volume-Profit Analysis Practice

Sales………………………………$800,000

Contribution Margin Ratio…………..30%

Degree of Operating Leverage……..12

Use the three figures above to determine Net Income.

a. $40,000

b. $20,000

c. $24,000

d. $48,000

800,000 × 0.3 = 240,000

240,000 / 12 = 20,000; B

Cost-Volume-Profit Analysis Practice

Sales………………………………$800,000

Contribution Margin Ratio…………..30%

Degree of Operating Leverage……..12

What would be the percentage increase in net income if their sales increase by $60,000? (Hint: Compute the percentage increase in sales then use DOL to solve for the net income percentage increase)

a. 75%

b. 90%

c. 300%

d. 200$

First we find out how much of 800,000 the increase is.

60,000 / 800,000 = 7.5% increase in sales

Then we multiply it by the DOL to find the answer

0.075 × 12 = 0.9 = 90%; B

Company produces and sells products, A and B. The company has provided the following monthly data relating to these two products.

…………………………………….……..A……………B

Selling Price Per Unit…………….….$250……….$160

Variable Cost………………….…….…140………….95

Expected Monthly Sales (units)……2000………..3000

Total monthly fixed cost: $332,000

How many units of each product must be sold to break even?

a. 1,660 of A and 2,490 of B

b. 2,500 of A and 3,750 of B

c. 1,175 of A and 1,763 of B

d. 1,600 of A and 2,400 of B

First, lets fill in the CM and total margin

…………………………………….……..A……………B

Selling Price Per Unit…………….….$250……….$160

Variable Cost………………….……...-140…………-95

………………………………………..$110………….$65

Expected Monthly Sales (units)…x 2000………x 3000

Total Margin………………………$220,000..+..$195,000 = $415,000

Total monthly fixed cost: $332,000

Next we divide the Fixed cost by the total margin to find our breakeven percentage.

332,000 / 415,000 = 80%

Lastly we apply the percentage to each expected sales!

2000 × 80% = 1,600 of A

3000 × 80% = 2,400 of B

Answer is D

Cost Volume Profit Analysis Practice Problem

Sample:

Sales……………..…$100,000

Variable Expenses…..$60,000

Fixed Expenses……...$25,000

What is the break even point in sales dollars?

Applicable formulas:

Breakeven in sales = Fixed Costs / CM ratio

CM ratio = CM / Sales

First we need to find the CM

100,000 - 60,000 = 40,000

Then we need the CMR

40,000/100,000 = 0.4

Use CMR to find the answer!

25,000/0.4 = $62,500

Budgeting Practice:

Fill in the blanks for the formulas.

Sales Budget: Budget sales revenue

1. Units to sell x ____

Units to sell x selling price

Budgeting Practice:

Fill in the blanks for the formulas.

Production Budget: Budget the number of units that will have to be made

Units to sell + ____ ___ ___ - _____ ______ = Units to make

Units to sell + Desired ending inventory - Beginning inventory = Units to make

Budgeting Practice:

Fill in the blanks for the formulas.

Direct Materials Budget: Budgeting the cost for materials to buy

Units to make x ____ ____ __ ___ = Production needs

Production needs + ___ ___ ___ - ___ ___ of materials = materials to buy.

Materials to buy x ___ ___ ___ = total budgeted cost of materials purchases

Units to make x Materials Quantity per Unit = Production needs

Production Needs + Desired ending inventory - beginning inventory of materials = materials to buy

Materials to buy x cost per yard = Total budgeted cost of materials purchases.

Budgeting Practice:

Fill in the blanks for the formulas.

Labor budget: Budget labor cost

Units to make x _____ x _____

Units to make x Hours to make a unit x labor rate per hour

Budgeting Practice:

Fill in the blanks for the formulas.

Overhead Budget: Budget Overhead cost

Units to make x ______________ = Budgeted VC

Budgeted VC + ___ ___ ___ = Total budgeted Overhead

Units to make x Variable Overhead Cost per Unit

Budgeted VC + Fixed Overhead Cost

Budgeting Practice:

Fill in the blanks for the formulas.

Finished Goods Inventory Budget

___ cost per unit, ___ cost per unit, & ___ cost per unit x ____ ___ ___ = Total cost per unit

Total cost per unit x __________ = Total Budgeted Cost of Finished Goods

DM cost per unit, DL cost per unit, & OH cost per unit x Cost Per Yard = Total Cost per Unit

Total cost per unit x Desired Ending Finished Goods Inventory = Total Budgeted Cost of Finished Goods

Budgeting Practice:

Fill in the blanks for the formulas.

Selling & Administrative Expense Budget

Units to make x ____________ = Budgeted VC

Budgeted VC + ____ _____ = Total Selling & Admin Expense Budget

Units to make x Variable Selling Cost per Unit = Budgeted VC

Budgeted VC + Budgeted FC = Total Selling & Admin Expense Budget

What is indicated by an unfavorable Materials Quantity Variance?

The actual usage of materials exceeded the amount allowed.

What would be the impact on the following variances if a senior employee was placed on the job that was previously performed by part-time, untrained personell?

Labor efficiency variance:

Labor rate:

Efficiency will be favorable because senior employees may get the job done faster

Rate will be unfavorable because you’ll be paying a higher wage, thus more than you budgeted for.

What is indicated by a favorable variable overhead efficiency variance?

VOE variance is an hours variance. Therefore, favorable would mean fewer hours were worked than what would’ve been allowed.

What is indicated by an unfavorable fixed overhead budget variance?

Cost increases in fixed overhead (rent, taxes, insurance, etc)

What is indicated by an unfavorable fixed overhead volume variance?

Fewer units were produced than had been budgeted. (Idle capacity is a bad thing)

ROI is compared to ____ _____ while Residual is compared to ____.

Current ROI, Minimum Required Rate of Return (MRRR)

What is the equation for residual income?

Residual = (___ - ____) x ______

Residual = (ROI - MRRR) x Average Operating Assets

What is the equation for ROI?

ROI = __________ / _________

ROI = Net operating income / Average Operating Assets

Measuring Investment Center Performance

A division is considering a new project that yields 18%. The division currently has an ROI of 20%; the MRRR for the division is 14%. How will the division’s ROI and Residual Income be impacted if the project is accepted?

20% ROI > 18% > 14% MRRR

ROI will decrease, Residual will increase

Measuring Investment Center Performance

What is the best way to measure the performance for comparing two managers to each other? (ROI/Residual)

What is the best way to compare a manager’s performance this year to his performance last year? (ROI/Residual)

What is the best way to compare the performance of two divisions that are different sizes? (ROI/Residual)

ROI

Residual

ROI

Fill in the blanks: (greater than, less than, equal to)

A positive Residual = ROI is ____ MRRR

0 Residual = ROI is _____ MRRR

A negative Residual = ROI is _____ MRRR

Greater than

Equal to

Less than

Relevant Costs for DIfferential Analysis

Product A has 40 CM per unit and takes 2 hours to make. Product B has 25 CM per unit and takes 1 hour to make. Which unit should be made first (which has the most CM/hour)?

Divide the CM by the hour to find CM/hour to get answer.

Product A: 40 / 2 = 20 CM per hour

Product B: 25 / 1 = 25 CM per hour

Product B first

Jones Company has two divisions, A and B. Division A’s capacity is 20,000 units per month; the division has an average monthly demand for 17,000 units from outside customers and earns a margin of $20 on each unit. Division B would like to buy 4,000 units each month from Division A. How much must Division A add to the transfer price to recoup the opportunity cost of lost external sales?

Find out the opportunity cost

17,000 + 4,000 = 21,000 total demand.

1,000 lost demand from customers; $20,000 (1,000 × 20)

Distribute the lost CM to the 4000 units

20,000 / 4000 = $5 per unit added on.

Relevant Costs for Differential Analysis: Make or Buy?

James’s Company costs for 2,000 units of Part C are as follows:

Direct Materials…………..….$3

Direct Labor…………….……$7

Variable Overhead……….…$4

Fixed Overhead Applied……$6

Total Cost……………………$20

Jesse Company has offered to sell James 2,000 units of Part C for $17 per unit. If James accepts the offer, the released facilities would be used to save $3,500 in relevent costs in the manufacturing of part D. However, $4 per unit of the fixed overhead applied to Part C would continue to be incurred by the company even if production of Part C were discontinued. How would net income be impacted if James accepted the offer?

Before we compare, we need to sort the relevant costs. Since $4 of FOA would continue to be incurred, it is irrelevant.

Direct Materials…………..….$3

Direct Labor…………….……$7

Variable Overhead……….…$4

Fixed Overhead Applied……$6 2

Total Cost……………………$20 16

Now we directly compare!

$16 cost to make

$17 cost to buy

$1 more to buy

Next, we determine the total cost and factor in the savings to get our answer.

$1 × 2000 = $2,000 cost - 3,5000 relevant savings = $1,500 Increase in Net Income

Relevant Costs for Differential Analysis: Sell or Invest?

Sample Problem:

Old Inventory cost $5,000

Can sell now for $6,000

Or process further at a cost of $2,000 and sell for $7,000

What is the advantage/disadvantage of processing further?

Simply compare cash flows

A: + $6,000

B: + $5,000 (7,000 - 2,000)

Processing further is inferior by $1,000.

Relevant Costs for Differential Analysis: Keep or Drop?

Sample Problem:

A company is considering the discontinuation of one of its product lines. The product line has a CM of $45,000 and fixed costs of $52,000. $4,000 of the fixed costs cannot be eliminated if it’s dropped. What would be the impact on net income if the company drops the product line?

Put it in a cash flow basis

-$45,000 in lost CM

+$48,000 saved FC (52-4)

$3,000 increase in net income

T/F A dollar is worth more today than a dollar at any future time.

True

Capital Expenditure Decisions

Sample Problem:

An investment will yield cash inflows of $1,000 per yer in each of the next 4 yaers. What is the cost of the investment if the internal rate of return is 18%? (Use your PV/FV table)

Infow: 1000

Periods: 4

Rate: 18%

Factor (PVA): 2.690

1,000 × 2.690 = $2,690.

T/F The Payback method of evaluating competing investments tells you how profitable the investments are.

False; it only tells you how long your money is held up for.

Working Capital requires a cash ____ (inflow/outflow) when the project begins, and generates a cash ____ (inflow/outflow) when the project ends.

Requires a cash inflow, generates a cash outflow.

T/F Relevant costs can include depreciation and allocated/common products needed for other products.

False. Relevant costs are costs than can be saved and do not include Depreciation and allocated/common products.

What is the MACRS method for?

Used for depreciation of assets for tax purposes. Residual is assumed to be 0 and purchase date is assumed to be July 1st.

If NPV < 0, you make _____ the rate

If NPV = 0, you make _____ the rate

If NPV > 0, you make _____ the rate

Less than

Equal to

More Than

Investments NPV practice

A company has a used machine with a current disposal price of $50,000, and an estimated remaining life of 8 years. A new machine is available at a price of $320,000. The new machine has the same estimated remaining life and the same capacity as the old machine, but would reduce energy costs by $65,000 per year. Both machines would have $0 salvage value. Using a discount rate of 16%, compute the net present value of a decision to replace the old machine with the new one.

Use the appropriate PVA/PV/FV/FVA table.

Find the factor; always use the annual cash flows

65,000; 8 periods; 16%; PVA because it’s yearly & we’re finding the Present value.

Factor: 4.344

PV = 4.344 × 65,000 = $282,360

Now we must subtract the cost of the new machine and add the salvage value of the old machine.

282360 - 320,000 + 50,000

NPV = $12,360

Investments NPV practice

A new machine costing $1,521,245 will yield cash savings of $240,000 each year for 15 years. It’s also anticipated the new machine will increase productivity and therefore increased margin. What annual dollar inflow from increased margin would the company have to experience to make the machine an acceptable investment if the minimum desired rate of return is 20%?

Applicable formula: Cost/Factor - Savings = NPV

First we find the factor

240,000; 15 periods; PVA

Factor: 4.675

Then we use the equation

1521245/4.675 - 240000 = $85,400

Investments NPV practice

A company purchased a machine with an estimated useful life of 15 years. The machine will generate cash inflows of $12,000 each year over the next 15 years. The machine will have no salvage value. If the NPV of this investment is 16,000, then what was the cost of the machine? Use a discount rate of 14%.

First we find the PV.

12,000; 15 periods; PVA; 14%

Factor: 6.142

PV = 12,000 × 6.142 = 73,704

Normally we would subtract the cost from the PV to find NPV. But we already know NPV and want to find out the cost. We can set up a little equation and solve for X.

73,704 - X = 16,000.

-x = 16,000 - 73704

-x = -57704

Cost = $57,704

A project will require an investment of $25,000. Anticipated cash flows are: $5,000 in year 1; $10,000 in year 2; and $4,000 in years 3-10. What is the payback period?

Year 1: 5,000 | Balance: (20,000)

Year 2: 10,000 | Balance: (10,000)

Year 3: 4,000 | Balance: (6,000)

Year 4: 4,000 | Balance: (2,000)

Year 5: 4,000 | Balance: 2,000

Payback period is 4.5 years

It’s 4.5 because in year 5, the cash flows are $ 4,000, while the balance is $ 2,000. Therefore, it will be paid off somewhere in the middle.