Y2 Intermediate Microeconomics Semester 1 Key terms

1/23

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

24 Terms

Three Axioms of Consumer Preferences:

Completeness

Transitivity

Monotonicity

Completeness Axiom of Consumer Preferences:

Completeness

Consumers possess preferences over all possible bundles

Consumers prefer bundles or is indifferent between the two

Transitivity Axiom of Consumer Preferences:

Transitivity:

consumer preferences are logical

A > B, B > C, A should be > C

indifference should be consistent

Monotonicity Axiom of Consumer Preferences:

Non-Satiation / Monotonicity:

Any marginal increase in the quantity of a good generates an increase in consumer’s utility

more = better

5 Properties of Indifference Curves

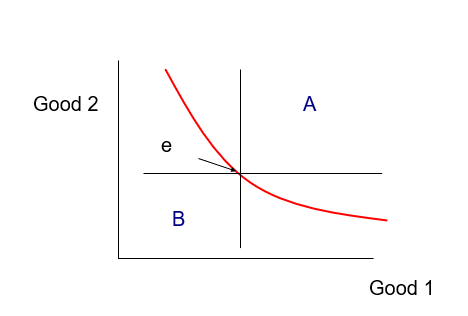

Utility is increasing in the distance from origin

Non-satiation, consumer must prefer any point in A > bundle e (more area = more of good + distance from origin

An indifference curve passes through every possible bundle

follows completeness ; consumer must be able to rank all bundles

Cannot cross

crossing invalidates indifference as comparisons are now made

Cannot have a positive gradient

bundle higher on the IC has more of at least one good and must be preferred rather than being indifferent.

Cannot be took thick

if a curve is more than one bundle thick, we can pick a point that has 1+ good compared to another point and is thus preferred, following from non-satiation

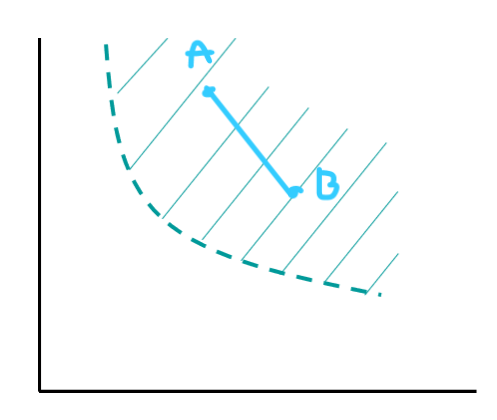

A common property of “Standard” Indifference Curves”

Very commonly convex to the origin

if you shade area above curve, any two points within can be connected without leaving the area, and thus the weakly preferred set is convex

MRS and Indifference Curves:

Marginal Rate of Substitution (MRS)

MRS - gradient of IC

Maximum amount of one good that the consumer would be willing to sacrifice in order to obtain one more unit of another good.

e.g. MRS = -2. ; willing to give up 2x Y for +1 X

MRS is diminishing due to gradient on standard ICs

Consumers prefer mixtures of goods according to convexity, rather than extremes

Utility functions and IC:

value of utility functions only tell us if A > B, cannot quantify by how much.

U(A) = 10 > 1 = U(B) and U(A) = 150 > 133 = U(B)

Both mean exactly the same thing: A is preferred to B

U (X,Y) = 3X+5Y , V (X,Y) = 8+6X+10Y

For (1,2) vs (2,1):

U(1,2) = 13 > 11 = U(2,1) ; (3)(1) + (5)(2) = 13 etc.

V(1,2) = 34 > 30 = V(2,1)

Utility functions and Monotonic transformations:

U (X,Y) = 3X+5Y , V (X,Y) = 8+6X+10Y

For (1,2) vs (2,1):

U(1,2) = 13 > 11 = U(2,1) ; (3)(1) + (5)(2) = 13 etc.

V(1,2) = 34 > 30 = V(2,1)

Monotonic transformations:

If V (X,Y) = 2U (X,Y) + 8, rankings are unchanged

involve taking the square root of U(X,Y) , e.g. V(X,Y)= √(U(X,Y)

or its logarithm, e.g. V(X,Y)= ln (U(X,Y)).

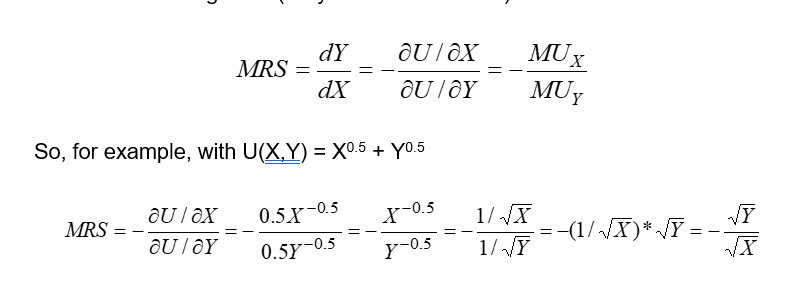

Mathematics for marginal utilities for two goods:

equation is a cobb douglas function

partial derivatives are first time (0.5 and take away 0.5 to X is now denominator)

Solve equation

If X is large relative to Y, the MRS is smaller meaning the consumer is willing to give up less Y to get an extra unit of X.

If Y is large relative to X, the MRS is larger , meaning the consumer is willing to give up more Y for X.

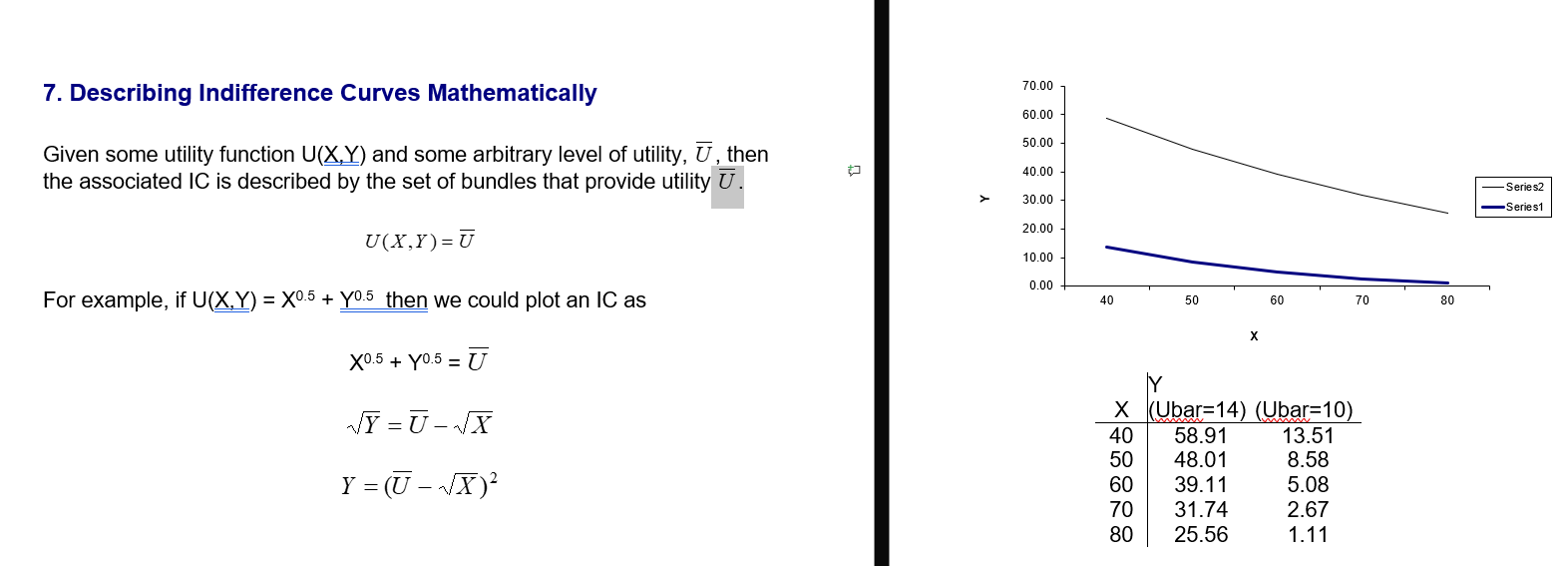

How to mathematically represent and calculate indifference curves:

determine function

Rearrange to have Y as subject

Divide both sides by square root to get just Y

plot and draw IC

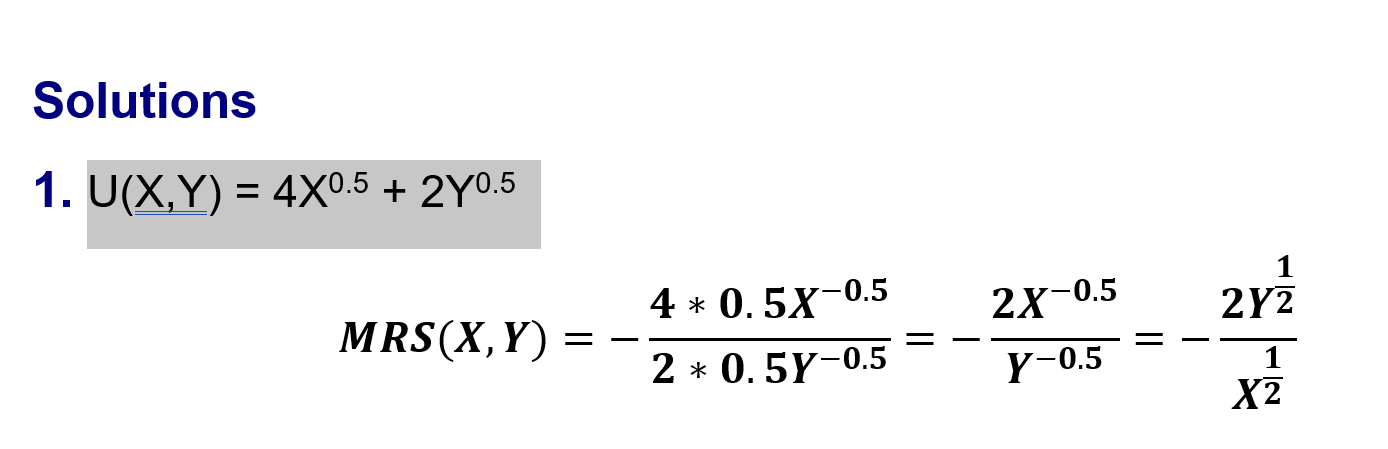

how to find MRS of utility function:

U (X,Y) = 4X^0.5 + 2Y^0.5

(negative because of formula above)

Step 1 - bring down power and subtract 1

MRS (X,Y) = - 4 0.5X^-0.5 / 2 0.5Y^-0.5

Solve:

MRS = - 2x^-0.5 / Y^-0.5

Step 2 - flip powers to positive but fractions flips too

Therefore, = - 2Y^1/2 / X^1/2

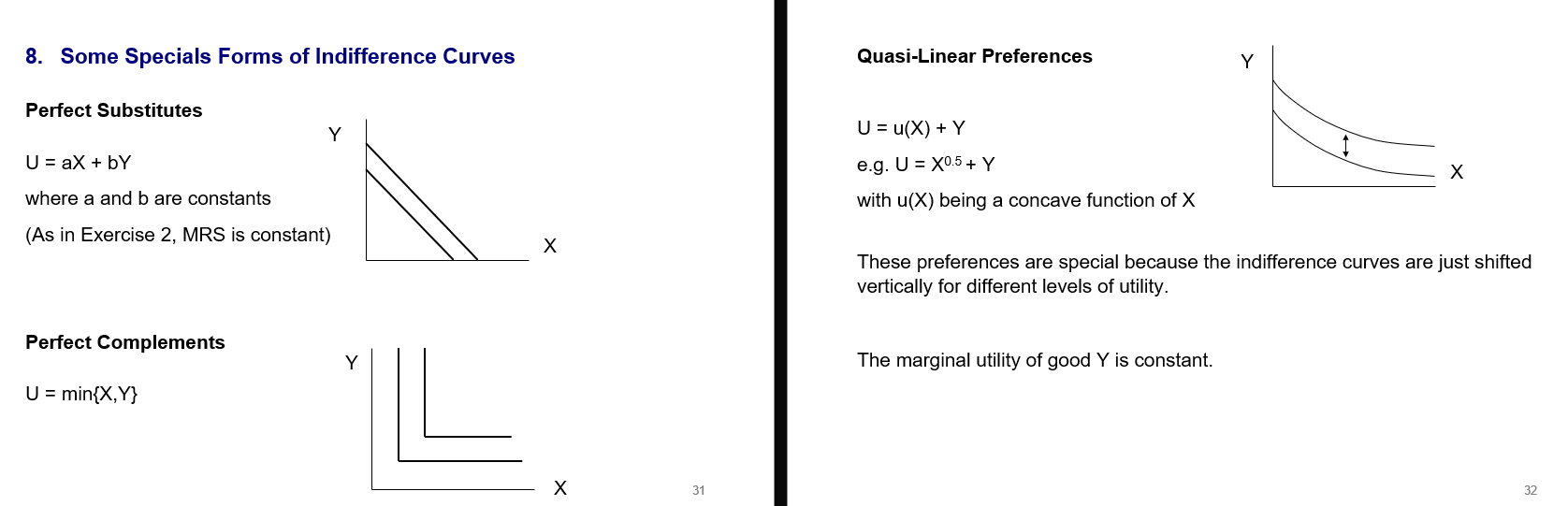

3 types of special indifference curves

Perfect substitutes

U = aX + bY

Perfect complements

U = min (X,Y)

Quasi-Linear Preferences

U = u(X) + Y such as X^0.5

u(X) a concave function of X

Marginal utility of good Y is constant

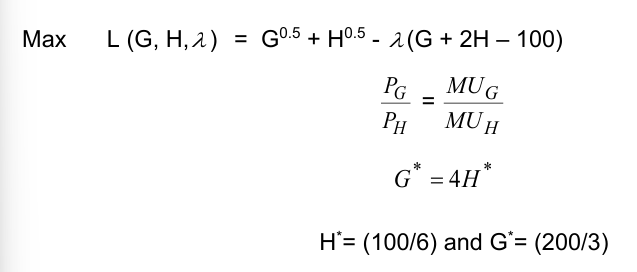

How to construct a demand function as part of demand and elasticity:

Constructing a demand function

We want to find the DF for good H, as a general function of pg, ph and M; H* = H* (pg,ph,M)

Add budget constraint

Max U (G,H) = G^0.5 + H^0.5 st. pgG + phH = M

Rearrange

Max U (G,H) = G^0.5 + H^0.5 - λ (pgG + phH - M)

Partial diffs

∂L / ∂G = 0.5G^-0.5 - λ pg = 0

∂L / ∂H = 0.5H6-0.5 - λ ph = 0

∂L / ∂λ = -(pgG + phH - M) = 0

Equate to remove lamda, then rearrange to find optimal ratio

0.5G^-0.5 / 0.5H^-0.5 = Pg / ph

ph / SQRT’G’ = pg / SQRT’h

G* = (ph^2 / pg^2)H*

Insert optimal ratio into BC

G* = (ph^2 / pg^2)H* with pgG* + phH* = M

pg [(ph^2 / pg^2)H*] + phH* = M ; converge and rearrange

(ph^2 / pg)H* + phH* = M

H* ((ph^2 / pg) = ph) = M ; remove H from each of the values*

H* = M / (Ph^2 / pg) + ph

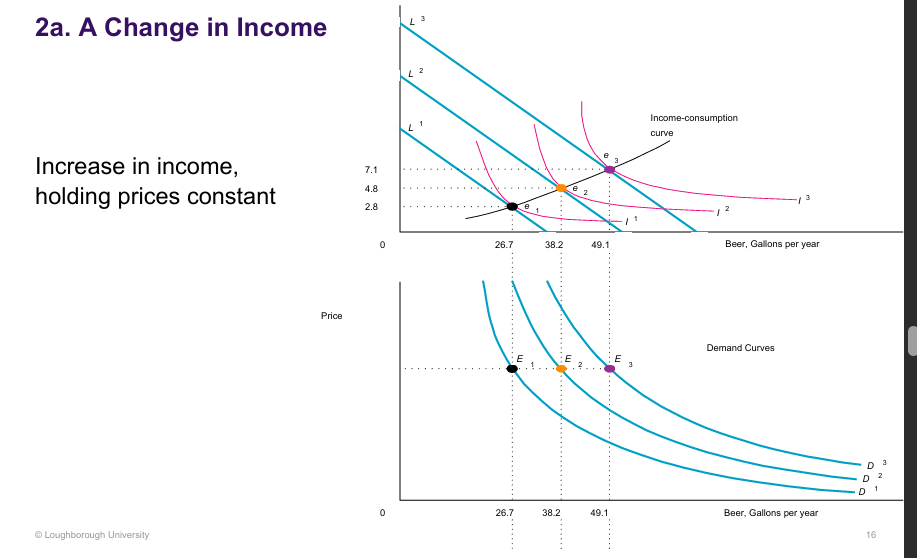

Change in income for Comparative Statics:

Consumption increases as income rises; the DF defines inferior and normal goods

If ∂H*/∂M > 0 ; Good H is a normal good.

If ∂H*/∂M < 0 ; Good H is an inferior good.

e.g. public transport, having children = inferior good

Our example before, we can verifying that good H is a normal good

H = M / (ph^2 / pg) + pH*

Comparative statics:

Comparative statics

A change in ENV will affect consumer behaviour

Gov - taxation, spending, regulation, policy decisions

Firm - pricing, marketing, investment decisions

Comparative statistics: analysis of changes in EQ that occur due to Env changes.

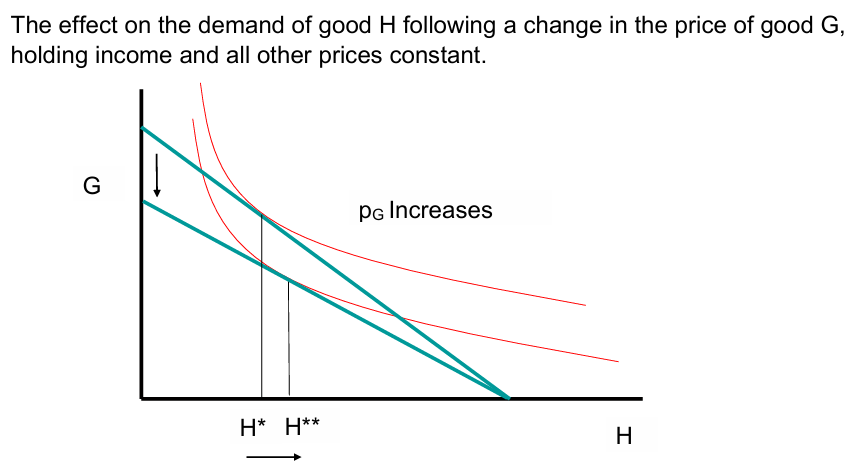

Change in Different’s good Price of Comparative Statics:

Price of good G increases → The budget line pivots inwards, since G becomes relatively more expensive.

Substitution effect → Consumers substitute away from the now pricier good G toward good H, increasing demand for H from H* to H**.

Income effect → The rise in pGp_GpG reduces real purchasing power, slightly offsetting the substitution effect depending on whether H is normal or inferior.

Goods G and H are substitutes (∂H/∂pG > 0)*

If ∂H/∂pG > 0 ; Good G and good H are substitutes (coke and pepsi)*

If ∂H/∂pG < 0 ; Good G and good H are complements (cars + petrol)*

If ∂H/∂pG = 0 ; Good G and good H are independent goods (choc + hats)*

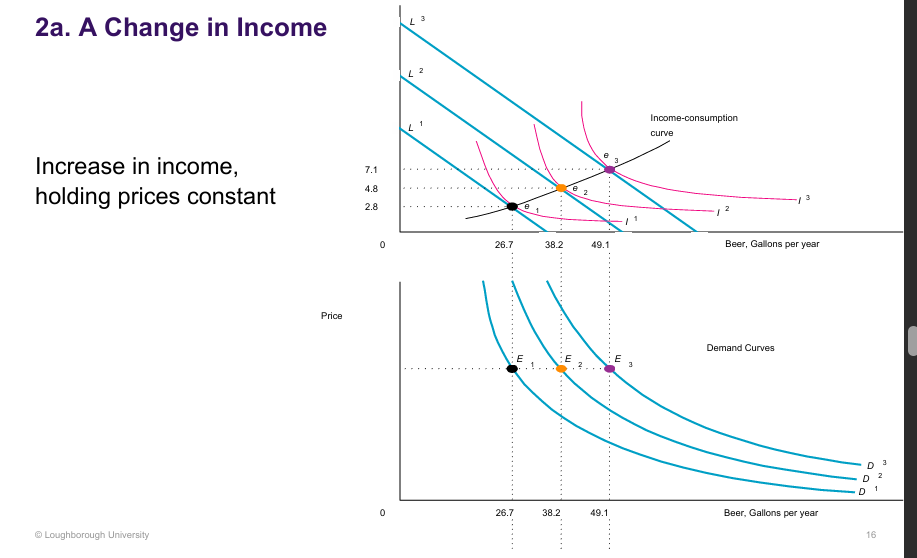

Change in Income of Comparative Statics:

Consumption increases as income rises; the DF defines inferior and normal goods

If ∂H*/∂M > 0 ; Good H is a normal good.

If ∂H*/∂M < 0 ; Good H is an inferior good.

e.g. public transport, having children = inferior good

Our example before, we can verifying that good H is a normal go

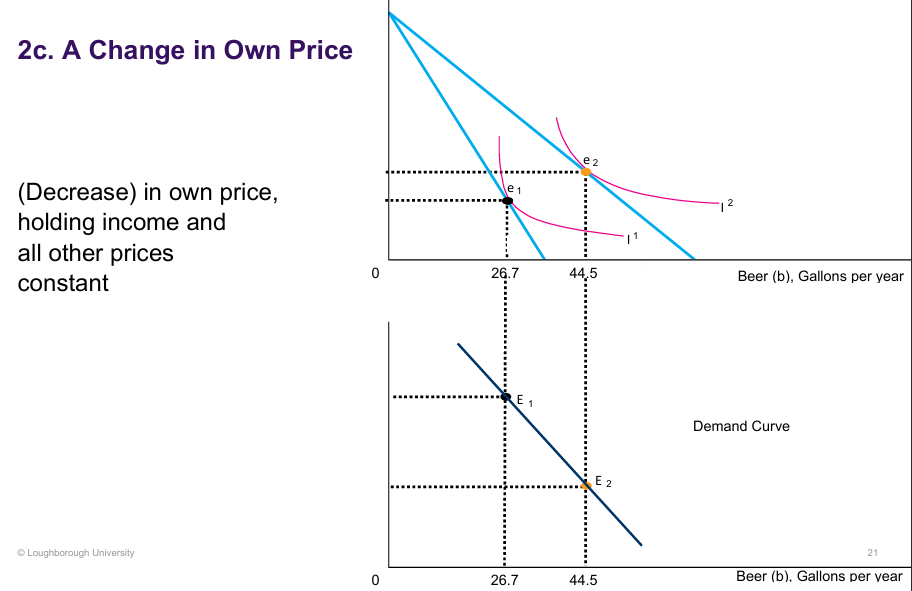

Change in Own Price of Comparative Statics:

Own price of beer decreases → The budget line pivots outward, allowing the consumer to buy more beer with the same income.

New equilibrium → Consumption moves from e₁ to e₂ as the consumer reaches a higher indifference curve.

Demand curve → The bottom graph shows that as the price falls, the quantity demanded increases — law of demand.

If ∂H/∂pH < 0 ; Good H is an ordinary good.*

If ∂H/∂pH > 0 ;Good H is a Giffen good*

Income elasticity of demand:

% change in demand for good H that follows 1% increase in income

A good is normal following ∂H/∂M > 0 ,* positive income elasticity because n>0 (M/H*>0)

n = % change in H / % change in M = ∂H/H / ∂M/M = ∂H* / ∂M x M / H****

Cross elasticity of demand:

XED: (for good H) % change in demand for good H that follows a 1% increase in the price of good G

𝜀𝐻G = % change in H / % change in pg = ∂H / ∂pg x pg / h***

Goods G and H will have positive XED if substitutes and negative XED if complements (negative = opposite action e.g. price increase leads to demand decrease and vice versa)

10% increase in cigarette price —> low income families reduce food demand by 17%

substitutes as LYF substitute food for ST cigarette satisfaction on a low budget

Demand function context - You own a business producing training shoes. Using past data, you estimate the demand for your product. The results suggest that your monthly sales, Qi, can be expressed by the following, where M is average income, {pA, pB, pC} are the prices of other firms and pi is your own price.

Qi = 0.6M + 0.7pA + 0.3pB - 0.2pC – 0.6pi

Qi = 0.6M + 0.7pA + 0.3pB - 0.2pC – 0.6pi

0.7PA = substitute (higher coefficient —> higher substitutability); higher PA increases sales

0.3PB = weak substitute

0.2PC = weak complement

Closest rival = Firm A; price has largest positive coefficient (0.7)

My sales respond most strongly to changes in Firm’s A price

Q) Currently, your price is 10, average income is 700 and your sales are 50. If income rises by 1% and price rises by 1%, what % change do you expect in your sales? (Hint: find the value of the income elasticity under these conditions).

Income elasticity: EM = 0.6 x 700 / 50 = 8.4 ; EM = M x Average Income / Sales

1% rise in income —> 8.4% increase in sales

Price elasticity: Ep = -0.6pi x 10 / 50 = -0.12 ; Ep = pi x price / sales

1% increase in price —> 0.12% reduction in sales

From econometric analysis, you know the sales of whiskey, QW, can be expressed by the following, where M is average income, and pW is the price of whiskey.

QW = 100 – 0.1M – 0.2pW

Currently, the price of whiskey is 10, and sales are 40. You are asked to predict the % change in whiskey sales after a potential tax increase that would lead to a 1% increase in the price of whiskey. Verify that your prediction would be -0.05%.

pw = 10

Qw = 40

Step 1 - FInd PED

Epw = dQw / dPw x Pw / Qw

dQw / dPw = -0.2 (in Equation)

Epw = (-0.2) x pw/qw = (-0.2) x 10/40 = - 0.05

Therefore, 1% increase in price —> -0.05% decrease in whiskey sales after a potential tax increase