Accounting Exam 1

1/89

Earn XP

Description and Tags

TGM 200

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

90 Terms

On May 7, Carpet Barn Company offered to pay $83,000 for land that had a selling price of $105,000. On May 15, Carpet Barn accepted a counteroffer of $95,000. On June 5, the land was assessed at a value of $115,000 for property tax purposes. On December 10, Carpet Barn Company was offered $135,000 for the land by another company. At what value should the land be recorded in Carpet Barn Company’s records?

$95,000

Revenues are reported when

work is completed on the job

Michael Anderson is starting a computer programming business and has deposited an initial investment of $15,000 into the business cash account. Identify how the accounting equation will be affected.

increase in assets (Cash) and increase in owner’s equity (Michael Anderson, Capital)

Earning revenue

increases assets, increases owner’s equity

Land originally purchased for $30,000 is sold for $62,000 in cash. What is the effect of the sale on the accounting equation?

assets increase by $32,000; owner's equity increases by $32,000

Which type of accountant typically practices as an individual or as a member of a public accounting firm?

Certified Public Accountant

If total assets decreased by $88,000 during a period of time and owner's equity increased by $71,000 during the same period, then the amount and direction (increase or decrease) of the period's change in total liabilities would be a(n)

$159,000 decrease

Which of the following is a guideline for behaving ethically?

I. | Identify the consequences of a decision and its effect on others. |

II. | Consider your obligations and responsibilities to those affected by the decision. |

III. | Identify your decision based on personal standards of honesty and fairness. |

I, II, and III

Ramon Ramos has withdrawn $750 from Ramos Repair Company’s cash account to deposit in his personal account. How does this transaction affect Ramos Repair Company’s accounting equation?

decrease in assets (Cash) and decrease in owner’s equity (Owner’s Withdrawal)

Many countries outside the United States use financial accounting standards issued by the

IASB

Which of the following financial statements reports information as of a specific date?

balance sheet

Abbie Marson is the sole owner and operator of Great Plains Company. As of the end of its accounting period, December 31, Year 1, Great Plains Company has assets of $940,000 and liabilities of $300,000. During Year 2, Marson invested an additional $73,000 and withdrew $33,000 from the business. What is the amount of net income during Year 2, assuming that as of December 31, Year 2, assets were $995,000 and liabilities were $270,000?

$45,000

Which of the following is most likely to obtain large amounts of resources by issuing stock?

corporation

The monetary value charged to customers for the performance of services sold is called a(n)

revenue

The accounting equation may be expressed as

Assets − Liabilities = Owner's Equity

For accounting purposes, the business entity should be considered separate from its owners if the entity is

a proprietorship, a partnership, and a corporation

A financial statement user would determine if a company was profitable or not during a specific period of time by reviewing the

income statement

The financial statement that presents a summary of the revenues and expenses of a business for a specific period of time, such as a month or year, is called a(n)

income statement

Which of the following is a service business? Dell, Walmart, Microsoft, or Facebook

Facebook, Inc.

Owner's withdrawals

decrease owner's equity

The initials GAAP stand for

generally accepted accounting principles

The Assets section of the balance sheet normally presents assets in

the order in which they will be converted into cash or used in operations

What is a characteristic of a corporation?

A corporation’s resources are limited to its individual owners’ resources.

Managerial accountants would be responsible for providing information regarding

expansion of a product line report to management

What is a good description of accounting’s role in business?

Accounting provides information to managers to operate the business and to other users to make decisions regarding the economic condition of the company.

On May 20, White Repair Service extended an offer of $108,000 for land that had been priced for sale at $140,000. On May 30, White Repair Service accepted the seller’s counteroffer of $115,000. On June 20, the land was assessed at a value of $95,000 for property tax purposes. On July 4, White Repair Service was offered $150,000 for the land by a national retail chain. At what value should the land be recorded in White Repair Service’s records?

$115,000

What are certifications for accountants?

CMA, CISA, CIA

Donner Company is selling a piece of land adjacent to its business. An appraisal reported the market value of the land to be $120,000. Focus Company initially offered to buy the land for $107,000. The companies settled on a purchase price of $115,000. On the same day, another piece of land on the same block sold for $122,000. Under the cost concept, what amount will be used to record this transaction in Focus Company’s accounting records?

$115,000

Which of the following is a business transaction?

purchase inventory on account

The objectivity concept requires that

amounts recorded in the financial statements be based on independently verifiable evidence

What transaction increases owner’s equity?

Provide services on account

In the chart of accounts, the balance sheet accounts are normally listed in which order?

assets, liabilities, owner’s equity

A transaction can first be found in the accounting records in the

journal

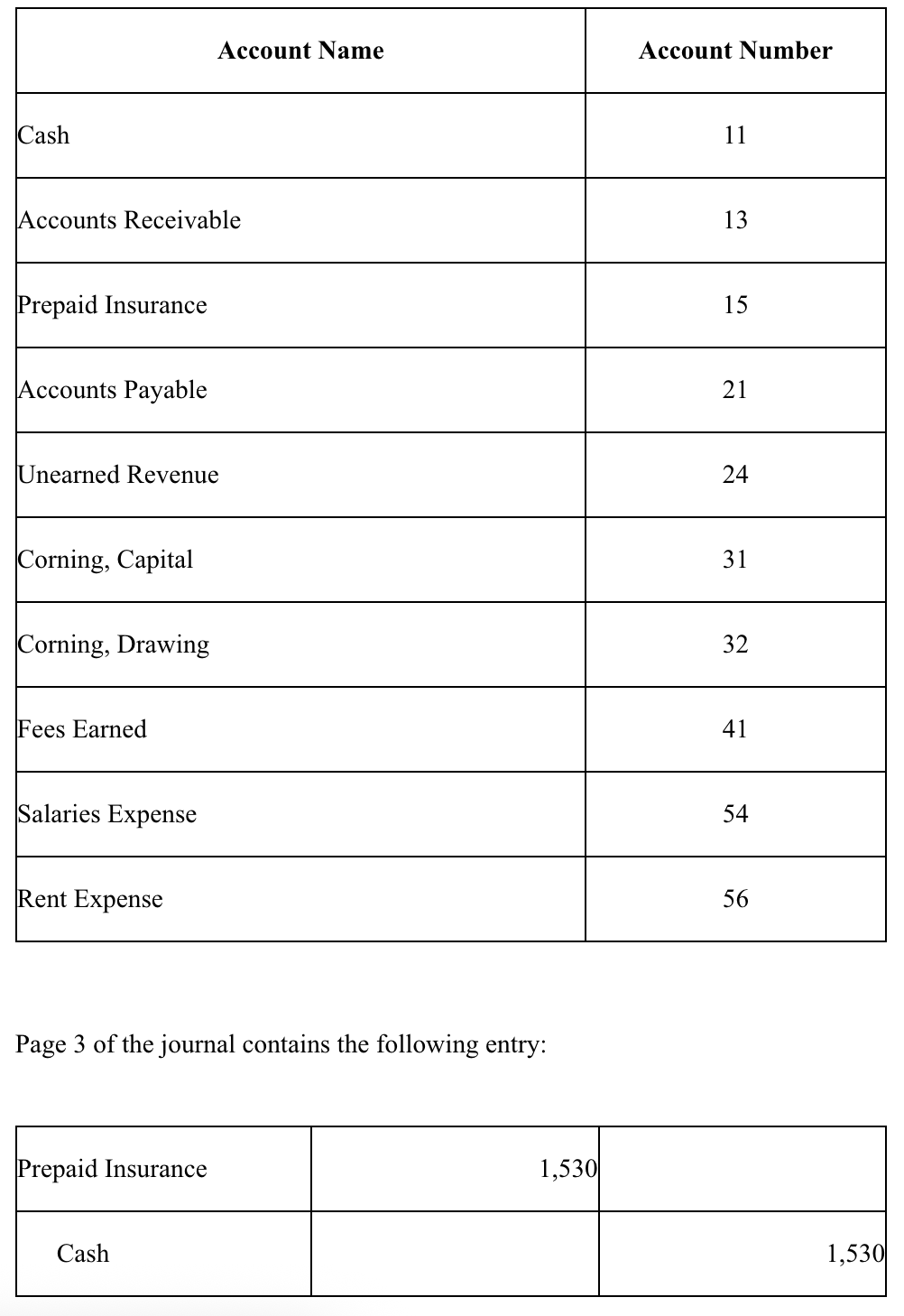

What is the posting reference that will be found in the cash account?

15

The classification and normal balance of the accounts payable account are

liability, credit balance

In which order are the accounts listed in the chart of accounts?

assets, liabilities, owner’s equity, revenues, expenses

Which of the following accounts are debited to record increases?

assets and expenses

A list of the accounts used by a business is called the

chart of accounts

Expenses can result from

consuming services

Owner’s equity will be reduced by all of the following except

revenues

The following accounts appear in the ledger of Monroe Entertainment Co. All accounts have normal balances.

Accounts Payable | $1,500 |

| Fees Earned | $3,600 |

Accounts Receivable | 1,800 |

| Insurance Expense | 1,300 |

Cash | 3,200 |

| Kim Monroe, Capital | 8,800 |

Kim Monroe, Drawing | 1,200 |

| Land | 3,000 |

Prepaid Insurance | 2,000 |

| Wages Expense | 1,400 |

When a trial balance is prepared, the total of the debits will be

$13,900

Which of the following groups of accounts is increased with a debit?

assets, drawing, expenses

A client has a massage and asks the company bookkeeper to mail her the bill. The bookkeeper should make which entry to record the invoice?

Accounts Receivable, debit; Fees Earned, credit

What is not true with a double-entry accounting system?

Each business transaction will have two debits.

Which of the following abbreviations is correct?

Debit, “Dr”; Credit, “Cr”

The debit side of an account

is the left side of the account

Which of the following applications of the rules of debit and credit is true?

increase Equipment with a debit and the normal balance is a debit

A debit may signify a(n)

decrease in liability accounts

Which of the following transactions increases owner’s equity?

Earn revenue

Office supplies were sold by Janer's Cleaning Service at cost to another repair shop, with cash received. Which of the following entries for Janer's Cleaning Service records this transaction?

Cash, debit; Office Supplies, credit

Which group of accounts is comprised of only assets?

Prepaid Expenses, Buildings, Patents

Joshua Scott invests $40,000 into his new business. How would this transaction be entered in the journal?

Cash 40,000

Joshua Scott, Capital 40,000

Invested cash in business.

Which are the parts of the T account?

title, debit side, credit side

What are correct rules of debits and credits?

Liabilities, revenues, and owner’s equity are increased by credits.

Assets are decreased by credits and have a normal debit balance.

Assets, expenses, and withdrawals are increased by debits.

Which of the following statements is not true about liabilities?

Liabilities do not include wages owed to employees of the company.

What is true concerning cash is true?

Cash is increased by debiting.

The gross increases in owner's equity attributable to business activities are called

revenues

Which of the following accounts would be increased with a credit?

Accounts Payable; Unearned Revenue; Collins, Capital

Which of the following entries records the withdrawal of cash by Sally Anderson, owner of a proprietorship, for personal use?

debit Sally Anderson, Drawing; credit Cash

The process of transferring the debits and credits from the journal entries to the accounts is called

posting

The balance in the prepaid rent account before adjustment at the end of the year is $32,000, which represents four months' rent paid on December 1. The adjusting entry required on December 31 is

debit Rent Expense, $8,000; credit Prepaid Rent, $8,000

By matching revenue earned during the accounting period to related incurred expenses,

net income or loss will be properly reported on the income statement

Deferred revenue is revenue that is

not earned but the cash has been received

The general term used to indicate delaying the recognition of an expense already paid or of a revenue already received is

deferral

The adjusting entry to record the depreciation of a building for the fiscal period is

debit Depreciation Expense; credit Accumulated Depreciation

Accrued revenues affect _____ on the balance sheet.

assets

Two income statements for Toby Sam Enterprises follow:

Toby Sam Enterprises | ||

|

|

|

| Year 2 | Year 1 |

Fees earned | $674,350 | $520,600 |

Operating expenses | 472,045 | 338,390 |

Income from operations | $202,305 | $182,210 |

|

|

|

Based on a vertical analysis of Toby Sam Enterprises' income statements, has income from operations increased or decreased as a percentage of revenue?

decreased by 5%

A business pays biweekly salaries of $20,000 every other Friday for a 10-day period ending on that day. The adjusting entry necessary at the end of the fiscal period ending on the second Wednesday of the pay period includes a

credit to Salaries Payable of $16,000

The account type and normal balance of Prepaid Expense are

asset, debit

If there is a balance in the unearned subscriptions account after adjusting entries are made, it represents a(n)

deferral

Which of the following accounts would likely be included in an accrual adjusting entry?

Interest Expense

Prior to the adjusting process, accrued expenses have

been incurred but not paid and not recorded

The balance in the office supplies account on January 1 was $7,000, supplies purchased during January were $3,000, and the supplies on hand on January 31 were $2,000. The amount to be used for the appropriate adjusting entry is

$8,000

At the end of the fiscal year, the usual adjusting entry for depreciation on equipment was omitted. Which of the following is true?

Net income will be overstated for the current year.

The term used to describe an expense that has not been paid and has not yet been recognized in the accounts by a routine entry is

accrued

The adjusting entry for gym memberships earned that were previously recorded in the unearned gym memberships account is

debit Unearned Gym Memberships; credit Gym Memberships Revenue

What effect will this adjusting journal entry have on the accounting records?

Supplies Expense | 760 |

|

Supplies |

| 760 |

decrease net income

Prepaid rent, representing rent for the next six months' occupancy, would be reported on the tenant's balance sheet as a(n)

asset

Using accrual accounting, expenses are recorded and reported only

when they are incurred, whether or not cash is paid

The unexpired insurance at the end of the fiscal period represents a(n)

deferred expense

Prepaid advertising, representing payment for the next quarter, would be reported on the balance sheet as

an asset

The cash basis of accounting records revenues and expenses when the cash is exchanged, while the accrual basis of accounting

records revenues and expenses when they are incurred

What is not true regarding vertical analysis?

in a vertical analysis of an income statement, each item is stated as a percent of total expenses

Which of the following is considered to be unearned revenue?

theater tickets sold for next month’s performance

When is the adjusted trial balance prepared?

after adjusting journal entries are posted

Generally accepted accounting principles require that companies use the _____ of accounting.

accrual basis

Which of the following steps in the accounting process would be completed last?

preparing the financial statements

Prepaid expenses are eventually expected to become

expenses when their future economic value expires or is used up

Prepaid expenses have

not yet been recorded as expenses

Which of the following pairs of accounts could not appear in the same adjusting entry?

Interest Income and Interest Expense