14.2 Measuring Money Currency M1 and M2

1/9

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

10 Terms

True or false?

A demand deposit is an investment option in which the deposits of many investors are pooled together and invested in a safe way.

False

A demand deposit is a checkable deposit in a bank that is available by making a cash withdrawal or writing a check.

Which of the following require the depositor to commit to leaving their investment in the bank for a certain period of time in exchange for higher interest rates?

Select the correct answer below:

money market account

demand deposit

certificate of deposit

savings deposit

certificate of deposit

Time deposits and certificate of deposit accounts are both accounts that the depositor has committed to leaving in the bank for a certain period of time in exchange for a higher rate of interest.

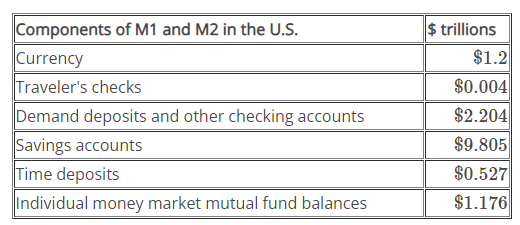

The table below shows the components of M1 and M2 in the U.S. Use the table to calculate Total M1. Round to the nearest third decimal place.

$13.213

M1 money supply is composed of coins and currency in circulation, checkable and savings deposits, and traveler's checks. To calculate M1, add these components together, which is equal to $13.213 trillion.

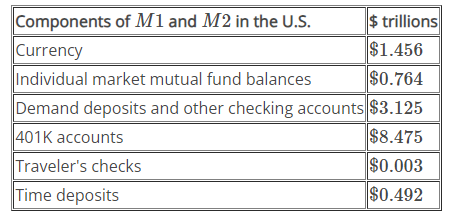

The Federal Reserve System is responsible for tracking the amounts of M1 and M2 and prepares a weekly release of information about the money supply. The table below shows the U.S. money stock components of M1 and M2. Use the table to calculate Total M1. Round to the third decimal place.

$4.582 trillion

M1 money supply is composed of coins and currency in circulation, checkable deposits, savings deposits, and traveler's checks. To calculate M1, add these components together which equals $4.584 trillion.

Examples of smart cards include _________

Select all that apply:

calling cards

debit cards

gift cards

credit cards

calling cards

gift cards

With a smart card, you can store a certain value of money on the card and then use the card to make purchases. Some “smart cards” used for specific purposes, like long-distance phone calls or making purchases at a campus bookstore and cafeteria, are not really all that smart, because you can only use them for certain purchases or in certain places.

Which of the following is part of M1? I. currency in a bank's vault II. cash in your wallet III. checkable deposits IV. traveler's checks

Select the correct answer below:

II, III, and IV

I, II, III, and IV

I, II, and III

II and III

II, III, and IV

M1 includes currency in circulation, checkable and savings deposits, and traveler's checks. M2 is a broader measure of the money supply than M1. Currency in a bank's vault would not count as M1.

Which of the following is the money supply that includes currency, checkable deposits, traveler's checks, savings deposits, money market funds, and certificates of deposit?

Select the correct answer below:

overall money supply

M0 money supply

M2 money supply

M1 money supply

M2 money supply

M1 and M2 money have several definitions, ranging from narrow to broad. M1 = coins and currency in circulation + checkable (demand) deposit + savings deposits + traveler’s checks. M2 = M1 + money market funds + certificates of deposit + other time deposits.

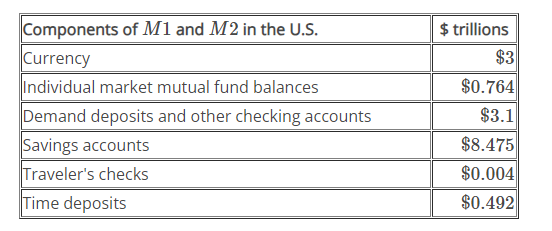

The Federal Reserve System is responsible for tracking the amounts of M1 and M2 and prepares a weekly release of information about the money supply. The table below shows the U.S. money stock components of M1 and M2. Use the table to calculate Total M1. Round to the third decimal place.

M1 money supply is composed of coins and currency in circulation, checkable deposits, savings deposits, and traveler's checks. To calculate M1, add these components together which is $14.579

Which of the following components are used to calculate M1? Select all that apply.

Select all that apply:

Savings accounts

Currency

Traveler's checks

Time deposits

Savings accounts

Currency

Traveler's checks

M1 money supply includes those monies that are very liquid such as cash, checkable (demand) deposits, savings deposits, and traveler’s checks.

You can store a certain amount of money on a _______ which can be used to make specific purchases at specific places.

Select the correct answer below:

debit card

smart card

credit card

None of the above

smart card

With a smart card, you can store a certain value of money on the card and then use the card to make purchases. Some “smart cards” used for specific purposes, like long-distance phone calls or making purchases at a campus bookstore and cafeteria, are not really all that smart, because you can only use them for certain purchases or in certain places.