Business Finance Formulas

1/48

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

49 Terms

Future Value (Annually compounding)

(5.1) Page 245

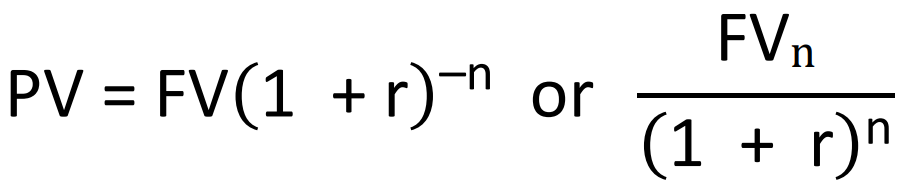

Present Value (Annually compounding)

(5.2) Page 250

Present value of a Perpetuity

(5.7) Page 259

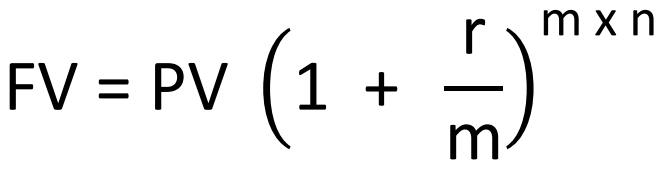

Future Value (Compounding Periodically)

(5.9) Page 266

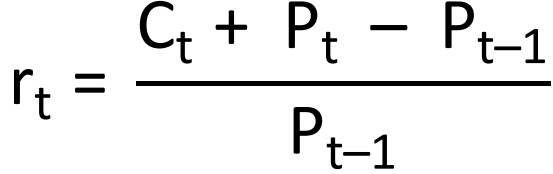

Total Rate of Return (Holding Period Return)

(8.1) Page 407

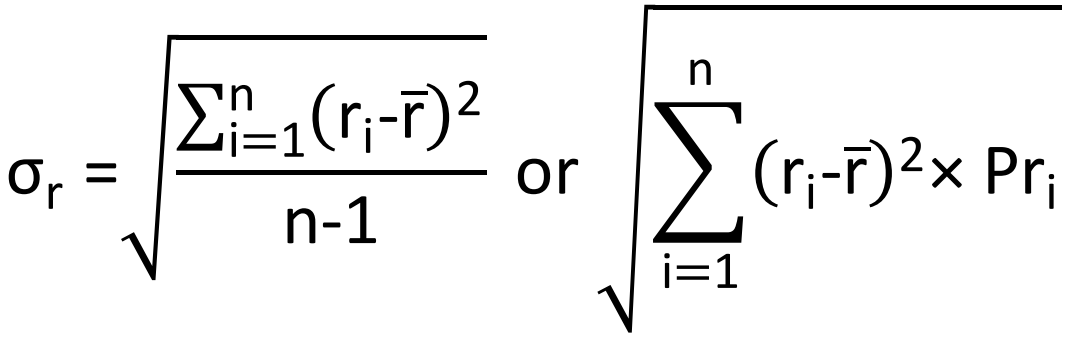

Standard deviation (Historical or Forcast)

(8.4a) Page 415 & (8.3a) Page 414

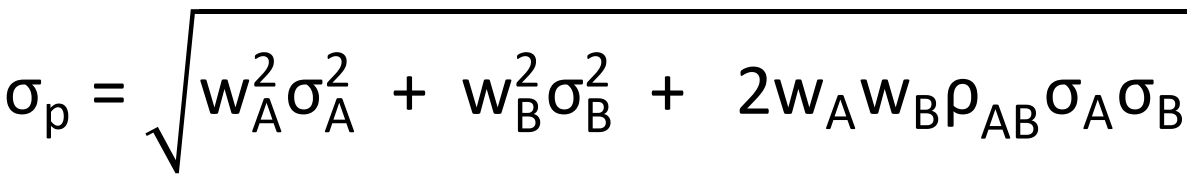

Standard Deviation of a Portfolio

(8.9) Page 426

Capital Asset Pricing Model (CAPM)

(8.12) Page 437

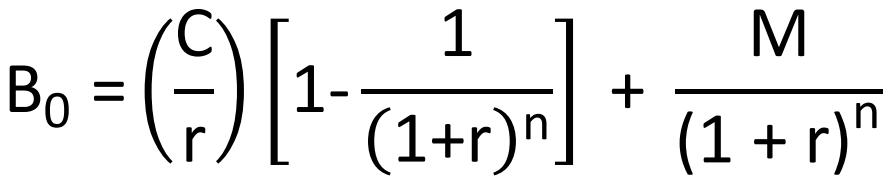

Present Value of an Annuity + a lump sum

(6.5a) Page 335

The Before-Tax Cost of Debt for a Bond with a $1,000 par value

(11.1) Page 480 (Gitman, Juchau and Flanagan (2011))

Price to Earnings Ratio (P/E)

(3.18) Page 158

After-tax cost of debt

(9.1) Page 472

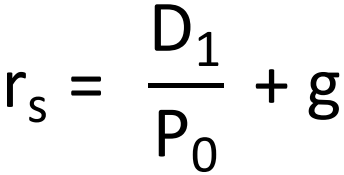

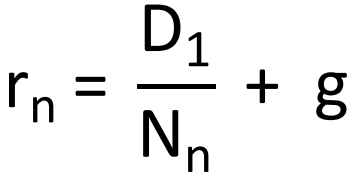

Required return on common stock

(9.4) Page 475

Cost of a new issue of common stock

(9.6) Page 477

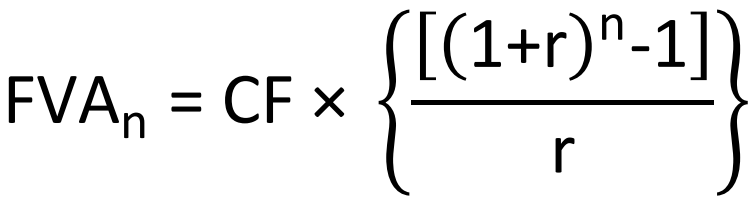

Future Value of an Ordinary Annuity

(5.3) Page 253

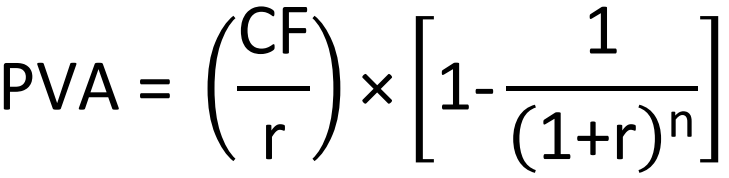

Present Value of an Ordinary Annuity

(5.4) Page 254

Present value of Annuity Due

(5.6) Page 258

Continuously Compounded Interest

(5.10) Page 268

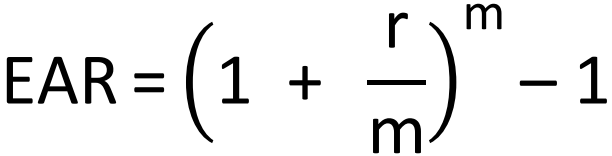

Effective Annual Rate of interest (EAR)

(5.11) Page 269

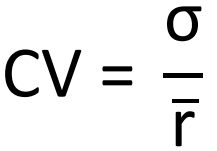

Coefficient of Variation (CV) (= Standard Deviation / Mean)

(8.5) Page 417

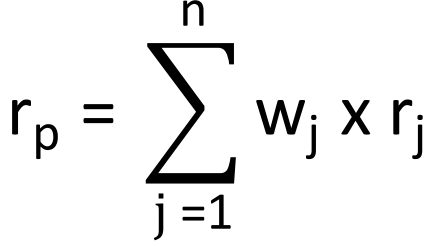

Portfolio Return

(8.6) Page 419

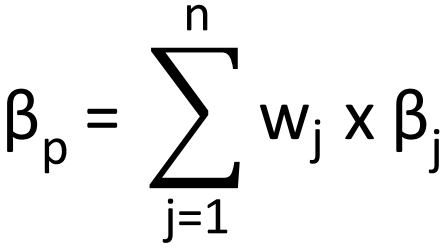

Portfolio Beta

(8.11) Page 435

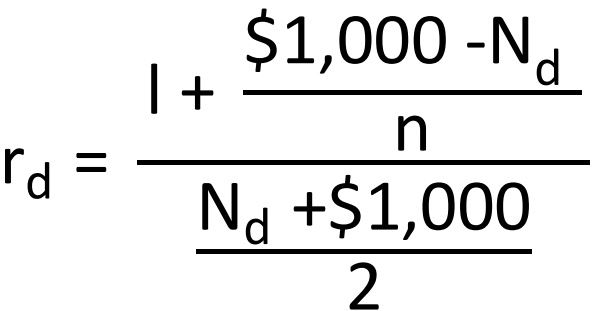

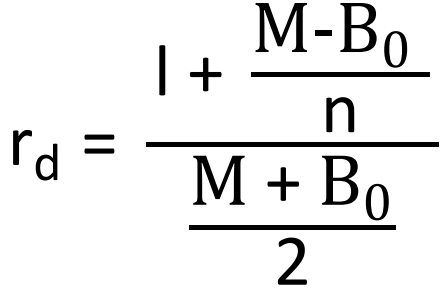

Approximate Yield to Maturity (YTM)

Page 343 & Study Guide Module 1.3

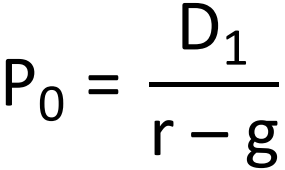

Gordon Growth Dividend Model

(7.4) Page 377

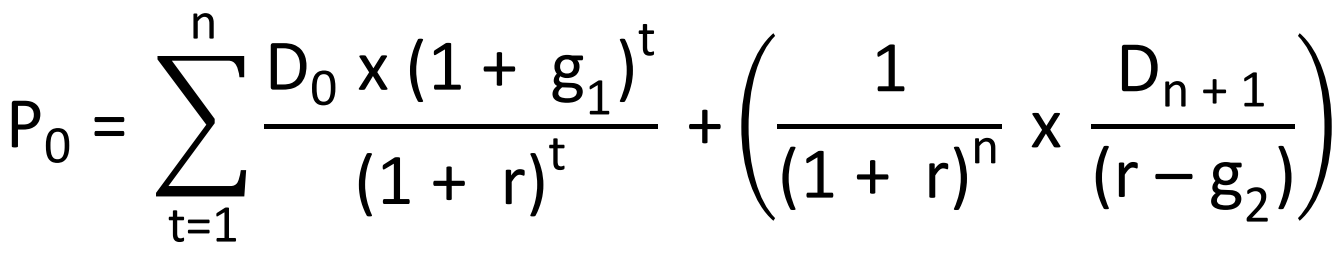

Variable-Growth Dividend Model

(7.5) Page 378 - 379)

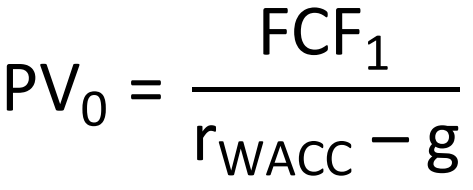

Terminal Value

(11.8) Page 567

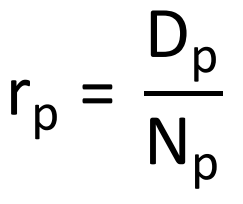

Cost of Preferred Stock

(9.2) Page 473

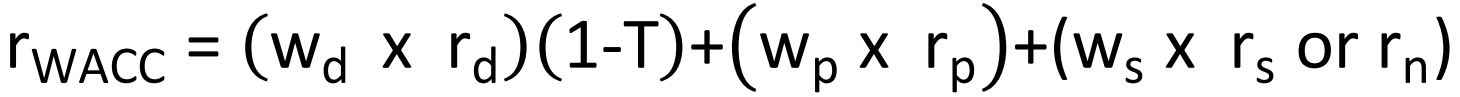

Weighted Average Cost of Capital

(9.8) Page 479

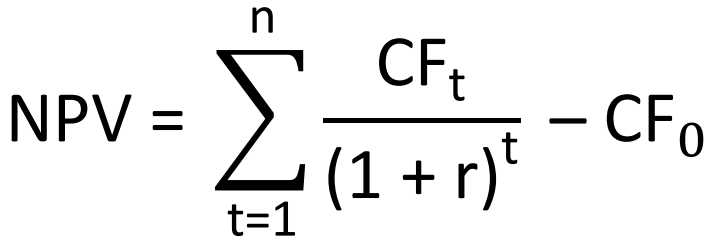

Net Present Value (NPV)

(10.1) Page 510

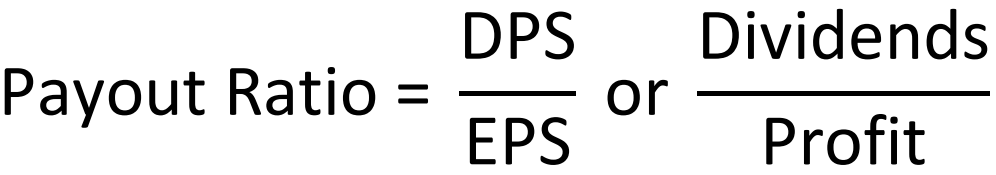

Payout Ratio

Page 710

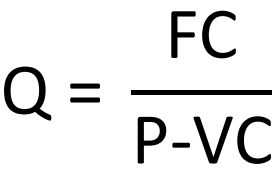

Break-Even Point

(12.3) Page 591

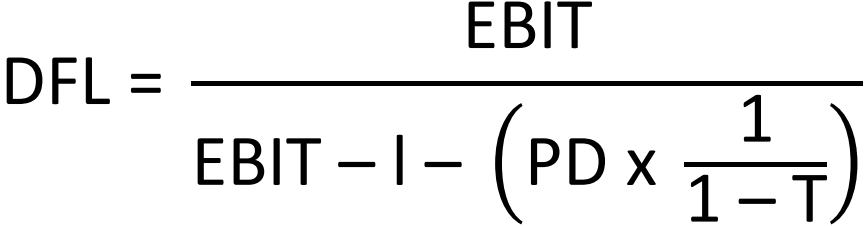

Degree of Financial Leverage (at a base level of EBIT)

(13.7) Page 573 (Gitman, Juchau and Flanagan (2011))

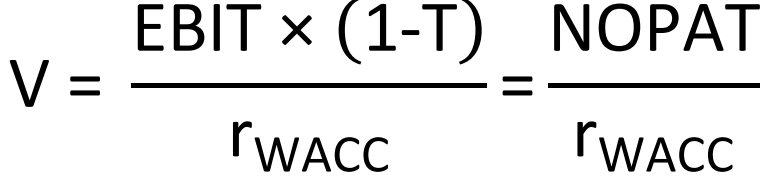

Value of a Firm (using NOPAT & WACC)

(13.11) Page 587 (Gitman, Juchau and Flanagan (2011))

Financial Breakeven Point

Page 590 (Gitman and Zutter (2014))

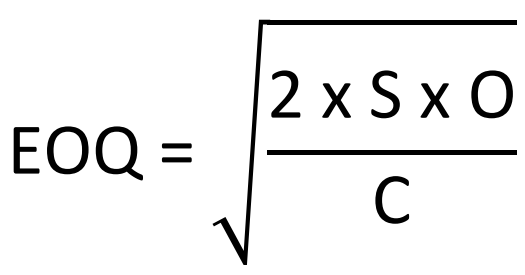

Economic Order Quantity (EOQ) Model

(15.7) Page 750

Total Inventory Cost

(15.6) Page 750

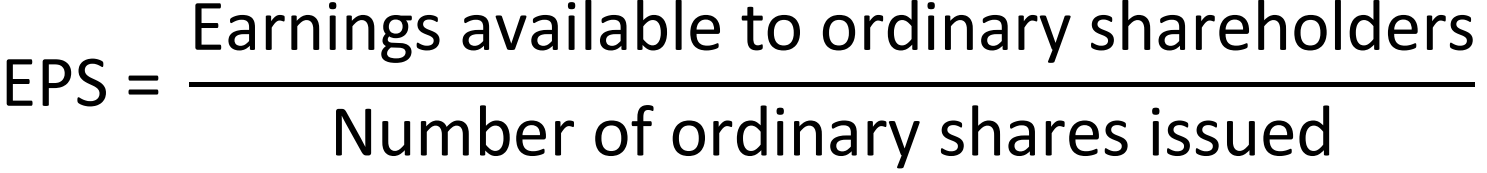

Earnings Per Share

(3.15) Page 155

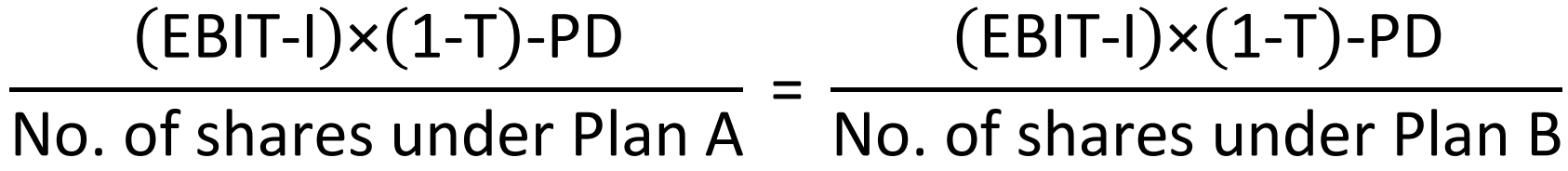

Indifference Point

Page 614 (Gitman, Juchau and Flanagan (2011))

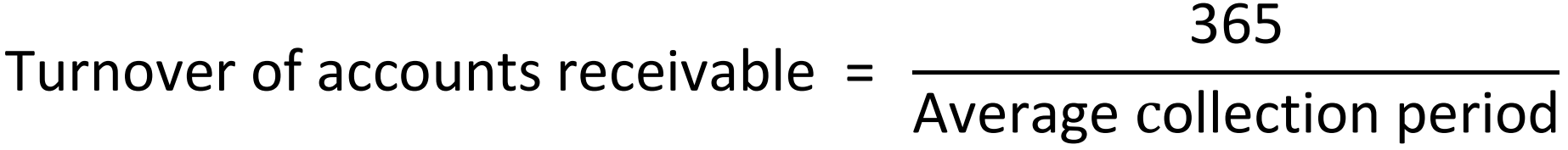

Accounts Receivable Turnover Ratio

(14.9) Page 636 (Gitman, Juchau and Flanagan (2011))

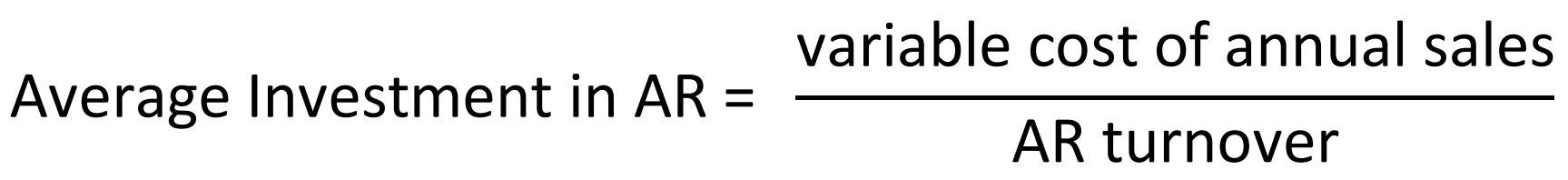

Average Investment in Accounts Receivable

(14.9) Page 636 (Gitman, Juchau and Flanagan (2011))

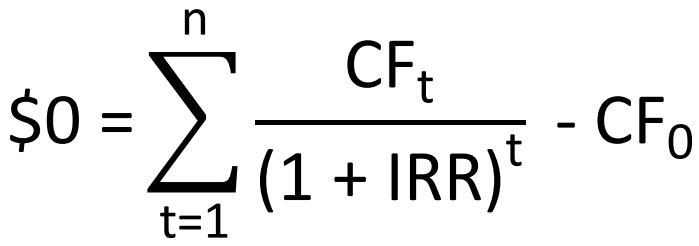

Internal Rate of Return (IRR)

(10.4) Page 517

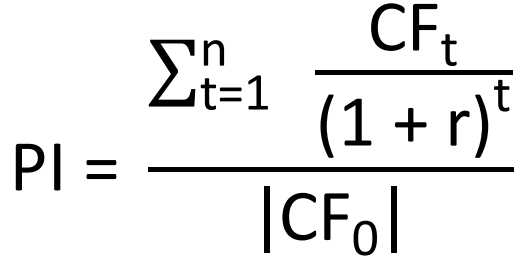

Profitability Index

(10.2) Page 513

Operating Break-Even Point

(12.2) Page 591

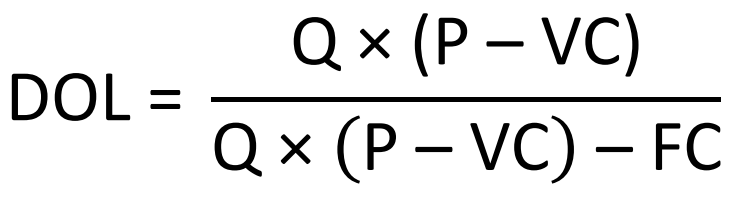

Degree of Operating Leverage

(12.6) Page 598

Degree of Total Leverage

(13.10) Page 575 (Gitman, Juchau and Flanagan (2011))

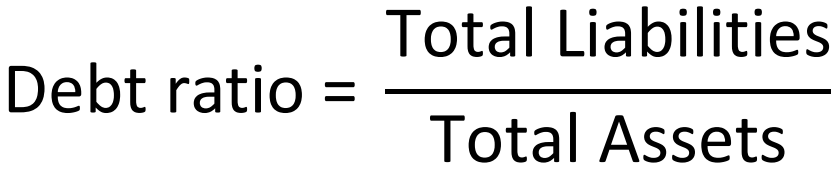

Debt Ratio

(3.8) Page 148

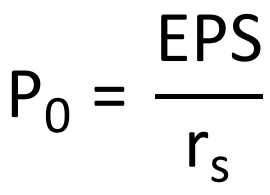

Zero Growth Valuation Model

(13.12) Page 592 (Gitman, Juchau and Flanagan (2011))

Reorder Point

(15.8) Page 751

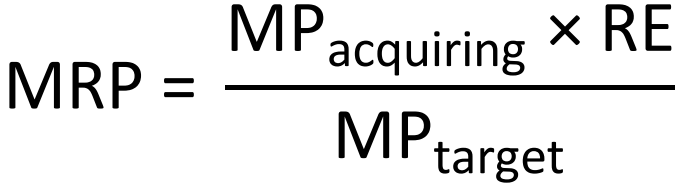

Ratio of Exchange in Market Price

(18.1) Page 866