exam 2 cost acc Multiple choice

1/17

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

18 Terms

Which of the following companies is most likely to use process costing?

C) Dental Bright Inc., a company manufacturing and selling toothpaste on a large scale

Serile Pharma places 840 units in production during the month of January. All 840 units are completed during the month. It had no opening inventory. Direct material costs added during January was $106,000 and conversion costs added during January was $11,600. What is the total cost per unit of the product produced during January?

140

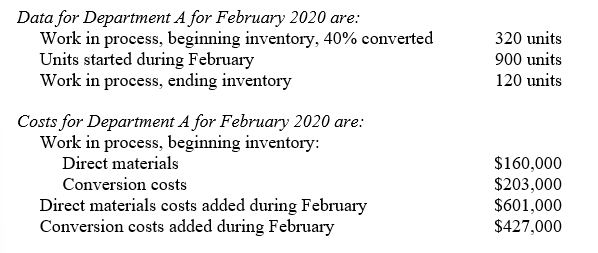

Charlie Chairs Inc., manufactures plastic moldings for car seats. Its costing system utilizes two cost categories, direct materials and conversion costs. Each product must pass through Department A and Department B. Direct materials are added at the beginning of production. Conversion costs are allocated evenly throughout production.

1100 units

Assembly department of Zahra Technologies had 100 units as work in process at the beginning of the month. These units were 60% complete. It has 300 units which are 25% complete at the end of the month. During the month, it completed and transferred 600 units. Direct materials are added at the beginning of production. Conversion costs are allocated evenly throughout production. Zahra uses weighted-average process-costing method. What is the total equivalent units in ending inventory for assignment of direct materials cost?

300 units

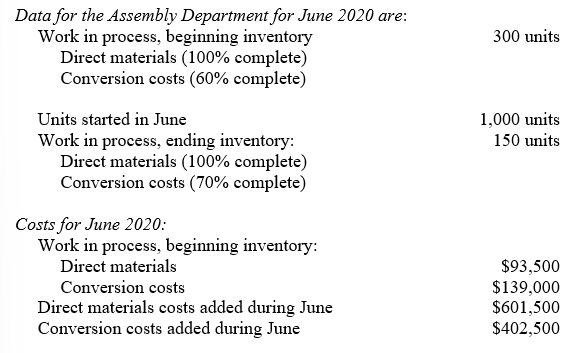

5. Timekeeper Inc. manufactures clocks on a highly automated assembly line. Its costing system uses two cost categories, direct materials and conversion costs. Each product must pass through the Assembly Department and the Testing Department. Direct materials are added at the beginning of the production process. Conversion costs are allocated evenly throughout production. Timekeeper Inc. uses weighted-average costing.

$534.62

6. Comfort chair company manufacturers a standard recliner. During February, the firm's Assembly Department started production of 73,400 chairs. During the month, the firm completed 78,700 chairs, and transferred them to the Finishing Department. The firm ended the month with 10,300 chairs in ending inventory. There were 15,600 chairs in beginning inventory. All direct materials costs are added at the beginning of the production cycle and conversion costs are added uniformly throughout the production process. The FIFO method of process costing is used by Comfort. Beginning work in process was 35% complete as to conversion costs, while ending work in process was 70% complete as to conversion costs. What is the amount of direct materials cost assigned to ending work-in-process inventory at the end of February?

(Round intermediary calculations to the nearest cent.)

23587

For February, the cost components of a picture frame include $0.37 for the glass, $0.62 for the wooden frame, and $0.87 for assembly. The assembly desk and tools cost $590. Two hundred fifty frames are expected to be produced in the coming year. What cost function best represents these costs?

B) y = 590 + 1.86X

8. Which of the following would most likely exhibit a cause and effect relationship?

A) The use of materials in the production of bookcases.

9. High Tech Manufacturing Inc., incurred total indirect manufacturing labor costs of $510,000. The company is labor intensive. Total labor hours during the period were 4,000. Using qualitative analysis, the manager and the management accountant determine that over the period the indirect manufacturing labor costs are mixed costs with only one cost driver–labor-hours. They separated the total indirect manufacturing labor costs into costs that are fixed ($130,000 based on 8,900 hours of labor) and costs that are variable ($380,000) based on the number of labor-hours used. The company has estimated 7,500 labor hours during the next period.

C) y = $130,000 + $95.00X

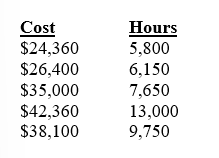

10. The Connors Company has assembled the following data pertaining to certain costs that cannot be easily identified as either fixed or variable. Connors Company has heard about a method of measuring cost functions called the high-low method and has decided to use it in this situation.

D) y = $9,860 + $2.50X

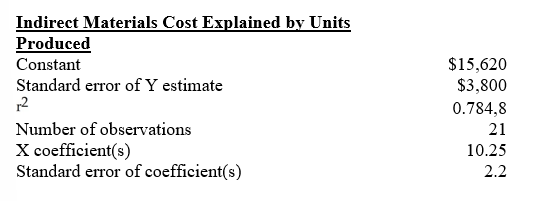

11. The H.W. Grant Corporation used regression analysis to predict the annual cost of indirect materials. The results were as follows:What is the cost estimation equation?

A) Y = $15,620 + $10.25X

12. Lucy and Company is a large bakery. When purchasing flour, it takes advantage of volume discounts, which are granted at percentage discounts that increase at levels such as 100, 500, 1,000, 2,000, and 3,000 pound increments. Lucy and Company would use which type of function for the cost of flour?

C) nonlinear cost function

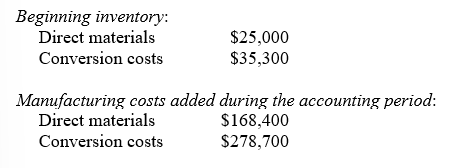

13. South Coast Appliance Store is a small company that has hired you to perform some management advisory services. The following information pertains to 2020 operations. What was the variable cost per unit sold for 2020?

C) $178.00

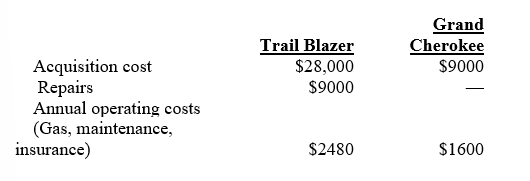

14. John's 8-year-old Chevrolet Trail Blazer requires repairs estimated at $9000 to make it road worthy again. His wife, Sherry, suggested that he should buy a 5-year-old used Jeep Grand Cherokee instead for $9000 cash. Sherry estimated the following costs for the two cars:

A) acquisition cost of the Trail Blazer

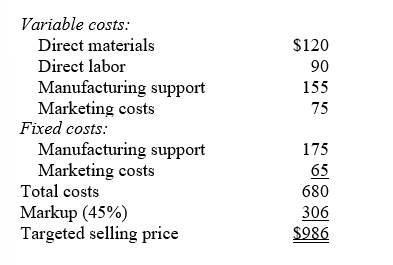

15. Red Rose Manufacturers Inc. is approached by a potential customer to fulfill a one-time-only special order for a product similar to one offered to domestic customers. The company has excess capacity. The following per unit data apply for sales to regular customers:

A) $440

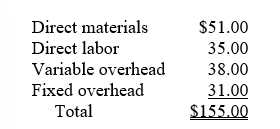

16. Rubium Micro Devices currently manufactures a subassembly for its main product. The costs per unit are as follows:Crayola Technologies Inc. has contacted Rubium with an offer to sell 10,000 of the subassemblies for $140.00 each. Rubium will eliminate $93,000 of fixed overhead if it accepts the proposal. Should Rubium make or buy the subassemblies? What is the difference between the two alternatives?

C) make; savings = $67,000

17. Which of the following is an irrelevant cost when considering where to drop a customer?

C) depreciation

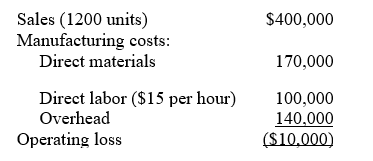

18.State Road Fabricators Inc. is considering eliminating Model A02777 because of losses over the past quarter. The past three months of information for Model A02777 are summarized below:Overhead costs are 60% variable and the remaining 40% is depreciation of special equipment for model A02777 that has no resale value.

If Model A02777 is dropped from the product line, operating income will:

B) decrease by $46,000