Economics

1/76

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

77 Terms

MARKETS/INTRO TO ECONOMICS

Define microeconomics

Microeconomics deals with the economic problem from an individual or micro point of view. Micro means small.

Describe the economic problem. Explain how the economic problem affects consumers, producers and the government

The economic problem is that there are not enough resources to satisfy our wants.

Define and explain opportunity cost and refer to how it affects consumers, producers and the government

Opportunity cost is defined as the real cost of the next best alternative foregone. The real cost of something is what you must give up when making a choice.

Identify a few characteristics of market, planned and mixed economies

Market economy:

The government doesn’t intervene

All decisions are driven by the individual profit motive.

The forces of supply and demand affect economic decision making.

Prices are determined by supply and demand.

Key economic decisions are made by consumers and producers.

Sophisticated tools and machinery are used as businesses seek to gain a competitive advantage over others.

There is a large amount of competition.

Survival of the fittest

Public health and education are underproduced.

Planned economy:

Economic decision making is made by the government in the interest of the state.

Collective rather than individual goals.

Government owns all resources and sets prices.

No private property

Consumers have little power or influence over the way economic decisions are made.

Overall goal is to have a completely equal society.

In reality an equal society doesn’t occur. privileged societies exist, mainly as a result of position.

Mixed economy:

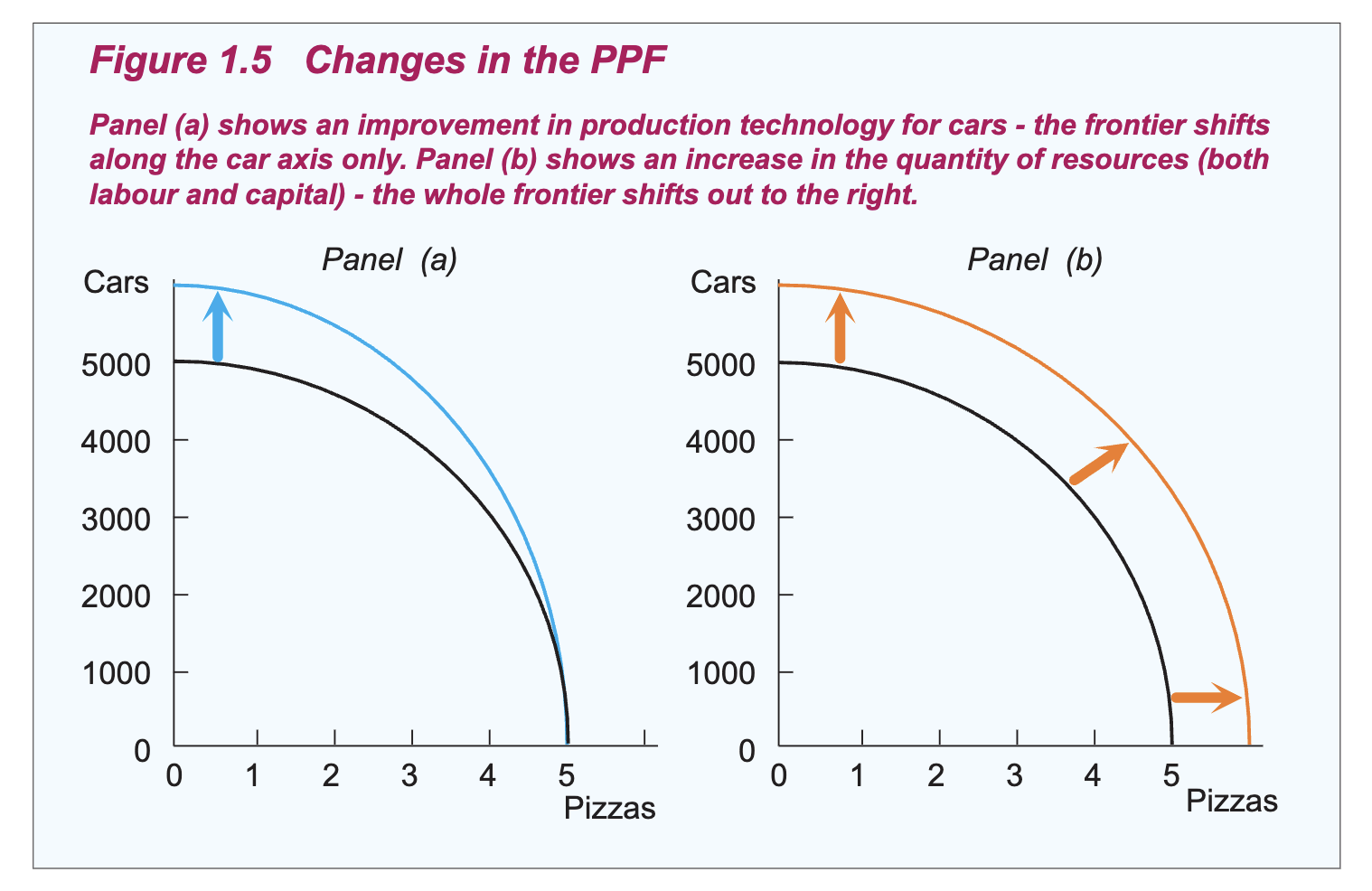

Show and explain the Production Possibility Frontier (PPF) model

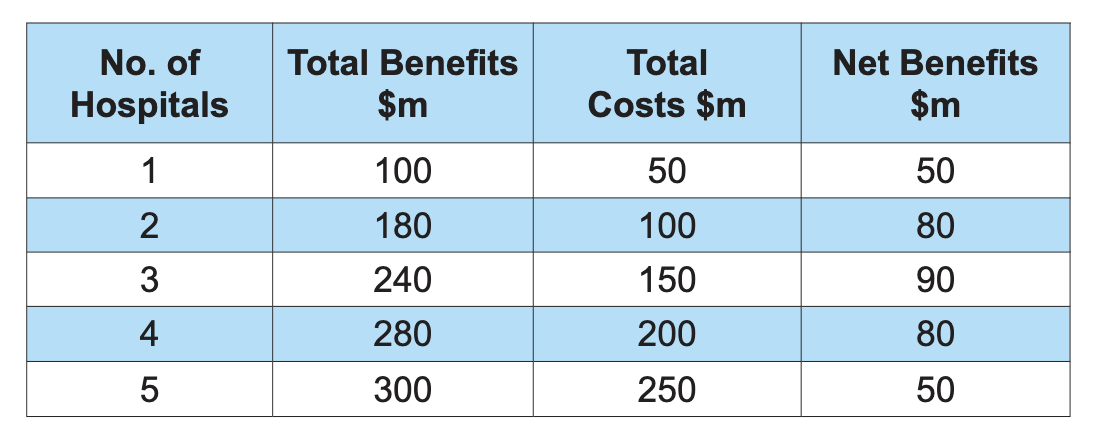

Describe the economic decision -making process - marginal benefits and marginal costs

Economists make decisions by comparing the benefits of using resources against their cost. Marginal benefit is the additional satisfaction or utility a consumer receives from consuming more than one unit of a good or service. A marginal cost is the expense of producing one or more item for sale. The principle of decreasing marginal benefit is that as you consume more of something the extra or additional benefit you get decreases. Economists like to use marginal analysis when making decisions about resource use. Marginal analysis compares the additional benefit derived from an activity with the extra cost incurred.

DEMAND, SUPPLY AND EQUILIBRIUM

Define Demand

The amount of a good or service that a consumer is both able and willing to buy at a particular price and time.

Define the law of demand

Refers to the inverse (negative) relationship between price and quantity demanded. The law of demand states that ceteris paribus, the higher the price, the lower the quantity demanded; and the lower the price the higher the quantity demanded. Movements along the demand curve are caused by changes in price.

Identify and describe six factors affecting demand

Non-price factors affecting demand:

The price of a substitute good

The price of a complementary good

Income

Advertising and media

Expectations

Trends and preferences

The price of a substitute good

A good that can be used in place of another good. A substitute is a good used instead of another good. For example, if train fares increase some people will switch to private transport and travel by car. This may lead to an increase in the demand for petrol, shifting the demand curve for petrol to the right. If the price of airline tickets were to increase, then it is likely that demand for domestic holidays within in Australia would increase.

The price of a complementary good

A good that is used in conjunction with another good. For example, if the price of holidays decreases, demand for luggage or perhaps suntan lotion will increase.

Income

When a person’s disposable income rises, consumers can afford to purchase more normal or luxury good, when a person’s disposable income falls, consumers will buy less normal or luxury goods. For example, if all teachers received a 5% rise in pay the demand for overseas holidays in January would rise. A fall in income would lead to a fall in demand for cars and consumer electronics, resulting in a shift to the left of the demand curve - demand decreases. An inferior good is a good where demand decreases as income rises, for example, home brand products, second hand clothes, public transport, used cars or instant noodles.

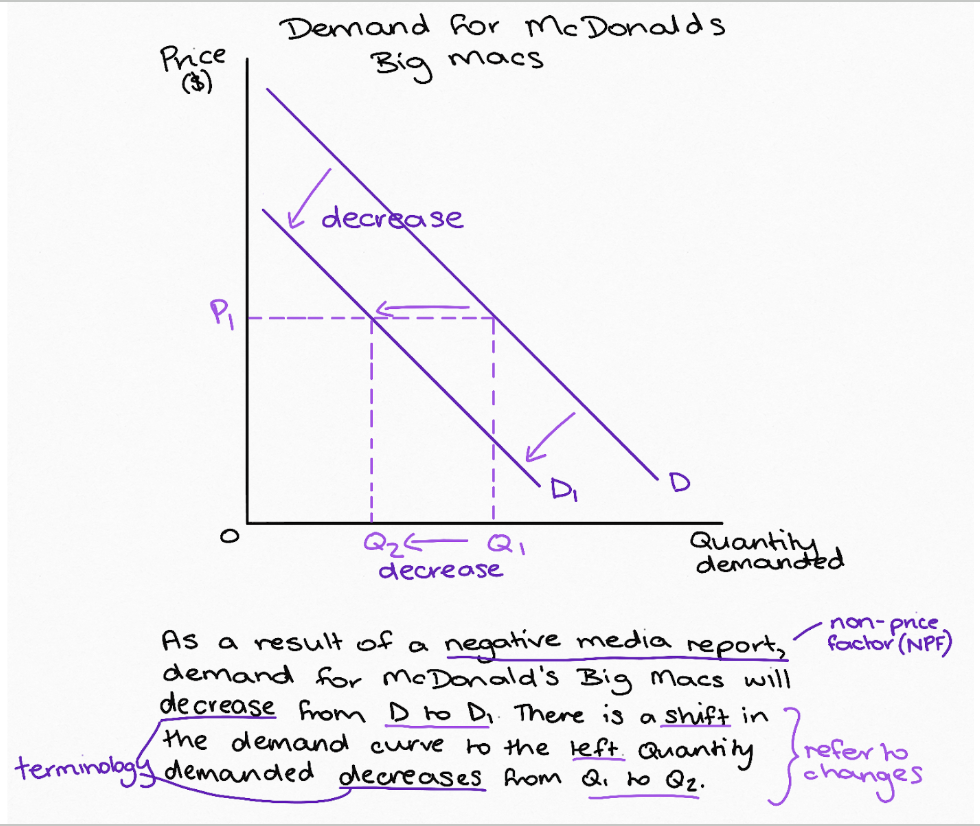

Advertising and media

A positive advertising campaign that raises awareness about the benefits of a good will result in an increase in demand for that good. A negative media report for a good will result in a decrease in demand for that good. For instance, if a news report claims that a popular brand of baby formula is contaminated with harmful bacteria, parents may stop buying it, causing a sharp decline in demand.

Expectations

If consumers expect prices to rise, demand increases now (e.g., buying fuel before a price hike).

If people expect prices to fall, they might hold off on buying. For example, if a sale is coming up, people might wait to buy clothes until they’re cheaper. This decreases demand.

Trends and preferences

Demand is affected by the changing preferences of consumers. Preferences are an individual’s attitudes towards goods and services. Items that are considered fashionable or popular during a particular time will experience an increase in demand. For example, If goods become more fashionable the demand curve shifts to the right, increasing demand at all price levels. If goods go out of fashion, the demand curve shifts to the left. The demand for Crocs surged in recent years as they became a popular fashion trend, especially among younger consumers and influencers.

Show and explain the effect of changes in price on quantity demanded i.e. expansion or contraction of demand

If the price of a good or service increases there will be a decrease (contraction) in the quantity demanded. If the price of a good decreases there will be an increase (expansion) in the quantity demanded.

Show and explain the effect of changes in non-price factors on quantity demanded i.e. increase or decrease in demand

Define supply

Supply refers to the quantity of a good or service that a producer is willing and able to sell at a particular price and time.

Define the law of supply

Rational, self-interested firms (Producers) will attempt to maximise their profit by supply more at a higher price. As price rises, supply expands. As price falls, supply contracts.There is a positive relationship between price and quantity supplied. The law of supply assumes that all non-price factors that may affect supply are held constant - the ceteris paribus assumption.

Identify and explain four factors affecting supply

The price of resources

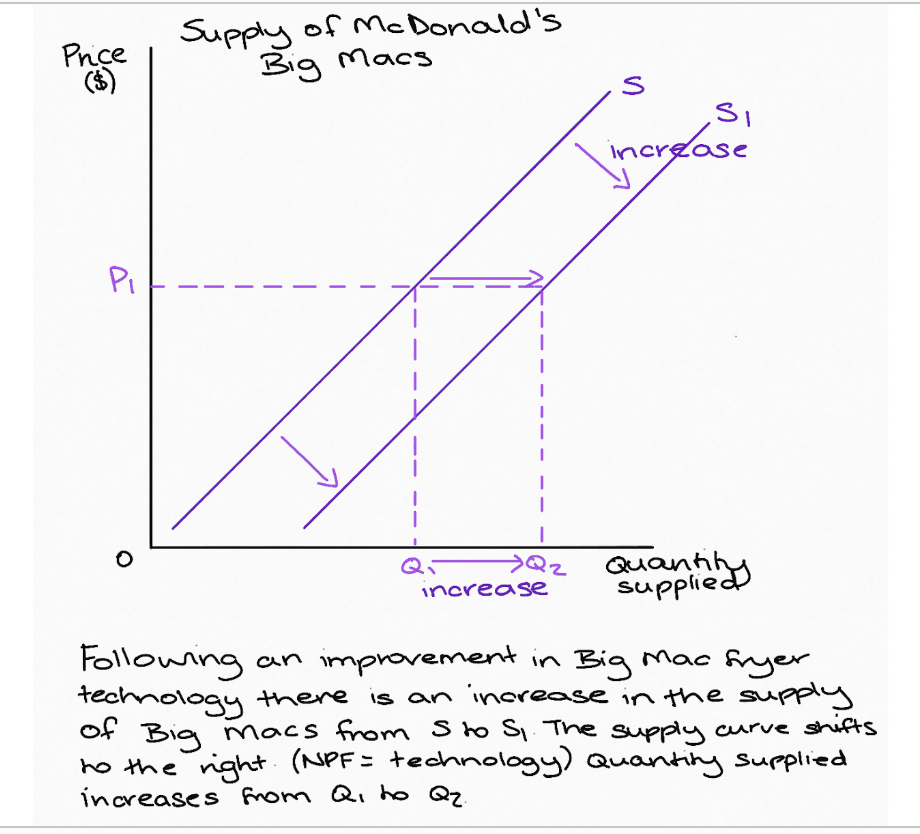

Technology

Number of sellers

Price of other goods

Expectations of producers

Weather/seasonal

The price of resources

The prices of resources - land, labour, capital and raw materials influence supply. If the price of a resource used to produce a good rise, the cost of production rises, so supply decreases and shifts the supply curve to the left. If producers’ costs fall resulting from a factor such as a fall in the price of raw materials or cost of labour, this will increase supply, shifting the supply curve outwards and to the right. Now at each price level more is supplied. Rising costs will have the opposite effect and shift the supply curve inwards and to the left. For example, a bakery sells cakes – if the price of self- raising flour goes up, it will be more expensive for the bakery to make cakes, therefore the number of cakes the bakery supplies will decrease.

Technology

An improvement in technology occurs when a new production method is discovered that lowers the cost of producing a good. More output can be produced from the same quantity of resources. An improvement in technology in production methods will result in an increase of supply. For example, a pizza restaurant invests in a new state of the art pizza oven that enables them to cook pizza quicker and at a lower cost. This results in an increase in supply.

Number of sellers

When new sellers enter the market, supply increases, shifting the curve to the right. This happens when profit opportunities are strong, leading to lower prices due to increased competition. For example, more avocado farmers in Australia can increase supply and lower prices. If sellers exit the market, supply decreases, shifting the curve to the left, which can raise prices. For example, if avocado farming becomes less profitable, fewer farmers may stay, reducing supply and increasing prices.

Price of other goods

Production combines resources to create goods. Since resources can be used for different products, producers adjust based on price changes to maximise profits. For example, a farmer may switch from wheat to wool if wool prices rise. Similarly, a car manufacturer may reduce petrol car production if demand shifts to electric cars. A clothing company might increase sneaker production if they become more popular than sandals.

Expectations of producers

Producers adjust supply based on future price expectations. If prices are expected to rise, firms may decrease current supply to sell later at higher prices. Investment in machinery and resources also depends on expected prices—rising iron ore prices encourage more exploration. Similarly, if a housing boom is anticipated, construction companies may invest in land and materials in advance.

Weather/seasonal

Weather significantly impacts agricultural supply. A good harvest increases output, shifting supply outward, while bad weather reduces supply. Seasonal events, like floods in North Queensland, can destroy banana crops, leading to shortages. Similarly, droughts can reduce wheat production, affecting overall supply.

Show and explain the effect of changes in price on quantity supplied i.e. expansion or contraction of supply

An increase of price increases (expands) the quantity supplied. A decrease of price decreases (contracts) the quantity supplied.

Show and explain the effect of changes in non-price factors on quantity supplied i.e. increase or decrease in supply

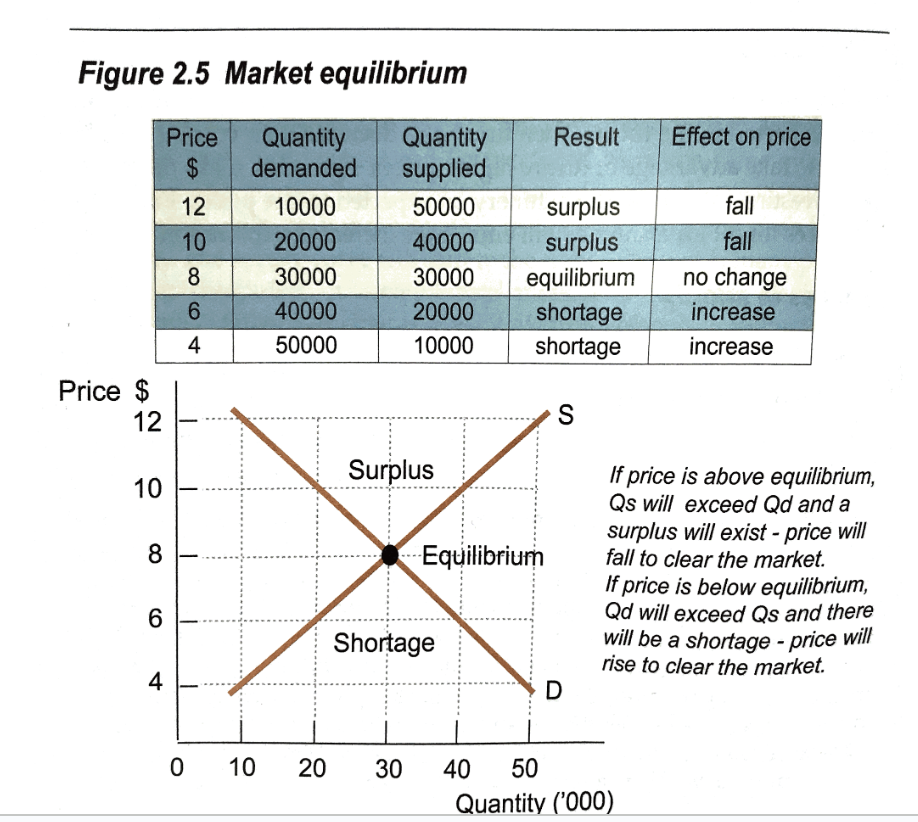

Describe the concept of market equilibrium

Markets: A medium where buyers and sellers come together to exchange goods and services.

Equilibrium: A state of balance in the economy, where there is no tendency to change. Equilibrium occurs in a market where supply = demand. Both buyers and sellers are willing and able to exchange goods at the equilibrium price. There is no surplus or shortage that exists.

Describe the effects of changes in demand and supply on market equilibrium

Explain the concepts of market clearing, shortages and surpluses

A shortage occurs when the quantity demanded is greater than the quantity supplied. A surplus occurs when the quantity supplied is greater than the quantity demanded.

Describe how the price mechanism clears market surpluses and shortages

A price mechanism is the price adjustments made by a change in quantity or supply. Prices are always adjusting in competitive markets in response to changes in demand and supply conditions. Changes to the market will create either temporary shortages or surpluses which will then cause price to change to re-establish a new equilibrium. The length of time required to eliminate shortages and surpluses though will vary from one market to another. Prices will increase if there is a surplus and prices will decrease if there is a shortage.

ELASTICITY

Describe the concept of price elasticity of demand - this includes defining.

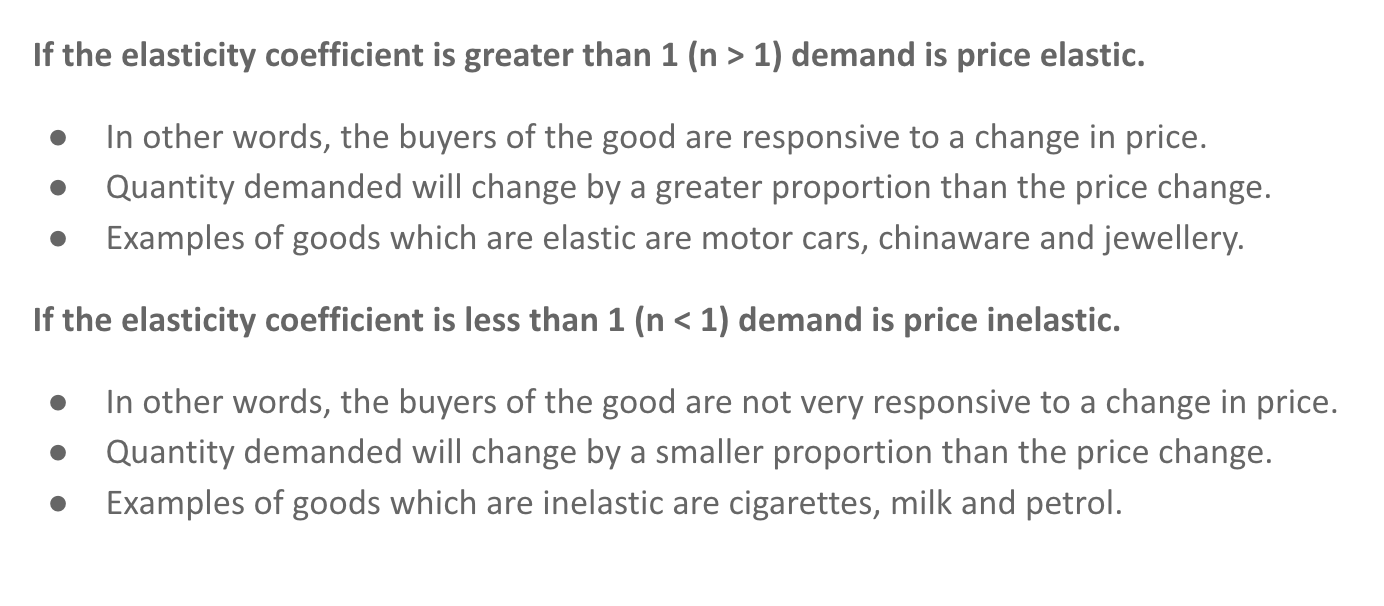

Price elasticity of demand is the responsiveness of quantity demanded to a change in the price of a good or service. We know that there is an inverse relationship between price and demand. An increase in price will cause quantity demanded to contract and vice versa. Elasticity is concerned with the question of how much. Elasticity allows us to consider real life examples which illustrate the relationship between price and quantity demanded. This information is useful to firms, economists, consumers and the government.

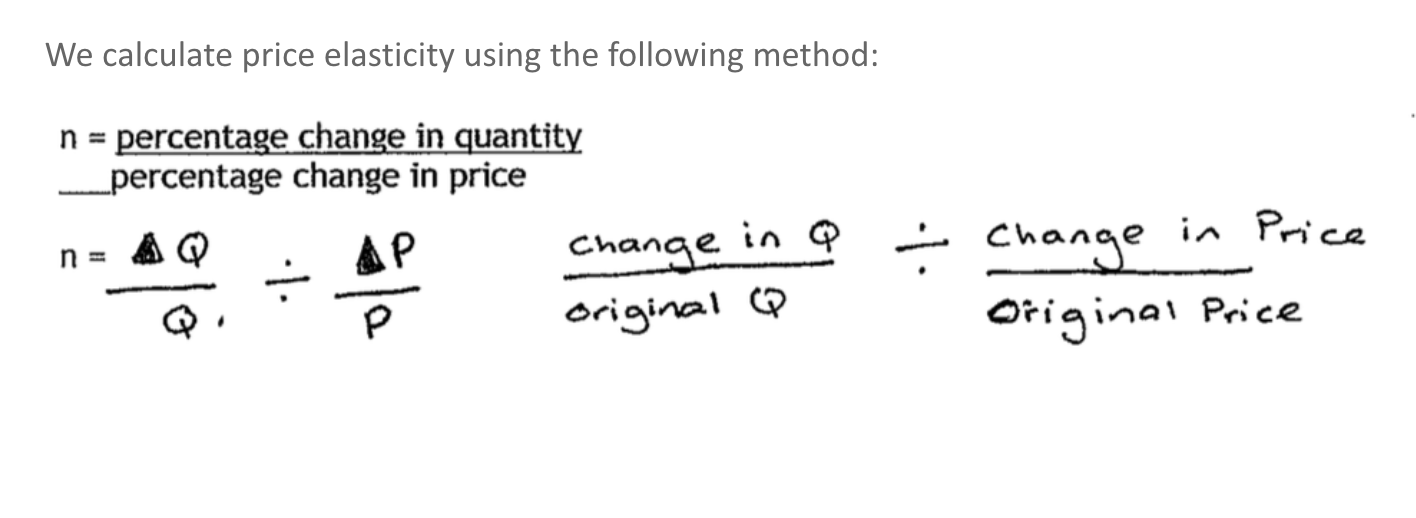

Identify and describe how price elasticity of demand is measured (formula/working out) and interpret the coefficient

Distinguish between goods that are price elastic and price inelastic in demand

An example of an elastic good is jewellery because it is not an item that people need so if prices go up they are less likely to buy it. An example of an inelastic good is petrol because many people drive cars which need petrol and if prices were to go up people would have no choice but to still purchase it.

Describe the link between price elasticity of demand and total revenue

If the price of an elastic good increases total revenue will decrease as a lot less people will be willing to buy the product but if prices decrease total revenue will increase as more people are willing to buy the product. If an inelastic good increase in price total revenue will increase as people are forced to still buy the product because they need it and if the price decreases total revenue will decrease because only a little more people will buy the product because most people still would of bought it at a higher price.

Describe the concept of price elasticity of supply - this includes defining.

Price elasticity of supply is the responsiveness of quantity supplied to a change in the price of a good or service. We know that there is a positive relationship between price and quantity supplied. However, when the price of a good or service increases, how willing and able are producers to supply more? Price elasticity of supply measures exactly this, or the strength of the law of supply for a particular good or service.

Distinguish between goods that are price elastic and price inelastic in supply

Goods that are price elastic to supply are clothing because it is very easy for producers to change the production of it in factories if they became more or less popular. Goods that are price inelastic to supply are agriculture because it takes time to grow and harvest them and if more was demanded it would take a while for more to be produced.

Identify and explain three factors affecting price elasticity of supply

Time

Nature of industries

Inventories

Time

The more time a producer has to respond to a change in price, the more elastic the supply of a good tends to be. If a producer can quickly adjust output in response to price changes, supply will be price elastic. However, in the immediate run, it may be difficult to increase production, especially if inventories are low, making supply highly inelastic or even perfectly inelastic. As time progresses, producers can acquire more inputs and expand production capacity, making supply more price elastic.For example, the supply of oil is relatively inelastic in the short term because it takes time to explore, extract, and refine crude oil. Even if oil prices rise, producers cannot immediately increase output due to drilling and infrastructure constraints. However, in the long run, as new oil reserves are discovered and extraction technologies improve, the supply of oil can expand, making it more elastic.

Nature of industries

The supply of most agricultural crops tends to be relatively price inelastic because planting decisions are made months before harvesting. For example, wheat, wool, and meat require up to 12 months to produce. If the price of wheat suddenly increases, farmers cannot respond immediately, as they must wait until the next growing season to adjust their supply. In contrast, manufactured goods tend to have a more elastic supply because production can be adjusted more quickly in response to price changes. Industries producing clothing, iPads, or textbooks can increase output relatively easily by ramping up factory production, hiring more workers, or utilizing existing machinery more efficiently.

Inventories

Inventories refer to stocks that a producer keeps stored for future sale. If a producer has the ability to store or warehouse its goods, it can respond fairly quickly to changes in demand, making supply relatively elastic. For example, supermarkets can store non-perishable goods such as canned foods, bottled beverages, and packaged snacks in large warehouses and ship them whenever a store runs out of stock. Similarly, manufacturers of electronics or clothing can keep surplus inventory in storage and distribute it as needed. In contrast, goods that are perishable, such as fresh fruit, vegetables, dairy products, and baked goods, cannot be stored for long periods without spoiling. As a result, their supply is relatively inelastic, as producers have limited ability to respond quickly to changes in demand.

Show and explain the application of price elasticity of demand and supply to markets

Explain the significance of elasticity for consumers, business and government including the incidence of tax and price discrimination

If a tax is placed on an elastic good the incidence will fall on producers as they are making less money because consumers aren’t very willing to buy it. The government also won’t make much revenue from it as less people are buying the good and therefore less money is made. Consumers aren’t greatly effected by it. If a tax is placed on an inelastic good the incidence falls on the consumer as they have no choice but to still buy the good. Producers and the government will make a greater revenue as most consumers will still buy the product. Price discrimination is the difference in price for goods and services depending on the consumers group and elasticity of demand.

MARKET EFFICIENCY

Describe the concept of efficiency

Efficiency is achieved if an economy is producing the goods and services that society wants at the lowest possible cost.

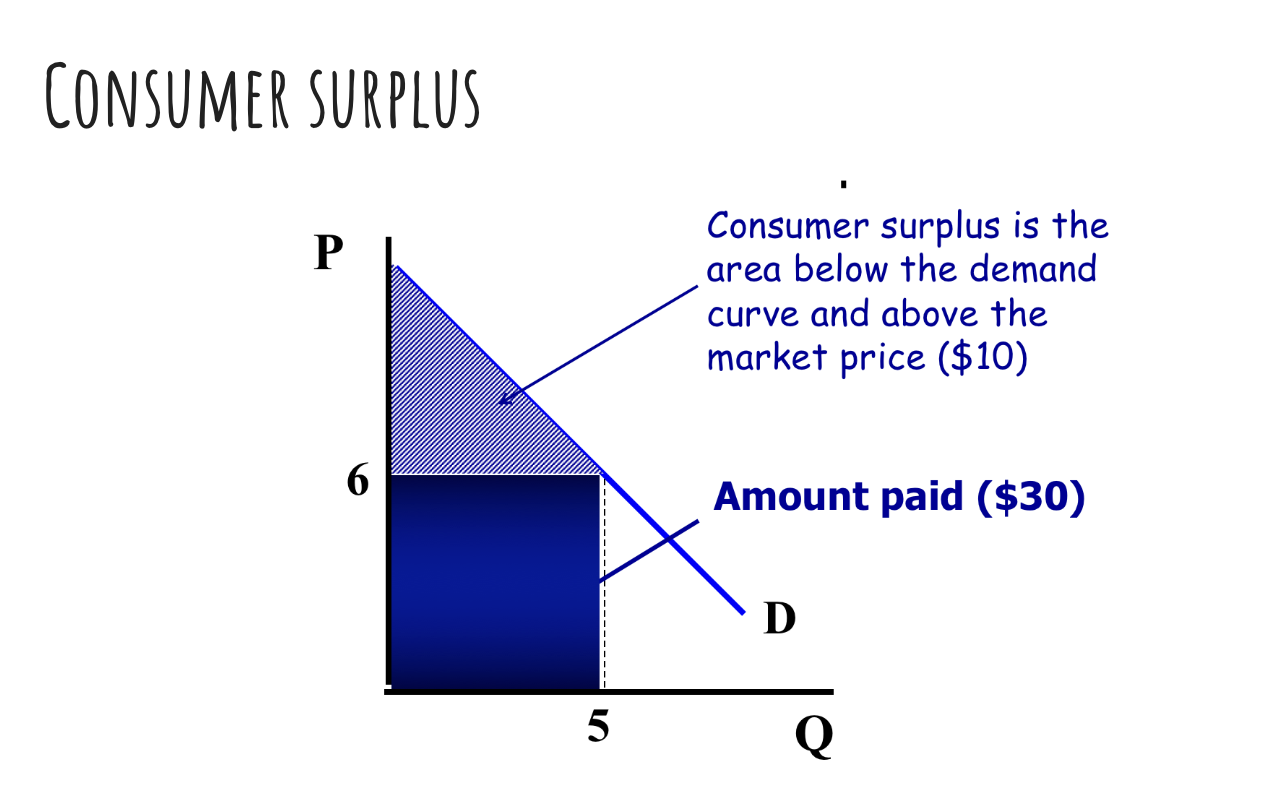

Describe the concept of consumer surplus and explain how it is calculated

Consumer surplus is equal to the difference between the buyer’s willingness to pay and the actual price paid. Consumer surplus measures the net benefits from consumption. If consumer surplus increases, then consumers are better off! Consumer surplus is the area below the demand curve but above the price.

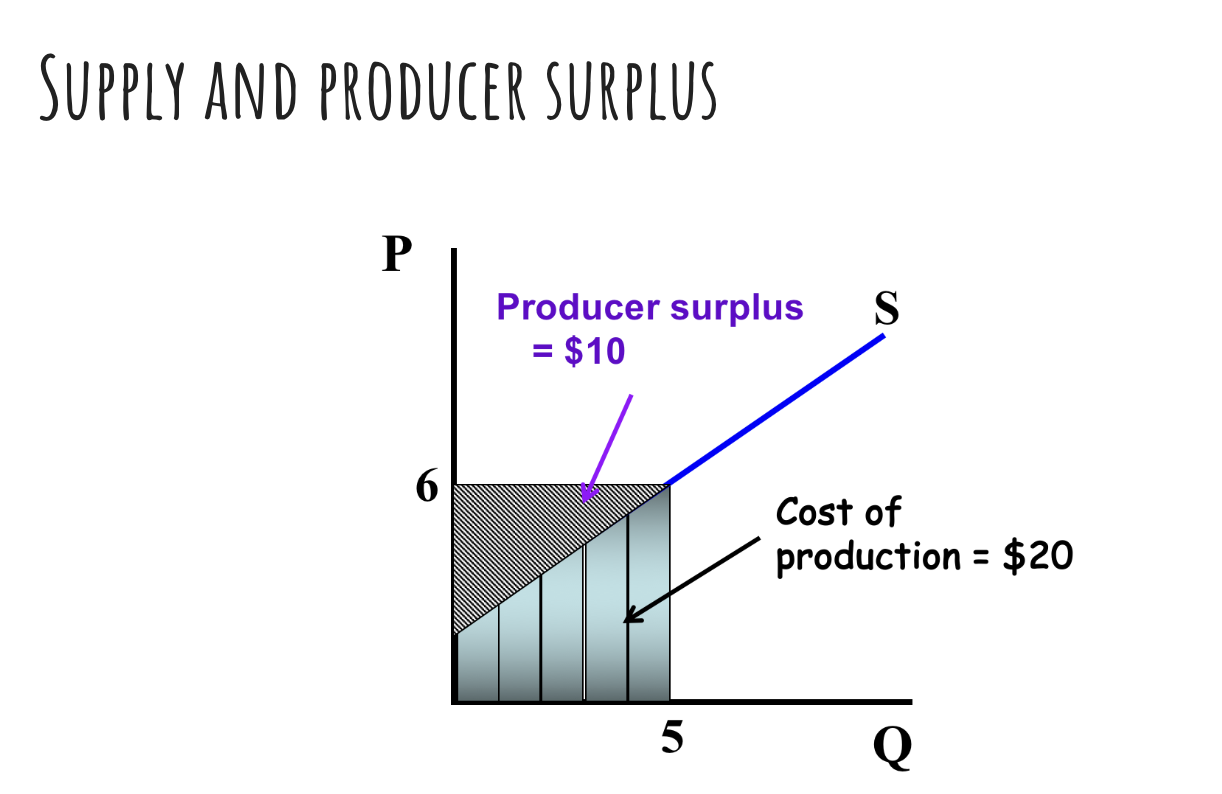

Describe the concept of producer surplus and explain how it is calculated

Producer surplus is the price of a good minus the marginal cost of producing it. Producer surplus is measured by the area below the price and above the supply curve. If producer surplus increases, then producers are better off.

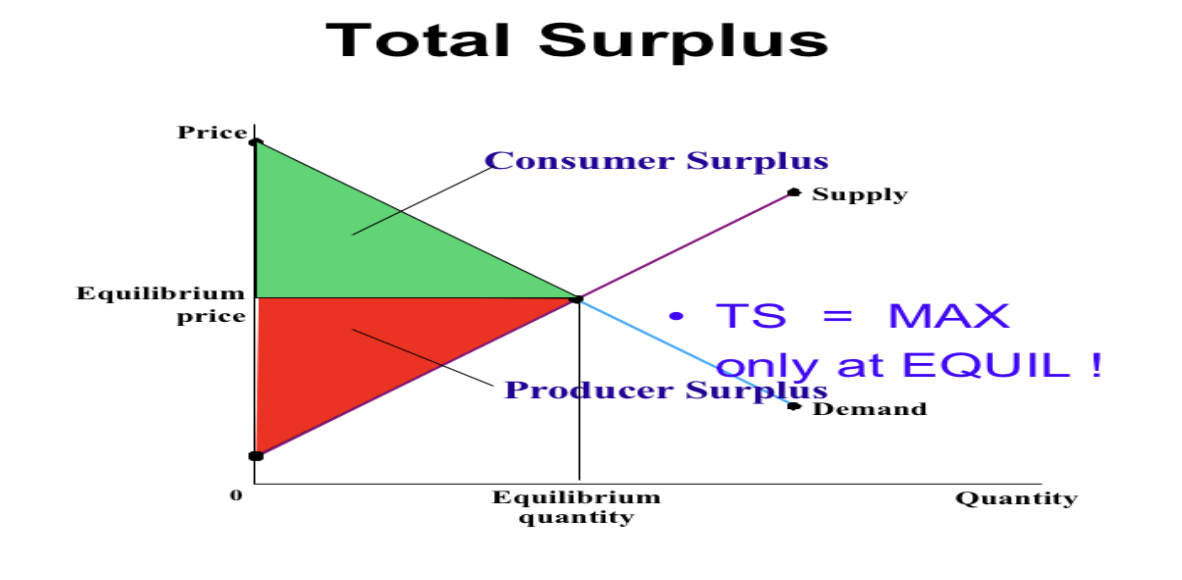

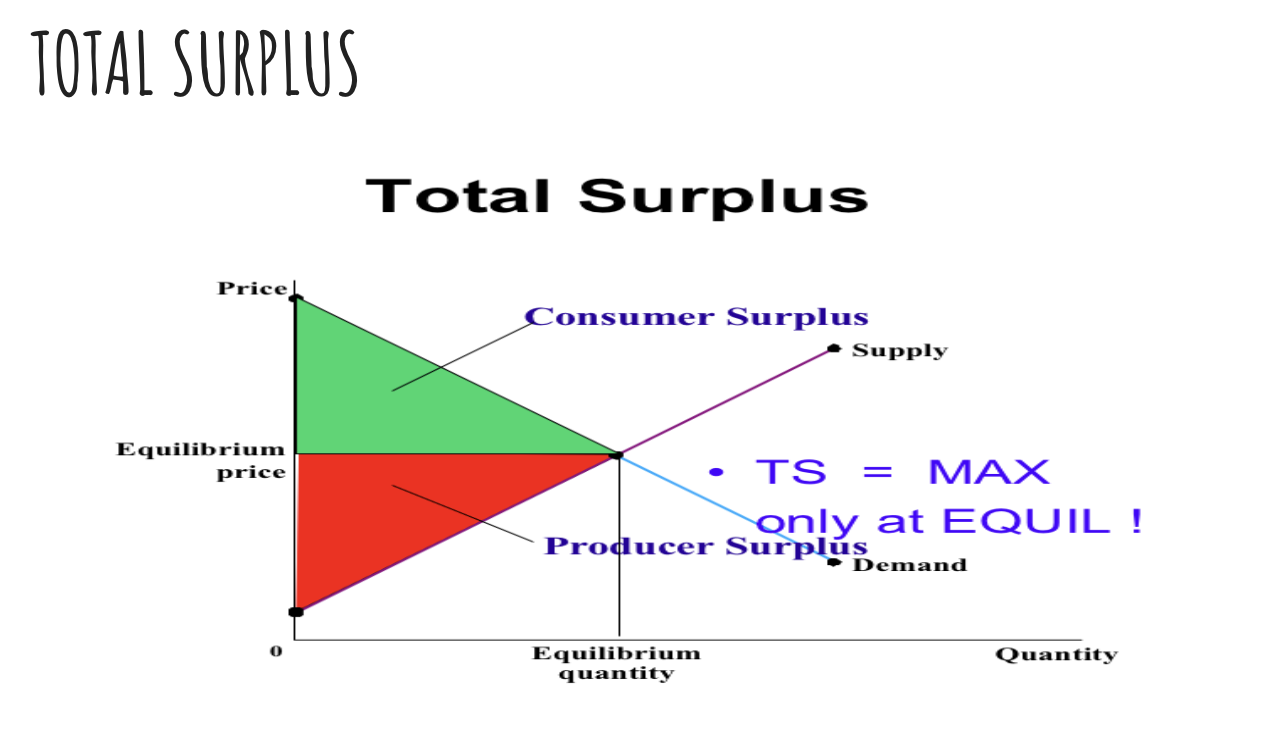

Describe the concept of total surplus and explain how it is calculated

The economic well-being of a society is measured as the sum of consumer surplus and producer surplus - total surplus. Market efficiency is attained when the allocation of resources maximises total surplus.

Use a market model to show and explain where total surplus is maximised

Total surplus is maximised at equilibrium.

Use a market model to show and explain how economic events can affect consumer surplus, producer surplus and total surplus.

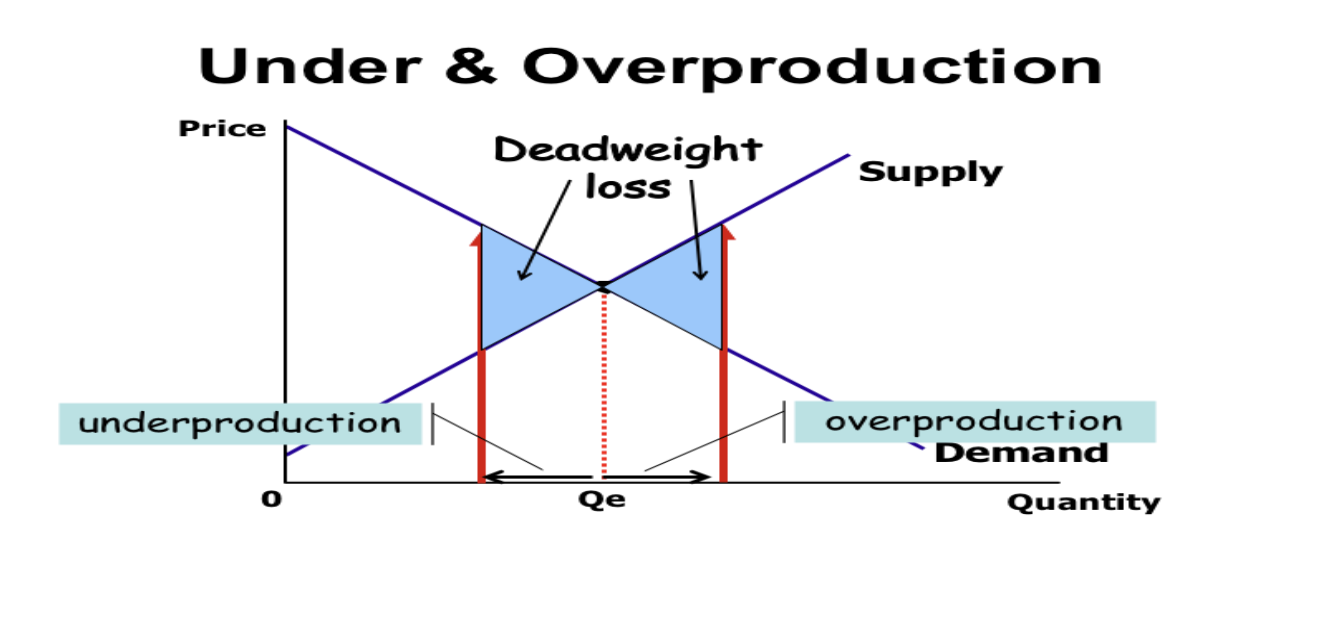

Define deadweight loss and identify why it occurs

A deadweight loss is when total surplus is reduced due to over or underproduction. A deadweight loss refers to an avoidable decrease in total surplus because something has has prevented the market from producing the optimal output.

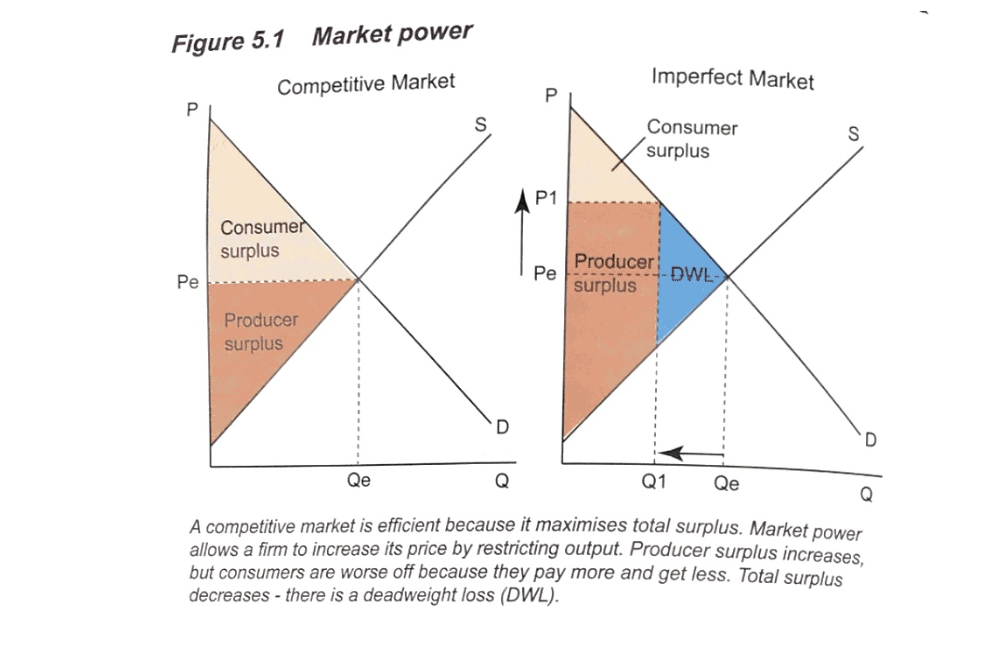

Describe the concept and causes of market power

In imperfect markets like monopolies or oligopolies, firms can use their market power to influence or manipulate market outcomes. A firm possesses market power when it can alter the market price by adjusting the quantity of its output. Firms with market power often have an incentive to reduce competition, either by limiting price competition or by decreasing the number of rivals in the market.

Show and explain how market power can influence market inefficiency i.e. a deadweight loss

Market power allows firms to increase their prices as there is no competition and consumers are stuck paying a higher price. Society is worse off as total surplus falls. There is now a deadweight loss which represents the loss of economic welfare because of a lack of competition. A deadweight loss occurs as the fall in consumer surplus exceeds the rise in producer surplus.

Identify and explain two examples of anti-competitive behaviour

Examples of this are:

Controlling a scarce resource - if a mining company pegged the only diamond mine in the country, it would have sole rights to mine the gems

A government licence granting a legal monopoly e.g. Australia Post.

A technological advantage - e.g. Microsoft has considerable market power because it supplies the operating system used in most computers.

A patent on an invention gives protection from competition (up to 17 years in Australia).

Extensive product differentiation, brand proliferation, large advertising

budget, controlling retail outlets.

Economies of scale - only a few firms can compete in the market because of the large setup (fixed) costs

Collusive behaviour - when firms agree to share markets, to fix prices or quantities or otherwise seek to reduce competition and/or prevent new firms entering a market

Describe policy options to influence market power, including regulation/deregulation and legislation

Explain the role of the Australian Competition and Consumer Commission (ACCC) in encouraging competition and discouraging anti-competitive behaviour

The role of the ACCC is to protect, strengthen and supplement the way competition works in Australian markets and industries to improve the efficiency of the economy and to increase the welfare of Australians. This means that the ACCC tries to ensure that the benefits of increased competition flow through to consumers in the form of lower prices and better service. It does this by prohibiting anti-competitive conduct by firms with market power such as price fixing and collusion.

Explain the concept of equity

Describe the relationship between equity and efficiency

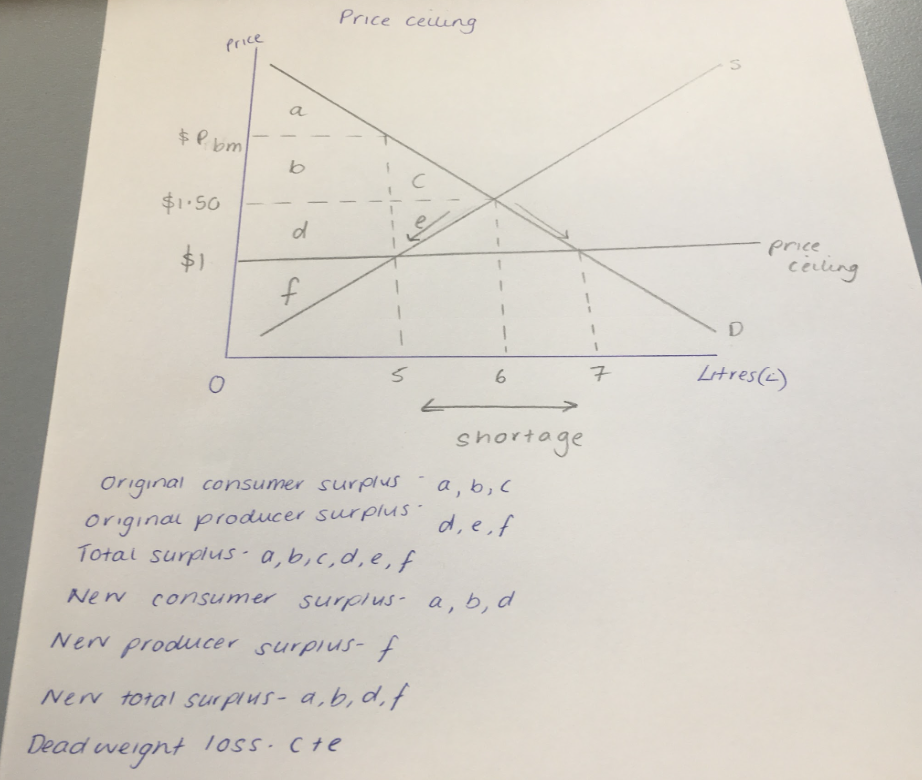

Define price ceiling

A price ceiling is the legislated maximum price that seller are allowed to charge in a market.

Show and explain the effects of price ceilings on consumer, producer and total surplus

A price ceiling benefits consumers more as they are paying a lower price for a product and there is a larger consumer surplus but some consumers are missing out as less is produced. The burden falls on the producers as they are making less total revenue and the producer surplus is less. This causes there to be a deadweight loss because there is a shortage and some consumers are missing out on the product. This causes total surplus to decrease.

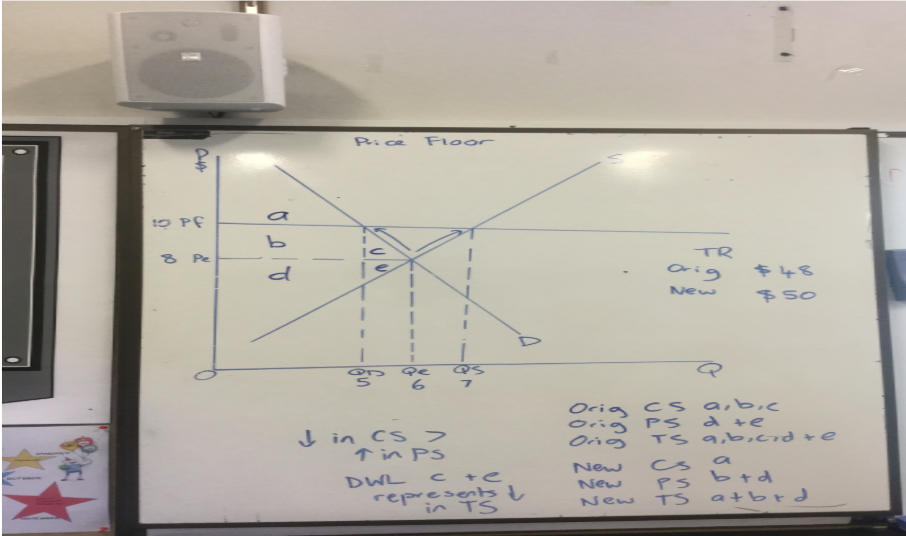

Show and explain the effects of price floors on consumer, producer and total surplus

A price floor benefits producers more because they are able to increase their prices and therefore make more total revenue. Producer surplus increases. The burden falls onto the consumers because they have to pay more. Consumer surplus decreases. There is now a deadweight loss as there is a surplus because producers are more willing to supply the product but consumers are less willing to buy it. Total surplus decreases.

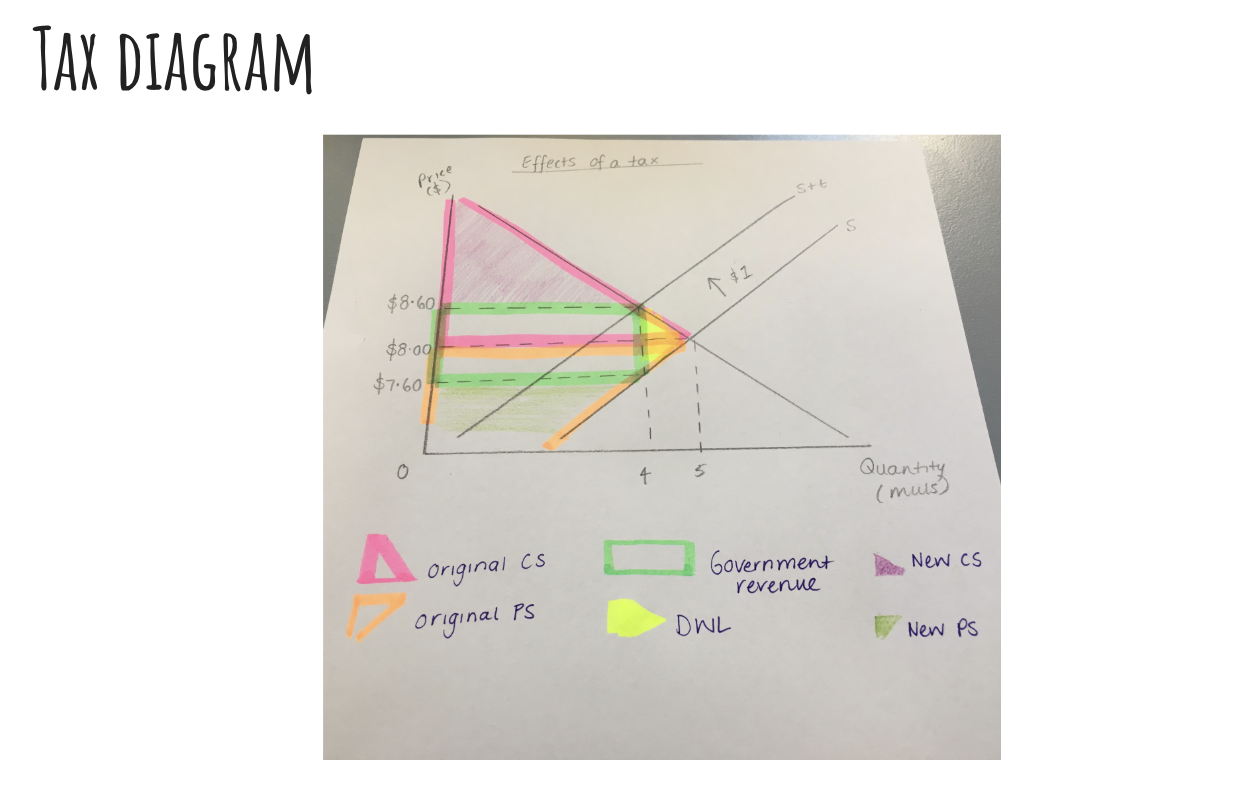

Show and explain the effects of a tax on a market

Taxes are mandatory payments made to the government. The aim of it is to raise revenue in order to finance government spending. Taxes are necessary to enable the government to fund their spending. However, taxes can result in inefficiency. levying tax on an otherwise efficient market will decrease total surplus. A portion of the surplus is simply transferred to the government. However, a portion of the surplus is also lost, it vanishes. This decreases surplus is the deadweight loss.

Show and explain the effects of a subsidy on a market

A subsidy is a financial grant paid to producers with the intention of lowering production costs, encouraging greater output, and often making the good or service more affordable for consumers. Economically, a subsidy acts as a negative tax, shifting the supply curve to the right and reducing the market price. Subsidies typically benefit both producers and consumers. However, the introduction of a subsidy raises important questions about efficiency and welfare. Ultimately, evaluating the efficiency of a subsidy depends on whether the social benefits justify the cost and any potential distortion to the market.

MARKET FAILURE

Describe the concept of market failure

There are a number of instances where the market is not capable of producing at the optimal or ‘best’ outcome for society. this is called market failure. Market failure occurs when resources are not allocated efficiently- in other words total economic surplus is not being maximised.

Define positive and negative externalities

Negative externalities are external costs associated with the production or consumption of goods and services, that spill over (passed onto) to third parties. They occur when production and/or consumption imposes external costs on third parties outside of the market for which no appropriate compensation is paid. Therefore, the good is underpriced and over produced/consumed.

Positive externalities are benefits associated with the production or consumption of goods and services, that spillover onto third parties. When a positive externality exists the private benefit (to the individual) is less than the overall benefit of the consumption or production to society. The market fails to capture the external benefits to society that occur from production or consumption of the good. Therefore, the good is overpriced and under consumed.

Show and explain how a positive and negative externality can influence market efficiency i.e. a deadweight loss

Show and explain how subsidies are used to correct market failure for goods with positive externalities

Show and explain how taxes are used to correct market failure for goods with negative externalities

Outline the classification of goods based on rivalry and excludability

Outline the concept of public goods and explain the free rider effect using examples

Outline the concept of common resources and explain the tragedy of the commons using examples

Describe policy options to reduce market failure associated with public goods and common resources