FINC2012 - TOPIC 7

1/40

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

41 Terms

What is a Real Option?

A real option gives management the right but not the obligation to make future decisions about a project’s scale, scope, or timing, depending on how uncertainty unfolds.

It adds value by allowing flexibility in response to new information.

Why are Real Options called “real”?

They are called real because they apply to real (physical or tangible) assets, not financial securities — e.g., a factory, mine, research project, or product line.

What is the link between Real Options and DCF analysis?

Traditional DCF (Net Present Value) assumes:

Investment decisions are irreversible,

Managers are passive, and

Future uncertainty is ignored.

Real options fix this by recognizing that investment timing and scale can change as conditions evolve.

How do Real Options add value beyond NPV?

They increase project value by capturing managerial flexibility:

Protecting downside losses (abandoning or delaying),

Amplifying upside potential (expanding when successful).

Thus, true project value = base NPV + real option value.

What are the main types of Real Options?

Option to Expand (Call)

Option to Wait (Timing Option) (Call)

Option to Abandon (Put)

Option to Alter Scale or Switch Inputs/Outputs (Exchange)

Option to Expand — Definition

Gives the firm the right to invest more capital to increase scale if the initial project performs well.

It’s a call option on future investment opportunities.

Example of Option to Expand

A company builds a pilot plant or prototype — unprofitable by itself, but grants the option to build full-scale facilities later if conditions improve.

Why can an initial project with a negative NPV still be valuable?

Because it may create future options with large potential value (e.g., expansion or technology platform options).

The option value can offset a negative base NPV.

What are typical industries where Expansion Options are important?

Pharmaceuticals (R&D stages)

Mining and energy (exploration → extraction)

High-tech and software (pilot → scale-up)

Real estate development (zoning → construction)

What is the analogy between real and financial options?

Real Option | Financial Analogue |

|---|---|

Option to expand | Call option on a future project |

Option to delay | Call option on timing |

Option to abandon | Put option on the project |

Option to switch | Exchange option between assets |

What does the Mark I and Mark II example illustrate?

Even a negative-NPV project (Mark I) can be justified if it creates a valuable future option (Mark II) — e.g., market entry to enable follow-on investment.

What is the Adjusted Present Value (APV) in real options?

APV=Base NPV+Option Value

If APV > 0, the project adds value even if base NPV < 0.

What increases real option value?

Higher underlying project value (S)

Lower exercise cost (X)

Higher volatility (σ)

Longer time to maturity (t)

Higher risk-free rate (r)

Why does volatility (σ) increase option value?

Because options have asymmetric payoffs:

You gain from upside,

You can walk away from downside.

→ More uncertainty increases the chance of extreme upside without forcing losses.

Pharmaceutical R&D as a Real Option

Drug development is sequential:

Each stage (clinical trial) = smaller investment with option to proceed later.

Each stage’s success unlocks the next option.

What is the Option to Wait (Timing Option)?

It’s the right to defer investment until uncertainty about prices or demand resolves.

Equivalent to a call option on the project’s future cash flows.

Why might a firm prefer to wait to invest?

To learn more about demand or costs,

To avoid irreversible sunk costs too early,

To preserve the option to invest later at better conditions.

When is the Option to Wait most valuable?

High uncertainty in project returns,

Low cost of delay, and

Exclusive rights (e.g., patents or leases).

What happens if you ignore the option to wait?

You may invest too early in a risky environment, destroying value that comes from strategic timing flexibility.

How do we calculate the value of the option to wait?

Using a binomial model:

Estimate up and down PVs,

Compute risk-neutral probability,

Find payoffs (max(PV − X, 0)),

Discount expected payoff at risk-free rate.

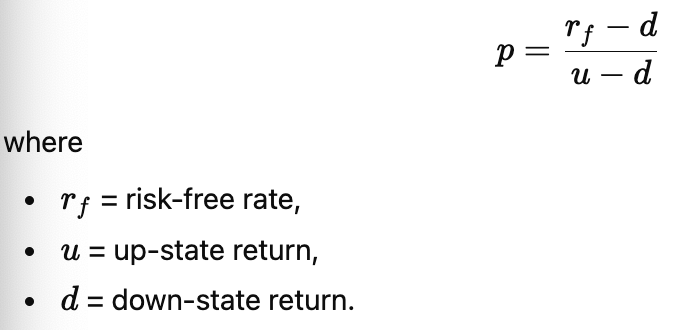

Formula for risk-neutral probability (p)

What is the Option to Abandon?

The right to terminate a project early and recover salvage value.

Equivalent to a put option on the project value.

How does the Option to Abandon create value?

It provides downside protection:

If the project underperforms, sell or repurpose assets instead of operating at a loss.

What is the underlying asset and strike in the Abandon Option?

Underlying asset: project value (PV of expected cash flows)

Exercise price (X): salvage or resale value of assets

When should the Abandon Option be exercised?

When:

Salvage Value (X) > PV of continuing operations

Option to Vary Output or Inputs — Definition

Gives flexibility to change production levels, inputs, or outputs depending on changing market conditions.

Examples of Option to Vary

Scale flexibility: expand or contract production in response to demand.

Switching flexibility:

Output: switch between product lines.

Input: switch between fuel sources or materials.

Real-world examples of Switching Options

Chemical plants switching feedstocks (oil vs. gas).

Car manufacturers alternating between models.

Power stations shifting between coal and gas.

Why are Switching Options valuable?

They let firms adapt cost structures and capture market opportunities, reducing exposure to input price risk and demand shocks.

What is the main challenge in valuing real options?

Real options often lack:

Clear underlying asset values,

Explicit exercise prices, and

Observable volatility estimates.

This makes standard models (like Black–Scholes) harder to apply directly.

What models are used to value real options?

Black–Scholes model (for continuous-time, one-decision options)

Binomial tree/lattice models (for discrete, staged decisions)

Monte Carlo simulations (for complex multi-factor projects)

Why can’t we rely solely on DCF for uncertain projects?

Because DCF treats uncertainty as purely negative.

Real options show that uncertainty + flexibility can increase value.

What are “learning options”?

Options that allow a firm to learn about market conditions or technology before committing fully — e.g., pilot programs or early-stage trials.

What are “growth options”?

Investments that open up future opportunities, such as entering a new market or acquiring patents.

They often have low current returns but high potential upside.

What are “abandonment options”?

Options that limit losses by exiting unprofitable projects early — improving downside protection and reducing risk exposure.

What are “switching options”?

Options allowing firms to change inputs, outputs, or operating modes, maintaining competitiveness as conditions change.

Relationship between uncertainty and real option value

Higher uncertainty increases the value of all real options because flexibility allows the firm to benefit from upside without bearing the full downside.

How do competitors affect real option value?

If competitors can preempt your decisions (e.g., invest first), your option to wait or expand becomes less valuable — competition erodes exclusivity.

Key takeaway: Value creation through flexibility

The value of flexibility comes not from changing the project’s cash flows, but from changing the firm’s ability to react to those cash flows once uncertainty resolves.

Common Real Options Misconceptions

❌ “Options are only for finance.”

→ Real options exist in any strategic investment.

❌ “Volatility is bad.”

→ For options, volatility is good — it increases potential upside.

❌ “DCF captures all value.”

→ DCF ignores managerial flexibility; real options correct this.

Summary of Option Types and Analogies

Option Type | Analogue | When Valuable | Effect on Value |

|---|---|---|---|

Expand | Call | When future success likely | Adds upside potential |

Wait | Call | When uncertainty high, delay cheap | Preserves timing flexibility |

Abandon | Put | When downside risk high | Limits losses |

Switch | Exchange | When inputs/outputs volatile | Adapts cost structure |