2.6.2 Demand-side policies

1/37

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

38 Terms

DEMAND SIDE POLICIES

policies designed to manipulate consumer demand

expansionary policy- aimed at increasing AD to bring about growth

deflationary policy- attempts to decrease AD to control inflation

MONETARY POLICY- DEFINITION

where central bank or regulatory authority attempts to control level of AD by altering base interest rates or amount of money in economy

FISCAL POLICY- DEFINITION

use of borrowing, government spending and taxation to manipulate level of AD and improve macroeconomic performance

MONETARY POLICIES- INTEREST RATES

interest rate is price of money and the MPC are able to change the official base rate in order to tackle inflation- called repo rate, rate the BoE will charge for short-term loans to other banks or financial institutions

change in repo rate affects market rates offered by banks to consumers and businesses as the BoE is lender of last resort

if they are short of money, they will have to borrow from Bank at repo rate and so they need to make sure that their interest rates are based on this rate so that they are able to make a reasonable return

MONETARY POLICY- INCREASE INTEREST RATE EFFECT

rise in IR cause fall in AD through 4 mechanisms:

increase in cost of borrowing

fall in price of assets

less confidence

increase in value of pound

MONETARY POLICY- INCREASE IR- COST OF BORROWING

will increase cost of borrowing for firms and consumers

will lead to a fall in I and C, reducing AD

higher IR require higher rates of return for investment

also makes savings more attractive, as interest earnt on them will be higher

MONETARY POLICY- INCREASE IR- ASSET PRICES

since less people borrowing and more saving- fall in demand for assets such as stocks, shares and gov bonds

leads to a fall in prices for these assets

so consumers will experience a negative wealth effect which will lead to a fall in consumption

also, investment is less attractive since firms are likely to see lower profits if prices fall

AD falls

MONETARY POLICY- INCREASE IR- CONFIDENCE

people less confident about borrowing and spending if IR rise

fall in consumer and business confidence leads to a fall in C and I, causing a fall in AD

also, other loans will become more expensive to repay and so consumers have to dedicate more of their income to paying back these debts

means they have less income to spend on g and s, so consumption will fall, causing AD to fall

MONETARY POLICY- INCREASE IR- VALUE OF POUND

higher rates will increase incentive for foreigners to hold their money in British banks as they can see a higher rate of return

so there will be increased demand for pounds and the value of the pound will rise

SPICED

decreases net trade and so AD

MONETARY POLICY- IR DISADVANTAGES

exchange rate may be affected so much that exports fall and imports rise significantly, causing a balance of trade deficit

changes in IR take up to 2 years to have their full effect (time lag)

IR may be so low that they can’t be decreased any further to stimulate demand

range of different interest rates and not all are affected by BoE base rate

lack of confidence in economy may mean that, no matter how low IR are, consumers and businesses do not want to borrow or banks do not want to lend to them

high IR over a long period will discourage investment and decrease LRAS

MONETARY POLICY- QUANTITATIVE EASING

when BoE buys assets in exchange for money to increase money supply and get money moving around economy during times of very low demand

can prevent liquidity trap, where even low IR cannot stimulate AD

MONETARY POLICY- QE- RESERVES

one way of buying assets is for BoE to increase size of banks’ accounts at the BoE, called ‘reserves’, which encourages them to lend money

after GFC, BoE found that many banks preferred to keep their money in reserves rather than lending it out so buying assets from bank did not have the effect they wanted

so Bank bought securities or bonds from private sector institutions such as insurance companies, pension funds and banks

MONETARY POLICY- QE EFFECTS

increases C and I, which increases AD and ensures country meets its inflation target:

increase asset prices

increase money supply

lower IR

MONETARY POLICY- QE- ASSET PRICES

bank buying assets- rise in demand- asset prices rise

causes a positive wealth effect since shares, houses etc. are worth more so increase in consumption

also cost of borrowing will decrease as higher asset prices mean lower yields (money earnt from assets), making it cheaper for households and businesses to finance spending

MONETARY POLICY- QE- MONEY SUPPLY

money supply increases

private sector companies receive more money which they can spend on g and s or other financial assets, which may increase I or C- so increase AD

may also push asset prices up further

banks have higher reserves, meaning they can increase their lending to households and businesses so both C and I increase as people can buy on credit

MONETARY POLICY- QE- INTEREST RATES

commercial banks may lower their IR as they’re receiving so much money from the BoE and so can offer very low interest deals to their customers

increased money supply will mean that price of money falls

will encourage borrowing, and increase I and C so increase AD

MONETARY POLICY- QE DISADVANTAGES

very risky and could cause high inflation

others say it would only lead to increased demand for second hand goods which pushes up prices but does not increase AD

no guarantee that higher asset prices lead into higher consumption through the wealth effect, especially if confidence remains low

can cause rising share prices which increases inequality

not meant to be permanent and there are concerns that banks and economies are too dependent on QE, particularly w/in Eurozone

ROLE OF BANK OF ENGLAND

Monetary Policy Committee (MPC) decides BoE base rate and QE

aim- inflation at 2% and if it goes >1% above/below, governor of BoE has to write a letter to the Chancellor of the Exchequer explaining why this is happened and what BoE is doing to bring it back to target

use CPI to see if target has been met

since 2009, MPC has kept bank rate at 0.5% and policy has become focused on boosting EG and employment

(reduced to 0.25% following Brexit but rose again)

plan to raise IR once neg output gap has been eliminated and economy is growing strongly

FISCAL POLICY- 2 WAYS TO INFLUENCE AD

rise in income tax will cause a fall in disposable income- will lead to a reduction in consumption, so decrease AD

or rise in corporation tax will decrease a firm’s post-tax profits - will lead to a reduction in investment, so decrease AD

rise in gov spending will increase AD

FISCAL POLICY- GOVERNMENT BUDGETS

gov’s fiscal (spending, borrowing and taxation) plans are outlined in budget

budget deficit- when gov spends more money than they receive

budget surplus- when the gov receives more money than they spend

FISCAL POLICY- DIRECT TAX

paid directly to gov by individual taxpayer

income tax~25% of tax revenue

FISCAL POLICY-INDIRECT TAX

where person charged with paying money to gov is able to pass on cost to someone else

like supplier to consumer

FISCAL POLICY- DISADVANTAGES

gov spending also impacts LRAS- so if you cut spending to reduce AD, may affect education quality

taxes and spending impact inequality

impact incentives- e.g. high taxes reduce incentives

expansionary fiscal policy difficult to undertake during austerity- gov needs to consider effect of policies on budget

impact of fiscal policy depends on the multiplier: the bigger the multiplier, the bigger the impact on AD

classicals argue that multiplier is almost 0 whilst Keynesians argue that it can be large if targeted correctly

time-lag

GREAT DEPRESSION

1930s

UK- unemployment >15%

US- unemployment almost 25%

areas most affected in UK were primary and manufacturing industry which relied on exports, so impacted by collapse of world trade

GD- CAUSES

consumer and business confidence

US banking system

protectionism

gold standard

GD- CAUSES- CONSUMER AND BUSINESS CONFIDENCE

loss of consumer and business confidence

shareholders lost money in crash and firms cut back investment which led to decrease AD

GD-CAUSES- US BANKING SYSTEM

banks lent too much in 1920s- created an unsustainable boom

gov allowed banks to fail after crash- decreased confidence further and reduced loans to businesses and consumers, causing a fall in AD

GD-CAUSES- PROTECTIONISM

reduced world trade- decreased AD and lowered confidence

firms involved in exports no longer able to pay bank loans, which caused bank failures in USA

USA introduced Smoot-Hawley Tariff Act in 1930 which decreased imports to USA

countries saw a reduction in exports which decreased in AD there

USA also suffered from a fall in exports as other countries retaliated

GD-CAUSES- GOLD STANDARD

gold standard- currency fixed to value of gold, so fixed to other currencies

left gold standard in 1914 but re-joined in 1925 at 1914 level and value, despite fact that value of pound had fallen

rejoining of gold standard meant pound was appreciated rapidly and exports fell as they became more expensive

UK went into GD with an overvalued exchange rate

GD- UK POLICY RESPONSES

thought balancing gov budget was key to recovery

emergency budget

cut public sector wages and unemployment benefit by 10%

raised income tax from 22.5% to 25%

reduced AD (needed to be increased)

balanced budget meant UK didn’t have to borrow from abroad and high IR- helped exchange rate

but high IR also reduced AD

UK forced to leave gold standard bc of speculation against it (???)

caused value of the pound to fall by 25% compared to other currencies and allowed BoE to cut IR by 2.5%, both of which helped increase AD

GD- USA POLICY RESPONSES

FDR introduced New Deal- promised public sector investment, work schemes for unemployed and fiscal stimulus to increase AD

USA reached full employment in 1943

GLOBAL FINANCIAL CRISIS- CAUSES

mortgage lending

‘prime’ and ‘sub-prime’ mortgages

fall in confidence

GFC- CAUSES- MORTGAGE LENDING

started by issues in mortgage lending in USA

early 2000s- poor people were encouraged by gov and banks to take out mortgages to buy their own homes- e.g. of moral hazard, as bank workers saw higher bonuses for selling more mortgages

were given low IR on loan for first few years, but many could not pay higher repayments later

houses repossessed, demand fell so prices fell- value of houses was now less than mortgage (known as negative equity)

GFC- CAUSES- ‘PRIME’ AND ‘SUB-PRIME’ MORTGAGES

banks had been grouping:

‘prime’ mortgages (people who were likely to pay back their loans)

‘sub-prime’ mortgages (those who weren’t)

and selling packages to other banks and investors as if they were all prime mortgages

aim was to reduce risk since it meant no bank was highly dependent on risky mortgages

but increased risk as many were now holding assets worth less than they had paid for them; it spread effects of housing crash and unpaid loans

GFC- CAUSES- CONFIDENCE

bc of mortgage grouping, there was a fall in confidence and banks stopped lending between each other, fearing that they would lose money if other banks collapsed

2008- Lehman Brothers (investment bank) was allowed to fail

caused panic as people believed bank after bank would be allowed to collapse, leading to losses for savers

GFC- UK AND USA POLICY RESPONSES

govs forced to nationalise banks and guarantee savers their money to prevent chaos of a collapsed banking system

e.g. British gov bought Northern Rock and most of Royal Bank of Scotland and Lloyds Bank

UK used expansionary monetary policies with low IR and QE

BoE said QE led to lower unemployment and higher growth

USA gov had a more expansionary fiscal policy-could be why it recovered faster

2010- UK prioritised reducing National Debt over providing a fiscal stimulus, but USA did not make this decision until 2013

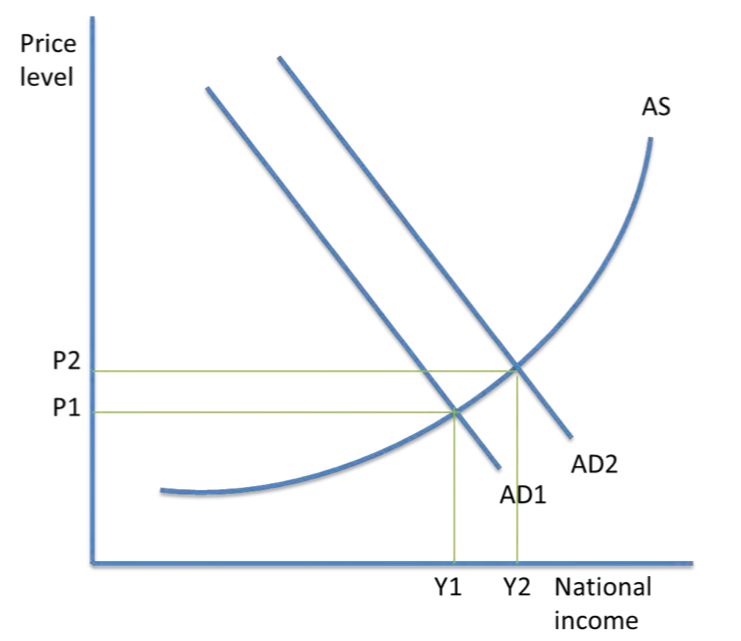

EXPANSIONARY FISCAL POLICY- DIAGRAM

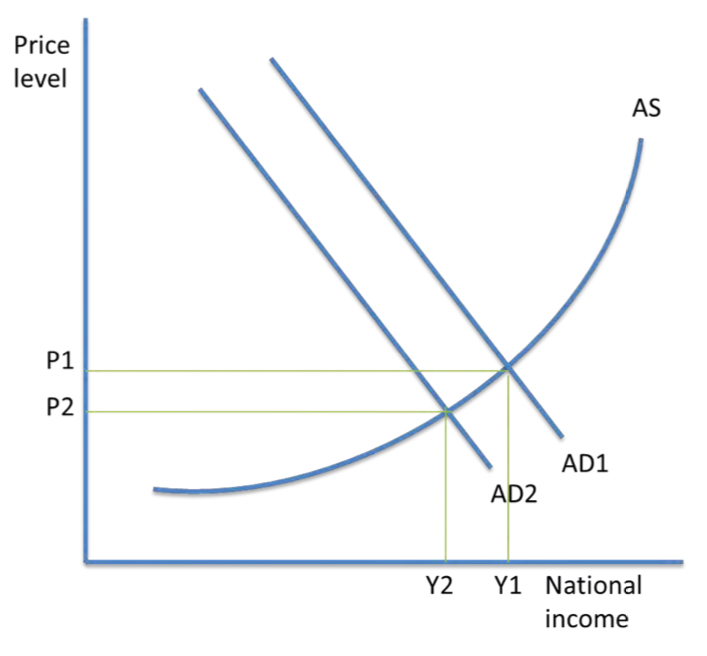

DEFLATIONARY FISCAL POLICY- DIAGRAM