4.5 marketing mix

1/45

Earn XP

Description and Tags

excluded HL topics + specific promotion strategies' adv/disadv

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

46 Terms

marketing mix

key decisions that must be taken in the effective marketing of a PRODUCT

influences if a business can sell it profitably

coordinated marketing mix

key marketing decisions that complement each other and work together to give customers a consistent message about the PRODUCT

these should be interrelated and fit together in an integrated marketing plan to target clear marketing objectives

product

end result of production process sold on the market to satisfy a consumer need or industrial need (purchased by businesses, not final consumers)

important to sell the right product to customers based on their expectations: quality, durability, performance, appearance

consumer durables

manufactured products that can be reused and are expected to have a reasonably long life

opposite: single-use

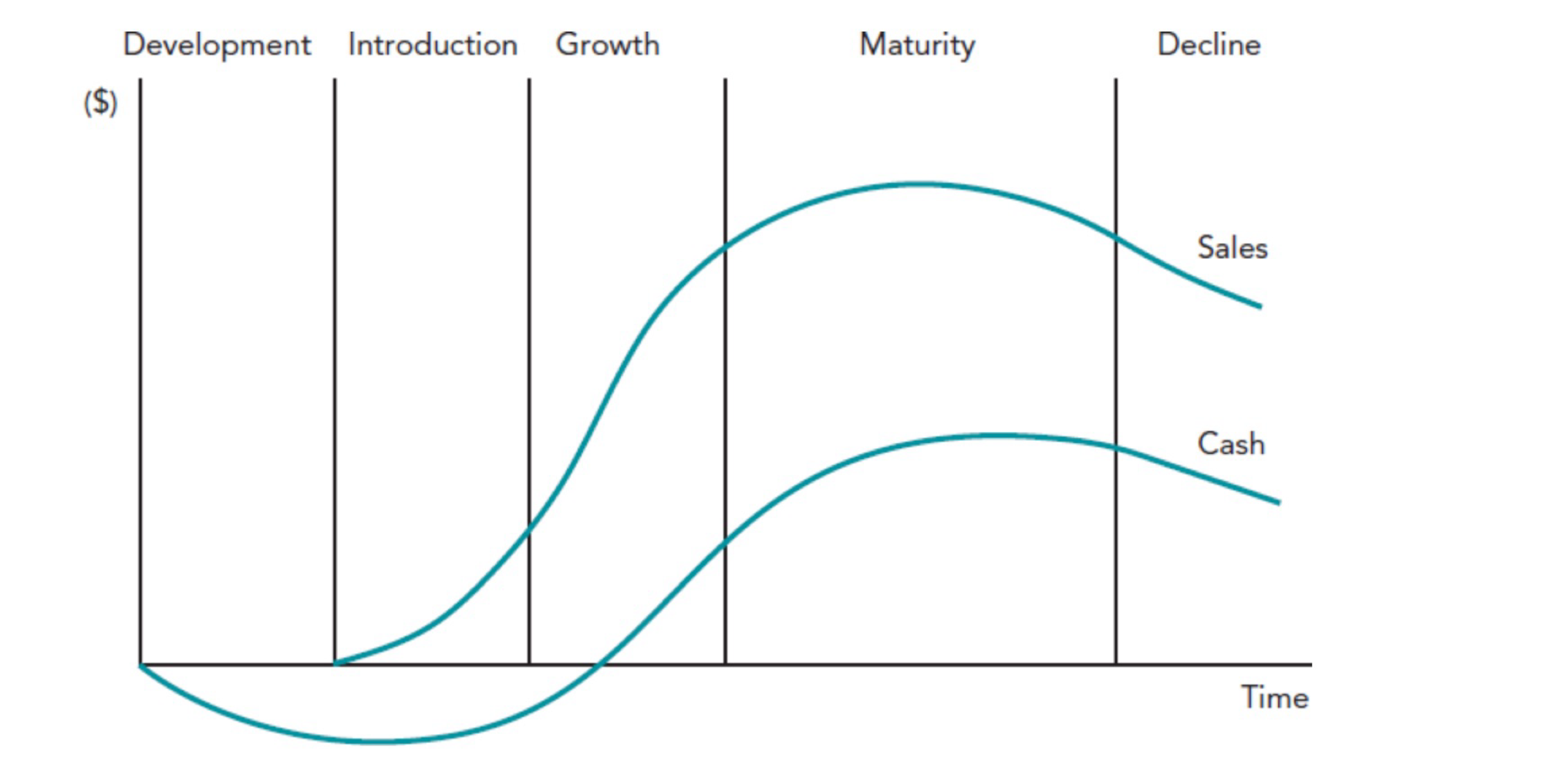

product life cycle

pattern of sales recorded by a product from launch to withdrawal from market

helps business know when to launch a new product/update existing product

product life cycle stages

introduction

growth

maturity/saturation

decline

product life cycle introduction

product: new model

promotion: high → above the line, informative to make customers aware of new product

pricing: depends → premium or penetration pricing

place: few

sales: low

product life cycle

product: make improvements to maintain consumer appeal

promotion: high → create brand identity, encourage customer loyalty and repeat purchases

pricing: increase (especially if initially used penetration pricing)

place: increase → due to increased consumer demand

sales: increase significantly but growth slows down to maturity

product life cycle maturity/saturation

product extension strategies used

promotion:

brand reinforcement → stress that product is different from competitors

below the line → aimed at target markets

pricing: lower → competitive pricing because competitors entering market

place: maximum geographical range of outlets, introduce new kinds of outlets

sales: stop growing but don’t decline significantly

increased competition, competitors copying growth strategies

technological advancements make existing less appealing

change in consumer tastes

saturation of market: people who want already have it, will only buy if existing breaks or there is newer technology

product life cycle decline

product: withdraw from market, replace with new product

promotion: minimal, only to inform about lowered prices

pricing: lowered to clear stock OR if product has cult following, can increase price to create exclusivity

place: eliminate unprofitable distribution outlets

product life cycle affects

investment

decline: invest heavily in R&D of new products to replace

profit margins

cash flow

product life cycle affects profit margins

growth/maturity: high sales → high gross/net profit margins

end of maturity: using competitive pricing → low gross/net profit margins

decline: sales fall → negative gross profit margins BUT if fixed costs already covered, might still have net profit

product life cycle effect on cash flow

development: negative because only cash outflow

unused factory capacity

high R&D costs

no sales

introduction: negative because revenue from sales < cost of sales + promotion

unused factory capacity

high promotional costs

penetration pricing

low sales

growth: increasing because sales increasing

when it is positive depends on length of consumer credit

maturity: most positive

high sales

lowest promotional costs

max factory capacity

decline: decreasing because price low and sales low

market saturation

demand for a particular product or service has reached its peak, competitors entered market

people who want the product already have it, will only buy if existing breaks or there is newer technology

product portfolio

made up of all product lines offered for sale by a business

can be analysed using BCG matrix

why need range of products in portfolio + what contributes to range

why need range?

reduced risk: less exposed to market changes (changes in consumer tastes/demand) → not dependent on performance of main products

balance → diversification

steady cash flow/profit performance

what contributes to range

new products

international adaptations (international marketing)

mergers and takeovers

balanced product portfolio

when one product reaches decline, should have other products in growth or introduction stage of product life cycle

ensures balanced risk profile, smoother cash flow and profits

extension strategies

introduced in maturity/saturation stage of product life cycle → to lengthen product life cycle

add features to original product

+ R&D and promotion for slightly revised product is less expensive than new product

- consumers may not be interested in a slightly revised product

repackage product

+ cheap and fast

- consumers feel misled once realise

discounted price

+ can reach new market segment of consumers with low spending power

- impacts brand image → better to replace earlier to avoid discounting

rebrand

+ can reach new market segments

- expensive

market development

+ increases sales

- need to adapt product/promotion to local laws/culture

brand

an identifying name/symbol that distinguishes a product from competitors’ product

aspects

awareness

loyalty

development

equity/value

importance of branding

instant recognition from logo

differentiate from competitors

employee motivation increases

customer referrals increase through social media

customers have expectations

customers have emotional attachment → customer loyalty

brand equity gives value to business beyond its tangible assets

internationally consistent, recognisable and transferrable → can exploit marketing EOS + sales increase

BUT international branding might not connect with local culture/tastes

brand awareness

extent to which consumers recognise product by name and special characteristics

usually due to logo/trademark associated with the brand

effects

increased sales (familiar, more likely to buy)

competitive advantage (differentiated)

is the primary goal of promotional activity in introduction phase

brand loyalty

tendency of consumers to choose a brand over others

seen by repeat purchases regardless of marketing pressure from competing brands

likely to promote through word of mouth

effects

reduced price sensitivity

repeat purchases (predictable and stable sales revenue)

reduced marketing costs (recommend through word of mouth)

increases the likelihood of successful product launches (more willing to try new offerings)

is the primary goal of promotional activity in growth phase

brand development

long-term strategy that involves strengthening the name and image of a brand to resonate with its target audience. (eg values, mission, vision)

features

visual identity (logos, designs)

tone and style of communication

values, mission, vision

alt: measures the infiltration of a products sales, usually per thousand population

if 100 people out of 1000 buy, brand development = 10

brand equity/value

estimation of how much a brand is worth. recorded on the balance sheet under non tangible assets.

when another company purchases, brand value = purchase price – net book value of the acquired brand.

alt: brand value = assets – liabilities

premium that a brand has because customers willing to pay more than they would for a non-branded product

if high awareness + development, will have high equity

trademark

form of intellectual property that is a distinctive name, symbol, motto or design that distinguishes a business/its products.

can be legally registered and cannot be copied.

value is under balance sheet intangible assets.

price

amount paid by consumer for product

will affect

demand

brand image

revenue and profits

depends on

cost of sales

competitors prices

market conditions

stage of product life cycle

marketing objectives

PED

pricing strategies

cost plus

penetration

predatory

loss leader

premium

competitive

dynamic

contribution

cost plus pricing

all direct costs + some indirect costs + fixed or % mark-up

mark up depends on demand, number of competitors, stage of product life cycle

advantages

easy to calculate for single-product business

price covers all costs of production

suitable for market leaders: they set the market price

disadvantages

difficult to calculate for multi-product businesses: difficult allocate indirect (fixed) costs

inflexible: could possibly charge higher

doesn’t consider market conditions

if sales decrease, average fixed costs increase, cost-plus price increases

penetration pricing

used for new products. initially set a low price to attract customers, then raise price.

accompanied by heavy promotion because aim to increase volume of sales

advantages

low cost → high demand → high sales

high sales volume → economies of scale → can lower price

can increase price later

disadvantages

low profit margins + if increase price might have customer resistance

price war: competitors with more resources can survive longer

perceived as low quality

loss leader

product that is sold at a loss and advertised to attract customers into the store → hope customers will purchase other products, which are priced to make a profit.

OR loss leader paired with complimentary product (eg printer cheap but ink expensive)

advantages

low price → high demand → high market share

complementary products’ profit compensates for loss from loss leader

disadvantages

customers may choose cheaper complementary product from competitors → overall loss since did not buy complementary product

predatory pricing

deliberately undercutting competitors prices to eliminate them from the market

illegal, creates monopoly

advantages

short term benefit customers → lower prices → demand increase

eliminates competitors

disadvantages

long term creates monopoly → when increase prices customers no other option

illegal → heavy fines

perceived as low quality

premium pricing

price is higher than needed

create impression that it is higher quality or value

advantages

customers perceive as high quality/stronger brand image → demand increase

price covers all costs

disadvantages

needs coordinated marketing mix

high price → lower demand if PED high → lower sales since choose competitors

dynamic pricing

demand is tracked in real time and prices are adjusted accordingly

demand high and capacity low → increase price to maximise revenue

demand low and capacity high → prices lowered to increase demand and maximise capacity utilisation

adv

maximises revenue

adapt to market conditions

disadv

advanced IT systems needed

consumers feel exploited

consumers alienated if find out that others bought at lower price

competitive pricing

matching/undercutting competitors’ prices → aim to increase sales

price matching

discounts for new customers → attract away from rivals

refund difference

adv

customer loyalty since can be assured that getting a competitive price

able to increase/maintain market share since remain competitive

disadv

reduces profit margins

may have higher costs than competitors → making loss will risk long-term survival

contribution pricing

set prices based on direct cost per unit and some allocation of total indirect costs (no markup, unlike cost-plus)

adv

ensures that each product does not make a loss

lower price than cost-plus → more competitive

disadv

need sell minimum quantity

unable to accurately allocate indirect costs

does not account for changes in quantity affecting unit cost of production (EOS/disEOS)

PED

PED = % quantity demanded / % change in price

always negative

if numerical value >1 → elastic: demand is more responsive to a change in price (eg luxury goods)

increasing price will decrease total revenue

decreasing price will increase total revenue

use competitive pricing:

if 0<numerical value<1 → inelastic: demand is less responsive to a change in price (eg necessities)

increasing price will increase total revenue

decreasing price will decrease total revenue

use price-skimming: set as high as possible then reduce over time. used when strong brand image.

factors

brand loyalty

availability of alternatives

% of consumer income that is taken up by the good

luxury/necessity

time period to adjust: longer time period, more elastic since more time to search for alternatives

promotion

communicate with customers with aim to

raise brand awareness → increase sales

remind about existing product + promote new product

encourage repeat purchases + attract new customers

above-the-line promotion

forms of communicating with potential customers that are aimed at mass market, not targeted

aims to increase brand awareness

types of advertising

informative → raise awareness of new product/communicate major changes

persuasive: creating distinct brand image → especially when little difference from competitors

advantages

raises awareness in wide-ranging audience → useful if product has mass appeal

disadvantages

high cost

unable target specific market

below-the-line promotion

forms of communicating with potential customers that are aimed at specific market segment

NOT DIRECTLY PAID FOR

examples: sales promotion, money-off coupons, customer loyalty schemes, BOGOF, POS displays, public relations, sponsorship

advantages (general)

direct communication with consumers

based on specific marketing objectives → can measure results against

through-the-line promotion

integrates both above and below the line elements

aim to convert customers into measurable and targetable sales

example: social media

use online marketing to communicate and directly sell

use influencers with high social-networking potential to create appealing messages that are likely to be passed on to many people

advantages

no-cost

global audience reach

target specific market segments

interactive

performance metrics

speed of transmission

disadvantages

lack of skill

time investment

negative feedback is public → damage brand image

security issue

performance metrics are not immediate

not everyone uses social media

influencer may not align with brand image

place

distribution channels: chain of intermediaries product passes through from manufacturer to consumer

companies may have multiple, depending on type of product and needs of consumers

players

manufacturers: produce goods → need widest geographical range of market BUT need maintain brand image

wholesalers: buys in bulk from manufacturer and holds goods, sells to retailers in smaller quantities

retailers: sell goods to final consumer → will sell goods but demand mark up to make profit

consumers: want ease of access to try before buying + ease of return

direct selling

manufacturer → consumer

example: online sales → reaches wide market

advantages

no markup, no profit margin taken by other business

complete control over marketing mix

faster

direct contact with consumer → market research

disadvantages

no outlets for consumers to try

need pay for all promotional costs + no after sales service since no intermediaries

need space for + pay cost of holding stock

delivery costs high since need deliver to consumer

manufacturers need focus on both producing and selling

single intermediary channel

manufacturer → retailer → consumer

usually for consumer goods/industrial goods to businesses

advantages

retailer has space for + pays cost of holding stock

retailer has outlets to display products and allow consumers try

retailer’s location is more convenient for consumer

manufacturers can focus on production

disadvantages

retailer makes profit through markup → more expensive for consumers

loss of control over marketing mix

no exclusive outlet: retailers sell competitors’ products too

manufacturer pays cost of delivery to retailer

two intermediary channel

manufacturer → wholesaler → retailer → consumer

advantages

wholesaler buys in bulk then sells to retailer (‘breaking bulk’)

wholesaler pays for cost of delivery to retailer

wholesaler has space for + pays cost of holding stock

best option when entering foreign market: since wholesaler has direct contact with retailers

disadvantages

two intermediaries who need to make profit → price for final consumers increase

slowest

manufacturer loses more control over marketing mix

people

employees/managers and how customers communicate with them

influenced by

who/how business is represented to customers → affects brand image and customer loyalty

if genuine → performance increase → honest feedback from customers

interpersonal skills, trained with service knowledge, high efficiency → customer satisfaction increases

process

procedures and policies put in place to provide service to customer

how it influences customer satisfaction

fast, efficient, avoid delays → brand image improved

clearly defined and everyone knows how → consistent customer experience

remain competitive, embrace new technology, up to date → meets customer expectations

physical evidence

how business and products are presented to customers

goods: product packaging

services: location, appearance, employee behaviour and appearance

important in coordinated marketing mix → justifies premium pricing

impacts customer experience and satisfaction

should be customer-tested and updated