Government Intervention in Markets

1/11

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

12 Terms

Taxation does what

reduces supply leading to an increase in price. This acts to discourage production/consumption of a good with negative externalities

with an ad valorem tax the supply curve becomes what

steeper

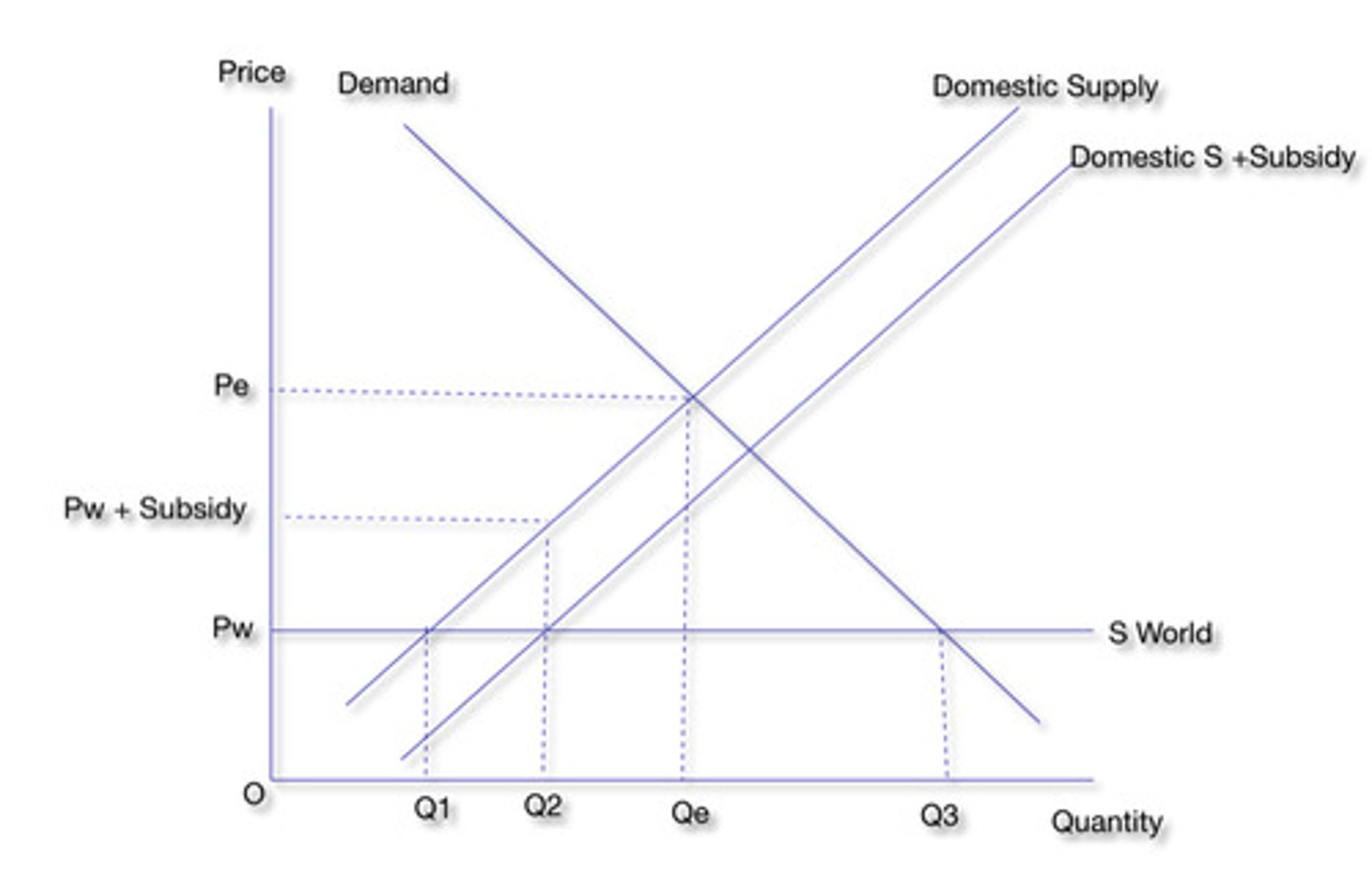

Subsidies increase what leading to a what

supply leading to a reduced price which encourages production/consumption of a good with positive externalities

Subsidy diagram

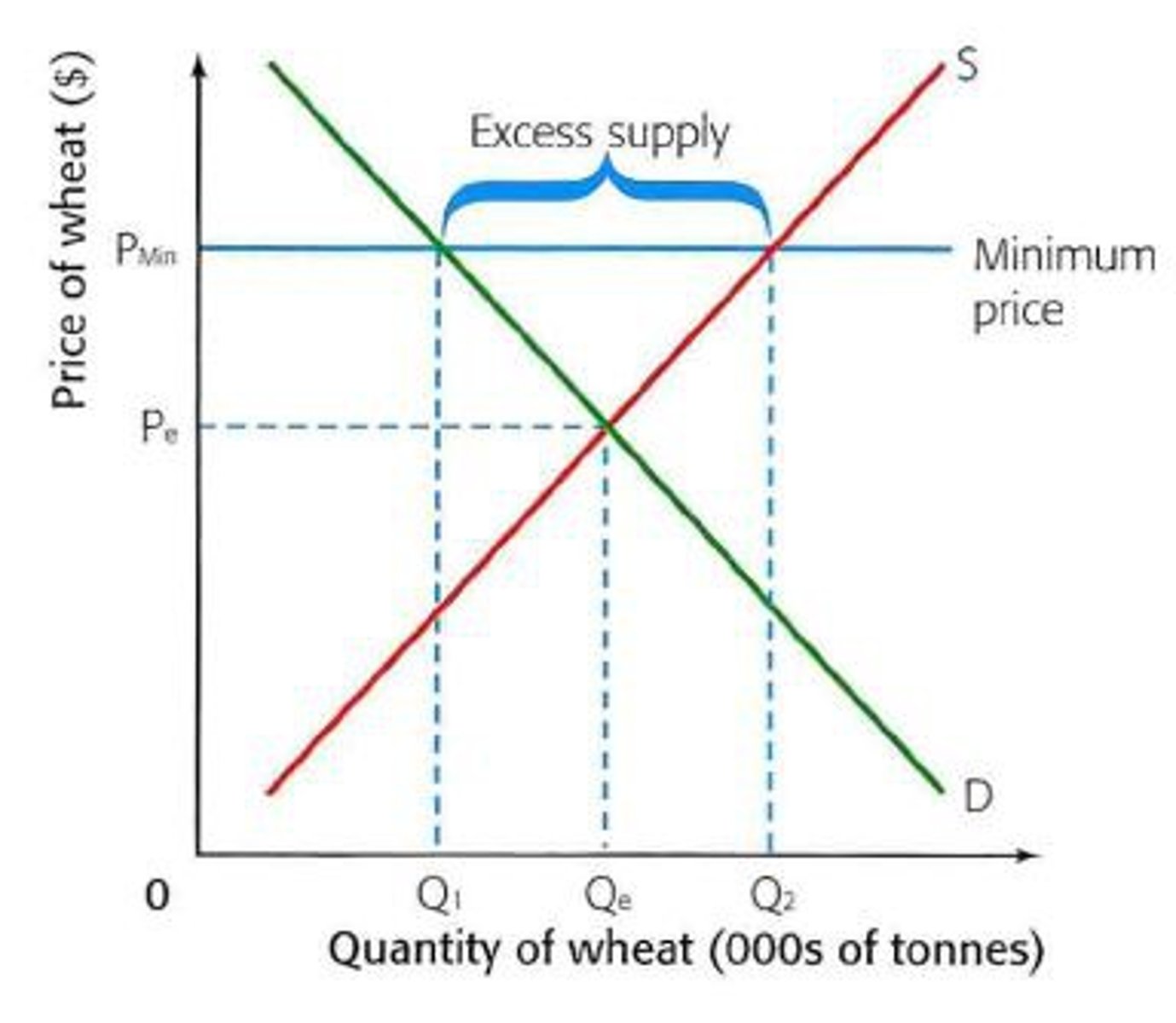

A minimum price may be set by a government to what

discourage consumption of a particular good

minimum price diagram

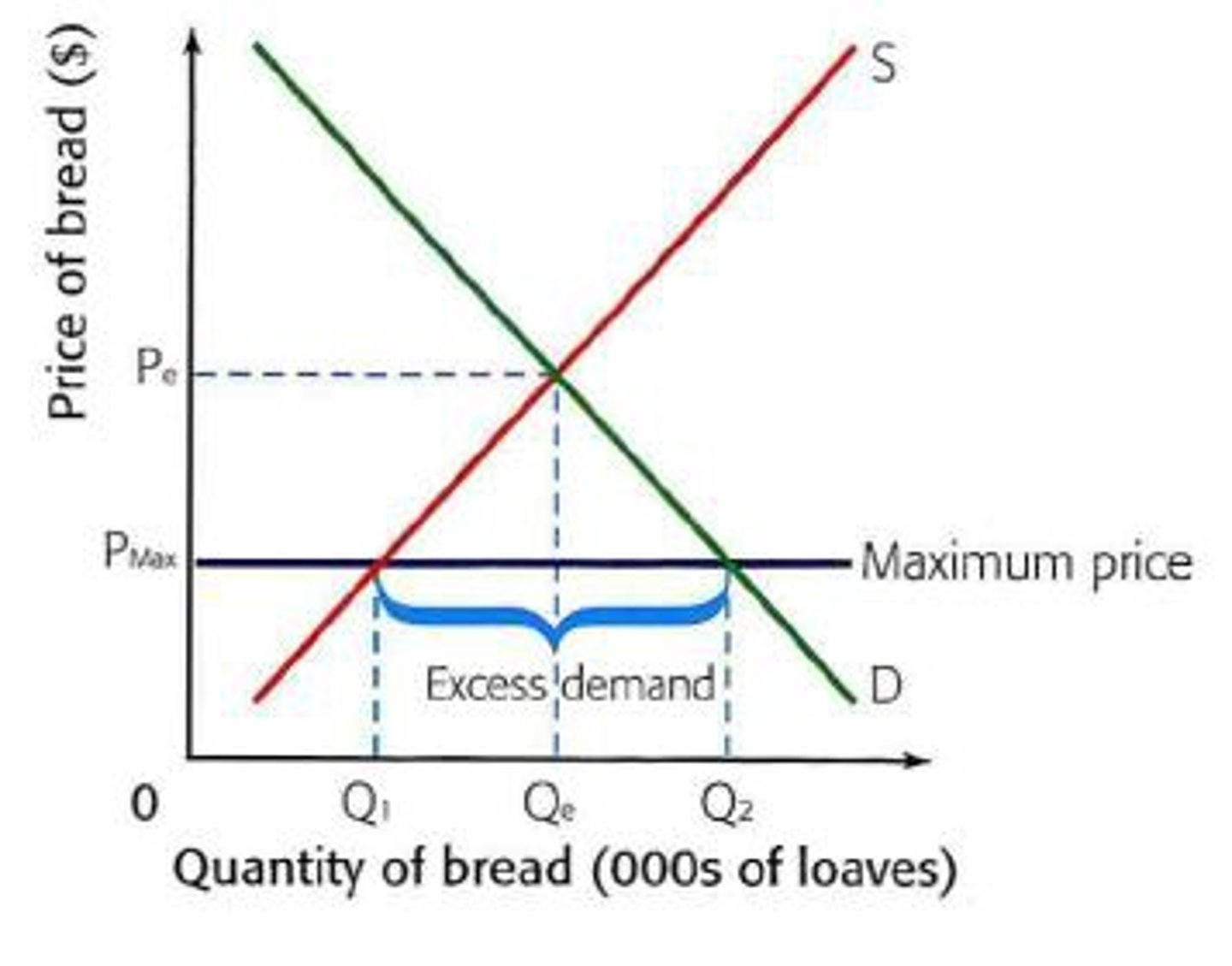

Maximum price may be set to what

encourage the consumption of a particular good

Maximum price diagram

Tradable pollution permits

to tackle negative externalities. The government decides the desired level of pollution and releases a number of permits. These permits can be traded by firms so that low polluters can sell to high polluters for profit.

State provision of public goods

the government provides a good or service, using tax revenue to fund it. These goods are not provided by the private sector due to the free rider problem.

Provision of Information

the government provides information to consumers to correct any problem of information gaps.

Regulation

to tackle negative externalities. The government imposes rules regarding the production or consumption of goods or services.