ECON 209 Final Exam

1/111

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

112 Terms

Economics

The study of choices people make to attain their goals, given their scarce resources

Scarcity:

A situation in which unlimited wants exceed the limited resources available to fulfill those wants

there are not enough goods and services to meet everyone’s needs and desires

An Economy:

A set of interrelated consumption and production activities in order to maintain a standard of living.

Market

A group of buyers and sellers of a good or service and the institutions or arrangements by which they come together to trade.

Capital

Goods used to make other goods. 2 types: physical + financial

Labour:

Sweat equity and the intelligence that is needed to produce goods and services.

includes all mental and physical human resources, including intelligence, and skills

3 Key economic IDEAS:

People are rational.

People respond to incentives.

Rational People make optimal decisions at the margin (selling at a loss is better than not at all)

Rationality

People make choices based on what they believe will make them happy. People do not deliberately do things to make themselves worse off

Marginal cost and benefit (MC and MB):

the additional cost or benefit associated with a small amount extra of some action.

ex: Should you watch an extra hour of TV, or study instead?

Opportunity costs:

what is given up when a choice or decision is made, including the best

the opportunity cost of you getting a university degree is the foregone salary that you give up by attending university

Microeconomics

The study of how households and firms make decisions and interact in markets.

Macroeconomics

The study of economy-wide phenomena, including inflation, unemployment, and economic growth.

Economic Systems: 3 Economic QUESTIONS

What goods and services will be produced by society?

How will the Goods and Services be Produced?

Who will receive the Goods and Services Produced?

Centrally Planned Economy

An economic system where government committees explicitly answer the three basic economic questions.

“command economy”

left side of spectrum

Communism

Cuba

Karl Marx, Communist Manifesto

Pure Market Economy

An economic system where households and firms (INDIVIDUALS) interact in markets to answer economic questions with minimal government intervention.

“Laissez-Faire”

right side of spectrum

capitalism

Singapore

Adam Smith, Invisible Hand

Mixed Economy

An economic system that combines elements of both centrally planned and market economies.

Ex: Canada

Invisible Hand

The concept introduced by Adam Smith, suggesting that individuals pursuing their self-interest can lead to desirable market outcomes.

MARKET ECONOMY

an economy that allocates resources through the decentralized decisions of many firms and households as they interact in markets for goods and services.

T/F: Market economies tend to be more efficient than centrally-planned economies

TRUE

In what scenarios do Market Economies NOT result in fully efficient outcomes?

government interference

Market outcomes might ignore people who are not involved in transactions

sometimes not time efficient

What are the two reasons we need government intervention?

Property rights

Market Failure

Market failure

When a market on its own fails to allocate resources efficiently.

Market Power (Monopoly)

EXTERNALITY

the impact of one person’s actions on the well-being of a bystander

MARKET POWER:

the ability of a single economic actor (or a small group of actors) to have a substantial influence on market prices.

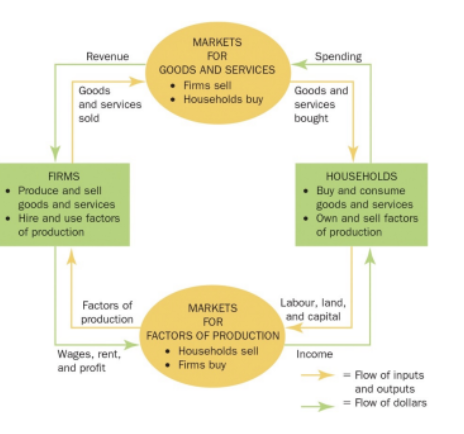

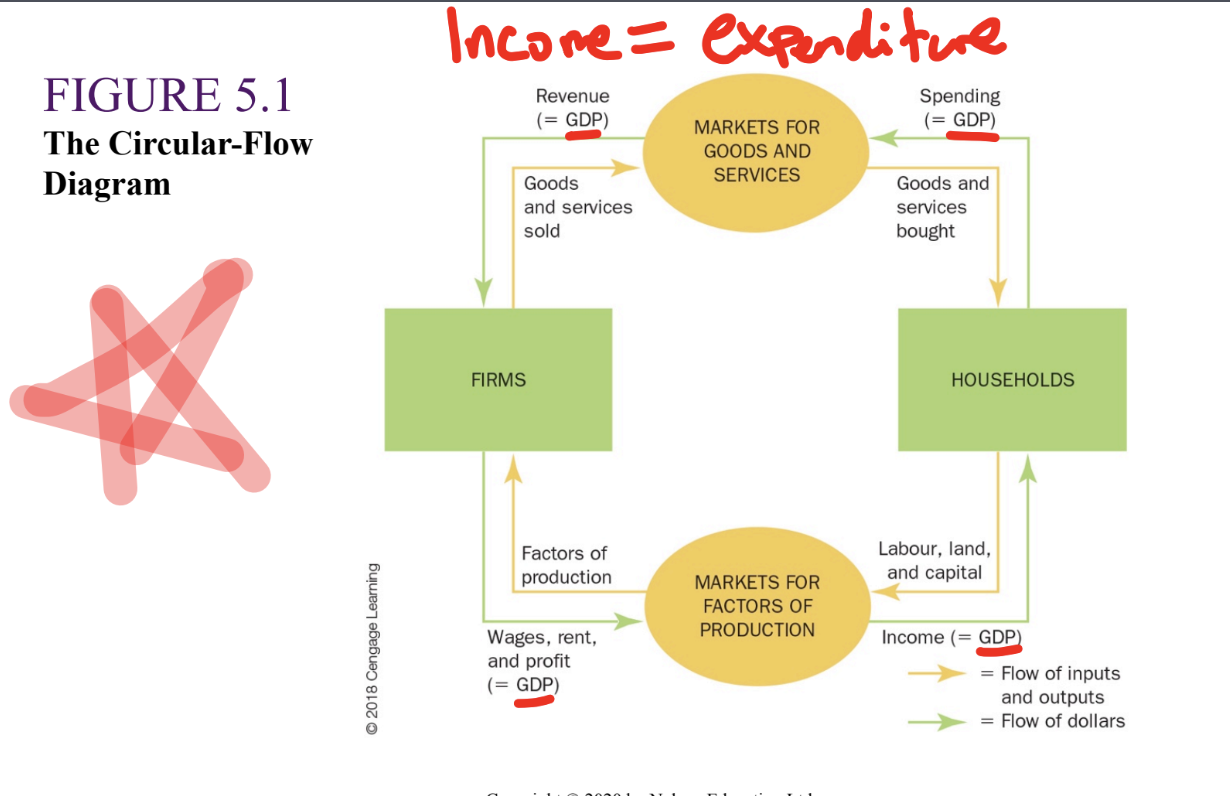

Circular flow

A diagram illustrating how money moves through markets between households and firms in an economy.

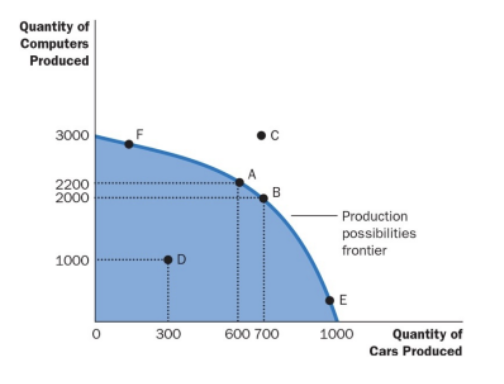

Production Possibilities Frontier (PPF)

A graph showing the maximum combination of goods an economy can produce given its resources and technology.

positive statement

a statement that describes the world as it is (was or will be)

FACT

can be tested by empirical analysis or measurements.

normative statement

statement that describes the world as it should or ought to be.

OPINION

Normative statements can also be used for events that have happened in the past (as long as the statement includes an opinion)

How to turn a normative statement into a positive one?

statement including opinion (ought/should) with numbers and evidence

ex: user fee of $50 should reduce doctor utilization rates by 10%

3 Characteristics of Perfect Competition

Many buyers and sellers- anyone can buy or sell

Identical products

No barriers to entry

Ceteris Paribus

The assumption that all other variables are constant when analyzing the relationship between two variables—such as price and quantity demanded.

The Law of Demand

when the price falls quantity demanded will rise (all else equal). Implication: Demand curve slopes downward, inverse relationship

Substitution effect:

The change in the quantity demanded due to a change in price making the good more or less expensive relative to other goods that are substitutes.

(the price of a product falls, consumer can now choose it over other similar products)

Income effect:

The change in the quantity demanded due to the effect of a change in the good’s price on consumers’ purchasing power

(the price of a product falls, consumer can now buy more)

A change in something other than price will cause…

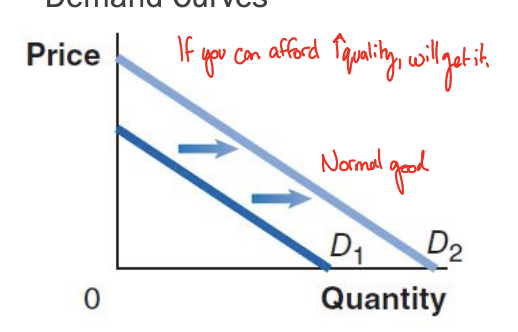

the entire demand/supply curve to shift. Right = increase, left = decrease.

Factors that Shift Market Demand

consumer income

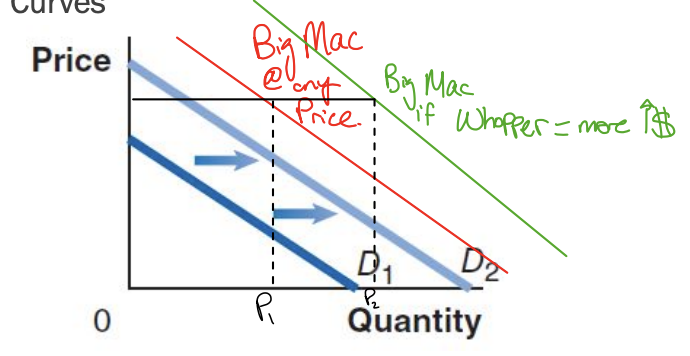

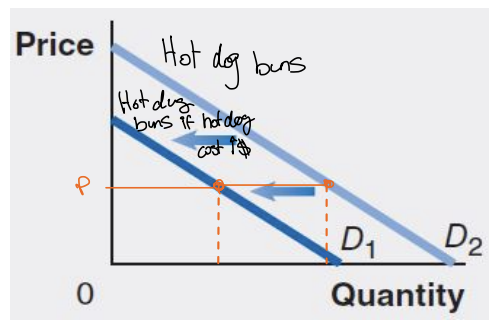

Prices of related goods

increase if products are substitutes, decreases if compliments

tastes

population + demographics

expectations

Normal good:

A good for which the demand increases as income rises, and decreases as income falls

if you can afford good quality, you’ll buy it

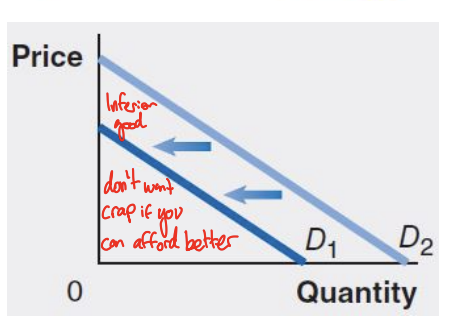

Inferior good:

A good for which the demand decreases as income rises, and increases as income falls.

if you can afford good quality, you won’t get back quality

or, lesser income = poorer quality

Substitutes:

Goods and services that can be used for the same purpose

Complements:

Goods and services that are used together.

How do expectations about future prices affect demand?

An expected increase in the price tomorrow increases demand today (gas going up tomorrow = fuel up today)

An expected decrease in the price tomorrow decreases demand today. (gas down tomorrow = fuel tomorrow)

The law of supply:

Holding everything else constant, when price rises quantity supplied increases. Implication: supply curves slope upward.

Variables that Shift Market Supply

Prices of inputs (labour cost)

Technological change (ease of production)

Prices of substitutes in production

Number of firms in the market (competition)

Expected future prices (sellers wait till high price to sell lots)

What are “inputs”

Inputs are things used in the production of a good or service.

increase in price to produce = less profit = less supply

cheap labour = make lots = sell lots

Change in Supply vs. Change in Quantity Supplied

CIQS: A change in the price of the product being examined causes a movement along the supply curve

CIS: Any other change affecting supply causes the entire supply curve to shift

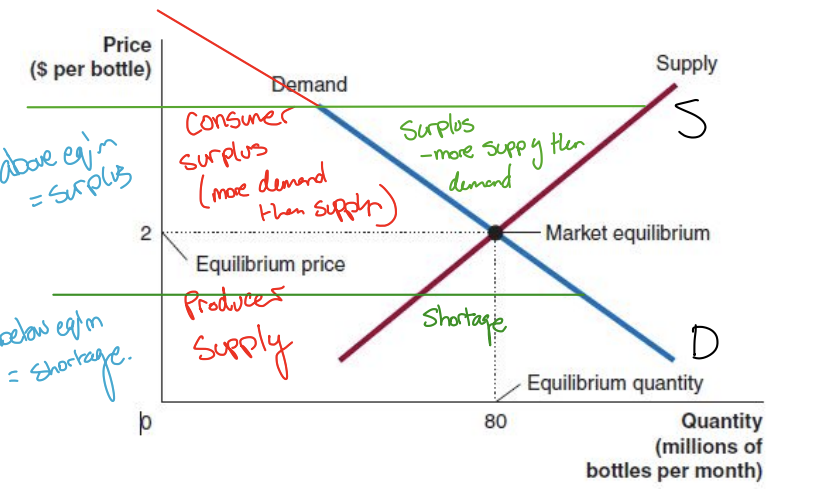

Consumer surplus vs surplus

above equilibrium price = “surplus”

CS: more demand than supply

Surplus: more supply than demand

Gross domestic product (GDP)

the market value of all final goods and services produced within a country in a given time period. (total income of nation)

best single measure of a society’s economic well-being

Circular Flow Diagram for GDP

INCOME = EXPENDITURE

T/F: GDP includes ONLY the value of final goods

True: The value of intermediategoods is already included in the prices of the final goods.

(you don’t count paper + book, only book)

intermediate goods vs final goods:

good is produced and is added to a firm’s inventory of goods to be used or sold later

you buy flour = final good

bakery buys flour = intermediate good

Components of GDP equation:

Y = C + I + G + NX

GDP = Consumption + Investment + Gov. purchases + Net Exports (export - import)

determine how much GDP and each of its components is affected:

Debbie spends $200 to buy her husband dinner at a toronto restaurant:

Consumption increases by $200

therefore GDP increases by $200

determine how much GDP and each of its components is affected:

Sarah spends $1800 on a new laptop to use in her publishing business. The laptop was built in China.

Investment rises by $1800, net exports fall by $1800, GDP is unchanged.

determine how much GDP and each of its components is affected:

Jane spends $1200 on a computer to use in her editing business. She got last year’s model on sale for a great price from a local manufacturer.

Current GDP and investment do not change because the computer was built last year.

determine how much GDP and each of its components is affected:

General Motors builds $500 million worth of cars, butconsumers only buy $470 million worth of them.

Consumption rises by $470 million, inventory investment rises by $30 million, and GDP rises by $500 million

THE COMPONENTS OF GDP:

Consumption

spending by households on goods and services, except for purchases of new housing.

THE COMPONENTS OF GDP:

Investment

spending on capital equipment, inventories, and structures, including household purchases of new housing

Nominal GDP:

the production of goods and services valued at current prices.

=P(t) * Q(t)

Real GDP

the production of goods and services valued atconstant prices

=P(base) * Q(t)

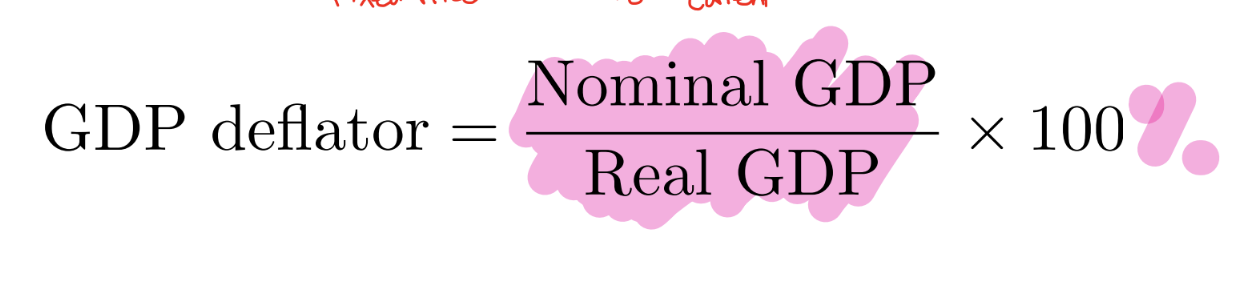

GDP Deflator

price level calculatedas the ratio of nominal GDP to real GDP times 100.

Inflation rate

percentage change in some measure of the price level from one period to the next

= (GDP2d - GDP1d)/GDP1d

Consumer price index (CPI)

overall measure of the cost of the goods and services bought by a typical consumer

ANY good, not necessarily this country/year

FIVE STEPS TO COMPUTING THE CPI AND THE INFLATION RATE

Determine the basket.

Find prices of each G&S of Basket @ each time

Compute Basket @ diff times

CPI = basket cost (now) / basket cost (base)

inflation rate = [CPI2-CPI1 ] / CPI1 or $basket2-$basket1 / basket1

![<ol><li><p><span>Determine the basket.</span></p></li><li><p><span>Find prices of each G&S of Basket @ each time</span></p></li><li><p><span>Compute Basket @ diff times</span></p></li><li><p><span>CPI = basket cost (now) / basket cost (base)</span></p></li><li><p><span>inflation rate = [CPI<sub>2</sub>-CPI<sub>1</sub> ] / CPI</span><sub>1</sub><span> or $basket</span><sub>2</sub><span>-$basket</span><sub>1</sub><span> / basket</span><sub>1</sub></p></li></ol>](https://knowt-user-attachments.s3.amazonaws.com/06611cf5-7b19-4024-8c4f-54c56687abb9.png)

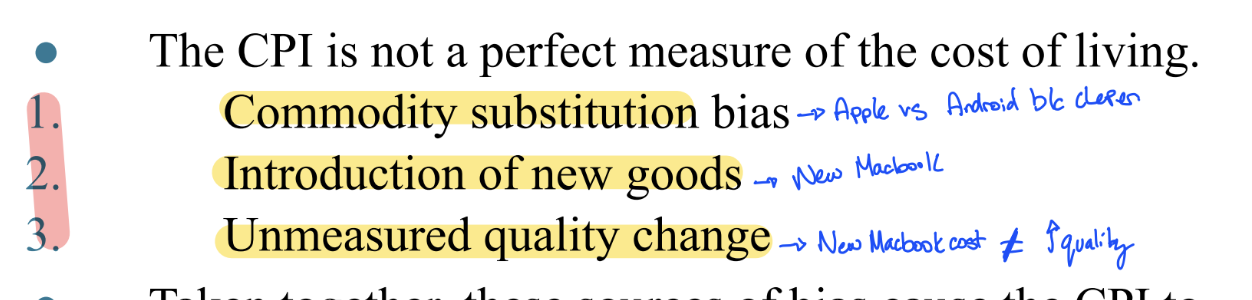

3 problems with CPI as not a measure of standard of living

Commodity substitution bias

Introduction of new goods

Unmeasured quality change

Indexation

the automatic correction of a dollar amount for the effects of inflation by law or contract

COLA (cost-of-living allowance)

automatically raises the wage when the CPI raises (only for gov’t employees)

Nominal interest rate:

the interest rate that is usually reported WITHOUT a correction for the effects of inflation

Real interest rate:

the interest rate that is corrected for the effects of inflation

Shoeleather costs

resources wasted when inflation encourages people to reduce their money holdings.

Menu costs

costs of changing prices.

How does inflation tend to raise the tax burden on income earned from savings?

income tax treats the nominal interest earned on savings as income, even though part of the nominal interest rate merely compensates for inflation.

Labour force:

sum of employed + unemployed workers in the economy

Employed persons:

did paid work, unpaid work for a family business, or worked for themselves (or were temporarily away from their jobs).

Unemployed persons:

Someone who is not currently at work but who is available for work and who has actively looked for work during the previous four weeks.

Problems with Measuring the Unemployment Rate

may understate unemployment (judgement b/w unemployed/not in labour force)

underemployment (nothing to measure part time vs full time)

overstate unemployment (people lie for tax evasion)

Unemployment Rate

= #unemployed/Labour Force

= #unemployed / (#UE + #E)

Labour Force participation rate

Labour Force/working age population

The four types of unemployment are:

Frictional unemployment

Structural unemployment

Cyclical unemployment

Seasonal unemployment

Frictional unemployment:

Short-term unemployment from the process of matching workers with jobs.

job searching

Structural unemployment:

Unemployment from a mismatch between the skills and attributes of workers and the requirements of jobs.

Cyclical unemployment:

Unemployment caused by a business cycle recession.

aka being “laid off”

Seasonal Unemployment

due to seasonal factors, like weather or fluctuations of demand due to the time of the year.

unemployment rate artificiallly high in winter, low in summer

Full employment definition:

When all unemployment is due to frictional and structural factors,

There will always be some unemployment in the economy.

“natural rate of unemployment”

Efficiency wage:

An above-market wage that a firm pays to increase workers’ productivity.

Change in Money Supply

ΔMS = (1/rd * Initial Deposit) + Current Circulation

4 primary functions of money:

medium of exchange (payment)

unit of account (standard)

store of value

deferred payment (future value)

fiat money

money authorized by central bank, not exchanged for anything else

if people stop believing in it, it ceases to be worth anything

simple deposit multiplier

1/rd

ratio of amount of deposits created by banks to the amount of reserves

how does BoC increase MS with open mark operations?

banks gain reserves (buy bonds) = increase loans = increase MS

how does BoC decrease MS with open market operations?

banks lose reserves (sell bonds) = decrease loans = decrease MS

why does the BoC increase and decrease MS?

the BoC is trying to sterilize offset of open market operations so the dollar value stays the same, so interest stays the same.

how does BoC control inflation from rising too high?

When Inflation is Rising (Above Target Range):

Increase Overnight Rates: BoC raises the overnight rate.

Effect on Borrowing: Higher overnight rates make borrowing more expensive for banks.

Effect on Loans: Banks increase interest rates for consumer and business loans.

Reduce Demand: Higher loan rates lead to less borrowing and spending.

Lower Inflation: Reduced demand for goods and services helps lower inflation.

how does BoC control inflation from falling too low?

When Inflation is Falling (Below Target Range):

Decrease Overnight Rates: BoC lowers the overnight rate.

Effect on Borrowing: Lower overnight rates make borrowing cheaper for banks.

Effect on Loans: Banks decrease interest rates for consumer and business loans.

Increase Demand: Lower loan rates lead to more borrowing and spending.

Raise Inflation: Increased demand for goods and services helps raise inflation.

describe 2 things that limit the precision of the BoC’s control of the MS.

The precision of the BoC’s control over the money supply is limited by:

Public keeping money as currency: Reduces deposits, diminishing the impact of BoC’s monetary policy.

Banks Holding Excess Reserves: Limits lending, weakening the intended effect on MS expansion or contraction.

If money supply grows FASTER than real GDP there will be…

inflation

If money supply grows slower than real GDP there will be…

deflation

Receipts

benefits/cash flowing in/positive cash flow

disbursements

cost/cash flowing out/negative flow

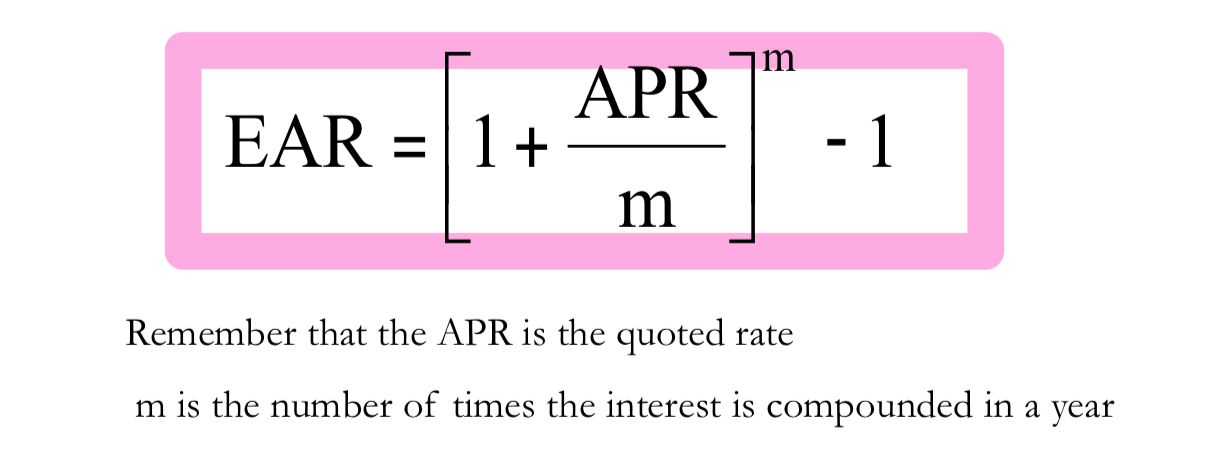

APR - annual percentage rate

annual rate based on periodic rate.

APR = period rate * #periods in a year

EAR - effective annual rate

actual rate accounting for compounding occurring through year