Antitrust Policy Quiz 2

1/51

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

52 Terms

Collusion

working together secretly to negotiate prices and quantities

Bertrand Duopoly (also known as Nash-in prices)

Assumes-two sellers, selling the exact same thing, setting prices simultaneously-buyers purchasr lowest price item. Sellers splot market in half

It’s a game-goal is to find an equilibrium

Nash Equilibrium

No player can unilaterally change its strategy in a way that improves its payoff

Strategy

a complete set of directions for how the player should play

Action

a particular move taken by a player

Best response

Player’s best strategy in response ot other possible strategies from other players

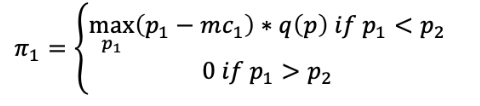

Profits

Seller 1’s best response to seller 2’s price is to set a slightly lower price, Seller 2 would respond the same way-this would lead them to cutting down to their marginal costs

Graph where you cut down to MC (Nash Equalibrium)

Bertrand Paradox

If you add a second seller to a market, and they play the Bertrand pricing game, price changes from the monopoly price to marginal cost. Adding more sellers doesn’t matter.

Not necessarily realistic but does suggest that sellers should consider what price their rivals will charge

Unrealistic aspects of Bertrand Model

1) Product differentiation-if products are even slightly different, lowest price would automatically win

2) Dynamic competition-If Seller 1 wins today, shouldn’t 2 undercut tomorrow

3) Full'/limited information-seelers don’t know each other’s cost all the time

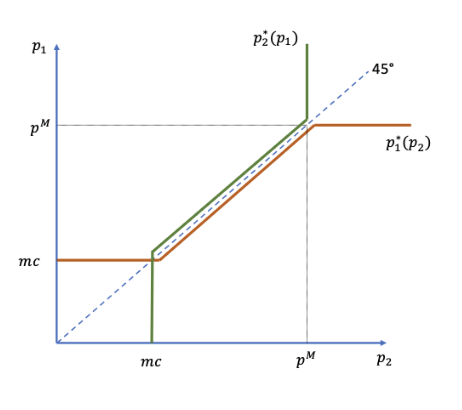

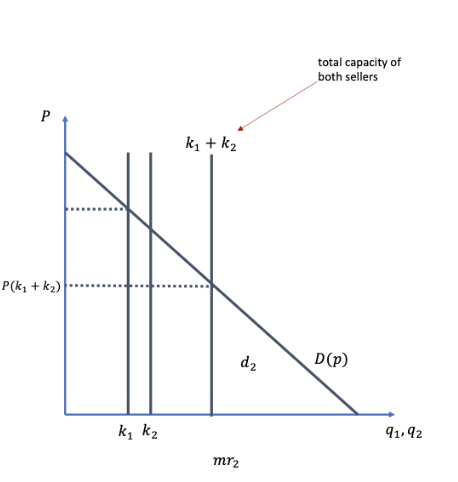

4) Capacity-what if winning seller can’t serve all demand (airline)

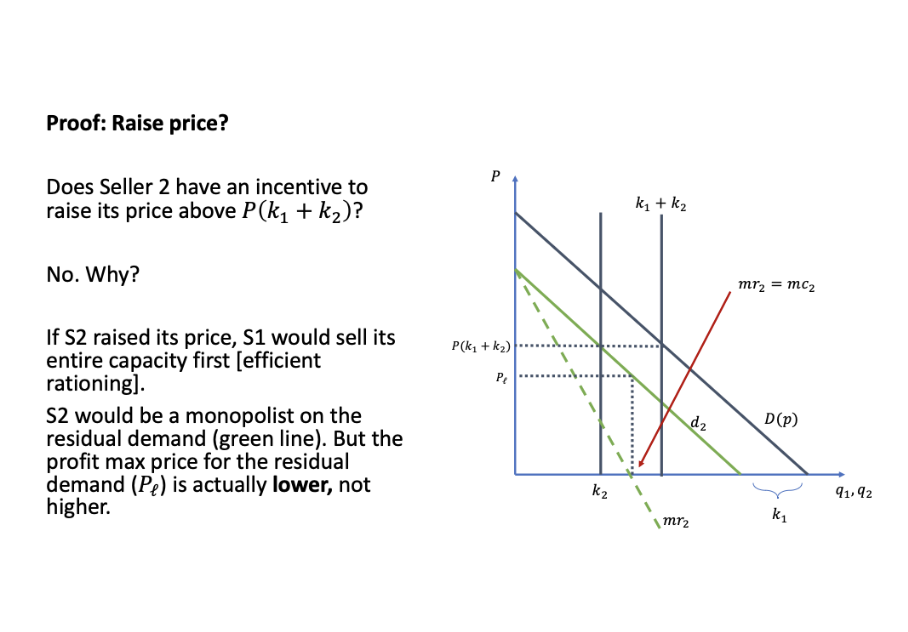

Limited capacity

Can help to reach nash equilibrium

Not raising/lower price in this limited capacity situation

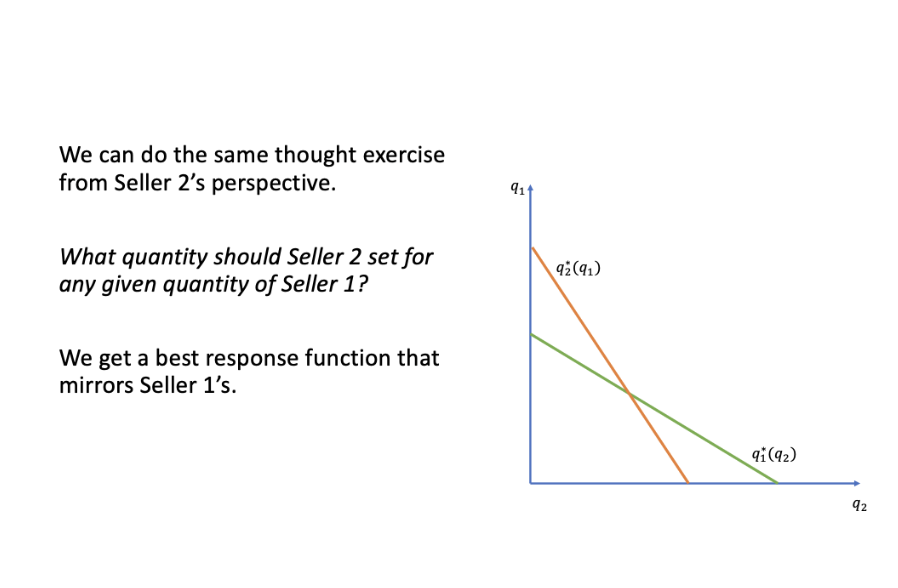

Cournot

Model with quantity (Bertrand uses prices)

Now known as Nash in quantities

Assumptions:

• Two sellers, selling the same exact product.

• Simultaneously decide quantity produced.

• Market price received by both firms is a function of total quantity

supplied: 𝑃 = 𝑃 𝑞! + 𝑞" = 𝑃(𝑄).

• Equilibrium is a pair of quantities where neither seller finds it

profitable to deviate.

* Quantity competition is isomorphic to a 2-stage game of capacity-

then-price competition.

Nash Equilibrium

a mutally consistent combination of actions and conjectures, such that neither seller finds it profitable to deviate

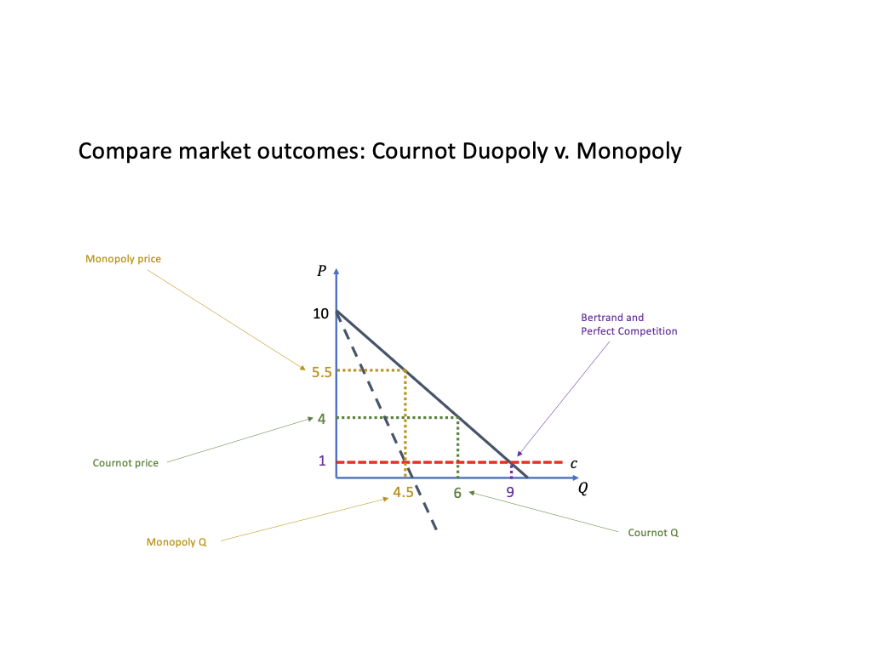

Comparing bertrand, cournot, and monopoly

Types of Collusion

Explicit/Price Fixing-per se illegal

Tacit Collusion-no explicit agreement but choose high prices because all benefit from them

Price Fixing

Oligopoly prices are lower than monopoly prices

Can act like two halves of a monopolist

Incentive to cheat though

More likely when there are fewer compeitors and are of similar size/costs

1990s Vitamin Cartel

• Major US/Euro/Japanese producers agreed to fix prices across dozens of

vitamin classes (C, E, B9, H, B5, etc. )

• Communication: Between bi-weekly and bi-yearly telephone or in-person

meetings to exchange information.

• Monitoring: Gather prices on cartel members by talking to buyers.

• Threats to the cartels

• Increased supply from the “competitive fringe” (mainly Chinese producers)

• Slow-down in demand growth.

• Mergers and re-alignments.

• Caught: ADM was being investigates for another cartel (Lysine) and

cooperated with the DOJ to provide info on the Vitamin cartels.

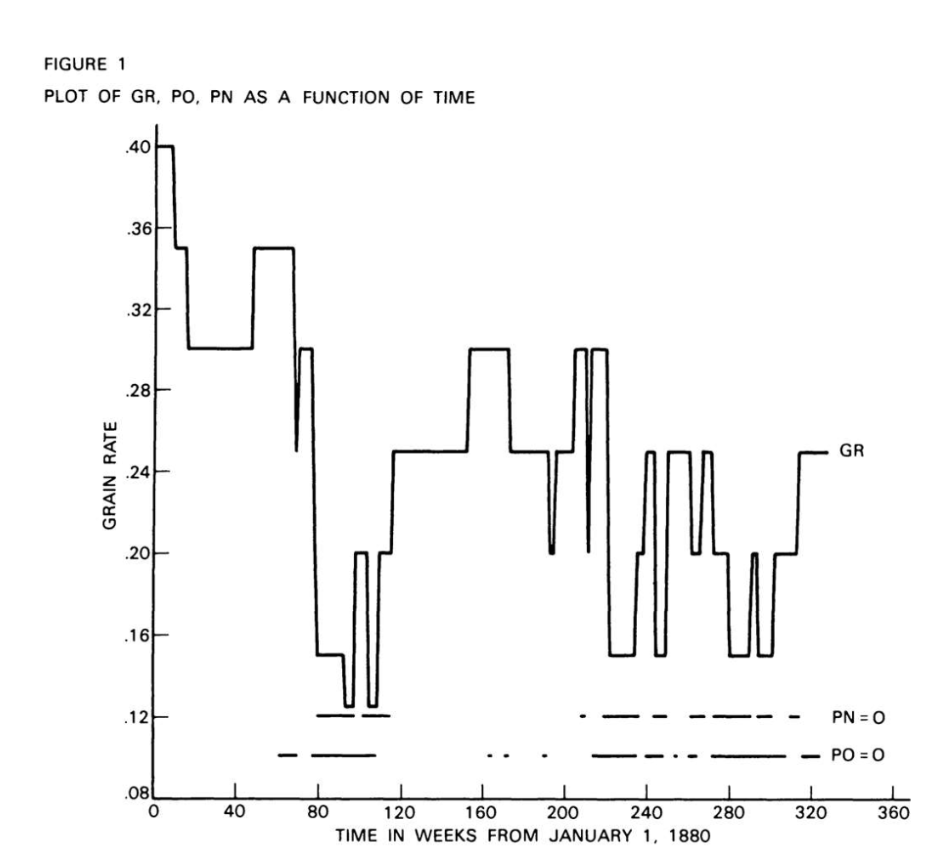

Railroads in the 1880s

Cartels

messy and hard to explain all price movement with simple theories

Tacit Collusion

avoids Bertrand result

• Two sellers sell the same product.

• Simultaneously announce the price.

• Lowest price product receives all of the demand.

• Same marginal cost (for now).

(so far, same as Bertrand)

But time is divided into a series of periods (example, days) and the

sellers play this same game every day.

Index time by

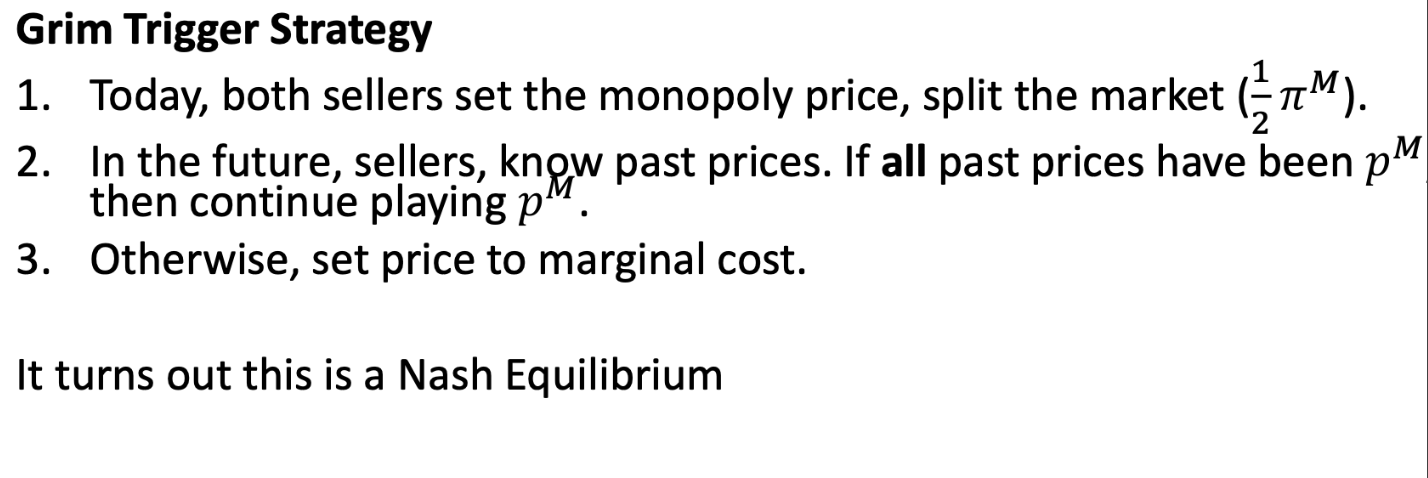

Grm Trigger Strategy

Grim Trigger part 2

Now the sellers care more about just today’s profit.

• There is a lot more at stake.

• They have more “tools” to choose from. [Larger strategy space.]

• They can “monitor” each other. [History of prices.]

![<p>Now the sellers care more about just today’s profit.<br>• There is a lot more at stake.<br>• They have more “tools” to choose from. [Larger strategy space.]<br>• They can “monitor” each other. [History of prices.]</p>](https://knowt-user-attachments.s3.amazonaws.com/2bc37973-4596-45be-a447-34f560a3b161.jpeg)

Value of $1 tomorrow

f=period

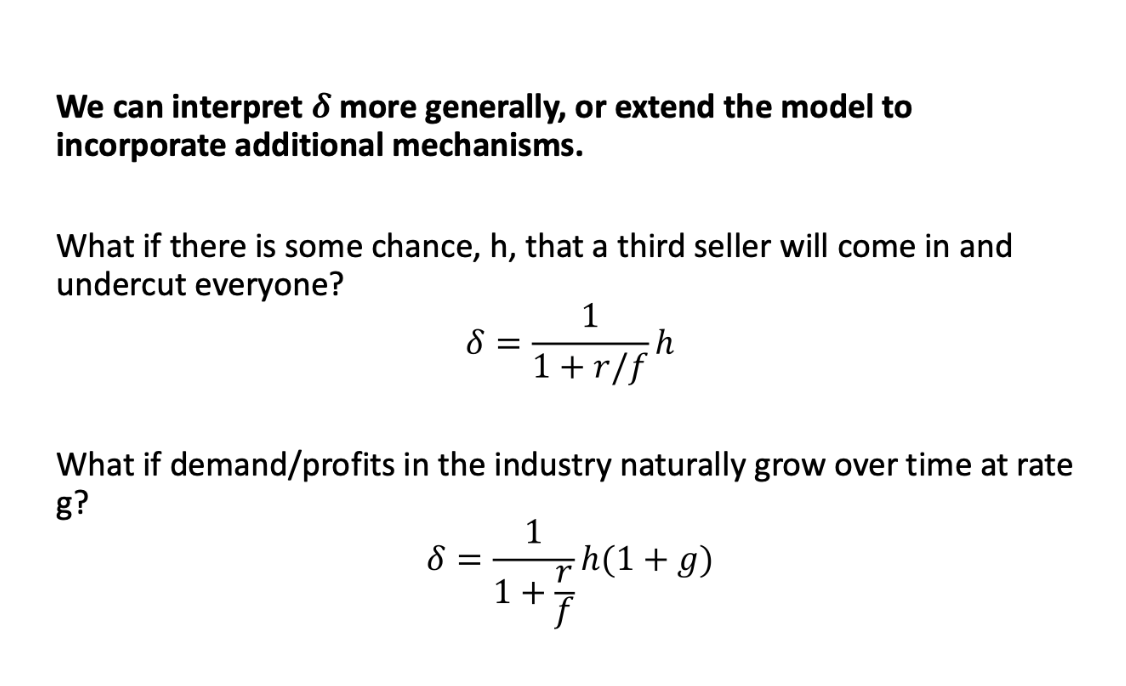

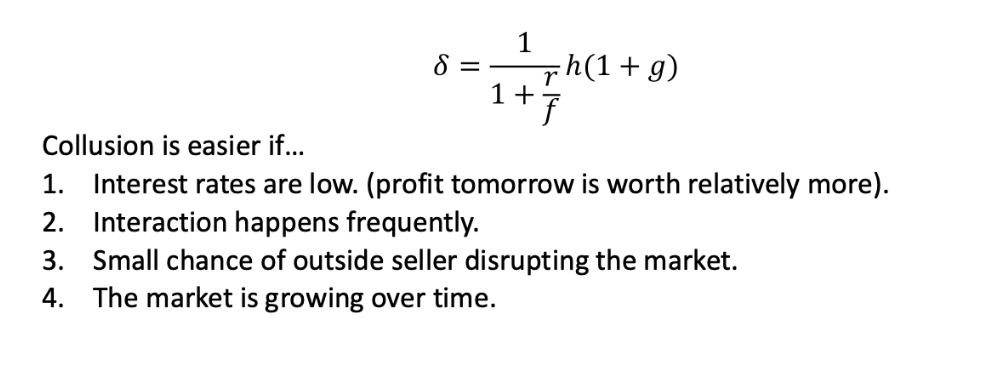

What if another seller enters? What if demand/profits grow?

So what effects if we collude?

Restraints of Trade

Pillar 1

Prohibits agreements that are unreasonablt harmful to comp

Horizontal agreement

Vertical Agreement

Other Agreements

1. Horizontal agreements between actual or potential competitors. The most likely

kind of agreement to raise competitive concerns.

2. Vertical agreements between parties at different levels of the supply chain (or

suppliers of complements). Often untroubling; but can raise concerns.

3. Other agreements between parties that are in neither a horizontal nor a vertical

relationship. Virtually never troubling under modern law.

Per se

a few horizontal agreements-nakely anticompetitve

Rule of reason

all vertical and most horizontal

Quick Look

In between-its a quick look

What types of agreements are exempt?

Not economically independent

a. Employees of the same company.

b. Business partners in a partnership.

c. Stores of the same chain.

d. Divisions of the same corporation.

Copperweld (1984)

1. Before 1984: a corporation could

be liable for conspiracy with its

own wholly-owned subsidiary.

2. Copperweld involved an

allegation that Copperweld was

conspiring with its own sub to

injure a rival.

3. Court held: a corporation and

wholly owned subsidiary are

not sufficiently separate to

“conspire” in violation of §1.

—UNITY OF INTERST IS KEY-team of horses controlled by single driver

Examples of wholly-owned subsidiaries:

• Alphabet wholly owns Google

• Apple wholly owns Beats

• Warner Bros wholly owns HBO

• Sony wholly owns Sony Interactive Entertainment

Examples of wholly-owned subsidiaries:

• Alphabet wholly owns Google

• Apple wholly owns Beats

• Warner Bros wholly owns HBO

• Sony wholly owns Sony Interactive EntertainmentParent company

Parent companyWholly-owned subsidiary

Wholly-owned subsidiary

What counts as single entity

Parent and wholly owned subsidiary, grandparent and wholly owned subsidary of wholly owned subsidiary, sibling wholly owned subsidiaries

Does Copperweld mean that anything involving complete ownership is immune from antitrust scrutiny?

No!

1. “A corporation’s initial acquisition of

control will always be subject to

scrutiny under Section 1 of the

Sherman Act and Section 7 of the

Clayton Act.”

2. And the conduct of the unitary firm

may be subject to Section 2 if a

monopolist (and Section 1 if it enters

agreements w others!).

3. Just can’t “collude” with each other.

American Needle Inc v NFL

National Football League Properties

(“NFLP”)

1. Created by 32 teams to jointly market IP

2. IP owned by individual teams

3. Teams free to withdraw at any time

NFLP gave exclusive license to Reebok to

make and sell headwear for all teams

American Needle sued under § 1

Key issue:

When NFLP acts, is it unilateral action or

joint conduct?

“The key is whether the [alleged

agreement] ... joins together

separate decisionmakers”

Is it an agreement “amongst

separate economic actors

pursuing separate economic

interests . . . that . . . deprives the

marketplace of independent

centers of decisionmaking.”

IT IS SUBJECT TO SECTION 1

Why?

1. “[S]eparately controlled potential

competitors with [distinct] economic

interests.”

2. Behavior driven by each team’s

own economic interest – which may

diverge or conflict.

3. Profit / loss sharing is relevant but

can’t be dispositive. (Why not?)

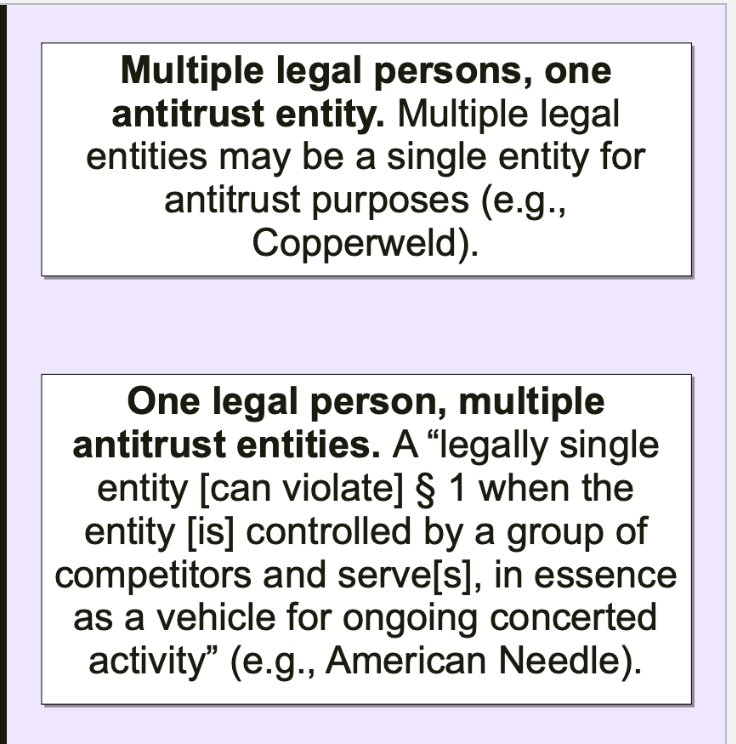

Legal person and antitrust

Monsanto Co v Spray-Rite Corp

1. Monsanto made herbicides

Small market share (3-15%)

2. Spray-Rite was a distributor for

Monsanto

90% of its sales were herbicides, but

only 16% of sales were Monsanto

3. Monsanto did not renew Spray-

Rite’s distributorship.

4. Spray-Rite sued!

Alleged that it was terminated as part

of a “resale price maintenance”

conspiracy between Monsanto and

other distributors.

USES THE RULE OF REASON—Supreme Court Affirm judgement that it is a violation but not for same reasons

Courts Test for was there an agreement:

t means as well that

evidence must be presented both that

the distributor communicated its

acquiescence or agreement, and that

this was sought by the manufacturer.”

2. “[T]here must be evidence that tends to

exclude the possibility of independent

action by the manufacturer and

distributor. That is, there must be direct or

circumstantial evidence that reasonably

tends to prove that the manufacturer and

others had a conscious commitment to

a common scheme.”8

Matsushita Electric Indusrtial Company v Zenith Radio Corp

. 21 Japanese TV companies

allegedly agreed to:

1. collectively raise prices in Japan; and

2. lower them in the United States...

3. ...to drive US firms out of business!

2. The Japanese companies then

would raise price in U.S. and make

monopoly profits!

What kind of antitrust claim is this?

Conspiracy to engage in collective

predatory pricing

Challenged under Sections 1 and 2

Very unusual theory!

Court didn’t buy accusations of preditory pricing

1. A 21-firm conspiracy over 20 years?

a. Hard to sustain, easy to cheat

b. Must endure losses for two decades

2. Difficulty in recoupment

a. Nowhere near monopoly after 20 yrs!

b. Scheme will fail if firms cheat or enter

3. Supracompetitive profits in Japan don’t

change the calculus

a. Doesn’t make low prices more profitable in

the United States

b. Evidence of a cartel in Japan doesn’t prove

predation in the United States

4. And proving agreement on minimum US

prices doesn’t imply predation.

Take aways:

1. Less plausible theories of harm may

require more evidence to survive

summary judgment.

A “sliding scale”?

2. Evidence must “tend to exclude”

independent action.

If conduct is equally consistent with no

conspiracy, it does not help the

plaintiff’s case at all. See Monsanto.

Dissent: the Court is invading the

factfinder’s province!

Preditory Pricing

Two key legal elements:

1. Pricing below the defendant’s

own costs; and

2. Dangerous probability of

recoupment of profits through

increased monopoly power after

the predation.

Bell Atlantic v Twombly

1. Breakup. When AT&T was broken up by consent decree in the 80s, it created many

local telephone monopolies (“Incumbent Local Exchange Carriers”; “ILECs”).

2. Competition? In the Telecommunications Act of 1996, the local monopolies were

withdrawn. New obligations were created (e.g., forced sharing, unbundling, etc.) to

encourage competitive entry by Competitive LECs (“CLECs”).

3. Competition, anyone? But it didn’t really happen!

So Twombly sued, alleging two agreements:

1. ILECs agreed to exclude competitive entry (CLECs) from their own markets.

2. ILECs agreed not to enter one another’s markets.

The ILECs moved to dismiss the complaint under Rule 12(b)(6) for failure to state a claim.

Complaint under Rule 8:

Must contain “a short and plain

statement of the claim showing the

pleader is entitled to relief.”

Must “give the defendant fair notice of

what the ... claim is and the grounds

upon which it rests.”

Dismissal under Rule 12(b)(6) for

failure to state a claim:

Before Twombly, the Conley v.

Gibson test (1957) governed: dismiss

a complaint only if “plaintiff can prove

no set of facts” entitling it to relief.

This was a generous standard

Complaint dismissed

1. Exclusion was rational for each ILEC individually: can’t infer agreement.

2. Not starting a competitive war was also rational: can’t infer agreement.

• “The ILECs were born in [a noncompetitive world], doubtless liked the world the way it was,

and surely knew the adage about him who lives by the sword. Hence, a natural explanation

for the noncompetition alleged is that the former Government-sanctioned monopolists were

sitting tight, expecting their neighbors to do the same thing.”

Ruled that you need plus factors to make decision!!!

A plaintiff needs “a complaint with

enough factual matter (taken as

true) to suggest that an agreement

was made. Asking for plausible

grounds to infer an agreement does

not impose a probability requirement

at the pleading stage; it simply calls

for enough fact to raise a

reasonable expectation that

discovery will reveal evidence of

illegal agreement

In Re Text Messaging

Judge Posner refused to dismiss a

complaint alleging price-fixing of SMS

messages.

Allegations:

1. Four providers with 90% share.

2. Exchanged price information in trade

ass’n “leadership” group.

3. Costs fell but prices rose.

4. Sudden uniform change in pricing:

new structure + 1/3 price increase.

5. Identical post-increase price (10c).

33

1. “[A] complaint must establish a

nonnegligible probability that the

claim is valid; but the probability need

not be as great as . . .

‘preponderance of the evidence.’”

2. “[C]omplex and historically

unprecedented changes in pricing

structure made at the very same time

by multiple competitors, . . . for no

other discernible reason . . . support

a plausible inference of conspiracy.”34

After Judge Posner’s, decision, the

case went back to the trial court for

discovery.

1. After discovery, defendants moved

for summary judgment

2. Trial court granted it

3. Back to Judge Posner...

4. ...who then affirmed SJ for

defendants.

1. Emails won’t do it.

1. Doesn’t speak to collusion. “Nothing in any of Hurditch’s emails suggests that he believed

there was a conspiracy among the carriers. There isn’t even evidence that he had ever

communicated on any subject with any employee of any of the other defendants.”

2. Efforts to delete. “The plaintiffs make much of the fact that Hurditch asked Roddy to delete

several emails in the chain that culminated in the “colusive” email. But that is consistent with his

not wanting to be detected by his superiors criticizing their management of the company.”

2. Pricing evidence wasn’t conclusive. Price increases accompanied surging

demand and were not in perfect lockstep.

3. Trade association doesn’t fill the gap. No evidence of unlawful agreement, and

no suspicious timing of price increases after meetings.

Some definitional hallmarks of “agreement”:

1. Evidence that acquiescence was sought and given (Monsanto)

2. Conscious commitment to a common scheme, even if not explicit / express (Monsanto)

3. MORE than:

1. mere knowing interdependent action (Twombly, Matsushita)

2. mere stating of conditions and policies (Monsanto)

Huge policy issue in the background:

• How could we workably prohibit tacit collusion? What is a company in a concentrated market

supposed to do? What would a remedy look like?

• What line can we draw that (a) is sensible, (b) doesn’t prohibit / punish too broadly, and (c) attaches at

a definable point that goes beyond mere parallelism?

Proving agreement:

1. Direct evidence of the agreement itself (e.g., emails describing it, testimony saying “we all agreed”)

2. Evidence of behavior that suggests an agreement (parallelism + “plus factors” like commc’ns)

trans-missouri freight

railroad price fixing

-majority held all restraints of trade illegal

Justice White’s dissent-argued for reasonableness standard

Addyston Pipe

Iron pipe cartel: was it a defense

that prices were set reasonably, to

avoid ruinous competition?

2. Judge Taft’s distinction:

1. Restraints “where the sole

object ... is merely to restrain

competition, and enhance or

maintain prices” are always

unlawful.

Today we say “naked” restraints.

2. “Ancillary” restraints are OK if

reasonably necessary to the

accomplishment of a main, lawful

purpose (e.g., noncompete upon

sale of a business)

Create rule of reason style test for ancillary restraints

United States v Trenton Potteries

Cartel of sanitary pottery makers

Defendants argue that their fixed prices were reasonable

Determine all price-fixing agreements to be unreasonable

Effect can be inferred by the nature alone-

Rules of Reason Steps

1) Plaintiff must show prima facie harm (anti competitive effect)

2) Defendant must show benefit (“Procompetitive justification”)

3) Plaintiff must show restraing should be condemned-either unecessary for benefit or harms exceed benefits

United States v National Society of Professional Engineers

Ethical canon-argued that no price quotes until after hiring engirnner ensured product safety

Court held that is not a perimitted justification under rule of reason—-public saefty and ethics are NOT cognizable benefits

Favor competition

NCAA v Alston

District Court (affirmed by 9th)

1) Imposed liability for NCAA rules limiting education related benefits for student athletes

2) DId not condemn rules limiting scholarships and pau related to athletic performance

NCAA appealed

Step 1) Anticompetitive effect: NCAA had power to set wages

Monopsony power in a labor

market

Exercised that power with clear

anticompetitive effects

Compensation and benefits

lower as a result

NCAA didn’t meaningfully

dispute this

Step 2) Procompetitive Rationale

NCAA claim they needed to protect amateurism (offer not clear definition of this, no evidence it had effects on consumer demand, but rules preventing inlimited payments unrelated to education might play role in differentiating the NCAA

Step 3) Plaintiff’s Ultimate Burden

restrictions on education-related benefits far greater than needed (consumers didn’t care)—-not required to be the least restrictive alternative though

Kavanugh’s concurrence:

1) Rule of reason

2) Price-fixing labor is price fixing labor

3) Supressing pay of students when they get biollions for colleges-and students who generate it get nothing

4) Tradition is not enough

Quick Look

1. Between per se illegality and the “full” rule of reason!

2. Plaintiff’s prima facie burden is discharged by the nature and context of an

agreement when the threat to competition is clear.

1. No need to show actual effects!

2. Somewhat like “indirect evidence” at step one of normal rule of reason?

3. Defendant has an opportunity to show that there are serious procompetitive

benefits; if so, burden flips back to plaintiff for fuller showing.

NCAA v Board of Regents of the University of Oklahoma

Quick look

NCAA’s plan:

1. Coordinated limitation on TV deals

2. Price coordination (fixed aggregate and

“recommended” payments)

3. Clear restriction on TV output

4. Purportedly intended to avoid

cannibalizing demand for live games

Legal proceedings:

5. Some schools sued the NCAA

6. Went to trial in district court

7. Trial court found a Section 1 violation

8. Court of appeals affirmed: illegal per se

Supreme Court found that it should not be a per se case!

1) Horizontal restraints are essential in some capacity for its existence

2) The intergrity of the product cannot be preserved except by mutal agreement

3) Respondents conceded that the great majority of regulations inhance competition

But this practice also was not okay!

1) Broader record made it clear it was harmful-price is higher and output lower than would otherwise be and both are unresponsive to consumer preference

2) So NCAA has a heavy burden of establishing an affirmative densene which compeititvely justifies the apparent deviation

Defendant’s justifications-this was just efficiency-enhancing

Coiurt reply-Price increased and quantity decreased

Also argue protect live audience-but no suporting evidence

Per se vs Rule of Reasons

Effects of a per se rule:

1. Easy to administer?

2. Cheaper to litigate?

Unless the bounds of the rule are unclear!

3. But overbroad rules chill competition!

Effects of a rule of reason?

4. More likely to get to the right result?

If we trust judicial accuracy in individual

cases!

5. More expensive to administer and

litigate?

6. Long expensive lawsuits...

...may discourage meritorious suits

...may allow plaintiffs to hold up defendants

with meritless claims

43

Wollman Paper

DOES ENTRY REMEDY COLLUSION?

EVIDENCE FROM THE GENERIC

PRESCRIPTION DRUG CARTEL

Branded drug loses exclusivity → ANDAs → generic entry

• Typically heralded as competition success story

(>50% market share at >50% lower prices [Scott Morton, 1999])

• Average prices in the 2010s increased substantially

Lawsuit: US States vs. Teva et. al. (May 20, 2019)

• List of cartelized drugs

• Date each cartel is formed

• For background, NP’s selection rule (e.g., quality ratings of rivals),

phone records, relevant emails and texts

• To check data, Teva’s breakdown of market share by drug-firm

• FDA: ANDA filings, approvals, and entry dates

• Medicaid: Price and quantity

• IQVIA: Scales Medicaid, alt. quantity measure

Drug-firm-quarter or drug-firm-year

Assume cartels play trigger strategy

PI File—-number of firms and how close they are

Data-list of cartelized drugs, dta formed, Nisha Patel’s selection rule

Large drug market definition-above vs below the median

Maternity leave-9 month period where no cartel formation

FDA response-less likely but medicare and other things really care

“most favored nation”-should get at least price of lowest nation