3.4 Market structures

1/61

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

62 Terms

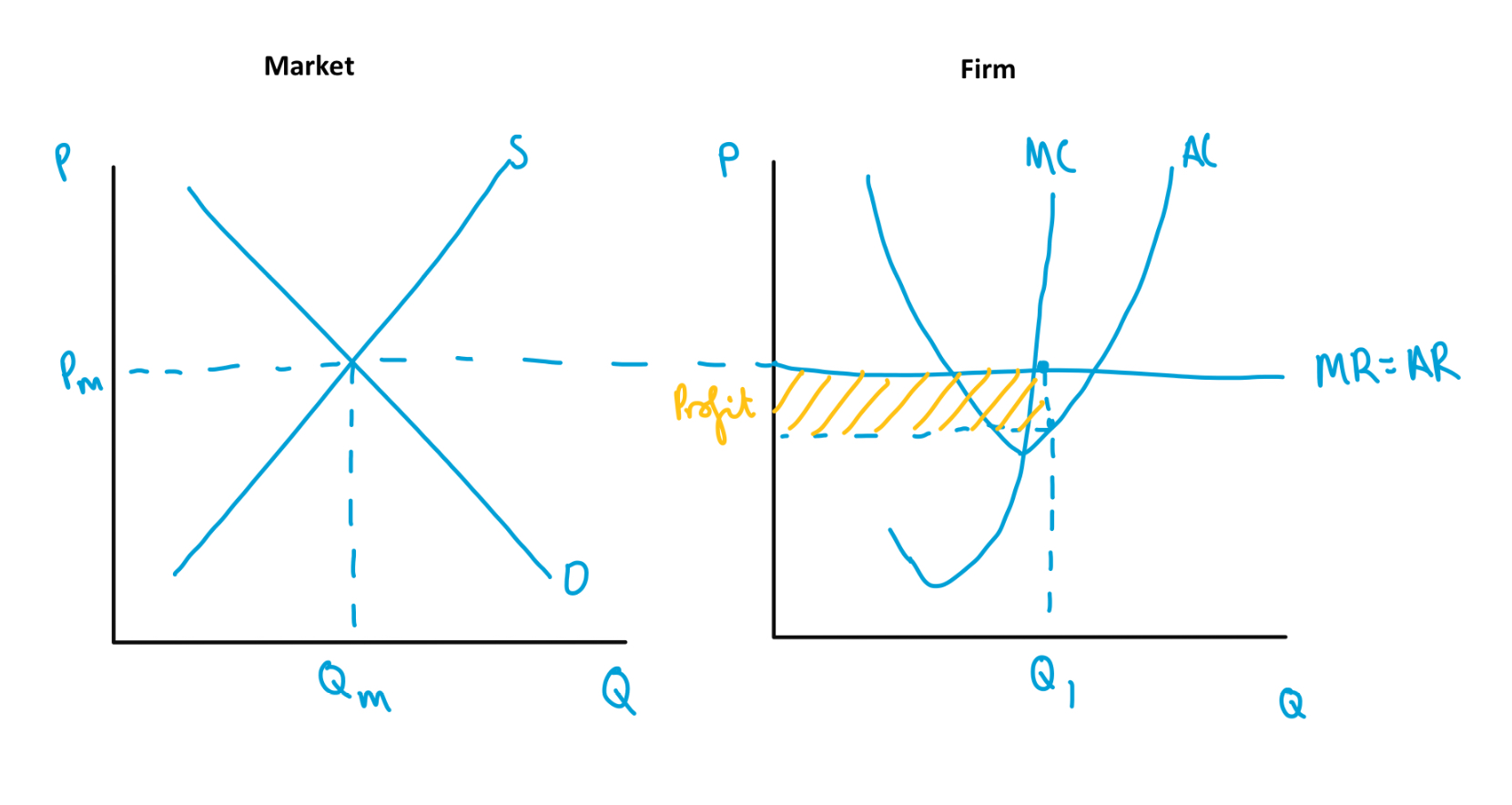

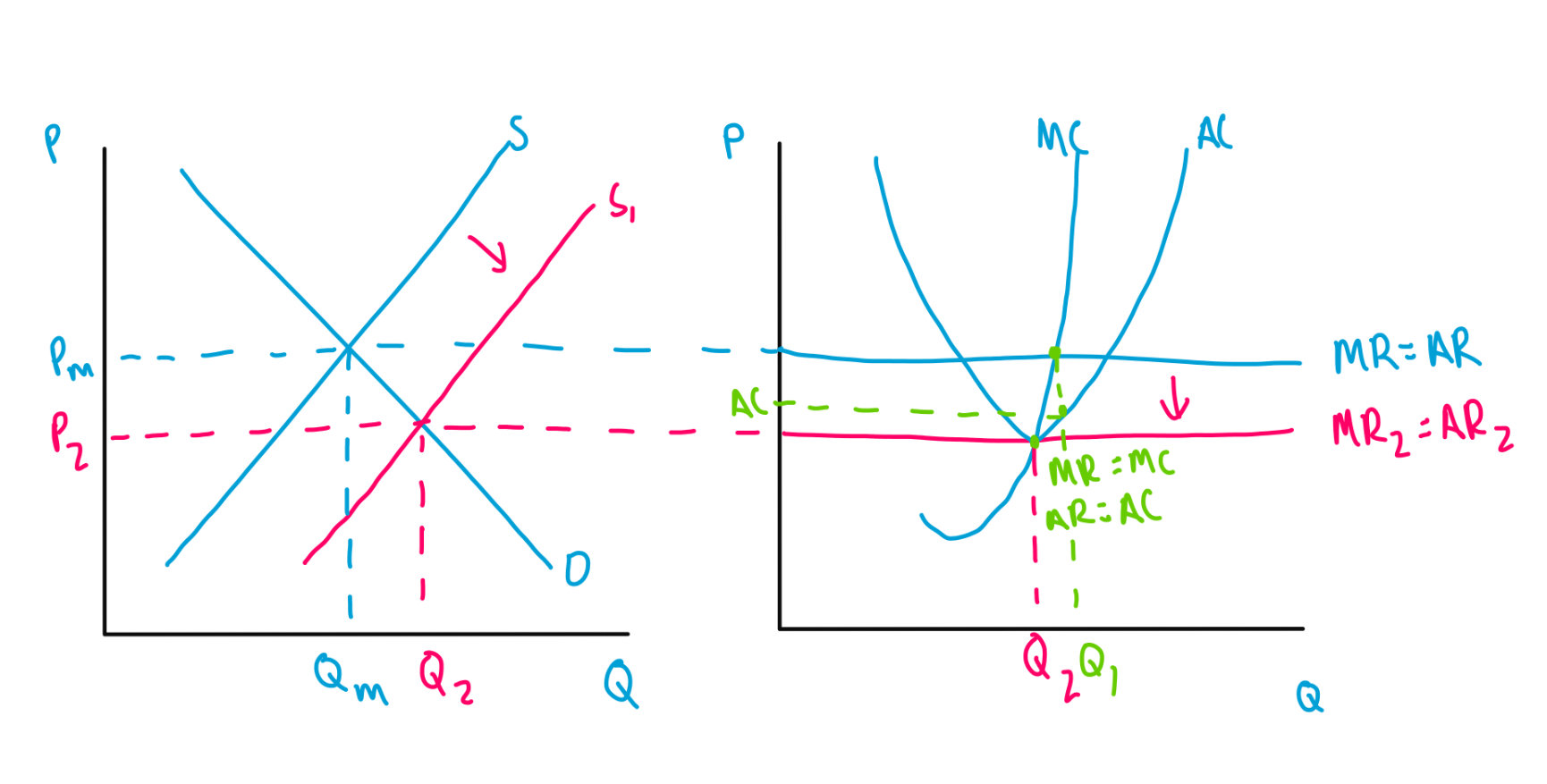

Perfect competition diagram in the short run

Perfect competition diagram in the long run

Perfect competition productive efficiency in short run

unlikely as not operating at bottom of AC curve

Perfect competition productive efficiency in long run

yes- firms cannot make a profit or loss in the long run, therefore must be operating at the bottom of the AC curve

Perfect competition allocative efficiency in short run

yes- as P=AR, AR=MR and MR=MC, P=MC, which is the condition for allocative efficiency

Perfect competition allocative efficiency in long run

yes- as P=AR, AR=MR and MR=MC, P=MC, which is the condition for allocative efficiency

Perfect competition dynamic efficiency in short run

no- profits are unlikely to be high enough to invest

and as firms have perfect information firms are not incentivised to innovate as other firms will copy them

Perfect competition dynamic efficiency in long run

no- firms can only make normal profit, so do not have enough to invest

and as firms have perfect information firms are not incentivised to innovate as other firms will copy them

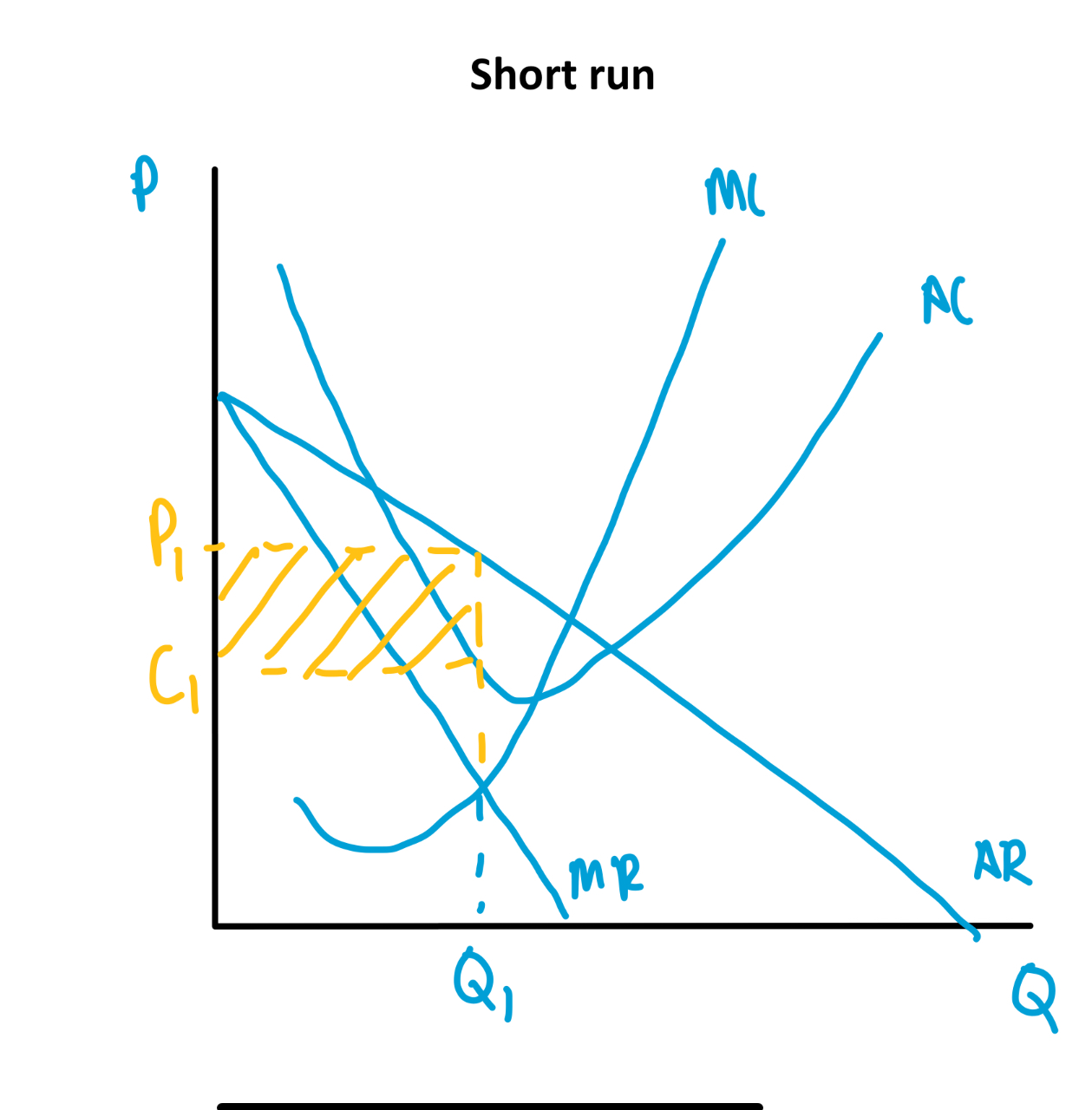

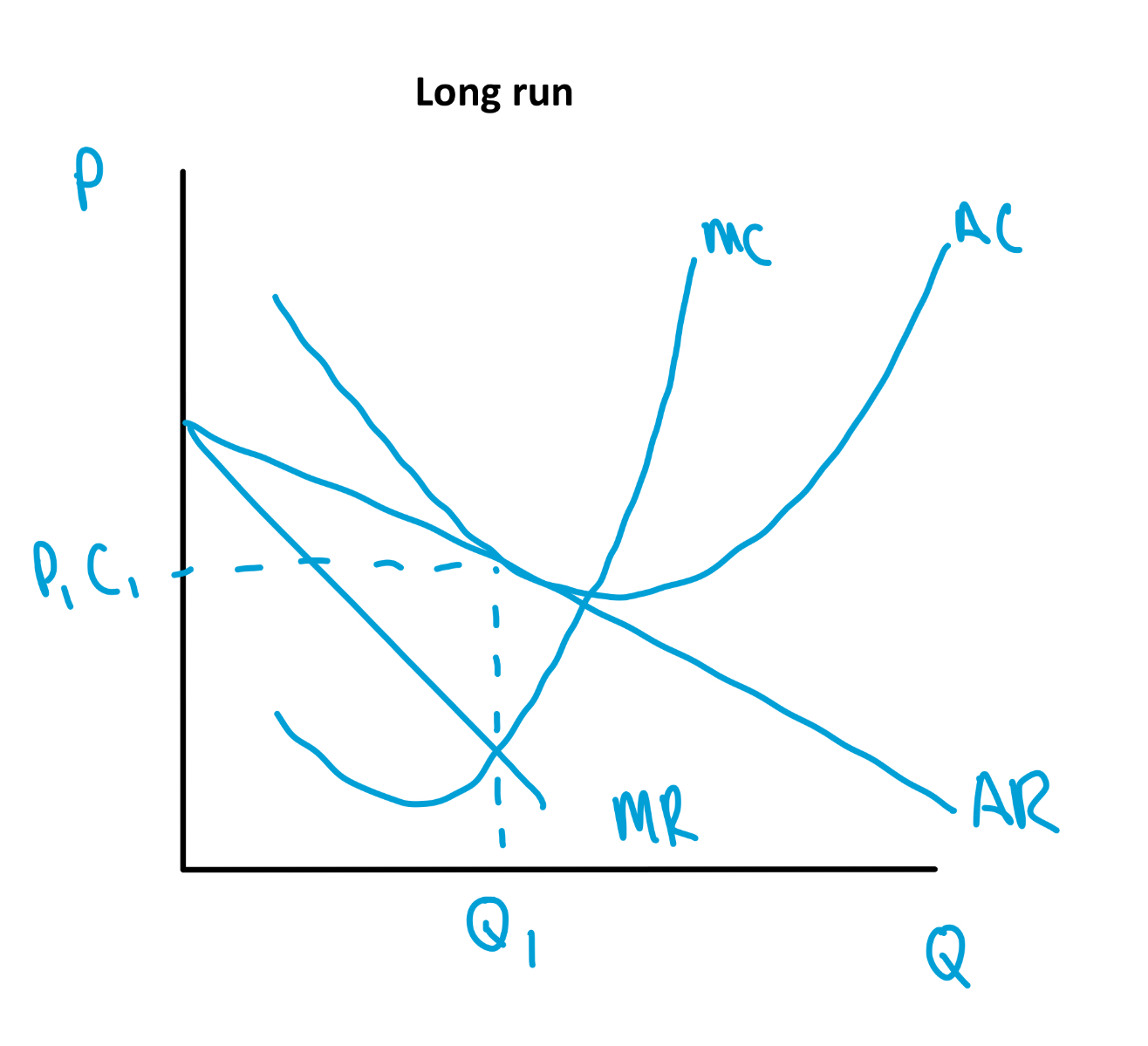

Short run Monopolistic competition

Long run Monopolistic competition

Example industries

restaurants

clothing stores

hairdresssers

nail salons

parcel delivery

Chain of analysis from short run to long run in monopolistic competition

AR and MR are steep in the short run as demand is more price inelastic for products

the existence of SNP incentivises more firms to enter the market, which is possible due to low barriers to entry

as firms enter the market, individual firms’ market share decreases

revenue curves/ demand curves shift in and left

there are more substitutes in the market, so demand becomes more price elastic

revenue curves become more shallow

revenue curves shift in until profits are normal, at which point firms stop entering the market

here AR=AC and this is the point at which firms are making normal profit

monopolistic competition productive efficiency in the short run

no as there is some differentiation between products

monopolistic competition productive efficiency in the long run

no- not perfect competition so firms are not forces to be productively efficient

monopolistic competition allocative efficiency in the short run

no as firms will set prices above MC

monopolistic competition allocative efficiency in the long run

no

monopolistic competition dynamic efficiency in the short run

small amount to differentiate products

monopolistic competition dynamic efficiency in the long run

no as there are no SNP

oligopoly kinked demand curve

concentration ratio defention

a measure of how concentrated a market is

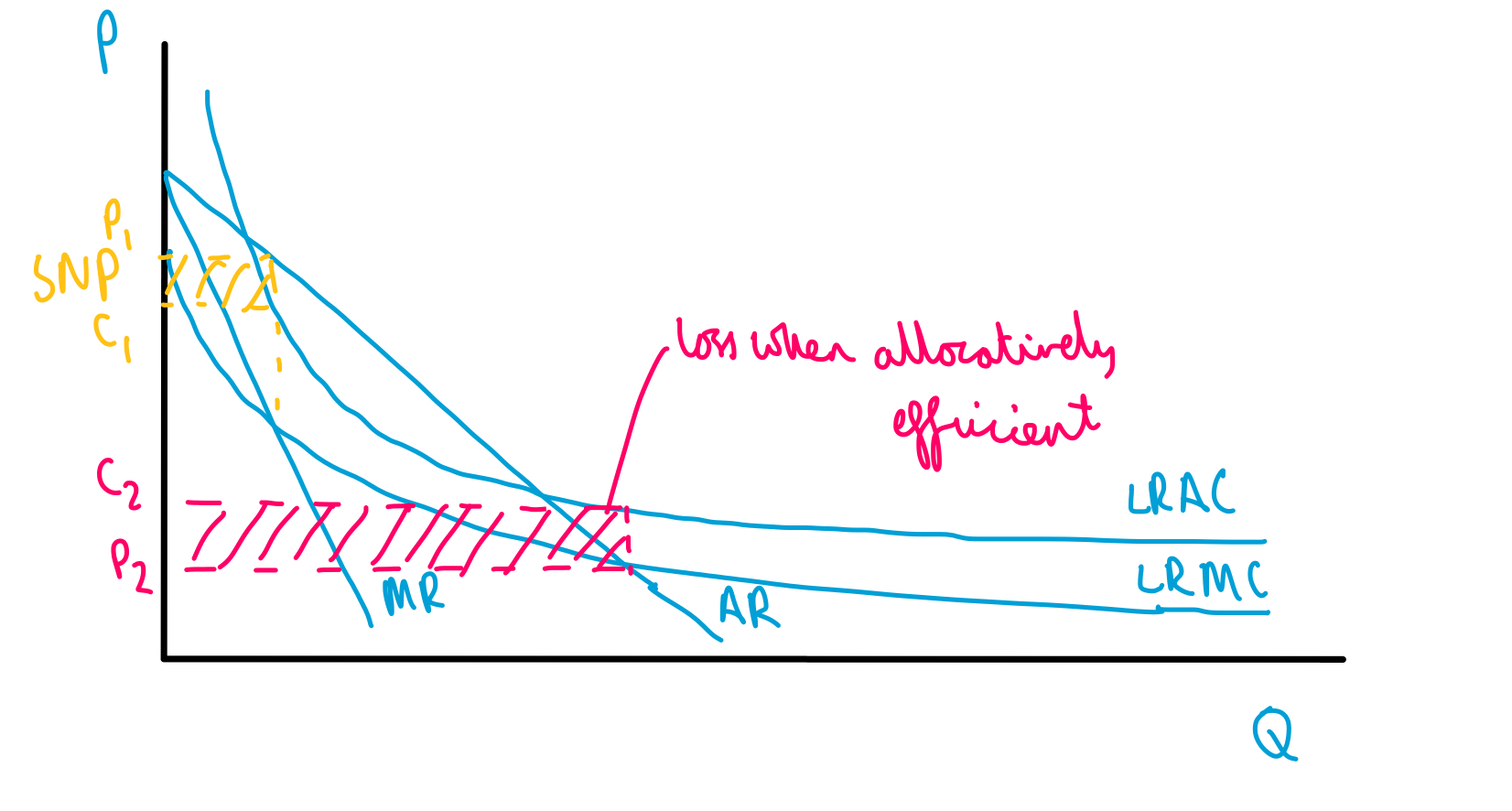

monopoly productive efficiency

unlikely to produce at the bottom of the AC curve as they can charge higher prices which consumers are forced to pay

monopoly allocative effiiciency

no as the point at which AR=MC is below the profit maximising point, so the good will be underconsumed

monopoly dyanmic efficiency

potentially due to presence of SNP, however unlikely due to lack of pressure from competition, depends on level of contestability

Natural Monopoly diagram

Why is LRAC downward sloping for a monopoly

economics of scale due to very high fixed costs and low marginal costs, as natural monopolies are often utilities

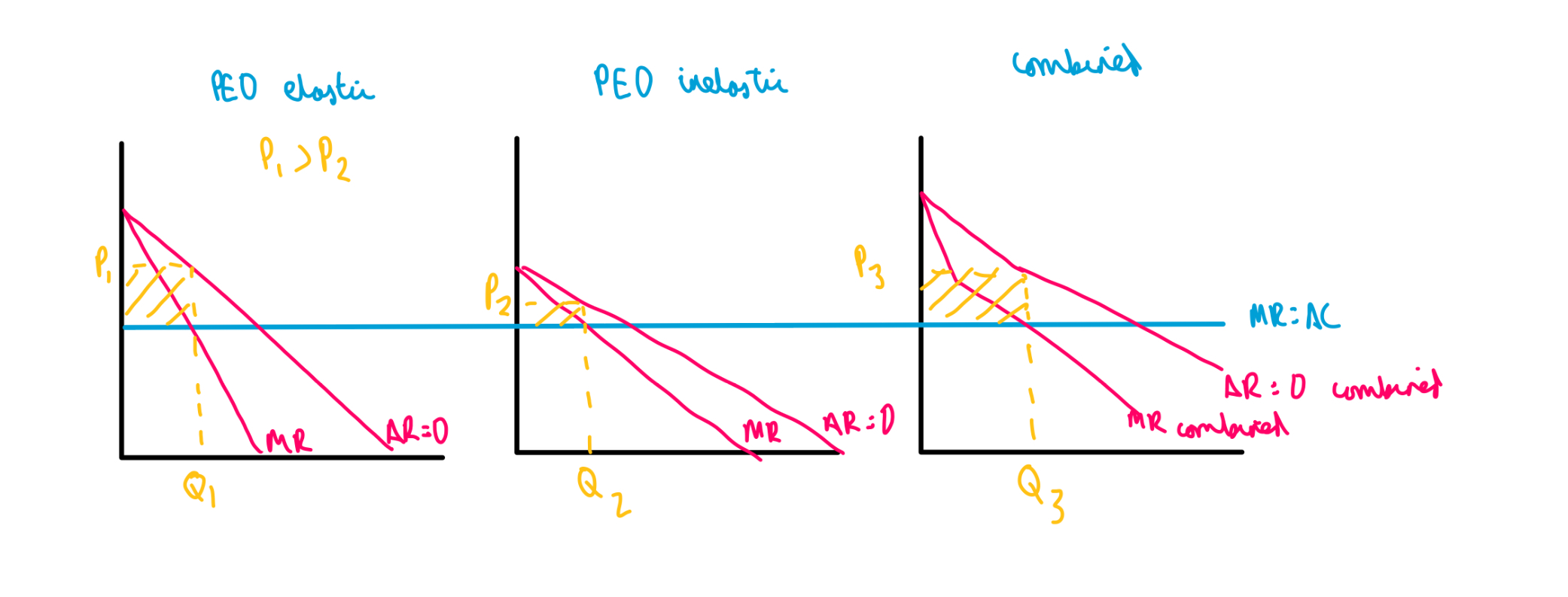

What is third degree price discrimination

when a seller charges different prices to different segments of customers for the same product

3 diagrams to show how third degree price discrimination is used in a market segment with price inelastic demand, price elastic demand and the overall marke

benefits to firms of price discrimination

increase revenue, might allow some firms to stay in business when they otherwise would have made a loss

benefits to consumers of price discrimination

spreads out demand eg for trains, reducing congestion

increases revenue for firms leading to SNP potential for dynamic efficiency and innovations

higher earners essentially subsidise lower earners

drawback to firms of price discrimination

administrative costs in separating the markets

drawback to consumers of price discrimination

some consumers will end up paying higher prices, which is likely to be allocatively inefficient

decline in consumer surplus

those paying lower prices may not be the poorest

profits could be used to finance predatory pricing

define efficiency

making optimal use of scarce resources

Productive efficiency

occurs at the level of output at which a firm operates at its lowest possible average cost

so minimum point of AC curve, which is where MC=AC

Allocative efficieny

occurs at the level of output where price=marginal cost, or where AR=MC

goods and services are produced in the quantities that best satisfy consumer preferences and maximise social welfare

X-efficiency

occurs when a firm minimises AC at a given level of output (so not necessarily the minimum point on the AC curve)

static efficiency

includes productive, allocative and x-efficiency

how well resources are being used at one point in time

dynamic efficiency

when potential gains to efficiency are maximised over time through R&D leading to invention and innovation

If an economy is productively efficient, where would it be on a PPF

on the PPF curve

DWL from allocative efficiency

what can x-inefficiency be caused by

wasteful and inefficient spending, eg. company retreats or excessive benefits

how are productive and x-efficiency different

productive efficiency only occurs at one output level, whereas x-efficiency can occur at any level of output

types of innovation

product innovation: improvements to products like adding face ID

process innovation: improvements to the way products are made/sold eg. online shoppig

what effect will dynamic efficiency have on the LRAC curve

shift LRAC in in the long term, as higher output per worker will be enabled

what is nessecary for dynamic efficiency

high profits

does dynamic efficiency lead to more or less competition in markets

depends upon whether it builds monopoly power

condition for monopoly

25% or greater market share

oligopoly defenition

a market in which a few large firms dominate

oligopoly concentration ratio

5 firm concentration ratio must be greater than 60%

characteristics of an oligopoly

5 firm concentration ratio is greater than 60%

compete through non-price competition

high barriers to entry and exit, especially through advertising, heavy spending on product development and R&D

ease of entry to the market is harder for smaller firms

interdependence

possibility for collusion

3 ways firms can choose prices in an oligopoly

price leadership

price agreement

price wars

pricing game payoff matrix

assumptions of matrix

only two firms

perfect information

simple 2 choice stratergy

what is both firms dominant stratergy

high output

what is the nash equilibrium

both high output

nash equilibrium meaning

both players play dominant strategy

dominant strategy meaning

best choice regardless of what other firm does

do the firms have an incentive to deviate from the nash equilibrium

no, as it would lower their profits

what would collusion lead to

both produce at a low output. however this may be unsustainable, as there is an incentive for each firm to switch to high output to increase their profits

types of collusion

horizontal collusion

vertical collusion

overt collusion

tacit collusion

why do firms collude

to maximise profits, eg. by reducing wasteful spending on marketing

collaboration that isnt legally collusion

sharing information that improves consumer safety

working to improve information that customers have access to

improving production or distribution of goods

overt collusion

when firms actively make an agreement to collude