Audit Exam 2

1/84

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

85 Terms

5-1 Auditors of U.S. public companies should follow the PCAOB’s auditing standards. (T/F)

T

5-3 Which of the following statements is true regarding auditing standard setting in the United States?

a. The AICPA is responsible for setting auditing standards for audits of nonpublic entities.

b. The PCAOB is responsible for setting auditing standards for audits of public companies.

c. The AICPA is responsible for setting auditing standards for audits of both public and nonpublic companies.

d. The SEC sets auditing standards for auditors of public and nonpublic companies.

e. Both (a) and (b) are correct.

e. Both (a) and (b) are correct.

5-6 The purpose of an audit is to enhance the degree of confidence that users can place on the financial statements. (T/F)

T

5-7 Which of the following statements is false?

a. The purpose of an audit is to enhance the degree of confidence that managers can place in the financial statements, thereby facilitating their decision making.

b. Auditors are responsible for having the appropriate competence and capabilities to perform the audit, should comply with ethical requirements, and maintain professional skepticism throughout the audit.

c. The auditor needs to obtain reasonable assurance as to whether the financial

statements are free from material misstatement.

d. An audit has inherent limitations such that the auditor is not able to obtain absolute assurance about whether the financial statements are free from misstatement.

a. The purpose of an audit is to enhance the degree of confidence that managers can place in the financial statements, thereby facilitating their decision making.

(Users not managers)

5-13 The cycle approach to auditing provides a way for breaking the audit up into manageable components. (T/F)

T

5-14 Within a particular cycle, the auditor focuses on the flow of transactions within that cycle, including how transactions are initiated, authorized, recorded, and reported. (T/F)

T

5-16 Which of the following accounts would not be included in the Acquisition and Payment for Long-Lived Assets Cycle?

a. Revenue.

b. Depreciation expense.

c. Gain on disposal.

d. Equipment.

a. Revenue.

5-17 The completeness assertion is typically the more relevant assertion for assets and revenue. (T/F)

F

5-18 A classic inventory fraud involves management understating ending inventory, thereby yielding a reduction in cost of goods sold and an overstatement of profitability. (T/F)

F (Overstate ending inventory)

5-19 Which of the following is not a management assertion? (COVERU)

a. Completeness.

b. Existence.

c. Rights and obligations.

d. Valuation.

e. Placement.

e. Placement.

5-20 Which management assertion is usually most relevant for liability accounts?

a. Completeness.

b. Existence.

c. Rights and obligations.

d. Presentation and disclosure.

e. None of the above address whether the components of the financial statements are properly classified, described, and disclosed.

a. Completeness.

5-21 Risk assessment procedures provide sufficient appropriate audit evidence on which to base an audit opinion. (T/F)

F

5-23 Audit procedures fall into three categories. Which of the following is not a category of

audit procedures?

a. Risk assessment procedures.

b. Tests of risks.

c. Tests of controls.

d. Substantive procedures.

e. All of the above are categories of audit procedures.

b. Tests of risks.

5-24 Which of the following is a true statement regarding audit evidence and audit

procedures?

a. The auditor has a responsibility to design and perform audit procedures to obtain

sufficient appropriate audit evidence.

b. Inquiry is a type of audit procedure that typically does not require the auditor to perform additional procedures.

c. Substantive procedures are performed to test the operating effectiveness of a client’s internal control.

d. Risk assessment procedures alone provide sufficient appropriate audit evidence on which to base an audit opinion.

a. The auditor has a responsibility to design and perform audit procedures to obtain

sufficient appropriate audit evidence.

5-27 Which of the following information should be included in audit documentation?

a. Procedures performed.

b. Audit evidence examined.

c. Conclusions reached with respect to relevant financial statement assertions.

d. All of the above should be included.

d. All of the above should be included.

5-28 Which of the following statements is false regarding audit documentation?

a. An audit program is an example of audit documentation.

b. The only purpose of audit documentation is to provide evidence that the audit was

planned and performed in accordance with auditing standards.

c. Audit documentation helps facilitate internal and external inspections of completed audits.

d. Audit documentation is required on all audit engagements.

b. The only purpose of audit documentation is to provide evidence that the audit was planned and performed in accordance with auditing standards.

5-34 The auditor assesses the risk of material misstatement at only the account level. (T/F)

F

5-35 Which of the following statements is true regarding the design of controls related to credit limits?

a. The effectiveness of the control design is contingent on the credit manager’s process for establishing and reviewing credit limits.

b. Because the process of establishing credit limits is fairly time consuming, the control should be designed so that the marketing manager has the ability to approve sales on an ad hoc basis while waiting for the credit approval.

c. The control should be designed so that the sales manager has final approval regarding credit limits.

d. All are true statements regarding the design of controls related to credit limits.

a. The effectiveness of the control design is contingent on the credit manager’s process for establishing and reviewing credit limits.

5-37 One valid approach to testing controls over credit review and approval for customers that are granted credit involves taking a sample of customer orders and tracing them through the system to determine whether: (a) there was proper review of credit and (b) credit authorization or denial was proper. (T/F)

T

5-44 In which of the following scenarios is the auditor most likely to obtain more (or more rigorous) substantive evidence?

a. When subjectivity related to the assertion is low.

b. When controls are determined to be operating effectively.

c. When the account is immaterial.

d. When the design of controls is determined to be ineffective.

d. When the design of controls is determined to be ineffective.

6-1 The appropriateness of audit evidence refers to its relevance and reliability. (T/F)

T

6-2 The sufficiency of evidence is a measure of evidence quality. (T/F)

F

6-3 An auditor determines that management integrity is high, the risk of materialmisstatement is low, and the client’s internal controls are effective. Which of the following conclusions can be reached regarding the need to obtain direct evidence about the account balances?

a. Direct evidence can be limited to material account balances, and the extent of testing should be sufficient to corroborate the auditor’s assessment of low risk.

b. Direct evidence of account balances is not needed.

c. Direct evidence can be obtained solely through analytical procedures.

d. Direct evidence should be obtained for all accounts, regardless of the auditor’s assessment of control risk.

a. Direct evidence can be limited to material account balances, and the extent of testing should be sufficient to corroborate the auditor’s assessment of low risk.

6-4 Which of the following statements is true regarding the sufficiency of evidence needed to test an account?

a. Evidence sufficiency is a measure of evidence quality.

b. Evidence sufficiency is affected by the quality of evidence.

c. A relationship does not exist between evidence sufficiency and evidence quality.

d. For a specific client, evidence sufficiency will be the same across all accounts.

b. Evidence sufficiency is affected by the quality of evidence.

6-5 A procedure that involves only inspection of documentation is usually considered to be of lower quality than a procedure involving reperformance. (T/F)

T

6-6 All audit procedures need to be performed at or after the client’s balance sheet date. (T/F)

F

6-7 The auditor is testing the completeness assertion. Which of the following statements is true regarding the auditor’s work?

a. The auditor would take a sample of recorded transactions and obtain supporting

documentation for those transactions.

b. The auditor would perform a process referred to as tracing.

c. The auditor would take a sample of source documents and obtain additional supporting documents for those transactions.

d. For a sample of items recorded in the sales journal, the auditor would obtain the related shipping documents and customer orders.

b. The auditor would perform a process referred to as tracing.

6-8 The auditor is gathering evidence to test the assertion that the client’s capitalization of leased equipment assets is properly valued. Which of the following sources of evidence will the auditor generally find to be of the highest quality (most reliable and relevant)?

a. Inspection of the leased equipment.

b. Inspection of documents, including the lease contract and recalculation of capitalized amount and current amortization.

c. Confirmation of the current purchase price for similar equipment with vendors.

d. Confirmation of the original cost of the equipment with the lessor.

b. Inspection of documents, including the lease contract and recalculation of capitalized amount and current amortization.

6-9 Substantive analytical procedures are required on every audit. (T/F)

F

6-10 One of the most rigorous approaches to substantive analytical procedures is regression analysis. (T/F)

T

6-17 The auditor should document significant issues that were identified and how they were resolved. (T/F)

T

6-18 The auditor should use a standardized audit program, without any modifications, for all clients. (T/F)

F

6-19 Which of the following statements is true regarding audit documentation?

a. Auditors document only those significant issues that have not been resolved by the audit report date.

b. Audit documentation provides the principal support for the audit opinion expressed by the auditor.

c. Audit documentation would identify who reviewed the audit work but not who performed the audit work.

d. Documentation must be in paper format.

b. Audit documentation provides the principal support for the audit opinion expressed by the auditor.

7-2 Performance materiality is an amount less than overall materiality and helps the auditor determine the extent of audit evidence needed. (T/F)

T

7-3 Which of the following statements is true regarding materiality?

a. Materiality is the magnitude of an omission or misstatement of accounting information that, in light of surrounding circumstances, makes it probable that the judgment of a reasonable person relying on the information would have been changed or influenced by the omission or misstatement.

b. Materiality is the magnitude of an omission or misstatement of accounting information that, in light of surrounding circumstances, makes it possible that the judgment of a reasonable person relying on the information would have been changed or influenced by the omission or misstatement.

c. A fact is material if there is a substantial likelihood that a reasonable investor would have viewed the fact as having significantly altered the total mix of information made available.

d. Both (a) and (c) are correct.

e. Both (b) and (c) are correct.

d. Both (a) and (c) are correct.

7-4 Which of the following statements is true concerning performance materiality?

a. Performance materiality is set less than overall materiality and helps the auditor

determine the extent of audit evidence to obtain.

b. If performance materiality is set too low, the auditor might not perform sufficient

procedures to detect material misstatements in the financial statements.

c. If performance materiality is set too high, the auditor might perform more substantive procedures than necessary.

d. Performance materiality is essentially the same as overall materiality.

a. Performance materiality is set less than overall materiality and helps the auditor

determine the extent of audit evidence to obtain.

7-5 Detection risk is the susceptibility of an assertion to a material misstatement before consideration of related controls. (T/F)

F

7-6 Some level of control risk is always present in an organization because of the inherent limitations of internal control. (T/F)

T

7-7 Which of the following statements represents the appropriate directional relationships?

a. As inherent risk increases, audit risk increases.

b. As inherent risk increases, audit risk decreases.

c. As control risk increases, detection risk decreases.

d. As control risk increases, inherent risk decreases.

c. As control risk increases, detection risk decreases.

7-9 A high level of detection risk means that the audit firm is willing to accept a low risk of not detecting a material misstatement. (T/F)

F

7-10 The nature of risk response refers to the sufficiency and appropriateness of evidence that is necessary given the risk of material misstatement and the level of acceptable audit risk. (T/F)

F

7-11 Assume that the auditor sets audit risk at 1%. What is the appropriate interpretation of

this level of audit risk?

a. The auditor is willing to take only a 1% chance that audit procedures will not detect a material misstatement.

b. The auditor is 99% confident that the audit procedures will detect a material misstatement.

c. The auditor is willing to take only a 1% chance of expressing an audit opinion that the financial statements are fairly presented when they are materially misstated.

d. The auditor is 99% confident that the audit opinion is correct.

c. The auditor is willing to take only a 1% chance of expressing an audit opinion that the financial statements are fairly presented when they are materially misstated.

7-12 Which of the following statements is false regarding the nature, timing, and extent of risk

responses?

a. The nature of risk response refers to the types of audit procedures applied given the nature of the account balance and the most relevant assertions regarding that account balance.

b. The timing of risk response refers to when the auditor performs the audit procedures.

c. When the risk of material misstatement is low, the auditor conducts the audit procedures closer to yearend, on an unannounced basis, and includes more elements of unpredictability in the procedures.

d. The extent of risk response refers to the sufficiency of evidence that is necessary given the client’s assessed risks, materiality, and the acceptable level of audit risk.

c. When the risk of material misstatement is low, the auditor conducts the audit procedures closer to yearend, on an unannounced basis, and includes more elements of unpredictability in the procedures.

8-1 Sampling can be used for both tests of controls and substantive tests of account

balances and assertions. (T/F)

T

8-2 Auditors can use sampling for testing either the effectiveness of controls (attributes sampling) or direct tests of account balances and assertions (monetary unit sampling). (T/F)

T

8-3 For which of the following auditing procedures would sampling be most appropriate?

a. Examining documents.

b. Inquiring of management.

c. Observing controls being completed.

d. Conducting analytical procedures.

a. Examining documents.

8-5 Sampling risk is the risk that the auditor’s conclusion based on a sample might be different from the conclusion that would be reached if the audit procedure were applied in the same way to the entire population. (T/F)

T

8-6 The risk of incorrect acceptance of internal control reliability is the risk that the auditor will conclude that an internal control is not effective when the internal control is effective. (T/F)

F

8-8 Refer to Exhibit 8.2 and determine which of the following terms matches this definition:

The risk that the auditor will conclude that internal controls are effective when internal controls are actually not effective.

a. The risk of incorrect acceptance of internal control reliability.

b. The risk of incorrect acceptance of book value.

c. The risk of incorrect rejection of internal control reliability.

d. The risk of incorrect rejection of book value.

e. None of the above.

a. The risk of incorrect acceptance of internal control reliability.

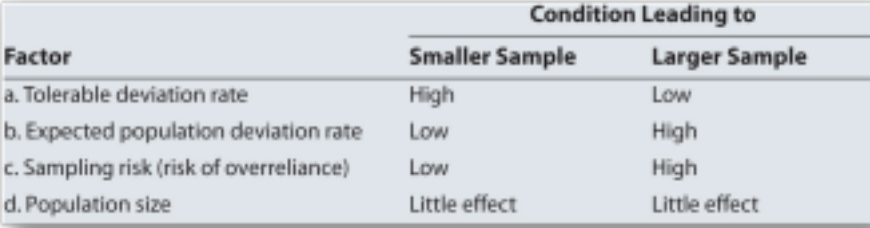

8-23 Which of the following relationships is inaccurate?

C

8-38 Data analytics is a broad construct referring to both qualitative and quantitative analysis tools that enable a decision maker to extract data, categorize it, identify patterns within it, and use it to enhance efficiency and effectiveness in decision making. (T/F)

T

Which of the following activities is not part of the activities within the audit opinion formulation process?

A. The auditor identifies and assesses risks of material misstatements and then responds to those identified risks.

B. The auditor determines the appropriate audit opinion(s) to issue.

C. The auditor determines the appropriate nonaudit consulting services to provide to the client.

D. The auditor develops a common understanding of the audit engagement with the client.

C. The auditor determines the appropriate nonaudit consulting services to provide to the client.

The completeness assertion is typically the more relevant assertion for assets and revenue. (T/F)

F (Liabilities)

Which of the following is a true statement regarding audit evidence and audit procedures?

A. Risk assessment procedures alone provide sufficient appropriate audit evidence on which to base an audit opinion.

B. Inquiry is a type of audit procedure that typically does not require the auditor to perform additional procedures.

C. Substantive procedures are performed to test the operating effectiveness of a client’s internal control.

D. The auditor has a responsibility to design and perform audit procedures to obtain sufficient appropriate audit evidence.

D. The auditor has a responsibility to design and perform audit procedures to obtain sufficient appropriate audit evidence.

In which of the following scenarios is the auditor most likely to obtain more (or more rigorous) substantive evidence?

A. When the design of controls is determined to be ineffective.

B. When the account is immaterial.

C. When controls are determined to be operating effectively.

D. When subjectivity related to the assertion is low.

A. When the design of controls is determined to be ineffective.

Within a particular cycle, the auditor focuses on the flow of transactions within that cycle, including how transactions are initiated, authorized, recorded, and reported. (T/F)

T

The client’s verbal evidence is more reliable than evidence from independent outside sources. (T/F)

F

A limitation of observation is that observing a process on one day does not necessarily indicate how the transactions were processed on a different day or over a relevant period of time. (T/F)

T

Directional testing involves testing transactions or balances for which type of error?

A. Neither overstatement nor understatement

B. Understated

C. Either overstated or understated

D. Overstatement

C. Either overstated or understated

External documentation may lack reliability. Which of the following is the most probable reason for that?

A. The documentation may be properly understood by the client in the response

B. The documentation may have been altered if the process is not controlled from inception.

C. The auditor may decide not to use the documentation and replace it with other documents.

D. The external party may be competent in performing duties

B. The documentation may have been altered if the process is not controlled from inception.

An auditor selects a sample of items recorded and vouches them back to the supporting documentation. This is an example of which of the following?

A. Directional testing for completeness.

B. Directional testing for existence.

C. Direct testing for valuation.

D. Direct testing for rights.

B. Directional testing for existence.

Why of the following type of audit evidence is the most persuasive?

A. Prenumbered client purchase order forms

B. Client work sheets supporting cost allocations

C. Bank statements obtained from the client

D. Client representation letter

C. Bank statements obtained from the client

There is an inverse relationship between the assessment of risk of material misstatement in an account and the amount of evidence required. (T/F)

F

Which of the following assertions would the auditor usually consider most relevant for accounts payable?

A. Valuation

B. Completeness

C. Existence

D. Disclosure

B. Completeness

Which of the following terms describes procedures designed to detect material misstatements in accounts?

A. Business risk procedures

B. Risk assessment procedures

C. Control tests

D. Substantive procedures

D. Substantive procedures

Inherent risk refers to the risk that a misstatement could occur in an assertion about a class of transaction, account balance, or disclosure, and which could be material, either individually or when aggregated with other misstatements, will not be prevented, or detected and corrected, on a timely basis by the entity’s internal control. (T/F)

F (Control Risk)

When may audit procedures be performed?

I - on the balance sheet date.

II - prior to the balance sheet date.

III - subsequent to the balance sheet date.

A. I only

B. I and II only

C. II only

D. I, II, and III

D. I, II, and III

Performance of audit procedures at an interim date causes the risk of material misstatement occurring between the interim date and the end of the year to do which of the following?

A. Become more difficult to ascertain.

B. Decrease.

C. Increase.

D. Remain the same.

C. Increase.

When are auditors required to use analytical procedures during the audit?

A. Planning the audit.

B. Substantive testing.

C. Completing the audit.

D. Planning & Completion

E. All of the above.

D. Planning & Completion

The type of audit procedure known as inquiry does not ordinarily provide sufficient audit evidence of the absence of a material misstatement, nor is it alone sufficient to test the operating effectiveness of controls. (T/F)

T

For an auditor to test the existence assertion of assets, testing will be performed beginning with the recorded asset and ending with the source documents. (T/F)

T

For which of the following auditing procedures would sampling be most appropriate?

A. Examining Documents.

B. Inquiring of management.

C. Observing controls being completed

D. Conducting Analytical procedures

A. Examining Documents.

Refer to Exhibit 8.2 and determine which of the following terms matches this definition: The risk that the auditor will conclude that internal controls are effective when internal controls are actually not effective.

A. The risk of incorrect acceptance of internal control reliability.

B. The risk of incorrect acceptance of book value.

C. The risk of incorrect rejection of internal control reliability.

D. The risk of incorrect rejection of book value.

E. None of the above.

A. The risk of incorrect acceptance of internal control reliability.

When the auditor detects control deviations, it is best to evaluate them quantitatively rather than qualitatively. (T/F)

F

The auditor should not pursue which of the following options when a control is ineffective?

A. Identify a compensating control.

B. Take a larger sample.

C. Assess control risk as lower than originally planned and change the audit approach accordingly.

D. Analyze the nature of the control deviations and identify implications.

C. Assess control risk as lower than originally planned and change the audit approach accordingly.

To test the existence assertion for sales, which of the following data analytics tools might you use?

A. Compare sales invoices with shipping documents.

B. Compare sales invoices with sales contracts.

C. Analyze data around year-end to ensure that sales are recorded in the correct period.

D. All of the above.

D. All of the above.

Performance materiality is an amount less than overall materiality and helps the auditor determine the extent of audit evidence needed. (T/F)

T

Which of the following statements is true concerning performance materiality?

A. Performance materiality is set less than overall materiality and helps the auditor determine the extent of audit evidence to obtain.

B. If performance materiality is set too low, the auditor might not perform sufficient procedures to detect material misstatements in the financial statements.

C. If performance materiality is set too high, the auditor might perform more substantive procedures than necessary.

D. Performance materiality is essentially the same as overall materiality.

A. Performance materiality is set less than overall materiality and helps the auditor determine the extent of audit evidence to obtain.

Which of the following statements represents the appropriate directional relationships?

A. As inherent risk increases, audit risk increases.

B. As inherent risk increases, audit risk decreases.

C. As control risk increases, detection risk decreases.

D. As control risk increases, inherent risk decreases.

C. As control risk increases, detection risk decreases.

Which of the following statements is false regarding the nature, timing, and extent of risk responses?

A. The nature of risk response refers to the types of audit procedures applied given the nature of the account balance and the most relevant assertions regarding that account balance.

B. The timing of risk response refers to when the auditor performs the audit procedures.

C. When the risk of material misstatement is low, the auditor conducts the audit procedures closer to yearend, on an unannounced basis, and includes more elements of unpredictability in the procedures.

D. The extent of risk response refers to the sufficiency of evidence that is necessary given the client’s assessed risks, materiality, and the acceptable level of audit risk.

C. When the risk of material misstatement is low, the auditor conducts the audit procedures closer to yearend, on an unannounced basis, and includes more elements of unpredictability in the procedures.

Some level of control risk is always present in an organization because of the inherent limitations of internal control. (T/F)

T

The risk of overreliance is the risk that the auditor will conclude that internal controls are effective when internal controls are actually not effective. (Term)

Risk of Over-reliance

The risk of underreliance is the risk that the auditor will conclude that the internal controls are not effective when internal controls are actually effective. (Term)

Risk of Under-reliance

Tolerable failure rate is a rate of deviation set by the auditor in respect of which the auditor seeks to obtain an appropriate level of assurance that the rate of deviation set by the auditor is not exceeded by the actual rate of deviation in the population

Tolerable failure rate

Expected Failure rate is an anticipation of the deviation rate in the entire population.

Expected Failure Rate