Interpretation of Financial Statements - Ratio Analysis

1/48

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

49 Terms

Why is interpretation of financial statements important?

In-depth understanding

Comparison

In-depth understanding

Interpretation is the commentary on the results of the ratios calculated

eg what do they mean, how is the company performing against benchmarks

Comparison

Ratios help to build up a picture of the position and performance of a company

Used for comparison and therefore must be used in context as if you calculate a ratio in isolation it won’t tell you a great deal about the financial health or performance of a company

Types of ratio

Profitability

Efficiency

Liquidity

Gearing

Profitability ratios

ROCE

GP Margin

OP Margin

ROCE

Return On Capital Employed

fundamental measure of business performance

what does it show?

expresses relationship between operating profit and average long-term capital invested in the business

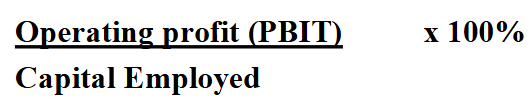

ROCE Equation

what is capital employed?

retained profit, reserves, share capital, share premium, non-current liabilities

Interpretation of ROCE

inputs & outputs

effectiveness of funds

shareholders

interest rate

inputs & outputs

compares inputs (capital invested) with outputs (operating profit)

effectiveness of funds

assesses the effectiveness with which funds have been deployed during the accounting period

high = attractive

shareholders

could the business/shareholders be getting a better return by investing its funds elsewhere

interest rate

ideally ROCE should be higher than the rate of interest in banks

GP Margin

Gross Profit Margin

relates gross profit to the same period’s sales revenue

what is it?

a measure of profitability in buying & selling products before other expenses

GP Margin Equation

interpretation

retained profit

profit level

liquidity

direct costs

retained profit

looks at how much of sales revenue is retained as gross profit

profit level

represents what a company made after paying off its COGS

liquidity

a high GP Margin means the company is more liquid and therefore can spend more on overheads

direct costs

if a company’s direct costs such as raw materials increase, the GP Margin will fall unless selling prices are increased

OP Margin

Operating Profit Margin

relates the operating profit for the period to the sales revenue generated

what does it show?

the margins earned on sales as well as the firm’s ability to control its operating costs

OP Margin Equation

interpretation

retained

indications

variations

retained

shows how much of the sales revenue is retained as operating profit

indications

the higher the OP Margin is the better

less than 5% means the company is in a very competitive sector or is doing badly

if the GP Margin is stable but the OP Margin is falling it indicates to examine operating costs

Efficiency ratios

NCA Turnover

TR Period

Inventory Holding Period

TP Period

NTC

NCA Turnover

Non-Current Asset Turnover

measure of how effectively the firm is using its long-term asset base to generate sales

NCA Turnover Equation

shows the amount of sales revenue generated per £ of non-current assets

interpretation

productivity level

indications

profitability level

measure of the level of activity & productivity of a company

highlights the company’s ability to generate sales revenue from its asset base

indications

if the assets aren’t producing sales then it is a drain on the company’s resources & efficiency

yet this may be distorted by the failure to replace assets