Government intervention and government failure

1/102

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

103 Terms

What is the main reason for government intervention in markets?

To correct market failure and improve economic efficiency and equity

Name three main ways governments influence the allocation of resources.

Public expenditure — direct provision of goods/services (e.g. education, healthcare).

Taxation — raising revenue and discouraging harmful activities (e.g. tobacco tax).

Regulation — setting legal limits or rules (e.g. pollution standards, safety laws).

What are the 7 key ways of government intervention to correct market failure?

indirect taxation

subsidies

price controls

state provision

regulation

extension of property rights

pollution permits

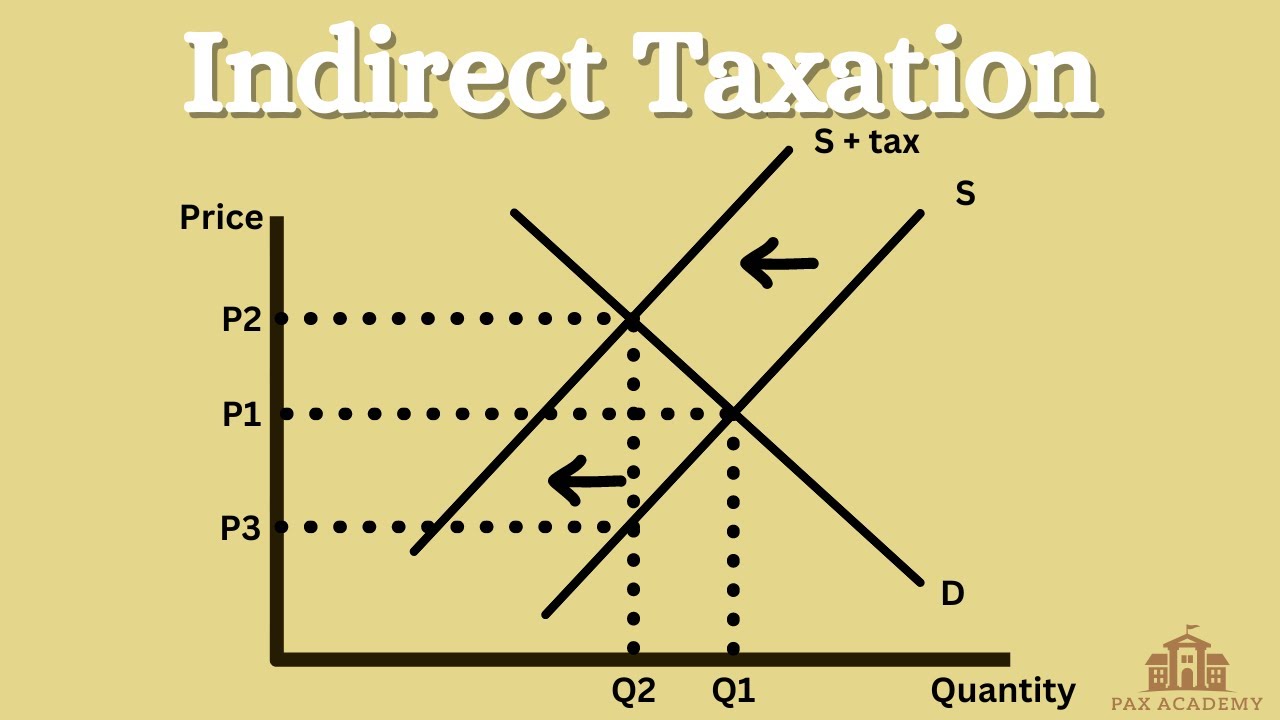

What is an indirect tax?

tax on goods or services e.g VAT

What is the purpose of an indirect tax?

To reduce consumption/production of goods with negative externalities (demerit goods) by increasing the production costs of producers e.g cigarettes

Draw the indirect tax graph.

What are the strengths of indirect tax?

internalises external costs

raises government revenue (can fund public goods)

consumers still have a choice

What are the weaknesses of indirect tax?

Regressive → hits low-income households harder.

Hard to set right tax level (imperfect info about external cost).

May lead to black markets or tax evasion if set too high.

Inelastic demand goods (e.g. petrol) → little behaviour change.

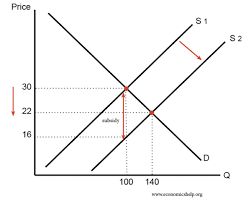

What are subsidies?

payments to producers or consumers to lower costs

What is a subsidy used for?

To encourage production or consumption of goods with positive externalities (merit goods) by lowering the producer’s of these goods production costs e.g education

Draw the graph for subsidies.

What are the advantages of subsidies?

Increases consumption of merit goods.

Can promote long-term growth and innovation.

Reduces underproduction

What are the disadvantages of subsidies?

High opportunity cost — taxpayer money.

Risk of dependency and inefficiency if firms rely on subsidies.

Hard to calculate true external benefit.

may be pocketed and not used for exact purpose

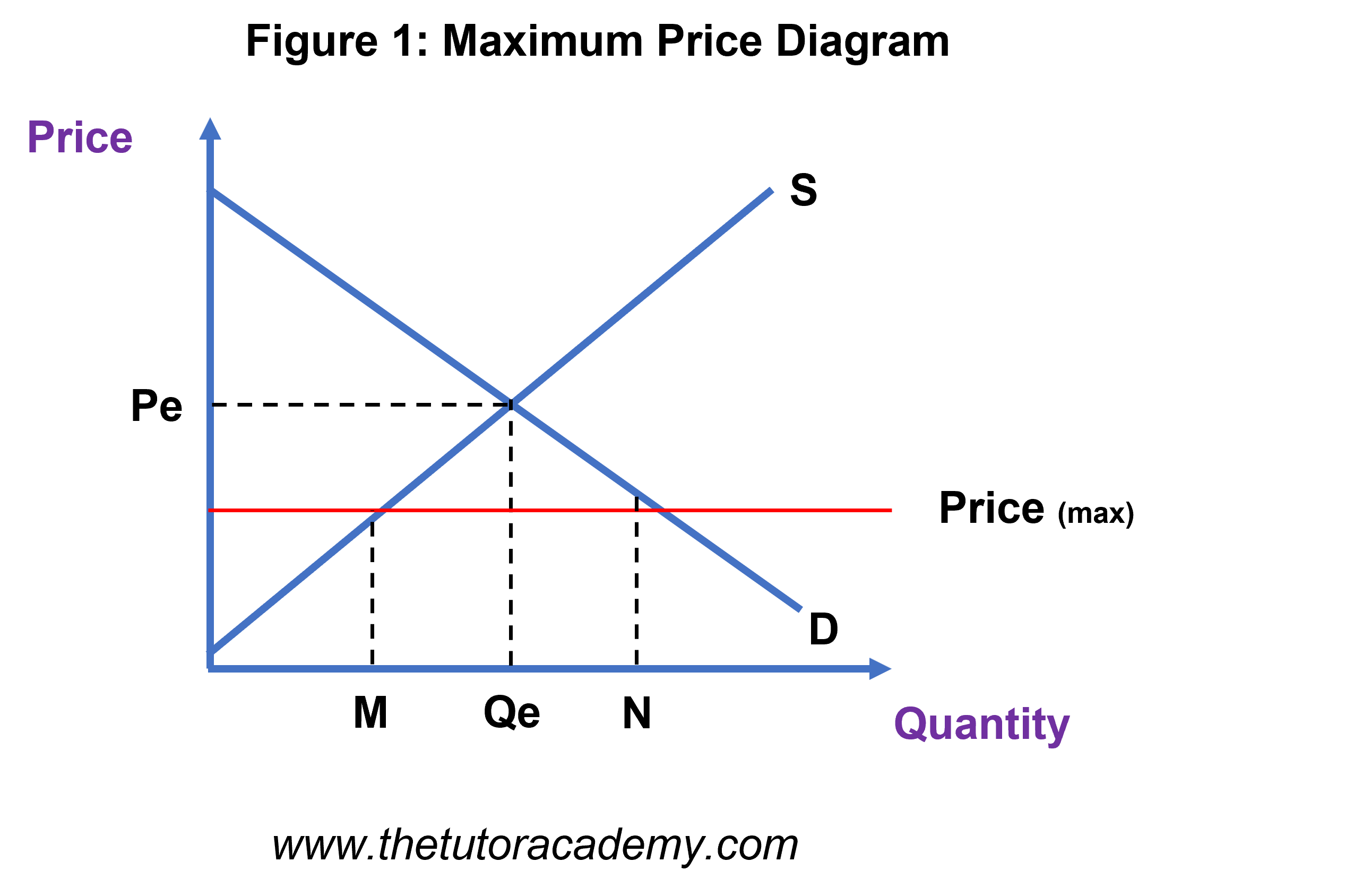

What are price controls?

Government-imposed limits on prices

What are the two-types of price controls?

maximum (price ceiling) or minimum (price floor)

What is a maximum price?

price set below equilibrium to encourage the consumption of a good e.g rent controls

Draw the maximum price graph.

lowers price, reduces incentive to supply but increases incentive to consume creating excess demand. Promotes equity.

What are the strengths of maximum price?

Can make essentials affordable

quick and visible form of intervention

stabilises the market in the short-term

promotes equity

What are the weaknesses of maximum price?

creates shortage (some consumers can’t buy either way due to shortage)

encourages black markets and exploitation

can distort market forces to create an inefficient allocation of resources

May require costly government rationing schemes

What is minimum price?

price set above equilibrium to discourage the consumption of demerit goods e.g alcohol

What else can minimum price do?

prevent workers from exploitation

Draw the minimum price graph.

higher prices incentivises supply but does the opposite to demand leading to a contraction - now there is excess supply

What are the advantages of minimum price?

Can raise incomes or reduce overconsumption

Quick and visible intervention

creates a decent wage increasing standard of living of the poorest people incentivising people to work

producers are protected from price volatility (degree of price variation over time)

reduces external costs

What are the limitations of minimum price?

creates excess supply (opportunity cost)

people may become over-dependent on the government’s help

could increase unemployment

Encourages black markets

What are regulations?

rules set by the government to be followed e.g ad restrictions

What does regulation aim to do?

Change behaviour by imposing rules and standards

What are the strengths of regulations?

positive externalities directly reduces harmful activity

disincentive to break rules

easy for the public to understand

can protect consumers where markets fail badly

What are the disadvantages of regulations?

Costly to enforce and monitor.

Risk of regulatory capture (firms influencing regulators).

Inflexible - doesn’t account for differences across firms.

Can stifle innovation and raise production costs.

What is state provision?

when the government directly provides goods or services

Give an example of state provision

The NHS or public education - public and merit goods

What are the advantages of state provision?

ensures universal access and equity

Corrects complete market failure (e.g. public goods)

What are the weaknesses of state provision?

Inefficient due to lack of competition and profit motive.

High opportunity cost - taxpayer-funded.

Risk of overuse or moral hazard (e.g. NHS waiting times)

What is meant by extending property rights?

Assigning ownership to resources so users bear responsibility for their use or misuse. It also prevents the tragedy of the commons

What are the strengths of extension of property rights?

Encourages responsible management and internalises costs.

Reduces overuse of common resources.

Can be flexible and market-driven

What are the weaknesses of extension of property rights?

Hard to assign property rights for global resources (air, oceans).

Monitoring and enforcement are costly.

May create inequality if rights are unevenly distributed

What are tradable pollution permits?

Allowances that let firms emit a certain amount of pollution, which can be bought and sold

What are the advantages of pollution permits?

Market-based - least-cost firms reduce pollution first.

Provides financial incentive to cut emissions.

benefits the environment in the long-run

raises revenue for greener firms

What are the disadvantages of pollution permits?

monitoring of emissions is expensive

firms may pass costs to consumers

competition is restricted as they raise barriers to entry

difficult to set correct cap (info problem)

risk of permit hoarding

Other than efficiency what are the four objectives of government policy?

Equity (fairness) – redistributing income via taxes and welfare.

Economic growth – encouraging productive investment.

Stability – reducing inflation and unemployment.

Sustainability – protecting future generations and the environment

What is meant by a mixed economy?

An economy where markets allocate resources but the government intervenes to correct failures

What is government failure?

when the government intervenes in a market to correct market failure but the intervention results in a misallocation of resources even worse than before

How is government failure different from market failure?

Market failure is caused by market inefficiencies; government failure is caused by policy inefficiencies

What are the six main reasons why government failure occurs?

distortion of the price mechanism

law of unintended consequences

inadequate (imperfect) information

administrative costs

conflicting objectives

regulatory capture

How can intervention distort markets?

it solves one problem but causes another as price signals are distorted. Signalling function is artificially altered leading to an inefficient allocation of resources. For example, minimum price creates excess supply (surplus) and this is bad in things like farms with perishable stocks

When might a distortion improve welfare?

When it increases fairness or corrects serious inequality (e.g. minimum wage)

Why might long-term distortions worsen efficiency?

Firms may become dependent on support and stop innovating

What’s the evaluation judgement?

Distortion isn’t automatically bad — acceptable if equity or welfare gains exceed efficiency losses

What is the law of unintended consequences?

when consumers or producers change behaviour in ways the government didn’t predict to maximise their self-interest

Give an example of unintended consequences of policy.

Black markets after bans

How can policymakers reduce unintended consequences?

By testing policies (pilot schemes) and combining with education or enforcement

Why are they hard to avoid?

Human behaviour is unpredictable and incentives can backfire

What’s the evaluation judgement?

Risk is higher for behaviour-based policies — but can be mitigated with careful design and evidence

How does inadequate information cause government failure?

governments and regulators rarely have full knowledge about the extent of market failure or the right level of intervention leading to over-correction or under-correction

Give an example of inadequate information leading to government failure.

setting the wrong level of pollution tax as external costs are hard to measure

How can governments reduce the problem of imperfect information?

By using research, pilot schemes, or independent expert bodies (e.g. OBR) to improve accuracy

Why might government still intervene despite imperfect info?

Even partial correction can improve welfare compared to doing nothing

Why might imperfect information persist even with data?

Markets change quickly, and political pressures or bias may lead to poor decisions

What’s the evaluation judgement for this cause?

It limits precision but doesn’t always make intervention harmful — depends on data quality and adaptability

What are administrative costs?

The costs of implementing and enforcing policies. They can be expensive and it means that resources are diverted from other priorities

What factors can lower administrative costs?

Technology, automation, and efficient monitoring systems

When might high administrative costs still be justified?

When long-term social benefits (like better health or cleaner air) outweigh the costs

What’s the evaluation judgement?

Justified if benefits exceed costs; risk of failure if bureaucracy (complex administrative system of rules) grows faster than impact

What are conflicting objectives?

the government has multiple aims such as economic growth, low inflation and low unemployment. Government goals may clash and one policy may be implemented at the expense of another

How can governments manage conflicting objectives?

Through better coordination and long-term planning (e.g. aligning fiscal and environmental policies)

Why might political cycles worsen this issue?

Short-term electoral goals often override long-term welfare aims

What’s the evaluation judgement?

Conflicts are inevitable, but clear priorities and consistency reduce the harm

What is regulatory capture?

when regulators become influenced by the firms in the industry they oversee resulting in weak enforcement or policies that favour firms, not consumers

How can it be prevented?

Independent agencies, transparency, and public accountability

What’s the evaluation judgement?

Capture risk can be reduced but not eliminated — needs strong institutions and oversight

What is competition policy?

Government action to promote competition and prevent abuse of market power by making markets more competitive

What is the core objective of competition policy?

to ensure markets work efficiently and to prevent monopoly abuse, collusion and anti-competitive mergers

What are the main principals of competition policy?

Promote competition

Prevent abuse of dominant position

Protect consumer welfare

Encourage efficiency and innovation

What does competition policy make sure but generally accept?

it makes sure that there is competition so consumers have cheaper and more options and that excessive profits aren’t made and that prices reflect costs of production.

it accepts that in some cases, economies of scale and barriers to entry means that monopoly power will be enjoyed but will deliver more efficient outcomes than in perfect competition

What is the role of the UK’s Competition and Markets Authority (CMA)?

Investigates mergers

Investigates anti-competitive behaviour

Can block mergers or impose fines

What is the focus of EU competition policy?

Preventing cartels, abuse of dominance, and anti-competitive mergers

What is an example of EU and UK competition policy in action?

Google (EU)

Fined for abusing dominant position in search

Shows regulation of market dominance

UK supermarket mergers

CMA investigates impact on prices and consumer choice

What are the 3 key elements of competition policy in the UK?

monopoly policy

merger policy

restrictive trading practices policy

Tell me about monopoly policy

the CMA conducts a cost-benefit analysis with information such as concentration ratios and complaints from consumers or other firms in the market tell them where to investigate further

What are some alternative approaches to the problem of monopoly?

price controls to restrict monopoly abuse

taxation of monopoly profits

state ownership of monopoly to act in public interest

compulsory break up of all monopolies - ‘monopoly busting’

Tell me about merger policy

it targets mergers that reduce competition and the creation of monopolies or oligopolies. This because few firms means less competition, high prices and less choice

Tell me about restrictive trading policy

it can be divided into 2 kinds: those undertaken independently by a single firm, and collective restrictive practices that involve either a written or implied agreement between 2 firms

What are some examples of independently undertaken restrictive practices?

decisions to charge discriminatory prices

the refusal to supply to a particular resale outlet

What is a key example of collective restricting trading practice?

a cartel agreement, in which firms come together to fix the price of a good

Define public ownership

when firms or industries are owned and run by the government on behalf of the public e.g NHS, BBC etc

What is nationalisation?

The transfer of ownership of assets or firms from the private sector to the public sector (the state).

What are advantages of public ownership/nationalisation?

Equity and universal access - ensures essential services are accessible to all

long-term investment can happen without short-term profit pressure

cheaper for consumers - benefit from economies of scale and allocative efficiency

reduces externalities as things are provided at socially optimum, not private

What are the disadvantages of public ownership/nationalisation?

productive inefficiency - lack of profit motive

poor incentives - weak management and limited innovation (X-inefficiency)

political interference - decisions based on electoral concerns

decrease quality of goods and services

very costly and burden falls on tax payers - could further indebt us

can lead to diseconomies of scale if industry gets too large

What can happen instead of nationalisation/public ownership?

a public private partnership (PPP). The UK is the current leader of this - has efficiency of private sector but interest of the public at heart e.g St Bartholemew’s hospital

What is privatisation?

the transfer of ownership of a firm or industry from the public sector to the private sector e.g British Gas

What are the arguments for privatisation?

increased efficiency - profit motive encourages cost reduction

greater competition - incentives improve performance

reduced government burden - raises revenue and reduces public sector borrowing

What are the arguments against privatisation?

short-termism - focus on profits over long-term investment

equity concerns - higher prices, reduced service in unprofitable areas

private monopoly risk (without competition)

less allocative efficiency

lack of strategic direction - focuses on dividends for shareholders

What is economic liberalisation?

opening up markets to private ownership and competition, and reducing government intervention in the economy. Closely related policies include deregulation and PPP

Define regulation

the imposition of rules and other constrains which restrict freedom of economic action

What are some other examples of regulatory bodies other than the CMA?

Ofwat for water

Ofcom for broadcasting

Ofgem for British gas

What are the strengths of regulation?

prevents market abuse - controls monopoly power

protects consumers - ensures serve quality and safety (e.g FSA for food)

corrects market failure - environmental protection

What are the weaknesses of regulation?

depends on how regulated a market is

regulatory capture

reduced innovation - limits pricing freedom

compliance costs - raises costs for firms e.g administrative costs

What is deregulation?

the removal or reduction of previously imposed regulations e.g bus services

What are the arguments for deregulation?

increased competition - lower prices and greater choice

improved efficiency - reduced bureaucracy (administrative systems, rules, procedures etc)

innovation

What are the arguments against deregulation?

inequality - services may focus on profitable customers

reduced consumer protection - lower safety or quality standards

market instability - risk of failure or crises