ECON 248 16.1 How Fiscal Policy Influences Aggregate Demand

1/12

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

13 Terms

The setting of government spending and taxation by government policy makers.

Fiscal Policy

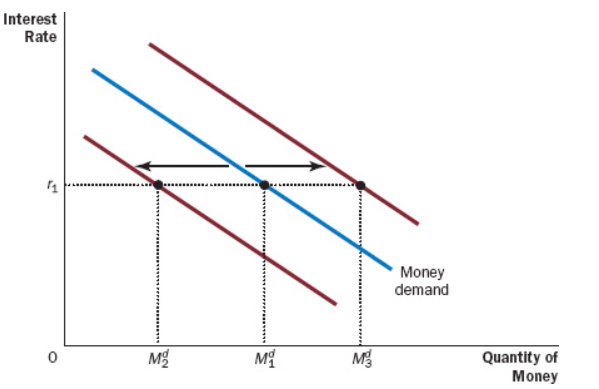

An () in the dollar value of transactions causes the demand for money to shift right and vice versa.

Increase

When government spending increases, aggregate demand for goods and services shifts ().

Right

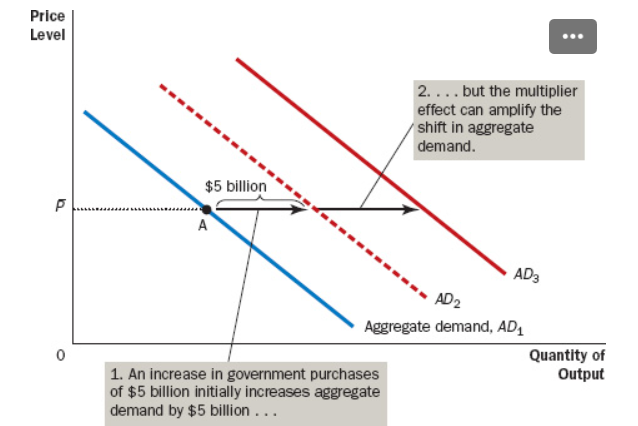

The additional shifts in aggregate demand that result when expansionary fiscal policy increases income and thereby increases consumer spending.

Multiplier Effect

() is a term referring to an increase in investment as a result of an increase in demand for goods and services.

Investment Accelerator

The fraction of extra income a household consumes rather than saves is called the (1). For example, if someone earned 1 dollar and spent 0.75$ of it, then the (1) is ().

Marginal Propensity To Consume(MPC), 3/4

The relevant formula for government purchases in a closed economy is the following:

1/(1-MPC) = Multiplier

The fraction of extra income that a Canadian household spends on imports is called ().

Marginal Propensity To Import(MPI)

The relevant formula for the government-purchases multiplier in an open economy is:

1/(1 - MPC + MPI) = Multiplier

The government purchases multiplier is smaller in a () compared to a (2), since a (2) doesn’t have MPI.

Open Economy, Closed Economy

A high MPC () the multiplier while a high MPI does the opposite.

Increases

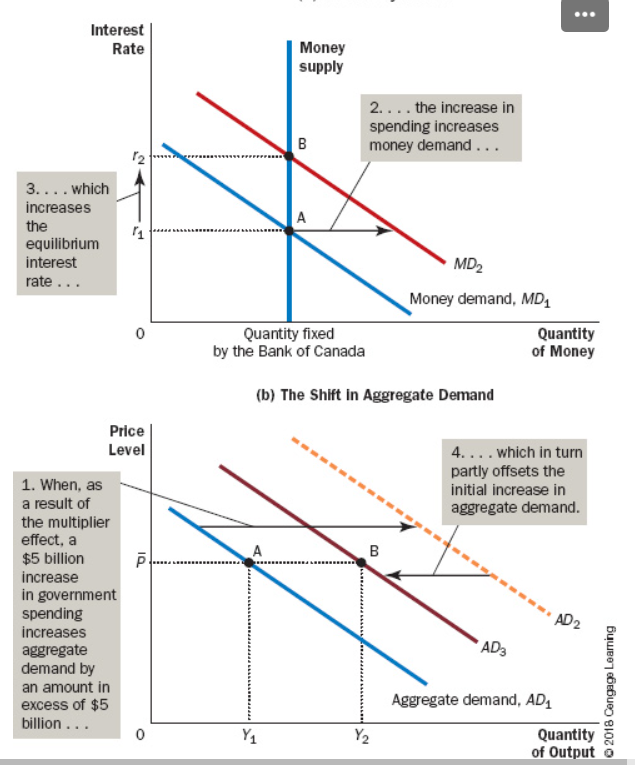

Due to a fiscal expansion, () also increase to keep the expanding demand in check, causing a ().

Interest Rates, Crowding-Out Effect on Investment

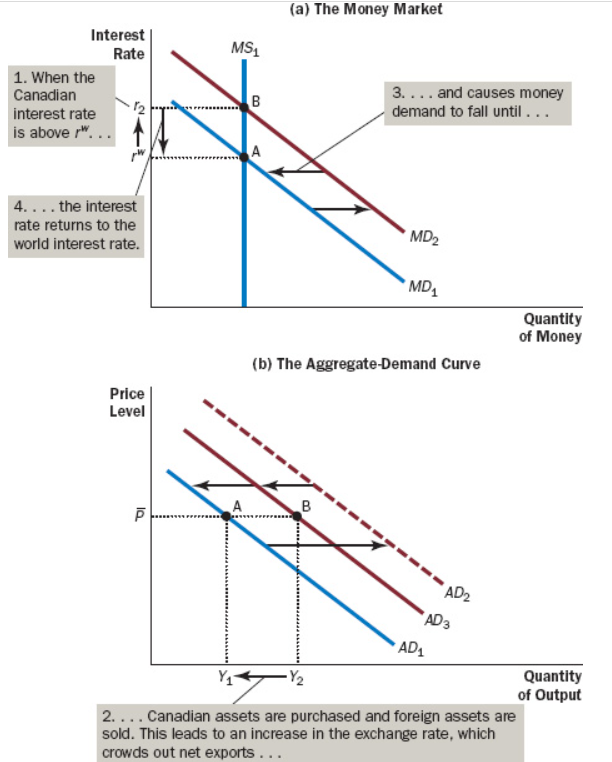

The offset in aggregate demand that results when expansionary fiscal policy in a small open economy with a flexible exchange rate raises the real exchange rate and thereby reduces net exports

Crowding-Out Effect On Net Exports