FMI Lec4 The money markets

1/31

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

32 Terms

Money Market

highly liquid, short-term financial assets

Why do businesses not store money in banks?

tax benefits

During 2008, money market assets ____ their liquidity

lost

3 characteristics of money markets

large denominations (>= 1million)

Low default risk

low maturity (<= 120 days)

Is a 2 year bond that matures in 100 days a money market asset?

no— it has low residual maturity

Does return matter in money markets?

not really. Lenders/Buyers just want to store surplus funds. Only liquidation

Appeal of money markets

access quickly to short term funds at low cost. great for cash flow management when inflows and outflows aren’t well synchronized

Why are money markets at a cost advantage over banks?

banks have EoS, info advantage, but they are too heavily regulated

banks cannot lend 100% of their borrowed$ but money markets can

Regulation Q (Glass-Steagall Act 1933): put an interest rate cap on deposits to limit competition btwn banks

Regulation Q (Glass-Steagall Act 1933)

limit competition between banks by putting an interest rate cap

excessive competition leads to market failure. sacrifice welfare for financial stability. repealed

THe Glass-steagall act caused money markets to ____

boom

rose 3000%

effects lasted even after repeal in 87

money market borrowers

gov

finance companies

banks and corps

money market lenders

mutual funds

insurance companies

pension funds

banks and corps

T-bill

<3 months, 1 year

zero-coupon discount

T notes

2-10 years

semiannual

T bonds

10+ years

semiannual

TIPS

5-30 yr

semiannual

inflation adjusted

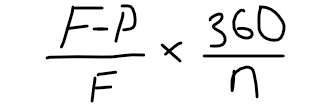

Annualized discount rate

n=maturity in days

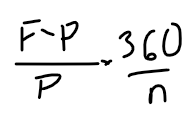

Investment rate

n=maturity in days

replace F of annualized discount rate with P

competitive bid at a T-bill auction

bids accepted in descending order of price until Q reached. then sold at lowest price.

<35% of issuance to each bidder

noncompetitive bid of t-bill auctions

bidders only provide amount not price, and they will take the price of the competitive bidders. their amount is guaranteed but they have no say over price

Federal Funds

short-term, unsecured loans between financial institutions to meet reserve requirements”

“Fed has cut interest rates”means ____

Federal Funds rate

How does federal reserve control federal fund rates?

influencing supply and demand.

rates move with T-bills.

Repos; Repurchase Agreements for Central Banks

a short-term loan where one party (usually a bank or dealer) sells securities — usually bonds — to another party (like the central bank) with a promise to buy them back later at a slightly higher price.

collateralized borrowing by CB

Negotiable certificates of deposit

deposit with specified interest rate and maturity.

term deposit: cannot withdraw before maturity

100k-10m USD

1-60 months

large market, second only to T bill

Buyers/lenders: wealthy individuals and pension funds

Commercial Paper CP

unsecured promissory notes

issued by a corporation maturity <270 days

drop in crises (like 9/11)

Asset-backed CP

secured by assets— securitized mortgages

collapsed during 2007 subprime mortgage crisis

Eurodollars

dollar denominated deposits in non-US bank

basis for LIBOR (London Interbank Offer Rate)

LIBOR scandal

LIBOR: the rate at which major global banks lend money to each other in the eurocurrency market

one side pays a fixed rate, and the other pays floating LIBOR rate betting it will decrease.

profit= $position(fixedrate - LIBOR)

banks colluded to get interest rate swaps

the Rates for different money market securities move ____

very closely

The primary differences between money market securities are in their ___ and ___ risk

credit and liquidity risk

money market securities should have

high liquidity

little price risk