Causes of Inflation: Quantity theory of money

1/34

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

35 Terms

inflation

ongoing process of persistently rising prices year on year

→ increase in average prices

price

rate at which money is exchanged for a good or a service

quantity theory of money

theory that links the inflation rate to the growth rate of money

M = money supply

V = velocity of money

P = price level (GDP deflator)

Y = real GDP

→ PY = nominal GDP = value of output

money velocity

number of times the average pound changes hands in a given time period

V = value of transactions/money supply

eg 50 loaves of bread, £2 per loaf → value of transactions = 100

V = 100/20 = 5

money demand function

M/P = real money balances = measures the purchasing power of the quantity of money

(M/P)^d = kY → money demand function

k shows how much money people want to hold for every unit of income

money demand function & quantity equation

assume demand for real balances equals supply → (M/P)^d = M/P

kY = M/P → M1/k = PY

if V = 1/k then MV = PY

implications of money demand function & quantity equation

if demand for money for each unit of income is high → large k, then money changes hands infrequently (small V)

assumption of constant velocity: implication

if we assume velocity is constant then the quantity equation is interpreted as the quantity theory of money

→ change in M must cause a proportional change in nominal GDP

→ Y is determined by FoP and production function so nominal GDP (PY) only changes due to changes in price level (P)

→ therefore the P is proportional to M

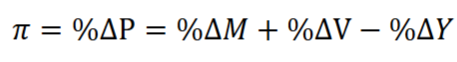

how inflation is generated: growth version of quantity equation

growth version of quantity equation shows how the inflation rate (%P) depends on the growth rate of M, V, Y

money demand

depends inversely on the interest rate on other financial assets/market interest rate → opportunity cost of holding money

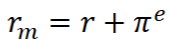

market rate = real interest rate when there is no inflation → rm = r

money demand in an inflationary world

Fischer equation

only consider anticipated change in money supply so consider economy being at the full employment output level

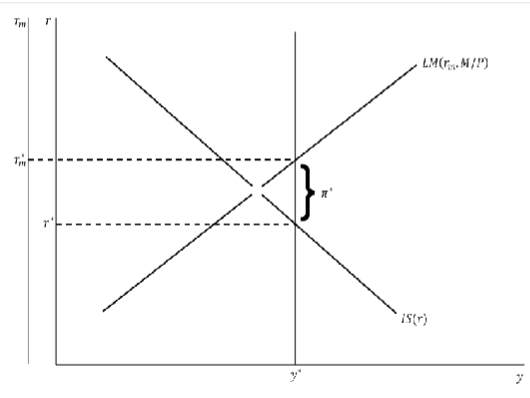

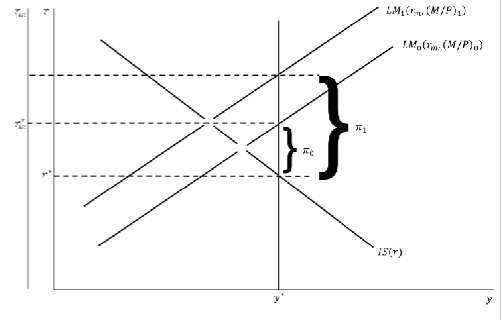

IS/LM curve

LM plotted against rm and depends on real money supply

IS depends on real interest rate r

vertical gap between rm and r measures the inflation rate at income level y*

assume fixed output Y*: increase in M^s

an increase in M^s if prices are unchanged → LM shifts outward → pushes down the price of money = nominal interest rate

→ decrease in real interest rate

→ stimulated borrowing & spending → excess demand → price must increase until it matches the increase in M

→ pushes real money balances back to original real money → end of boom period

assume fixed output Y*: rising Y

excess supply → prices must fall → real money supply increases (M bar/P)

→ %ΔP = %ΔM - %ΔY

assume constant velocity so P falls by the same amount as the increase in Y

assume fixed output Y*: fall in k

k = propensity to hold money

k decreases due to contactless payments eg → real money demand falls

→ if price is constant then LM shifts outward

(M bar/P) = kYbar → (M bar/P)1/k = Y bar

yet no equilibrium until price increases to offset the tendency of fall in money demand that shifts LM

→ 𝛑 = %ΔP = %ΔM + %ΔV - %ΔY

inflation generated equation

effects of inflation on velocity & real GDP are uncontrollable

monetary authorities have trend growth rate in the money supply to control the trend rate of inflation precisely (1-1 relationship)

implications of growth theory of money for economies

→ implies that countries with high money growth rates should have higher inflation rates

→ across time the LR trend in a country’s inflation should be similar to the LR trend in the country’s money growth rate

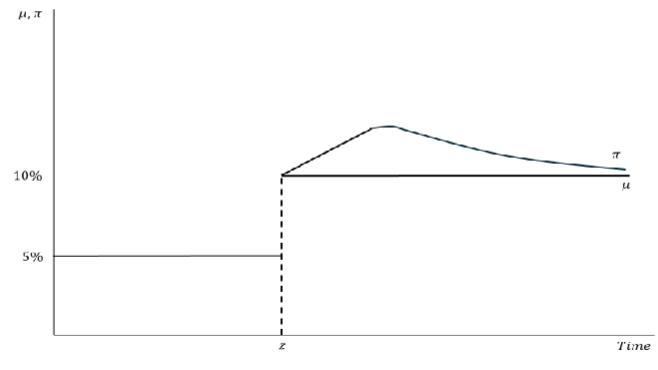

how is inflation affected when the growth rate of money supply is increased?

assume %ΔM^s increases

→ LM0 shifts outward to LM1

constant inflation at 𝛑0: fall in rm and r → creates excess demand for goods

→ upward pressure on inflation → overshooting P → real money supply starts shrinking → shifts LM in opposite direction (inward)

how does the economy move from LM0 to LM1? (overshooting)

real money supply falls due to:

higher money supply growth rate

fall in money demand

→ extra effect on money demand occurs at the point in time at which the money supply growth rate increased if everything works instantaneously

how does a higher money supply growth rate cause a fall in money demand?

→ higher inflation & nominal interest rate

→ higher opportunity cost of holding money

→ people reduce demand for money

→ further induces additional excess demand for goods & services

→ raises price level

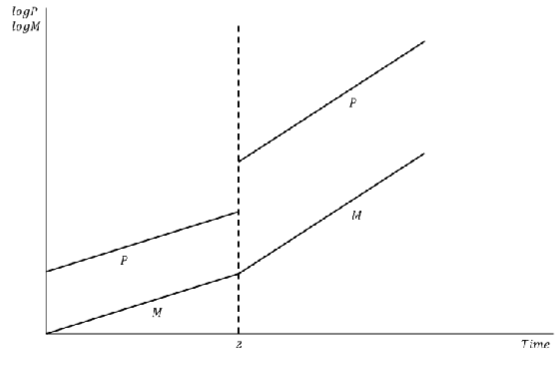

graph of overshooting

z = increase in the growth rate money supply eg covid

the price level and money supply

when money supply growth rate rises, some is regarded as temporary and some as permanent

→ tendency for P to rise but in a steady fashion and at a higher rate than the growth rate of money supply = overshooting

how does this growth rate of M being temporary affect future inflation?

if people think the increase is temporary, they don’t raise their LR inflation expectations

→ nominal interest rate doesn’t increase → money demand only declines by a negligible amount

→ not much pressure on inflation rate: at z there is no overshooting effect as only force on inflation is growth rate of money supply itself

permanent?

the longer the new higher growth rate of M^s persists then more people will believe in permanency of the higher growth rate money supply

→ adjust inflation expectations to be higher in the long run

→ increases nominal interest rate → decreases real demand for money → inflation rises

outcome

→ new equilibrium as LM moves enough to raise rm above r by amount of new higher inflation

→ r and y unaffected

→ nominal interest rate is higher, inflation higher, money supply growth rate is higher

policy implications

not possible for BoE to permanently lower interest rate by increasing money supply

increase in growth rate of money supply produces a rise in the inflation rate and a rise in rm

initially possible to have a temporary fall in rm

social costs of inflation

costs of expected inflation

costs of unexpected inflation

expected: shoe leather cost

real money balances reduced due to inflation tax

nominal interest rate is high due to high inflation

people want to hold just enough cash for their immediate consumption and deposit rest in back to earn interest

→ same monthly spending but lower average money holding → frequent trips to bank to withdraw smaller amounts of cash

expected: menu cost

induces firms to change posted prices on menus more often

eg stores regularly print and mail out new catalogues

higher the inflation the more frequently firms must change prices and incur costs

expected: relative price distortions

as a result of menu costs firms change prices infrequently so some prices do no keep up with inflation

different firms change their prices at different times leading to relative price distortions that causes micro inefficiencies in allocation of resources

unexpected: tax treatment

some taxes eg capital gains are not adjusted to account for inflation

may accumulate wealth through nominal gain in stocks

yet with high inflation there may be no real capital gain but will have to pay tax on the nominal gain

unexpected: general inconvenience

inflation makes it harder to compare nominal values from different time periods

complicates long term financial planning

eg saving for uni education, retirement

unexpected: arbitrary redistribution of purchasing power

many long term contracts (loans, fixed pensions) are not indexed but based on E𝛑

if 𝛑 is different from E𝛑 then some gain at others’ expenses

𝛑>E𝛑 → purchasing power transferred from lenders to borrowers & vice versa

additional cost: increased uncertainty

high inflation is more variable and unpredictable

→ arbitrary redistributions of wealth are more likely which increases uncertainty, making risk-averse people worse off

benefits of inflation

costs of inflation favour 0 inflation yet may not be optimal

moderate inflation of 2-3% may be better as it helps adjust real wages without nominal cuts if there is a significant decrease in inflation

non-0 inflation may facilitate labour market flexibility