financial accounting 1

0.0(0)

Card Sorting

1/56

Earn XP

Description and Tags

Study Analytics

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

57 Terms

1

New cards

What is accouting?

process of identifying, measuring and communicating financial information about a business entity

2

New cards

gross profit

sales revenue less purchase costs

3

New cards

net profit

sales revenue less total costs

4

New cards

what does an income statement do

it summaries all income and expenditure over a period of time

5

New cards

separate entity concept

business activities are kept separate from owners

6

New cards

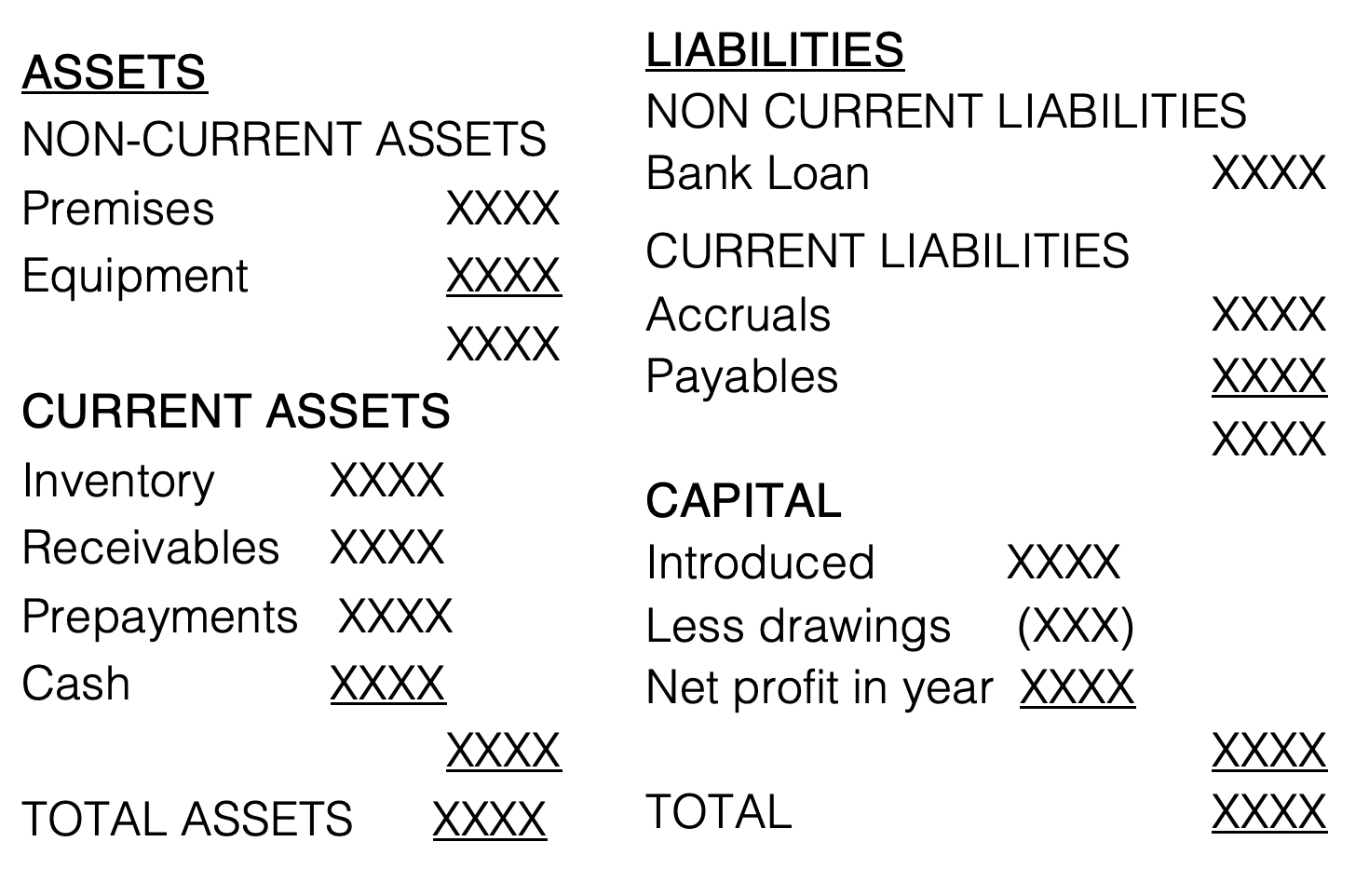

what is a balance sheet

financial statement which shows financial position at a specific point of time

7

New cards

accounting equation

Assets = Liabilities + Capital

8

New cards

what is an asset?

- resources owned/controlled by the business to give future economic benefit

- cash in bank, stock, machinery

- cash in bank, stock, machinery

9

New cards

liability

- what business owes

- bank debt, taxes

- bank debt, taxes

10

New cards

capital

- investment by the owner

- money introduced and retained profit

- money introduced and retained profit

11

New cards

expenditure

- revenue

- capital

- revenue

- capital

is a transaction or event which causes a decrease in ownership interest

- revenue expenditure = expense used in period or matches with revenue for the period

- capital expenditure = expense used on items in this and future periods

- revenue expenditure = expense used in period or matches with revenue for the period

- capital expenditure = expense used on items in this and future periods

12

New cards

nominal ledger

the main place where accounting transactions are recorded.

13

New cards

main principles of bookkeeping

- dual effect

- separate entity concept

- accounting equation

- separate entity concept

- accounting equation

14

New cards

how is accounting equation linked to dual effect

every transaction has two effects on the accounting equation

( if assets increase then liabilities or capital must increase)

( if assets increase then liabilities or capital must increase)

15

New cards

DEAD CLIC

Debit

- Expenses

- Assets

- Drawings

Credit

- Liabilities

- Income

- Capital

- Expenses

- Assets

- Drawings

Credit

- Liabilities

- Income

- Capital

16

New cards

what is balancing figure

- used to make debit and credit total equal

- put at the bottom of the smaller side

- put at the bottom of the smaller side

17

New cards

where does capital, cash, loan, drawings go

balance sheet

18

New cards

where does purchases, sales, expenses go

income statement

19

New cards

why would a suspense account be on a balance sheet

an error has been made

20

New cards

what does the IASB framework set out

concepts which underlie the preparation of financial statements

21

New cards

key accounting assumptions

accruals - expenses should be matched to the period hey relate and to the expenses they generate

going concern - assume entity will continue to trade for the foreseeable future

going concern - assume entity will continue to trade for the foreseeable future

22

New cards

cash flow = ?

cash in - cash out

23

New cards

what is an accrual

expenses incurred but not invoiced yet

24

New cards

what is a prepayment

expenses paid in advance

25

New cards

adjustments are needed to comply with

IASB and UK company law

26

New cards

how is an accrual recognised in BS and IS

recognise the liability in the BS (Cr Accruals), increase the expenses in the IS (Dr Expense)

27

New cards

how is a prepayment recognised in IS and BS

decrease expense in IS (Cr Expense), recognise the asses in the BS (Dr Prepayment)

28

New cards

what is the prudence concept

recognising a profit very slowly but when u anticipate a loss u account for it fast

29

New cards

difference between bad and doubtful debt

bad debt = definitely irrecoverable, not getting the money

Doubtful deft = some chance of recovery but also a risk of non payment

Doubtful deft = some chance of recovery but also a risk of non payment

30

New cards

how do u recognise a bad debt

as an expense in the IS

31

New cards

how do u recognise doubtful debt

Dr bad debt expense

Cr Doubtful Debts Provision.

\

Cr Doubtful Debts Provision.

\

32

New cards

which method should be used for inventory valuation

FIFO or WAC in financial accounting, used every year

33

New cards

what is net realisable value

estimated future selling price less ll additional costs to be incurred before sale

34

New cards

what is deprecation and why do we need it

the systematic allocation of a non-current asset over its useful economic life.

need it to spread the cost of a non current asset gradually over the years of its use and wearing out.

need it to spread the cost of a non current asset gradually over the years of its use and wearing out.

35

New cards

how do u calculate deprecation

1. straight line method

2. reducing balance method

2. reducing balance method

36

New cards

who is VAT administered by

HMRC

37

New cards

what are the types of supple (3)

- standard rate

- zero rated

- exempt

- zero rated

- exempt

38

New cards

what are the two types of discount

trade and early settlement

39

New cards

payables?

debt owed by a business (liabilities)

40

New cards

what is the standard rate of VAT

20%

41

New cards

what is the zero rate of VAT

10%

42

New cards

when do u calculate VAT in respect to discount

after all discounts

43

New cards

what’s a non-current asset

assets and property owned by a business that are not easily converted to cash within a year - long term asset

44

New cards

when can VAT not be recovered?

when a registered VAT business buys a motor car

45

New cards

what’s NBV

net book value - which is the original purchase cost minus the deprecation charged to date on that asset

46

New cards

residual value?

estimated amount that a company can acquire when they dispose of an asset at the end of its useful life

47

New cards

receivables?

amount owed to a business

48

New cards

difference between a profit and loss account and a balance sheet?

The Balance Sheet is a statement of assets, liabilities and capital, whereas the Profit and Loss account is a statement of income and expenses.

49

New cards

what are creditors

people that are lending money to the business

50

New cards

when can u claim capital on a car

when its for business use

51

New cards

examples of capital items

equipment, machinery, buildings, facilities, and vehicles

52

New cards

what is the cost of sales lay out

sales = a

\

cost of sales:

opening inventory = b

\+ purchases = c

\- closing stock= d

\

gross profit = a-(b\`+c-d)

\

cost of sales:

opening inventory = b

\+ purchases = c

\- closing stock= d

\

gross profit = a-(b\`+c-d)

53

New cards

what is inventory valued at

the lower out of cost or NRV

54

New cards

how do u calculate NRV

selling price - selling cost

55

New cards

bad debt provisions and movement?

only debit the movement between provisions

56

New cards

is receivables an asset or a liability

asset

57

New cards

what does the balance sheet look like?